Wafer Cutting Fluid Market

Wafer Cutting Fluid Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705089 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Wafer Cutting Fluid Market Size

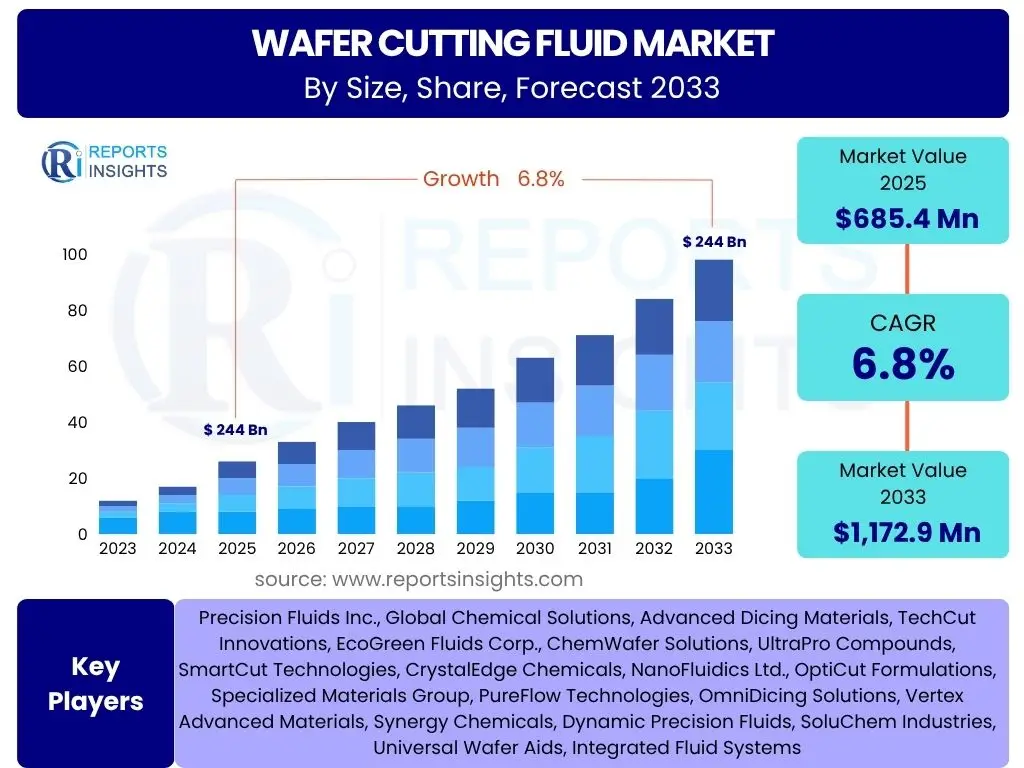

According to Reports Insights Consulting Pvt Ltd, The Wafer Cutting Fluid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 685.4 million in 2025 and is projected to reach USD 1,172.9 million by the end of the forecast period in 2033. This growth is primarily fueled by the relentless expansion of the global semiconductor industry, driven by advancements in consumer electronics, automotive electrification, artificial intelligence, and 5G technology. The increasing demand for miniaturized, high-performance, and complex semiconductor devices necessitates more precise and efficient wafer processing, directly impacting the consumption of specialized cutting fluids.

The market's expansion is further supported by significant investments in new fabrication facilities and research and development initiatives aimed at improving wafer yield and reducing operational costs. Emerging economies, particularly in Asia Pacific, are at the forefront of this growth, establishing themselves as key hubs for semiconductor manufacturing. These regions are witnessing a surge in domestic and foreign investments in advanced semiconductor technologies, which, in turn, fuels the demand for high-quality wafer cutting fluids to ensure manufacturing precision and efficiency.

Key Wafer Cutting Fluid Market Trends & Insights

The Wafer Cutting Fluid market is currently experiencing several transformative trends, driven by the semiconductor industry's evolution towards higher precision, enhanced efficiency, and environmental sustainability. User inquiries frequently highlight the shift towards eco-friendly formulations, the demand for fluids compatible with new substrate materials, and the impact of advanced manufacturing techniques. These trends underscore the industry's focus on improving wafer yield, reducing operational costs, and adhering to stringent environmental regulations, while also addressing the complexities introduced by next-generation semiconductor devices.

Manufacturers are increasingly investing in research and development to create novel fluid formulations that offer superior cutting performance, extended tool life, and improved particulate suspension. This push for innovation is critical as wafer materials become more diverse, including silicon carbide (SiC), gallium nitride (GaN), and other compound semiconductors, which require specific chemical and physical properties from cutting fluids. Furthermore, the integration of automation and data analytics in wafer processing lines is influencing the demand for fluids that support higher throughput and offer real-time performance monitoring capabilities, ensuring consistent quality and minimizing downtime.

- Development of eco-friendly and biodegradable wafer cutting fluid formulations is gaining significant traction due to increasing environmental regulations and corporate sustainability initiatives.

- Rising demand for cutting fluids optimized for advanced materials such as silicon carbide (SiC) and gallium nitride (GaN) for power electronics and high-frequency applications.

- Miniaturization and increasing complexity of semiconductor devices drive the need for higher precision cutting fluids that reduce kerf loss and improve surface quality.

- Integration of advanced filtration systems and recycling technologies extends the lifespan of cutting fluids, reducing consumption and waste.

- Growing adoption of automated dicing and cutting processes necessitates fluids with consistent performance and low foaming characteristics to support high-throughput operations.

- Emphasis on fluids that offer superior cooling and lubrication properties to manage thermal stress during high-speed cutting operations, preventing material damage.

- Shift towards water-soluble and low-VOC (Volatile Organic Compound) formulations to enhance worker safety and reduce environmental impact.

AI Impact Analysis on Wafer Cutting Fluid

The integration of Artificial Intelligence (AI) and machine learning (ML) within semiconductor manufacturing is poised to significantly transform the Wafer Cutting Fluid market. Common user inquiries regarding AI's impact often revolve around its potential for process optimization, predictive maintenance, quality control, and the development of new material formulations. AI's ability to analyze vast datasets from manufacturing processes can lead to more efficient use of cutting fluids, reduced waste, and improved overall yield, directly addressing key industry challenges related to cost and operational efficiency.

AI algorithms can monitor real-time cutting parameters, fluid properties, and equipment performance to predict optimal fluid usage, detect anomalies, and schedule preventive maintenance for dicing equipment. This data-driven approach minimizes unexpected downtime and ensures consistent cutting quality, which is paramount in semiconductor fabrication. Furthermore, AI can accelerate the research and development of new cutting fluid formulations by simulating molecular interactions and predicting performance characteristics, leading to the quicker introduction of more effective and sustainable products tailored for emerging wafer materials and advanced packaging techniques.

- AI-driven process optimization: Enhances cutting fluid lifespan and efficiency by analyzing real-time usage data, leading to precise dosing and reduced waste.

- Predictive maintenance: AI algorithms can forecast equipment failures related to fluid contamination or degradation, minimizing downtime and optimizing maintenance schedules.

- Automated quality control: AI-powered vision systems can detect microscopic defects caused by cutting fluids, ensuring higher wafer yield and reducing rework.

- Fluid formulation development: AI and machine learning accelerate the discovery and optimization of new cutting fluid chemistries by simulating performance and material interactions.

- Supply chain optimization: AI can improve logistics and inventory management for cutting fluid suppliers and consumers, ensuring timely delivery and minimizing stockouts.

- Enhanced environmental monitoring: AI can track and report on the environmental impact of cutting fluids, aiding in compliance and sustainability efforts.

Key Takeaways Wafer Cutting Fluid Market Size & Forecast

The Wafer Cutting Fluid market is on a robust growth trajectory, primarily driven by the expanding global semiconductor industry and the escalating demand for high-performance electronic devices. Key takeaways from market size and forecast analyses indicate a sustained Compound Annual Growth Rate (CAGR) through 2033, reflecting continuous innovation in wafer materials and cutting technologies. This growth is underpinned by significant investments in semiconductor fabrication plants and research efforts focused on improving yield and efficiency in the dicing process. The market's resilience is evident in its ability to adapt to rapid technological shifts, emphasizing precision, environmental responsibility, and cost-effectiveness in fluid formulations.

Geographically, Asia Pacific remains the dominant and fastest-growing region, owing to its concentrated semiconductor manufacturing base and ongoing expansion plans. The market is also seeing a shift towards more specialized and sustainable cutting fluid solutions, moving away from conventional chemistries to advanced, eco-friendly formulations that cater to ultra-thin wafers and exotic materials. These developments highlight the industry's commitment to both technological advancement and environmental stewardship, positioning the wafer cutting fluid market as a crucial enabler of future semiconductor innovations.

- Significant market growth: The Wafer Cutting Fluid Market is projected to experience a substantial CAGR of 6.8% from 2025 to 2033, driven by semiconductor industry expansion.

- Asia Pacific dominance: The Asia Pacific region is expected to maintain its leading position and fastest growth rate due to extensive semiconductor manufacturing investments and capacity expansion.

- Technological advancements: Increasing demand for advanced packaging, thinner wafers, and new substrate materials (SiC, GaN) necessitates specialized and high-performance cutting fluids.

- Sustainability focus: Growing emphasis on developing and adopting eco-friendly, biodegradable, and low-VOC cutting fluid formulations to meet regulatory standards and corporate environmental goals.

- Yield and efficiency paramount: Innovations in cutting fluid chemistry are crucial for minimizing kerf loss, improving surface quality, and extending tool life, directly impacting wafer yield and production efficiency.

Wafer Cutting Fluid Market Drivers Analysis

The Wafer Cutting Fluid market is propelled by a confluence of factors, fundamentally rooted in the vigorous expansion and technological evolution of the global semiconductor industry. The escalating demand for electronic devices across various sectors, including consumer electronics, automotive, telecommunications, and data centers, necessitates a continuous increase in semiconductor chip production. This surge in manufacturing volume directly translates to a higher consumption of wafer cutting fluids, which are indispensable for precise and damage-free dicing of silicon and other advanced material wafers. Furthermore, the relentless pursuit of miniaturization and enhanced performance in integrated circuits drives the adoption of more sophisticated wafer cutting techniques and, consequently, more specialized cutting fluids.

Beyond the sheer volume, the transition to advanced materials like silicon carbide (SiC) and gallium nitride (GaN) for power electronics and high-frequency applications presents another significant driver. These materials are much harder and more brittle than traditional silicon, requiring specific cutting fluid formulations that can effectively cool, lubricate, and remove debris without causing micro-cracks or surface damage. Additionally, the increasing complexity of semiconductor packaging, including 3D ICs and advanced heterogeneous integration, demands even greater precision in wafer dicing, further boosting the demand for high-performance and innovative cutting fluid solutions that ensure high yield rates and superior die quality.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Semiconductor Industry Growth | +1.8% | Global, particularly Asia Pacific (China, Taiwan, South Korea) | Long-term |

| Rising Demand for Advanced Packaging | +1.5% | Global, especially North America, Asia Pacific | Mid-term |

| Proliferation of IoT, AI, and 5G Technologies | +1.3% | Global | Mid-term to Long-term |

| Increasing Adoption of SiC and GaN Wafers | +1.2% | Europe, North America, Asia Pacific (Japan, South Korea) | Short-term to Mid-term |

| Miniaturization of Electronic Devices | +1.0% | Global | Long-term |

| Investments in New Fab Facilities | +0.8% | Asia Pacific, North America, Europe | Mid-term |

| Focus on High Wafer Yield and Quality | +0.7% | Global | Ongoing |

Wafer Cutting Fluid Market Restraints Analysis

Despite the robust growth drivers, the Wafer Cutting Fluid market faces several restraints that could potentially impede its expansion. One significant challenge is the stringent environmental regulations concerning the disposal and usage of chemical substances. Many conventional cutting fluids contain components that are harmful to the environment or human health, leading to increased costs associated with waste treatment, compliance, and the development of eco-friendly alternatives. This regulatory pressure can slow down market adoption of certain formulations and necessitates substantial R&D investments from manufacturers.

Another restraint stems from the high initial investment required for advanced wafer cutting equipment and the associated specialized fluid management systems. Small and medium-sized enterprises (SMEs) in the semiconductor manufacturing ecosystem may find it challenging to afford these capital expenditures, limiting their access to the latest technologies and high-performance fluids. Furthermore, the cyclical nature of the semiconductor industry, characterized by periods of oversupply and demand fluctuations, can lead to volatility in the demand for wafer cutting fluids, making long-term planning and investment decisions challenging for market participants. The competition from alternative cutting technologies, such as laser dicing, while currently niche for certain applications, also poses a potential long-term restraint by reducing reliance on traditional fluid-dependent processes.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations | -0.9% | Europe, North America, specific Asian countries | Ongoing, Long-term |

| High Disposal and Treatment Costs | -0.8% | Global | Ongoing |

| Volatility of Semiconductor Market | -0.7% | Global | Short-term to Mid-term |

| Competition from Alternative Cutting Technologies (e.g., Laser Dicing) | -0.6% | Global | Mid-term to Long-term |

| High R&D Costs for New Formulations | -0.5% | Global | Ongoing |

| Supply Chain Disruptions for Raw Materials | -0.4% | Global | Short-term |

Wafer Cutting Fluid Market Opportunities Analysis

The Wafer Cutting Fluid market presents several significant opportunities for growth, primarily stemming from the continuous innovation within the semiconductor industry and the increasing emphasis on sustainable manufacturing practices. The rapid development and commercialization of new compound semiconductor materials, such as silicon carbide (SiC) and gallium nitride (GaN), for high-power and high-frequency applications, create a strong demand for specialized cutting fluids. These materials require unique fluid properties to ensure efficient cutting, minimize damage, and maximize yield, representing a lucrative niche for manufacturers capable of developing tailored solutions. Furthermore, the global push towards electric vehicles (EVs) and renewable energy systems, which heavily rely on power electronics built from these advanced materials, will further amplify this demand.

Another prominent opportunity lies in the growing trend towards green chemistry and sustainable manufacturing. Companies are increasingly seeking eco-friendly and biodegradable cutting fluid formulations to reduce their environmental footprint and comply with evolving regulations. This creates an opening for market players to invest in research and development of non-toxic, low-VOC (Volatile Organic Compound), and easily disposable fluids, gaining a competitive edge and appealing to a broader customer base committed to sustainability. Additionally, the proliferation of advanced packaging technologies, including 3D ICs, fan-out wafer-level packaging (FOWLP), and chiplets, demands ultra-precise dicing, thereby increasing the market for high-performance cutting fluids that can meet these exacting requirements and contribute to higher throughput and yield rates in complex assembly processes.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Eco-Friendly & Biodegradable Fluids | +1.4% | Europe, North America, Japan | Mid-term to Long-term |

| Increasing Demand for SiC and GaN Specific Fluids | +1.3% | Global, particularly major semiconductor hubs | Short-term to Mid-term |

| Growth in Advanced Packaging Technologies | +1.2% | Asia Pacific, North America | Mid-term |

| Expansion in Automotive Electronics (EVs, ADAS) | +1.1% | Global | Long-term |

| Integration of AI/ML for Process Optimization | +1.0% | Global | Mid-term to Long-term |

| Customization for Diverse Wafer Materials | +0.9% | Global | Ongoing |

Wafer Cutting Fluid Market Challenges Impact Analysis

The Wafer Cutting Fluid market faces several critical challenges that demand strategic responses from industry participants. One significant hurdle is the escalating cost of raw materials, which can fluctuate due to geopolitical tensions, supply chain disruptions, and global economic volatility. This directly impacts the production cost of cutting fluids, potentially eroding profit margins for manufacturers and leading to higher prices for end-users, which can in turn affect adoption rates, especially for specialized, high-performance formulations. Maintaining a stable and cost-effective supply chain for diverse chemical components is a persistent concern.

Another key challenge is the continuous need for innovation to keep pace with the rapid advancements in semiconductor technology. As wafer materials become more complex (e.g., ultra-thin, brittle, or composite materials) and dicing processes demand even greater precision (e.g., for smaller die sizes and advanced packaging), existing cutting fluid formulations may become obsolete. Manufacturers must invest heavily in research and development to create new fluids that offer superior performance, better cooling, reduced kerf loss, and enhanced compatibility with next-generation dicing equipment and materials. Furthermore, managing the environmental impact of cutting fluids, from their chemical composition to their disposal, presents a formidable regulatory and operational challenge, requiring continuous efforts towards developing sustainable solutions that meet stringent global environmental standards while maintaining performance integrity.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Fluctuating Raw Material Costs | -0.9% | Global | Short-term to Mid-term |

| Technological Advancements Requiring Continuous R&D | -0.8% | Global | Ongoing |

| Managing Environmental Compliance & Waste Disposal | -0.7% | Europe, North America, parts of Asia | Ongoing, Long-term |

| Competition from Laser Dicing and Dry Cutting Technologies | -0.6% | Global | Mid-term to Long-term |

| Need for Highly Customized Solutions for Niche Applications | -0.5% | Global | Ongoing |

| Skilled Labor Shortage for Fluid Management | -0.4% | North America, Europe | Long-term |

| IP Protection and Counterfeiting Concerns | -0.3% | Global | Ongoing |

Wafer Cutting Fluid Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Wafer Cutting Fluid market, covering historical trends, current market dynamics, and future growth projections. The scope encompasses detailed segmentation analysis by various types, applications, and end-user industries, offering a granular view of market performance across different categories. Furthermore, it includes a thorough regional analysis, highlighting key market developments and opportunities in major geographical segments such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The report also profiles leading market players, providing insights into their strategies, product portfolios, and recent developments to offer a complete competitive landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 685.4 Million |

| Market Forecast in 2033 | USD 1,172.9 Million |

| Growth Rate | 6.8% CAGR |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Precision Fluids Inc., Global Chemical Solutions, Advanced Dicing Materials, TechCut Innovations, EcoGreen Fluids Corp., ChemWafer Solutions, UltraPro Compounds, SmartCut Technologies, CrystalEdge Chemicals, NanoFluidics Ltd., OptiCut Formulations, Specialized Materials Group, PureFlow Technologies, OmniDicing Solutions, Vertex Advanced Materials, Synergy Chemicals, Dynamic Precision Fluids, SoluChem Industries, Universal Wafer Aids, Integrated Fluid Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Wafer Cutting Fluid market is comprehensively segmented based on various critical parameters, including fluid type, application, and end-use industry. This granular segmentation provides a detailed understanding of the market's diverse dynamics and specific growth opportunities within each category. By analyzing these segments, stakeholders can identify high-potential areas, tailor product development, and optimize market entry strategies, ensuring alignment with specific industry demands and technological requirements. The varied properties of different fluid types cater to distinct cutting processes and wafer materials, while diverse applications highlight the extensive usage across the semiconductor manufacturing value chain.

The segmentation by fluid type, encompassing water-based, oil-based, synthetic, and semi-synthetic fluids, reflects the chemical versatility required to address different dicing challenges, from standard silicon to advanced compound semiconductors. Each type offers unique advantages in terms of cooling, lubrication, and particulate removal. Application-based segmentation further delineates the market by the specific wafer material being cut, recognizing that silicon, SiC, GaN, sapphire, and glass wafers each demand tailored fluid characteristics for optimal yield and surface quality. Finally, the end-use industry segmentation provides insight into the primary sectors driving demand, from high-volume consumer electronics to specialized automotive and telecommunications markets, each with distinct performance requirements for the final semiconductor devices.

- By Type:

- Water-Based Fluids: Offer good cooling, often eco-friendlier.

- Oil-Based Fluids: Known for superior lubrication and anti-corrosion properties.

- Synthetic Fluids: Provide excellent performance, thermal stability, and long lifespan.

- Semi-Synthetic Fluids: Balance performance of synthetic with cost-effectiveness.

- Other Formulations: Includes specialized or emerging fluid chemistries.

- By Application:

- Silicon Wafer Dicing: Largest segment due to widespread silicon use.

- Compound Semiconductor Wafer Dicing (SiC, GaN, GaAs, InP): Growing rapidly due to EV, 5G, and power electronics.

- Sapphire Wafer Dicing: Used primarily in LED and some power device manufacturing.

- Glass Wafer Dicing: Essential for advanced packaging and display technologies.

- Other Advanced Material Dicing: Includes niche materials and emerging substrates.

- By End-Use Industry:

- Consumer Electronics: Smartphones, laptops, wearables, etc.

- Automotive: ADAS, infotainment, EV power modules.

- Telecommunications: 5G infrastructure, network devices.

- Industrial: Automation, power management, robotics.

- Healthcare: Medical imaging, diagnostic devices.

- Aerospace & Defense: High-reliability components for extreme environments.

- Others: Includes research, energy, and other specialized applications.

Regional Highlights

- Asia Pacific (APAC): Dominates the global Wafer Cutting Fluid market due to its robust semiconductor manufacturing ecosystem, concentrated in countries like Taiwan, South Korea, China, and Japan. The region is a hub for major foundries and advanced packaging facilities, benefiting from significant government support and continuous investments in new fabrication plants. The surging demand for consumer electronics, automotive components, and 5G infrastructure in this region fuels the largest share of wafer production and, consequently, cutting fluid consumption. Future growth is expected to remain strong as countries like India and Southeast Asian nations expand their semiconductor capabilities.

- North America: Represents a significant market, driven by strong R&D activities, the presence of leading semiconductor equipment manufacturers, and a focus on high-performance computing, AI, and defense applications. While not as dominant in volume manufacturing as APAC, North America leads in the development of advanced materials and cutting-edge dicing technologies, necessitating high-specification wafer cutting fluids. Emphasis on domestic manufacturing and supply chain resilience also contributes to sustained demand.

- Europe: Characterized by a strong presence in automotive electronics, industrial applications, and power semiconductors, particularly those based on SiC and GaN. This focus on advanced compound semiconductors drives the demand for specialized wafer cutting fluids tailored to these harder and more brittle materials. European environmental regulations also push for innovation in eco-friendly and sustainable fluid formulations, positioning the region as a leader in green chemistry for semiconductor manufacturing.

- Latin America: A nascent but growing market for wafer cutting fluids, primarily driven by increasing investments in electronics manufacturing and assembly operations, especially in countries like Mexico and Brazil. While its market share is currently smaller, the region presents opportunities as local industrialization initiatives and foreign investments expand the demand for semiconductor components.

- Middle East and Africa (MEA): Currently holds the smallest share of the Wafer Cutting Fluid market. However, emerging economies within the MEA region are gradually developing their industrial and technology sectors, including nascent semiconductor-related activities. Future growth will be contingent on increased foreign direct investment, infrastructure development, and the establishment of local electronics manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Cutting Fluid Market.- Precision Fluids Inc.

- Global Chemical Solutions

- Advanced Dicing Materials

- TechCut Innovations

- EcoGreen Fluids Corp.

- ChemWafer Solutions

- UltraPro Compounds

- SmartCut Technologies

- CrystalEdge Chemicals

- NanoFluidics Ltd.

- OptiCut Formulations

- Specialized Materials Group

- PureFlow Technologies

- OmniDicing Solutions

- Vertex Advanced Materials

- Synergy Chemicals

- Dynamic Precision Fluids

- SoluChem Industries

- Universal Wafer Aids

- Integrated Fluid Systems

Frequently Asked Questions

What is the projected growth rate of the Wafer Cutting Fluid Market?

The Wafer Cutting Fluid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033, driven by the expansion of the global semiconductor industry and increasing demand for advanced electronic devices.

Which region dominates the Wafer Cutting Fluid Market?

The Asia Pacific region currently dominates the Wafer Cutting Fluid Market and is expected to maintain its leading position due to its concentrated semiconductor manufacturing base, extensive investments in new fabrication facilities, and high production volumes of electronic components.

What are the key trends influencing the Wafer Cutting Fluid Market?

Key trends include the development of eco-friendly and biodegradable fluid formulations, increasing demand for fluids optimized for advanced materials like SiC and GaN, and the need for higher precision fluids driven by semiconductor miniaturization and advanced packaging technologies.

How does AI impact the Wafer Cutting Fluid Market?

AI impacts the market through process optimization by analyzing real-time data to enhance fluid efficiency and lifespan, predictive maintenance for dicing equipment, automated quality control for defect detection, and accelerated development of new fluid formulations.

What are the main drivers for the Wafer Cutting Fluid Market?

Primary drivers include the robust growth of the global semiconductor industry, rising demand for advanced packaging, proliferation of IoT, AI, and 5G technologies, and the increasing adoption of challenging materials such as SiC and GaN wafers in various applications.