Static Random Access Memory Market

Static Random Access Memory Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704913 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Static Random Access Memory Market Size

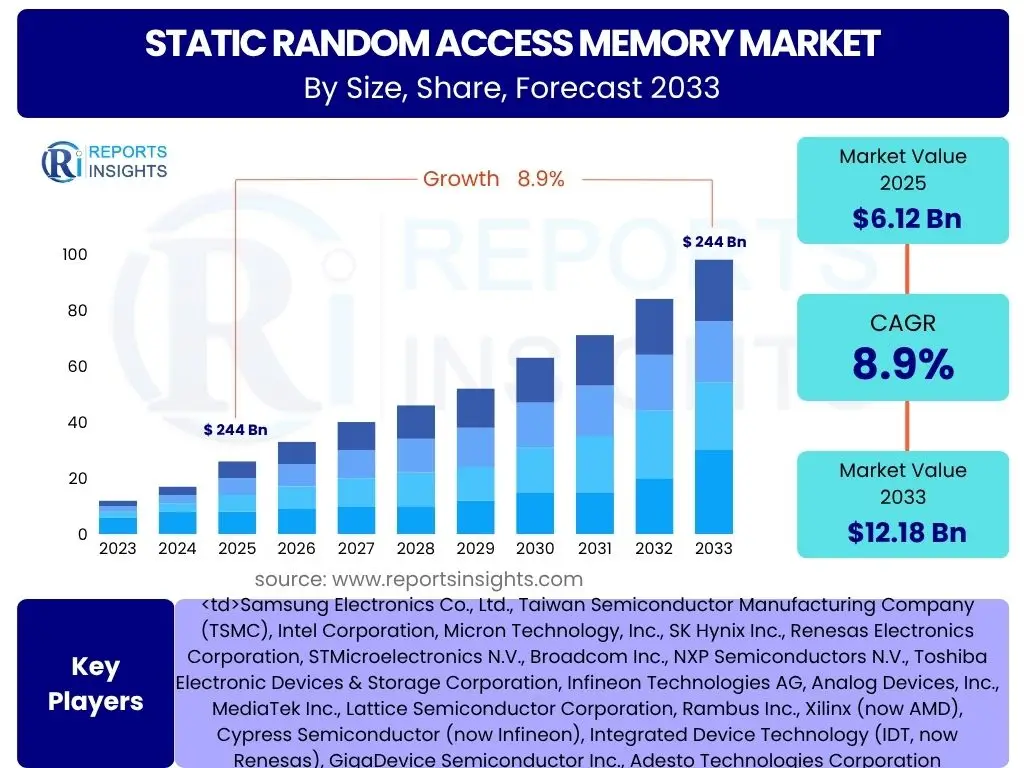

According to Reports Insights Consulting Pvt Ltd, The Static Random Access Memory Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2033. The market is estimated at USD 6.12 billion in 2025 and is projected to reach USD 12.18 billion by the end of the forecast period in 2033.

Key Static Random Access Memory Market Trends & Insights

The Static Random Access Memory (SRAM) market is experiencing significant evolution, driven by the escalating demand for high-speed, low-power, and compact memory solutions across various advanced applications. Current trends indicate a strong focus on embedded SRAM solutions for System-on-Chip (SoC) designs, where integrating memory directly onto the processor die enhances performance and reduces power consumption. Furthermore, the push towards edge computing and IoT devices is necessitating highly efficient SRAM variants capable of operating reliably in constrained environments.

Another prominent trend involves the development of specialized SRAM architectures tailored for Artificial Intelligence (AI) and Machine Learning (ML) workloads. These designs often prioritize faster access times and higher bandwidth to support the intensive data processing requirements of neural networks and parallel computing. Innovations in manufacturing processes, including advancements in FinFET and Gate-All-Around (GAA) technologies, are enabling higher density and improved performance, addressing the critical need for more sophisticated on-chip memory solutions. This sustained innovation ensures SRAM remains a vital component in the semiconductor ecosystem, despite the emergence of alternative memory technologies.

- Increasing integration of embedded SRAM in SoCs for enhanced performance and power efficiency.

- Growing demand for specialized SRAM in AI/ML accelerators and high-performance computing (HPC).

- Development of ultra-low power SRAM for IoT, wearable devices, and edge computing applications.

- Advancements in manufacturing processes (e.g., FinFET, GAA) enabling higher density and speed.

- Proliferation of automotive electronics requiring high-reliability and robust SRAM solutions.

AI Impact Analysis on Static Random Access Memory

The rapid expansion of Artificial Intelligence (AI) and Machine Learning (ML) has profoundly impacted the Static Random Access Memory (SRAM) market by creating a substantial demand for specialized, high-performance, and high-bandwidth memory solutions. AI workloads, particularly in training and inference operations, are characterized by massive parallel computations and frequent data access, which necessitate memory that can keep pace with processing units. SRAM, with its intrinsic speed and low latency, is ideally positioned to serve as cache memory, scratchpad memory, and even as embedded memory directly within AI accelerators (e.g., GPUs, NPUs, ASICs).

Furthermore, the emergence of in-memory computing paradigms, where computation is performed directly within memory to minimize data movement, significantly boosts the relevance of SRAM. AI developers and hardware designers are increasingly looking for on-chip memory solutions that can reduce the energy footprint and latency associated with fetching data from off-chip DRAM. This trend is driving innovation in SRAM design, focusing on multi-port SRAM, content-addressable memory (CAM) based on SRAM, and other custom architectures that are optimized for AI's unique computational patterns. Consequently, AI's continuous growth is a primary driver for the strategic development and deployment of advanced SRAM technologies.

- Increased demand for high-bandwidth and low-latency SRAM in AI accelerators.

- SRAM serving as essential on-chip cache and scratchpad memory for AI/ML processing units.

- Advancements in in-memory computing concepts leveraging SRAM for energy-efficient AI operations.

- Development of specialized SRAM architectures (e.g., multi-port, CAM) for AI workloads.

- Contribution to reducing data movement bottlenecks in AI systems.

Key Takeaways Static Random Access Memory Market Size & Forecast

The Static Random Access Memory (SRAM) market is poised for robust growth, driven by the indispensable role of high-speed, low-power memory in an increasingly data-intensive world. The forecast period indicates a significant expansion in market value, primarily fueled by advancements in computing architectures and the proliferation of smart, connected devices. A key takeaway is the continuing criticality of SRAM in performance-sensitive applications, where its speed and efficiency outweigh its higher cost per bit compared to other memory types, ensuring its sustained demand in premium segments.

Another crucial insight is the strategic shift towards embedded and specialized SRAM solutions, rather than standalone chips, reflecting the industry's focus on system-level optimization. The market's future will be heavily influenced by how effectively SRAM can adapt to the evolving demands of artificial intelligence, edge computing, and automotive electronics. The ongoing innovation in design and manufacturing processes will be vital in overcoming density and cost challenges, thereby unlocking new opportunities and solidifying SRAM's position as a foundational element of advanced electronic systems.

- Significant market growth anticipated, reaching over USD 12 billion by 2033.

- SRAM's indispensable role in high-performance computing, AI, and embedded systems.

- Emphasis on embedded and specialized SRAM designs for system-level efficiency.

- Innovation in manufacturing technologies crucial for future density and power improvements.

- Continued relevance despite competition due to unique performance characteristics.

Static Random Access Memory Market Drivers Analysis

The Static Random Access Memory (SRAM) market is propelled by several potent drivers, primarily stemming from the pervasive need for faster and more reliable memory solutions across various technological domains. The escalating demand for high-performance computing (HPC) and data centers, for instance, necessitates memory with extremely low latency and high bandwidth to process vast amounts of data quickly, a role perfectly suited for SRAM. Similarly, the rapid expansion of Artificial Intelligence (AI) and Machine Learning (ML) applications requires on-chip memory that can keep pace with sophisticated processing units, making embedded SRAM a critical component. The growth of the Internet of Things (IoT) and edge computing also fuels demand for low-power and fast memory, as these devices often operate with limited energy resources but require rapid data processing capabilities.

Furthermore, the automotive sector's continuous advancements, particularly in Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles, significantly contribute to the market's expansion. These applications rely on high-reliability, real-time data processing, where SRAM's speed and robustness are paramount for safety-critical functions. The consumer electronics market, driven by the incessant need for faster smartphones, gaming consoles, and smart devices, continues to integrate more embedded SRAM for improved user experience. These diverse applications collectively underscore SRAM's foundational importance and act as key drivers for its continued market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for High-Performance Computing (HPC) and Data Centers | +2.5% | North America, Asia Pacific, Europe | Short to Mid-term (2025-2029) |

| Proliferation of AI and Machine Learning Applications | +2.0% | Global, particularly North America, China, Europe | Mid to Long-term (2027-2033) |

| Growth of IoT, Edge Computing, and Wearable Devices | +1.8% | Global, particularly Asia Pacific, North America | Short to Mid-term (2025-2030) |

| Advancements in Automotive Electronics and ADAS | +1.5% | Europe, North America, Japan | Mid to Long-term (2028-2033) |

Static Random Access Memory Market Restraints Analysis

Despite its significant advantages, the Static Random Access Memory (SRAM) market faces several notable restraints that could temper its growth. A primary challenge is the relatively higher cost per bit compared to Dynamic Random Access Memory (DRAM). This cost disparity often limits SRAM's application to scenarios where its speed and low latency are absolutely critical, precluding its use in large-capacity main memory applications where DRAM offers a more economical solution. Consequently, designers must carefully balance performance requirements against budget constraints, often opting for a hybrid memory architecture.

Another significant restraint is SRAM's inherently lower density compared to DRAM. Each SRAM cell typically requires six transistors (6T SRAM), whereas a DRAM cell requires only one transistor and a capacitor, making DRAM much more compact. This lower density means that for a given chip area, SRAM offers less storage capacity, which can be a limiting factor for applications demanding large amounts of on-chip memory. Furthermore, the complexity of manufacturing processes for advanced SRAM designs, especially at smaller process nodes, can lead to increased production costs and potential yield issues. Lastly, the increasing competition from emerging non-volatile memory (NVM) technologies, such as MRAM (Magnetoresistive RAM) and ReRAM (Resistive RAM), which offer a combination of speed, density, and non-volatility, presents a long-term challenge to SRAM's dominance in certain niche applications.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Higher Cost Per Bit Compared to DRAM | -1.2% | Global | Ongoing |

| Lower Density and Scalability Challenges | -0.9% | Global | Ongoing |

| Competition from Emerging Memory Technologies (e.g., MRAM, ReRAM) | -0.7% | Global | Mid to Long-term (2027-2033) |

| Increasing Manufacturing Complexity and Yield Challenges | -0.5% | Global (affecting major fabs) | Short to Mid-term (2025-2029) |

Static Random Access Memory Market Opportunities Analysis

The Static Random Access Memory (SRAM) market is presented with several promising opportunities that could significantly accelerate its growth trajectory. One major avenue lies in the continued development of specialized SRAM for Artificial Intelligence (AI) and Machine Learning (ML) accelerators. As AI hardware evolves, there is a growing need for memory that can efficiently handle parallel processing and in-memory computing, areas where custom SRAM designs can offer significant performance and energy efficiency advantages over conventional memory. This specialization allows SRAM to maintain its competitive edge in a rapidly expanding and critical technological sector.

Furthermore, the expansion into niche markets that require ultra-low power consumption and high reliability offers substantial growth potential. This includes applications in medical implants, advanced industrial control systems, and robust aerospace components, where standard memory solutions may not meet stringent performance and environmental requirements. Advancements in embedded SRAM within System-on-Chip (SoC) designs also present a significant opportunity, as semiconductor manufacturers strive to integrate more functionality and improve performance within a single chip. This trend reduces power consumption and physical footprint, making SRAM an ideal candidate for integration into complex chip designs. Lastly, the ongoing exploration of novel computing architectures, such as neuromorphic computing and quantum computing, may unlock entirely new demands for highly specialized, fast, and stable memory technologies, where SRAM, or its derivatives, could play a crucial role.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Specialized SRAM for AI/ML Accelerators | +2.3% | Global, particularly North America, Asia Pacific | Mid to Long-term (2027-2033) |

| Expansion into Niche Markets Requiring Ultra-Low Power & High Reliability | +1.7% | Europe, North America, Japan | Short to Mid-term (2025-2030) |

| Advancements in Embedded SRAM for System-on-Chip (SoC) Designs | +1.5% | Global | Ongoing |

| Integration with Novel Computing Architectures (e.g., Neuromorphic, Quantum) | +1.0% | North America, Europe | Long-term (2030-2033) |

Static Random Access Memory Market Challenges Impact Analysis

The Static Random Access Memory (SRAM) market faces distinct challenges that require strategic navigation to sustain growth and innovation. One significant hurdle is the escalating research and development (R&D) costs associated with designing and producing new SRAM technologies, especially as process nodes shrink and architectural complexities increase. Developing advanced SRAM cells that offer higher density, lower power, and improved performance requires substantial investment in materials science, lithography, and circuit design, which can strain resources for manufacturers and potentially slow down the pace of innovation for smaller players.

Furthermore, the global semiconductor supply chain is highly complex and susceptible to geopolitical influences, trade disputes, and natural disasters, posing a considerable challenge for SRAM manufacturers. Disruptions in the supply of critical raw materials, manufacturing equipment, or skilled labor can lead to production delays and increased costs, impacting market stability and product availability. Maintaining power efficiency at higher densities is another persistent challenge. As more SRAM cells are packed into a smaller area, managing leakage current and dynamic power consumption becomes increasingly difficult, potentially limiting the performance benefits of scaling. Finally, attracting and retaining specialized talent for advanced memory design and manufacturing is a continuous challenge, as the field demands highly specific expertise in semiconductor physics, electrical engineering, and materials science, creating a competitive environment for skilled professionals.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Escalating Research and Development Costs | -0.8% | Global | Ongoing |

| Supply Chain Complexities and Geopolitical Influences | -0.6% | Global | Short to Mid-term (2025-2028) |

| Maintaining Power Efficiency at Higher Densities | -0.4% | Global | Ongoing |

| Talent Shortage in Advanced Memory Design and Manufacturing | -0.3% | North America, Europe, Asia Pacific | Long-term (2029-2033) |

Static Random Access Memory Market - Updated Report Scope

This report offers an in-depth analysis of the Static Random Access Memory (SRAM) market, providing a comprehensive overview of its current landscape, key trends, drivers, restraints, and opportunities. It details market size estimations and forecasts across various segments and regions, offering stakeholders strategic insights into market dynamics. The report incorporates the impact of emerging technologies like AI and provides a competitive analysis of leading players, enabling a thorough understanding of the market's trajectory and potential for growth.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 6.12 billion |

| Market Forecast in 2033 | USD 12.18 billion |

| Growth Rate | 8.9% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics Co., Ltd., Taiwan Semiconductor Manufacturing Company (TSMC), Intel Corporation, Micron Technology, Inc., SK Hynix Inc., Renesas Electronics Corporation, STMicroelectronics N.V., Broadcom Inc., NXP Semiconductors N.V., Toshiba Electronic Devices & Storage Corporation, Infineon Technologies AG, Analog Devices, Inc., MediaTek Inc., Lattice Semiconductor Corporation, Rambus Inc., Xilinx (now AMD), Cypress Semiconductor (now Infineon), Integrated Device Technology (IDT, now Renesas), GigaDevice Semiconductor Inc., Adesto Technologies Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Static Random Access Memory (SRAM) market is comprehensively segmented to provide a detailed understanding of its diverse applications and technological variations. This segmentation allows for precise analysis of market dynamics, revealing growth opportunities and competitive landscapes within specific product types, design architectures, and end-use industries. Understanding these distinct segments is crucial for stakeholders to tailor strategies, optimize product development, and target high-potential areas within the evolving SRAM market.

- By Type: This segment categorizes SRAM based on its operational characteristics and interface.

- Asynchronous SRAM: Characterized by independent read/write operations without a clock signal.

- Synchronous SRAM: Operations are synchronized with a clock signal, offering higher speeds.

- Low Power SRAM: Designed for minimal power consumption, crucial for battery-operated devices.

- Bi-Port SRAM: Allows simultaneous access from two independent ports.

- Multi-Port SRAM: Supports more than two simultaneous accesses, often used in high-performance applications.

- Others: Includes specialized SRAM types like Content-Addressable Memory (CAM).

- By Design: Segmentation based on the transistor configuration of the SRAM cell.

- 6T SRAM: The most common design, using six transistors per cell for balance of performance and stability.

- 8T SRAM: Offers higher stability and lower power consumption, often at the expense of density.

- Multi-Port SRAM: Designs optimized for concurrent access, typically found in networking or parallel processing units.

- Custom/Embedded SRAM: Tailored designs integrated directly into SoCs for specific application requirements.

- By Application: Categorizes SRAM by the end-use product or system it is integrated into.

- Consumer Electronics: Includes smartphones, tablets, wearables, digital cameras, and gaming consoles where speed and efficiency are paramount.

- Automotive: Critical for ADAS, infotainment systems, engine control units (ECUs), and autonomous driving systems requiring high reliability and real-time processing.

- Industrial: Used in industrial automation, robotics, control systems, and machinery for robust and efficient operation.

- Telecommunications: Essential for networking equipment, routers, switches, and base stations for high-speed data handling.

- Data Centers: Utilized in servers and storage systems as cache memory for faster data access and processing.

- Medical Devices: Found in diagnostic equipment, monitoring devices, and implantable devices where reliability and low power are crucial.

- Aerospace & Defense: Applications demanding extreme reliability, radiation hardening, and high performance in harsh environments.

- Others: Encompasses various niche applications not covered in the primary categories.

- By End-Use Industry: Groups the market by the major industries that leverage SRAM technology.

- Semiconductor & Electronics: The core industry involved in design and manufacturing of integrated circuits containing SRAM.

- Automotive: Manufacturers of vehicles and automotive components.

- Telecommunications: Companies involved in network infrastructure and communication devices.

- Healthcare: Manufacturers of medical equipment and devices.

- Industrial Automation: Industries utilizing automated systems and robotics.

- Data Processing: Companies involved in data storage, analysis, and cloud services.

- Others: Diverse sectors such as defense, research, and specialized computing.

Regional Highlights

- Asia Pacific (APAC): Dominates the Static Random Access Memory market, largely driven by its robust semiconductor manufacturing ecosystem, high concentration of consumer electronics production, and rapid adoption of advanced technologies like 5G, AI, and IoT in countries like China, South Korea, Japan, and Taiwan. The region is a major hub for R&D and manufacturing of electronic components, fostering strong demand for embedded and discrete SRAM solutions in devices ranging from smartphones to data center infrastructure.

- North America: A significant market for SRAM, characterized by strong demand from high-performance computing (HPC), data centers, and the burgeoning AI and machine learning sectors. The presence of leading technology companies and a focus on advanced research and development initiatives, particularly in Silicon Valley, drives innovation and adoption of specialized SRAM solutions for cutting-edge applications.

- Europe: Exhibits steady growth in the SRAM market, propelled by its flourishing automotive industry, strong industrial automation sector, and growing investments in smart infrastructure. Germany and the Nordic countries are key contributors, focusing on high-reliability SRAM for industrial controls, automotive electronics, and embedded systems, leveraging Europe's emphasis on precision engineering and robust manufacturing.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets for SRAM, with growth primarily driven by increasing digitalization, expanding telecommunications infrastructure, and growing adoption of consumer electronics. While smaller in market share, ongoing investments in smart cities, industrialization, and network upgrades are creating new opportunities for SRAM integration, especially in embedded and low-power applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Static Random Access Memory Market.- Samsung Electronics Co., Ltd.

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Intel Corporation

- Micron Technology, Inc.

- SK Hynix Inc.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Broadcom Inc.

- NXP Semiconductors N.V.

- Toshiba Electronic Devices & Storage Corporation

- Infineon Technologies AG

- Analog Devices, Inc.

- MediaTek Inc.

- Lattice Semiconductor Corporation

- Rambus Inc.

- AMD (formerly Xilinx)

- GigaDevice Semiconductor Inc.

- Adesto Technologies Corporation

- Cypress Semiconductor (now part of Infineon)

- Integrated Device Technology (IDT, now part of Renesas)

Frequently Asked Questions

What is Static Random Access Memory (SRAM) and how does it differ from DRAM?

Static Random Access Memory (SRAM) is a type of volatile semiconductor memory that stores data using a bistable latching circuitry, typically composed of transistors. Unlike Dynamic Random Access Memory (DRAM), SRAM does not require periodic refreshing of its data, making it faster and more stable. However, SRAM is typically more expensive per bit and has lower density due to its more complex cell structure, making it ideal for cache memory in CPUs, high-speed buffers, and embedded systems.

What are the primary applications driving the growth of the SRAM market?

The primary applications driving the SRAM market's growth include high-performance computing (HPC), data centers, and the expanding field of Artificial Intelligence (AI) and Machine Learning (ML), where its speed and low latency are critical for cache and scratchpad memory. Additionally, the proliferation of the Internet of Things (IoT), edge computing, and advanced automotive electronics (ADAS) significantly contributes to demand for low-power and highly reliable embedded SRAM solutions.

What are the key factors restraining the growth of the SRAM market?

Key restraints for the SRAM market include its relatively high cost per bit compared to DRAM, limiting its use in large-capacity memory applications. SRAM also has lower density, making it less suitable for high-capacity main memory. Furthermore, increasing manufacturing complexity at smaller process nodes and growing competition from emerging non-volatile memory technologies like MRAM and ReRAM pose challenges to its market expansion.

How is Artificial Intelligence impacting the Static Random Access Memory market?

Artificial Intelligence (AI) significantly impacts the SRAM market by driving demand for high-bandwidth, low-latency, and energy-efficient on-chip memory. AI accelerators and processors rely heavily on SRAM for fast data access, caching, and scratchpad memory to handle parallel computations. AI is also fostering innovation in specialized SRAM architectures, including multi-port and in-memory computing designs, optimized for AI workloads, thus ensuring SRAM's continued relevance in this rapidly evolving sector.

Which regions are key contributors to the Static Random Access Memory market, and why?

Asia Pacific (APAC) is the dominant region due to its extensive semiconductor manufacturing infrastructure, large consumer electronics production, and rapid adoption of advanced technologies in countries like China, South Korea, and Taiwan. North America is a significant contributor driven by its leading high-performance computing, data center, and AI industries. Europe also holds a strong position, especially in the automotive and industrial automation sectors, demanding high-reliability embedded SRAM solutions.