Aerial Cable and Accessory Market

Aerial Cable and Accessory Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704576 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Aerial Cable and Accessory Market Size

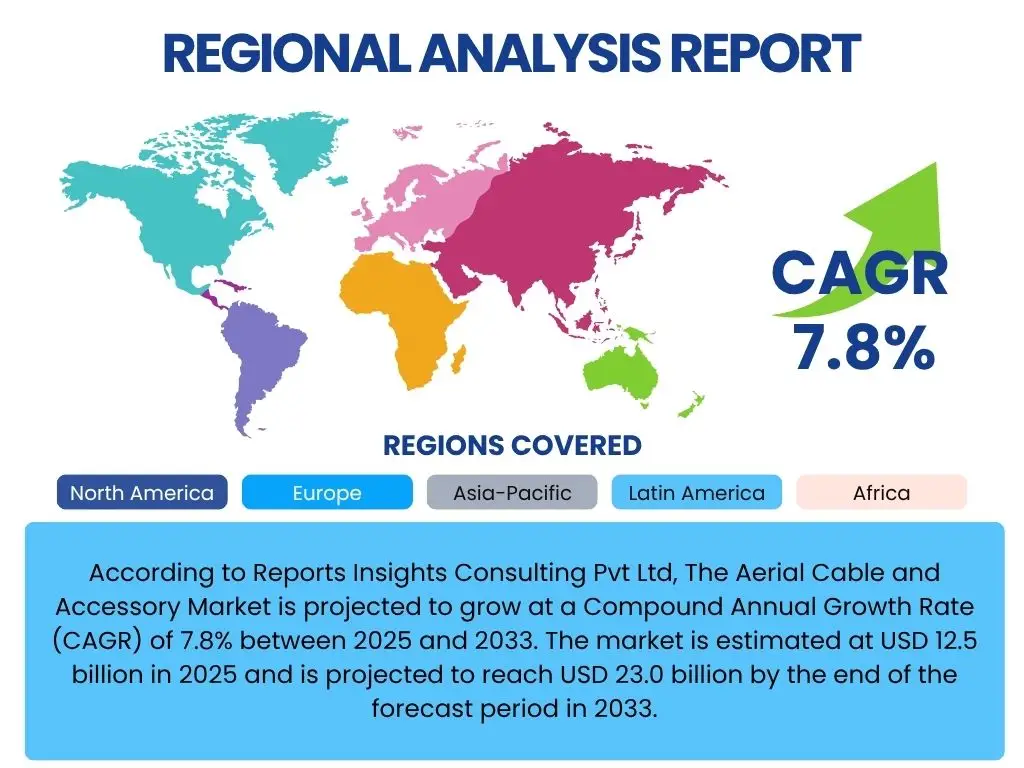

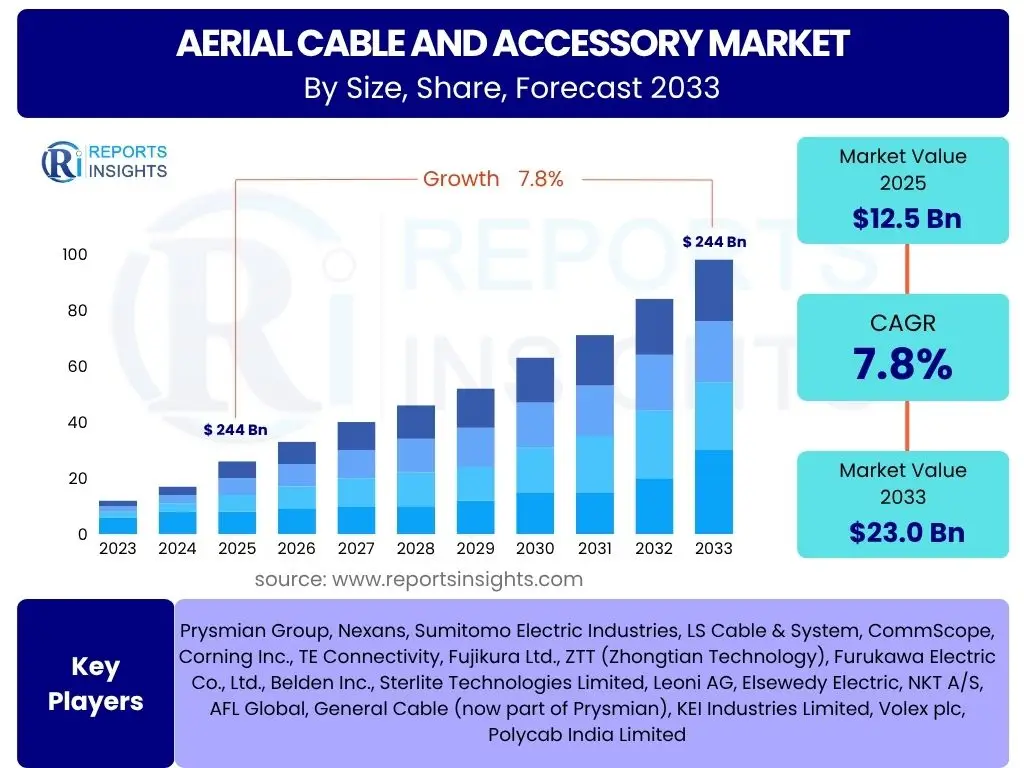

According to Reports Insights Consulting Pvt Ltd, The Aerial Cable and Accessory Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 12.5 billion in 2025 and is projected to reach USD 23.0 billion by the end of the forecast period in 2033.

Key Aerial Cable and Accessory Market Trends & Insights

User inquiries frequently highlight the accelerating pace of digital transformation and the increasing demand for high-speed internet connectivity as primary drivers for the aerial cable and accessory market. There is significant interest in how advancements in wireless technologies, particularly 5G deployment, are influencing the need for robust backhaul infrastructure, often relying on aerial fiber optic cables. Furthermore, smart city initiatives and the integration of renewable energy sources are compelling factors shaping market dynamics, creating a sustained demand for efficient and resilient aerial power and communication lines.

Another area of common user focus revolves around the adoption of more durable and environmentally friendly materials in cable manufacturing, alongside the development of advanced accessories that simplify installation and enhance network reliability. The push for reducing operational costs through predictive maintenance and automated monitoring systems also emerges as a key theme. These trends collectively underscore a market moving towards greater efficiency, sustainability, and technological integration, driven by the global expansion of digital infrastructure and green energy grids.

- Rapid global deployment of 5G networks and fiber-to-the-home (FTTH) infrastructure.

- Increasing adoption of smart grid technologies and renewable energy integration.

- Growing demand for aerial cables with enhanced durability and weather resistance.

- Emphasis on lightweight and easy-to-install cable and accessory solutions.

- Technological advancements in fiber optic cable design, including higher fiber counts and reduced diameter.

AI Impact Analysis on Aerial Cable and Accessory

User questions related to the impact of AI on the Aerial Cable and Accessory market often center on its potential to revolutionize network management, predictive maintenance, and operational efficiency. There is a keen interest in how artificial intelligence can optimize the design and deployment of aerial cable infrastructure, reducing costs and improving performance. Concerns are frequently raised regarding data privacy, the complexity of integrating AI systems into existing legacy networks, and the need for specialized skills to manage these advanced technologies effectively.

The core expectations users have from AI's influence in this domain include enhanced reliability through automated fault detection, optimized resource allocation for maintenance, and improved network security. AI is also anticipated to play a crucial role in managing the vast amounts of data generated by modern communication networks, enabling more informed decision-making for network upgrades and capacity planning. Overall, AI is seen as a transformative force capable of making aerial infrastructure more resilient, efficient, and intelligent.

- AI-powered predictive maintenance for aerial cable networks, reducing downtime.

- Optimization of cable routing and network design using AI algorithms for efficiency.

- Automated fault detection and localization in aerial transmission lines.

- Enhanced quality control during the manufacturing process of aerial cables and accessories.

- Data analytics and anomaly detection for proactive management of aerial infrastructure.

Key Takeaways Aerial Cable and Accessory Market Size & Forecast

Common user questions regarding key takeaways from the Aerial Cable and Accessory market size and forecast consistently point to the robust growth trajectory driven by relentless global digitalization and the expanding footprint of high-speed connectivity. The underlying insight is that the foundational infrastructure for modern communication and power distribution networks heavily relies on aerial solutions, ensuring sustained demand despite technological shifts. The projected market expansion underscores significant opportunities for innovation in materials, installation techniques, and smart integration.

Furthermore, inquiries reveal a strong emphasis on the interplay between emerging technologies, such as 5G and IoT, and the traditional cable infrastructure market. It is clear that while wireless technologies capture headlines, their effective deployment is contingent upon a reliable and high-capacity wired backbone, often comprising aerial cables. This dual dependency positions the aerial cable and accessory market as an indispensable component of the broader digital economy, promising continued investment and technological evolution in the forecast period.

- The market is poised for significant growth, driven by global digital infrastructure expansion.

- Fiber optic aerial cables are expected to be a major growth segment due to increasing data demand.

- Investments in smart grids and renewable energy infrastructure will boost demand for aerial power cables.

- Technological advancements in cable materials and design are crucial for market competitiveness.

- Regional disparities in infrastructure development will create varied investment opportunities.

Aerial Cable and Accessory Market Drivers Analysis

The aerial cable and accessory market is primarily propelled by the escalating demand for reliable high-speed internet and communication services globally. This is largely fueled by the pervasive rollout of 5G networks and the ambitious goals of fiber-to-the-home (FTTH) deployments in urban and rural areas. Governments and private entities are investing heavily in modernizing existing infrastructure and building new networks to support the growing data traffic and connectivity needs of businesses and consumers.

Beyond telecommunications, the market also benefits significantly from the ongoing transformation of power grids into smart grids and the integration of renewable energy sources. Aerial power cables and associated accessories are essential for transmitting electricity efficiently from diverse generation points to consumption centers. Urbanization, leading to the expansion of cities and industrial zones, further necessitates the development of extensive and robust aerial cable networks for both power and communication, underpinning the market's sustained growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Digitalization and Broadband Expansion | +1.2% | Global, particularly Asia Pacific, North America, Europe | Short-term to Long-term |

| Rapid 5G Network Deployments | +1.0% | North America, Europe, China, South Korea, Japan | Short-term to Mid-term |

| Smart Grid and Renewable Energy Integration | +0.8% | Europe, North America, emerging economies | Mid-term to Long-term |

| Increasing Urbanization and Infrastructure Development | +0.7% | Asia Pacific, Latin America, Africa | Mid-term to Long-term |

Aerial Cable and Accessory Market Restraints Analysis

Despite robust growth drivers, the aerial cable and accessory market faces several restraints that can impede its full potential. A significant challenge is the substantial upfront capital investment required for deploying extensive aerial networks. This includes the costs associated with purchasing high-quality cables and accessories, as well as the considerable expenses for installation, right-of-way acquisition, and permitting, which can be prohibitive for smaller players or projects in developing regions.

Another critical restraint is the volatility in raw material prices, particularly for copper, aluminum, and optical fibers. Fluctuations in these commodity markets directly impact manufacturing costs, leading to unpredictable pricing for finished products and potentially affecting project budgets and profitability. Furthermore, stringent environmental regulations and lengthy approval processes for infrastructure projects in certain regions can delay deployments and increase overall project timelines and costs, posing an operational hurdle for market participants.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Upfront Capital Investment | -0.6% | Global, particularly developing nations | Short-term to Mid-term |

| Volatility in Raw Material Prices | -0.5% | Global | Short-term |

| Stringent Regulations and Permitting Processes | -0.4% | Europe, North America, select APAC countries | Mid-term |

| Environmental and Aesthetic Concerns of Aerial Lines | -0.3% | Developed urban areas, environmentally sensitive regions | Long-term |

Aerial Cable and Accessory Market Opportunities Analysis

The aerial cable and accessory market is ripe with opportunities, particularly driven by the increasing focus on rural broadband expansion initiatives worldwide. Many governments and telecom operators are actively working to bridge the digital divide by providing high-speed internet access to underserved rural communities, where aerial deployment is often the most cost-effective and feasible solution due to terrain or existing infrastructure limitations. This creates significant demand for various types of aerial cables and their supporting accessories.

Furthermore, the continuous evolution of smart city concepts and the integration of Internet of Things (IoT) devices present a burgeoning opportunity. Smart cities require robust, interconnected networks for traffic management, public safety, utility monitoring, and more, frequently relying on aerial infrastructure for efficient data transmission. The upgrade and maintenance of aging power grids, especially in developed economies, also provide a steady stream of demand for modern, high-capacity aerial power cables and resilient accessories designed for enhanced durability and performance.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rural Broadband and Digital Inclusion Programs | +1.1% | Global, especially emerging economies, underserved areas | Mid-term to Long-term |

| Smart City and IoT Infrastructure Development | +0.9% | Developed and rapidly urbanizing regions | Mid-term to Long-term |

| Grid Modernization and Aging Infrastructure Replacement | +0.8% | North America, Europe, mature APAC economies | Long-term |

| Development of Specialized Cables for Harsh Environments | +0.6% | Regions prone to extreme weather conditions | Short-term to Mid-term |

Aerial Cable and Accessory Market Challenges Impact Analysis

The aerial cable and accessory market faces notable challenges that can impact project execution and market growth. One significant challenge is the complex and often lengthy permitting and right-of-way acquisition processes. Gaining approvals from various authorities, landowners, and environmental agencies can introduce considerable delays and increase administrative costs, hindering the timely completion of infrastructure projects, particularly in densely populated or environmentally sensitive areas.

Another key challenge is the increasing competition from alternative infrastructure deployment methods, such as underground cabling and advanced wireless technologies like satellite internet. While aerial solutions offer cost and ease-of-installation advantages in many scenarios, the perceived aesthetic impact and vulnerability to environmental factors like storms can sometimes steer projects towards alternative, albeit often more expensive, deployment methods. Furthermore, the specialized skill set required for safe and efficient aerial installation can lead to labor shortages in some regions, posing a logistical hurdle for market participants.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complex Permitting and Right-of-Way Acquisition | -0.7% | Global, particularly densely populated areas | Short-term to Mid-term |

| Competition from Underground Cabling and Wireless Solutions | -0.5% | Urban areas, developed markets | Mid-term to Long-term |

| Vulnerability to Environmental Factors (e.g., storms) | -0.4% | Regions prone to severe weather events | Short-term |

| Skilled Labor Shortage for Installation and Maintenance | -0.3% | North America, Europe, select APAC regions | Mid-term |

Aerial Cable and Accessory Market - Updated Report Scope

This report provides a comprehensive analysis of the global Aerial Cable and Accessory Market, detailing market size, growth trends, competitive landscape, and strategic insights. It covers various segments by type, material, application, and installation method, offering a granular view of market dynamics across key geographical regions. The study includes historical data, current market conditions, and future projections to provide a holistic understanding of the industry's evolution.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 12.5 billion |

| Market Forecast in 2033 | USD 23.0 billion |

| Growth Rate | 7.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans, Sumitomo Electric Industries, LS Cable & System, CommScope, Corning Inc., TE Connectivity, Fujikura Ltd., ZTT (Zhongtian Technology), Furukawa Electric Co., Ltd., Belden Inc., Sterlite Technologies Limited, Leoni AG, Elsewedy Electric, NKT A/S, AFL Global, General Cable (now part of Prysmian), KEI Industries Limited, Volex plc, Polycab India Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Aerial Cable and Accessory Market is comprehensively segmented to provide a detailed understanding of its diverse components and applications. This segmentation highlights the various cable types, the materials utilized in their construction, the primary industries benefiting from their deployment, and the different methods of installation. Such a granular analysis helps in identifying specific growth pockets, technological advancements, and shifts in demand across different market verticals.

The segmentation further allows for a deeper dive into the market dynamics, revealing how specific technological innovations in fiber optics or power transmission impact particular segments. Understanding these distinctions is crucial for manufacturers to tailor their product offerings, for service providers to optimize their infrastructure investments, and for investors to identify lucrative opportunities within the evolving landscape of global connectivity and power distribution networks.

- By Type:

- Fiber Optic Aerial Cables: Driven by high-speed internet demand.

- Coaxial Aerial Cables: Primarily for legacy TV and internet services.

- Twisted Pair Aerial Cables: Used for traditional telephony and low-speed data.

- Power Aerial Cables:

- Aerial Bundled Cables (ABC): Compact and safer for distribution.

- Bare Conductor: Traditional high-voltage transmission lines.

- Insulated Conductor: Enhanced safety and reliability.

- By Material:

- Aluminum: Cost-effective for power transmission.

- Copper: High conductivity for power and communication.

- Steel: Used for strength in support elements and conductors.

- Optical Fiber: Core component for high-bandwidth data transmission.

- Others: Dielectric materials, HDPE for insulation and sheathing.

- By Application:

- Telecommunications: For backbone networks and last-mile connectivity.

- Power Transmission & Distribution:

- High Voltage: For long-distance bulk power transfer.

- Medium Voltage: For sub-transmission and primary distribution.

- Low Voltage: For final distribution to consumers.

- Railways: For signaling and power supply.

- Street Lighting: Powering public lighting infrastructure.

- Others: CATV networks, industrial applications.

- By Installation:

- Self-Supporting Aerial Cables: Integrated strength member, easier installation.

- Messenger Supported Aerial Cables: Require separate messenger wire for support.

- All-Dielectric Self-Supporting (ADSS): Non-metallic, for high-voltage lines.

- Optical Ground Wire (OPGW): Combines grounding and fiber optic functions.

- Figure-8 Cables: Integrated messenger for easy suspension.

Regional Highlights

- North America: This region is characterized by substantial investments in 5G infrastructure deployment and smart grid upgrades. The U.S. and Canada are leading in fiber optic network expansion and modernization of aging power transmission lines, driving consistent demand for advanced aerial cables and accessories. Regulatory support for broadband expansion also contributes significantly to market growth here.

- Europe: Europe exhibits a strong focus on renewable energy integration and digital transformation initiatives, necessitating robust aerial cable networks for both power and telecommunications. Countries like Germany, France, and the UK are actively investing in FTTH and rural connectivity projects, while also emphasizing sustainable and resilient infrastructure solutions.

- Asia Pacific (APAC): APAC is expected to be the fastest-growing region, fueled by rapid urbanization, massive infrastructure development projects, and increasing internet penetration, particularly in China, India, and Southeast Asian countries. The aggressive rollout of 5G networks, smart city projects, and government-led broadband initiatives are key drivers propelling the market in this region.

- Latin America: This region is experiencing significant growth in broadband access and digital infrastructure, driven by increasing government investments and private sector participation. Countries like Brazil and Mexico are witnessing expanding fiber optic deployments and modernization of power grids, creating a growing demand for aerial cable solutions, especially in underserved areas.

- Middle East and Africa (MEA): The MEA region is characterized by burgeoning telecommunications infrastructure development, especially in the GCC countries and parts of Africa, driven by rising data consumption and digital transformation agendas. While still emerging, significant investments in new smart cities and energy projects are setting the stage for substantial market expansion in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerial Cable and Accessory Market.- Prysmian Group

- Nexans

- Sumitomo Electric Industries

- LS Cable & System

- CommScope

- Corning Inc.

- TE Connectivity

- Fujikura Ltd.

- ZTT (Zhongtian Technology)

- Furukawa Electric Co., Ltd.

- Belden Inc.

- Sterlite Technologies Limited

- Leoni AG

- Elsewedy Electric

- NKT A/S

- AFL Global

- General Cable (now part of Prysmian)

- KEI Industries Limited

- Volex plc

- Polycab India Limited

Frequently Asked Questions

What is an aerial cable and what are its primary uses?

An aerial cable is an electrical or optical cable suspended above ground, typically from poles or other structures. Its primary uses include transmitting electricity in power distribution networks, facilitating telecommunications for internet and telephone services, and providing connectivity for railway signaling and street lighting systems. Aerial installations are often cost-effective and easier to deploy in various terrains.

What types of aerial cables are available in the market?

The market offers several types of aerial cables, including Fiber Optic Aerial Cables for high-speed data, Coaxial Aerial Cables for video and internet, Twisted Pair Aerial Cables for traditional voice services, and various Power Aerial Cables such as Aerial Bundled Cables (ABC) for low and medium voltage distribution, and bare or insulated conductors for high-voltage transmission. Selection depends on specific application requirements for bandwidth, voltage, and environmental conditions.

How do aerial cable accessories contribute to network reliability?

Aerial cable accessories are crucial for ensuring network reliability by providing essential support, protection, and connection points. This includes components like clamps, brackets, connectors, tensioners, and splice enclosures, which securely attach cables to poles, protect splices from environmental damage, and manage cable tension to prevent sagging or breakage. Proper accessories mitigate stress on cables, reduce signal loss, and enhance the overall longevity and performance of the aerial infrastructure.

What factors are driving the growth of the aerial cable and accessory market?

Key factors driving market growth include the global expansion of 5G networks and fiber-to-the-home (FTTH) initiatives, increasing investments in smart grid infrastructure and renewable energy integration, and rapid urbanization leading to expanded power and communication networks. Government support for digital inclusion programs and the need for cost-effective infrastructure deployment in rural areas also significantly contribute to market expansion.

What are the main challenges faced by the aerial cable and accessory market?

Major challenges include the substantial upfront capital investment required for extensive aerial network deployment, volatility in raw material prices (e.g., copper, aluminum, fiber), and complex, time-consuming permitting and right-of-way acquisition processes. Additionally, competition from alternative underground cabling solutions and the vulnerability of aerial lines to extreme weather events present ongoing hurdles for market players.