Aircraft Recycling Market

Aircraft Recycling Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703727 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Aircraft Recycling Market Size

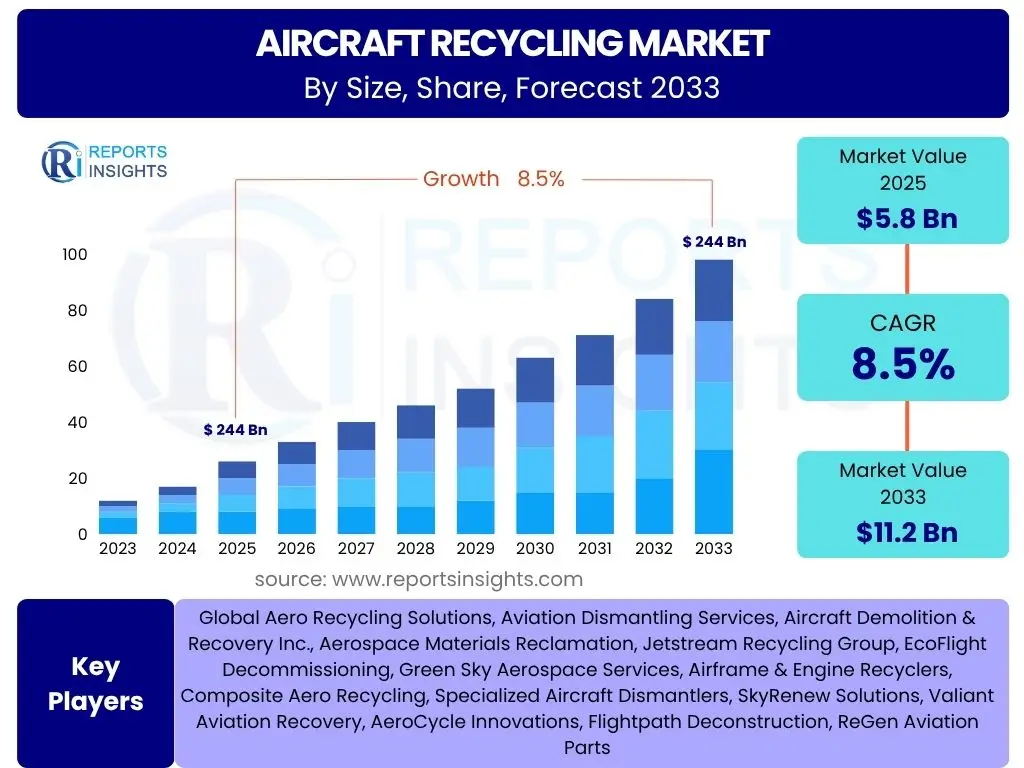

According to Reports Insights Consulting Pvt Ltd, The Aircraft Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Key Aircraft Recycling Market Trends & Insights

The aircraft recycling market is undergoing significant transformation driven by sustainability imperatives, technological advancements, and a growing fleet of end-of-life aircraft. Stakeholders, including airlines, MRO (Maintenance, Repair, and Overhaul) facilities, and material recovery companies, are increasingly focused on maximizing the value extraction from retired aircraft while minimizing environmental impact. The shift towards a circular economy model for aerospace materials is a prominent trend, pushing for innovative dismantling techniques and sophisticated material separation processes.

Furthermore, there is a notable rise in the demand for recycled components and materials within the aerospace supply chain, driven by both economic benefits and regulatory pressures. This demand is fostering new partnerships between recyclers and original equipment manufacturers (OEMs) or MRO providers to establish closed-loop systems for critical materials. The market is also seeing an expansion of specialized facilities capable of handling complex aircraft structures and hazardous materials, ensuring compliance with stringent environmental regulations worldwide.

- Increasing focus on circular economy principles for aerospace materials.

- Rising demand for reclaimed aircraft parts and components, particularly for older aircraft fleets.

- Technological advancements in dismantling, material separation, and recovery processes.

- Stringent environmental regulations and mandates driving sustainable end-of-life solutions.

- Growth in partnerships between recyclers, MROs, and OEMs for material reintroduction.

AI Impact Analysis on Aircraft Recycling

The integration of Artificial Intelligence (AI) and machine learning technologies is set to revolutionize the aircraft recycling industry by enhancing efficiency, safety, and material recovery rates. Common user inquiries often revolve around how AI can optimize the complex dismantling process, improve the identification and sorting of diverse materials, and predict the optimal reusability of individual components. AI algorithms can analyze vast datasets related to aircraft operational history, maintenance records, and material properties to make informed decisions regarding component recovery and material reprocessing, leading to higher value extraction.

AI's influence extends to predictive maintenance for retired aircraft components, allowing recyclers to identify parts with remaining operational life for re-certification and resale, thus significantly boosting economic returns. Moreover, AI-powered robotics can automate labor-intensive and hazardous tasks such as precise cutting, material sorting, and contaminant detection, thereby improving worker safety and overall operational speed. This technological adoption addresses critical industry challenges by streamlining complex processes and maximizing resource utilization.

- AI-driven optimization of aircraft dismantling sequences and material separation.

- Enhanced component reusability assessment through predictive analytics.

- Automated sorting and identification of diverse materials (e.g., metals, composites, plastics).

- Improved supply chain management for reclaimed parts, reducing lead times and costs.

- Robotics integration for hazardous and labor-intensive recycling tasks.

Key Takeaways Aircraft Recycling Market Size & Forecast

The Aircraft Recycling Market is poised for substantial growth over the forecast period, driven primarily by the escalating number of aircraft retirements, particularly within commercial aviation, and increasing global emphasis on environmental sustainability. Stakeholders are keen to understand the core factors contributing to this expansion and the potential for new market entrants or technological disruptions. The market's upward trajectory is reinforced by the economic benefits derived from recycling, such as the recovery of high-value materials and the resale of serviceable parts, which offers a cost-effective alternative to new components for MRO operations.

Moreover, the tightening of environmental regulations worldwide is compelling airlines and aircraft owners to adopt more responsible end-of-life practices, further stimulating market demand for recycling services. This regulatory push, coupled with advancements in recycling technologies, is expanding the scope of what can be recycled from an aircraft, including complex composite materials. The forecast indicates sustained growth, positioning the aircraft recycling industry as a vital component of the broader aerospace and defense circular economy, offering significant opportunities for innovation and investment.

- Robust growth projected due to increasing global aircraft fleet retirements.

- Market expansion is significantly influenced by stringent environmental policies and sustainability goals.

- Economic viability of parts re-use and material recovery drives market adoption.

- Technological advancements are broadening the spectrum of recyclable aircraft components.

- Emerging markets present considerable opportunities for new recycling infrastructure development.

Aircraft Recycling Market Drivers Analysis

The Aircraft Recycling Market is propelled by several robust drivers, primarily the burgeoning number of end-of-life aircraft globally. As airline fleets undergo modernization and older generation aircraft reach their operational limits, the volume of aircraft available for dismantling and recycling naturally increases. This trend is particularly evident in the commercial aviation sector, where continuous advancements in aircraft technology lead to accelerated fleet renewal cycles. Furthermore, the economic incentive of recovering valuable materials and components from retired aircraft provides a significant impetus for market growth. The high cost of new aerospace-grade materials and parts makes recycled alternatives highly attractive to maintenance, repair, and overhaul (MRO) organizations and smaller airlines seeking cost-effective solutions.

Environmental regulations and the global push for sustainability also play a critical role in driving the market. Governments and international aviation bodies are increasingly imposing stricter guidelines for waste management and resource conservation, compelling the industry to adopt responsible recycling practices. This regulatory pressure, coupled with a growing corporate social responsibility (CSR) focus among aviation stakeholders, ensures that aircraft disposal is managed through environmentally sound methods. Lastly, technological advancements in dismantling and material recovery processes are making recycling more efficient and economically viable, enhancing the overall attractiveness of aircraft recycling services.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Number of End-of-Life Aircraft | +2.5% | Global, particularly North America, Europe, Asia Pacific | Short to Mid-term (2025-2030) |

| Stringent Environmental Regulations | +2.0% | Europe, North America, select APAC countries | Mid to Long-term (2027-2033) |

| High Demand for Recycled Aircraft Parts and Materials | +1.8% | Global, especially cost-sensitive markets | Short to Mid-term (2025-2030) |

| Technological Advancements in Recycling Processes | +1.5% | Global, especially developed economies | Mid to Long-term (2027-2033) |

| Focus on Circular Economy and Resource Efficiency | +1.2% | Europe, North America, emerging APAC markets | Long-term (2028-2033) |

Aircraft Recycling Market Restraints Analysis

Despite the positive growth trajectory, the Aircraft Recycling Market faces several notable restraints that could temper its expansion. One significant challenge is the inherent complexity of aircraft structures, which are comprised of a vast array of diverse materials, including advanced composites, specialized alloys, and hazardous substances. The intricate design and assembly make the dismantling process highly labor-intensive and require specialized equipment, leading to high operational costs. Furthermore, the presence of hazardous materials such as asbestos, mercury, and various oils necessitates rigorous safety protocols and specialized disposal procedures, adding to the overall expense and complexity of the recycling process. This specialized handling often requires certified facilities and highly trained personnel, which are not universally available.

Another key restraint is the fragmented nature of the supply chain for recycled aircraft parts and materials. Establishing consistent quality standards and ensuring traceability for re-certified components can be challenging, which may hinder their widespread adoption by original equipment manufacturers (OEMs) or tier-one suppliers. Additionally, the fluctuating prices of raw materials can impact the profitability of material recovery, making the economic viability of recycling less predictable. In some regions, a lack of comprehensive regulatory frameworks specifically addressing aircraft end-of-life management and recycling standards can also impede market development, creating uncertainty for investors and operators. The significant initial capital investment required for state-of-the-art recycling facilities also acts as a barrier to entry for new market players.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment and Operational Costs | -1.5% | Global, especially developing regions | Short to Mid-term (2025-2030) |

| Complexities of Material Segregation and Hazardous Waste Handling | -1.2% | Global | Short to Mid-term (2025-2030) |

| Lack of Standardized Certification for Recycled Parts | -1.0% | Global, particularly critical for OEMs | Mid to Long-term (2027-2033) |

| Volatile Raw Material Prices Affecting Recovery Economics | -0.8% | Global | Short-term (2025-2027) |

| Limited Infrastructure and Regulatory Clarity in Certain Regions | -0.7% | Emerging markets, some parts of Asia Pacific and Africa | Mid to Long-term (2027-2033) |

Aircraft Recycling Market Opportunities Analysis

The Aircraft Recycling Market presents several lucrative opportunities for growth and innovation. The increasing global focus on sustainability and the circular economy offers a significant avenue for market expansion. Companies that can demonstrate robust environmental stewardship through advanced recycling processes will likely gain a competitive edge and attract eco-conscious clients. There is a burgeoning demand for materials such as aluminum, titanium, and specialized alloys that can be recovered from aircraft, reducing the reliance on virgin resources and offering cost savings for manufacturers. Furthermore, the re-certification and resale of serviceable aircraft components, ranging from engines to avionics, represent a high-value segment, especially for operators of older aircraft models seeking affordable spare parts.

Geographical expansion into emerging aviation markets, particularly in Asia Pacific, Latin America, and the Middle East, represents a substantial opportunity. These regions are experiencing rapid growth in their air fleets, which will eventually lead to a corresponding increase in end-of-life aircraft. Developing local recycling infrastructure and expertise in these regions can tap into new revenue streams. Moreover, strategic partnerships and collaborations between aircraft recyclers, MRO providers, material processing companies, and even aircraft manufacturers can create integrated service offerings, optimize supply chains for recycled materials, and enhance overall market efficiency. Innovation in recycling technologies, including advanced composite material recovery and robotic dismantling, also presents a strong growth opportunity, enabling higher recovery rates and more environmentally friendly processes.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Advanced Composite Recycling Technologies | +2.0% | Global, particularly North America, Europe | Mid to Long-term (2027-2033) |

| Expansion into Emerging Aviation Markets (e.g., APAC, LATAM) | +1.8% | Asia Pacific, Latin America, Middle East | Mid to Long-term (2027-2033) |

| Increasing Demand for High-Value Component Re-certification and Resale | +1.5% | Global, especially for older fleet operators | Short to Mid-term (2025-2030) |

| Strategic Partnerships Across the Aerospace Value Chain | +1.3% | Global | Short to Mid-term (2025-2030) |

| Military Aircraft Decommissioning and Recycling | +1.0% | North America, Europe, Asia | Long-term (2028-2033) |

Aircraft Recycling Market Challenges Impact Analysis

The Aircraft Recycling Market, while promising, contends with several significant challenges that necessitate strategic navigation. One primary challenge is the highly specialized and capital-intensive nature of aircraft dismantling and material processing. The sheer size and complex engineering of aircraft require purpose-built facilities, advanced machinery, and a highly skilled workforce, leading to substantial upfront investment and ongoing operational costs. This can be a barrier to entry for new players and limit market expansion in regions lacking adequate financial and technological resources. Moreover, ensuring the environmental integrity of the recycling process, especially concerning the handling and disposal of hazardous materials and composites, adds layers of regulatory compliance and cost.

Another significant challenge revolves around market volatility for recovered materials. The profitability of recycling operations can be heavily influenced by fluctuations in global commodity prices for metals like aluminum and titanium. If the market price for these recycled materials drops significantly, it can diminish the economic incentive for comprehensive recycling, potentially leading to less sustainable disposal methods. Furthermore, the intellectual property rights and traceability requirements for re-certified aircraft parts pose complexities. Ensuring that salvaged components meet stringent aviation safety standards and are properly documented for re-entry into the supply chain demands robust quality control and certification processes, which can be time-consuming and expensive. Lastly, the relatively long lifespan of aircraft means that the supply of end-of-life aircraft, while growing, can be somewhat unpredictable compared to other industrial waste streams, making long-term planning challenging for recyclers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment and Operating Costs for Facilities | -1.8% | Global, particularly developing nations | Short to Mid-term (2025-2030) |

| Fluctuations in Commodity Prices for Recycled Materials | -1.4% | Global | Short-term (2025-2027) |

| Ensuring Quality and Traceability of Recertified Parts | -1.1% | Global, critical for MROs and OEMs | Mid to Long-term (2027-2033) |

| Managing Complex Composite Materials and Hazardous Substances | -0.9% | Global | Short to Mid-term (2025-2030) |

| Unpredictable Supply of End-of-Life Aircraft | -0.6% | Global | Long-term (2028-2033) |

Aircraft Recycling Market - Updated Report Scope

This comprehensive report delves into the intricate dynamics of the Aircraft Recycling Market, offering a detailed analysis of its current landscape and future trajectory. It provides an in-depth assessment of market size, growth drivers, restraints, opportunities, and challenges across various segments and key regions. The scope encompasses detailed market estimations for both value and volume, providing strategic insights for stakeholders, investors, and industry participants. Emphasis is placed on identifying emerging trends, technological advancements, and the competitive environment shaping the industry, ensuring a holistic understanding of the market's potential.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 8.5% |

| Number of Pages | 257 |

| Key Trends | |

| Segments Covered | |

| Key Companies Covered | Global Aero Recycling Solutions, Aviation Dismantling Services, Aircraft Demolition & Recovery Inc., Aerospace Materials Reclamation, Jetstream Recycling Group, EcoFlight Decommissioning, Green Sky Aerospace Services, Airframe & Engine Recyclers, Composite Aero Recycling, Specialized Aircraft Dismantlers, SkyRenew Solutions, Valiant Aviation Recovery, AeroCycle Innovations, Flightpath Deconstruction, ReGen Aviation Parts |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Aircraft Recycling Market is comprehensively segmented to provide a granular view of its diverse components and dynamics. This segmentation facilitates a deeper understanding of specific market niches, demand patterns, and growth opportunities across different aircraft types, components, materials, applications, and end-users. Each segment reflects unique operational requirements, material recovery challenges, and value propositions, allowing for targeted strategic planning and investment. The detailed breakdown highlights the significant contributions of various elements to the overall market landscape, from commercial airliners providing the largest volume of end-of-life aircraft to the intricate process of reclaiming high-value avionics.

- By Aircraft Type:

- Commercial Aircraft

- Military Aircraft

- General Aviation

- Business Jets

- By Component:

- Airframe (Fuselage, Wings, Tail)

- Engines (Turbofan, Turboprop)

- Avionics

- Landing Gear

- Interiors (Seats, Galleys)

- Other Components (Electrical Systems, Hydraulics)

- By Material:

- Aluminum Alloys

- Steel Alloys

- Titanium Alloys

- Composites (Carbon Fiber, Fiberglass)

- Plastics

- Others

- By Application:

- Parts Re-use

- Material Recovery (Scrap Metal Sales, Composite Recycling)

- Other Applications

- By End-User:

- Maintenance, Repair, and Overhaul (MRO) Providers

- Aircraft Manufacturers

- Airlines

- Material Processors

- Others

Regional Highlights

- North America: This region holds a significant share of the aircraft recycling market due to a large number of aging commercial and military aircraft, robust regulatory frameworks supporting recycling, and the presence of numerous dismantling and MRO facilities. The emphasis on environmental compliance and a well-established infrastructure for material recovery further solidify its market position.

- Europe: Europe is a key market, driven by stringent environmental regulations, particularly the European Union's directives on end-of-life products and waste management. Innovation in recycling technologies, strong commitment to circular economy principles, and the presence of leading aerospace companies contribute to its growth.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate, fueled by the rapid expansion of air fleets, increasing aircraft retirements, and growing awareness of sustainable practices. Emerging economies in the region are investing in developing recycling infrastructure to meet future demand and comply with evolving environmental norms.

- Latin America: This region is an emerging market for aircraft recycling, characterized by a growing aviation sector and increasing recognition of the economic benefits of component re-use. Development of local capabilities and international partnerships will be crucial for market expansion.

- Middle East and Africa (MEA): While still developing, the MEA region presents opportunities as its aviation sector expands. The focus on establishing sustainable practices and the potential for new recycling facilities, particularly in response to fleet modernization, will drive gradual market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Recycling Market.- Global Aero Recycling Solutions

- Aviation Dismantling Services

- Aircraft Demolition & Recovery Inc.

- Aerospace Materials Reclamation

- Jetstream Recycling Group

- EcoFlight Decommissioning

- Green Sky Aerospace Services

- Airframe & Engine Recyclers

- Composite Aero Recycling

- Specialized Aircraft Dismantlers

- SkyRenew Solutions

- Valiant Aviation Recovery

- AeroCycle Innovations

- Flightpath Deconstruction

- ReGen Aviation Parts

- Waste Management Aviation Solutions

- Sustainable Aero Services

- Phoenix Aviation Recycling

- Apex Aircraft Recovery

- Total Aero Salvage

Frequently Asked Questions

What is aircraft recycling?

Aircraft recycling is the process of safely dismantling retired aircraft, recovering valuable components for re-use or re-certification, and processing materials like metals, plastics, and composites for reprocessing and reintroduction into the supply chain. It aims to minimize waste, reduce environmental impact, and extract economic value from end-of-life aircraft.

Why is aircraft recycling important?

Aircraft recycling is crucial for environmental sustainability by diverting significant waste from landfills, conserving valuable raw materials, and reducing energy consumption associated with producing new materials. Economically, it provides a cost-effective source of spare parts for the MRO market and recovers high-value metals, supporting a circular economy within the aerospace industry.

What are the primary benefits of aircraft recycling?

The key benefits include significant environmental advantages such as reduced carbon footprint and waste. Economically, it offers substantial cost savings through the availability of affordable, re-certified parts and the sale of recovered materials. It also contributes to supply chain resilience by providing alternative sources for critical components and raw materials.

What challenges exist in the aircraft recycling market?

Challenges include the high capital investment required for specialized facilities, the complexity of dismantling multi-material aircraft, safe handling of hazardous materials, and the need for stringent certification of re-used parts. Additionally, the fluctuating market prices for salvaged materials and the unpredictable supply of end-of-life aircraft pose operational difficulties.

What is the future outlook for the aircraft recycling market?

The future outlook is robust, with significant growth projected due to an increasing number of aircraft retirements, tightening environmental regulations, and advancements in recycling technologies. The market is expected to expand globally, driven by the growing demand for sustainable practices and the economic incentives of material and component recovery, especially in emerging aviation markets.