Agricultural Crop Insurance Market

Agricultural Crop Insurance Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705863 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Agricultural Crop Insurance Market Size

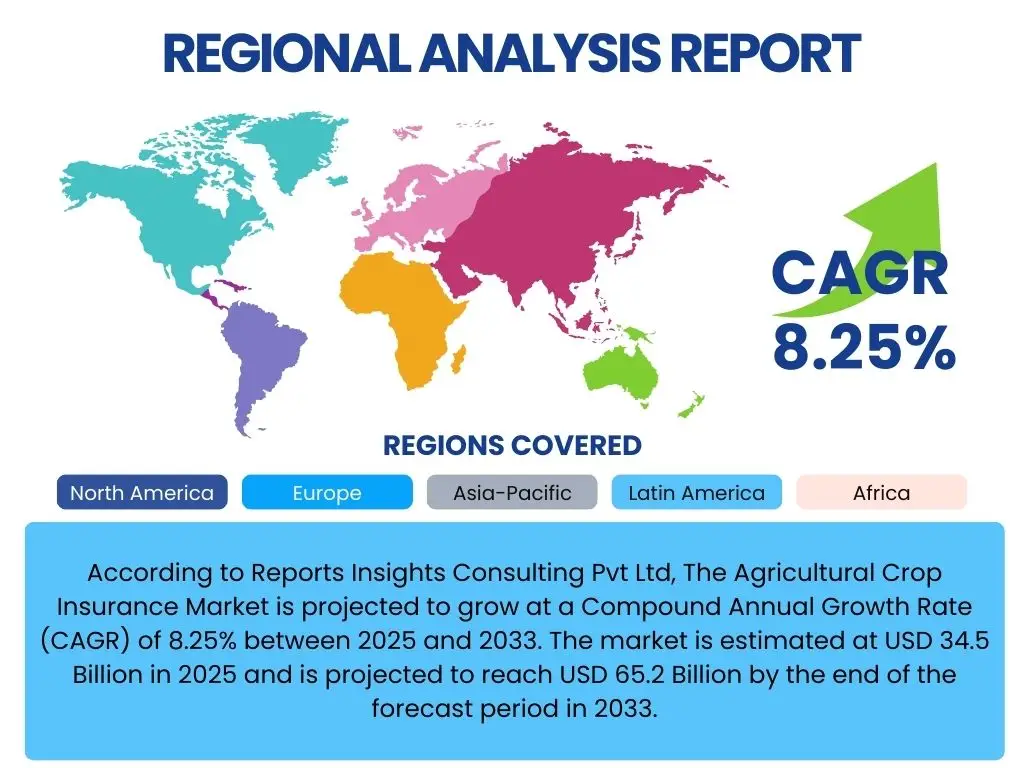

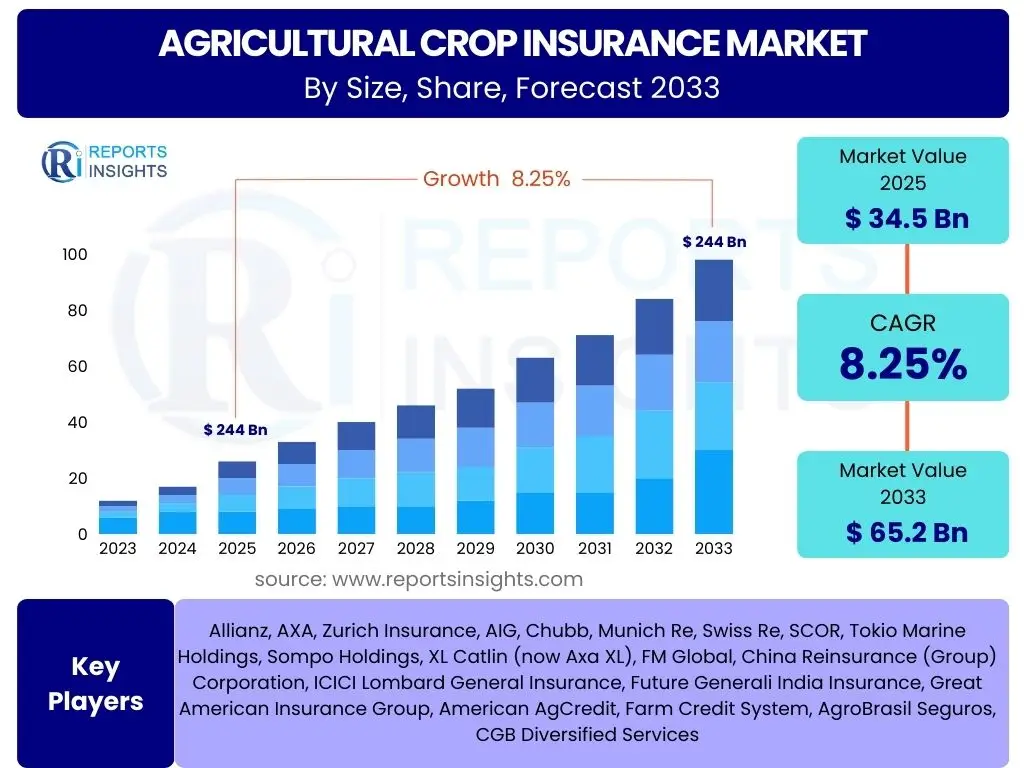

According to Reports Insights Consulting Pvt Ltd, The Agricultural Crop Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.25% between 2025 and 2033. The market is estimated at USD 34.5 Billion in 2025 and is projected to reach USD 65.2 Billion by the end of the forecast period in 2033.

Key Agricultural Crop Insurance Market Trends & Insights

The agricultural crop insurance market is currently shaped by a confluence of evolving environmental conditions, technological advancements, and shifting policy landscapes. A primary trend involves the increasing frequency and intensity of extreme weather events, which elevates the risk profile for farmers globally and, in turn, drives the demand for robust insurance solutions. This heightened climate volatility is prompting a re-evaluation of traditional insurance models, pushing for more dynamic and responsive coverage options that can adapt to rapid changes in environmental risk.

Another significant insight pertains to the accelerating adoption of technology within the agricultural sector. Digital platforms, remote sensing, and advanced data analytics are transforming how risks are assessed, policies are underwritten, and claims are processed. This technological integration enhances accuracy, reduces operational costs, and facilitates more tailored insurance products, allowing for better risk management and greater financial stability for farmers. Furthermore, there is a growing trend towards parametric insurance, which simplifies the claims process by triggering payouts based on pre-defined weather indices rather than actual loss assessments, offering quicker relief to affected farmers.

The market also observes a consistent increase in government support and subsidies aimed at promoting agricultural insurance adoption. Governments worldwide recognize the critical role of crop insurance in ensuring food security and stabilizing rural economies. This support often comes in the form of premium subsidies, framework development, and awareness campaigns, which are crucial for expanding market penetration, particularly among smallholder farmers in developing regions. Public-private partnerships are also becoming more prevalent, leveraging the strengths of both sectors to create more resilient and accessible insurance programs.

- Increasing climate change volatility and extreme weather events drive demand for comprehensive coverage.

- Rapid technological integration, including remote sensing, AI, and big data analytics, enhances risk assessment and claims processing.

- Growing popularity of parametric insurance solutions for quicker payouts based on objective triggers.

- Rising government support and subsidies promote market penetration and farmer adoption.

- Development of localized and region-specific insurance products to address diverse agricultural risks.

- Shift towards holistic risk management solutions integrating insurance with advisory services.

AI Impact Analysis on Agricultural Crop Insurance

The integration of Artificial Intelligence (AI) into the agricultural crop insurance sector is fundamentally transforming traditional operational paradigms, addressing long-standing challenges related to risk assessment, fraud detection, and claims processing. Users are keen to understand how AI can improve the accuracy of predictions regarding crop yield losses due to various perils, thus enabling insurers to develop more precise and equitable premium structures. The ability of AI to analyze vast datasets, including historical weather patterns, soil conditions, satellite imagery, and market prices, allows for a more granular understanding of agricultural risks than ever before, moving away from generalized assessments to highly individualized risk profiles.

Furthermore, there is significant interest in how AI can streamline and automate the claims process. Traditionally, claims assessment can be time-consuming and labor-intensive, often requiring on-site inspections. AI-powered image recognition and drone technology, combined with machine learning algorithms, can quickly verify crop damage, assess the extent of losses, and even predict potential future impacts. This not only accelerates payout times, providing farmers with much-needed liquidity swiftly but also reduces administrative overheads for insurance providers, improving overall efficiency and customer satisfaction.

Beyond operational efficiencies, users also anticipate AI's role in fraud prevention and the development of more innovative insurance products. AI algorithms can identify anomalies and suspicious patterns in claims data, significantly reducing fraudulent activities. Moreover, by leveraging predictive analytics, AI can facilitate the creation of dynamic policies that adjust in real-time to changing environmental conditions or market fluctuations. This enables insurers to offer hyper-personalized coverage options, such as micro-insurance for small farmers or index-based policies linked to specific weather variables, ultimately enhancing the resilience of agricultural systems against unforeseen events.

- Enhanced risk assessment through predictive analytics leveraging vast agricultural and climatic datasets.

- Automated and accelerated claims processing using satellite imagery, drone technology, and machine learning.

- Improved fraud detection capabilities by identifying anomalous patterns in claims data.

- Development of personalized and dynamic insurance policies based on real-time data.

- Optimization of pricing models, leading to more accurate and fair premiums.

- Facilitation of parametric insurance products by reliably monitoring weather and environmental indices.

Key Takeaways Agricultural Crop Insurance Market Size & Forecast

Analysis of the agricultural crop insurance market size and forecast reveals a robust and expanding sector, primarily driven by the escalating challenges posed by climate change and the increasing global demand for food security. A key takeaway is the consistent growth trajectory, indicating that agricultural insurance is no longer a niche product but a critical component of modern agricultural risk management strategies. The projected substantial increase in market value signifies a heightened awareness among farmers regarding the financial protections offered by insurance against unpredictable weather events and market fluctuations, moving beyond traditional risk mitigation practices.

Another significant insight derived from the market forecast is the pivotal role of technological adoption in scaling the market. The integration of advanced analytics, remote sensing, and AI is not only making insurance products more efficient and accessible but also expanding the scope of what can be insured and how quickly claims can be settled. This technological push is expected to unlock new market segments and improve the viability of offering insurance in previously underserved regions, making coverage more inclusive and reflective of diverse agricultural practices.

The forecast also underscores the continued importance of governmental support and public-private partnerships in fostering market growth. Subsidies and policy frameworks established by governments play a crucial role in reducing premium burdens for farmers, thereby stimulating adoption rates. The synergistic efforts between state entities and private insurers are instrumental in building resilient agricultural systems that can withstand future shocks. This collaborative approach ensures that insurance solutions are both innovative and widely available, contributing to the long-term sustainability and stability of the global agricultural sector.

- Sustained and significant market growth is anticipated, driven by climate volatility and increasing food security concerns.

- Technological advancements, including AI and remote sensing, are crucial enablers of market expansion and efficiency.

- Governmental support and public-private partnerships are foundational to expanding market reach and farmer adoption.

- The market is shifting towards more sophisticated, data-driven, and customized insurance products.

- Increased awareness among farmers regarding the necessity of financial protection against agricultural risks.

Agricultural Crop Insurance Market Drivers Analysis

The agricultural crop insurance market is propelled by several potent drivers that reflect the evolving landscape of global agriculture. Foremost among these is the escalating impact of climate change, manifesting as increased frequency and severity of extreme weather events such as droughts, floods, hailstorms, and unseasonal frosts. These unpredictable climatic patterns pose significant threats to crop yields, making farmers more vulnerable to financial losses and consequently driving their demand for comprehensive insurance solutions to mitigate these risks and ensure income stability.

Secondly, the growing global population necessitates enhanced food security, placing immense pressure on agricultural productivity. Governments and international organizations are increasingly recognizing crop insurance as a vital tool to stabilize agricultural output and protect farmers' livelihoods, thereby ensuring a consistent food supply. This recognition often translates into supportive policies, subsidies, and regulatory frameworks that encourage the adoption of crop insurance, making it more accessible and affordable for farmers across various scales and regions.

Furthermore, advancements in agricultural technology and data analytics are significantly contributing to market expansion. Technologies such as satellite imaging, drones, IoT sensors, and AI-driven platforms provide precise data on weather patterns, soil health, and crop conditions, enabling insurers to develop more accurate risk assessments, tailor-made policies, and efficient claims processing. This technological integration not only enhances the effectiveness of insurance products but also builds greater trust and transparency between insurers and policyholders, stimulating market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Climate Change Volatility | +1.8% | Global, particularly drought-prone (e.g., Africa, Australia) & flood-prone (e.g., Asia) regions | Short to Long-term (2025-2033) |

| Rising Awareness and Farmer Education | +1.2% | Emerging economies (e.g., India, Brazil, African nations) | Medium-term (2026-2030) |

| Government Support and Subsidies | +1.5% | Major agricultural economies (e.g., USA, EU, China, India) | Short to Long-term (2025-2033) |

| Technological Advancements (AI, Remote Sensing) | +1.3% | Developed and rapidly developing agricultural markets (e.g., North America, Europe, China) | Medium to Long-term (2027-2033) |

| Growing Need for Food Security | +1.0% | Global, especially regions with high population growth | Long-term (2028-2033) |

Agricultural Crop Insurance Market Restraints Analysis

Despite significant growth potential, the agricultural crop insurance market faces several notable restraints that can impede its expansion. One primary challenge is the high premium cost associated with comprehensive crop insurance policies, which can be prohibitive for many farmers, particularly smallholder farmers in developing regions who operate on tight margins. The perceived value versus the direct cost often deters farmers from adopting or renewing policies, especially if they have not experienced significant losses in recent seasons, leading to low uptake rates.

Another significant restraint is the lack of adequate awareness and understanding among farmers regarding the benefits, terms, and conditions of crop insurance. Many farmers, particularly in remote or less developed agricultural areas, may not fully grasp how insurance can mitigate financial risks or how to navigate the claims process effectively. This knowledge gap, combined with a general skepticism towards financial products, creates a barrier to broader market penetration, requiring extensive educational initiatives and localized outreach efforts.

Furthermore, the complexities involved in risk assessment and data collection, particularly in diverse agricultural landscapes, pose a challenge. Accurately assessing individual farm-level risks, verifying losses, and managing claims can be resource-intensive for insurers. This complexity can lead to delays in payouts, disputes, and higher administrative costs, which can in turn affect the affordability and attractiveness of insurance products for farmers. The reliance on traditional methods for loss assessment in many regions also contributes to these inefficiencies, highlighting the need for greater technological integration.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Premium Costs for Farmers | -1.5% | Global, particularly developing and emerging economies | Short to Medium-term (2025-2029) |

| Lack of Awareness and Understanding Among Farmers | -1.0% | Rural and less developed agricultural regions (e.g., parts of Africa, Southeast Asia) | Long-term (2025-2033) |

| Complexities in Risk Assessment and Data Collection | -0.8% | Regions with diverse topography and fragmented landholdings (e.g., parts of India, Europe) | Medium-term (2026-2030) |

| Moral Hazard and Adverse Selection Issues | -0.7% | All regions, but more pronounced in nascent markets | Short to Medium-term (2025-2029) |

Agricultural Crop Insurance Market Opportunities Analysis

The agricultural crop insurance market is ripe with opportunities that can significantly accelerate its growth and penetration. One major avenue lies in the expansion of parametric insurance products. These innovative policies pay out based on pre-defined triggers (e.g., rainfall levels, temperature extremes) rather than actual crop loss assessments, simplifying the claims process and enabling faster payouts. The transparency and efficiency of parametric solutions make them particularly appealing in regions where traditional loss assessment is challenging or time-consuming, offering a scalable model for broader market reach and enhanced farmer satisfaction.

Another compelling opportunity resides in the development and proliferation of micro-insurance solutions, specifically tailored for smallholder farmers in emerging and developing economies. These farmers, often operating with limited resources and facing high vulnerability to climate shocks, represent a vast underserved market. Designing affordable, simplified, and accessible micro-insurance products, often delivered through mobile platforms or local cooperatives, can unlock significant growth by providing essential financial protection to a demographic that traditionally lacks access to formal insurance mechanisms. Public-private partnerships are key in subsidizing and distributing these products effectively.

Furthermore, the integration of advanced digital technologies presents extensive opportunities for innovation and efficiency. Utilizing blockchain for transparent policy management and claims, integrating IoT devices for real-time farm monitoring, and leveraging advanced AI for predictive modeling can transform the entire insurance value chain. These technologies not only reduce operational costs and mitigate fraud but also enable the creation of highly customized, dynamic policies that adapt to changing farm conditions. This technological leap can attract new players, foster competition, and ultimately drive greater market efficiency and farmer engagement.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Parametric Insurance | +1.6% | Global, particularly Asia Pacific, Latin America, Africa | Short to Medium-term (2025-2030) |

| Expansion of Micro-insurance for Smallholder Farmers | +1.4% | Emerging and developing economies (e.g., Sub-Saharan Africa, South Asia) | Medium to Long-term (2027-2033) |

| Leveraging Blockchain for Transparency and Efficiency | +1.0% | Global, particularly in claims management and policy tracking | Long-term (2028-2033) |

| Integration of IoT and Real-time Monitoring | +1.1% | Developed agricultural markets (e.g., North America, Europe) | Medium to Long-term (2027-2033) |

| Public-Private Partnerships and Collaborations | +1.3% | All regions, especially for policy development and risk sharing | Short to Long-term (2025-2033) |

Agricultural Crop Insurance Market Challenges Impact Analysis

The agricultural crop insurance market faces several inherent challenges that require innovative solutions to overcome. One significant hurdle is the accurate modeling of climate risks and their specific impacts on diverse agricultural ecosystems. The unpredictable nature of extreme weather events, coupled with localized variations in climate patterns, makes it complex for insurers to precisely quantify risks, develop appropriate pricing models, and ensure the long-term solvency of insurance schemes. This difficulty in accurate risk assessment can lead to either underpricing (resulting in insurer losses) or overpricing (leading to low farmer adoption).

Another critical challenge is the issue of data availability and reliability, particularly in developing regions. Robust and consistent historical data on crop yields, weather patterns, soil conditions, and pest outbreaks are essential for effective risk underwriting and claims validation. However, such comprehensive data often lack standardization or are simply unavailable in many agricultural areas, hindering the development of precise insurance products and increasing the operational costs associated with data collection and verification. This data gap can limit the scalability of advanced, data-driven insurance solutions.

Furthermore, the market grapples with the challenge of moral hazard and adverse selection. Moral hazard occurs when insured farmers might take fewer precautions against crop failure because they are insured, potentially increasing losses. Adverse selection arises when only farmers with a higher likelihood of experiencing losses opt for insurance, skewing the risk pool. Effectively managing these behavioral challenges requires sophisticated policy design, monitoring mechanisms, and community engagement to ensure the sustainability and fairness of insurance programs, preventing significant financial drains on insurers and maintaining market integrity.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Accurate Climate Risk Modeling | -1.2% | Global, particularly for nascent and rapidly changing climatic zones | Short to Long-term (2025-2033) |

| Data Availability and Reliability | -1.0% | Developing economies (e.g., Africa, parts of Asia and Latin America) | Medium-term (2026-2030) |

| Moral Hazard and Adverse Selection | -0.9% | All regions, especially during policy design and implementation | Short to Medium-term (2025-2029) |

| Farmer Trust and Adoption Rates | -0.8% | Regions with limited prior insurance experience or unfavorable past experiences | Long-term (2028-2033) |

| Regulatory Framework Complexity | -0.7% | Countries with evolving or fragmented agricultural policies | Medium-term (2026-2030) |

Agricultural Crop Insurance Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Agricultural Crop Insurance Market, examining its historical performance, current dynamics, and future projections from 2019 to 2033. It offers crucial insights into market size, growth drivers, restraints, opportunities, and challenges, leveraging extensive market research and data analytics. The report segments the market by product type, coverage, distribution channel, and farm size, providing a granular view of market trends across different categories. It also features a detailed regional analysis and profiles of key industry players, offering a holistic perspective on the competitive landscape and strategic developments within the agricultural crop insurance sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 34.5 Billion |

| Market Forecast in 2033 | USD 65.2 Billion |

| Growth Rate | 8.25% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Allianz, AXA, Zurich Insurance, AIG, Chubb, Munich Re, Swiss Re, SCOR, Tokio Marine Holdings, Sompo Holdings, XL Catlin (now Axa XL), FM Global, China Reinsurance (Group) Corporation, ICICI Lombard General Insurance, Future Generali India Insurance, Great American Insurance Group, American AgCredit, Farm Credit System, AgroBrasil Seguros, CGB Diversified Services |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The agricultural crop insurance market is comprehensively segmented to provide a detailed understanding of its diverse facets and varying dynamics across different parameters. This segmentation enables a granular analysis of market demand, product preferences, distribution channels, and farmer specific needs, aiding stakeholders in strategic decision-making and product development. Each segment plays a crucial role in defining the overall market structure and future growth trajectories, reflecting the diverse approaches to agricultural risk management globally.

By dissecting the market across these key segments, the report offers valuable insights into consumer behavior, technological adoption rates, and regional preferences. Understanding these segmentations helps identify high-growth areas, assess competitive landscapes, and pinpoint specific opportunities for market penetration and innovation. For instance, the distinction between yield-based and revenue-based coverage highlights differing risk priorities for farmers, while the breakdown by farm size underscores the need for tailored products for smallholder versus large commercial operations.

- Product Type:

- Multi-Peril Crop Insurance (MPCI): Comprehensive coverage against a broad range of natural perils.

- Crop-Hail Insurance: Specific coverage against hail damage, often supplemental to MPCI.

- Named Peril Crop Insurance: Covers only specified risks, offering more affordable but limited protection.

- Others: Includes specialized covers such as livestock or aquaculture insurance.

- Coverage:

- Yield-based: Compensates farmers for actual yield losses below a guaranteed level.

- Revenue-based: Protects against declines in revenue due to yield loss or price changes.

- Weather-based (Index-based): Payouts triggered by specific weather parameters (e.g., rainfall, temperature).

- Area-based: Insurance based on average yield or revenue of a geographical area.

- Distribution Channel:

- Direct Sales: Insurers sell policies directly to farmers.

- Agents/Brokers: Independent agents or brokers facilitate policy sales.

- Bancassurance: Banks offer insurance products to their agricultural clients.

- Online Platforms: Digital platforms and mobile applications for policy purchase and management.

- Farm Size:

- Small Farms: Characterized by limited landholdings and resources, often in emerging economies.

- Medium Farms: Intermediate size farms with moderate resources and commercial operations.

- Large Farms: Extensive commercial operations, typically found in developed agricultural regions.

Regional Highlights

- North America: Dominates the market, largely driven by comprehensive government-backed programs like the Federal Crop Insurance Program in the USA. High adoption of advanced technologies and substantial government subsidies contribute to its market maturity and stability. Canada also shows strong growth due to increasing climate volatility and proactive risk management by farmers.

- Europe: Characterized by robust regulatory frameworks and a focus on sustainable agriculture. Countries like Germany, France, Italy, and Spain show significant uptake, supported by EU agricultural policies and subsidies. Emphasis is on protecting against yield losses due to extreme weather and promoting climate-resilient farming.

- Asia Pacific (APAC): Expected to witness the fastest growth due to a large agricultural base, increasing farmer awareness, and significant government initiatives (e.g., India's Pradhan Mantri Fasal Bima Yojana, China's extensive agricultural insurance system). Climate vulnerability and a vast number of smallholder farmers drive demand for micro-insurance and parametric solutions in this region.

- Latin America: Exhibits promising growth, particularly in agricultural powerhouses like Brazil and Argentina. The region faces substantial climate risks, leading to rising demand for insurance products. Development of tailored policies and improving distribution networks are key growth factors.

- Middle East and Africa (MEA): Represents an emerging market with significant untapped potential. While currently smaller, increasing recognition of food security challenges, limited irrigation, and high climate vulnerability are driving interest in crop insurance. Pilot programs and international collaborations are paving the way for future expansion, especially in countries like South Africa and Egypt.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Crop Insurance Market.- Allianz

- AXA

- Zurich Insurance

- AIG

- Chubb

- Munich Re

- Swiss Re

- SCOR

- Tokio Marine Holdings

- Sompo Holdings

- XL Catlin (now Axa XL)

- FM Global

- China Reinsurance (Group) Corporation

- ICICI Lombard General Insurance

- Future Generali India Insurance

- Great American Insurance Group

- American AgCredit

- Farm Credit System

- AgroBrasil Seguros

- CGB Diversified Services

Frequently Asked Questions

Analyze common user questions about the Agricultural Crop Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is agricultural crop insurance?

Agricultural crop insurance is a financial tool designed to protect farmers against financial losses resulting from yield or revenue reduction due to natural perils such as adverse weather, pests, diseases, or market price fluctuations. It provides compensation to farmers, stabilizing their income and ensuring agricultural sustainability.

Why is agricultural crop insurance important?

Crop insurance is crucial for mitigating the significant financial risks faced by farmers from unpredictable events like droughts, floods, or price drops. It ensures income stability, supports farm viability, reduces reliance on disaster aid, and encourages investment in agricultural productivity, contributing to overall food security.

How does climate change affect crop insurance?

Climate change intensifies extreme weather events, making crop losses more frequent and severe. This increases the demand for crop insurance but also raises the cost and complexity of risk assessment for insurers, driving innovation in data-driven and parametric insurance solutions to adapt to new risk profiles.

What are the benefits of parametric crop insurance?

Parametric crop insurance offers several benefits, including rapid payouts triggered by pre-defined weather indices (e.g., rainfall, temperature) rather than direct loss assessment. This simplifies the claims process, reduces administrative costs, increases transparency, and provides quicker financial relief to farmers.

Which regions are leading in crop insurance adoption?

North America, particularly the USA, leads in crop insurance adoption due to established government programs and high awareness. Asia Pacific, especially China and India, is experiencing rapid growth driven by large agricultural bases and increasing government support, positioning it as a key growth region.