Saa based Supply Chain Management Software Market

Saa based Supply Chain Management Software Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701592 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Saa based Supply Chain Management Software Market Size

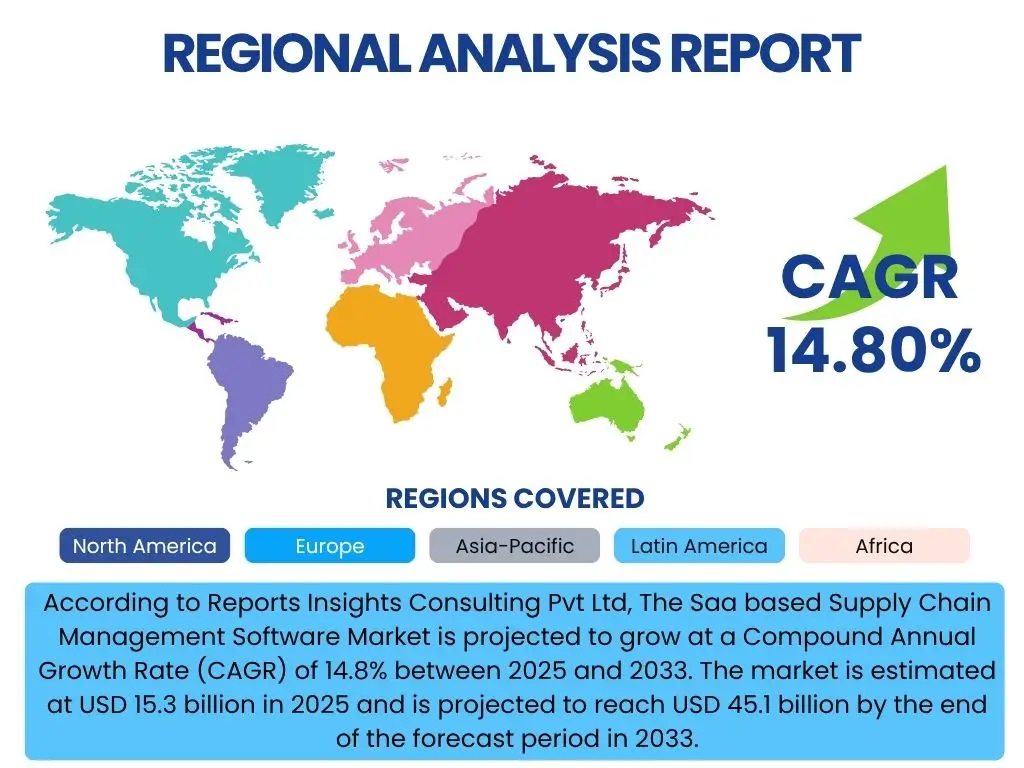

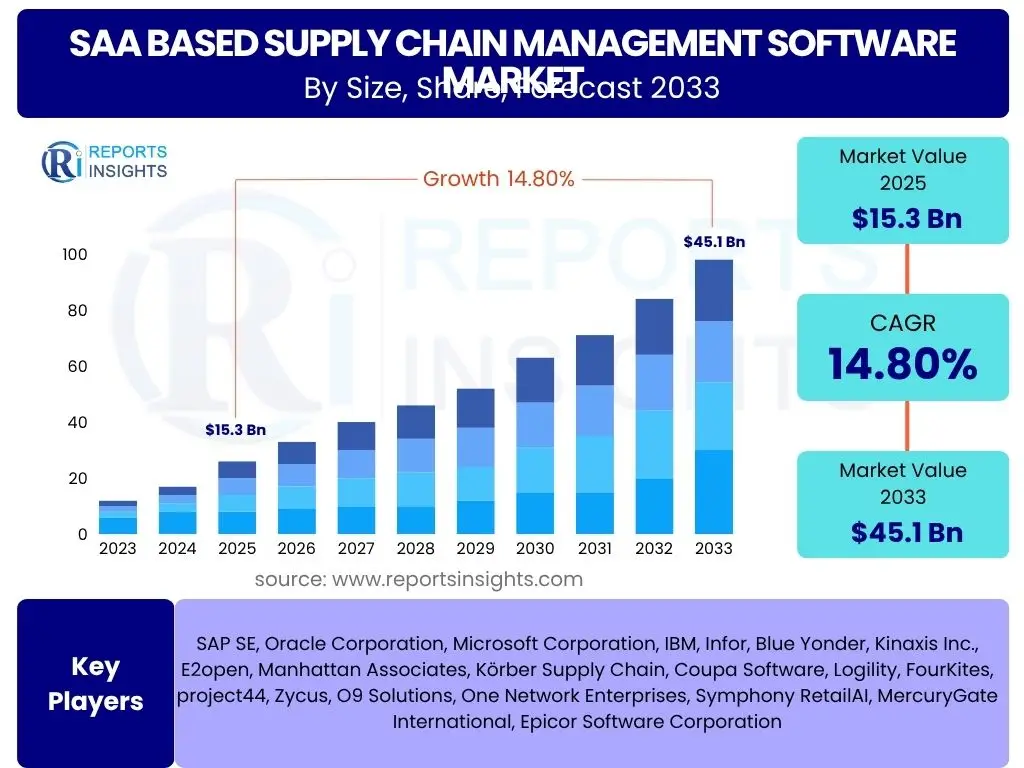

According to Reports Insights Consulting Pvt Ltd, The Saa based Supply Chain Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2025 and 2033. The market is estimated at USD 15.3 billion in 2025 and is projected to reach USD 45.1 billion by the end of the forecast period in 2033.

Key Saa based Supply Chain Management Software Market Trends & Insights

The SaaS-based Supply Chain Management (SCM) market is currently undergoing a transformative phase, driven by the increasing need for agile, transparent, and resilient supply chains in an ever-more complex global economic landscape. Users are keenly interested in understanding how cloud-based solutions are evolving to meet complex global demands, including the provision of real-time visibility across all supply chain nodes, from sourcing to last-mile delivery, and the integration of advanced predictive capabilities to anticipate disruptions. There is significant inquiry into the accelerated adoption rates of cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) within SCM platforms, alongside a growing focus on sustainable and ethical supply chain practices, driven by consumer demand and regulatory pressures. Companies are increasingly seeking comprehensive solutions that not only optimize operational efficiency but also provide distinct competitive advantages through enhanced data analytics, seamless collaboration features, and the ability to adapt swiftly to unforeseen circumstances.

The profound shift towards remote work models and globally distributed operations has further amplified the demand for highly accessible, cloud-native SCM solutions that facilitate seamless collaboration and data sharing across disparate geographies and organizational silos. Enterprises are prioritizing platforms that offer unparalleled scalability and flexibility, allowing them to rapidly adjust to volatile market fluctuations, geopolitical tensions, and emergent supply chain disruptions. Furthermore, the burgeoning integration of Internet of Things (IoT) devices for granular tracking and monitoring, alongside blockchain technology for immutable transaction records, into SaaS SCM platforms represents a major point of interest for users, as these technologies promise unprecedented levels of data accuracy, traceability, and enhanced security. The market is also witnessing a significant trend towards the development of highly configurable and industry-specific SaaS SCM solutions, meticulously designed to address the unique operational challenges, regulatory requirements, and competitive dynamics of various vertical sectors, ranging from retail and manufacturing to healthcare and logistics.

- Increased adoption of cloud-native SCM solutions for enhanced agility, scalability, and accessibility.

- Rising demand for real-time visibility, end-to-end traceability, and predictive analytics across the entire supply chain.

- Growing emphasis on sustainability, circular economy principles, and ethical sourcing within SCM operations.

- Deep integration of advanced technologies such as AI, ML, IoT, and blockchain for intelligent automation and data-driven insights.

- Shift towards highly configurable, modular, and industry-specific SaaS SCM offerings tailored to unique sector needs.

- Focus on supply chain resilience and risk management capabilities to mitigate global disruptions.

AI Impact Analysis on Saa based Supply Chain Management Software

User inquiries concerning the profound impact of Artificial Intelligence (AI) on SaaS-based Supply Chain Management reveal a strong and accelerating interest in its transformative potential to revolutionize traditional SCM processes. Users are keenly focused on understanding precisely how AI algorithms and machine learning models can significantly enhance forecasting accuracy, automate a wide array of routine and complex SCM tasks, and provide deeper, actionable insights from vast and disparate data sets that are otherwise impossible for human analysis. Key themes of inquiry consistently revolve around the practical application of AI in critical areas such as granular demand planning, dynamic inventory optimization, intelligent route optimization for logistics, and proactive risk management across the entire supply chain lifecycle. There is a palpable and shared expectation that AI will be the pivotal enabler for developing more resilient, efficient, and cost-effective supply chains, fundamentally shifting decision-making from reactive problem-solving to proactive, predictive strategic planning.

Despite the pervasive optimism surrounding AI's capabilities, users also frequently express concerns regarding the foundational aspects of data quality and integrity, the potential for algorithmic bias in decision-making, and the inherent expertise required to successfully implement, manage, and continuously optimize AI-driven SCM solutions. The critical ability of AI-powered systems to integrate seamlessly with existing legacy systems, a common pain point for many enterprises, and the absolute necessity for robust cybersecurity measures to protect sensitive supply chain data from sophisticated threats, are frequently questioned and remain top-of-mind. Furthermore, users are increasingly keen to understand the quantifiable return on investment (ROI) derived from AI deployments and how these advanced AI-powered tools can actively support broader sustainability initiatives by optimizing resource utilization, minimizing waste, and reducing the overall carbon footprint across the entire supply chain network. The overarching sentiment indicates that AI is unequivocally a critical and indispensable enabler for the next generation of intelligent SCM, provided its associated challenges, particularly data governance and integration, are comprehensively addressed and effectively mitigated.

- Significant enhancement of demand forecasting accuracy through advanced machine learning algorithms, reducing stockouts and overstock.

- Intelligent automation of repetitive and complex tasks in inventory management, order fulfillment, and supplier interactions.

- Dynamic optimization of logistics and transportation routes, leading to substantial cost reductions and improved delivery times.

- Proactive identification and mitigation of supply chain risks by analyzing vast datasets for potential disruptions and vulnerabilities.

- Creation of autonomous decision-making processes in areas like procurement and warehouse operations, increasing efficiency.

- Better resource utilization and waste reduction across the supply chain, supporting sustainability goals.

Key Takeaways Saa based Supply Chain Management Software Market Size & Forecast

Analysis of common user questions regarding the SaaS-based Supply Chain Management market size and forecast consistently highlights a widespread consensus on the significant and sustained growth trajectory, along with a keen interest in understanding the underlying drivers propelling this expansion. Users are primarily driven by the imperative to comprehend the core reasons for the accelerated adoption of SaaS SCM, such as the increasing complexity and volatility of global supply chains, the pervasive imperative for rapid digital transformation across all business functions, and the urgent need for greater resilience and agility in the face of escalating global disruptions. The projected substantial growth, reflected in the compelling CAGR and market value estimations, indicates a strong and unwavering market confidence in cloud-based solutions to comprehensively address contemporary supply chain challenges, signaling a definitive shift away from traditional on-premise, monolithic systems towards flexible and adaptable cloud architectures.

The collective insights derived from user queries underscore that businesses across a diverse spectrum of sectors are increasingly recognizing the profound long-term value and strategic imperative of investing in flexible, highly scalable, and inherently data-driven SCM platforms. Key takeaways from this market analysis include the growing and critical emphasis on real-time data analytics for actionable insights, the strategic integration of advanced technologies like AI and IoT for enhanced predictive capabilities and automation, and the recognition of supply chain visibility as a fundamental competitive differentiator in today's dynamic market environment. The market forecast robustly underscores a definitive and accelerating shift towards a more integrated, intelligent, and autonomous supply chain ecosystem, where SaaS solutions serve not merely as supporting tools but as the foundational backbone for achieving superior operational efficiency, strategic decision-making, and unparalleled responsiveness to market demands. This paradigm shift positions SaaS SCM as a central pillar for future enterprise success and innovation.

- Robust and consistent market expansion driven by global digital transformation initiatives and the increasing complexity of supply networks.

- Significant and sustained investment in cloud-based SCM solutions for enhancing operational agility, resilience, and adaptability.

- A strategic pivot towards leveraging real-time data analytics and predictive capabilities to optimize supply chain performance.

- Increasing enterprise-wide recognition of SaaS SCM as a critical competitive differentiator and a core component for business continuity.

- Steady and broadening adoption across diverse industries, all seeking to achieve operational excellence, cost optimization, and improved responsiveness.

- The clear trend towards intelligent and interconnected supply chain ecosystems powered by cloud infrastructure.

Saa based Supply Chain Management Software Market Drivers Analysis

The robust expansion of the SaaS-based Supply Chain Management market is fundamentally driven by the escalating complexity and inherent volatility of global supply chains, coupled with the pervasive need for ubiquitous real-time visibility and stringent control. As businesses increasingly operate across fragmented, international networks characterized by multiple suppliers, diverse logistical partners, and stringent regulatory requirements, the demand for integrated, universally accessible, and infinitely scalable SCM solutions becomes paramount. The intrinsic flexibility, lower total cost of ownership (TCO), and reduced upfront investment associated with SaaS models enable businesses of all sizes, particularly the vast ecosystem of small and medium-sized enterprises (SMEs) that traditionally lacked resources, to adopt sophisticated supply chain technologies that were previously only accessible to large, resource-rich corporations. This democratization of advanced SCM tools is a significant and accelerating catalyst for market growth, fostering broader adoption across a myriad of industry verticals and geographical regions.

Furthermore, the unprecedented and sustained growth of e-commerce and the strategic imperative of omnichannel retail have necessitated highly responsive, efficient, and customer-centric supply chain operations, directly fueling the exponential demand for SaaS SCM solutions. Modern consumers expect faster deliveries, greater transparency regarding order status, and personalized experiences, which collectively push businesses to continuously optimize their logistics, inventory management, and intricate order fulfillment processes. SaaS platforms, with their inherent ability to quickly and seamlessly integrate with other enterprise systems (such as ERP and CRM) and their capacity to provide real-time, actionable data, are ideally positioned to meet these dynamic and ever-evolving market requirements. The ongoing, widespread push for digital transformation across virtually all industries, fundamentally aimed at improving operational efficiency, significantly reducing costs, enhancing decision-making capabilities, and fostering innovation, serves as a pervasive and underlying driver for the rapid adoption of cloud-based SCM software, making it an indispensable component of modern business strategy.

In addition to these core drivers, the increasing frequency and severity of global disruptions—ranging from pandemics and geopolitical conflicts to natural disasters and economic downturns—have underscored the critical need for resilient and agile supply chains. Businesses are now prioritizing solutions that offer advanced risk management, scenario planning, and the ability to quickly pivot operations. SaaS SCM platforms are uniquely suited to address these demands by providing cloud-based collaboration tools, real-time data dashboards for rapid response, and AI-powered analytics to predict and mitigate future shocks. Moreover, the growing focus on sustainability and corporate social responsibility (CSR) initiatives is driving demand for SCM solutions that can track environmental impact, ensure ethical sourcing, and optimize resource usage, thereby encouraging the adoption of SaaS platforms equipped with such capabilities.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Complexity and Volatility of Global Supply Chains | +3.2% | Global, particularly North America, Europe, APAC's export-oriented economies | Short to Medium Term (2025-2029) |

| Growing Demand for Real-time Visibility and Data-Driven Decision Making | +2.8% | Global, especially highly competitive and data-intensive markets | Short to Medium Term (2025-2030) |

| Rapid Expansion of E-commerce and Omnichannel Retail Strategies | +2.5% | North America, Europe, APAC (China, India, Southeast Asia) | Short to Medium Term (2025-2029) |

| Pervasive Digital Transformation Initiatives Across Diverse Industries | +2.3% | Global, all developed and emerging economies embracing Industry 4.0 | Medium to Long Term (2026-2033) |

| Lower Total Cost of Ownership (TCO) and Greater Accessibility for SMEs | +1.9% | SMEs globally, emerging markets in Latin America, MEA | Short to Medium Term (2025-2030) |

| Enhanced Need for Supply Chain Resilience and Risk Management | +1.7% | Global, particularly industries vulnerable to geopolitical or environmental shocks | Short to Long Term (2025-2033) |

Saa based Supply Chain Management Software Market Restraints Analysis

Despite the compelling advantages and growing momentum of SaaS-based SCM, several significant restraints continue to impede its unhindered growth and full market penetration. A paramount concern for numerous organizations, particularly those handling highly sensitive data, operating in industries with stringent regulatory compliance requirements (e.g., healthcare, finance), or managing intellectual property, is the inherent challenge of data security and privacy in cloud environments. The reliance on third-party cloud infrastructure raises legitimate questions about data ownership, compliance with diverse and evolving regional data protection laws (e.g., GDPR in Europe, CCPA in California, HIPAA in healthcare), and the ever-present potential for sophisticated cyber breaches. This pervasive apprehension can lead to considerable hesitation and reluctance in migrating critical supply chain data and core operations to a cloud environment, especially for companies with deeply ingrained internal security policies or those that have previously experienced damaging cyber incidents.

Another notable and persistent restraint is the significant complexity involved in seamlessly integrating SaaS SCM solutions with a diverse array of existing legacy systems, such as Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Warehouse Management Systems (WMS), and various homegrown applications. Many established businesses operate with deeply entrenched, on-premise software infrastructures that have been customized over decades, and the transition to a cloud-based SCM platform necessitates substantial investment in complex integration efforts, potential challenges with large-scale data migration, and comprehensive employee training. The perceived risk of vendor lock-in, where businesses become heavily reliant on a single SaaS provider's ecosystem, also acts as a deterrent, as it can limit future flexibility, stifle innovation from alternative providers, and potentially lead to higher long-term costs if switching providers becomes necessary due to evolving business needs or dissatisfaction with services.

Furthermore, the requirement for robust, consistent, and high-speed internet connectivity and adequate IT infrastructure across all operational locations within a global supply chain can be a significant limiting factor, particularly in developing regions or remote areas where reliable internet access may not be universally available or stable. This connectivity dependency can undermine the real-time capabilities and collaborative benefits central to SaaS SCM. Additionally, while SaaS models offer flexibility, some enterprises, especially those with highly unique or niche supply chain processes, find that the standardized nature of many SaaS offerings may not provide the deep customization levels required to perfectly match their specific operational workflows. Achieving such bespoke configurations often involves additional development costs or compromises, which can negate some of the cost-efficiency benefits associated with SaaS adoption, posing a challenge for highly specialized industries seeking tailor-made solutions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Lingering Data Security and Privacy Concerns in Cloud Environments | -1.5% | Global, particularly Europe (GDPR), North America (CCPA), and highly regulated industries | Short to Medium Term (2025-2030) |

| Complexity and Cost of Integration with Diverse Legacy IT Systems | -1.2% | Established businesses globally, especially large enterprises with entrenched infrastructure | Medium Term (2026-2032) |

| Risk of Vendor Lock-in and Limitations on Deep Customization | -0.8% | Global, affecting businesses seeking high specificity or long-term flexibility | Medium to Long Term (2027-2033) |

| Dependence on Robust Internet Connectivity and Infrastructure | -0.5% | Emerging markets in Asia Pacific, Latin America, MEA, and remote operational sites | Short to Medium Term (2025-2030) |

| Resistance to Change and Cultural Inertia within Organizations | -0.4% | Global, across organizations with rigid structures or traditional mindsets | Short to Medium Term (2025-2028) |

Saa based Supply Chain Management Software Market Opportunities Analysis

The SaaS-based Supply Chain Management market is currently replete with substantial opportunities, primarily driven by the increasing and innovative integration of emerging technologies and the strategic expansion into previously underserved markets. The rapid proliferation of Internet of Things (IoT) devices across every conceivable node of the supply chain, from intelligent warehouses and automated factories to connected vehicles and smart inventory sensors, presents a significant and transformative opportunity for SaaS SCM providers. By leveraging the immense volumes of real-time data generated by IoT devices, these platforms can offer unprecedented capabilities in real-time tracking, predictive maintenance for assets, and highly optimized inventory management. This moves beyond traditional data silos, enabling the creation of truly intelligent, responsive, and self-optimizing supply chains. Similarly, the growing adoption and maturation of blockchain technology offer a compelling opportunity for vastly improved supply chain transparency, enhanced traceability of goods from origin to consumption, and bolstered security against fraud and tampering, particularly critical for verifying product provenance and combating counterfeit goods across various industries.

Moreover, the intensifying global focus on sustainability, ethical sourcing, and corporate social responsibility (CSR) across virtually all industries is creating new and rapidly expanding avenues for specialized SaaS SCM solutions. Companies are actively seeking sophisticated tools to track and reduce their environmental impact (e.g., carbon footprint), ensure stringent labor compliance throughout their supplier networks, and manage resource consumption more efficiently across their entire supply chain. This burgeoning demand for 'green' SCM and ethical supply chain management not only represents a significant niche but also a rapidly expanding market segment that aligns with global environmental and social governance (ESG) objectives. Furthermore, the substantial untapped potential residing in small and medium-sized enterprises (SMEs) and the burgeoning economies of emerging regions offers a lucrative and scalable opportunity for market penetration. As these businesses increasingly recognize the undeniable need for digital transformation to remain competitive, and with SaaS models inherently offering lower entry barriers compared to traditional software, providers can tailor scalable, cost-effective, and user-friendly solutions to capture this expanding and dynamic customer base.

Beyond technological and market segment expansion, the continuous and escalating demand for robust supply chain resilience in the wake of escalating global disruptions, such as pandemics, geopolitical instabilities, and climate change impacts, creates an enduring opportunity for SaaS SCM solutions. Providers can differentiate themselves by offering advanced risk management modules, sophisticated scenario planning capabilities, and rapid response mechanisms that empower businesses to proactively mitigate and adapt to unforeseen shocks. The trend towards hyper-personalization and customized last-mile delivery, especially within the e-commerce sector, also presents an opportunity for SaaS SCM platforms to offer highly flexible and configurable logistics and order fulfillment modules that can cater to diverse customer expectations. Finally, the growing integration of AI and Machine Learning (ML) beyond basic analytics, moving towards autonomous decision-making in procurement, inventory, and logistics, opens significant avenues for innovation and market leadership for providers capable of delivering true intelligent automation within their SaaS SCM offerings.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Deep Integration with IoT for Advanced Real-time Visibility and Automation | +2.0% | Global, particularly manufacturing, logistics, retail, and asset-intensive industries | Medium to Long Term (2026-2033) |

| Wider Adoption of Blockchain for Enhanced Supply Chain Transparency and Traceability | +1.8% | Global, especially food & beverage, pharmaceuticals, luxury goods, and automotive sectors | Medium to Long Term (2027-2033) |

| Increasing Demand for Sustainable and Ethical Supply Chain Solutions (ESG) | +1.6% | Europe, North America, and environmentally conscious industries globally | Short to Medium Term (2025-2030) |

| Strategic Expansion into Underserved SME and Emerging Markets | +1.5% | Asia Pacific, Latin America, Africa, and nascent economies undergoing digital transformation | Short to Medium Term (2025-2030) |

| Leveraging AI/ML for Advanced Predictive Analytics and Autonomous Optimization | +1.3% | Global, across all industries seeking significant efficiency gains and proactive decision-making | Short to Medium Term (2025-2031) |

| Development of Hyper-personalized and Last-mile Delivery Optimization Modules | +1.1% | Global, especially e-commerce, retail, and consumer goods sectors | Short to Medium Term (2025-2029) |

Saa based Supply Chain Management Software Market Challenges Impact Analysis

The SaaS-based Supply Chain Management market, despite its strong growth trajectory, faces several significant challenges that can impede its full potential and widespread, seamless adoption across diverse enterprises. One key and pervasive challenge is the inherent complexity of data integration and ensuring true interoperability across disparate systems within an organization's existing IT ecosystem. Many companies, particularly large and established enterprises, utilize a patchwork of legacy on-premise systems alongside newer cloud solutions, creating a fragmented landscape. Achieving seamless, real-time data flow and a unified, single source of truth for the entire supply chain becomes an arduous undertaking. This can lead to persistent data silos, inconsistencies, and inaccuracies, ultimately undermining the promise of end-to-end visibility and collaborative efficiency that SaaS SCM aims to provide. Such integration efforts often require extensive customization, complex API development, and specialized professional services, which significantly add to the total cost and extend the implementation timeline, making the transition more daunting for potential adopters.

Another prominent and growing challenge is the escalating talent gap and the critical need for skilled professionals who possess the dual expertise required to effectively implement, manage, and continuously optimize these increasingly advanced SaaS SCM platforms. As these solutions become more sophisticated, incorporating cutting-edge technologies like Artificial Intelligence, Machine Learning, and blockchain, there is a burgeoning demand for individuals possessing not only deep supply chain domain expertise but also strong technical proficiency in cloud environments, data analytics, and platform configuration. This scarcity of qualified talent can considerably slow down adoption rates, impair the successful realization of anticipated benefits from these technologies, and increase operational costs due as companies compete for limited skilled resources. Furthermore, the dynamic nature of global supply chains means that businesses must continuously adapt to new threats and opportunities, requiring an agile mindset and the ability to leverage flexible SaaS solutions, which can be a cultural hurdle for traditionally rigid organizations.

Finally, ensuring robust cybersecurity measures and maintaining continuous compliance with an ever-evolving and increasingly complex landscape of regional and international data regulations (such as GDPR, CCPA, HIPAA, and various industry-specific mandates like those in pharmaceuticals or aerospace) remains a constant and significant challenge for both SaaS SCM providers and their end-user organizations. Protecting sensitive supply chain data—including proprietary information, customer details, and logistical movements—from sophisticated cyber threats like ransomware, phishing, and data breaches requires continuous investment in advanced security protocols, regular audits, and proactive threat intelligence. Any security lapse can lead to severe financial penalties, reputational damage, and disruption of operations. Moreover, managing the legal and operational complexities of cross-border data flows and ensuring adherence to diverse national data sovereignty laws adds another layer of complexity, demanding constant vigilance and adaptability from both software vendors and their clients to maintain legal adherence and customer trust in a globally interconnected supply chain environment.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complexity of Data Integration and Interoperability with Legacy Systems | -1.0% | Global, particularly large, established enterprises with diverse IT landscapes | Medium Term (2026-2031) |

| Talent Shortage in Supply Chain Domain and Cloud Technology Expertise | -0.8% | North America, Europe, rapidly digitizing regions with high demand for skilled professionals | Short to Medium Term (2025-2030) |

| Ensuring Robust Cybersecurity and Navigating Evolving Data Compliance Regulations | -0.7% | Global, across all industries handling sensitive data and operating across borders | Continuous (2025-2033) |

| Managing Customization Needs versus Standardized SaaS Offerings | -0.5% | Global, highly specialized industries or enterprises with unique operational workflows | Medium Term (2026-2032) |

| Mitigating Supply Chain Disruptions and Geopolitical Volatility | -0.4% | Global, particularly for businesses with complex international supply chains | Continuous (2025-2033) |

Saa based Supply Chain Management Software Market - Updated Report Scope

This comprehensive market research report provides an in-depth and granular analysis of the global SaaS-based Supply Chain Management Software market, offering critical insights into its current status, historical performance from 2019 to 2023, and projected future growth trajectory up to 2033. The report meticulously examines key market attributes including market size, prevailing trends, driving forces, constraining factors, emerging opportunities, and inherent challenges across various segments and pivotal geographical regions. It aims to equip all stakeholders, including technology providers, investors, and end-users, with a profound understanding of the complex market dynamics, the competitive landscape, and actionable strategic recommendations to navigate and capitalize on the evolving industry paradigm, fostering informed decision-making and sustainable growth.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.3 billion |

| Market Forecast in 2033 | USD 45.1 billion |

| Growth Rate | 14.8% CAGR |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Oracle Corporation, Microsoft Corporation, IBM, Infor, Blue Yonder, Kinaxis Inc., E2open, Manhattan Associates, Körber Supply Chain, Coupa Software, Logility, FourKites, project44, Zycus, O9 Solutions, One Network Enterprises, Symphony RetailAI, MercuryGate International, Epicor Software Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The SaaS-based Supply Chain Management Software market is meticulously segmented to provide a granular and comprehensive view of its remarkably diverse and rapidly evolving landscape, enabling a precise understanding of market dynamics across various dimensions. This detailed segmentation facilitates a precise analysis of specific growth drivers, emerging trends, and lucrative opportunities within distinct niches, highlighting where particular functionalities, deployment models, or industry-specific requirements are gaining significant traction. Such a granular perspective is absolutely crucial for all stakeholders, including technology providers, investors, and end-users, to accurately identify specific target markets, develop highly tailored and compelling solutions, and formulate exceptionally effective market penetration and expansion strategies that resonate with discrete customer needs.

The market is primarily categorized by component, which precisely distinguishes between the various software solutions that constitute the core of SCM functionalities (e.g., procurement, inventory, logistics) and the essential professional services (e.g., consulting, implementation, support) that facilitate their successful adoption and ongoing operational efficiency. Furthermore, it is comprehensively segmented by deployment model, reflecting the evolving preferences for different types of cloud infrastructure, whether public, private, or hybrid, each offering distinct advantages in terms of cost, security, and control. Segmentation by organization size provides crucial insights into the adoption patterns and specific needs of businesses across different scales, from agile small and medium-sized enterprises (SMEs) to large, complex multinational corporations. This helps in understanding the scalability requirements and budget considerations for different client types.

The segmentation by industry vertical is particularly insightful, as it reveals the unique operational demands, regulatory landscapes, and specialized applications of SaaS SCM across a broad spectrum of diverse sectors, including but not limited to retail & e-commerce, manufacturing, healthcare, automotive, and logistics. Each industry presents distinct challenges and opportunities that influence the adoption and customization of SCM solutions. Finally, the functional segmentation, which focuses on core SCM processes such as procurement & sourcing, inventory & warehouse management, and supply chain planning & forecasting, helps to pinpoint areas of strongest innovation, highest demand, and greatest competitive intensity. Collectively, these detailed segmentations provide a holistic, multi-dimensional perspective on the market's intricate structure, illuminating key growth areas and informing strategic planning for market participants.

- By Component:

- Software (Solutions for Procurement, Inventory Management, Order Management, Warehouse Management, Transportation Management, Supplier Relationship Management, Demand Planning, Others)

- Services (Consulting, Implementation, Support & Maintenance)

- By Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

- By Organization Size:

- Small & Medium Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Retail & E-commerce

- Manufacturing (Discrete, Process)

- Healthcare & Pharmaceuticals

- Automotive

- Food & Beverages

- Logistics & Transportation

- Consumer Goods

- Others (Energy & Utilities, IT & Telecom)

- By Function:

- Procurement & Sourcing

- Inventory & Warehouse Management

- Order Fulfillment & Logistics

- Supply Chain Planning & Forecasting

- Supplier Relationship Management

Regional Highlights

- North America: North America stands as the dominant force in the SaaS-based Supply Chain Management software market, characterized by its pioneering adoption of advanced cloud technologies and substantial ongoing investments in comprehensive digital transformation initiatives across industries. The region benefits immensely from a highly developed IT infrastructure, a robust ecosystem of leading technology providers, and a pervasive strategic emphasis on enhancing supply chain resilience, transparency, and operational optimization. Both the United States and Canada are at the forefront of this adoption, driven by complex consumer demands and the imperative for competitive advantage in a mature market.

- Europe: The European market for SaaS SCM exhibits substantial and consistent growth, largely propelled by increasingly stringent regulatory frameworks that promote greater supply chain transparency, sustainability, and ethical practices, such as the EU's due diligence regulations. This is coupled with a strong and diverse manufacturing base, a dynamic retail sector, and sophisticated logistics networks. Countries like Germany, the United Kingdom, and France are leading the regional adoption, focusing intensely on integrating advanced analytics, artificial intelligence, and automation into their SCM processes to not only enhance operational efficiency but also ensure rigorous compliance with evolving environmental and social governance (ESG) standards.

- Asia Pacific (APAC): Positioned as the fastest-growing region in the SaaS SCM market, APAC's expansion is fundamentally propelled by rapid industrialization, the burgeoning and highly dynamic e-commerce markets, and aggressive digital transformation initiatives across both established and emerging economies. Key contributors include economic powerhouses like China and India, alongside the rapidly developing nations of Southeast Asia. The region's expanding manufacturing base, coupled with its immense and increasingly complex logistics networks, is creating an immense and sustained demand for scalable, cost-effective, and adaptable SaaS SCM solutions to manage growth and enhance global competitiveness.

- Latin America: Latin America demonstrates a significant and emerging growth trajectory, as businesses across the region increasingly recognize the tangible benefits of cloud-based solutions for overcoming persistent logistical challenges, improving operational efficiencies, and enhancing connectivity within fragmented markets. While still in a developing phase compared to more mature markets, countries like Brazil, Mexico, and Argentina are witnessing rising adoption rates. This is primarily driven by various regional trade agreements, a growing imperative for modernizing outdated supply chain infrastructure, and the necessity to adapt to evolving consumer behaviors and global trade dynamics.

- Middle East and Africa (MEA): The Middle East and Africa region shows promising long-term potential for SaaS SCM market expansion, underpinned by significant government investments aimed at diversifying economies beyond traditional resource industries and developing ambitious smart city initiatives. The adoption of SaaS SCM is gradually increasing, particularly in the Gulf Cooperation Council (GCC) countries and South Africa, as organizations across various sectors seek to streamline their complex supply chains, enhance visibility, and improve their overall competitiveness in an increasingly globalized and interconnected economy. The focus on developing logistics hubs and diversifying industrial capabilities further fuels this growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Saa based Supply Chain Management Software Market.- SAP SE

- Oracle Corporation

- Microsoft Corporation

- IBM

- Infor

- Blue Yonder (formerly JDA Software)

- Kinaxis Inc.

- E2open

- Manhattan Associates

- Körber Supply Chain (HighJump)

- Coupa Software

- Logility

- FourKites

- project44

- Zycus

- O9 Solutions

- One Network Enterprises

- Symphony RetailAI

- MercuryGate International

- Epicor Software Corporation

Frequently Asked Questions

What is SaaS-based Supply Chain Management (SCM) software?

SaaS-based SCM software refers to cloud-hosted applications that manage and optimize the entire spectrum of supply chain operations, encompassing critical functions such as procurement, inventory management, logistics, order fulfillment, and demand planning. This software is delivered as a service over the internet on a subscription model, offering unparalleled scalability, global accessibility, and significantly reducing the need for extensive on-premise infrastructure setup and ongoing maintenance by the end-user organization.

How does SaaS SCM enhance supply chain resilience in the face of disruptions?

SaaS SCM significantly enhances supply chain resilience by providing real-time, end-to-end visibility into all operational facets, enabling organizations to proactively identify potential risks and vulnerabilities across the network. It facilitates dynamic inventory optimization to prevent stockouts or overstock, and empowers rapid, agile responses to unforeseen disruptions through advanced collaborative tools, predictive analytics for scenario planning, and automated decision-making processes to reroute or reallocate resources efficiently.

What are the primary benefits of adopting SaaS SCM for small and medium-sized enterprises (SMEs)?

For small and medium-sized enterprises (SMEs), adopting SaaS SCM offers a compelling array of benefits, including substantially lower upfront capital expenditure, faster and simpler deployment processes, significantly reduced IT infrastructure overhead and maintenance costs, and inherent scalability to seamlessly grow with evolving business needs. It provides SMEs with accessible entry to advanced SCM functionalities previously only available to large enterprises, leading to improved operational efficiency, enhanced competitiveness, and a better return on investment.

How is Artificial Intelligence (AI) fundamentally impacting SaaS SCM solutions?

Artificial Intelligence is fundamentally transforming SaaS SCM solutions by enabling groundbreaking advancements such as highly accurate demand forecasting through sophisticated machine learning algorithms, intelligent automation of complex inventory and order fulfillment processes, and dynamic optimization of transportation routes for cost and time efficiency. AI also enhances proactive risk management with predictive insights derived from vast datasets, leading to more intelligent, autonomous, and self-optimizing supply chains capable of adapting to complex market conditions.

What are the key considerations when choosing a SaaS SCM provider for an enterprise?

When selecting a SaaS SCM provider, key considerations for an enterprise include the robustness of the provider's data security protocols and compliance certifications, the seamless integration capabilities with existing enterprise resource planning (ERP) and legacy systems, the scalability and flexibility of the solution to accommodate future growth and evolving business requirements, the availability of industry-specific features, the reputation and quality of customer support services, and a thorough analysis of the total cost of ownership over the anticipated contract period.