Ultra high purity Anhydrou Hydrogen Chloride Gas Market

Ultra high purity Anhydrou Hydrogen Chloride Gas Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704544 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Ultra high purity Anhydrou Hydrogen Chloride Gas Market Size

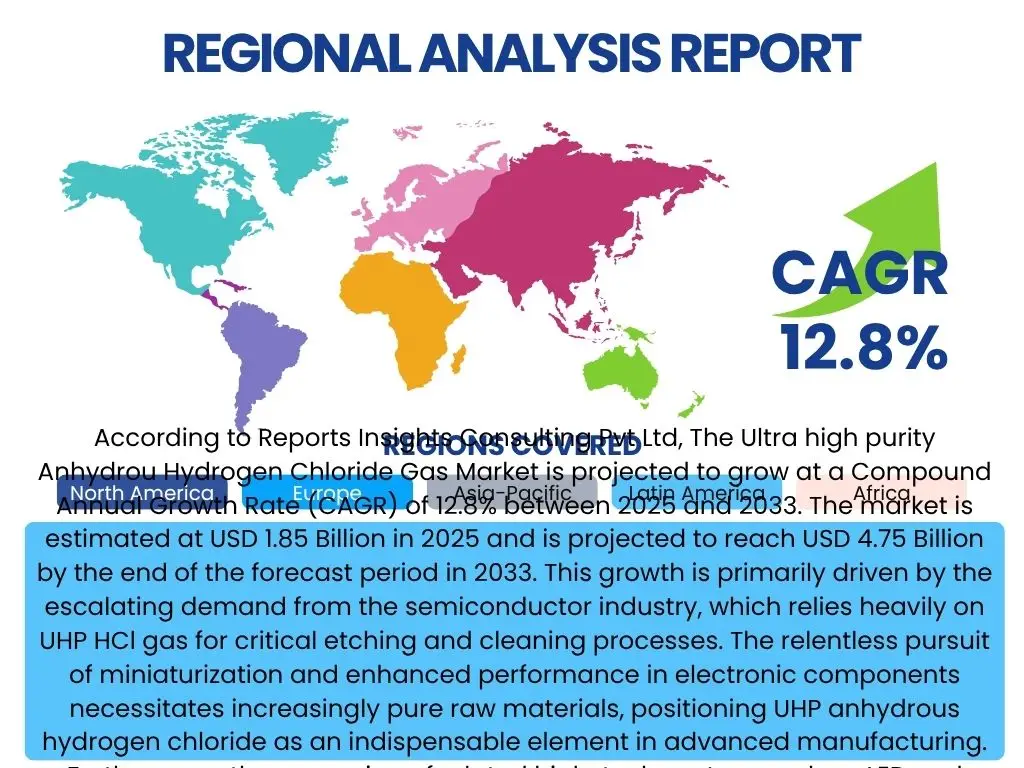

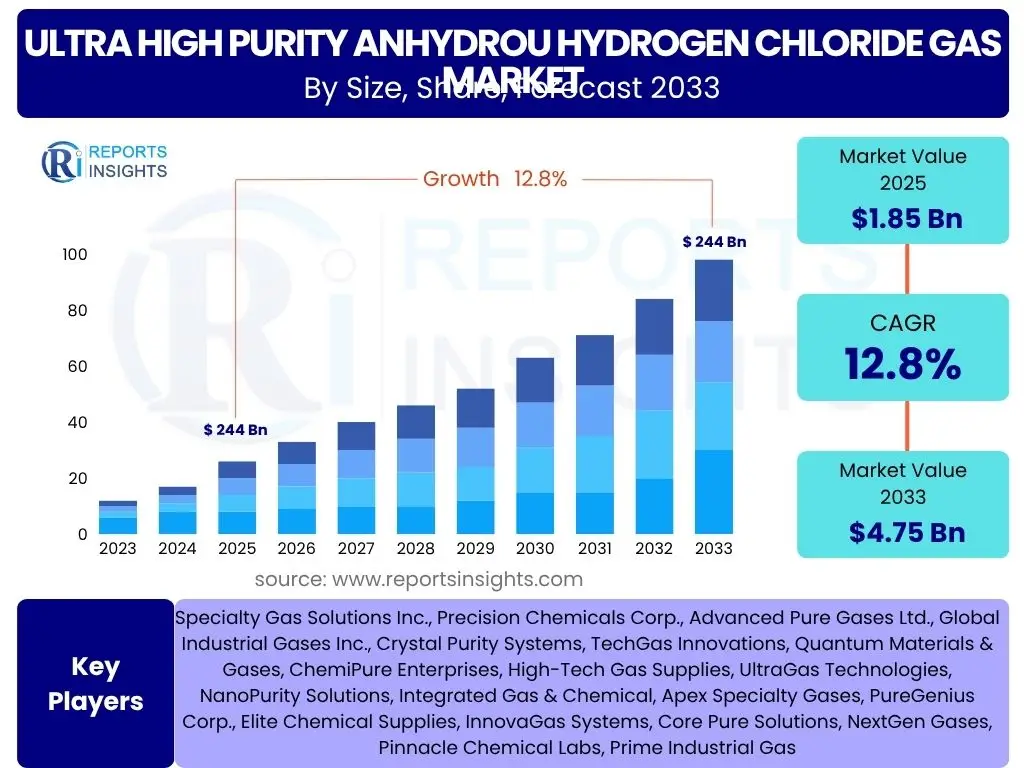

According to Reports Insights Consulting Pvt Ltd, The Ultra high purity Anhydrou Hydrogen Chloride Gas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2025 and 2033. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 4.75 Billion by the end of the forecast period in 2033. This growth is primarily driven by the escalating demand from the semiconductor industry, which relies heavily on UHP HCl gas for critical etching and cleaning processes. The relentless pursuit of miniaturization and enhanced performance in electronic components necessitates increasingly pure raw materials, positioning UHP anhydrous hydrogen chloride as an indispensable element in advanced manufacturing. Furthermore, the expansion of related high-tech sectors, such as LED and optoelectronics, along with stringent quality requirements in pharmaceutical synthesis, contribute significantly to the market's robust expansion.

The market's valuation reflects the specialized nature of UHP HCl gas, characterized by its complex production processes and critical applications. The projected substantial increase in market value over the forecast period underscores the rising global investment in fabrication plants and advanced material research. As technological advancements continue to drive demand for higher purity levels, the market is poised for sustained expansion, with key players focusing on innovation in purification technologies and secure supply chain management to meet the escalating industrial requirements. This trajectory highlights the strategic importance of UHP HCl gas within the broader landscape of high-tech manufacturing and its foundational role in enabling next-generation electronic devices.

Key Ultra high purity Anhydrou Hydrogen Chloride Gas Market Trends & Insights

Market stakeholders frequently inquire about the emerging trends and underlying insights shaping the Ultra high purity Anhydrous Hydrogen Chloride Gas market. Analysis reveals a prominent focus on achieving even higher purity levels, driven by the exacting demands of advanced semiconductor fabrication processes that are pushing towards sub-10nm nodes. There is also a significant trend towards optimizing supply chain resilience and localized production, minimizing geopolitical risks and ensuring consistent availability of this critical material. Furthermore, increasing environmental scrutiny is fostering innovation in sustainable production methods and waste management, alongside a growing emphasis on safety protocols given the hazardous nature of HCl gas. User inquiries also frequently touch upon the integration of advanced analytics and automation within the production and delivery pipeline to ensure consistent quality and reduce human error.

Another significant insight revolves around the diversification of end-use applications beyond traditional semiconductor manufacturing. While semiconductors remain the primary driver, the increasing adoption of UHP HCl gas in advanced LED technologies, specialized photovoltaic cell production, and high-purity pharmaceutical synthesis is gaining traction. This diversification contributes to market stability and opens new avenues for growth. Moreover, the market is witnessing a trend towards long-term supply agreements between gas manufacturers and major end-users, reflecting the strategic importance of securing a reliable supply of UHP HCl for uninterrupted production in highly capital-intensive industries. These agreements often include provisions for quality assurance, delivery logistics, and technical support, solidifying partnerships across the value chain.

The global competitive landscape is also evolving, with increasing consolidation among major players seeking to expand their production capacities and technological capabilities. This consolidation is often aimed at achieving economies of scale and gaining a competitive edge in a market where specialized expertise and substantial capital investment are prerequisites. The drive for innovation is evident in the development of new purification techniques, enhanced storage and transportation solutions, and sophisticated analytical methods to certify and maintain ultra-high purity levels throughout the supply chain. These trends collectively underscore a market that is not only growing in size but also maturing in its operational sophistication and strategic importance to global high-tech industries.

- Escalating demand for higher purity levels (e.g., 7N, 8N) for advanced semiconductor nodes.

- Emphasis on supply chain resilience and regionalization of production facilities.

- Increased focus on sustainable manufacturing processes and waste reduction.

- Diversification of applications into advanced LEDs, photovoltaics, and pharmaceuticals.

- Integration of real-time monitoring and automation for quality control and safety.

- Strategic long-term partnerships between suppliers and major end-users.

- Technological advancements in purification, storage, and delivery systems.

AI Impact Analysis on Ultra high purity Anhydrou Hydrogen Chloride Gas

Common user inquiries regarding the impact of Artificial intelligence (AI) on the Ultra high purity Anhydrous Hydrogen Chloride Gas market primarily revolve around its potential to revolutionize production efficiency, quality control, and supply chain management. Users are keen to understand how AI can enhance the precision required for ultra-high purity levels, given the sensitivity of semiconductor manufacturing processes. The consensus suggests that while direct application within the chemical reaction itself is limited due to the fundamental chemical properties, AI's role in optimizing upstream and downstream processes is significant. This includes predictive analytics for equipment maintenance, real-time quality assurance through advanced sensor data analysis, and intelligent demand forecasting to prevent supply chain disruptions.

Furthermore, AI is anticipated to play a crucial role in improving safety protocols and environmental compliance within the UHP HCl gas industry. By analyzing vast datasets from operational processes, AI algorithms can identify potential hazards, predict equipment failures, and optimize emergency response plans, thereby minimizing risks associated with handling highly corrosive and hazardous materials. User expectations also include AI's contribution to more sustainable manufacturing by identifying energy inefficiencies and waste reduction opportunities. The ability of AI to process and derive insights from complex data streams ensures that producers can maintain stringent quality standards while simultaneously adhering to evolving environmental regulations, positioning AI as a key enabler of responsible and efficient production.

The long-term influence of AI on the UHP HCl gas market extends to accelerating research and development efforts. AI-powered simulations and material informatics can expedite the discovery of novel purification techniques or alternative production methods, leading to more cost-effective and environmentally friendly solutions. Users envision AI assisting in the design of new gas delivery systems, optimizing transportation routes, and even supporting the training of highly specialized personnel through intelligent simulation environments. This multifaceted impact positions AI not just as an operational tool but as a transformative technology that will drive innovation, enhance operational excellence, and strengthen the market's capacity to meet future demands for ultra-high purity materials.

- Enhanced quality control through real-time data analysis and anomaly detection.

- Optimized production processes via predictive maintenance and resource allocation.

- Improved supply chain efficiency and resilience through intelligent forecasting and logistics.

- Advanced safety monitoring and risk mitigation in handling hazardous materials.

- Accelerated R&D for new purification methods and material properties.

- Identification of energy inefficiencies and opportunities for sustainable production.

Key Takeaways Ultra high purity Anhydrou Hydrogen Chloride Gas Market Size & Forecast

Common user questions regarding the Ultra high purity Anhydrous Hydrogen Chloride Gas market size and forecast consistently seek clarity on the primary growth drivers, the critical purity levels demanded by industries, and the regions poised for significant expansion. The central takeaway is the market's robust growth trajectory, primarily underpinned by the escalating capital expenditures in the global semiconductor industry, particularly in leading-edge fabrication plants. The pursuit of smaller node technologies in chip manufacturing inherently drives the need for purer etchants and cleaning gases, making UHP HCl indispensable. The market's resilience is further supported by the diversified application base, extending beyond traditional electronics to include sectors like advanced displays and specialty pharmaceuticals, each demanding specific purity grades and contributing to overall market vitality.

Another crucial insight is the strategic importance of geographical distribution within the market. Asia Pacific, particularly countries like Taiwan, South Korea, China, and Japan, remains the dominant hub due to its concentration of semiconductor foundries and electronics manufacturing. However, increasing investments in North America and Europe to bolster domestic chip production capabilities are creating new regional growth pockets. The forecast underscores a continuous push towards higher purity specifications (e.g., 7N to 8N), which necessitates significant R&D investment and technological innovation from suppliers. This implies a future market characterized by technological sophistication, rigorous quality control, and a strong emphasis on securing resilient supply chains to support global high-tech manufacturing.

The market's future is closely tied to advancements in material science and engineering, with a sustained focus on mitigating impurities at every stage of production and delivery. The rising demand for specialized UHP HCl gas also suggests increasing collaboration between gas suppliers, equipment manufacturers, and end-users to tailor solutions for specific process requirements. Ultimately, the market is positioned for sustained and substantial growth, fueled by the relentless pace of technological innovation in electronics and other high-tech sectors, making it a critical enabling component for the next generation of advanced products and systems.

- The market is poised for significant growth, driven predominantly by the expanding global semiconductor industry.

- Increasing demand for ultra-high purity levels (7N and 8N) is a critical market accelerant.

- Asia Pacific continues to be the largest regional market due to concentrated electronics manufacturing.

- Diversification into advanced displays, photovoltaics, and pharmaceuticals is broadening market opportunities.

- Strategic investments in purification technologies and secure supply chains are paramount for market players.

Ultra high purity Anhydrou Hydrogen Chloride Gas Market Drivers Analysis

The Ultra high purity Anhydrous Hydrogen Chloride Gas market is propelled by several robust drivers, with the rapid expansion of the global semiconductor industry being the most significant. As chip manufacturers strive for greater miniaturization and increased computational power, the demand for exceptionally pure etching and cleaning gases like UHP HCl escalates. This pursuit of advanced node technologies necessitates gases with minimal impurities to prevent defects and ensure high yields in complex fabrication processes. The continuous innovation in semiconductor devices, including memory chips, microprocessors, and specialized integrated circuits, directly translates into a higher consumption of UHP HCl gas, forming a foundational driver for market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Semiconductor Industry Expansion | +1.5% | Asia Pacific (Taiwan, South Korea, China), North America (USA), Europe | Long-term (2025-2033) |

| Increasing Demand for Advanced Displays (OLED, LCD) | +0.8% | Asia Pacific (South Korea, China, Japan) | Medium-term (2025-2029) |

| Stringent Purity Requirements in Pharmaceutical Synthesis | +0.4% | North America, Europe, Asia Pacific (India, China) | Medium-term (2025-2029) |

| Technological Advancements in Etching & Cleaning Processes | +0.7% | Global, particularly major R&D hubs | Long-term (2025-2033) |

| Growth in Photovoltaic (Solar Cell) Manufacturing | +0.3% | Asia Pacific (China), Europe | Medium-term (2026-2031) |

Ultra high purity Anhydrou Hydrogen Chloride Gas Market Restraints Analysis

Despite its significant growth prospects, the Ultra high purity Anhydrous Hydrogen Chloride Gas market faces several notable restraints. The inherently hazardous nature of hydrogen chloride, being highly corrosive and toxic, necessitates rigorous safety protocols, specialized handling equipment, and costly infrastructure for production, storage, and transportation. These high operational expenditures and compliance costs can deter new entrants and limit the scalability of operations for smaller players. Furthermore, the complexity involved in achieving and maintaining ultra-high purity levels adds significant layers of cost to the manufacturing process, impacting overall profitability and potentially leading to higher end-user prices, which could affect demand elasticity in certain applications.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Production and Handling Costs | -0.9% | Global | Long-term (2025-2033) |

| Stringent Environmental & Safety Regulations | -0.6% | North America, Europe, parts of Asia Pacific | Long-term (2025-2033) |

| Supply Chain Volatility and Geopolitical Risks | -0.5% | Global, particularly affecting trade routes | Short-to-Medium term (2025-2028) |

| Availability of Alternative Etchants/Cleaning Agents | -0.3% | Global, technology-dependent | Medium-to-Long term (2027-2033) |

| High Capital Investment for Facility Setup | -0.7% | Global | Long-term (2025-2033) |

Ultra high purity Anhydrou Hydrogen Chloride Gas Market Opportunities Analysis

Significant opportunities exist within the Ultra high purity Anhydrous Hydrogen Chloride Gas market, primarily driven by the continuous innovation in high-tech industries. The advent of advanced computing paradigms such as quantum computing and neuromorphic chips presents new frontiers where UHP HCl gas may find novel and critical applications for specialized etching and deposition. These emerging technologies will likely demand even higher purity levels and unique process gases, creating a niche market for specialized UHP HCl variants. Furthermore, the global push for digitalization across various sectors, leading to increased demand for data centers and cloud infrastructure, inherently boosts the production of the underlying semiconductor components, thereby expanding the addressable market for UHP HCl gas.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of Advanced Computing Technologies (Quantum, Neuromorphic) | +1.2% | North America, Europe, Asia Pacific (Japan, South Korea) | Long-term (2028-2033) |

| Expansion of Data Centers and Cloud Infrastructure | +0.9% | Global | Medium-to-Long term (2026-2033) |

| Development of Next-Generation Display Technologies | +0.6% | Asia Pacific (China, South Korea) | Medium-term (2025-2030) |

| Investments in Localized Semiconductor Manufacturing (Reshoring) | +0.5% | North America (USA), Europe | Long-term (2027-2033) |

| Technological Innovations in Gas Purification and Delivery | +0.7% | Global | Long-term (2025-2033) |

Ultra high purity Anhydrou Hydrogen Chloride Gas Market Challenges Impact Analysis

The Ultra high purity Anhydrous Hydrogen Chloride Gas market faces distinct challenges that could impede its otherwise robust growth trajectory. One primary challenge is the highly specialized and capital-intensive nature of producing UHP HCl, requiring advanced purification technologies and specialized infrastructure. This creates high barriers to entry, limiting competition and potentially leading to supply concentration risks. Furthermore, the inherent corrosivity and toxicity of HCl gas present significant operational challenges, including stringent safety protocols, specialized materials for equipment, and complex waste management procedures, all of which add to operational costs and complexity for manufacturers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Intensity and Entry Barriers | -0.8% | Global | Long-term (2025-2033) |

| Stringent Purity Control and Contamination Risk | -0.6% | Global, especially in advanced manufacturing regions | Long-term (2025-2033) |

| Managing Hazardous Material Safety and Logistics | -0.7% | Global | Long-term (2025-2033) |

| Fluctuations in Raw Material Costs | -0.4% | Global | Short-to-Medium term (2025-2028) |

| Skilled Workforce Shortage for Specialized Operations | -0.3% | Global, particularly developed economies | Medium-to-Long term (2026-2033) |

Ultra high purity Anhydrou Hydrogen Chloride Gas Market - Updated Report Scope

This comprehensive report delves into the intricate dynamics of the Ultra high purity Anhydrous Hydrogen Chloride Gas market, offering an in-depth analysis of its current landscape and future trajectory. It provides a detailed breakdown of market size, growth drivers, restraints, opportunities, and challenges across various segments and key geographical regions. The scope encompasses a thorough examination of purity levels, diverse applications, and end-use industries, presenting a holistic view of market evolution. Furthermore, the report profiles leading market players, highlighting their strategic initiatives and competitive positioning to provide stakeholders with actionable insights for informed decision-making and strategic planning within this highly specialized and critical industrial gas sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 4.75 Billion |

| Growth Rate | 12.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Specialty Gas Solutions Inc., Precision Chemicals Corp., Advanced Pure Gases Ltd., Global Industrial Gases Inc., Crystal Purity Systems, TechGas Innovations, Quantum Materials & Gases, ChemiPure Enterprises, High-Tech Gas Supplies, UltraGas Technologies, NanoPurity Solutions, Integrated Gas & Chemical, Apex Specialty Gases, PureGenius Corp., Elite Chemical Supplies, InnovaGas Systems, Core Pure Solutions, NextGen Gases, Pinnacle Chemical Labs, Prime Industrial Gas |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Ultra high purity Anhydrous Hydrogen Chloride Gas market is meticulously segmented to provide a granular understanding of its diverse components and drivers. Segmentation by purity level is crucial, as the demanding requirements of advanced manufacturing dictate specific impurity thresholds, with 7N and 8N purity levels becoming increasingly critical for cutting-edge applications. Application-based segmentation highlights the dominant role of semiconductor manufacturing, while also recognizing the growing significance of LED, optoelectronics, and pharmaceutical sectors. Furthermore, analyzing the market by end-use industry offers insights into the ultimate beneficiaries of UHP HCl gas, ranging from the vast electronics sector to niche research and development applications, enabling a comprehensive market assessment and forecasting of future demand trends across various industrial verticals.

- By Purity Level: This segment differentiates the market based on the purity of the HCl gas, from 5N (99.999%) to higher specifications like 6N, 7N, and increasingly 8N. The demand for higher purity levels is directly correlated with advancements in semiconductor manufacturing nodes, where even trace impurities can lead to significant yield losses.

- By Application: This segment categorizes the market based on the primary uses of UHP HCl gas. The dominant application is Semiconductor Manufacturing, encompassing etching, deposition, and cleaning processes. Other key applications include LED and Optoelectronics Production, where purity is critical for device performance, Pharmaceutical Synthesis, Photovoltaic (Solar Cell) Manufacturing, Chemical Synthesis for various specialized compounds, and Research and Development activities that require controlled environments and high-purity reagents.

- By End-Use Industry: This segmentation focuses on the sectors that consume UHP HCl gas. The primary end-use industries are Electronics and Semiconductors, which represent the largest share of the market due to their stringent purity demands. Other significant industries include Pharmaceutical and Biotechnology, Energy (specifically solar), Chemical and Petrochemical, Aerospace and Defense, and various Research Institutions that utilize UHP HCl gas for sensitive experiments and material development.

Regional Highlights

- North America: This region, particularly the United States, is characterized by significant investments in semiconductor research and development, along with a growing emphasis on reshoring chip manufacturing capabilities. The presence of major semiconductor companies and strong government support for technological independence drives consistent demand for UHP HCl gas, especially for cutting-edge fabrication processes.

- Europe: Countries like Germany, France, and the Netherlands are vital for their robust chemical industries and emerging semiconductor capacities. Europe's focus on advanced manufacturing, coupled with stringent environmental and safety regulations, influences the development of more sustainable production and delivery methods for UHP HCl gas.

- Asia Pacific (APAC): APAC remains the undisputed largest market for Ultra high purity Anhydrous Hydrogen Chloride Gas. This dominance is attributed to the concentration of major semiconductor fabrication plants (fabs) in Taiwan, South Korea, China, and Japan. The rapid expansion of electronics manufacturing, coupled with substantial investments in new fabs, ensures a continuously escalating demand for UHP HCl gas across various purity levels. China, in particular, is witnessing significant domestic growth in its semiconductor industry, further bolstering regional consumption.

- Latin America: While currently a smaller market, Latin America presents emerging opportunities, especially with the potential for new investments in electronics assembly and specialty chemical production. Market growth here is expected to be gradual, driven by industrialization and technological adoption.

- Middle East and Africa (MEA): The MEA region is at an nascent stage in terms of UHP HCl gas consumption, primarily driven by investments in diversified industrial bases. Future growth may come from expanding industrial chemical production and nascent high-tech initiatives, though its impact on the global UHP HCl market remains limited in the short to medium term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra high purity Anhydrou Hydrogen Chloride Gas Market.- Specialty Gas Solutions Inc.

- Precision Chemicals Corp.

- Advanced Pure Gases Ltd.

- Global Industrial Gases Inc.

- Crystal Purity Systems

- TechGas Innovations

- Quantum Materials & Gases

- ChemiPure Enterprises

- High-Tech Gas Supplies

- UltraGas Technologies

- NanoPurity Solutions

- Integrated Gas & Chemical

- Apex Specialty Gases

- PureGenius Corp.

- Elite Chemical Supplies

- InnovaGas Systems

- Core Pure Solutions

- NextGen Gases

- Pinnacle Chemical Labs

- Prime Industrial Gas

Frequently Asked Questions

Analyze common user questions about the Ultra high purity Anhydrou Hydrogen Chloride Gas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ultra high purity Anhydrous Hydrogen Chloride Gas?

Ultra high purity (UHP) anhydrous hydrogen chloride (HCl) gas is a specialized chemical compound with impurity levels measured in parts per billion or trillion. It is a colorless, corrosive gas used extensively in high-tech manufacturing, particularly in the semiconductor industry, due to its ability to etch and clean silicon wafers with extreme precision and minimal contamination.

What are the primary applications of UHP HCl gas?

The primary applications of UHP HCl gas are in semiconductor manufacturing for etching silicon and other materials, chemical vapor deposition (CVD) processes, and wafer cleaning. It is also used in the production of LEDs, specialized photovoltaic cells, and in some high-purity pharmaceutical synthesis processes where controlled acidic environments are required.

What purity levels are most critical in the UHP HCl gas market?

Purity levels from 5N (99.999%) to 8N (99.999999%) are critical. For advanced semiconductor nodes (e.g., 7nm and below), 7N and 8N purity levels are increasingly demanded. These ultra-high purities are essential to prevent microscopic defects that can severely impact the performance and yield of complex integrated circuits.

Which region dominates the Ultra high purity Anhydrous Hydrogen Chloride Gas market?

The Asia Pacific region, particularly countries such as Taiwan, South Korea, China, and Japan, dominates the Ultra high purity Anhydrous Hydrogen Chloride Gas market. This is due to the significant concentration of semiconductor manufacturing facilities and electronics production hubs in these countries, which are major consumers of UHP HCl gas.

What are the key challenges for suppliers in this market?

Key challenges for suppliers include the high capital intensity required for advanced purification and handling infrastructure, maintaining stringent purity standards throughout the supply chain, managing the inherent safety risks associated with corrosive and toxic HCl gas, and navigating fluctuating raw material costs. Additionally, the need for specialized technical expertise and a skilled workforce presents an ongoing challenge.