Home Appliance Recycling Market

Home Appliance Recycling Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703913 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Home Appliance Recycling Market Size

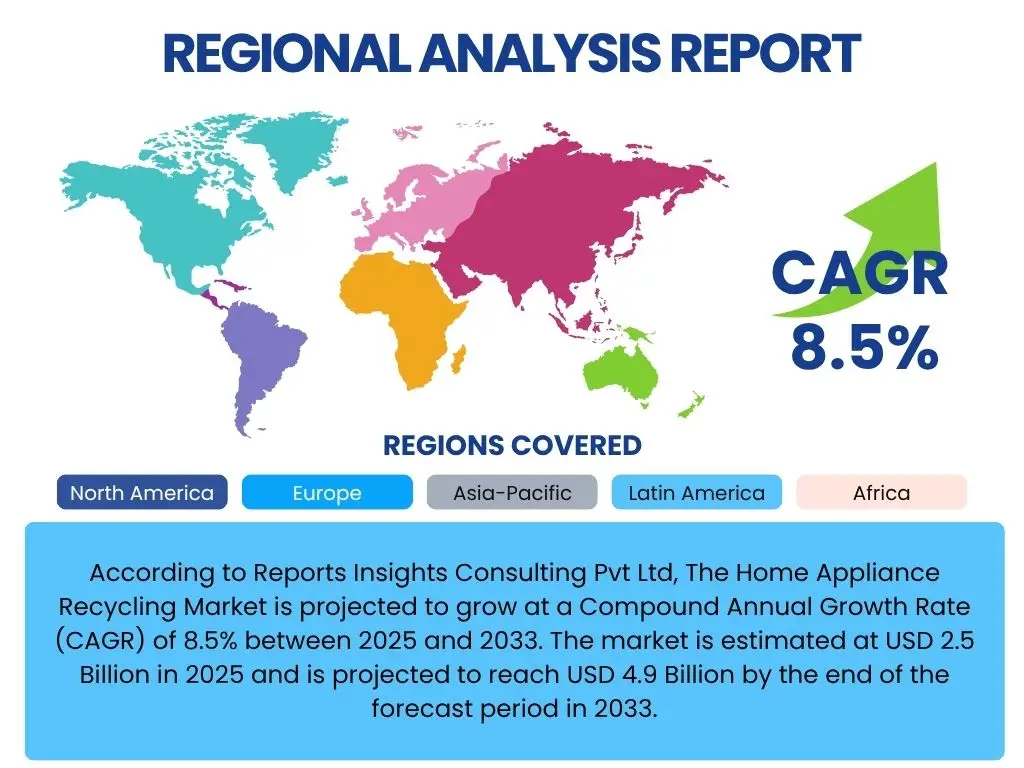

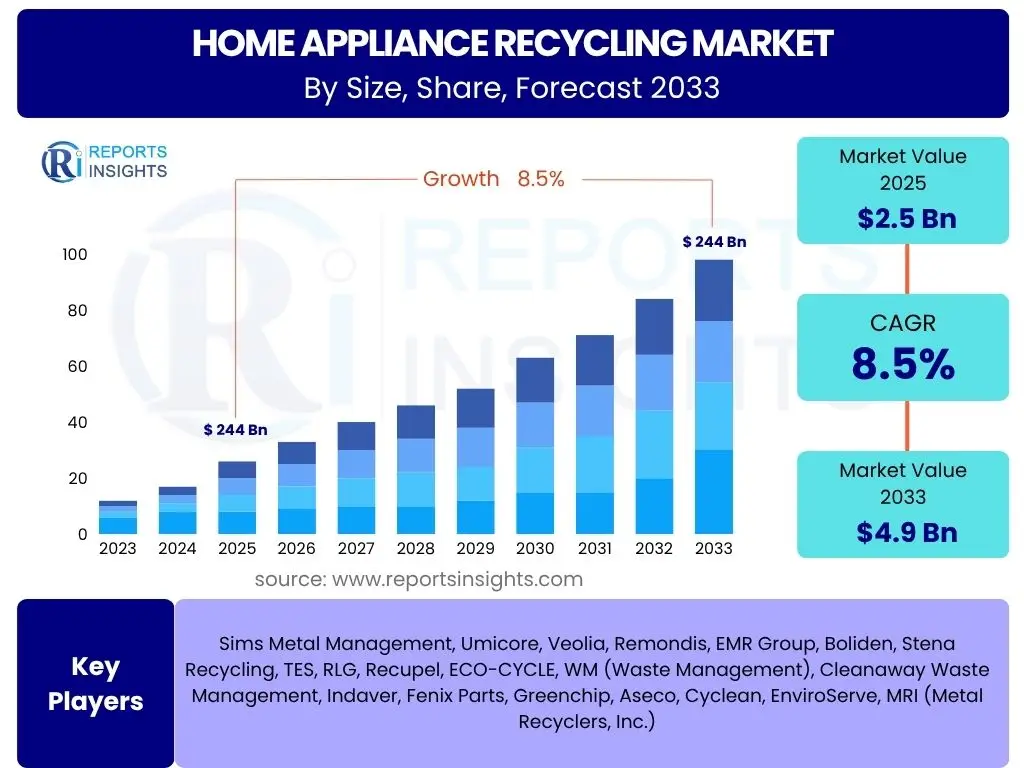

According to Reports Insights Consulting Pvt Ltd, The Home Appliance Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at USD 2.5 Billion in 2025 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Key Home Appliance Recycling Market Trends & Insights

The home appliance recycling market is undergoing significant transformation, driven by a global push towards sustainability and circular economy principles. Common inquiries revolve around how evolving regulatory landscapes, technological advancements, and shifting consumer expectations are reshaping the industry. The market is witnessing increased emphasis on Extended Producer Responsibility (EPR) schemes, which mandate manufacturers to manage the end-of-life cycle of their products, thereby fostering greater investment in recycling infrastructure. Furthermore, innovations in material recovery and pre-processing technologies are enabling higher recycling rates and the extraction of valuable resources, reducing reliance on virgin materials and mitigating environmental impact.

There is a growing consumer awareness regarding responsible disposal of electronic waste (e-waste), including home appliances, which is creating demand for accessible and efficient recycling solutions. This heightened awareness, coupled with the rising volume of discarded appliances due to shorter product lifecycles and increased purchasing power, contributes to the expansion of the recycling market. Companies are exploring advanced logistics and collection methods, including reverse logistics and smart collection points, to streamline the recycling process and improve efficiency across the value chain. The integration of IoT in modern appliances also presents future opportunities for data-driven end-of-life management, although it adds complexity to material separation and data security.

- Circular Economy Integration: Increasing adoption of closed-loop systems and remanufacturing initiatives.

- Advanced Material Recovery: Development of sophisticated techniques for extracting rare earth elements and critical minerals.

- Evolving Regulatory Frameworks: Stricter e-waste and WEEE (Waste Electrical and Electronic Equipment) directives globally.

- Consumer Awareness & Demand: Growing public consciousness regarding environmental impact and responsible disposal.

- Digitalization of Recycling Logistics: Implementation of smart collection, tracking, and sorting systems.

- Partnerships & Collaborations: Increased collaboration between manufacturers, recyclers, and policy makers.

- Modular Design & Repairability: A design trend aiming to simplify disassembly and material recovery.

AI Impact Analysis on Home Appliance Recycling

The integration of Artificial Intelligence (AI) is set to revolutionize the home appliance recycling sector by addressing key operational inefficiencies and enhancing material recovery rates. User queries frequently focus on how AI can automate sorting processes, optimize logistics, and improve the purity of recycled materials. AI-powered vision systems are proving instrumental in rapidly identifying and segregating different types of plastics, metals, and electronic components, which significantly increases throughput and reduces manual labor requirements. This precision sorting minimizes contamination, ensuring higher quality secondary raw materials that are more appealing to manufacturers for integration into new products.

Beyond sorting, AI applications extend to predictive maintenance for recycling machinery, optimizing equipment uptime and reducing operational costs. Furthermore, AI algorithms can analyze vast datasets to forecast appliance disposal trends, allowing recycling facilities to better plan their capacities and resource allocation. Smart logistics, leveraging AI for route optimization and collection point management, can reduce transportation costs and carbon footprints. As home appliances become increasingly "smart" and interconnected, AI will also play a role in managing data wiping and ensuring data security during the recycling process, addressing privacy concerns associated with connected devices.

- AI-Driven Automated Sorting: Enhanced precision and speed in material identification and separation.

- Optimized Logistics & Collection: Intelligent route planning and demand forecasting for efficient pick-up.

- Predictive Maintenance: AI monitoring of recycling equipment to minimize downtime and enhance operational efficiency.

- Improved Material Purity: Higher quality recycled outputs due to advanced identification techniques.

- Data Management & Security: Secure wiping of personal data from smart appliances during disposal.

- Resource Efficiency: Better utilization of labor and machinery through intelligent process control.

Key Takeaways Home Appliance Recycling Market Size & Forecast

The projected growth of the Home Appliance Recycling Market from USD 2.5 Billion in 2025 to USD 4.9 Billion by 2033, at an 8.5% CAGR, underscores its critical role in the global sustainability agenda and circular economy transition. Common user questions highlight the underlying drivers of this growth, primarily focusing on the increasing volume of e-waste, stringent environmental regulations, and a heightened corporate and consumer awareness of ecological impacts. The market's expansion is not merely an environmental imperative but also an economic opportunity, driven by the recovery of valuable materials and the creation of new business models around resource efficiency and secondary raw materials.

This robust growth trajectory is further supported by continuous technological advancements in recycling processes, including automation and AI integration, which enhance efficiency and material recovery rates. The forecast indicates a shift towards more sophisticated and integrated recycling ecosystems, where collaboration across the value chain – from manufacturers to consumers – becomes paramount. Strategic investments in infrastructure development, particularly in emerging economies where appliance penetration is rapidly increasing, will be crucial for sustained market expansion. The market's future will be defined by its ability to overcome logistical challenges, adapt to complex product designs, and capitalize on the growing demand for sustainable resource management solutions.

- Strong Growth Trajectory: Reflects escalating e-waste volumes and the strategic importance of recycling.

- Regulatory Imperative: Policy and legislation are key accelerators for market expansion and compliance.

- Economic Viability: Value recovery from materials drives profitability and new market entrants.

- Technological Advancements: Innovations in sorting, processing, and automation are critical for efficiency.

- Circular Economy Core: Central to global efforts in resource conservation and waste reduction.

- Consumer & Corporate Responsibility: Increasing demand for sustainable practices from both ends of the supply chain.

Home Appliance Recycling Market Drivers Analysis

The Home Appliance Recycling Market is propelled by several potent drivers that underscore its growing significance in the global economy and environmental landscape. The most impactful drivers include the proliferation of stringent e-waste regulations worldwide, particularly Extended Producer Responsibility (EPR) schemes, which legally obligate manufacturers to take responsibility for the end-of-life management of their products. This regulatory push forces industries to invest in recycling infrastructure and develop more sustainable product lifecycles, creating a consistent supply of materials for the recycling sector. Additionally, the rapid increase in global appliance sales, driven by population growth, urbanization, and rising disposable incomes, inevitably leads to a larger volume of end-of-life appliances requiring proper disposal and recycling, thereby expanding the market's addressable volume.

Furthermore, heightened consumer environmental awareness and corporate sustainability initiatives are acting as significant catalysts. Consumers are increasingly seeking environmentally responsible disposal methods for their old appliances, creating demand for accessible and reliable recycling services. Simultaneously, companies are adopting sustainability as a core business strategy, driven by brand reputation, stakeholder pressure, and the pursuit of circular economy models. These initiatives often involve commitments to increasing recycled content in new products and ensuring responsible disposal of old ones. Technological advancements in recycling processes, such as advanced material separation techniques and robotics, are also enhancing the efficiency and economic viability of appliance recycling, making it more attractive for investment and scaling up operations globally.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stricter E-waste Regulations (e.g., WEEE, EPR) | +2.1% | Europe, North America, parts of Asia Pacific | Short-to-Medium Term (2025-2029) |

| Increasing Consumer Environmental Awareness | +1.5% | North America, Europe, Developed Asia | Medium-to-Long Term (2027-2033) |

| Growth in Appliance Sales & Replacement Cycles | +1.8% | Asia Pacific, Latin America, Global | Medium-to-Long Term (2027-2033) |

| Technological Advancements in Recycling Processes | +1.3% | Global | Long Term (2029-2033) |

| Circular Economy Initiatives & Resource Scarcity | +1.8% | Europe, North America | Long Term (2029-2033) |

Home Appliance Recycling Market Restraints Analysis

Despite significant growth drivers, the Home Appliance Recycling Market faces several notable restraints that can impede its full potential. One primary challenge is the high cost associated with collection, transportation, and sophisticated processing of discarded appliances, especially in regions with dispersed populations or inadequate logistics infrastructure. The sheer volume and weight of appliances, coupled with the need for specialized handling of hazardous components, contribute to elevated operational expenses. This economic hurdle can make compliant recycling less competitive compared to informal, often environmentally damaging, disposal methods, particularly in developing economies where regulatory enforcement may be weaker.

Another significant restraint is the lack of standardized recycling infrastructure and inconsistent regulatory frameworks across different countries and even within regions. This disparity creates complexities for multinational manufacturers and recycling companies attempting to implement uniform, efficient recycling programs. Furthermore, the design complexity of modern appliances, incorporating a diverse array of materials, integrated circuits, and hazardous substances, makes disassembly and material separation challenging and costly. Volatility in the prices of recovered raw materials can also pose a financial risk to recyclers, impacting their profitability and willingness to invest in advanced technologies and expanded capacities, thereby slowing market growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Collection & Processing Costs | -1.2% | Global, particularly developing regions | Short-to-Medium Term (2025-2029) |

| Lack of Standardized Infrastructure | -0.9% | Global, varying by region | Medium Term (2027-2031) |

| Complex Appliance Design (Difficult Disassembly) | -1.1% | Global | Long Term (2029-2033) |

| Low Public Awareness & Participation (Informal Disposal) | -0.8% | Asia Pacific, Latin America, Africa | Short-to-Medium Term (2025-2029) |

| Volatility in Recycled Material Prices | -0.7% | Global | Short Term (2025-2027) |

Home Appliance Recycling Market Opportunities Analysis

The Home Appliance Recycling Market presents numerous opportunities for growth and innovation, driven by evolving industry dynamics and technological advancements. One significant opportunity lies in the expansion into emerging markets, particularly in Asia Pacific, Latin America, and Africa, where appliance penetration is rapidly increasing but formal recycling infrastructure is often nascent. Developing robust collection and processing networks in these regions can tap into vast untapped volumes of end-of-life appliances, fostering new economic opportunities and contributing to sustainable development. Furthermore, the increasing focus on the circular economy creates avenues for value-added services such as refurbishment, repair, and remanufacturing of appliance components, extending product lifecycles beyond mere material recovery and generating higher economic returns.

Technological innovation represents another major opportunity, especially in the development and deployment of advanced recycling techniques. This includes robotics for automated dismantling, AI-powered sorting systems for enhanced material purity, and chemical recycling methods for complex plastics. Such advancements can significantly improve efficiency, reduce costs, and enable the recovery of materials previously deemed uneconomical to recycle, including critical raw materials and rare earth elements from electronic components. Strategic partnerships between appliance manufacturers, recyclers, technology providers, and waste management companies can also unlock new business models, facilitate knowledge transfer, and streamline the entire reverse logistics chain, fostering a more integrated and efficient recycling ecosystem.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Markets (Infrastructure Development) | +1.9% | Asia Pacific, Latin America, Africa | Long Term (2029-2033) |

| Development of Advanced Recycling Technologies | +1.6% | Global | Medium-to-Long Term (2027-2033) |

| Strategic Partnerships & EPR Implementation | +1.4% | Europe, North America, emerging economies | Medium Term (2027-2031) |

| Value Recovery from Critical Raw Materials (CRMs) | +1.5% | Global | Long Term (2029-2033) |

| Emergence of Circular Economy Business Models (Repair/Remanufacture) | +1.3% | Europe, North America | Medium-to-Long Term (2027-2033) |

Home Appliance Recycling Market Challenges Impact Analysis

The Home Appliance Recycling Market faces several critical challenges that demand innovative solutions and collaborative efforts. One pervasive challenge is the widespread practice of illegal dumping and informal recycling, particularly in developing regions, which undermines formal recycling efforts and leads to significant environmental pollution and health hazards. These informal channels often lack proper safeguards for handling hazardous materials, resulting in the release of toxins and the inefficient recovery of valuable resources. Additionally, the increasing complexity and rapid evolution of appliance technologies, especially smart appliances embedded with IoT capabilities, pose significant challenges for recyclers. This complexity makes safe and effective data wiping crucial, alongside the intricate task of dismantling products containing diverse and often bonded materials.

Another key challenge is the lack of harmonized global standards for design for recycling, which complicates material separation and processing for multinational recycling operations. Variances in product design across manufacturers mean recyclers must adapt to a wide array of appliance constructions, increasing operational complexity and costs. Furthermore, consumer participation remains a persistent challenge; despite growing awareness, convenient and incentivized disposal options are not always available or adequately promoted, leading to appliances being improperly stored or discarded. Overcoming these challenges will require robust regulatory enforcement, technological breakthroughs in de-manufacturing, and widespread public education and engagement campaigns to foster a truly circular economy for home appliances.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Illegal Dumping & Informal Recycling | -1.5% | Asia Pacific, Latin America, Africa | Long Term (2029-2033) |

| Complex Material Composition & Design for Recycling | -1.0% | Global | Long Term (2029-2033) |

| Data Security & Privacy Concerns (Smart Appliances) | -0.8% | Global | Medium Term (2027-2031) |

| Lack of Consistent Consumer Participation & Incentives | -0.7% | Global | Short-to-Medium Term (2025-2029) |

| High Capital Investment for Advanced Facilities | -0.9% | Global | Short-to-Medium Term (2025-2029) |

Home Appliance Recycling Market - Updated Report Scope

This report provides a comprehensive analysis of the Home Appliance Recycling Market, offering in-depth insights into its size, growth trajectory, key trends, and the strategic landscape from 2025 to 2033. The scope encompasses detailed market segmentation, regional analyses, and competitive profiling of leading industry players. It delves into the factors driving market expansion, including regulatory pressures and technological advancements, while also identifying significant restraints and emerging opportunities. The report further examines the impact of artificial intelligence on recycling processes and outlines the challenges faced by the industry, providing a holistic view for stakeholders seeking to understand and capitalize on the market's evolving dynamics.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 8.5% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Sims Metal Management, Umicore, Veolia, Remondis, EMR Group, Boliden, Stena Recycling, TES, RLG, Recupel, ECO-CYCLE, WM (Waste Management), Cleanaway Waste Management, Indaver, Fenix Parts, Greenchip, Aseco, Cyclean, EnviroServe, MRI (Metal Recyclers, Inc.) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Home Appliance Recycling Market is meticulously segmented to provide a detailed understanding of its diverse components and drivers. This segmentation allows for precise analysis of market dynamics across various dimensions, including the types of appliances recycled, the materials recovered, the end-user categories contributing to the waste stream, and the specific services involved in the recycling process. Such granular insights are crucial for identifying niche market opportunities, developing targeted recycling strategies, and understanding regional disparities in demand and infrastructure.

Analyzing the market by appliance type reveals the different processing requirements and material compositions, from large cooling units to small kitchen gadgets. Material type segmentation highlights the economic value chains for recovered metals, plastics, and other valuable components, influencing investment in specific processing technologies. Furthermore, categorizing by end-user and service type helps to identify the primary sources of appliance waste and the prevalent business models in the recycling industry, including collection, logistics, and advanced material recovery, thereby providing a comprehensive view of the market's structure and operational landscape.

- By Appliance Type:

- Large Appliances (Refrigerators, Freezers, Washing Machines, Dryers, Dishwashers, Ovens, Stoves, Air Conditioners)

- Small Appliances (Microwaves, Toasters, Coffee Makers, Blenders, Vacuum Cleaners, Hair Dryers, Irons, Electric Kettles)

- Cooling & Heating Appliances (Heat Pumps, Water Heaters, Room Heaters)

- By Material Type:

- Metals (Ferrous, Non-Ferrous, Precious Metals)

- Plastics (PP, ABS, PS, PVC, Others)

- Glass

- Electronic Components (PCBs, Capacitors, Resistors)

- Refrigerants & Insulating Materials

- Other Materials (Rubber, Wood, Textiles)

- By End-User:

- Residential

- Commercial

- Industrial

- By Service Type:

- Collection

- Transportation & Logistics

- Dismantling & Shredding

- Material Separation & Processing

- Refurbishment & Re-use

- By Source of Waste:

- Household WEEE

- Commercial WEEE

- Industrial WEEE

Regional Highlights

- North America: This region represents a mature market with established e-waste regulations and high consumer awareness. The U.S. and Canada are characterized by significant volumes of appliance waste, driven by high consumption rates and relatively short product lifecycles. Strong regulatory frameworks and corporate sustainability goals are propelling investments in advanced recycling technologies and infrastructure expansion.

- Europe: A pioneering region in circular economy initiatives and WEEE (Waste Electrical and Electronic Equipment) directives, Europe boasts some of the highest recycling rates globally. Countries like Germany, France, and the UK have well-developed collection and processing networks, supported by robust Extended Producer Responsibility (EPR) schemes. Innovation in material recovery and resource efficiency is a key focus here.

- Asia Pacific (APAC): The fastest-growing market for home appliances, APAC presents immense opportunities for recycling due to its large population and increasing appliance penetration. While some countries like Japan and South Korea have advanced recycling systems, others, particularly developing nations such as India and China, are still building formal infrastructure, facing challenges from informal recycling and illegal dumping. Regulatory frameworks are rapidly evolving across the region.

- Latin America: This region is an emerging market for home appliance recycling, characterized by growing economic development and increasing demand for appliances. While formal recycling infrastructure is still nascent in many areas, rising environmental awareness and the implementation of initial e-waste regulations are gradually fostering market development. Collaborative efforts with international partners are crucial for capacity building.

- Middle East and Africa (MEA): The MEA region is in the early stages of developing its home appliance recycling market. Appliance penetration is steadily increasing, leading to a growing volume of e-waste. Challenges include limited formal collection systems, a reliance on informal recycling, and the need for significant investment in infrastructure. However, rising environmental consciousness and government initiatives to address e-waste are creating new opportunities for growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Appliance Recycling Market.- Sims Metal Management

- Umicore

- Veolia

- Remondis

- EMR Group

- Boliden

- Stena Recycling

- TES

- RLG

- Recupel

- ECO-CYCLE

- WM (Waste Management)

- Cleanaway Waste Management

- Indaver

- Fenix Parts

- Greenchip

- Aseco

- Cyclean

- EnviroServe

- MRI (Metal Recyclers, Inc.)

Frequently Asked Questions

What is home appliance recycling?

Home appliance recycling involves the systematic collection, dismantling, and processing of end-of-life household appliances to recover valuable materials and safely dispose of hazardous components. This process aims to minimize waste sent to landfills, conserve natural resources, reduce energy consumption, and prevent environmental pollution by reintroducing materials into the production cycle.

Why is home appliance recycling important?

Home appliance recycling is crucial for environmental protection, resource conservation, and economic sustainability. It prevents hazardous substances from contaminating soil and water, reduces greenhouse gas emissions associated with manufacturing from virgin materials, lessens landfill burden, and recovers valuable resources like metals and plastics, contributing to the circular economy and creating green jobs.

What are the main challenges in home appliance recycling?

Key challenges include high collection and processing costs, the complex and diverse material composition of modern appliances, a lack of standardized recycling infrastructure globally, the presence of hazardous materials requiring specialized handling, and low consumer participation due to insufficient awareness or inconvenient disposal options. Illegal dumping and informal recycling further undermine formal efforts.

How does AI contribute to appliance recycling?

Artificial intelligence enhances appliance recycling through automated sorting systems that rapidly and accurately identify different materials, improving purity and efficiency. AI also optimizes logistics for collection and transportation, predicts equipment maintenance needs, and helps in the secure wiping of data from smart appliances, streamlining operations and maximizing resource recovery.

What future trends will shape the home appliance recycling market?

Future trends shaping the market include stricter global e-waste regulations, the widespread adoption of circular economy principles by manufacturers, advancements in material science enabling easier recycling, increased integration of AI and robotics in recycling facilities, and a growing consumer demand for sustainable product lifecycles and responsible disposal solutions.