Washed Silica Sand Market

Washed Silica Sand Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701355 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Washed Silica Sand Market Size

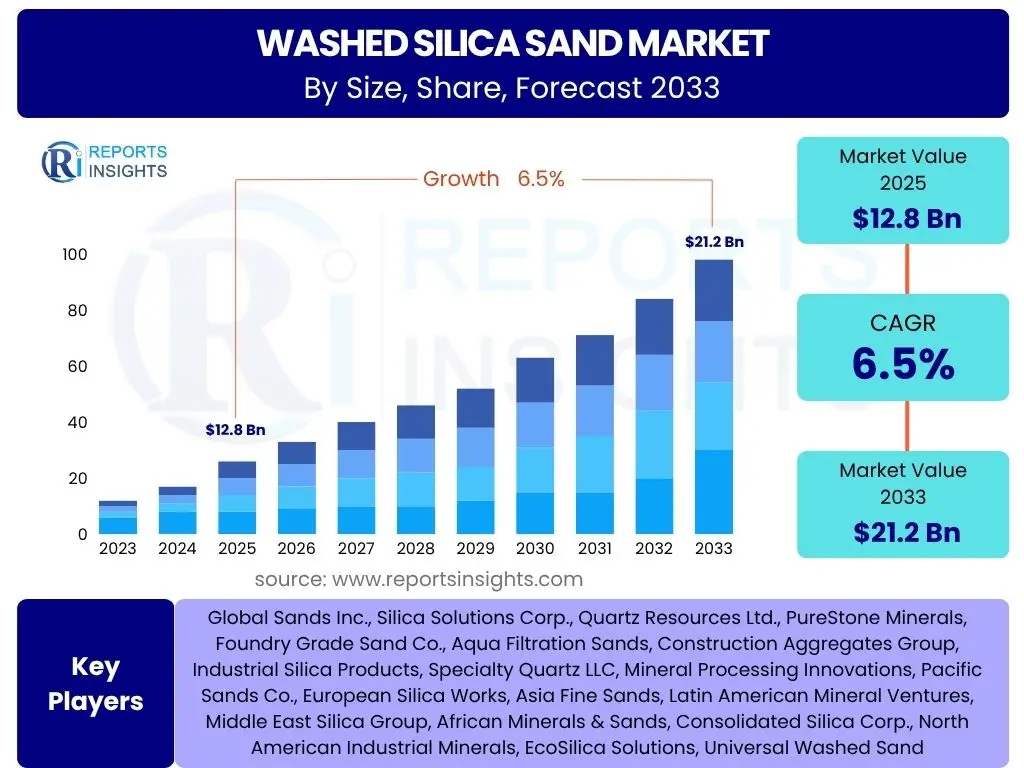

According to Reports Insights Consulting Pvt Ltd, The Washed Silica Sand Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2033. The market is estimated at USD 12.8 Billion in 2025 and is projected to reach USD 21.2 Billion by the end of the forecast period in 2033.

Key Washed Silica Sand Market Trends & Insights

Common inquiries regarding trends in the Washed Silica Sand market often revolve around sustainability, technological advancements, and the evolution of end-use applications. Users frequently seek to understand how environmental regulations are shaping the industry, the impact of digitalization on processing, and the emergence of new demand sectors beyond traditional uses like glass and construction. There is also significant interest in the regional dynamics, particularly the growth trajectories in developing economies and the strategic shifts by major players.

The market is currently witnessing a notable shift towards higher purity grades of silica sand, driven by the increasing demand from specialized applications such as solar panel manufacturing, advanced electronics, and high-performance ceramics. This trend necessitates more sophisticated washing and processing techniques. Furthermore, there is a growing emphasis on optimizing supply chain logistics and reducing transportation costs, given the bulk nature of the product and its raw material status, leading to investment in strategically located processing facilities. The integration of advanced analytics for demand forecasting and inventory management is also becoming a critical trend to enhance operational efficiency.

Another significant trend is the rising adoption of sustainable mining and processing practices. This includes water recycling in washing plants to minimize environmental footprint, rehabilitation of mining sites, and energy efficiency initiatives. The industry is also exploring opportunities in the circular economy, such as the potential for recycling silica sand from construction and demolition waste, though this remains nascent. These trends collectively underscore a market moving towards greater efficiency, higher quality, and increased environmental responsibility.

- Growing demand for high-purity silica sand in specialized applications.

- Increasing adoption of sustainable mining and processing practices.

- Focus on optimizing supply chain logistics and reducing transportation costs.

- Technological advancements in washing and classification methods.

- Shifting demand dynamics with robust growth in emerging economies.

AI Impact Analysis on Washed Silica Sand

Users frequently inquire about the transformative potential of Artificial Intelligence (AI) in the Washed Silica Sand sector, specifically asking how AI can enhance operational efficiency, improve product quality, and contribute to sustainability. Key themes include the application of AI in predictive maintenance for mining and processing equipment, its role in optimizing resource utilization, and its capacity to provide deeper insights into market dynamics and demand forecasting. Concerns also touch upon the investment required for AI implementation and the need for skilled personnel to manage these advanced systems.

AI's influence is beginning to reshape traditional mining and processing operations for washed silica sand. Predictive analytics, powered by AI algorithms, enables proactive maintenance of heavy machinery and processing equipment, significantly reducing downtime and operational costs. By analyzing sensor data from conveyors, crushers, and washing plants, AI can detect potential failures before they occur, scheduling maintenance precisely when needed. This not only extends equipment lifespan but also ensures continuous production flow, which is crucial for meeting market demand efficiently.

Beyond maintenance, AI is also poised to revolutionize quality control and process optimization in silica sand production. Machine learning models can analyze real-time data from washing and classification processes, adjusting parameters to achieve desired particle size distribution and purity levels with greater accuracy and consistency. This ensures that the end product meets the stringent specifications required by various industries, from glass manufacturing to specialized electronics. Furthermore, AI-driven demand forecasting can help producers align their output with market needs, minimizing inventory costs and improving overall supply chain responsiveness, thereby enhancing the industry's competitiveness and resilience.

- Optimization of mining and processing operations through AI-powered predictive analytics.

- Enhanced quality control and consistency in product specifications via machine learning algorithms.

- Improved supply chain efficiency and demand forecasting using AI-driven insights.

- Automation of data analysis for faster decision-making in production and logistics.

- Potential for reduced operational costs and increased resource utilization.

Key Takeaways Washed Silica Sand Market Size & Forecast

Common user questions regarding key takeaways from the Washed Silica Sand market size and forecast often focus on identifying the primary growth drivers, understanding the market's resilience to economic fluctuations, and pinpointing the most promising regional and application segments. Users are keen to grasp the underlying factors contributing to the projected growth and how these factors might be influenced by broader economic and technological shifts. The importance of specific product grades and their market performance also frequently emerges as a key area of interest.

The Washed Silica Sand market is set for robust growth, primarily propelled by the unwavering expansion of the global construction and infrastructure sectors, especially in emerging economies. The increasing urbanization and industrialization across Asia Pacific and parts of Latin America are creating sustained demand for construction materials, where silica sand is a fundamental component for concrete, mortar, and other building elements. Concurrently, the steady growth in the flat glass and container glass manufacturing industries, driven by packaging and architectural applications, continues to underpin a significant portion of the market's revenue. These foundational demands provide a strong base for future market expansion, illustrating its relative stability.

A crucial takeaway is the escalating significance of high-purity silica sand, which commands premium prices and offers substantial growth opportunities within niche, high-value applications. Industries such as solar energy (photovoltaics), advanced ceramics, and specialized electronics are increasingly reliant on ultra-pure silica sand, driving innovation in processing and quality assurance. While environmental regulations and logistical challenges present headwinds, strategic investments in sustainable practices and localized production facilities are anticipated to mitigate these issues. The market's future trajectory is characterized by a dual focus on serving large-volume traditional industries while capitalizing on the high-growth potential of specialized, purity-driven segments.

- Steady market expansion primarily driven by global construction and infrastructure development.

- Significant growth in demand for high-purity silica sand from specialized industries like solar and electronics.

- Asia Pacific is projected to be the dominant and fastest-growing region due to rapid industrialization and urbanization.

- Technological advancements in processing are key to meeting stringent purity requirements and enhancing efficiency.

- Environmental sustainability and responsible mining practices are becoming increasingly critical competitive factors.

Washed Silica Sand Market Drivers Analysis

The Washed Silica Sand market's growth is fundamentally driven by the sustained expansion of its key end-use industries. As a versatile material, its demand is intrinsically linked to global economic development, particularly in sectors requiring high-quality raw materials for manufacturing and construction. The increasing population and urbanization trends worldwide contribute significantly to the escalating need for infrastructure and housing, directly translating into higher consumption of silica sand. This pervasive demand ensures a resilient growth trajectory for the market, despite potential economic fluctuations in specific regions or sectors.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Construction and Infrastructure Development | +2.5% | Global, particularly Asia Pacific (China, India, Southeast Asia), North America | 2025-2033 |

| Expansion of Glass Manufacturing Industry (Flat Glass, Container Glass, Specialty Glass) | +1.8% | Europe, Asia Pacific, North America | 2025-2033 |

| Increasing Demand from Foundry Applications (Metal Casting) | +0.8% | Europe, North America, Asia Pacific | 2025-2030 |

| Rising Application in Oil & Gas (Frac Sand for Hydraulic Fracturing) | +0.7% | North America (US, Canada), Middle East | 2025-2028 |

| Growth in Water Treatment and Filtration Systems | +0.5% | Global, especially emerging economies | 2025-2033 |

Washed Silica Sand Market Restraints Analysis

Despite the robust demand, the Washed Silica Sand market faces several significant restraints that could impede its growth. These primarily revolve around environmental compliance, the inherent challenges of transporting bulk materials, and the finite nature of high-quality raw material reserves. Stringent regulations aimed at mitigating the environmental impact of mining and processing operations impose additional costs and complexities on producers, affecting profitability and market entry. Furthermore, the sheer volume and weight of silica sand make logistics a critical and often expensive component of the supply chain, particularly for long-distance deliveries to end-users.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Strict Environmental Regulations and Permitting Challenges | -1.2% | Europe, North America, parts of Asia Pacific | 2025-2033 |

| High Transportation Costs for Bulk Material | -0.9% | Global, particularly for landlocked regions | 2025-2033 |

| Depletion of High-Quality Silica Sand Reserves | -0.7% | Region-specific, e.g., certain mature mining regions | 2028-2033 |

| Health and Safety Concerns (Silicosis Risk) | -0.4% | Global (regulatory bodies, labor unions) | 2025-2033 |

Washed Silica Sand Market Opportunities Analysis

The Washed Silica Sand market presents numerous opportunities for growth and innovation, largely driven by the evolution of existing applications and the emergence of new, high-value end-uses. The burgeoning demand for specialized glass in sectors like solar energy and electronics offers a premium market for ultra-high purity silica sand, encouraging producers to invest in advanced purification technologies. Furthermore, rapid urbanization and infrastructure projects in developing nations are creating massive, sustained demand for construction materials, providing a foundational opportunity for volume growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of Specialty Glass and Advanced Materials Applications (Solar, Electronics) | +1.5% | Asia Pacific, Europe, North America | 2025-2033 |

| Increased Infrastructure Spending in Emerging Economies | +1.2% | Asia Pacific (India, Southeast Asia), Latin America, Africa | 2025-2033 |

| Technological Advancements in Processing and Purification Techniques | +0.9% | Global (for producers seeking competitive edge) | 2025-2033 |

| Growing Adoption of Sustainable Mining and Production Practices | +0.6% | Global (ESG-driven investment, regulatory push) | 2025-2033 |

Washed Silica Sand Market Challenges Impact Analysis

The Washed Silica Sand market faces several significant challenges that necessitate strategic planning and adaptive solutions from industry players. These challenges include the inherent volatility of energy prices, which directly impacts the energy-intensive processing of silica sand, as well as the complexity of navigating diverse and evolving regulatory landscapes across different regions. Additionally, securing a consistent supply of skilled labor for mining and processing operations remains a persistent hurdle, alongside the potential for supply chain disruptions stemming from geopolitical events or natural disasters. Addressing these multifaceted challenges is crucial for maintaining operational efficiency and market competitiveness.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Fluctuating Energy Prices and High Processing Costs | -0.8% | Global | 2025-2033 |

| Complexity of Regulatory Compliance and Permitting | -0.7% | Europe, North America, specific Asian countries | 2025-2033 |

| Supply Chain Vulnerabilities and Geopolitical Risks | -0.6% | Global (impacts import/export regions) | 2025-2030 |

| Shortage of Skilled Labor and Rising Labor Costs | -0.4% | Developed economies, specific mining regions | 2025-2033 |

Washed Silica Sand Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Washed Silica Sand market, offering detailed insights into market dynamics, segmentation, regional trends, and competitive landscape. The scope encompasses a thorough examination of market size and forecast from 2025 to 2033, historical data from 2019 to 2023, and a deep dive into the key drivers, restraints, opportunities, and challenges shaping the industry. Emphasis is placed on identifying high-growth segments and understanding the strategic maneuvers of leading market players, ensuring a holistic perspective for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 12.8 Billion |

| Market Forecast in 2033 | USD 21.2 Billion |

| Growth Rate | 6.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Sands Inc., Silica Solutions Corp., Quartz Resources Ltd., PureStone Minerals, Foundry Grade Sand Co., Aqua Filtration Sands, Construction Aggregates Group, Industrial Silica Products, Specialty Quartz LLC, Mineral Processing Innovations, Pacific Sands Co., European Silica Works, Asia Fine Sands, Latin American Mineral Ventures, Middle East Silica Group, African Minerals & Sands, Consolidated Silica Corp., North American Industrial Minerals, EcoSilica Solutions, Universal Washed Sand |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Washed Silica Sand market is comprehensively segmented to provide granular insights into its diverse applications and quality requirements. Understanding these segmentations is crucial for stakeholders to identify specific growth pockets, tailor product offerings, and devise effective market entry strategies. The market's segmentation by application highlights its essential role across various industrial sectors, while classification by grade underscores the increasing demand for specific purity levels to meet stringent end-user specifications. Regional segmentation further delineates market performance and opportunities based on geographical economic development and industrial concentration.

- By Application:

- Glass Manufacturing: Encompasses flat glass for construction and automotive, container glass for packaging, and specialty glass for solar panels and electronics.

- Foundry: Utilized as a mold and core material in metal casting, requiring specific grain size and refractory properties.

- Construction: Essential component in concrete, mortar, asphalt mixtures, and various building materials due to its strength and inertness.

- Oil & Gas (Frac Sand): Serves as a proppant in hydraulic fracturing to keep fissures open and facilitate hydrocarbon extraction.

- Ceramics & Refractories: Used in the production of tiles, sanitaryware, and high-temperature resistant materials.

- Filtration: Employed as a filter medium in water purification and wastewater treatment plants.

- Chemical: Utilized in the production of silicon chemicals, sodium silicate, and other derivatives.

- Other Applications: Includes abrasives, sports turf, golf course bunkers, and agricultural uses.

- By Grade:

- High Purity: Characterized by minimal impurities (e.g., iron, alumina), essential for specialized applications like solar glass, electronics, and optical fibers.

- Medium Purity: Suitable for general glass manufacturing, standard foundry applications, and some chemical processes.

- Low Purity: Primarily used in construction aggregates and basic filtration systems where color and minor impurities are less critical.

- By End-Use Industry:

- Building & Construction: Incorporates all construction-related applications of washed silica sand.

- Industrial: Covers glass manufacturing, foundry, ceramics, and other manufacturing processes.

- Energy: Primarily includes the oil & gas (frac sand) sector.

- Environmental: Focuses on water treatment and filtration applications.

Regional Highlights

- North America: This region holds a significant share of the Washed Silica Sand market, primarily driven by robust demand from the oil and gas sector for frac sand and a steady construction industry. The United States is a major producer and consumer, particularly in the Permian Basin for hydraulic fracturing activities. Advancements in environmental regulations and increasing focus on sustainable mining practices are influencing operational strategies across the region. Canada also contributes to the market, albeit on a smaller scale, with demand from industrial applications.

- Europe: The European market for Washed Silica Sand is characterized by mature industrial sectors, particularly glass manufacturing and foundry applications. Countries like Germany, France, and Italy are key consumers due to their established manufacturing bases. The region exhibits a strong emphasis on high-quality and high-purity silica sand, driven by stringent environmental standards and a focus on specialized industrial applications. Innovation in processing technologies to meet these high standards is a consistent trend.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing and largest market for Washed Silica Sand during the forecast period. Rapid urbanization, massive infrastructure development projects, and expanding manufacturing industries (especially glass and construction) in countries like China, India, and Southeast Asian nations are the primary drivers. The burgeoning electronics and solar panel industries are also fueling demand for high-purity silica sand. The region benefits from abundant raw material availability in certain areas, coupled with lower production costs, making it a competitive landscape.

- Latin America: The market in Latin America is witnessing steady growth, largely propelled by ongoing construction and infrastructure development initiatives, particularly in Brazil, Mexico, and Argentina. While the market size is smaller compared to APAC or North America, its potential is significant given the region's developing economies and increasing industrialization. Investments in mining and processing capabilities are gradually increasing to cater to domestic demand and potential export opportunities.

- Middle East and Africa (MEA): The MEA region's Washed Silica Sand market is primarily driven by extensive construction activities and ambitious infrastructure projects, especially in the Gulf Cooperation Council (GCC) countries. Diversification efforts away from oil economies are leading to increased investment in manufacturing and industrial sectors, indirectly boosting demand for silica sand. Africa also presents emerging opportunities, with growth in construction and potential for raw material extraction, although logistical challenges remain a factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Washed Silica Sand Market.- Global Sands Inc.

- Silica Solutions Corp.

- Quartz Resources Ltd.

- PureStone Minerals

- Foundry Grade Sand Co.

- Aqua Filtration Sands

- Construction Aggregates Group

- Industrial Silica Products

- Specialty Quartz LLC

- Mineral Processing Innovations

- Pacific Sands Co.

- European Silica Works

- Asia Fine Sands

- Latin American Mineral Ventures

- Middle East Silica Group

- African Minerals & Sands

- Consolidated Silica Corp.

- North American Industrial Minerals

- EcoSilica Solutions

- Universal Washed Sand

Frequently Asked Questions

Analyze common user questions about the Washed Silica Sand market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Washed Silica Sand market?

The primary growth driver for the Washed Silica Sand market is the expanding global construction and infrastructure development, particularly in emerging economies, coupled with the consistent demand from the glass manufacturing industry.

Which geographical region is expected to lead the Washed Silica Sand market in terms of growth?

Asia Pacific (APAC) is projected to be the fastest-growing and largest market for Washed Silica Sand, driven by rapid urbanization, extensive infrastructure projects, and a booming manufacturing sector in countries like China and India.

How do environmental regulations impact the Washed Silica Sand industry?

Environmental regulations significantly impact the industry by increasing operational costs through stringent permitting requirements, environmental impact assessments, and the need for sustainable mining and processing practices, often acting as a restraint but also fostering innovation.

What role does technological advancement play in the production of Washed Silica Sand?

Technological advancements, including AI and advanced processing techniques, are crucial for optimizing mining operations, enhancing quality control, achieving higher purity grades, and improving overall efficiency and cost-effectiveness in Washed Silica Sand production.

What are the key applications of Washed Silica Sand?

Washed Silica Sand is primarily used in glass manufacturing, foundry applications, construction (concrete, mortar), oil and gas (as frac sand), water treatment and filtration, ceramics, and various chemical processes, highlighting its versatile industrial utility.