Extreme Sport Travel Insurance Market

Extreme Sport Travel Insurance Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705844 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Extreme Sport Travel Insurance Market Size

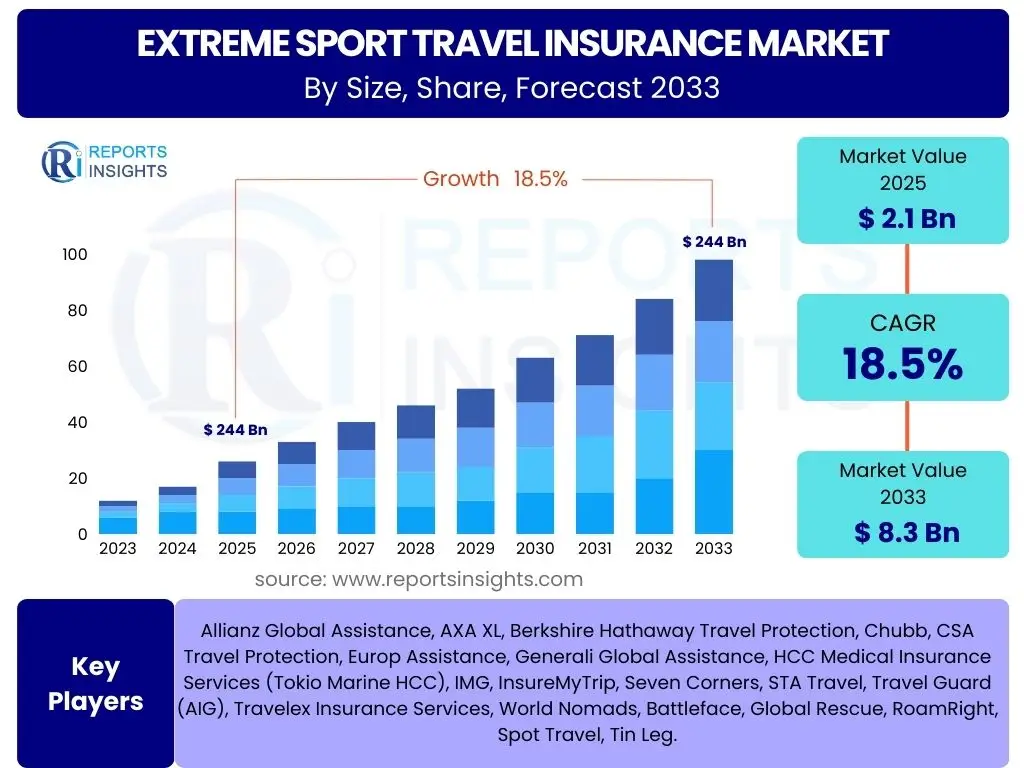

According to Reports Insights Consulting Pvt Ltd, The Extreme Sport Travel Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 2.1 Billion in 2025 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

Key Extreme Sport Travel Insurance Market Trends & Insights

Current market trends indicate a significant shift towards personalized and modular extreme sport travel insurance policies, reflecting the diverse and often specific needs of adventurers. Insurers are increasingly leveraging digital platforms and mobile applications to enhance customer engagement, streamline policy purchases, and expedite claims processing. A growing emphasis on sustainability and responsible tourism is also influencing policy offerings, with some insurers beginning to consider the environmental impact of activities covered.

Furthermore, there is a rising demand for comprehensive coverage that extends beyond traditional medical emergencies to include equipment damage, search and rescue operations, and even specific training-related injuries. The integration of health monitoring devices and wearable technology presents an emerging trend, potentially allowing for dynamic premium adjustments and proactive risk management. This evolution highlights a market moving towards greater customization, technological integration, and a broader understanding of adventurer requirements.

- Personalization of policies based on activity and risk level.

- Increased adoption of digital platforms for policy management.

- Growing focus on sustainable and responsible tourism inclusions.

- Integration of real-time data from wearable technology.

- Demand for holistic coverage, including equipment and rescue.

AI Impact Analysis on Extreme Sport Travel Insurance

Artificial intelligence is poised to revolutionize the extreme sport travel insurance market by enhancing efficiency, accuracy, and personalization across various operations. Users frequently inquire about AI's potential to improve risk assessment, leading to more precise premium calculations for high-risk activities. AI-powered algorithms can analyze vast datasets, including geographical data, weather patterns, historical accident rates for specific sports, and individual traveler profiles, to generate highly tailored risk profiles. This capability addresses a core user concern regarding fair and accurate pricing.

Beyond risk assessment, AI is expected to streamline claims processing through automated verification and fraud detection, significantly reducing payout times and operational costs. Customers are interested in how AI can facilitate instant access to policy information and support via chatbots, improving the overall customer experience. The application of AI also extends to predicting emerging risks in new or evolving extreme sports, allowing insurers to proactively develop suitable coverage options. This technological integration promises a more agile, responsive, and customer-centric insurance landscape for extreme sports.

- Enhanced risk assessment and dynamic pricing models.

- Automated claims processing and fraud detection.

- Personalized policy recommendations through data analysis.

- Improved customer service via AI-powered chatbots.

- Predictive analytics for emerging extreme sport risks.

Key Takeaways Extreme Sport Travel Insurance Market Size & Forecast

The extreme sport travel insurance market is poised for robust growth, driven by increasing participation in adventure tourism and a heightened awareness of associated risks. A key takeaway is the burgeoning demand for specialized coverage that moves beyond standard travel insurance, acknowledging the unique perils of activities like mountaineering, skydiving, and whitewater rafting. This necessitates a more granular approach to policy design and risk assessment, moving away from one-size-fits-all solutions.

Another significant insight is the critical role of digital transformation and AI in shaping the market's future. Insurers that successfully leverage technology for personalized offerings, efficient claims, and seamless customer experiences will gain a competitive edge. The market's expansion is not uniform, with varying growth rates influenced by regional preferences for specific extreme sports, economic conditions, and regulatory environments. Understanding these nuances will be crucial for strategic market penetration and sustained growth over the forecast period.

- Substantial market growth fueled by adventure tourism.

- Increasing demand for highly specialized and customizable policies.

- Technological innovation, particularly AI, is a key growth enabler.

- Regional disparities in market development and extreme sport popularity.

- Focus on tailored risk assessment and streamlined customer journeys.

Extreme Sport Travel Insurance Market Drivers Analysis

The extreme sport travel insurance market is significantly propelled by several key drivers that reflect evolving consumer behaviors and advancements in the travel and leisure sector. A primary driver is the escalating global participation in adventure and extreme sports. As individuals increasingly seek unique and adrenaline-fueled experiences, the necessity for specialized insurance coverage becomes paramount. This surge in interest is not limited to traditional adventure hubs but is expanding into new regions, broadening the potential customer base for tailored insurance products.

Moreover, rising disposable incomes in developing economies contribute to greater affordability for adventure travel, consequently boosting the demand for appropriate insurance. Enhanced awareness regarding the inherent risks associated with extreme activities, coupled with effective marketing and educational campaigns by insurance providers, further encourages travelers to secure comprehensive coverage. The development of new and accessible extreme sports also continually expands the scope of insurable activities, driving innovation in policy design and coverage options.

Technological advancements, including the proliferation of online platforms and mobile applications, have significantly simplified the process of researching, comparing, and purchasing extreme sport travel insurance. This ease of access removes previous barriers to entry for many potential customers, making specialized coverage more readily available and transparent. The confluence of these factors creates a fertile ground for sustained growth in the extreme sport travel insurance market, pushing insurers to innovate and adapt to diverse consumer needs.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Participation in Extreme Sports & Adventure Tourism | +3.0% | Global, particularly North America, Europe, Oceania, parts of APAC | Long-term |

| Rising Awareness of Risks & Need for Specialized Coverage | +2.5% | Developed markets, gradually increasing in emerging economies | Medium-term |

| Technological Advancements & Digital Distribution Channels | +2.0% | Global, especially urban and digitally-savvy populations | Short to Medium-term |

| Growth in Disposable Incomes & Adventure Travel Budgets | +1.8% | Emerging economies (e.g., China, India, Southeast Asia, Latin America) | Long-term |

| Expansion of Niche & Emerging Extreme Sports | +1.5% | Global, driven by innovation and cultural trends | Long-term |

Extreme Sport Travel Insurance Market Restraints Analysis

Despite significant growth potential, the extreme sport travel insurance market faces several notable restraints that could temper its expansion. One prominent challenge is the perception of high premium costs among potential consumers. Given the elevated risk profiles associated with extreme sports, insurance premiums for comprehensive coverage tend to be substantially higher than those for standard travel insurance. This cost can act as a deterrent, especially for budget-conscious travelers or those participating in multiple activities, leading some to forgo adequate coverage or opt for less comprehensive, cheaper alternatives.

Another significant restraint involves the complexity and variability of policy terms and exclusions. Many extreme sport activities are categorized differently by various insurers, and specific clauses regarding pre-existing medical conditions, professional participation, or unguided activities can be confusing. This lack of standardization and clear communication can lead to consumer distrust, misunderstandings, and ultimately, dissatisfaction during the claims process, thereby hindering market adoption. Educating consumers about nuanced policy details remains a persistent hurdle.

Furthermore, the fluctuating global economic conditions and geopolitical uncertainties can impact discretionary spending on adventure travel, consequently affecting demand for extreme sport travel insurance. Economic downturns or regional instabilities may cause travelers to reduce their travel frequency or opt for less risky and less expensive forms of tourism. Regulatory complexities and varying legal frameworks across different countries also pose a challenge for insurers operating globally, requiring adherence to diverse compliance standards that can increase operational costs and complexity.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Perception of High Premium Costs | -2.5% | Emerging markets, price-sensitive consumer segments globally | Medium-term |

| Complexity and Lack of Standardization in Policy Terms & Exclusions | -2.0% | Global, impacting consumer confidence across all regions | Long-term |

| Economic Downturns and Geopolitical Instabilities | -1.8% | Global, particularly regions affected by economic volatility | Short-term (cyclical) |

| Limited Awareness and Understanding of Specialized Coverage Needs | -1.5% | Developing countries and segments new to extreme sports | Long-term |

Extreme Sport Travel Insurance Market Opportunities Analysis

The extreme sport travel insurance market presents numerous opportunities for innovation and growth, driven by evolving consumer preferences and technological advancements. One significant opportunity lies in the development of highly customized and modular insurance products. As extreme sports diversify, there is an increasing need for policies that can be tailored precisely to specific activities, durations, and risk levels, allowing customers to pay only for the coverage they truly need. This approach can attract a broader customer base, including those who previously found policies too generic or expensive.

Leveraging big data analytics and artificial intelligence represents a substantial opportunity to refine risk assessment models. By analyzing vast amounts of data on accident rates, environmental conditions, and participant profiles, insurers can offer more accurate pricing and reduce fraudulent claims. This technological integration can also enable dynamic pricing, where premiums adjust based on real-time factors or the actual level of risk undertaken, appealing to a tech-savvy generation of adventurers. Furthermore, partnerships with adventure tour operators, sports federations, and equipment manufacturers can create new distribution channels and embedded insurance solutions, reaching customers directly at the point of booking or purchase of their adventure experience.

The expansion into emerging markets, particularly in Asia Pacific and Latin America, where adventure tourism is rapidly gaining traction, offers significant untapped potential. These regions are witnessing a surge in disposable incomes and a growing interest in outdoor and extreme activities, creating a fertile ground for market entry and growth. Additionally, the increasing demand for sustainable and eco-friendly travel provides an opportunity for insurers to integrate responsible tourism clauses or offer incentives for environmentally conscious adventurers, aligning with broader consumer values and enhancing brand appeal.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Highly Customized & Modular Policies | +3.5% | Global, appealing to diverse adventurer segments | Medium to Long-term |

| Leveraging Big Data & AI for Enhanced Risk Assessment & Pricing | +3.0% | Global, particularly technologically advanced markets | Short to Medium-term |

| Strategic Partnerships with Adventure Tour Operators & Sports Federations | +2.8% | Global, especially in key adventure tourism destinations | Medium-term |

| Expansion into Untapped Emerging Markets (APAC, LATAM) | +2.5% | Asia Pacific, Latin America, parts of MEA | Long-term |

| Integration of Sustainable & Responsible Tourism Offerings | +1.5% | Developed markets, environmentally conscious consumer segments | Medium to Long-term |

Extreme Sport Travel Insurance Market Challenges Impact Analysis

The extreme sport travel insurance market faces distinct challenges that necessitate innovative solutions from insurers. A significant hurdle is the accurate assessment and pricing of risk for a vast and constantly evolving array of extreme activities. The inherently unpredictable nature of many extreme sports, combined with varying skill levels of participants and diverse environmental conditions, makes it difficult to standardize risk profiles. This complexity can lead to either underpricing, resulting in unsustainable losses, or overpricing, which deters potential customers and reduces market penetration. Developing robust actuarial models capable of handling this variability is an ongoing challenge.

Another major challenge is managing and mitigating fraudulent claims. The high costs associated with medical emergencies, search and rescue operations, and equipment replacement in extreme sports can incentivize fraudulent activities. Insurers must invest in sophisticated fraud detection systems and verification processes to protect their profitability and maintain reasonable premiums for legitimate policyholders. This requires a delicate balance to avoid cumbersome processes that might frustrate genuine claimants.

Furthermore, regulatory compliance across multiple jurisdictions presents a complex operational challenge for global extreme sport travel insurers. Insurance regulations vary significantly from country to country, encompassing licensing requirements, consumer protection laws, and data privacy standards. Navigating these diverse legal landscapes while offering seamless international coverage can be resource-intensive and requires constant vigilance. Ensuring policy adherence and proper coverage validation for incidents occurring in remote or internationally ambiguous locations also adds layers of complexity, impacting claims efficiency and customer satisfaction.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Accurate Risk Assessment & Pricing for Diverse Activities | -2.8% | Global, impacting new policy development and profitability | Long-term |

| Managing & Mitigating Fraudulent Claims | -2.5% | Global, affecting operational costs and premium stability | Medium-term |

| Navigating Complex Regulatory & Compliance Landscapes | -2.0% | Global, particularly for international insurers | Long-term |

| Consumer Education & Overcoming Misconceptions about Coverage | -1.5% | All markets, especially new entrants and less informed segments | Long-term |

| Competitive Pressure & Market Saturation in Developed Regions | -1.0% | North America, Europe, Australia | Short to Medium-term |

Extreme Sport Travel Insurance Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the Extreme Sport Travel Insurance market, covering historical trends, current market dynamics, and future projections. The scope includes a detailed examination of market size, growth drivers, restraints, opportunities, and challenges. It further delves into the segmentation of the market by various criteria, offering regional insights and profiling key industry players to provide a holistic view of the competitive landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Allianz Global Assistance, AXA XL, Berkshire Hathaway Travel Protection, Chubb, CSA Travel Protection, Europ Assistance, Generali Global Assistance, HCC Medical Insurance Services (Tokio Marine HCC), IMG, InsureMyTrip, Seven Corners, STA Travel, Travel Guard (AIG), Travelex Insurance Services, World Nomads, Battleface, Global Rescue, RoamRight, Spot Travel, Tin Leg. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Extreme Sport Travel Insurance market is comprehensively segmented to provide a detailed understanding of its diverse facets, reflecting the varied needs of adventurers and the complexities of coverage. This segmentation allows for targeted product development and marketing strategies, addressing specific market niches and consumer preferences. Understanding these segments is crucial for insurers to tailor their offerings effectively and for stakeholders to identify key growth areas within this specialized insurance landscape.

The market is primarily segmented by activity type, coverage type, distribution channel, traveler type, and age group. Each segment highlights distinct market dynamics and consumer behaviors. For instance, the needs of a solo skydiver differ significantly from those of a group embarking on a mountaineering expedition, influencing policy structure, risk assessment, and premium calculations. Analyzing these segments provides a granular view of market demand and supply, enabling more precise forecasting and strategic planning.

- By Activity Type: This segment categorizes policies based on the specific extreme sport or adventure activity covered. It includes popular activities such as Mountaineering (including trekking and high-altitude climbing), Skiing/Snowboarding (off-piste, heli-skiing), Scuba Diving (deep-sea, cave diving), Skydiving, Surfing, Whitewater Rafting, Bungee Jumping, and Rock Climbing. The "Others" sub-segment encompasses a growing range of niche activities like canyoning, paragliding, kitesurfing, and caving, each requiring specific risk assessments and coverage provisions.

- By Coverage Type: This segment defines the various types of benefits and protections offered within the policies. Key coverage types include Medical Expenses (for injuries sustained during activities), Emergency Evacuation & Repatriation (crucial for remote locations), Accidental Death & Dismemberment, Trip Cancellation/Interruption (due to unforeseen circumstances), Personal Liability (for damage or injury caused to third parties), Baggage Loss, Equipment Damage/Loss (vital for expensive sports gear), and Search and Rescue operations (often a high-cost component in remote adventure travel).

- By Distribution Channel: This segment outlines how extreme sport travel insurance policies are sold and reached to consumers. It encompasses Online Travel Agencies (OTAs), dedicated Insurance Aggregators (comparison websites), Direct Insurance Providers (via their official websites and mobile apps), Traditional Insurance Agents/Brokers (offering personalized advice), and Affinity Partnerships (collaborations with sports clubs, adventure tour operators, or associations to offer bundled or exclusive policies). The rise of digital channels is particularly prominent here.

- By Traveler Type: This segmentation differentiates between individuals seeking coverage for personal adventures and organized groups. Individual Travelers typically seek flexibility and tailored policies for their solo or small-group trips. Group Travelers, such as expeditions, corporate adventure retreats, or school trips, often require specific group policies with different liability and emergency management considerations.

- By Age Group: This segment recognizes that risk profiles and insurance needs can vary significantly with age. Youth (18-25) may be more prone to higher-risk activities and have different budget considerations. Adults (26-55) represent a large segment of active adventurers with potentially diverse financial capacities. Seniors (56+) participating in extreme sports often require specialized medical coverage due to age-related health considerations, driving the need for distinct policy offerings.

Regional Highlights

- North America: The North American market, particularly the United States and Canada, represents a significant share of the extreme sport travel insurance market. This region benefits from a robust adventure tourism infrastructure, high disposable incomes, and a strong culture of outdoor recreation. The increasing popularity of activities such as skiing, snowboarding, rock climbing, and whitewater rafting drives consistent demand for specialized coverage. Insurers in this region are often at the forefront of technological adoption, offering sophisticated online platforms and personalized policy options to a digitally-savvy consumer base. Demand for comprehensive medical and evacuation coverage is particularly high due to the high cost of healthcare.

- Europe: Europe is a mature and diverse market for extreme sport travel insurance, characterized by varying national regulations and a wide array of adventure tourism destinations, from the Alps to coastal surfing spots. Countries like France, Switzerland, Austria, and Italy are hubs for winter sports and mountaineering, while Spain and Portugal attract surfers and outdoor enthusiasts. The presence of well-established insurance providers and a strong emphasis on consumer protection contribute to a competitive market. There is a growing trend towards cross-border policy validity and a demand for flexible, short-term coverage options catering to frequent adventurers.

- Asia Pacific (APAC): The Asia Pacific region is rapidly emerging as a high-growth market for extreme sport travel insurance. Countries like Australia and New Zealand have long-established adventure tourism sectors and a high penetration of specialized insurance. However, the most significant growth is projected from emerging economies such as China, India, and Southeast Asian nations. Rising disposable incomes, a burgeoning middle class, and increasing exposure to Western adventure sports through media are fueling participation. The market here is characterized by a high reliance on digital distribution channels and a demand for affordable yet comprehensive policies, driving innovation in micro-insurance and mobile-first solutions.

- Latin America: The Latin American market for extreme sport travel insurance is still developing but shows considerable potential, driven by its rich biodiversity and diverse landscapes suitable for adventure tourism, from the Andes mountains to Amazon rainforest expeditions. Countries such as Brazil, Argentina, Chile, and Costa Rica are attracting a growing number of international and domestic adventurers. Challenges include lower insurance penetration rates and a need for greater consumer awareness regarding the importance of specialized coverage. Opportunities lie in educational initiatives and partnerships with local tour operators to integrate insurance offerings directly into adventure travel packages.

- Middle East and Africa (MEA): The MEA region is a nascent but promising market for extreme sport travel insurance. While traditional tourism dominates, there is a nascent but growing interest in adventure activities such as desert safaris, mountaineering in the Atlas Mountains, and diving in the Red Sea. The development of new mega-tourism projects and efforts to diversify economies away from oil are creating new adventure tourism hotspots, particularly in the GCC countries. The market here is driven by a mix of inbound international tourists and a gradually increasing number of local adventurers. Cultural nuances and varying levels of healthcare infrastructure present unique considerations for insurance providers in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Extreme Sport Travel Insurance Market.- Allianz Global Assistance

- AXA XL

- Berkshire Hathaway Travel Protection

- Chubb

- CSA Travel Protection

- Europ Assistance

- Generali Global Assistance

- HCC Medical Insurance Services (Tokio Marine HCC)

- IMG

- InsureMyTrip

- Seven Corners

- STA Travel

- Travel Guard (AIG)

- Travelex Insurance Services

- World Nomads

- Battleface

- Global Rescue

- RoamRight

- Spot Travel

- Tin Leg

Frequently Asked Questions

What is extreme sport travel insurance?

Extreme sport travel insurance is a specialized form of travel insurance designed to cover medical emergencies, accidents, and other unforeseen events specifically arising from participation in high-risk or adventurous activities such as mountaineering, skydiving, whitewater rafting, or off-piste skiing, which are typically excluded from standard travel insurance policies.

Why is specialized insurance necessary for extreme sports?

Standard travel insurance often excludes injuries or incidents resulting from activities deemed "high risk" or "extreme." Specialized extreme sport travel insurance provides essential coverage for medical emergencies, emergency evacuation, repatriation, and sometimes equipment damage, ensuring financial protection against the heightened perils associated with these activities.

How does AI impact extreme sport travel insurance?

AI impacts extreme sport travel insurance by enhancing risk assessment through data analysis, leading to more accurate premium pricing. It also streamlines claims processing, automates fraud detection, and improves customer service through AI-powered chatbots, offering a more personalized and efficient experience for policyholders.

What are the key factors driving the growth of this market?

The market's growth is primarily driven by the increasing global participation in adventure and extreme sports, rising awareness among travelers about associated risks, advancements in digital distribution channels making policies more accessible, and growing disposable incomes allowing for more adventure tourism.

What types of activities are typically covered by extreme sport policies?

Typical activities covered include mountaineering, rock climbing, skiing and snowboarding (including off-piste), scuba diving, skydiving, surfing, whitewater rafting, bungee jumping, and various other high-adrenaline or high-altitude sports, often with specific conditions or requirements outlined in the policy.