Safety and Security Film Market

Safety and Security Film Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701502 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Safety and Security Film Market Size

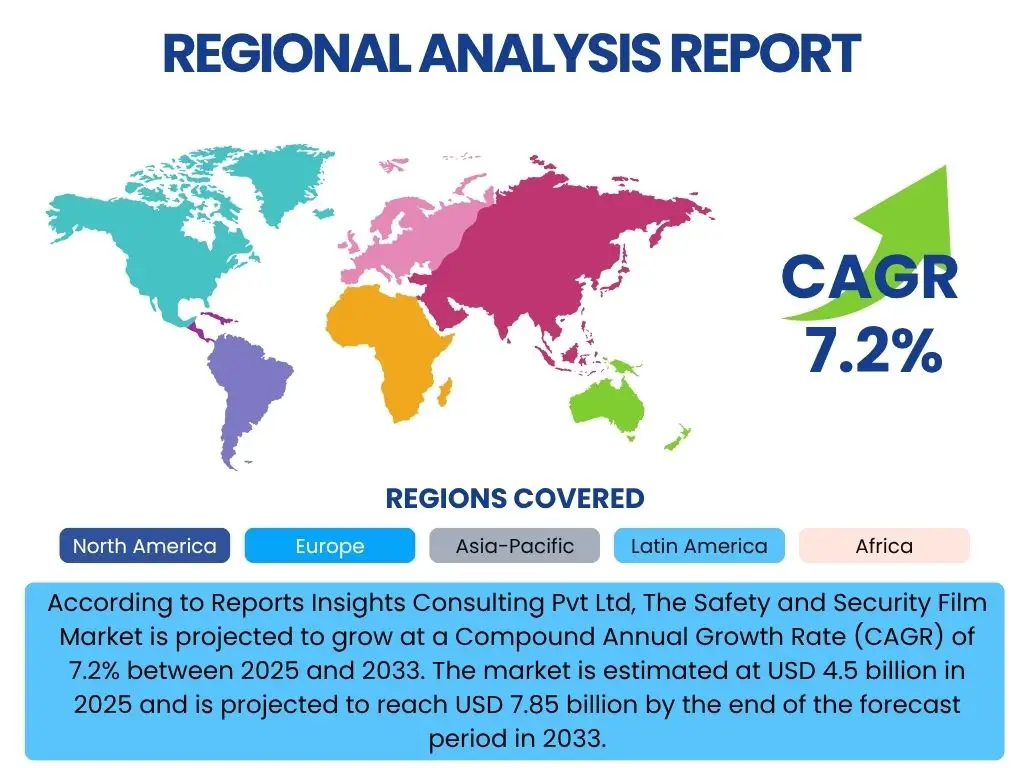

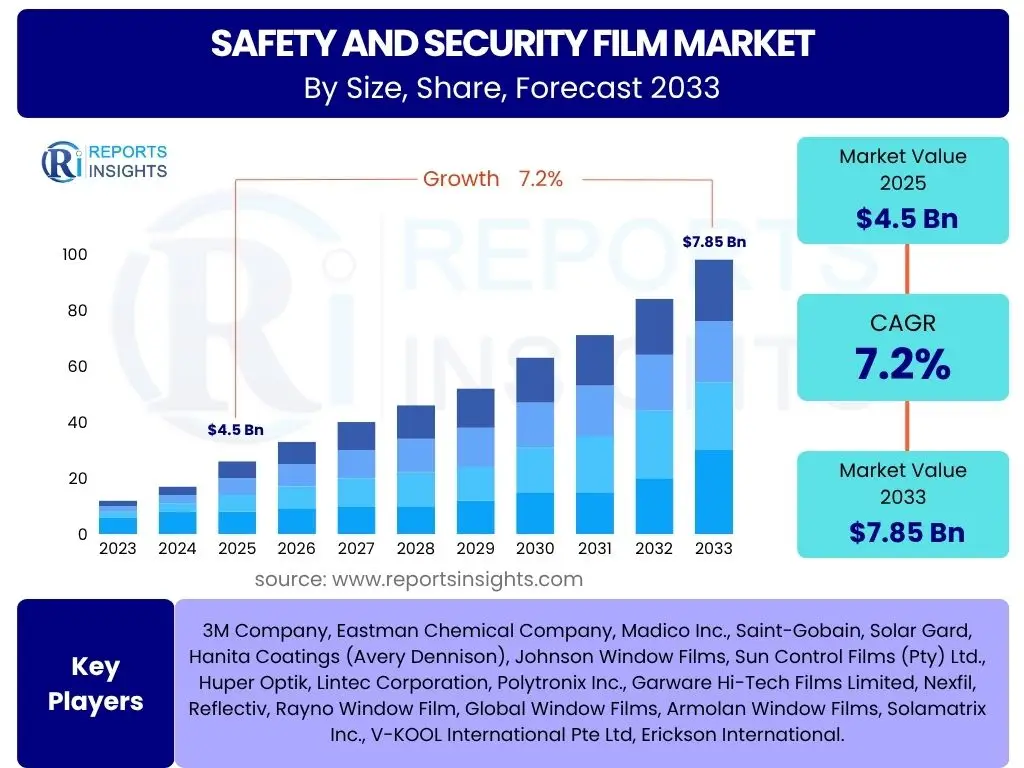

According to Reports Insights Consulting Pvt Ltd, The Safety and Security Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2033. The market is estimated at USD 4.5 billion in 2025 and is projected to reach USD 7.85 billion by the end of the forecast period in 2033.

Key Safety and Security Film Market Trends & Insights

The safety and security film market is experiencing dynamic shifts, driven by escalating global security concerns and a heightened emphasis on building resilience. Users frequently inquire about advancements in film technology, the integration of smart features, and the expanding scope of applications beyond traditional security. A prevalent question revolves around the market's response to growing demand for both protective and energy-efficient solutions, particularly in light of climate change and rising energy costs. Furthermore, there is significant interest in how these films contribute to occupant safety in diverse environments, from residential homes to critical infrastructure, and how regulatory frameworks are influencing their adoption across various regions.

Another area of keen interest among users is the market's trajectory concerning customization and aesthetic appeal. Consumers and commercial entities are increasingly seeking solutions that not only provide robust protection but also seamlessly integrate with architectural designs or enhance the visual appearance of spaces. This includes inquiries about tinted, clear, and decorative options that still offer high levels of security and UV protection. The interplay between durability, longevity, and ease of installation is also a recurring theme, highlighting the demand for high-performance products that offer a strong return on investment and simplify the retrofitting process for existing structures.

- Growing demand for multi-functional films offering both security and energy efficiency.

- Increased adoption in residential sectors due to rising home invasion concerns.

- Technological advancements leading to clearer, stronger, and more durable films.

- Emphasis on blast mitigation and anti-shatter solutions for public and commercial buildings.

- Integration of smart film technologies with building management systems.

- Expansion of applications in automotive and marine industries for enhanced safety.

- Surge in retrofitting projects for older infrastructure to meet modern safety standards.

- Development of sustainable and eco-friendly film manufacturing processes.

AI Impact Analysis on Safety and Security Film

User queries regarding the impact of Artificial Intelligence (AI) on the safety and security film market primarily revolve around how AI can enhance the effectiveness, monitoring, and integration of these protective solutions. Common questions explore AI's role in the manufacturing process for quality control and predictive maintenance, its potential to develop more intelligent film materials, and its application in smart building systems where security films play a role. Users are keen to understand if AI can contribute to real-time threat detection through integrated sensors in films or improve the responsiveness of security measures in conjunction with film deployment, moving beyond passive protection to active deterrence and analysis.

Furthermore, there is curiosity about how AI can optimize the selection and installation of safety and security films for specific environments, considering factors like solar heat gain, UV exposure, and potential threats. This includes inquiries into AI-driven analytics that can assess vulnerability points in structures and recommend optimal film types and thicknesses. While AI may not directly alter the chemical composition of films in a revolutionary way, its influence is profound in creating smarter, more responsive, and more efficiently deployed security ecosystems where films are a critical component, enhancing overall safety protocols through data-driven insights and automated responses.

- AI-driven quality control in film manufacturing processes, reducing defects and improving consistency.

- Predictive analytics for material performance, optimizing film durability and lifespan in varied conditions.

- Integration of AI with smart sensor technology embedded within or alongside films for real-time monitoring of breaches or impacts.

- AI-enhanced threat assessment and vulnerability analysis for buildings, recommending specific film solutions.

- Automated incident response protocols triggered by film-integrated sensors linked to AI security systems.

- Optimization of film application and installation through AI-powered spatial analysis and simulation.

- Development of AI algorithms to analyze environmental data (e.g., solar radiation, temperature) for dynamic film properties.

- Improved supply chain efficiency and inventory management for film manufacturers and distributors via AI.

Key Takeaways Safety and Security Film Market Size & Forecast

Common user questions regarding key takeaways from the Safety and Security Film market size and forecast highlight a strong interest in the overall growth trajectory, the primary drivers of this expansion, and the long-term investment potential of the sector. Users frequently ask about the financial viability and market stability, seeking confirmation of sustained demand in both developed and emerging economies. There is a clear desire to understand which end-use sectors are poised for the most significant growth and what external factors, such as geopolitical events or regulatory changes, are expected to exert the most influence on market dynamics over the forecast period.

Insights also reveal a user focus on the evolving technological landscape and its impact on market share. Questions arise about the competitive intensity, the emergence of new players, and the potential for consolidation within the industry. Understanding the relative contribution of different product types—such as clear versus tinted films—to the overall market revenue is also a frequent point of inquiry. Ultimately, users are seeking a concise summary of the market's health, its resilience to economic fluctuations, and its capacity for innovation to meet diverse security and safety needs globally.

- The market is poised for robust growth, driven by increasing global security threats and regulatory mandates.

- Commercial and residential sectors are projected to remain primary revenue contributors, with significant opportunities in retrofitting.

- Technological innovation, particularly in multi-functional and smart films, will be a key differentiator for market players.

- Emerging economies in Asia Pacific and Latin America are expected to exhibit high growth rates due to rapid urbanization and infrastructure development.

- Awareness campaigns and government initiatives promoting safety standards will accelerate adoption across various applications.

Safety and Security Film Market Drivers Analysis

The safety and security film market is primarily driven by a global increase in security concerns, encompassing everything from property crime and vandalism to more severe threats like terrorism and natural disasters. This heightened awareness compels individuals, businesses, and governments to invest in robust protective measures. Concurrently, evolving building codes and stricter regulatory mandates in many countries are increasingly requiring the use of shatter-resistant and impact-resistant glazing, directly boosting the demand for these specialized films.

Furthermore, the growing construction industry, particularly in emerging economies, contributes significantly to market expansion as new buildings incorporate safety and security films from the outset. There is also a rising recognition of the multifaceted benefits offered by these films, extending beyond security to include UV protection, energy efficiency, and glare reduction. This comprehensive value proposition broadens their appeal and encourages widespread adoption across diverse end-use sectors.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Security Concerns and Threats | +1.5% | Global, particularly North America, Europe, Middle East | Short to Long-term (2025-2033) |

| Stricter Building Codes and Safety Regulations | +1.2% | North America, Europe, Asia Pacific (developed economies) | Mid to Long-term (2027-2033) |

| Growth in Construction and Infrastructure Development | +1.0% | Asia Pacific (China, India), Latin America, MEA | Short to Mid-term (2025-2030) |

| Rising Awareness of Multifunctional Benefits (UV, Energy Savings) | +0.8% | Global, especially environmentally conscious regions | Mid to Long-term (2026-2033) |

Safety and Security Film Market Restraints Analysis

Despite the strong growth drivers, the safety and security film market faces certain restraints that could impede its full potential. A significant challenge is the relatively high initial cost of procurement and professional installation. While the long-term benefits often outweigh the upfront investment, the perceived expense can deter price-sensitive consumers and businesses, particularly small and medium-sized enterprises (SMEs) operating on tight budgets. This cost factor often leads to a preference for cheaper, less effective alternatives or a complete deferral of security upgrades.

Another notable restraint is the lack of widespread awareness and understanding of the benefits and capabilities of modern safety and security films in certain regions or among specific consumer segments. Many potential end-users may not fully grasp the protective advantages, energy savings, or UV protection offered by these films, opting instead for traditional security measures or simply overlooking the need for such advanced solutions. This knowledge gap necessitates significant marketing and educational efforts from industry players to expand market penetration. Additionally, the availability of do-it-yourself (DIY) film options, while seemingly cost-effective, often results in sub-optimal application and performance, leading to customer dissatisfaction and potentially undermining the market's professional image.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Installation Costs and Product Price | -0.8% | Global, particularly price-sensitive emerging markets | Short to Mid-term (2025-2029) |

| Lack of Awareness and Education Among End-users | -0.6% | Developing regions, smaller businesses | Mid-term (2026-2031) |

| Availability of Cheaper, Less Effective Alternatives | -0.4% | Global, especially lower-income demographics | Short-term (2025-2027) |

Safety and Security Film Market Opportunities Analysis

The safety and security film market presents several promising opportunities for growth and innovation. A significant avenue lies in the burgeoning smart building and smart city initiatives worldwide. As cities integrate advanced technologies for enhanced safety and efficiency, there is a growing demand for intelligent film solutions that can communicate with building management systems, offering real-time data on impacts, breaches, or environmental changes. This trend fosters the development of films with embedded sensors or connectivity features, expanding their functional scope beyond passive protection.

Another key opportunity is the vast potential in retrofitting existing commercial and residential buildings, particularly older structures that were constructed before modern safety standards or without consideration for energy efficiency. These buildings represent a substantial untapped market for upgrades that improve both security and environmental performance. Furthermore, the expansion into specialized applications, such as anti-graffiti films, bird strike prevention films, and even privacy films that double as security barriers, opens up new niche markets and revenue streams for manufacturers and installers. The continuous push for sustainable building materials and practices also creates an opportunity for developing eco-friendly film options, appealing to an increasingly environmentally conscious consumer base and contributing to green building certifications.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with Smart Building Technologies and IoT | +1.0% | North America, Europe, developed Asia Pacific | Mid to Long-term (2027-2033) |

| Retrofitting Existing Commercial and Residential Buildings | +0.9% | Global, especially mature markets with older infrastructure | Short to Long-term (2025-2033) |

| Expansion into Niche and Specialized Applications | +0.7% | Global, catering to specific industry needs | Mid-term (2026-2031) |

| Development of Sustainable and Eco-friendly Film Solutions | +0.6% | Europe, North America, environmentally conscious regions | Mid to Long-term (2028-2033) |

Safety and Security Film Market Challenges Impact Analysis

The safety and security film market faces several challenges that require strategic responses from industry participants. One significant hurdle is intense price competition, particularly from generic or lower-quality film manufacturers. This can pressure profit margins for established players, making it difficult to differentiate products solely on price and necessitating a greater emphasis on quality, brand reputation, and added-value services. The market's fragmentation, with numerous regional and smaller players, further exacerbates this competitive environment, making it challenging for larger companies to maintain market dominance.

Another critical challenge is the need for highly skilled labor for proper installation. The effectiveness of safety and security films is heavily dependent on precise, professional application, yet a shortage of adequately trained installers can lead to subpar outcomes, compromising film performance and customer satisfaction. This can also create bottlenecks in project execution, especially for large-scale commercial deployments. Furthermore, fluctuations in raw material prices, particularly for polyester (PET) and adhesives, pose a consistent challenge to manufacturing costs and can impact pricing strategies, potentially affecting market accessibility for some consumers. Ensuring consistent product quality across diverse manufacturing sites and supply chains also remains a perpetual challenge, especially given the technical specifications required for security applications.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Price Competition and Market Fragmentation | -0.7% | Global, particularly in mature and price-sensitive markets | Short to Mid-term (2025-2029) |

| Requirement for Skilled Installation and Labor Shortages | -0.5% | North America, Europe, rapidly growing Asian economies | Mid-term (2026-2031) |

| Fluctuations in Raw Material Prices and Supply Chain Disruptions | -0.4% | Global | Short-term (2025-2027) |

Safety and Security Film Market - Updated Report Scope

This report provides a comprehensive analysis of the global Safety and Security Film Market, offering in-depth insights into market size, growth trends, drivers, restraints, opportunities, and challenges across various segments and key regions. It examines the technological advancements shaping the industry, the impact of emerging trends like AI integration, and the competitive landscape with profiles of major market participants. The scope is designed to assist stakeholders in making informed strategic decisions by delivering a holistic understanding of market dynamics from 2019 through 2033.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.85 Billion |

| Growth Rate | 7.2% |

| Number of Pages | 245 |

| Key Trends | |

| Segments Covered | |

| Key Companies Covered | 3M Company, Eastman Chemical Company, Madico Inc., Saint-Gobain, Solar Gard, Hanita Coatings (Avery Dennison), Johnson Window Films, Sun Control Films (Pty) Ltd., Huper Optik, Lintec Corporation, Polytronix Inc., Garware Hi-Tech Films Limited, Nexfil, Reflectiv, Rayno Window Film, Global Window Films, Armolan Window Films, Solamatrix Inc., V-KOOL International Pte Ltd, Erickson International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Safety and Security Film market is meticulously segmented to provide a granular understanding of its diverse components and evolving demand patterns. This segmentation allows for a detailed analysis of market performance across different product types, technologies, applications, and end-use sectors, revealing specific growth avenues and market saturation points. Understanding these segments is crucial for stakeholders to tailor product offerings, marketing strategies, and regional focus, ensuring alignment with specific market needs and regulatory requirements. The granular breakdown helps identify underserved niches and areas of high potential, enabling targeted investment and strategic development.

The market's segmentation by product type, such as clear/transparent versus tinted films, highlights varying preferences based on aesthetic and functional requirements, while technology segmentation delves into manufacturing processes that dictate performance characteristics. Application and end-use segmentation further illuminate how these films are adopted across diverse environments—from residential homes seeking basic protection to high-security government facilities requiring blast mitigation. This comprehensive segmentation framework is vital for assessing market size, forecasting future trends, and identifying key opportunities and challenges unique to each market sub-segment, providing a clear roadmap for market participants.

- By Product Type:

- Tinted Films

- Clear/Transparent Films

- Reflective Films

- Low-E (Low Emissivity) Films

- Decorative Films

- By Technology:

- Laminated Films

- Coated Films

- Other Technologies

- By Application:

- Residential Buildings

- Commercial Buildings

- Office Buildings

- Retail Establishments

- Healthcare Facilities

- Educational Institutions

- Government Buildings

- Hospitality Sector

- Automotive

- Marine Vessels

- Industrial Facilities

- By End-Use:

- Blast Mitigation

- Crime Prevention

- Personal Safety

- UV Protection

- Energy Savings

- Glare Reduction

- Aesthetics Enhancement

Regional Highlights

- North America: This region holds a significant share of the market, driven by stringent safety regulations, high awareness regarding security threats, and a well-established construction sector. The demand for retrofitting older buildings with advanced security and energy-efficient films is particularly strong. Early adoption of innovative film technologies and smart building solutions also contributes to its market dominance.

- Europe: Europe is another key market, characterized by strict energy efficiency mandates, an aging building infrastructure requiring upgrades, and a proactive approach to public safety and security. Countries like Germany, the UK, and France are leading in adopting multi-functional films that combine security with thermal insulation and UV protection, driven by environmental consciousness and high energy costs.

- Asia Pacific (APAC): This region is projected to exhibit the highest growth rate during the forecast period. Rapid urbanization, significant infrastructure development, and a growing middle class are fueling demand for both residential and commercial safety solutions. Countries such as China, India, and Southeast Asian nations are investing heavily in new construction, and increasing disposable incomes are making advanced security solutions more accessible to a wider population.

- Latin America: The market in Latin America is witnessing steady growth, largely due to increasing security concerns and a burgeoning construction industry in countries like Brazil and Mexico. While initial cost remains a consideration, the long-term benefits of enhanced safety and energy efficiency are gradually gaining traction among consumers and businesses.

- Middle East and Africa (MEA): The MEA region is experiencing substantial growth, particularly in the Middle East, driven by significant government spending on infrastructure, large-scale commercial projects, and a heightened focus on security in critical facilities. African markets, while nascent, show promising growth potential as urbanization and industrialization accelerate, leading to increased demand for protective solutions in both public and private sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Safety and Security Film Market.- 3M Company

- Eastman Chemical Company

- Madico Inc.

- Saint-Gobain

- Solar Gard

- Hanita Coatings (Avery Dennison)

- Johnson Window Films

- Sun Control Films (Pty) Ltd.

- Huper Optik

- Lintec Corporation

- Polytronix Inc.

- Garware Hi-Tech Films Limited

- Nexfil

- Reflectiv

- Rayno Window Film

- Global Window Films

- Armolan Window Films

- Solamatrix Inc.

- V-KOOL International Pte Ltd

- Erickson International

Frequently Asked Questions

Analyze common user questions about the Safety and Security Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are safety and security films?

Safety and security films are multi-layered polyester films applied to glass surfaces to hold shattered glass together upon impact, preventing dangerous shards from flying and deterring forced entry. They enhance glass strength, mitigate blast effects, and offer protection from natural disasters, vandalism, and accidents, while often providing additional benefits like UV protection and energy efficiency.

How do safety and security films work to enhance protection?

These films work by bonding strongly to the glass surface using specialized adhesives. When the glass breaks due to impact, pressure, or blast, the film holds the fragments securely in place, preventing them from scattering inward or outward. This maintains the integrity of the window opening for a longer period, slowing down intruders, containing dangerous debris, and protecting occupants from injury.

What are the primary benefits of installing security films in homes or businesses?

The primary benefits include enhanced protection against break-ins, reduced risk of injury from shattered glass, mitigation of blast effects, improved privacy, and significant UV protection that prevents fading of interiors. Many films also offer energy savings by reducing heat gain and loss, leading to lower utility bills and increased occupant comfort.

Are safety and security films visible, and do they affect the aesthetics of windows?

Safety and security films are available in various opacities, from optically clear films that are virtually invisible and maintain natural light transmission, to tinted, reflective, or decorative options that can enhance privacy or add aesthetic appeal. The choice depends on specific needs, ensuring that functional requirements are met without compromising the visual appearance of the property.

How durable are security films, and what is their typical lifespan?

Modern safety and security films are highly durable and designed for long-term performance, typically lasting 10 to 15 years or more, depending on the film type, quality of installation, and environmental exposure. They are engineered to resist scratching, peeling, and bubbling, and are backed by manufacturers' warranties, ensuring sustained protection and clarity over their lifespan.