Silica Sand Market

Silica Sand Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701090 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Silica Sand Market Size

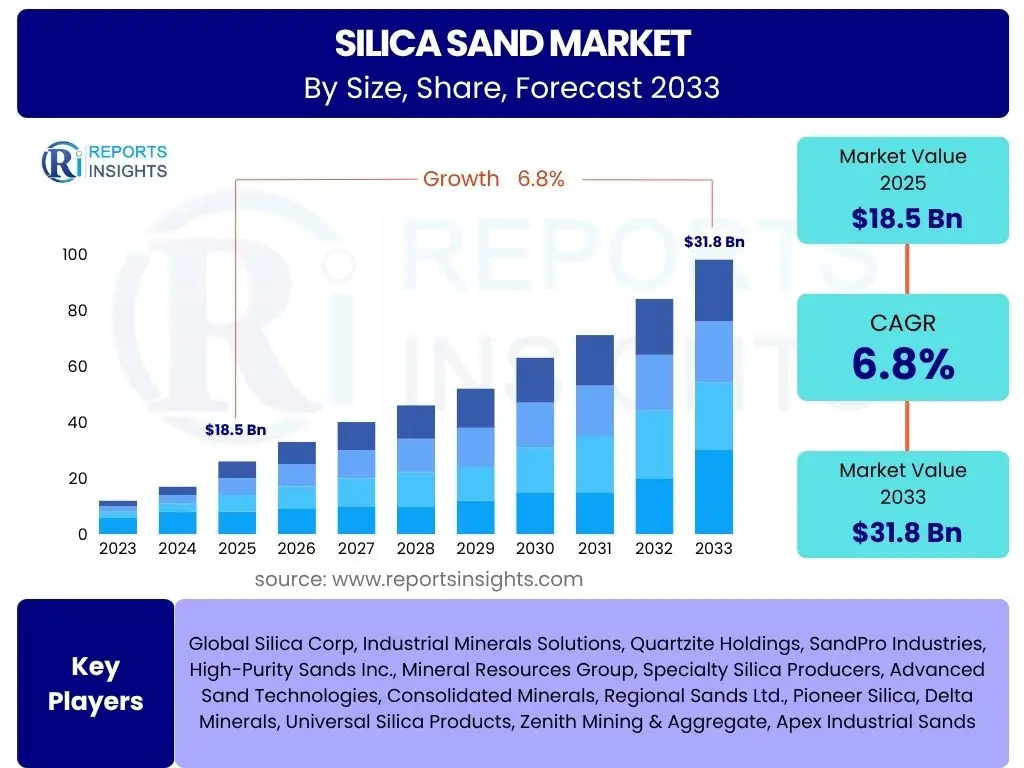

According to Reports Insights Consulting Pvt Ltd, The Silica Sand Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2033.

Key Silica Sand Market Trends & Insights

The Silica Sand market is currently shaped by several dynamic trends reflecting evolving industrial demands and increasing sustainability considerations. Common user inquiries frequently focus on how new applications are influencing demand, the impact of environmental regulations on sourcing, and the role of technological advancements in extraction and processing. These discussions highlight a shift towards higher purity grades of silica sand, driven by the electronics and solar industries, alongside a persistent demand from traditional sectors like construction and glass manufacturing. The industry is also witnessing a growing emphasis on supply chain resilience and localized sourcing to mitigate geopolitical risks and transportation costs, compelling producers to optimize logistics and explore new reserves closer to consumption hubs.

- Increasing demand for high-purity silica in electronics and solar energy.

- Growing adoption of advanced mining and processing technologies for efficiency and environmental compliance.

- Rising focus on sustainable sourcing and reduced environmental footprint.

- Fluctuations in demand from the oil and gas (frac sand) sector impacting overall market dynamics.

- Expansion of construction and infrastructure projects, especially in emerging economies.

- Development of innovative applications in water filtration and specialized ceramics.

AI Impact Analysis on Silica Sand

The integration of Artificial Intelligence (AI) across the silica sand value chain is a topic of increasing user interest, particularly concerning its potential to revolutionize operational efficiency, resource management, and quality control. Users often inquire about how AI can enhance exploration and extraction processes, optimize logistics, and ensure the consistent purity of silica sand for diverse industrial applications. The technology promises to address critical industry challenges such as reducing waste, improving safety standards, and providing predictive insights into market demand and supply chain vulnerabilities. This adoption is expected to foster a more data-driven and agile operational environment within the silica sand industry, driving both cost efficiencies and enhanced product quality.

- Enhanced exploration and geological mapping for identifying new silica sand reserves.

- Optimization of mining operations through predictive maintenance and autonomous equipment.

- Improved quality control and sorting processes for high-purity silica sand using AI-driven analytics.

- Logistics and supply chain optimization for efficient transportation and reduced costs.

- Predictive analytics for demand forecasting and inventory management, minimizing waste.

- Safety monitoring and risk assessment in mining environments through real-time data analysis.

Key Takeaways Silica Sand Market Size & Forecast

Key takeaways from the Silica Sand market size and forecast consistently highlight a robust growth trajectory, primarily fueled by sustained demand from critical industrial sectors and emerging high-tech applications. Users frequently seek concise insights into the primary growth drivers, the expected market valuation by the end of the forecast period, and the long-term sustainability of this expansion. The analysis underscores that while traditional sectors like construction and glass manufacturing remain foundational, the burgeoning demand for specialized silica in electronics, photovoltaics, and advanced ceramics is propelling the market towards higher value and greater sophistication. This diversification is critical for maintaining resilience against fluctuations in any single end-use industry, ensuring steady market progression.

- The Silica Sand market is poised for significant expansion, driven by diverse industrial applications.

- Robust demand from glass manufacturing, construction, and foundry industries forms the market's backbone.

- High-purity silica demand from electronics and solar energy sectors is a key growth accelerator.

- The market is expected to achieve substantial valuation by 2033, indicating strong investment potential.

- Sustainability practices and technological advancements are critical for future market development.

- Regional disparities in demand and supply dynamics will influence localized market trends.

Silica Sand Market Drivers Analysis

The Silica Sand market's robust growth trajectory is primarily propelled by an escalating demand across various industrial sectors. A significant driver is the continuous expansion of the global construction industry, which relies heavily on silica sand for concrete, mortar, and other building materials. Rapid urbanization, particularly in emerging economies, necessitates extensive infrastructure development, including residential, commercial, and public works, all of which consume substantial quantities of silica sand. This foundational demand ensures a consistent baseline for market expansion.

Furthermore, the booming glass manufacturing sector, encompassing flat glass for architectural applications, container glass for packaging, and specialized glass for automotive and solar panels, represents another pivotal driver. As consumer electronics evolve and the adoption of renewable energy sources accelerates, the need for high-quality silica sand in producing displays, optical fibers, and photovoltaic cells intensifies. This high-purity demand segment commands premium pricing and drives innovation in processing techniques.

The oil and gas industry, specifically hydraulic fracturing (frac sand), also significantly influences market dynamics, albeit with some volatility. While regional variations exist, periods of increased exploration and production activity boost the demand for frac sand, a specialized type of silica sand essential for extracting shale oil and gas. Beyond these primary drivers, advancements in material science and an increasing need for specialized abrasives and filtration media also contribute to the overall market impetus, ensuring a diverse and expanding application landscape for silica sand.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Construction and Infrastructure Development | +2.1% | Global, particularly APAC (China, India), North America | Long-term (2025-2033) |

| Rising Demand from Glass Manufacturing (Flat Glass, Container Glass, Solar Panels) | +1.8% | Global, Europe, APAC | Long-term (2025-2033) |

| Increasing Application in Electronics and Photovoltaics | +1.5% | APAC (South Korea, Japan), North America, Europe | Medium-term to Long-term (2025-2033) |

| Steady Demand from Foundry Industry for Metal Casting | +0.8% | Global, China, India, Germany, USA | Medium-term (2025-2030) |

| Resurgence in Hydraulic Fracturing (Frac Sand) Demand | +0.6% | North America (USA, Canada) | Short-term to Medium-term (2025-2028) |

Silica Sand Market Restraints Analysis

Despite its widespread applications, the Silica Sand market faces several notable restraints that could temper its growth trajectory. Environmental regulations pose a significant challenge, as mining operations are often subject to stringent rules regarding land use, water consumption, dust emissions, and habitat preservation. Obtaining permits can be a lengthy and complex process, sometimes leading to delays or outright rejections of new mining projects. These regulations can increase operational costs for producers, as investments in compliance technologies and remediation efforts become necessary, potentially impacting profit margins and market competitiveness.

Another key restraint is the high cost associated with transportation and logistics. Silica sand is a bulk commodity, and its economic viability is heavily dependent on proximity to end-use markets. Long-distance transportation, especially across diverse terrains or international borders, can significantly inflate costs, making certain reserves economically unfeasible to extract. This often limits market accessibility for producers and can lead to regional price disparities, affecting demand-supply dynamics in various geographies.

Furthermore, health concerns related to crystalline silica dust exposure, specifically silicosis, present a persistent challenge for the industry. Workplace safety regulations are continuously tightening globally, necessitating substantial investments in dust suppression systems, personal protective equipment, and employee training. While essential for worker well-being, these measures add to operational expenses and can influence public perception of mining activities. The availability of high-quality, easily accessible reserves is also becoming a constraint, as prime deposits are depleted, forcing companies to explore more challenging or remote locations, further escalating extraction costs and environmental impact.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations and Permitting Challenges | -1.2% | Global, particularly Europe, North America | Long-term (2025-2033) |

| High Transportation and Logistics Costs | -0.9% | Global, influencing regional pricing | Long-term (2025-2033) |

| Health and Safety Concerns Related to Silica Dust Exposure | -0.7% | Global, especially developed economies | Ongoing |

| Depletion of High-Quality, Easily Accessible Reserves | -0.5% | Regional, affecting established mining areas | Medium-term to Long-term (2028-2033) |

| Competition from Alternative Materials in Certain Applications | -0.3% | Specific niches, e.g., synthetic aggregates | Medium-term (2025-2030) |

Silica Sand Market Opportunities Analysis

Significant opportunities are emerging within the Silica Sand market, driven by technological advancements and evolving industrial needs. One prominent area is the increasing demand for specialized and high-purity silica sand, particularly from the electronics, semiconductor, and solar panel industries. These sectors require ultra-pure grades of silica for critical applications, offering higher profit margins for producers capable of meeting stringent quality specifications. Investments in advanced processing and purification technologies can unlock these premium market segments, creating significant avenues for growth and diversification beyond traditional bulk applications.

Another key opportunity lies in the development and adoption of sustainable mining and processing technologies. As environmental concerns escalate and regulatory pressures intensify, companies that innovate in areas such as water recycling, reduced energy consumption, and responsible land reclamation can gain a competitive edge. This not only enhances corporate social responsibility but also opens doors to new markets and partnerships with environmentally conscious industries. Furthermore, the potential for valorizing mining by-products or exploring alternative sources, such as recycled glass, could contribute to a more circular economy model for silica resources.

Geographical expansion into rapidly industrializing regions, particularly in Southeast Asia, Africa, and parts of Latin America, presents substantial market opportunities. These regions are experiencing significant infrastructure development, urbanization, and industrial growth, leading to an increasing demand for construction materials, glass products, and other silica-intensive commodities. Establishing local production facilities or robust supply chains in these areas can capitalize on burgeoning markets, reducing logistical costs and fostering stronger regional partnerships. Additionally, the continuous research and development into new applications for silica, such as in advanced ceramics, composites, and nanotechnology, offer long-term growth prospects for the market.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for High-Purity Silica in Electronics & Semiconductors | +1.5% | APAC (Taiwan, South Korea), North America, Europe | Long-term (2025-2033) |

| Investment in Sustainable Mining & Processing Technologies | +1.0% | Global, particularly Europe, North America | Medium-term to Long-term (2027-2033) |

| Expansion into Emerging Markets for Infrastructure & Construction | +0.9% | Southeast Asia, Africa, Latin America | Long-term (2025-2033) |

| Development of New Applications (e.g., Advanced Ceramics, Composites) | +0.7% | Global, Research & Development hubs | Long-term (2028-2033) |

| Recycling and Reuse of Glass Cullet as a Supplementary Source | +0.4% | Europe, North America | Medium-term (2025-2030) |

Silica Sand Market Challenges Impact Analysis

The Silica Sand market confronts several critical challenges that demand strategic responses from industry participants. One primary challenge involves navigating the increasingly complex and stringent regulatory landscape. Environmental protection agencies and local governments are enforcing stricter rules regarding mining operations, including limits on water usage, dust emissions, land disturbance, and rehabilitation requirements. Compliance often necessitates substantial capital investment in advanced equipment and processes, driving up operational costs and potentially reducing profit margins. Moreover, prolonged permitting processes can delay new projects, impacting supply responsiveness to market demand.

Another significant hurdle is the volatility of energy prices and associated operational costs. Silica sand extraction and processing, particularly for higher purity grades, are energy-intensive activities. Fluctuations in global energy markets can directly impact production expenses, making it difficult for producers to maintain stable pricing and profitability. This challenge is further exacerbated by the increasing global focus on decarbonization, which may necessitate transitions to more expensive, cleaner energy sources or investments in carbon capture technologies, adding further financial strain to operations.

Furthermore, managing public perception and local community relations remains a persistent challenge for mining companies. Concerns over environmental impact, noise pollution, traffic disruption, and potential health risks can lead to local opposition and protests, complicating land acquisition and expansion plans. Establishing strong community engagement strategies, demonstrating environmental stewardship, and ensuring transparent operations are crucial for mitigating these social license challenges. Lastly, ensuring a stable and cost-effective supply chain, especially for specialized grades and international distribution, continues to be an operational challenge, susceptible to geopolitical instability, trade barriers, and infrastructure limitations.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Regulatory Scrutiny and Compliance Costs | -1.1% | Global, particularly developed regions | Long-term (2025-2033) |

| Volatile Energy Prices and Operational Cost Management | -0.8% | Global | Ongoing |

| Public Opposition and Social License to Operate Issues | -0.6% | Local/National, site-specific | Ongoing |

| Supply Chain Disruptions and Logistics Complexities | -0.5% | Global, influencing import/export dynamics | Short-term to Medium-term (2025-2027) |

| Securing Access to New High-Quality Reserves | -0.4% | Regional, affecting long-term supply | Long-term (2028-2033) |

Silica Sand Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the global Silica Sand market, offering valuable insights into its current landscape, historical performance, and future growth projections. The scope encompasses detailed segmentation analysis, regional market dynamics, competitive intelligence on key players, and an examination of the major drivers, restraints, opportunities, and challenges influencing the industry. It also includes a dedicated assessment of AI's burgeoning impact and the critical trends shaping the market's evolution, presenting a holistic view for stakeholders and strategic decision-makers.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Growth Rate | 6.8% CAGR |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Silica Corp, Industrial Minerals Solutions, Quartzite Holdings, SandPro Industries, High-Purity Sands Inc., Mineral Resources Group, Specialty Silica Producers, Advanced Sand Technologies, Consolidated Minerals, Regional Sands Ltd., Pioneer Silica, Delta Minerals, Universal Silica Products, Zenith Mining & Aggregate, Apex Industrial Sands |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Silica Sand market is comprehensively segmented to provide granular insights into its diverse applications, quality grades, and end-use industries, enabling a thorough understanding of market dynamics across various dimensions. This segmentation helps identify key growth areas, consumer preferences, and technological shifts impacting different market facets. By analyzing each segment, stakeholders can pinpoint specific opportunities and tailor strategies to capitalize on evolving demands, from traditional construction needs to the highly specialized requirements of advanced electronics.

- By Application:

- Glass Manufacturing: Primarily used in flat glass, container glass, and specialty glass for solar panels and electronics.

- Foundry Casting: Essential for producing molds and cores in metal casting due to its high thermal resistance.

- Hydraulic Fracturing (Frac Sand): A critical proppant in oil and gas extraction from shale formations.

- Filtration: Utilized in water treatment, wastewater management, and industrial filtration processes.

- Abrasives: Employed in sandblasting, grinding, and polishing applications.

- Ceramics: A key component in the production of tiles, sanitary ware, and industrial ceramics.

- Chemicals: Used in the manufacturing of silicon chemicals, silicates, and other chemical compounds.

- Others: Includes applications in sports fields, paints and coatings, and agricultural uses.

- By Grade:

- High Purity Silica Sand: Characterized by minimal impurities, essential for electronics, solar panels, and specialized glass.

- Standard Purity Silica Sand: Used for general construction, basic glass, and foundry applications.

- By End-Use Industry:

- Construction: Incorporates silica sand in concrete, mortar, asphalt, and other building materials.

- Oil & Gas: Driven by hydraulic fracturing activities for oil and gas extraction.

- Glass & Ceramics: Pertains to manufacturing of various glass products and ceramic materials.

- Electronics & Solar: Crucial for silicon wafers, solar cells, and advanced display technologies.

- Chemicals: Involves the production of silicon-based chemicals and derivatives.

- Water Treatment: Utilizes silica sand for filtration beds and purification systems.

- Metals & Metallurgy: Primarily for foundry applications and refractories.

- Others: Includes industries such as sports, paints & coatings, and agriculture.

Regional Highlights

The global Silica Sand market exhibits distinct regional dynamics, influenced by varying industrialization rates, regulatory environments, and resource availability. Each major geographic segment contributes uniquely to the overall market landscape, driven by specific demand drivers and supply chain characteristics. Understanding these regional nuances is crucial for companies aiming to optimize their market penetration strategies and capitalize on localized growth opportunities.

North America holds a significant share in the Silica Sand market, primarily driven by its robust construction sector and the fluctuating but substantial demand from the oil and gas industry for hydraulic fracturing. The United States, in particular, is a major consumer and producer of frac sand. However, the region also faces stringent environmental regulations and rising transportation costs, compelling producers to innovate in logistics and explore high-purity applications beyond energy. The emphasis on advanced manufacturing and specialized glass products further bolsters demand for high-grade silica sand.

Europe represents a mature market with strong demand from its well-established glass manufacturing industry, encompassing architectural, automotive, and specialty glass sectors. Environmental sustainability and circular economy initiatives are key drivers in this region, pushing for more efficient mining practices and increased recycling of glass cullet. Strict regulations regarding dust emissions and land rehabilitation also shape the operational landscape, leading to investments in cleaner production technologies and responsible sourcing. Countries like Germany, France, and Italy are significant consumers, maintaining a steady demand for various grades of silica sand.

The Asia Pacific (APAC) region is projected to be the fastest-growing market for Silica Sand, fueled by rapid industrialization, urbanization, and massive infrastructure development projects, particularly in China and India. The burgeoning electronics, solar energy, and automotive industries in countries like South Korea, Japan, and Taiwan are creating immense demand for high-purity silica. The region benefits from abundant reserves and lower labor costs, although increasing environmental scrutiny and growing awareness of sustainable practices are beginning to influence mining operations. The sheer scale of construction and manufacturing activities positions APAC as a critical growth engine for the global market.

Latin America shows steady growth, driven by investments in infrastructure and a developing construction sector, alongside its domestic oil and gas activities in countries like Brazil and Argentina. While not as dominant as North America or APAC, the region offers untapped potential, with increasing urbanization rates and industrial expansion stimulating demand for building materials and glass. However, economic volatility and political instability in certain countries can present challenges for market development and investment. Exploration of new reserves and improved logistics infrastructure are key to unlocking the region's full potential.

The Middle East and Africa (MEA) region is witnessing growth propelled by large-scale construction projects, particularly in the GCC countries, alongside demand from nascent industrial sectors. Investments in diversifying economies away from oil dependency are fostering growth in manufacturing and infrastructure, which in turn drives the demand for silica sand. While local availability of reserves varies, strategic geographical positioning makes certain countries important players in the international silica sand trade. Challenges include water scarcity for processing and the need for robust infrastructure to support expanded mining and distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silica Sand Market.- Global Silica Corp

- Industrial Minerals Solutions

- Quartzite Holdings

- SandPro Industries

- High-Purity Sands Inc.

- Mineral Resources Group

- Specialty Silica Producers

- Advanced Sand Technologies

- Consolidated Minerals

- Regional Sands Ltd.

- Pioneer Silica

- Delta Minerals

- Universal Silica Products

- Zenith Mining & Aggregate

- Apex Industrial Sands

- Blue Horizon Minerals

- Crystalline Industries

- Eco Sand Solutions

- Precision Mineral Group

- TerraForm Resources

Frequently Asked Questions

What is silica sand primarily used for?

Silica sand is primarily used in glass manufacturing, foundry casting, and as frac sand in the oil and gas industry. Its high purity grades are also critical for advanced applications in electronics, solar panels, and specialized ceramics due to its unique chemical and physical properties.

How is the global silica sand market expected to grow by 2033?

The global silica sand market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033, reaching an estimated value of USD 31.8 Billion by 2033 from USD 18.5 Billion in 2025. This growth is driven by increasing industrial demand and emerging applications.

What are the main drivers of the silica sand market?

Key drivers include the expanding construction and infrastructure sectors, rising demand from the glass manufacturing industry, and the increasing need for high-purity silica in electronics and solar energy production. The oil and gas industry's demand for frac sand also significantly contributes to market growth.

What environmental concerns are associated with silica sand mining?

Environmental concerns include land degradation, habitat disruption, water consumption during processing, and dust emissions. Stringent environmental regulations aim to mitigate these impacts, requiring advanced mitigation strategies and responsible land reclamation from mining companies.

How is AI impacting the silica sand industry?

AI is impacting the silica sand industry by enhancing operational efficiency through predictive maintenance and automation in mining. It also optimizes supply chain logistics, improves quality control processes for high-purity grades, and provides valuable data analytics for demand forecasting and resource management.