Ship Loader Market

Ship Loader Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704016 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Ship Loader Market Size

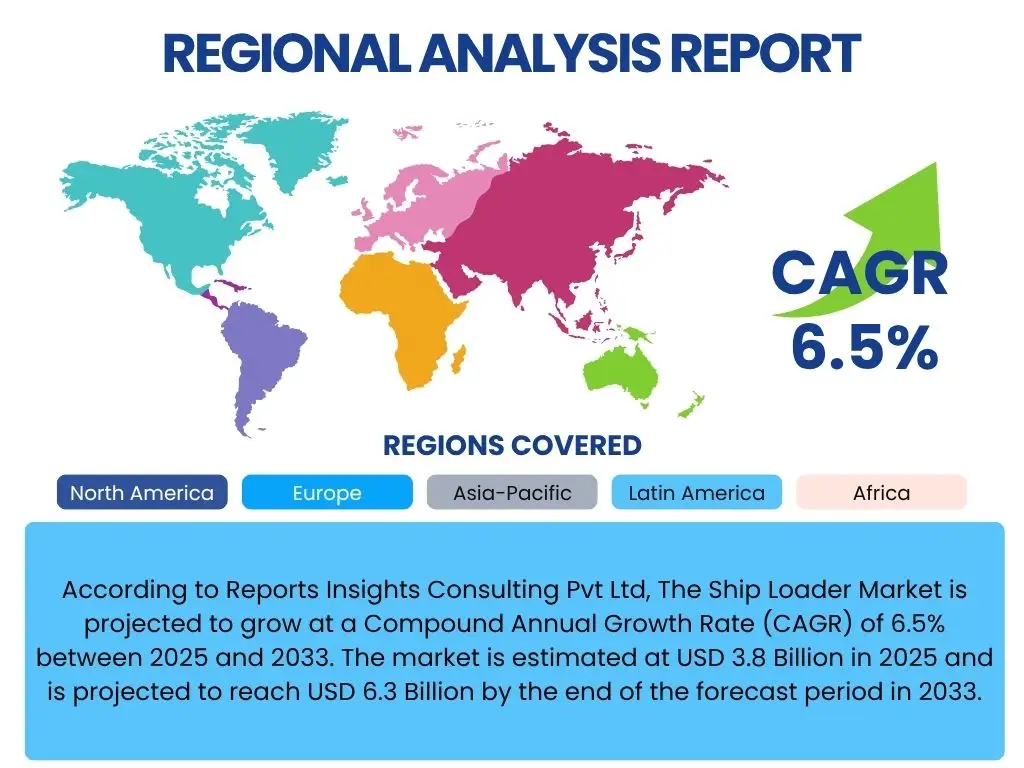

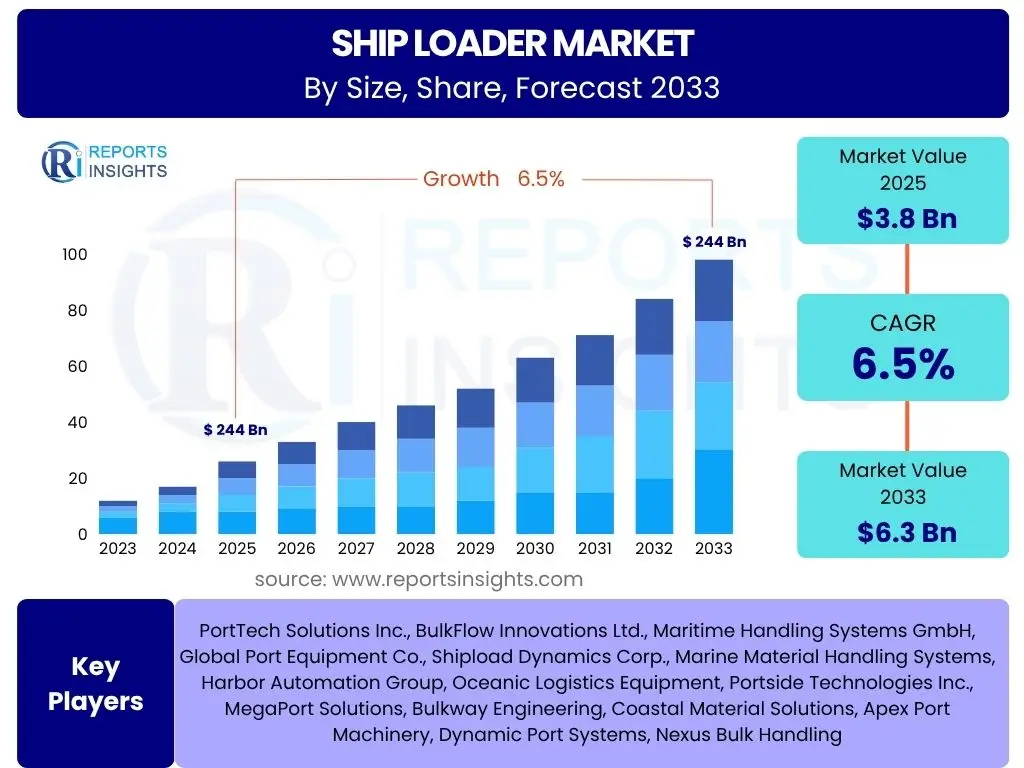

According to Reports Insights Consulting Pvt Ltd, The Ship Loader Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2033. The market is estimated at USD 3.8 Billion in 2025 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033.

Key Ship Loader Market Trends & Insights

The Ship Loader market is currently experiencing significant shifts driven by advancements in automation, increasing port capacities, and the growing demand for efficient bulk material handling. Stakeholders are keen on understanding how these trends will influence operational expenditures, turnaround times, and overall port productivity. The market is trending towards higher levels of sophistication in equipment design, incorporating features that enhance environmental compliance and worker safety, while simultaneously seeking to reduce labor costs and improve operational throughput.

Furthermore, the drive for greater efficiency and sustainability within global logistics is pushing the adoption of advanced ship loading technologies. This includes integrated systems that offer real-time data analysis, remote monitoring capabilities, and enhanced material flow control. The emphasis on faster loading and unloading cycles, particularly for high-volume commodities like iron ore, coal, and grains, is compelling port operators and terminal owners to invest in next-generation ship loaders. This strategic investment aims to capitalize on expanding trade routes and the increasing size of bulk carriers.

- Increased adoption of automation and digitalization in port operations.

- Growing demand for higher capacity and faster loading rates to accommodate larger vessels.

- Focus on environmental sustainability through reduced dust emissions and energy consumption.

- Integration of advanced sensing and control technologies for enhanced operational safety.

- Shift towards modular and flexible ship loader designs for versatile material handling.

AI Impact Analysis on Ship Loader

Artificial Intelligence (AI) is set to revolutionize the Ship Loader market by introducing unprecedented levels of efficiency, predictive capabilities, and autonomous operation. Users are primarily concerned with how AI can optimize loading schedules, predict maintenance needs, enhance safety protocols, and ultimately reduce operational costs. The expectation is that AI integration will move ship loading operations from reactive to proactive, minimizing downtime and maximizing throughput by analyzing vast datasets from sensors and operational logs.

The potential for AI to create fully autonomous ship loading systems is a significant area of interest, promising to address labor shortages and increase operational consistency. Additionally, AI-driven analytics can provide insights into optimal material flow, vessel positioning, and real-time performance adjustments, leading to substantial gains in efficiency. While the initial investment and complexity of integrating AI systems are concerns, the long-term benefits in terms of operational reliability and cost savings are driving market participants to explore these advanced solutions vigorously.

- Predictive maintenance using AI algorithms to anticipate equipment failures.

- Optimization of loading sequences and material flow for increased efficiency.

- Autonomous operation of ship loaders, reducing human intervention and labor costs.

- Enhanced safety monitoring through AI-powered anomaly detection.

- Real-time data analysis for immediate operational adjustments and performance improvements.

Key Takeaways Ship Loader Market Size & Forecast

The Ship Loader market is poised for robust growth, driven by an expanding global trade in bulk commodities and significant investments in port infrastructure modernization. Key takeaways indicate a strong trajectory for market expansion, with a clear emphasis on technological integration to meet future demands. Stakeholders should recognize the critical role of automation and digitalization in shaping the competitive landscape, alongside the imperative for sustainable and efficient operations to maintain market relevance.

The projected increase in market valuation underscores the ongoing need for advanced material handling solutions at ports worldwide. This growth is not merely volumetric but also qualitative, reflecting a shift towards smarter, more resilient, and environmentally compliant ship loading systems. Companies prioritizing innovation in automation, AI integration, and energy efficiency are best positioned to capitalize on these evolving market dynamics, ensuring long-term profitability and market leadership in a rapidly modernizing global trade environment.

- Significant market growth projected, reaching USD 6.3 Billion by 2033.

- Automation and AI integration are critical drivers for future market development.

- Sustainable and energy-efficient solutions are becoming increasingly important.

- Investments in port infrastructure modernization are fueling demand for new ship loaders.

- Emerging economies present substantial growth opportunities due to expanding trade activities.

Ship Loader Market Drivers Analysis

The expansion of the global bulk trade, particularly in commodities such as iron ore, coal, grains, and fertilizers, serves as a primary driver for the Ship Loader market. As economies worldwide continue to industrialize and develop, the demand for these raw materials and agricultural products escalates, necessitating more efficient and higher-capacity loading solutions at ports. Furthermore, the ongoing investments in port infrastructure development and modernization projects across various regions are directly stimulating the demand for advanced ship loaders. These investments aim to enhance port throughput, reduce vessel turnaround times, and accommodate the increasing size of bulk carriers, thereby driving the adoption of sophisticated loading systems.

Additionally, the global push towards automation and digitalization in port operations is a significant catalyst. Ports are increasingly adopting smart technologies to improve operational efficiency, reduce labor costs, and enhance safety standards. Ship loaders equipped with advanced automation, remote control capabilities, and data analytics integration are becoming standard requirements, moving away from conventional manual operations. This technological shift is not only improving the efficiency of loading processes but also contributing to environmental compliance by minimizing dust emissions and optimizing energy consumption, further bolstering market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Global Bulk Trade | +1.8% | Asia Pacific, Latin America, Europe | Short to Medium Term (2025-2029) |

| Port Infrastructure Development | +1.5% | Emerging Economies, Middle East & Africa | Medium to Long Term (2027-2033) |

| Increasing Demand for Automation | +1.2% | North America, Europe, East Asia | Short to Medium Term (2025-2030) |

| Larger Vessel Sizes | +1.0% | Global Maritime Hubs | Medium Term (2026-2031) |

Ship Loader Market Restraints Analysis

Despite the positive growth outlook, the Ship Loader market faces several significant restraints that could impede its expansion. One of the primary inhibitors is the high initial capital investment required for acquiring and installing modern ship loading systems. These advanced systems, especially those incorporating automation and AI, represent a substantial financial outlay for port operators and terminal owners, which can be particularly challenging for smaller ports or those in developing economies with limited access to capital. This high cost can lead to longer decision-making cycles and deferment of new investments, slowing market adoption.

Furthermore, economic downturns and geopolitical uncertainties pose considerable risks to the market. Fluctuations in global trade volumes, often influenced by economic recessions, trade disputes, or political instabilities, directly impact the demand for bulk commodities and, consequently, the need for new ship loaders. Such macroeconomic volatility can reduce investment in new port projects or lead to a slowdown in existing expansion plans. Regulatory complexities and environmental compliance standards, while necessary, can also act as restraints by increasing the operational costs and lead times for project approvals, particularly concerning dust emissions and noise pollution, requiring additional investments in mitigation technologies.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Capital Expenditure | -0.8% | Global, particularly Developing Regions | Short to Medium Term (2025-2030) |

| Economic Volatility & Geopolitical Risks | -0.7% | Global | Short Term (2025-2028) |

| Complex Regulatory & Environmental Standards | -0.5% | Europe, North America, Australia | Medium Term (2026-2031) |

| Skilled Labor Shortage for Maintenance | -0.4% | Developed Markets | Medium to Long Term (2027-2033) |

Ship Loader Market Opportunities Analysis

The Ship Loader market is presented with significant growth opportunities stemming from the ongoing modernization and expansion of existing ports and the development of new port facilities, especially in emerging economies. Countries in Asia Pacific, Latin America, and Africa are investing heavily in maritime infrastructure to support their growing economies and increasing international trade activities. This surge in port development creates a fertile ground for the deployment of advanced ship loading solutions, including fixed, mobile, and rail-mounted systems tailored to various capacities and bulk materials.

Furthermore, the increasing focus on smart port initiatives and the adoption of Industry 4.0 technologies offer substantial avenues for market expansion. This involves integrating Internet of Things (IoT), artificial intelligence (AI), and advanced analytics into ship loader operations, enabling real-time monitoring, predictive maintenance, and autonomous capabilities. Such technological advancements enhance operational efficiency, reduce downtime, and improve safety, making these solutions highly attractive to port operators seeking competitive advantages. Additionally, the global push for environmental sustainability opens up opportunities for manufacturers to develop and offer energy-efficient and low-emission ship loaders, aligning with stringent environmental regulations and corporate social responsibility goals.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Port Modernization & Expansion in Emerging Economies | +1.5% | Asia Pacific, Latin America, Africa | Medium to Long Term (2026-2033) |

| Rise of Smart Port Initiatives & Digitalization | +1.3% | Global, especially Developed Markets | Short to Medium Term (2025-2030) |

| Technological Advancements in Automation & AI | +1.1% | Global | Short to Medium Term (2025-2029) |

| Demand for Eco-Friendly & Energy-Efficient Solutions | +0.9% | Europe, North America | Medium Term (2026-2031) |

Ship Loader Market Challenges Impact Analysis

The Ship Loader market faces several notable challenges that could impede its growth and adoption. One significant challenge is the complexity of integrating advanced ship loader systems with existing port infrastructure and diverse operational protocols. This integration often requires substantial modifications to current systems, extensive training for personnel, and careful planning to avoid disruptions to ongoing port activities. The interoperability of new technologies with legacy systems can be a technical hurdle, requiring customized solutions that increase project costs and implementation timelines.

Another major challenge is the volatility of commodity prices and global trade policies. Fluctuations in the prices of bulk commodities, such as coal, iron ore, or grains, can directly impact the profitability of mining companies and agricultural exporters, subsequently affecting their investment in new or upgraded port equipment. Furthermore, evolving international trade agreements, tariffs, and geopolitical tensions can disrupt supply chains and reduce trade volumes, thereby dampening the demand for new ship loaders. The intense competition within the ship loader manufacturing industry also poses a challenge, as companies must continuously innovate and offer cost-effective solutions while maintaining high quality and performance standards to remain competitive.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with Legacy Port Infrastructure | -0.7% | Global | Short to Medium Term (2025-2030) |

| Volatility in Commodity Prices & Trade Policies | -0.6% | Global | Short Term (2025-2028) |

| Intense Market Competition | -0.5% | Global | Medium Term (2026-2031) |

| Cybersecurity Risks for Connected Systems | -0.4% | Developed Markets | Medium to Long Term (2027-2033) |

Ship Loader Market - Updated Report Scope

This report provides a comprehensive analysis of the Ship Loader Market, detailing its size, growth trajectory, key trends, and the impact of emerging technologies such as Artificial Intelligence. It covers the market from 2019 to 2033, offering historical insights, current market valuations, and future projections. The scope encompasses detailed segmentation across various parameters, regional breakdowns, and profiles of key industry players, providing a holistic view of market dynamics to aid strategic decision-making for stakeholders interested in bulk material handling solutions.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 6.5% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | PortTech Solutions Inc., BulkFlow Innovations Ltd., Maritime Handling Systems GmbH, Global Port Equipment Co., Shipload Dynamics Corp., Marine Material Handling Systems, Harbor Automation Group, Oceanic Logistics Equipment, Portside Technologies Inc., MegaPort Solutions, Bulkway Engineering, Coastal Material Solutions, Apex Port Machinery, Dynamic Port Systems, Nexus Bulk Handling |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Ship Loader market is comprehensively segmented to provide a granular view of its various facets, enabling a deeper understanding of market dynamics across different product types, operational modes, and applications. This segmentation allows for the identification of specific niches and growth areas within the broader market, catering to diverse industry needs and operational requirements. The market is primarily segmented by type, differentiating between fixed, mobile, and rail-mounted systems, which are deployed based on port layout, flexibility requirements, and volume handling capacities. Additionally, segmentation by operation distinguishes between manual, semi-automatic, and fully automatic loaders, reflecting the varying degrees of automation adopted by port operators.

Further segmentation by application highlights the diverse range of bulk commodities handled by these machines, including but not limited to coal, iron ore, grains, and fertilizers, each requiring specific design considerations for efficient loading. Capacity-based segmentation provides insights into the demand for different throughput levels, from smaller ports handling moderate volumes to mega-ports requiring extremely high-capacity loaders. This multi-dimensional segmentation is crucial for stakeholders to analyze market trends, identify lucrative opportunities, and formulate targeted strategies, ensuring that products and services align with precise market demands and operational contexts across the globe.

- By Type: Fixed Ship Loaders, Mobile Ship Loaders, Rail-Mounted Ship Loaders, Gantry Ship Loaders

- By Operation: Manual, Semi-Automatic, Automatic

- By Application: Coal, Iron Ore, Grains, Fertilizers, Cement, Aggregates, Others

- By Capacity: Up to 500 TPH, 501-1500 TPH, 1501-3000 TPH, Above 3000 TPH

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to robust economic growth, massive investments in port infrastructure, and high demand for bulk commodities from countries like China, India, and Australia. The region is a hub for both production and consumption of raw materials, driving the need for advanced ship loading solutions.

- North America: Exhibits steady growth, driven by modernization of existing ports, adoption of automation technologies, and strategic investments to enhance trade efficiency, particularly in the US and Canada. Environmental regulations also spur demand for cleaner, more efficient loaders.

- Europe: Characterized by a focus on sustainable and automated port operations. Countries like Germany, Netherlands, and UK are investing in smart port initiatives and upgrading older infrastructure to accommodate larger vessels and comply with stringent environmental standards.

- Latin America: Shows promising growth owing to increasing commodity exports (e.g., iron ore from Brazil, agricultural products from Argentina) and ongoing port expansion projects to improve global trade connectivity and efficiency.

- Middle East and Africa (MEA): Emerging as a significant market with substantial investments in new port developments and industrial zones, particularly in the GCC countries and South Africa, driven by diversification efforts and increased trade flows.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ship Loader Market.- PortTech Solutions Inc.

- BulkFlow Innovations Ltd.

- Maritime Handling Systems GmbH

- Global Port Equipment Co.

- Shipload Dynamics Corp.

- Marine Material Handling Systems

- Harbor Automation Group

- Oceanic Logistics Equipment

- Portside Technologies Inc.

- MegaPort Solutions

- Bulkway Engineering

- Coastal Material Solutions

- Apex Port Machinery

- Dynamic Port Systems

- Nexus Bulk Handling

Frequently Asked Questions

What is a ship loader and how does it work?

A ship loader is a specialized piece of port equipment designed to efficiently transfer bulk materials, such as coal, iron ore, grains, or fertilizers, from a stockyard or conveyor system onto a vessel. It typically uses a conveyor belt system, boom, and sometimes a telescopic chute or spout to guide the material directly into the ship's hold, optimizing loading speed and minimizing spillage.

What are the key types of ship loaders available?

Ship loaders are primarily categorized by their mobility and design. Common types include fixed ship loaders, which are stationary structures; mobile ship loaders, which can be moved on wheels; and rail-mounted ship loaders, which operate on rails along the berth. Gantry ship loaders, often resembling cranes, are also used for specific applications requiring greater reach or flexibility.

How is AI impacting the ship loader market?

AI is transforming the ship loader market by enabling advanced automation, predictive maintenance, and operational optimization. AI algorithms analyze data from sensors to predict equipment failures, allowing for proactive maintenance. They also optimize loading sequences and material flow, enhancing efficiency, reducing human error, and improving safety through real-time monitoring and autonomous capabilities.

What factors are driving the growth of the ship loader market?

The ship loader market's growth is primarily driven by the expansion of global bulk trade, significant investments in port infrastructure development and modernization, and the increasing demand for automation and digitalization in port operations. The rising size of bulk carriers also necessitates higher capacity and faster loading solutions, further stimulating market demand.

What are the main challenges faced by the ship loader market?

Key challenges in the ship loader market include the high initial capital investment required for modern systems, complexities in integrating new technologies with existing port infrastructure, and volatility in global commodity prices and trade policies. Intense market competition and the need for skilled labor for maintenance of advanced systems also present significant hurdles.