Small Cell and Femtocell Market

Small Cell and Femtocell Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704198 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Small Cell and Femtocell Market Size

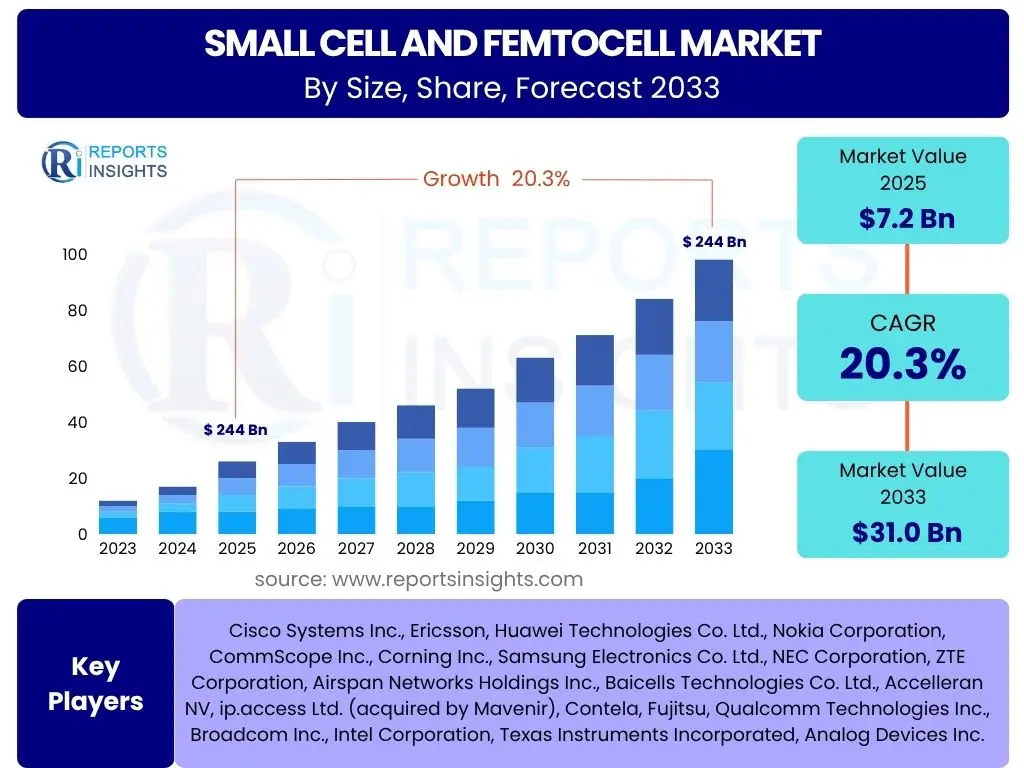

According to Reports Insights Consulting Pvt Ltd, The Small Cell and Femtocell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.3% between 2025 and 2033. The market is estimated at USD 7.2 Billion in 2025 and is projected to reach USD 31.0 Billion by the end of the forecast period in 2033.

Key Small Cell and Femtocell Market Trends & Insights

The Small Cell and Femtocell market is experiencing transformative shifts driven by the escalating demand for high-speed, reliable, and pervasive mobile connectivity. A primary trend is the significant role small cells play in 5G network densification, which is critical for achieving the ultra-low latency and massive connectivity promised by the next-generation cellular technology. As mobile data traffic continues its exponential growth, traditional macrocell networks face capacity limitations, making small cells indispensable for offloading traffic and improving network performance in dense urban areas, large venues, and enterprise environments.

Another crucial insight is the increasing adoption of small cells for private cellular networks within enterprises and industrial settings. Industries are leveraging 4G LTE and 5G small cells to build dedicated, secure, and high-performance networks for mission-critical applications such as industrial automation, smart manufacturing, and logistics. This trend is amplified by the availability of shared and unlicensed spectrum options, such as CBRS in the United States, which empowers enterprises to deploy their own localized networks without relying solely on public mobile network operators.

Furthermore, the market is witnessing the emergence of multi-operator small cells and neutral host solutions, which enable multiple mobile network operators to share the same small cell infrastructure. This approach reduces deployment costs and accelerates network expansion, particularly in challenging indoor environments or public spaces where deploying individual small cells for each operator is impractical. The integration of artificial intelligence and machine learning for network optimization, predictive maintenance, and autonomous network management is also becoming a pivotal trend, enhancing the efficiency and scalability of small cell deployments.

- Accelerated 5G Network Densification and Expansion

- Proliferation of Private LTE and 5G Networks in Enterprise and Industrial Sectors

- Growing Adoption of Neutral Host and Multi-Operator Small Cell Solutions

- Increasing Focus on Open RAN Architectures for Greater Flexibility and Vendor Diversity

- Integration of AI/ML for Automated Network Planning, Optimization, and Operations

- Development of Converged Access Solutions for Fixed and Mobile Networks

AI Impact Analysis on Small Cell and Femtocell

Artificial Intelligence (AI) and Machine Learning (ML) are profoundly reshaping the Small Cell and Femtocell market by introducing unprecedented levels of automation, efficiency, and intelligence into network operations. Users frequently inquire about how AI can optimize network performance, reduce operational expenditures, and enhance the overall user experience in densely deployed small cell environments. AI-driven analytics can process vast amounts of real-time data from small cells, including traffic patterns, interference levels, and user behavior, to dynamically adjust network parameters, allocate resources, and predict potential issues before they impact service quality.

The application of AI extends to autonomous network planning and deployment, enabling operators to identify optimal locations for small cell installations, predict coverage gaps, and streamline the entire deployment process. This significantly reduces the manual effort and time traditionally associated with network build-outs. Furthermore, AI algorithms can facilitate predictive maintenance by analyzing equipment performance data to anticipate failures, allowing proactive interventions that minimize downtime and operational disruptions. This is particularly crucial for maintaining high service availability in complex small cell networks.

Moreover, AI plays a vital role in enhancing the security and energy efficiency of small cell networks. By leveraging machine learning models, network anomalies and potential security threats can be detected and mitigated in real-time, safeguarding critical infrastructure and sensitive data. AI-powered energy management systems can optimize power consumption across the small cell network by intelligently scaling resources based on demand, leading to substantial energy savings and reduced carbon footprint. The integration of AI therefore transforms small cell networks from static infrastructure into intelligent, self-optimizing, and resilient systems capable of adapting to dynamic traffic demands and environmental conditions.

- Enhanced Network Optimization and Resource Allocation through Predictive Analytics

- Automated Site Planning and Deployment for Faster Rollouts

- Proactive Maintenance and Fault Detection, Minimizing Downtime

- Optimized Energy Consumption for Greener Network Operations

- Real-time Anomaly Detection and Enhanced Security

- Improved User Experience through Dynamic Load Balancing and Interference Management

Key Takeaways Small Cell and Femtocell Market Size & Forecast

The Small Cell and Femtocell market is poised for robust expansion, driven primarily by the global rollout of 5G networks and the imperative for network densification to support burgeoning data traffic. A critical takeaway is the projected double-digit Compound Annual Growth Rate (CAGR) from 2025 to 2033, signaling strong investment and deployment activities across various sectors. This growth underscores the fundamental role small cells play in delivering the ubiquitous, high-capacity, and low-latency connectivity essential for modern digital economies and emerging applications like IoT and Industry 4.0.

Furthermore, the market's significant growth from USD 7.2 Billion in 2025 to USD 31.0 Billion by 2033 highlights a transformative period where small cells transition from complementary solutions to foundational elements of heterogeneous networks. This expansion is not solely driven by traditional mobile operators but increasingly by enterprises, private network deployments, and neutral host providers seeking dedicated and localized connectivity solutions. The forecast indicates a shift towards more diverse deployment models and a broader range of use cases beyond conventional cellular coverage enhancement.

Finally, a key insight from the forecast is the enduring importance of technological advancements, particularly in areas like Open RAN integration, AI-driven network management, and support for higher frequency bands (e.g., mmWave). These innovations will be critical in unlocking the full potential of small cells, making them more efficient, cost-effective, and adaptable to future demands. The strong market trajectory reflects a clear industry consensus on the indispensable nature of small cells for delivering next-generation connectivity and supporting digital transformation across industries.

- Significant market expansion with a robust CAGR of 20.3% from 2025 to 2033.

- Integral role of small cells in enabling comprehensive 5G network coverage and capacity.

- Strong adoption driven by enterprise private networks and industrial IoT applications.

- Increasing diversity in deployment models, including neutral host and multi-operator solutions.

- Technological innovation, particularly AI/ML and Open RAN, is crucial for future growth and efficiency.

Small Cell and Femtocell Market Drivers Analysis

The accelerating global deployment of 5G networks stands as a paramount driver for the Small Cell and Femtocell market. 5G technology, with its emphasis on enhanced mobile broadband, ultra-reliable low-latency communication, and massive machine-type communication, necessitates a significantly denser network infrastructure than previous generations. Small cells are critical for filling coverage gaps, improving indoor penetration, and providing the necessary capacity in high-traffic urban areas, stadiums, and transportation hubs. This densification is essential for realizing the full potential of 5G applications and supporting the exponential growth in mobile data consumption worldwide.

Another significant driver is the increasing demand for high-capacity, dedicated connectivity solutions within the enterprise and industrial sectors. Businesses are increasingly recognizing the value of private LTE and 5G networks powered by small cells to support mission-critical applications, enhance operational efficiency, and enable digital transformation initiatives. These private networks offer superior security, lower latency, and greater control compared to public networks, making them ideal for applications in manufacturing, logistics, healthcare, and smart campuses. The availability of shared and unlicensed spectrum, such as CBRS, further lowers the barrier to entry for enterprises to deploy their own networks.

The proliferation of Internet of Things (IoT) devices and the push towards smart cities also fuel the market's growth. IoT deployments require pervasive and reliable connectivity for a multitude of sensors, devices, and applications, from smart streetlights to connected vehicles and environmental monitoring. Small cells, due to their smaller footprint and ease of deployment, are ideally suited to provide the localized coverage and capacity required to support dense IoT ecosystems. Furthermore, the development of neutral host models and government initiatives to improve digital infrastructure contribute to a favorable environment for small cell adoption by reducing the financial and logistical burdens associated with individual operator deployments.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global 5G Network Rollout and Densification | +5.5% | Global, particularly North America, APAC, Europe | Short to Medium Term (2025-2030) |

| Rising Demand for Enterprise Private Networks | +4.8% | North America, Europe, parts of APAC (e.g., Japan, South Korea) | Medium to Long Term (2025-2033) |

| Exponential Growth in Mobile Data Traffic | +4.2% | Global, particularly high-density urban areas | Short to Long Term (2025-2033) |

| Proliferation of IoT Devices and Smart City Initiatives | +3.5% | Global, focused on urban and industrial areas | Medium to Long Term (2026-2033) |

| Government Initiatives and Spectrum Availability (e.g., CBRS) | +2.3% | North America, Europe, select emerging markets | Short to Medium Term (2025-2030) |

Small Cell and Femtocell Market Restraints Analysis

Despite the strong growth drivers, the Small Cell and Femtocell market faces several significant restraints that could impede its full potential. One of the primary challenges is the complexity and high upfront costs associated with small cell deployment. This includes expenses for site acquisition, backhaul infrastructure (fiber, millimeter wave), power provisioning, and planning permissions. Unlike macrocells, which serve a wider area, small cells require a much denser deployment, escalating these per-site costs into substantial capital expenditures for operators and enterprises, particularly in urban environments with limited space and complex regulatory landscapes.

Another key restraint is the regulatory and permitting hurdles involved in deploying small cells, especially in public spaces. Obtaining rights-of-way, negotiating with local municipalities, and adhering to diverse zoning laws and aesthetic requirements can be time-consuming and often unpredictable. This administrative burden can significantly delay deployment schedules and increase project costs. Public resistance due to concerns about aesthetics, electromagnetic field (EMF) exposure, or privacy can also present unexpected obstacles, requiring extensive public engagement and sometimes leading to project abandonment.

Furthermore, backhaul capacity and integration challenges pose a considerable restraint. Small cells, particularly those supporting 5G, generate massive amounts of data, necessitating robust and reliable backhaul connections to the core network. Ensuring adequate fiber availability or deploying high-capacity wireless backhaul solutions (like millimeter wave or E-band) can be technically complex and expensive, especially in older infrastructure zones or remote areas. Interoperability issues between different vendors' equipment and the complexities of integrating small cells seamlessly into existing macrocell networks also add to the operational challenges and can slow down deployment velocity.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Upfront Deployment Costs and CAPEX | -2.8% | Global, particularly emerging markets | Short to Medium Term (2025-2030) |

| Regulatory and Permitting Complexities | -2.5% | North America, Europe (diverse local regulations) | Short to Long Term (2025-2033) |

| Backhaul Infrastructure Limitations | -2.0% | Global, particularly less developed regions | Short to Medium Term (2025-2030) |

| Public Acceptance and Aesthetic Concerns | -1.5% | Europe, North America (urban areas) | Medium Term (2026-2031) |

| Interoperability and Integration Challenges | -1.2% | Global, across diverse vendor ecosystems | Short to Medium Term (2025-2029) |

Small Cell and Femtocell Market Opportunities Analysis

The Small Cell and Femtocell market is replete with substantial opportunities, primarily driven by evolving technological paradigms and expanding application domains. One significant opportunity lies in the proliferation of Open RAN (Radio Access Network) architectures. Open RAN disaggregates hardware and software, promoting vendor diversity and fostering innovation. This open ecosystem enables more flexible, scalable, and cost-effective small cell deployments, allowing operators to mix and match components from different vendors and potentially reducing dependence on single, large equipment providers. The modular nature of Open RAN can simplify network upgrades and accelerate time-to-market for new services, presenting a compelling value proposition for mobile network operators and private network deployers.

Another key opportunity emerges from the increasing demand for enhanced indoor coverage and capacity, especially within large enterprises, commercial buildings, and public venues. While outdoor small cells address urban densification, a significant portion of data traffic originates indoors. Small cells and femtocells are ideally suited to provide superior indoor wireless performance, addressing connectivity challenges in offices, shopping malls, hospitals, and transportation hubs. The push for smart buildings and smart campuses, integrating IoT devices and advanced automation, further amplifies the need for robust indoor small cell solutions, creating a lucrative segment for specialized vendors.

Furthermore, the convergence of edge computing with small cell deployments presents a transformative opportunity. By embedding computing capabilities directly at the network edge, closer to end-users and data sources, small cells can enable ultra-low latency applications, improve data processing efficiency, and reduce reliance on centralized data centers. This synergy facilitates the development of innovative services in areas such as augmented reality, virtual reality, real-time industrial automation, and vehicle-to-everything (V2X) communication. The ongoing development of new spectrum bands, particularly in the millimeter wave (mmWave) frequencies, also offers vast untapped capacity that small cells are uniquely positioned to leverage, opening new avenues for high-bandwidth, localized services.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Open RAN Integration and Ecosystem Growth | +3.0% | Global, strong interest in North America, Europe, Japan | Medium to Long Term (2026-2033) |

| Growing Demand for Indoor Connectivity and Enterprise Solutions | +2.7% | Global, particularly mature economies | Short to Long Term (2025-2033) |

| Synergy with Edge Computing and AI Integration | +2.5% | Global, focused on innovative markets | Medium to Long Term (2027-2033) |

| Leveraging New Spectrum Bands (e.g., mmWave, CBRS) | +2.0% | North America, APAC, parts of Europe | Short to Medium Term (2025-2030) |

| Expansion into Untapped Markets (e.g., Rural Broadband, Developing Regions) | +1.8% | Emerging economies, underserved rural areas | Medium to Long Term (2028-2033) |

Small Cell and Femtocell Market Challenges Impact Analysis

The Small Cell and Femtocell market, while promising, grapples with several inherent challenges that can affect its growth trajectory and widespread adoption. One significant challenge is the ongoing issue of backhaul connectivity. Small cells, especially those designed for 5G, require high-capacity, low-latency backhaul to transport massive amounts of data to and from the core network. In many areas, particularly dense urban environments or historically underserved regions, deploying sufficient fiber optic infrastructure can be prohibitively expensive and time-consuming. Relying on wireless backhaul solutions can introduce latency and capacity limitations, creating a bottleneck that constrains the performance benefits of small cells.

Another considerable challenge relates to the power consumption and energy efficiency of small cell deployments. While individual small cells consume less power than macrocells, the sheer volume of deployments required for comprehensive coverage means that the cumulative energy footprint can be substantial. Operators face increasing pressure to reduce operational costs and meet sustainability targets, making energy-efficient small cell designs and intelligent power management solutions critical. Overcoming this challenge requires continuous innovation in hardware design, power management algorithms, and the integration of renewable energy sources.

Furthermore, the rapidly evolving technological landscape and the need for skilled labor present notable challenges. The cellular industry is undergoing rapid transformation with 5G, Open RAN, and edge computing, requiring continuous adaptation and investment in new technologies. Ensuring interoperability between diverse vendors in an Open RAN environment, for instance, can be complex. Moreover, there is a persistent shortage of skilled professionals capable of planning, deploying, optimizing, and maintaining advanced small cell networks. This talent gap can lead to slower deployments, higher operational costs, and suboptimal network performance, underscoring the need for robust training and workforce development initiatives within the industry.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Backhaul Deployment and Capacity Constraints | -2.2% | Global, pervasive in diverse geographical areas | Short to Medium Term (2025-2030) |

| Power Consumption and Energy Efficiency | -1.8% | Global, particularly relevant for network operators | Medium to Long Term (2026-2033) |

| Skilled Labor Shortage and Workforce Development | -1.5% | Global, affecting deployment speed and quality | Short to Long Term (2025-2033) |

| Interoperability and Standardization Issues in Heterogeneous Networks | -1.3% | Global, especially in multi-vendor environments | Short to Medium Term (2025-2029) |

| Security Threats and Network Vulnerabilities | -1.0% | Global, critical for all network deployments | Short to Long Term (2025-2033) |

Small Cell and Femtocell Market - Updated Report Scope

This comprehensive report delves into the intricate dynamics of the global Small Cell and Femtocell Market, offering a detailed analysis of its current landscape, historical trends, and future growth trajectories. The scope encompasses a thorough examination of market size, growth drivers, restraints, opportunities, and challenges across various segments and key geographical regions. It provides strategic insights for stakeholders to navigate the evolving market and capitalize on emerging trends, including the impact of 5G rollout, private network adoption, and technological advancements like AI and Open RAN.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 7.2 Billion |

| Market Forecast in 2033 | USD 31.0 Billion |

| Growth Rate | 20.3% |

| Number of Pages | 265 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems Inc., Ericsson, Huawei Technologies Co. Ltd., Nokia Corporation, CommScope Inc., Corning Inc., Samsung Electronics Co. Ltd., NEC Corporation, ZTE Corporation, Airspan Networks Holdings Inc., Baicells Technologies Co. Ltd., Accelleran NV, ip.access Ltd. (acquired by Mavenir), Contela, Fujitsu, Qualcomm Technologies Inc., Broadcom Inc., Intel Corporation, Texas Instruments Incorporated, Analog Devices Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Small Cell and Femtocell market is intricately segmented to reflect the diverse range of products, deployment scenarios, technologies, and applications driving its expansion. This detailed segmentation provides a granular view of market dynamics, enabling a comprehensive understanding of specific market niches and their growth potential. Analyzing these segments helps identify key areas of investment and strategic focus for various stakeholders, from equipment manufacturers to service providers and end-users.

- By Type: This segment categorizes small cells based on their power output and coverage area, including Picocell, Femtocell, Microcell, and Metrocell. Each type serves distinct deployment needs, ranging from very small indoor coverage to larger urban outdoor areas.

- By Deployment: This includes Indoor Small Cells and Outdoor Small Cells, reflecting where the units are physically installed. Indoor deployments often focus on enterprise buildings, residential areas, and public venues, while outdoor deployments address urban densification and rural connectivity.

- By Technology: This segmentation covers the cellular generations supported, primarily 3G, 4G/LTE, and 5G. The transition to 5G is a major driver, but existing 4G/LTE deployments continue to be significant.

- By Application: This segment defines the primary use cases or environments for small cells, such as Residential, Enterprise, Public Space, Industrial IoT, Smart Cities, and Transportation. This highlights the expanding utility of small cells beyond traditional mobile broadband.

- By End-User: This identifies the primary customers or beneficiaries of small cell deployments, including Telecom Operators, various Enterprises (e.g., Healthcare, Retail, Manufacturing), and Government entities. The rise of enterprise and private networks is particularly notable in this segment.

Regional Highlights

- North America: The region is a leading market for Small Cell and Femtocell deployments, driven by aggressive 5G rollout initiatives, particularly in the United States and Canada. Strong government support for infrastructure development, the early adoption of shared spectrum like CBRS (Citizens Broadband Radio Service), and a mature enterprise market are key contributors. There is significant investment in private LTE/5G networks across various industries, including manufacturing, logistics, and healthcare, fueling demand for small cells in indoor and campus environments. Additionally, the region is at the forefront of Open RAN experimentation and deployment, further accelerating small cell innovation.

- Europe: Europe exhibits substantial growth in the Small Cell and Femtocell market, primarily propelled by network densification efforts for 5G and the increasing focus on smart city initiatives. Countries like the UK, Germany, and France are actively deploying small cells to enhance urban coverage and capacity. Regulatory frameworks are gradually evolving to simplify small cell installations, though variations across countries can still present challenges. The region is also witnessing a rising adoption of small cells in enterprise settings, especially for industrial automation and smart manufacturing applications, driven by strong industrial bases.

- Asia Pacific (APAC): APAC is projected to be the largest and fastest-growing market due to massive 5G deployments in countries like China, Japan, South Korea, and India. The sheer scale of mobile subscriber bases and rapidly increasing data consumption necessitate extensive network densification through small cells. Government-led digital transformation initiatives, rapid urbanization, and significant investments in smart infrastructure and Industry 4.0 are propelling market expansion. Emerging economies within APAC are also investing in small cell solutions to bridge digital divides and enhance rural connectivity.

- Latin America: The Small Cell and Femtocell market in Latin America is in a growth phase, driven by increasing mobile penetration, rising demand for high-speed internet, and nascent 5G rollouts in major economies like Brazil and Mexico. The region faces challenges related to infrastructure development and regulatory consistency, but opportunities exist in improving urban connectivity, enhancing enterprise productivity, and extending coverage to underserved areas. Investments in telecom infrastructure are expected to gradually accelerate small cell adoption.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth in the Small Cell and Femtocell market, fueled by ongoing digital transformation efforts, ambitious smart city projects (e.g., in UAE, Saudi Arabia), and increasing mobile data consumption. While 5G deployments are progressing, particularly in GCC countries, the region also sees continued demand for 4G LTE small cells to expand coverage and capacity in developing areas. Challenges include diverse regulatory landscapes and infrastructure disparities, but the long-term potential remains significant due to population growth and urbanization trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Small Cell and Femtocell Market.- Cisco Systems Inc.

- Ericsson

- Huawei Technologies Co. Ltd.

- Nokia Corporation

- CommScope Inc.

- Corning Inc.

- Samsung Electronics Co. Ltd.

- NEC Corporation

- ZTE Corporation

- Airspan Networks Holdings Inc.

- Baicells Technologies Co. Ltd.

- Accelleran NV

- ip.access Ltd.

- Contela

- Fujitsu

- Qualcomm Technologies Inc.

- Broadcom Inc.

- Intel Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

Frequently Asked Questions

What is the projected growth rate of the Small Cell and Femtocell Market?

The Small Cell and Femtocell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.3% between 2025 and 2033, reaching USD 31.0 Billion by 2033.

How does 5G impact the demand for Small Cells?

5G heavily relies on network densification to deliver high speeds and low latency, making Small Cells indispensable for extending coverage, enhancing capacity in dense areas, and facilitating specific 5G use cases like private networks and industrial IoT.

What are the primary drivers for Small Cell and Femtocell market growth?

Key drivers include the global rollout of 5G networks, the exponential growth in mobile data traffic, increasing demand for enterprise private networks, and the proliferation of IoT devices and smart city initiatives.

What role does AI play in Small Cell deployment and management?

AI enhances Small Cell networks through automated planning and optimization, predictive maintenance, real-time resource allocation, improved energy efficiency, and enhanced security, leading to more intelligent and cost-effective operations.

Which regions are leading in Small Cell and Femtocell adoption?

North America and Asia Pacific are leading regions due to aggressive 5G deployments, significant investments in private networks, and advanced technological adoption, with Europe also showing strong growth in urban densification and enterprise solutions.