Rotary Valve Market

Rotary Valve Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702379 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Rotary Valve Market Size

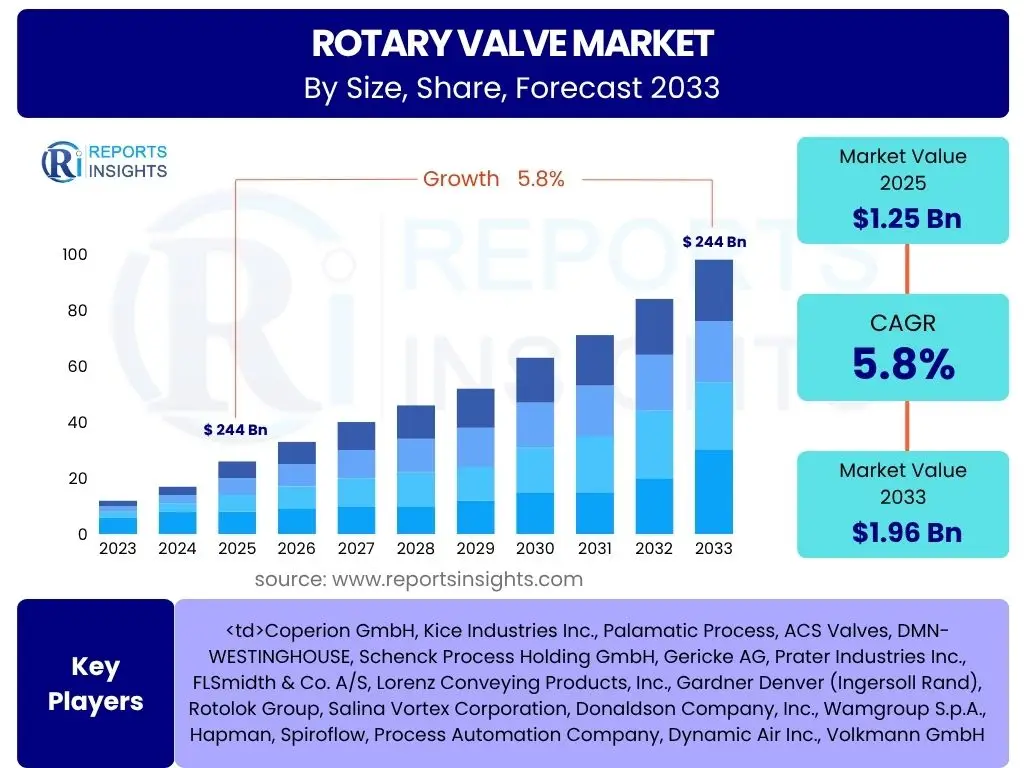

According to Reports Insights Consulting Pvt Ltd, The Rotary Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. The market is estimated at USD 1.25 billion in 2025 and is projected to reach USD 1.96 billion by the end of the forecast period in 2033.

Key Rotary Valve Market Trends & Insights

Analysis of common user inquiries regarding trends in the Rotary Valve market reveals a strong focus on automation integration, efficiency improvements, and material handling advancements. Users frequently ask about the adoption of smart technologies, the impact of sustainability initiatives, and the demand for specialized valve designs for challenging applications. There is also significant interest in the regional growth patterns and the influence of industrialization in emerging economies on market trajectory.

- Increasing demand for automation and industrial digitalization across various manufacturing sectors.

- Growing adoption of rotary valves in pneumatic conveying and bulk material handling systems to enhance process efficiency.

- Emphasis on hygienic and sanitary designs, particularly in the food & beverage and pharmaceutical industries.

- Development of advanced materials and coatings for improved wear resistance and extended valve lifespan.

- Rising focus on energy-efficient valve designs to reduce operational costs and environmental impact.

- Customization and modularity in rotary valve solutions to meet diverse application requirements.

AI Impact Analysis on Rotary Valve

Common user questions regarding AI's impact on the Rotary Valve market primarily revolve around predictive maintenance, process optimization, and enhanced design capabilities. Users are keen to understand how AI can reduce downtime, improve operational efficiency, and contribute to more intelligent manufacturing processes. There is also an interest in AI's role in optimizing material flow, detecting anomalies, and potentially automating the selection and configuration of rotary valves for specific industrial needs.

- AI-powered predictive maintenance: Utilizing sensor data and machine learning algorithms to anticipate valve wear and schedule maintenance, reducing unplanned downtime.

- Optimized operational efficiency: AI can analyze material flow patterns and adjust valve settings in real-time for improved throughput and reduced energy consumption.

- Enhanced design and simulation: AI tools can aid in rapid prototyping and performance simulation of new rotary valve designs, accelerating product development.

- Supply chain optimization: AI can improve inventory management for spare parts and optimize logistics, ensuring timely availability of components.

- Quality control and anomaly detection: AI vision systems can detect imperfections in manufactured valves or inconsistencies in material discharge, ensuring higher product quality.

Key Takeaways Rotary Valve Market Size & Forecast

An examination of common user questions about the Rotary Valve market's size and forecast highlights key areas of interest, including the primary growth drivers, the expected market value by the end of the forecast period, and the industries contributing most significantly to this growth. Users frequently inquire about the Compound Annual Growth Rate (CAGR) and the factors that will sustain this growth trajectory, indicating a strong desire to understand the long-term viability and investment potential within the sector.

- The market is poised for steady growth, driven by increasing industrial automation and material handling needs.

- Significant expansion is anticipated in emerging economies due to ongoing industrialization projects.

- Technological advancements in valve design and material science will be crucial for market evolution.

- The food & beverage and pharmaceutical sectors are expected to remain key revenue contributors due to stringent hygiene requirements.

- The overall market size is projected to reach nearly USD 2 billion by 2033, indicating a robust and expanding industry.

Rotary Valve Market Drivers Analysis

The Rotary Valve market is primarily propelled by the escalating demand for efficient and automated material handling solutions across diverse industrial sectors. Industries such as food and beverage, pharmaceuticals, chemicals, plastics, and agriculture are increasingly investing in bulk material processing and pneumatic conveying systems, where rotary valves are indispensable for precise flow control and dust management. Furthermore, the global trend towards industrial digitalization and smart manufacturing practices necessitates advanced valve technologies that can seamlessly integrate into automated production lines, driving market expansion.

Stringent regulatory requirements pertaining to workplace safety, environmental emissions, and product contamination also play a significant role in fostering the adoption of high-performance rotary valves. Companies are compelled to upgrade their existing infrastructure with valves that offer superior sealing capabilities and minimize material spillage or airborne dust, thereby ensuring compliance and operational integrity. The robust growth of manufacturing and processing industries in developing regions further contributes to the sustained demand for rotary valve solutions.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Industrial Automation | +1.5% | Global, particularly North America, Europe, APAC | Short to Long-term |

| Growth in Food & Beverage and Pharmaceutical Industries | +1.2% | Global | Short to Long-term |

| Rising Demand for Efficient Material Handling | +1.0% | Global | Short to Long-term |

| Strict Regulatory Compliance & Safety Standards | +0.8% | Europe, North America | Mid to Long-term |

| Expansion of Chemical and Plastics Industries | +0.7% | APAC, North America | Mid to Long-term |

Rotary Valve Market Restraints Analysis

Despite robust growth drivers, the Rotary Valve market faces several restraints that could impede its expansion. One significant factor is the relatively high initial capital expenditure required for advanced rotary valve systems, especially those designed for demanding applications such as high-temperature, abrasive, or corrosive materials. This substantial upfront investment can deter small and medium-sized enterprises (SMEs) or companies with limited budgets from upgrading to newer, more efficient technologies, prompting them to rely on older equipment or seek lower-cost alternatives.

Another restraint stems from the ongoing maintenance and operational costs associated with rotary valves, particularly concerning wear and tear parts like rotor tips and seals. The operational environment, material characteristics, and frequent usage can lead to accelerated component degradation, necessitating regular replacements and maintenance interventions. The availability of alternative material handling technologies, such as screw conveyors, vibratory feeders, and pneumatic conveying systems (without dedicated rotary valves for certain applications), also poses a competitive threat, as these alternatives may be perceived as more cost-effective or suitable for specific low-pressure or gravity-feed scenarios, thus limiting rotary valve adoption in some segments.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Capital Expenditure | -0.9% | Global, particularly developing regions | Short to Mid-term |

| Maintenance and Operational Costs | -0.7% | Global | Short to Long-term |

| Competition from Alternative Technologies | -0.5% | Global | Mid-term |

| Economic Downturns and Industrial Slowdown | -0.4% | Global | Short-term |

| Complexity in Handling Diverse Materials | -0.3% | Global | Mid-term |

Rotary Valve Market Opportunities Analysis

The Rotary Valve market presents significant opportunities for growth, particularly through expansion into emerging markets and the increasing demand for customized solutions. Rapid industrialization and infrastructure development in regions like Asia Pacific, Latin America, and parts of Africa are creating new avenues for the adoption of efficient material handling equipment, including rotary valves. Manufacturers can capitalize on these burgeoning economies by offering cost-effective yet reliable solutions tailored to local industrial needs, thereby expanding their market footprint significantly.

Furthermore, the growing emphasis on Industry 4.0 and the integration of smart technologies offer substantial growth potential. Developing rotary valves with advanced sensors, IoT capabilities, and connectivity features for remote monitoring and predictive maintenance can provide a competitive edge. There is also a continuous demand for retrofitting and upgrading existing industrial plants with more efficient and compliant rotary valve systems, ensuring a steady revenue stream for manufacturers. Innovations in material science, allowing for the creation of valves capable of handling highly abrasive, corrosive, or sticky materials, will unlock new application areas and strengthen market positions.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion in Emerging Economies | +1.3% | APAC, Latin America, MEA | Mid to Long-term |

| Integration with Industry 4.0 and IoT | +1.1% | Global | Mid to Long-term |

| Customization for Niche Applications | +0.9% | Global | Short to Long-term |

| Retrofitting and Upgrading Existing Systems | +0.7% | North America, Europe | Short to Mid-term |

| Advancements in Material Science for Valve Construction | +0.6% | Global | Long-term |

Rotary Valve Market Challenges Impact Analysis

The Rotary Valve market faces several challenges that require strategic responses from manufacturers and suppliers. One primary challenge is the technical complexity involved in designing and manufacturing rotary valves capable of consistently handling a diverse range of materials, including abrasive, cohesive, or high-temperature substances, without excessive wear or product degradation. Ensuring an effective and durable seal, particularly in high-pressure differentials or vacuum applications, remains a significant engineering hurdle that impacts valve performance and lifespan. Overcoming these material-specific challenges often requires extensive R&D and specialized manufacturing processes, driving up production costs.

Another significant challenge is managing the perception of high maintenance requirements and downtime associated with poorly selected or maintained rotary valves. While modern designs aim to minimize this, end-users often factor in potential operational interruptions and repair costs into their purchasing decisions. Intense competition among market players, coupled with price sensitivity in certain segments, further pressures manufacturers to innovate while maintaining competitive pricing. Additionally, a shortage of skilled technicians for installation, calibration, and maintenance of complex rotary valve systems in various industries poses an operational challenge, potentially leading to suboptimal performance or premature failure if not addressed through comprehensive training and support initiatives.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Technical Complexity in Material Handling | -0.8% | Global | Short to Long-term |

| High Maintenance Perception and Downtime Concerns | -0.6% | Global | Short to Mid-term |

| Intense Market Competition and Price Sensitivity | -0.5% | Global | Short to Mid-term |

| Ensuring Airtight Sealing and Preventing Leakage | -0.4% | Global | Short to Long-term |

| Skilled Labor Shortage for Installation & Maintenance | -0.3% | Global | Mid-term |

Rotary Valve Market - Updated Report Scope

This report provides a comprehensive analysis of the global Rotary Valve Market, encompassing market size estimations, growth forecasts, and detailed segmentation. It offers an in-depth examination of key trends, drivers, restraints, opportunities, and challenges influencing market dynamics. The scope includes an assessment of AI's impact, a competitive landscape analysis of leading players, and regional insights to provide a holistic understanding of the market's current state and future trajectory.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.25 billion |

| Market Forecast in 2033 | USD 1.96 billion |

| Growth Rate | 5.8% CAGR |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Coperion GmbH, Kice Industries Inc., Palamatic Process, ACS Valves, DMN-WESTINGHOUSE, Schenck Process Holding GmbH, Gericke AG, Prater Industries Inc., FLSmidth & Co. A/S, Lorenz Conveying Products, Inc., Gardner Denver (Ingersoll Rand), Rotolok Group, Salina Vortex Corporation, Donaldson Company, Inc., Wamgroup S.p.A., Hapman, Spiroflow, Process Automation Company, Dynamic Air Inc., Volkmann GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Rotary Valve market is comprehensively segmented based on several critical parameters to provide a granular view of its structure and opportunities. This segmentation allows for a detailed analysis of market dynamics across different product types, applications, end-use industries, and materials of construction. Understanding these segments is crucial for identifying specific growth pockets, tailoring product offerings, and formulating targeted market strategies for diverse industrial requirements.

- By Type: Includes Drop-Through Rotary Valves (for gravity feed), Blow-Through Rotary Valves (for pneumatic conveying lines), Offset Rotary Valves (for sticky or difficult materials), Metering Rotary Valves (for precise dosing), Sanitary Rotary Valves (for hygienic applications), and High-Pressure Rotary Valves (for systems with pressure differentials).

- By Application: Covers key industrial uses such as Dust Collection (for air filtration systems), Pneumatic Conveying (for material transport), Batching and Feeding (for controlled material dispensing), Mixing and Blending (for incorporating ingredients), and Dosing (for accurate quantity control).

- By End-use Industry: Encompasses a wide range of sectors including Food and Beverage (for handling grains, powders), Pharmaceuticals (for sterile environments), Chemical (for corrosive and abrasive substances), Plastics and Rubber (for resins and granules), Agriculture (for fertilizers, seeds), Mining (for minerals, ores), Power Generation (for fly ash, coal), Building and Construction (for cement, aggregates), and Others (e.g., Pulp & Paper, Water Treatment).

- By Material of Construction: Categorized by the materials used in valve manufacturing, such as Cast Iron (for general industrial use), Stainless Steel (for corrosion resistance and hygiene), Aluminum (for lightweight applications), Special Alloys (for extreme temperatures or chemical resistance), and Composite Materials (for specific performance needs).

Regional Highlights

- North America: Characterized by a mature industrial base and early adoption of automation. Strong demand from food & beverage, pharmaceuticals, and chemical industries. Emphasis on robust, high-performance valves and compliance with stringent safety standards.

- Europe: Driven by strict regulatory frameworks regarding emissions and hygiene. Significant market share in high-precision and sanitary rotary valves for the pharmaceutical and specialized chemical sectors. Focus on energy efficiency and sustainable manufacturing practices.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, infrastructure development, and expanding manufacturing sectors in countries like China, India, and Southeast Asia. High demand from food processing, agriculture, and construction industries. Increasing adoption of automated material handling systems.

- Latin America: Growing industrial sector, particularly in mining, agriculture, and food processing. Increasing investment in modernizing industrial infrastructure, leading to rising demand for efficient rotary valve solutions.

- Middle East and Africa (MEA): Emerging market with increasing industrial investments, especially in petrochemicals, mining, and food processing. Growth is spurred by diversification efforts and the need for advanced material handling technologies to support developing industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotary Valve Market.- Coperion GmbH

- Kice Industries Inc.

- Palamatic Process

- ACS Valves

- DMN-WESTINGHOUSE

- Schenck Process Holding GmbH

- Gericke AG

- Prater Industries Inc.

- FLSmidth & Co. A/S

- Lorenz Conveying Products, Inc.

- Gardner Denver (Ingersoll Rand)

- Rotolok Group

- Salina Vortex Corporation

- Donaldson Company, Inc.

- Wamgroup S.p.A.

- Hapman

- Spiroflow

- Process Automation Company

- Dynamic Air Inc.

- Volkmann GmbH

Frequently Asked Questions

What is a rotary valve and its primary function?

A rotary valve, also known as a rotary airlock or rotary feeder, is a mechanical device used in bulk material handling systems to regulate the flow of dry bulk solids from one chamber to another while maintaining an airtight seal between the two. Its primary function is to provide a consistent, controlled discharge of material, prevent air or gas leakage, and often to serve as a safety barrier against explosions or fires in dust collection systems.

What are the main types of rotary valves?

The main types of rotary valves include drop-through (gravity-fed), blow-through (for pneumatic conveying lines), offset (for sticky materials), metering (for precise dosing), sanitary (for hygienic applications), and high-pressure (for systems with significant pressure differentials). Each type is designed to optimize performance for specific material characteristics and system requirements.

Which industries primarily use rotary valves?

Rotary valves are extensively used across a wide range of industries that handle dry bulk solids. Key sectors include food and beverage processing, pharmaceuticals, chemicals, plastics and rubber, agriculture, mining, power generation, and building and construction. These industries rely on rotary valves for applications such as dust collection, pneumatic conveying, batching, and precise feeding.

What factors should be considered when selecting a rotary valve?

Key factors for selecting a rotary valve include the type of material being handled (abrasive, sticky, corrosive, hazardous), particle size, flow rate requirements, system pressure or vacuum conditions, temperature, sanitation requirements, and available space. Proper selection ensures optimal performance, minimizes wear, and enhances operational efficiency and safety.

How does a rotary valve contribute to process efficiency?

A rotary valve contributes to process efficiency by ensuring a continuous and regulated flow of bulk materials, preventing interruptions and maintaining consistent throughput. It minimizes air leakage between pressure zones, optimizing pneumatic conveying systems and reducing energy consumption. Additionally, by controlling material discharge and acting as a fire/explosion barrier, it enhances process safety and reduces product loss, leading to overall operational improvements.