Wafer Frame Market

Wafer Frame Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700861 | Last Updated : July 28, 2025 |

Format : ![]()

![]()

![]()

![]()

Wafer Frame Market Size

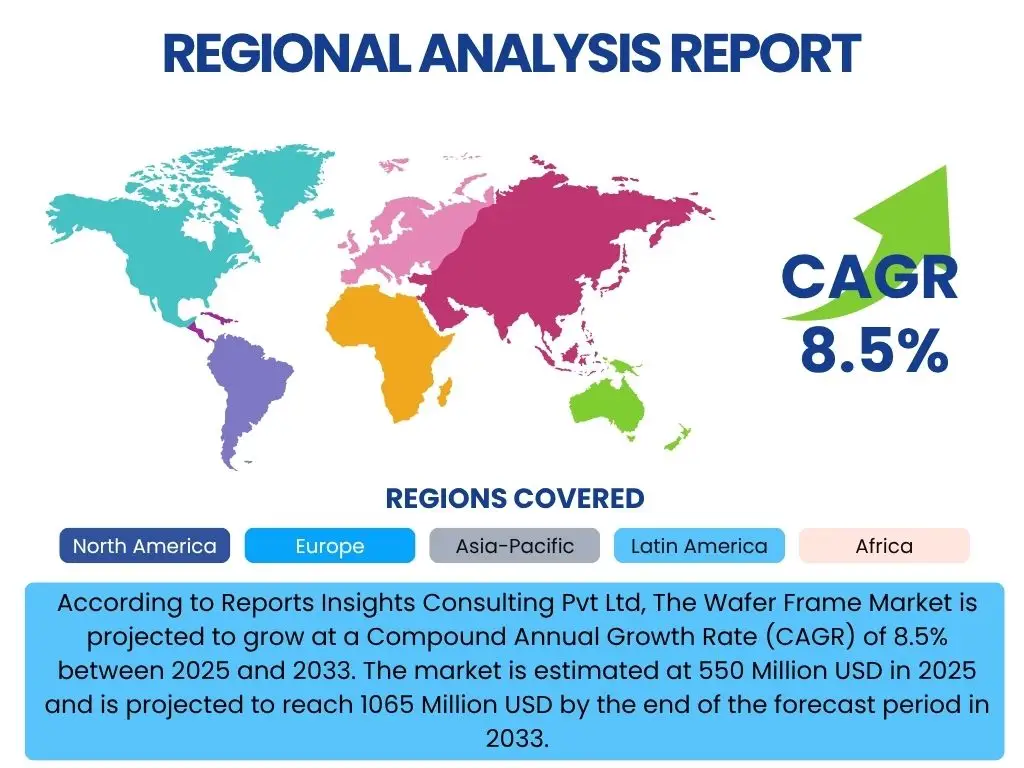

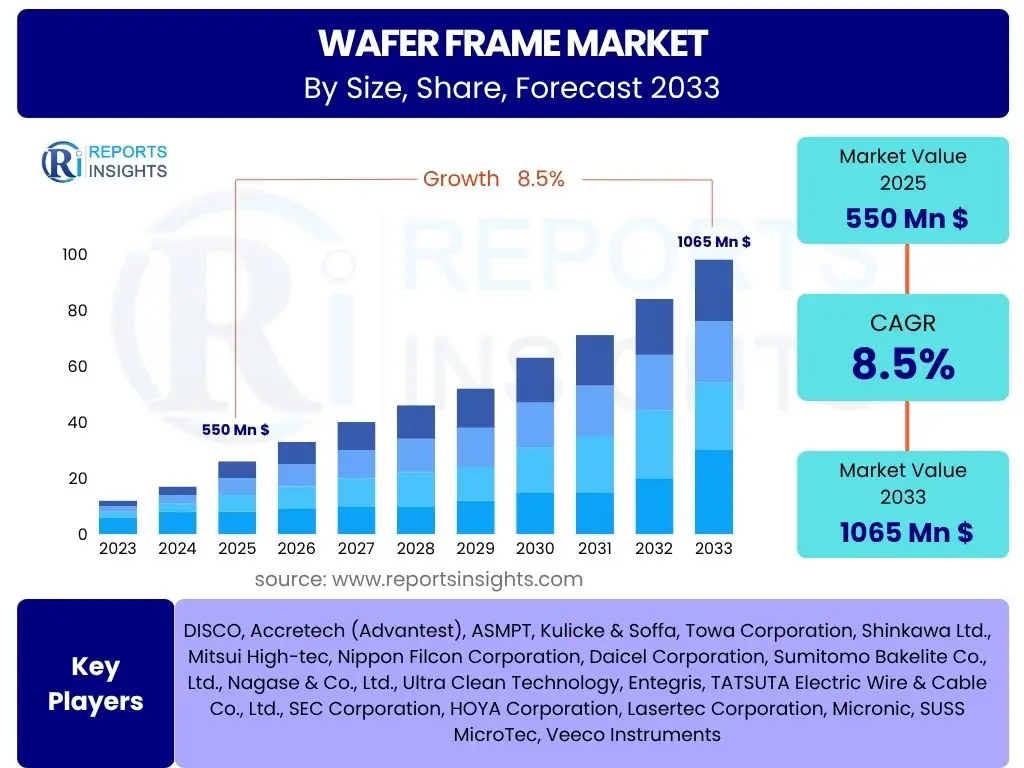

According to Reports Insights Consulting Pvt Ltd, The Wafer Frame Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at 550 Million USD in 2025 and is projected to reach 1065 Million USD by the end of the forecast period in 2033.

Key Wafer Frame Market Trends & Insights

The wafer frame market is undergoing significant transformation, driven by persistent demand for smaller, more powerful, and cost-effective semiconductor devices. User inquiries frequently center on how technological advancements in semiconductor manufacturing, particularly advanced packaging techniques and wafer thinning, are influencing wafer frame design and material requirements. There is a strong interest in understanding the shift towards more sustainable and reusable wafer frame solutions, reflecting broader industry trends towards environmental responsibility and operational efficiency.

Moreover, common questions arise regarding the impact of automation and smart manufacturing practices on wafer frame production and handling. Users are keen to know about the adoption of robotics and automated material handling systems (AMHS) within fabrication facilities and their implications for the integration of wafer frames into high-volume manufacturing lines. The evolving landscape of semiconductor applications, from artificial intelligence and high-performance computing to automotive electronics and 5G infrastructure, also prompts questions about specialized wafer frame solutions designed for unique operational environments and reliability standards.

Another key area of user interest revolves around the supply chain resilience and geographical distribution of wafer frame manufacturing. With ongoing global supply chain challenges and geopolitical considerations, users are seeking insights into regional manufacturing capabilities, diversification strategies, and the potential for localized production to mitigate risks. This also extends to inquiries about the raw material sourcing for wafer frames, emphasizing the importance of a stable and diversified supply to support the rapid expansion of semiconductor fabrication capacities worldwide.

- Miniaturization and wafer thinning drive demand for precision frames.

- Advanced packaging technologies (e.g., 3D ICs, fan-out, chiplets) necessitate specialized frame designs.

- Increasing automation in semiconductor manufacturing integrates wafer frames into automated handling systems.

- Development of sustainable, reusable, and recyclable wafer frame materials gains traction.

- Growing focus on cost-efficiency and yield optimization impacts frame material selection and design.

- Expansion of emerging applications like AI, 5G, and automotive electronics fuels specific frame requirements.

AI Impact Analysis on Wafer Frame

User queries regarding the impact of Artificial Intelligence (AI) on the wafer frame domain often explore its potential to revolutionize design, manufacturing, and quality control processes. There is a strong interest in how AI algorithms can optimize wafer frame geometries for improved wafer handling stability and reduced stress, especially with increasingly thin and brittle wafers. Concerns and expectations also revolve around AI's capacity for predictive analytics, anticipating material fatigue or potential failures in frames, thereby enhancing operational safety and extending product lifespan.

Furthermore, common user questions highlight AI's role in automating and refining inspection processes. Users are curious about how machine learning and computer vision can detect minute defects on wafer frames that might be imperceptible to the human eye, ensuring higher quality standards and preventing yield losses in subsequent semiconductor manufacturing steps. The integration of AI into smart factories is also a recurring theme, with users wanting to understand how AI-driven insights from real-time data can optimize production scheduling, material flow, and equipment maintenance related to wafer frame handling.

The long-term implications of AI for supply chain management within the wafer frame ecosystem are also a significant area of inquiry. Users seek to understand how AI can forecast demand fluctuations, manage inventory levels, and optimize logistics for wafer frame components, thereby building a more resilient and efficient supply chain. This extends to the potential for AI to facilitate customized frame designs based on specific customer requirements and rapid prototyping, accelerating innovation and responsiveness in a dynamic semiconductor market.

- AI-driven design optimization for enhanced wafer frame stability and material efficiency.

- Predictive maintenance using AI for wafer frame handling equipment, reducing downtime.

- Automated optical inspection (AOI) with AI for rapid and precise defect detection on frames.

- AI for real-time process control and optimization in wafer frame manufacturing.

- Supply chain optimization through AI-powered demand forecasting and inventory management for frame materials.

Key Takeaways Wafer Frame Market Size & Forecast

User inquiries about the key takeaways from the wafer frame market size and forecast consistently point towards a future defined by sustained growth, driven primarily by the relentless expansion of the global semiconductor industry. The forecast underscores the critical role of wafer frames as indispensable components in the semiconductor manufacturing process, particularly with the escalating demand for advanced packaging solutions that require more sophisticated and precise handling mechanisms. Insights reveal that market expansion is not merely quantitative but also qualitative, emphasizing innovation in materials science and design to meet evolving technological demands.

A significant insight derived from the market analysis is the pronounced regional dominance of Asia-Pacific, which continues to be the epicenter of semiconductor manufacturing. This region is expected to lead growth in the wafer frame market, fueled by massive investments in new fabrication plants and the expansion of existing capacities in countries like China, Taiwan, South Korea, and Japan. The forecast suggests that North America and Europe, while smaller in market share, will continue to contribute through specialized high-value applications and cutting-edge research and development in advanced frame technologies.

Furthermore, the market forecast highlights a crucial trend towards operational efficiency and sustainability within the wafer frame segment. Companies are increasingly investing in automation and smart manufacturing solutions to reduce costs, improve throughput, and minimize environmental impact. The drive towards reusable and recyclable frame materials, coupled with enhanced material handling systems, indicates a holistic industry approach to meeting future demands while adhering to stringent environmental regulations and corporate sustainability goals. These factors collectively shape the strategic direction for stakeholders across the wafer frame value chain.

- The market is poised for robust growth, exceeding 8% CAGR, propelled by global semiconductor expansion.

- Advanced packaging and wafer thinning are primary growth catalysts, demanding specialized frame solutions.

- Asia-Pacific will remain the dominant and fastest-growing region due to high concentration of semiconductor fabrication.

- Technological advancements in materials and automation are critical for future market competitiveness.

- Sustainability and reusability of wafer frames are emerging as significant long-term market drivers.

Wafer Frame Market Drivers Analysis

The wafer frame market is significantly driven by the continuous expansion and technological evolution of the global semiconductor industry. As demand for electronic devices ranging from smartphones and IoT devices to advanced automotive systems and data center infrastructure continues to surge, the underlying need for high-quality semiconductor components intensifies. This directly translates into an increased requirement for wafer frames, which are essential for the safe and efficient handling, processing, and packaging of silicon wafers during various stages of manufacturing. The industry's push towards higher integration, greater computational power, and energy efficiency further necessitates advanced wafer frame solutions capable of accommodating thinner wafers and complex multi-die structures.

Another major driver is the accelerating adoption of advanced packaging technologies such as 3D ICs, System-in-Package (SiP), and Fan-Out Wafer Level Packaging (FOWLP). These innovative packaging methods allow for enhanced performance, reduced form factors, and improved power efficiency, but they also introduce new challenges for wafer handling. Wafer frames must evolve to meet the precise demands of these technologies, often requiring specialized designs, materials, and greater dimensional stability to prevent warpage and ensure accurate alignment during intricate processes like stacking and bonding. The transition from traditional wire bonding to advanced packaging techniques is a strong impetus for innovation in the wafer frame segment.

Furthermore, the global proliferation of 5G networks, the rapid development of Artificial Intelligence (AI) and Machine Learning (ML) applications, and the burgeoning electric vehicle (EV) market are creating unprecedented demand for high-performance chips. Each of these sectors relies heavily on advanced semiconductors, thereby driving investments in new fabrication facilities and expanding existing ones. This capacity expansion directly fuels the demand for wafer frames. Additionally, the increasing focus on automation within semiconductor fabs, including the use of robotic handling systems, mandates wafer frames that are compatible with such sophisticated automated environments, promoting standardization and precision in frame design and manufacturing.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Exponential Growth in Semiconductor Industry | +1.2% | Global | Long-term (2025-2033) |

| Increasing Adoption of Advanced Packaging | +1.0% | Asia-Pacific, North America | Mid-term (2027-2033) |

| Expansion of 5G Infrastructure & AI/ML Devices | +0.8% | Global | Mid-term (2026-2032) |

| Rise in IoT and Connected Devices | +0.7% | Global | Long-term (2025-2033) |

| Growing Demand in Automotive Electronics (EVs, ADAS) | +0.9% | Europe, North America, Asia-Pacific | Long-term (2025-2033) |

Wafer Frame Market Restraints Analysis

Despite robust growth drivers, the wafer frame market faces certain restraints that could temper its expansion. One significant challenge is the inherent cyclicality and volatility of the global semiconductor industry. Periods of oversupply or economic slowdowns can lead to reduced capital expenditure by semiconductor manufacturers, directly impacting the demand for wafer frames and related equipment. This cyclical nature makes long-term planning and investment challenging for wafer frame suppliers, requiring them to maintain flexibility and adapt quickly to market shifts, which can sometimes lead to reduced profit margins or delayed technological advancements.

Another key restraint is the high cost associated with advanced materials and precision manufacturing processes required for modern wafer frames. As semiconductor technology progresses, wafers become thinner, more fragile, and require increasingly sophisticated handling solutions to prevent damage. This necessitates the use of specialized materials like high-grade stainless steel or engineered plastics with specific thermal and mechanical properties, which are more expensive to source and process. The ongoing research and development into new materials and designs also incurs substantial costs, which can ultimately be passed on to customers, potentially limiting adoption, especially for manufacturers operating on tighter budgets or in less advanced segments.

Furthermore, intense competition among existing market players and the emergence of new entrants, particularly in cost-sensitive regions, can exert downward pressure on pricing. This competitive landscape, coupled with the relatively standardized nature of some basic wafer frame designs, can make it difficult for companies to differentiate their offerings solely on technological superiority, leading to price wars. Additionally, stringent quality control requirements and the need for significant capital investment in highly specialized manufacturing equipment act as barriers to entry, yet they also place a burden on established players to continuously upgrade their facilities and maintain compliance, thereby impacting overall profitability and growth potential.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Semiconductor Industry Cyclicality & Volatility | -0.8% | Global | Short to Mid-term (2025-2028) |

| High Manufacturing Costs of Advanced Frames | -0.6% | Global | Ongoing |

| Intense Market Competition & Price Pressure | -0.5% | Asia-Pacific, Global | Ongoing |

| Material Supply Chain Disruptions | -0.4% | Global | Short-term (2025-2026) |

| Technical Challenges with Ultra-Thin Wafers | -0.3% | Global | Mid-term (2027-2030) |

Wafer Frame Market Opportunities Analysis

The wafer frame market is presented with several promising opportunities that can accelerate its growth trajectory and foster innovation. A significant opportunity lies in the development and widespread adoption of sustainable and environmentally friendly wafer frame solutions. With increasing global emphasis on eco-conscious manufacturing and corporate social responsibility, there is a growing demand for frames made from recyclable materials, those with extended lifespans, or designs that facilitate reusability across multiple production cycles. This shift not only aligns with sustainability goals but also offers potential for cost reduction through material efficiency and reduced waste, opening new market segments for innovative suppliers.

Another substantial opportunity stems from the continuous evolution of advanced packaging technologies and the emergence of new semiconductor applications. As the industry moves towards heterogeneous integration, chiplets, and novel 3D stacking architectures, there is an escalating need for highly customized and specialized wafer frames capable of supporting these intricate processes. This includes frames designed for extreme precision, enhanced thermal management, or compatibility with new bonding techniques. Companies that can quickly adapt their R&D and manufacturing capabilities to develop these cutting-edge, niche solutions will find significant growth avenues, establishing themselves as key partners in the advanced semiconductor ecosystem.

Furthermore, the increasing trend towards smart manufacturing and Industry 4.0 initiatives within semiconductor fabrication plants presents an opportunity for wafer frame suppliers to integrate their products into fully automated and data-driven environments. This involves developing frames that are compatible with robotic handling systems, equipped with RFID tags for enhanced traceability, and designed to minimize human intervention. Additionally, the expansion of semiconductor manufacturing into new geographical regions, driven by government incentives and supply chain diversification strategies, creates fresh market entry points and demand for localized wafer frame supply chains, particularly in emerging markets that are investing heavily in domestic chip production capabilities.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Sustainable & Reusable Materials | +1.0% | Global | Mid to Long-term (2027-2033) |

| Specialized Frames for Emerging Advanced Packaging | +0.9% | Asia-Pacific, North America | Mid-term (2026-2032) |

| Integration with Smart Manufacturing & Automation | +0.8% | Global | Long-term (2025-2033) |

| Expansion into New Geographic Markets | +0.7% | Emerging APAC, Europe, North America | Long-term (2025-2033) |

| Enhanced Traceability & Data Integration (e.g., RFID) | +0.6% | Global | Mid-term (2027-2031) |

Wafer Frame Market Challenges Impact Analysis

The wafer frame market faces several significant challenges that demand innovative solutions and strategic adaptation from industry participants. A primary challenge is the escalating technical complexity associated with handling increasingly thin and large-diameter wafers, particularly those moving towards 18-inch sizes and thicknesses below 50 micrometers. Such wafers are highly susceptible to warpage, breakage, and contamination, requiring wafer frames with extremely tight dimensional tolerances, superior material properties for stiffness and thermal stability, and advanced surface treatments. Developing and manufacturing these high-precision frames while maintaining cost-effectiveness is a formidable engineering and production hurdle that requires continuous R&D investment and expertise.

Another critical challenge revolves around maintaining consistent quality and high yields in a high-volume manufacturing environment. Any defect or inconsistency in a wafer frame can lead to significant yield losses in downstream semiconductor fabrication processes, resulting in substantial financial implications for chip manufacturers. This necessitates rigorous quality control measures, advanced inspection technologies, and robust process controls throughout the wafer frame production lifecycle. Ensuring uniformity across millions of frames, especially when dealing with new materials or complex geometries for advanced packaging, adds another layer of complexity to manufacturing operations and requires significant capital expenditure in automation and advanced metrology equipment.

Furthermore, geopolitical tensions and trade disputes pose a considerable challenge to the global wafer frame supply chain. Dependencies on specific regions for raw materials or specialized manufacturing capabilities can expose companies to supply disruptions, increased logistics costs, and unpredictable trade policies. The industry's push for supply chain resilience and diversification, while offering long-term stability, often involves costly and time-consuming efforts to establish new partnerships and qualify alternative suppliers. Additionally, the shortage of skilled labor with expertise in advanced materials science, precision engineering, and semiconductor manufacturing processes also presents a bottleneck, affecting both the development of next-generation frames and the efficient operation of manufacturing facilities.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Technical Complexities of Ultra-Thin Wafer Handling | -0.7% | Global | Ongoing |

| Maintaining High Quality & Yield in Mass Production | -0.6% | Global | Ongoing |

| Geopolitical Tensions & Supply Chain Vulnerability | -0.5% | Global | Short to Mid-term (2025-2028) |

| Skilled Labor Shortage in Advanced Manufacturing | -0.4% | Global | Long-term (2025-2033) |

| Rapid Technological Obsolescence | -0.3% | Global | Ongoing |

Wafer Frame Market - Updated Report Scope

This comprehensive market research report on the Wafer Frame Market offers an in-depth analysis of the current market landscape, historical performance, and future projections. It provides a detailed examination of market dynamics, including key drivers, restraints, opportunities, and challenges that influence market growth and strategic decision-making for stakeholders. The report incorporates the latest technological advancements and their impact on wafer frame design, materials, and manufacturing processes, offering a forward-looking perspective on industry evolution.

The scope extends to a meticulous segmentation analysis, breaking down the market by type, material, wafer size, application, and end-use industry, alongside a robust regional analysis covering major geographies. It profiles leading market players, evaluating their strategies, product portfolios, and competitive positioning. This report serves as an invaluable resource for industry participants, investors, and new entrants seeking actionable insights to navigate the complexities and capitalize on the opportunities within the rapidly evolving wafer frame ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | 550 Million USD |

| Market Forecast in 2033 | 1065 Million USD |

| Growth Rate | 8.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | DISCO, Accretech (Advantest), ASMPT, Kulicke & Soffa, Towa Corporation, Shinkawa Ltd., Mitsui High-tec, Nippon Filcon Corporation, Daicel Corporation, Sumitomo Bakelite Co., Ltd., Nagase & Co., Ltd., Ultra Clean Technology, Entegris, TATSUTA Electric Wire & Cable Co., Ltd., SEC Corporation, HOYA Corporation, Lasertec Corporation, Micronic, SUSS MicroTec, Veeco Instruments |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Wafer Frame Market is meticulously segmented to provide a granular understanding of its diverse components and dynamics. This segmentation facilitates a deeper analysis of market trends, growth drivers, and opportunities across various product types, materials, wafer sizes, and end-use applications. Each segment reflects distinct technological requirements and market demands, influenced by the evolving landscape of semiconductor manufacturing and the specific needs of different industry verticals. Understanding these segments is crucial for stakeholders to identify lucrative niches and tailor their strategies effectively.

The segmentation by type, encompassing dicing frames, lead frames, and film frames, highlights the functional diversity of wafer handling solutions required at different stages of semiconductor production. Dicing frames, for instance, are critical during the process of separating individual dies from a wafer, demanding high precision and stability. Similarly, the breakdown by material, including stainless steel, plastic, and ceramic, showcases the industry's reliance on materials with varied properties suited for thermal management, chemical resistance, and mechanical strength, contingent on the specific manufacturing environment and wafer type being processed.

Furthermore, market segmentation by wafer size (e.g., 6-inch, 8-inch, 12-inch) underscores the industry's progression towards larger wafers for increased economies of scale, while also acknowledging the continued relevance of smaller sizes for specialized applications. The application segment, differentiating between Integrated Device Manufacturers (IDM), Foundries, and Outsourced Semiconductor Assembly and Test (OSAT) companies, reflects the diverse operational models within the semiconductor value chain. Lastly, the end-use industry segmentation provides insights into the primary sectors driving demand, from consumer electronics and automotive to healthcare and telecommunications, each imposing unique performance and reliability requirements on wafer frames.

- By Type: Dicing Frame, Lead Frame, Film Frame, Others.

- By Material: Stainless Steel, Plastic, Ceramic, Alloy, Others.

- By Wafer Size: 6-inch Wafer Frame, 8-inch Wafer Frame, 12-inch Wafer Frame, 18-inch Wafer Frame, Other Wafer Sizes.

- By Application: Integrated Device Manufacturers (IDM), Foundries, Outsourced Semiconductor Assembly and Test (OSAT), Research & Development Institutions.

- By End-Use Industry: Consumer Electronics, Automotive, Industrial, Healthcare, Telecommunication, Others.

Regional Highlights

- Asia Pacific (APAC): Dominates the global wafer frame market, primarily driven by the concentration of leading semiconductor foundries, IDMs, and OSAT players in countries such as Taiwan, South Korea, China, and Japan. This region is witnessing massive investments in new fabrication facilities and capacity expansions, fueling an immense demand for wafer frames. The rapid growth of advanced packaging technologies and the extensive manufacturing ecosystem make APAC the largest and fastest-growing market. Countries like China are also investing heavily in domestic semiconductor production, further bolstering regional demand.

- North America: A significant market for wafer frames, characterized by a strong emphasis on research and development, design, and advanced manufacturing processes. The region houses key players in semiconductor equipment, materials, and design, contributing to the demand for high-precision and specialized wafer frames for cutting-edge technologies. While not as dominant in volume manufacturing as APAC, North America plays a crucial role in driving innovation and developing next-generation wafer frame solutions.

- Europe: Represents a mature market for wafer frames, with a focus on niche and specialized applications, particularly in industrial, automotive, and specific research sectors. European countries are investing in smart manufacturing initiatives and advanced material development, contributing to the demand for high-quality, reliable, and often customized wafer frames. The region's commitment to sustainability also drives innovation in environmentally friendly wafer frame solutions.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets for wafer frames, with growing, albeit smaller, semiconductor manufacturing ecosystems. While still reliant on imports for most advanced semiconductor components, increasing digitalization, industrialization, and infrastructure development are gradually contributing to the demand for semiconductors, and consequently, wafer frames. Future growth in these regions will largely depend on sustained investments in domestic electronics manufacturing and technological infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Frame Market.- DISCO

- Accretech (Advantest)

- ASMPT

- Kulicke & Soffa

- Towa Corporation

- Shinkawa Ltd.

- Mitsui High-tec

- Nippon Filcon Corporation

- Daicel Corporation

- Sumitomo Bakelite Co., Ltd.

- Nagase & Co., Ltd.

- Ultra Clean Technology

- Entegris

- TATSUTA Electric Wire & Cable Co., Ltd.

- SEC Corporation

- HOYA Corporation

- Lasertec Corporation

- Micronic

- SUSS MicroTec

- Veeco Instruments

Frequently Asked Questions

Analyze common user questions about the Wafer Frame market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a wafer frame and why is it important in semiconductor manufacturing?

A wafer frame is a circular or rectangular ring used to hold a semiconductor wafer during various stages of manufacturing, such as dicing, grinding, bonding, and packaging. Its importance lies in providing mechanical support, protection against damage and contamination, and enabling precise handling and alignment of fragile wafers, crucial for maintaining yield and quality throughout the intricate fabrication process.

What materials are commonly used for wafer frames and why?

Wafer frames are typically made from materials such as stainless steel, various types of plastic (e.g., polycarbonate, PEEK), ceramic, or specialized alloys. The choice of material depends on the specific process requirements, including thermal stability, chemical resistance, mechanical strength, and cost. Stainless steel offers high rigidity and durability, while plastics provide flexibility and chemical inertness for certain applications, and ceramics offer excellent thermal properties.

How do advanced packaging technologies impact wafer frame design?

Advanced packaging technologies like 3D ICs, fan-out, and chiplets demand thinner, more precise, and highly stable wafer frames. These technologies require frames that can handle ultra-thin wafers without warpage, facilitate extremely accurate alignment for stacking, and are compatible with new bonding techniques. This drives innovation in frame material science, dimensional accuracy, and specialized designs to support the increased complexity and miniaturization in packaging.

What role does automation play in the wafer frame market?

Automation is increasingly vital, impacting both the manufacturing of wafer frames and their integration into semiconductor fabs. Automated material handling systems (AMHS) and robotics necessitate wafer frames with precise dimensions and features for seamless machine compatibility. In turn, AI-driven automation is used for quality inspection and design optimization of frames, improving efficiency, reducing human error, and ensuring consistent product quality in high-volume production.

What are the key sustainability trends in wafer frame manufacturing?

Key sustainability trends include the development of reusable and recyclable wafer frames, reducing reliance on single-use components. There is a growing focus on using eco-friendly materials that have a lower environmental footprint throughout their lifecycle. Additionally, efforts are being made to optimize manufacturing processes to reduce waste and energy consumption, aligning with broader industry goals for green manufacturing and corporate social responsibility.