Single Use Valve Market

Single Use Valve Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701420 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Single Use Valve Market Size

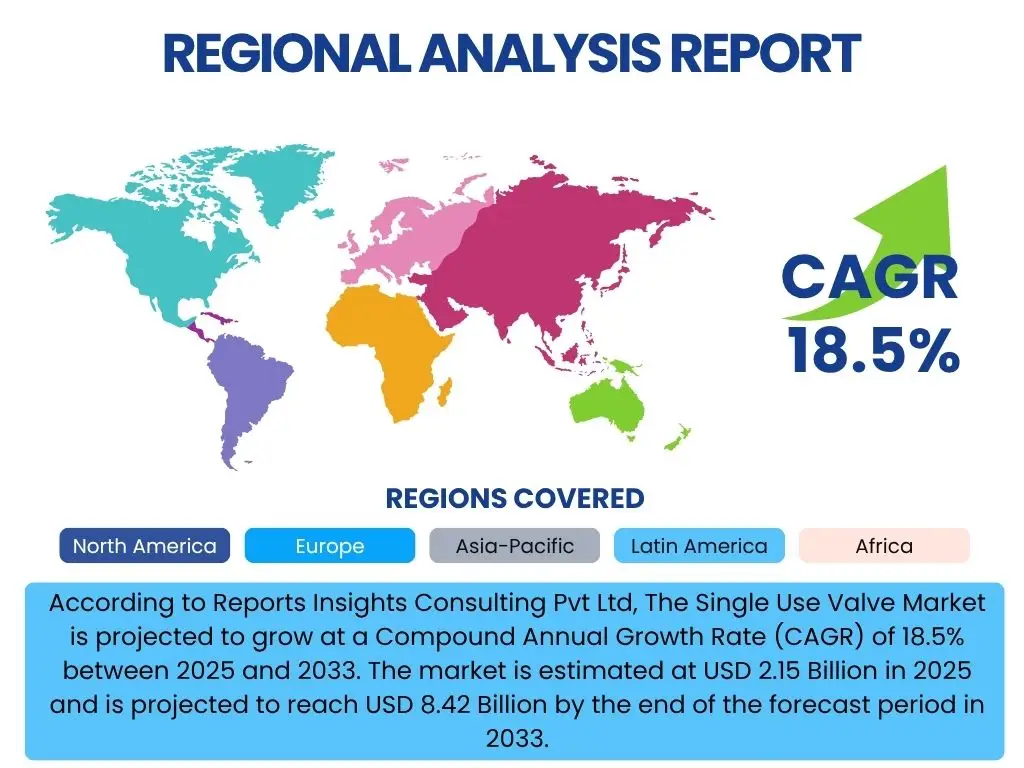

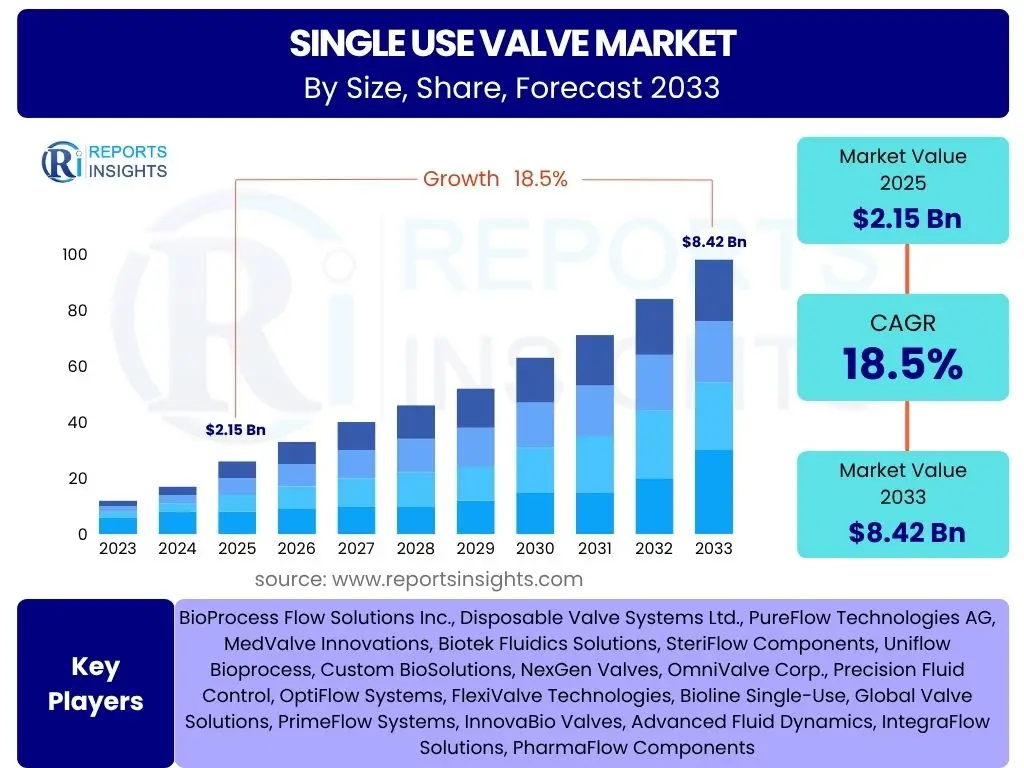

According to Reports Insights Consulting Pvt Ltd, The Single Use Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 2.15 Billion in 2025 and is projected to reach USD 8.42 Billion by the end of the forecast period in 2033.

Key Single Use Valve Market Trends & Insights

The single use valve market is experiencing robust growth, driven by an increasing adoption of single-use technologies within the biopharmaceutical sector. Users frequently inquire about the specific innovations and operational advantages that are shaping this market. A key insight revolves around the undeniable shift towards flexible, sterile, and cost-efficient manufacturing processes, which single-use valves inherently support. The emphasis on reducing cross-contamination risks and accelerating product development timelines is a paramount factor influencing this trend, particularly in the production of advanced biologics, vaccines, and cell and gene therapies.

Furthermore, there is a growing interest in how these valves integrate into broader single-use systems, enabling fully closed and automated bioprocessing workflows. The desire for enhanced supply chain resilience and reduced capital expenditure also steers the industry towards these disposable solutions. Users are keenly observing advancements in material science and design, seeking improvements in leachables and extractables profiles, as well as greater compatibility with diverse process fluids and sterilization methods. The ongoing expansion of biomanufacturing capabilities globally, particularly in emerging economies, further solidifies the market's upward trajectory, making single-use valves an indispensable component of modern bioprocess lines.

- Accelerated adoption of single-use systems in biopharmaceutical manufacturing due to flexibility and reduced contamination risk.

- Rising demand for advanced biologics, vaccines, and personalized medicines, necessitating agile production methods.

- Technological advancements in material science, improving valve integrity, durability, and chemical compatibility.

- Increasing focus on process intensification and automation within single-use bioprocessing workflows.

- Growing investment in Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) leveraging single-use technologies.

- Emphasis on reducing cleaning-in-place (CIP) and sterilization-in-place (SIP) costs and validation complexities.

- Expanding application beyond traditional biopharma to include food & beverage, and diagnostic industries.

AI Impact Analysis on Single Use Valve

Users are increasingly curious about the transformative role of Artificial Intelligence (AI) and Machine Learning (ML) in enhancing the functionality and lifecycle management of single use valves within complex bioprocessing environments. Common inquiries revolve around AI's capacity to optimize valve performance, predict maintenance needs, and improve overall system reliability. AI can analyze vast datasets from bioreactors and processing lines, identifying subtle patterns in flow rates, pressure differentials, and sensor data that might indicate impending valve wear or potential failures. This predictive capability allows for proactive intervention, minimizing downtime and ensuring consistent process integrity, which is critical for sensitive biopharmaceutical production.

Moreover, AI algorithms can contribute to the design and material selection processes for new single use valve generations. By simulating various operational conditions and material interactions, AI can help engineers optimize valve geometry, select more resilient polymers, and ensure better performance characteristics. Beyond design, AI integration in supply chain management for single use components can enhance forecasting, inventory optimization, and logistics, reducing lead times and ensuring the timely availability of critical components. While direct AI integration within the physical valve itself is nascent, its pervasive influence on the surrounding ecosystem of bioprocessing, from process control to supply chain efficiency, is poised to significantly impact the value proposition and operational effectiveness of single use valve technologies.

- Predictive maintenance for single-use systems, reducing unexpected valve failures and process interruptions.

- Optimization of bioprocess parameters, including flow control and pressure regulation, through AI-driven analytics.

- Enhanced quality control by real-time data analysis, identifying anomalies in valve performance or material integrity.

- Improved supply chain forecasting and inventory management for single-use components, including valves, via AI algorithms.

- Accelerated design and material innovation for single-use valves using AI-powered simulation and optimization tools.

- Automated anomaly detection in production lines, ensuring consistent valve functionality and preventing product loss.

Key Takeaways Single Use Valve Market Size & Forecast

Analysis of common user questions regarding the single use valve market size and forecast reveals a strong interest in the market's trajectory and its underlying growth drivers. The primary takeaway is the consistent and significant expansion of the market, driven by the biopharmaceutical industry's increasing reliance on single-use technologies for efficiency, sterility, and flexibility. Users are keen to understand how factors such as the proliferation of biologics, the emergence of advanced therapies like cell and gene therapies, and the global push for faster drug development cycles contribute to this upward trend. The forecast indicates sustained double-digit growth, underscoring the indispensable role of single use valves in modern biomanufacturing.

A secondary, yet crucial, insight is the market's resilience and adaptability in the face of evolving industry needs and global health crises. The ability of single use valve technology to rapidly scale up production, minimize contamination risks, and reduce capital expenditure makes it a preferred choice for both established pharmaceutical giants and agile biotechnology startups. While challenges related to sustainability and waste management persist, continuous innovation in material science and recycling initiatives are expected to mitigate these concerns, reinforcing the positive long-term outlook for the single use valve market. The market's growth is not merely volumetric but also indicative of a fundamental shift in bioprocessing paradigms.

- The Single Use Valve Market is projected for substantial growth, reaching USD 8.42 Billion by 2033 from USD 2.15 Billion in 2025, demonstrating an impressive 18.5% CAGR.

- Strong adoption of single-use technologies in biopharma, particularly for biologics, vaccines, and advanced therapies, is the primary growth catalyst.

- The market benefits from reduced operational costs, minimized cross-contamination risks, and accelerated production timelines offered by single-use solutions.

- Geographic expansion, especially in Asia Pacific, coupled with increasing investments in biomanufacturing infrastructure, is contributing significantly to market size.

- Despite challenges related to waste management and supply chain stability, continuous innovation and strategic partnerships are driving market resilience and expansion.

Single Use Valve Market Drivers Analysis

The single use valve market is primarily propelled by the exponential growth in the biopharmaceutical sector, particularly in the production of monoclonal antibodies, vaccines, and advanced therapies such as cell and gene therapies. These complex biologics necessitate highly sterile, flexible, and efficient manufacturing processes that single-use technologies, including valves, are uniquely positioned to provide. The imperative to reduce the risk of cross-contamination, a critical concern in multi-product facilities, further drives the adoption of disposable components. Moreover, the inherent cost savings associated with single-use systems, by eliminating the need for expensive cleaning-in-place (CIP) and sterilization-in-place (SIP) equipment and validation, significantly incentivizes their widespread integration across bioprocessing workflows.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Biopharmaceutical R&D and Production | +5.2% | Global, particularly North America, Europe, APAC | 2025-2033 (Long-term) |

| Reduced Risk of Cross-Contamination in Multi-Product Facilities | +4.8% | Global, high-value drug manufacturing regions | 2025-2030 (Mid-term) |

| Lower Capital Expenditure and Operational Costs | +4.5% | Emerging markets, new facility startups | 2025-2033 (Long-term) |

| Flexibility and Scalability in Bioprocessing Operations | +4.0% | Global, especially for contract manufacturers | 2025-2033 (Long-term) |

| Growth in Cell and Gene Therapy Manufacturing | +3.5% | North America, Europe, select APAC countries | 2026-2033 (Mid to Long-term) |

| Faster Turnaround Times for Drug Development | +3.0% | Global, pharmaceutical innovation hubs | 2025-2030 (Mid-term) |

| Stringent Regulatory Requirements for Sterility | +2.8% | North America, Europe, highly regulated markets | 2025-2033 (Long-term) |

Single Use Valve Market Restraints Analysis

Despite significant advantages, the single use valve market faces certain restraints that could impede its growth. A primary concern revolves around the environmental impact of plastic waste generated by disposable components. While industry efforts towards recycling and sustainable materials are underway, the sheer volume of single-use plastics poses a substantial environmental challenge and often incurs higher disposal costs, particularly for biohazardous waste. Additionally, the perceived higher direct material cost per batch compared to traditional stainless steel systems, despite operational savings, can be a deterrent for some manufacturers, especially those with established stainless steel infrastructures and lower volume production.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Environmental Concerns and Waste Management | -3.5% | Europe, North America (regions with strict environmental policies) | 2027-2033 (Mid to Long-term) |

| Potential for Leachables and Extractables | -3.0% | Global, particularly high-purity drug manufacturing | 2025-2030 (Mid-term) |

| High Initial Procurement Cost per Component | -2.8% | Small and medium-sized enterprises, emerging markets | 2025-2028 (Short to Mid-term) |

| Supply Chain Vulnerabilities and Dependencies | -2.5% | Global, geopolitical hotspots | 2025-2027 (Short-term) |

| Limited Reusability and Durability for Certain Applications | -2.0% | Specific industrial biotech processes | 2025-2033 (Long-term) |

| Standardization Challenges Across Manufacturers | -1.8% | Global, complex system integrators | 2026-2031 (Mid-term) |

Single Use Valve Market Opportunities Analysis

Significant opportunities abound for the single use valve market, particularly with the escalating demand for highly specialized and personalized medicines, such as cell and gene therapies. These therapies, often produced in smaller, more agile batches, are ideally suited for single-use technologies due to their inherent flexibility, rapid turnaround capabilities, and minimal cross-contamination risk. Furthermore, the expansion of biomanufacturing capabilities into emerging economies presents a fertile ground for market penetration. These regions, often building new facilities, are more inclined to adopt modern single-use systems from inception, bypassing the significant capital investment required for traditional stainless steel infrastructure.

Another key opportunity lies in technological advancements, specifically in the development of more sustainable materials and intelligent single-use systems. Innovation in biodegradable or easily recyclable polymers will address environmental concerns, enhancing market acceptance. The integration of sensors and smart features within single use valves can provide real-time data on process parameters, enabling better control, monitoring, and ultimately, greater process efficiency and reliability, thereby creating higher value propositions for end-users.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Cell and Gene Therapy Manufacturing | +4.9% | North America, Europe, Asia Pacific | 2025-2033 (Long-term) |

| Development of Sustainable and Recyclable Materials | +4.5% | Global, especially environmentally conscious markets | 2027-2033 (Mid to Long-term) |

| Growth in Emerging Markets and Developing Biomanufacturing Hubs | +4.2% | China, India, Brazil, South Korea | 2025-2033 (Long-term) |

| Integration with Advanced Bioprocessing Automation and Smart Systems | +3.8% | Global, leading biopharma companies | 2026-2032 (Mid-term) |

| Increased Adoption in Vaccine Production and Personalized Medicine | +3.5% | Global, particularly post-pandemic preparedness | 2025-2030 (Mid-term) |

| Application Expansion Beyond Biopharma (e.g., Food, Diagnostics) | +2.9% | Global, diversified industrial markets | 2028-2033 (Long-term) |

Single Use Valve Market Challenges Impact Analysis

The single use valve market faces several significant challenges that could affect its growth trajectory. One of the most pressing concerns is the increasing scrutiny over environmental sustainability and the management of plastic waste generated by disposable components. As global regulations and public sentiment shift towards greener practices, the industry must innovate to provide more environmentally friendly solutions, such as recyclable or biodegradable materials, to maintain its growth momentum. Another substantial challenge lies in ensuring the robustness and resilience of the supply chain for single-use components. Geopolitical events, raw material shortages, and logistics disruptions can severely impact the availability of critical single-use valves, potentially halting or delaying vital biopharmaceutical production.

Furthermore, concerns regarding leachables and extractables remain a constant challenge, particularly for highly sensitive drug products. Manufacturers must continually invest in rigorous testing and advanced material science to mitigate these risks and ensure product purity and patient safety. The relatively high cost per unit compared to traditional reusable components, despite the long-term operational savings, can also be a hurdle for some smaller enterprises or for processes with very high volume requirements, prompting a careful cost-benefit analysis before adoption. Addressing these challenges through innovation, strategic partnerships, and improved supply chain management will be crucial for sustained market expansion.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Managing Environmental Impact and Waste Disposal | -4.0% | Europe, North America, highly regulated economies | 2026-2033 (Long-term) |

| Supply Chain Resilience and Raw Material Volatility | -3.7% | Global, particularly regions dependent on specific suppliers | 2025-2029 (Short to Mid-term) |

| Ensuring Low Leachables & Extractables for Product Purity | -3.2% | Global, high-value biopharmaceutical production | 2025-2033 (Long-term) |

| Lack of Standardization Across Different Manufacturers | -2.9% | Global, complex multi-vendor bioprocess systems | 2027-2032 (Mid-term) |

| Perceived High Unit Cost Compared to Reusable Systems | -2.5% | Cost-sensitive markets, large-scale bulk manufacturing | 2025-2028 (Short to Mid-term) |

| User Acceptance and Training for New Technologies | -1.5% | Emerging markets, traditional manufacturing facilities | 2025-2027 (Short-term) |

Single Use Valve Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Single Use Valve Market, offering a detailed segmentation by various parameters including type, material, application, and end-user. It meticulously examines market dynamics, trends, drivers, restraints, opportunities, and challenges influencing market growth from 2025 to 2033. The report also features a thorough regional analysis, highlighting key market performances across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, alongside profiles of leading market players, offering strategic insights for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 8.42 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | BioProcess Flow Solutions Inc., Disposable Valve Systems Ltd., PureFlow Technologies AG, MedValve Innovations, Biotek Fluidics Solutions, SteriFlow Components, Uniflow Bioprocess, Custom BioSolutions, NexGen Valves, OmniValve Corp., Precision Fluid Control, OptiFlow Systems, FlexiValve Technologies, Bioline Single-Use, Global Valve Solutions, PrimeFlow Systems, InnovaBio Valves, Advanced Fluid Dynamics, IntegraFlow Solutions, PharmaFlow Components |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The single use valve market is extensively segmented to provide a granular view of its diverse applications and product types. Understanding these segmentations is crucial for identifying specific growth pockets and developing targeted strategies within the biopharmaceutical and related industries. The segmentation by type includes various valve designs such as diaphragm, pinch, check, and ball valves, each serving distinct fluid control purposes within single-use systems. Material segmentation highlights the prevalent polymers used, ensuring chemical compatibility and structural integrity.

Further segmentation by application details the specific processes where these valves are indispensable, ranging from filtration and aseptic transfer to highly sensitive cell culture and chromatography operations. The end-user segmentation delineates the primary consumers of these valves, including large biopharmaceutical manufacturers, agile contract research and manufacturing organizations, and burgeoning biotech startups. This comprehensive breakdown allows for a deeper understanding of market dynamics, enabling stakeholders to pinpoint high-growth areas and tailor product offerings to specific industry needs.

- By Type: Covers the diverse designs and mechanisms of single-use valves, essential for various fluid handling tasks.

- Diaphragm Valves: Widely used for sterile and precise flow control.

- Pinch Valves: Ideal for media transfer and gentle fluid handling.

- Check Valves: Prevent backflow in critical bioprocess lines.

- Ball Valves: Utilized for on/off control and diverting flow.

- Sampling Valves: Designed for aseptic sampling in bioreactors and process vessels.

- Others: Includes specialized valves for specific applications.

- By Material: Focuses on the polymeric compositions that ensure biocompatibility and chemical resistance.

- Polypropylene (PP): Common for general fluid handling and low-pressure applications.

- Polycarbonate (PC): Offers transparency and rigidity for certain valve components.

- Polyethylene (PE): Known for its flexibility and chemical inertness.

- Silicone: Used for tubing and flexible valve components due to its elasticity and heat resistance.

- Polyvinylidene Fluoride (PVDF): Chosen for excellent chemical resistance and mechanical strength.

- Others: Encompasses advanced polymers and multi-layer composites.

- By Application: Details the specific processes and functions where single-use valves are employed.

- Filtration: Used in tangential flow filtration (TFF) and sterile filtration setups.

- Aseptic Transfer: Critical for sterile media and buffer transfer between vessels.

- Flow Control: Regulating fluid movement in bioreactors, chromatography, and filling lines.

- Sampling: Enabling sterile and representative sampling without compromising process integrity.

- Cell Culture: Integral to bioreactor setups for media addition, harvesting, and gas control.

- Chromatography: Used in purification processes for precise buffer and product flow.

- Others: Includes applications in single-use mixing, filling, and formulation.

- By End-User: Identifies the key industries and organizations adopting single-use valve technology.

- Biopharmaceutical Manufacturers: Largest segment, driven by biologics and vaccine production.

- Contract Research Organizations (CROs): Utilize single-use systems for flexible and rapid R&D.

- Contract Manufacturing Organizations (CMOs): Adopt single-use valves for diverse client projects and reduced changeover times.

- Academic & Research Institutes: Employ single-use solutions for small-scale, experimental bioprocessing.

- Biotech Companies: Often rely on single-use for agile startup operations and specialized therapies.

- Others: Includes diagnostic companies, food & beverage processing, and veterinary medicine.

Regional Highlights

- North America: Dominates the single use valve market due to the presence of a robust biopharmaceutical industry, significant R&D investments, and early adoption of advanced bioprocessing technologies. The United States is a key contributor, leading in biologics and cell & gene therapy development, which drives high demand for single-use solutions.

- Europe: Represents a substantial market share, propelled by strong regulatory support for biopharmaceutical innovation, a well-established healthcare infrastructure, and increasing investment in biomanufacturing facilities, particularly in countries like Germany, the UK, and France. Focus on advanced therapies and sustainable manufacturing practices further stimulates growth.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate during the forecast period, driven by expanding biopharmaceutical manufacturing capabilities in China, India, Japan, and South Korea. Increased foreign investment, growing domestic demand for biologics, and government initiatives to boost local drug production are key factors.

- Latin America: Showing nascent growth, primarily in countries like Brazil and Mexico, attributed to rising healthcare expenditure, increasing investment in local biomanufacturing, and a growing awareness of the benefits of single-use technologies in emerging pharmaceutical sectors.

- Middle East and Africa (MEA): A developing market for single use valves, characterized by rising healthcare infrastructure development, increased focus on biopharmaceutical production, and growing adoption of modern manufacturing practices in select countries like Saudi Arabia and UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Use Valve Market.- BioProcess Flow Solutions Inc.

- Disposable Valve Systems Ltd.

- PureFlow Technologies AG

- MedValve Innovations

- Biotek Fluidics Solutions

- SteriFlow Components

- Uniflow Bioprocess

- Custom BioSolutions

- NexGen Valves

- OmniValve Corp.

- Precision Fluid Control

- OptiFlow Systems

- FlexiValve Technologies

- Bioline Single-Use

- Global Valve Solutions

- PrimeFlow Systems

- InnovaBio Valves

- Advanced Fluid Dynamics

- IntegraFlow Solutions

- PharmaFlow Components

Frequently Asked Questions

What are single use valves and why are they used in bioprocessing?

Single use valves are disposable fluid control components made from biocompatible polymers, designed for one-time use in biopharmaceutical manufacturing. They are used to manage the flow of liquids and gases in sterile environments, eliminating the need for cleaning, sterilization, and validation, thereby reducing the risk of cross-contamination and accelerating production timelines.

What are the primary benefits of adopting single use valves in pharmaceutical manufacturing?

The primary benefits include significant reduction in capital expenditure by eliminating large stainless steel equipment, decreased operational costs due to no cleaning or sterilization, minimized risk of cross-contamination between batches, faster turnaround times for product changeovers, and increased flexibility and scalability in manufacturing processes.

What challenges does the single use valve market face?

Key challenges include environmental concerns related to plastic waste disposal, potential for leachables and extractables affecting product purity, ensuring robust and resilient supply chains for disposable components, and the ongoing need for standardization across different manufacturers' designs and interfaces.

How is AI impacting the single use valve market and bioprocessing operations?

AI is impacting the market by enabling predictive maintenance for single-use systems, optimizing bioprocess parameters, enhancing quality control through real-time data analysis, improving supply chain efficiency, and accelerating the design and material innovation of single-use valves for better performance and sustainability.

What is the forecast growth for the Single Use Valve Market by 2033?

The Single Use Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033, reaching an estimated market value of USD 8.42 Billion by the end of the forecast period.