Rolling Mill Roll Market

Rolling Mill Roll Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703118 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Rolling Mill Roll Market Size

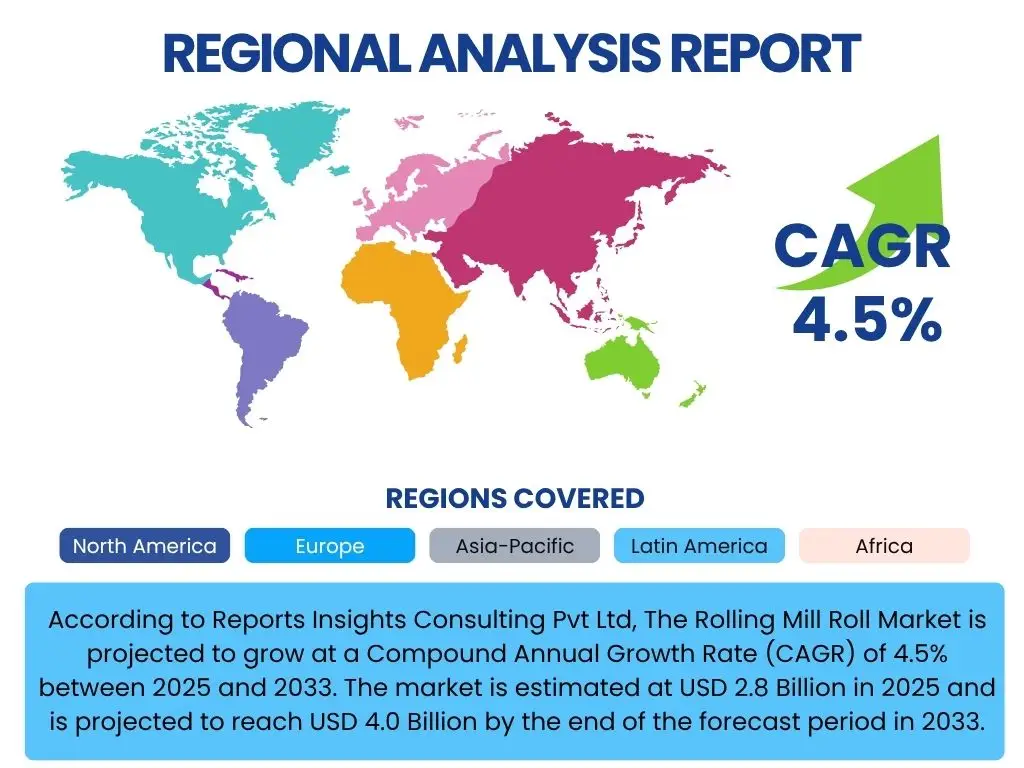

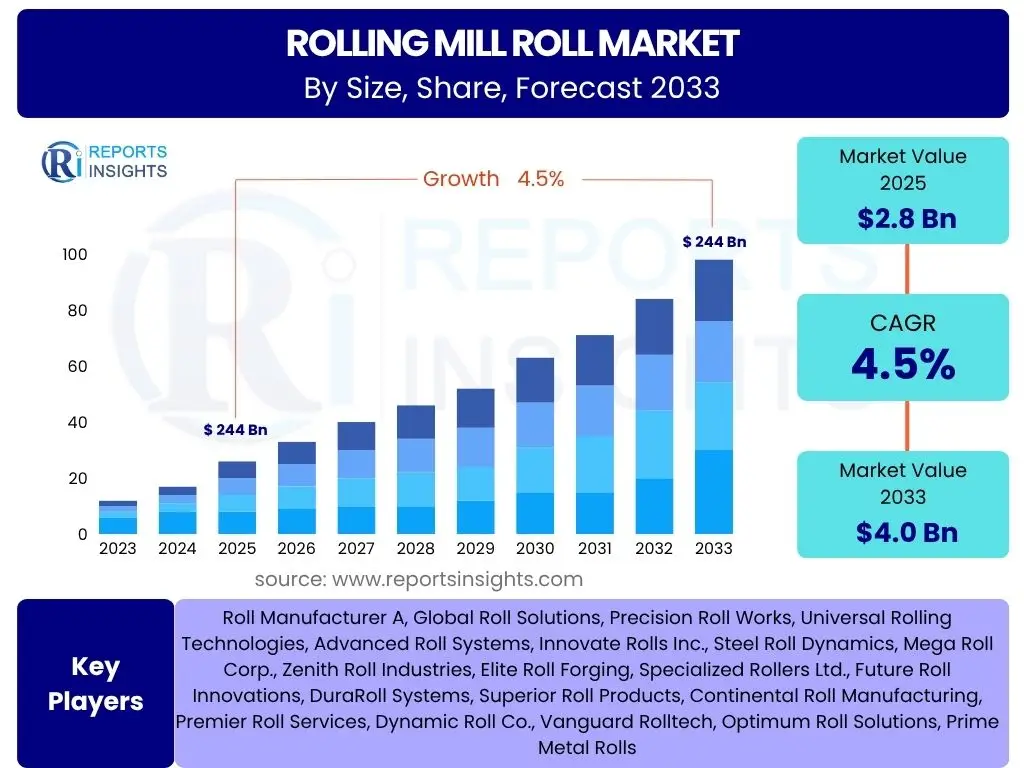

According to Reports Insights Consulting Pvt Ltd, The Rolling Mill Roll Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2033. The market is estimated at USD 2.8 Billion in 2025 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Key Rolling Mill Roll Market Trends & Insights

The global Rolling Mill Roll market is currently experiencing dynamic shifts driven by advancements in material science and increasing demand from end-use industries. Key user inquiries often revolve around the adoption of advanced materials like high-speed steel and tungsten carbide, which offer superior wear resistance and extended operational life, directly impacting productivity and cost-efficiency in rolling operations. There is a growing emphasis on custom-engineered rolls tailored to specific application requirements, moving away from a one-size-fits-all approach, which reflects the evolving complexities of modern metallurgical processes.

Another significant trend gaining traction is the integration of smart manufacturing principles and IoT into rolling mill operations. This includes the use of sensors for real-time monitoring of roll performance, temperature, and wear, enabling predictive maintenance and optimizing operational parameters. Such technological integration aims to minimize downtime, reduce operational costs, and enhance the overall efficiency of steel and metal production lines. Furthermore, the market is witnessing an increased focus on sustainability, prompting manufacturers to develop rolls with longer lifespans and explore recycling initiatives for used rolls, aligning with global environmental objectives.

The expansion of infrastructure projects globally, particularly in developing economies, is fueling the demand for steel and other metals, consequently driving the need for high-performance rolling mill rolls. This demand is not uniform across all regions, with Asia Pacific exhibiting particularly robust growth due to rapid industrialization and urbanization. Innovation in roll design, aimed at reducing energy consumption during the rolling process, also represents a notable trend, reflecting the industry's commitment to operational efficiency and environmental responsibility.

- Adoption of advanced materials such as High-Speed Steel (HSS) and Tungsten Carbide (TC) for enhanced durability and performance.

- Increased demand for custom-engineered and application-specific rolling mill rolls.

- Integration of smart manufacturing, IoT, and predictive analytics for optimized roll management.

- Growing focus on sustainable manufacturing practices and roll recycling programs.

- Expansion of infrastructure and construction sectors driving demand for rolled products.

- Emphasis on energy-efficient roll designs and manufacturing processes.

AI Impact Analysis on Rolling Mill Roll

User questions regarding the impact of Artificial Intelligence (AI) on the Rolling Mill Roll market frequently touch upon its potential to revolutionize design, manufacturing, and operational maintenance. AI algorithms are increasingly being explored for optimizing roll design parameters, predicting material behavior during rolling, and simulating performance under various stress conditions. This allows for the creation of more robust and efficient roll geometries, minimizing material waste and accelerating the design cycle. The ability of AI to process vast datasets related to material properties, temperature, and pressure enables engineers to make informed decisions, leading to superior roll products.

In manufacturing, AI-powered systems can enhance precision in machining and grinding processes, ensuring tighter tolerances and higher surface finishes for rolls. Machine learning models can analyze real-time production data to identify anomalies, predict equipment failures, and optimize production schedules, thereby improving manufacturing throughput and reducing defects. For operational maintenance, AI plays a crucial role in predictive maintenance strategies. By analyzing sensor data from rolling mills—such as vibration, temperature, and acoustic signatures—AI can anticipate roll wear and potential failures before they occur, scheduling maintenance proactively and significantly reducing unscheduled downtime and catastrophic failures.

Furthermore, AI is instrumental in quality control by analyzing visual data from rolls post-production or during operation to detect surface defects, cracks, or other irregularities that might compromise performance. This ensures that only high-quality rolls are deployed, preventing costly production halts and maintaining product integrity. The long-term impact of AI is expected to lead to more resilient, higher-performing, and cost-effective rolling mill rolls, transforming traditional manufacturing practices into data-driven, intelligent operations that enhance overall productivity and competitive advantage.

- Optimization of roll design through AI-driven simulations and material property analysis.

- Enhanced manufacturing precision and process control via AI-powered systems.

- Predictive maintenance for rolling mill rolls, minimizing downtime and extending operational life.

- AI-enabled quality control for real-time defect detection and analysis.

- Improved operational efficiency and resource utilization through intelligent automation.

Key Takeaways Rolling Mill Roll Market Size & Forecast

The Rolling Mill Roll market is poised for steady growth, reflecting the consistent global demand for processed metals across various industrial sectors. Key takeaways from market size and forecast analysis highlight that while traditional steel production remains a cornerstone, increasing complexity in alloy manufacturing and specialized metalworking processes are driving demand for advanced and high-performance rolls. The moderate Compound Annual Growth Rate (CAGR) signifies a mature yet evolving market, where innovation in material science and manufacturing technologies will be crucial for competitive advantage and market expansion.

The market's valuation reaching USD 4.0 Billion by 2033 underscores the sustained investment in steel and non-ferrous metal industries, particularly in emerging economies where industrialization and urbanization continue at a rapid pace. This growth trajectory is supported by the ongoing need for infrastructure development, automotive production, and consumer goods manufacturing, all of which rely heavily on rolled metal products. Furthermore, the emphasis on energy efficiency and environmental regulations is shaping product development, pushing manufacturers to innovate rolls that contribute to sustainable production processes.

A significant insight is the shift towards specialized and high-value-added rolls, moving beyond conventional cast iron rolls to advanced materials like HSS and TC, which command higher prices but offer superior performance and longer service life. This trend suggests a market that values quality, durability, and operational efficiency over mere cost savings, reflecting the high stakes involved in continuous rolling operations. The forecast indicates that companies investing in R&D for new materials, advanced manufacturing techniques, and smart solutions will be best positioned to capitalize on future opportunities and maintain market leadership.

- Consistent demand for rolled metals drives steady market expansion.

- Growth fueled by infrastructure development, automotive, and general manufacturing sectors.

- Shift towards high-performance and specialty rolls made from advanced materials.

- Technological advancements in roll design and manufacturing are critical for future growth.

- Sustainability initiatives influencing product development and market dynamics.

Rolling Mill Roll Market Drivers Analysis

The global Rolling Mill Roll market is significantly propelled by the robust expansion of the steel and metal industry, which is intrinsically linked to global industrialization and urbanization. As economies develop, the demand for construction materials, automotive components, and various manufactured goods escalates, directly increasing the need for rolled metal products. This sustained demand necessitates a consistent supply of high-performance rolling mill rolls, driving market growth. Additionally, the continuous technological advancements in metallurgy require rolls capable of processing new, high-strength alloys and achieving tighter tolerances, thereby encouraging innovation and product upgrades within the market.

Infrastructure development projects across emerging economies, particularly in Asia Pacific and parts of Africa, serve as a major catalyst for market expansion. These projects, including new buildings, bridges, railways, and energy infrastructure, require massive amounts of steel and other metals, intensifying the operational demands on rolling mills. Furthermore, the automotive sector's evolving landscape, characterized by a shift towards lightweight and high-strength materials for enhanced fuel efficiency and safety, drives demand for specialized rolls. The ongoing replacement of older rolls with more efficient and durable alternatives also contributes significantly to market growth, as mills seek to optimize productivity and reduce maintenance costs.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Steel and Metal Industry Demand | +1.2% | Global, particularly Asia Pacific (China, India) | Long-term (2025-2033) |

| Infrastructure Development & Urbanization | +1.0% | Emerging Economies (Southeast Asia, Latin America, Africa) | Medium to Long-term (2025-2030) |

| Technological Advancements in Metallurgy | +0.8% | North America, Europe, East Asia (Japan, South Korea) | Continuous (2025-2033) |

| Increasing Automotive Production | +0.7% | Global, especially China, EU, North America | Medium-term (2025-2028) |

| Demand for High-Performance Rolls | +0.8% | Global | Long-term (2025-2033) |

Rolling Mill Roll Market Restraints Analysis

The Rolling Mill Roll market faces several significant restraints that could impede its growth trajectory. One primary challenge is the high capital expenditure associated with establishing and upgrading rolling mill facilities, which includes the significant cost of acquiring high-quality rolls. This substantial upfront investment can deter new entrants and limit expansion plans for existing players, particularly in regions with tighter financial markets or fluctuating economic conditions. Furthermore, the market is susceptible to volatility in raw material prices, especially for alloys used in advanced roll manufacturing, which can directly impact production costs and profit margins for roll manufacturers, leading to price instability for end-users.

Environmental regulations and stringent policies regarding industrial emissions and waste management pose another restraint. Manufacturers must invest heavily in cleaner technologies and sustainable production practices, which adds to operational costs and can influence market dynamics. Additionally, the inherent cyclical nature of the steel and metal industry, influenced by global economic cycles, trade policies, and geopolitical tensions, can lead to periods of reduced demand for rolling mill rolls. Overcapacity in some regional markets, leading to intense price competition and diminished profitability, also acts as a dampening factor, compelling manufacturers to operate with slimmer margins.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Expenditure for Mills | -0.9% | Global, particularly developing regions | Long-term (2025-2033) |

| Volatility in Raw Material Prices | -0.8% | Global | Short to Medium-term (2025-2027) |

| Stringent Environmental Regulations | -0.7% | Europe, North America, parts of Asia | Continuous (2025-2033) |

| Cyclical Nature of Steel Industry | -0.6% | Global | Intermittent (Based on Economic Cycles) |

| Market Overcapacity & Intense Competition | -0.5% | China, parts of Europe | Medium-term (2025-2029) |

Rolling Mill Roll Market Opportunities Analysis

The Rolling Mill Roll market is presented with several promising opportunities that can significantly contribute to its expansion and evolution. One key opportunity lies in the growing demand for specialized alloys and high-strength steels, particularly from the automotive, aerospace, and defense sectors. These industries require rolls capable of processing advanced materials with precision, opening avenues for manufacturers to innovate and supply high-value-added products. The trend towards lightweighting in vehicles and aircraft, for instance, necessitates specific rolling capabilities that can be met by cutting-edge roll designs and materials, creating a niche for specialized roll manufacturers.

The increasing adoption of Industry 4.0 and smart manufacturing technologies within rolling mills offers another substantial opportunity. This includes integrating IoT sensors for real-time performance monitoring, AI for predictive maintenance, and automation for optimizing production processes. Roll manufacturers who can develop and offer smart rolls with embedded sensors or provide integrated solutions for roll management will gain a competitive edge. Furthermore, the push for energy efficiency and sustainable production practices across the metal industry provides an opportunity for developing and marketing eco-friendly rolls that reduce energy consumption and have a longer operational lifespan, aligning with global environmental goals.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Specialty Alloys | +1.1% | Global, particularly North America, Europe, Asia Pacific | Long-term (2025-2033) |

| Adoption of Industry 4.0 and Smart Manufacturing | +0.9% | Developed Economies (Germany, Japan, USA) | Medium to Long-term (2025-2030) |

| Focus on Energy Efficiency and Sustainability | +0.8% | Europe, North America, Japan | Continuous (2025-2033) |

| Expansion into Niche Applications | +0.7% | Global, depending on specific industrial growth | Medium to Long-term (2025-2033) |

| Aftermarket Service and Maintenance | +0.6% | Global | Continuous (2025-2033) |

Rolling Mill Roll Market Challenges Impact Analysis

The Rolling Mill Roll market faces several significant challenges that demand strategic responses from manufacturers. One of the primary challenges is intense price competition, especially from manufacturers in regions with lower production costs. This drives down profit margins and makes it difficult for companies with higher operational expenses or those focused on premium products to compete solely on price. The requirement for continuous technological innovation to keep pace with evolving metallurgical processes and demand for advanced materials is also a significant hurdle. This necessitates substantial investment in research and development, which can be particularly burdensome for smaller players.

Another major challenge involves managing the complex supply chain for raw materials, which often involves sourcing specialized alloys and components from various global suppliers. Disruptions in this supply chain due to geopolitical events, trade disputes, or natural disasters can lead to material shortages, price fluctuations, and delays in production. Furthermore, skilled labor shortages, particularly for specialized metallurgical engineers and experienced technicians proficient in roll manufacturing and maintenance, pose a long-term challenge. The highly technical nature of roll production and the need for precision manufacturing require a skilled workforce, which is becoming increasingly difficult to recruit and retain, impacting production quality and efficiency.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Price Competition | -0.8% | Global, particularly Asia | Continuous (2025-2033) |

| Need for Continuous Technological Innovation | -0.7% | Global | Long-term (2025-2033) |

| Supply Chain Disruptions & Volatility | -0.6% | Global | Short to Medium-term (2025-2028) |

| Shortage of Skilled Labor | -0.5% | Developed Economies | Long-term (2025-2033) |

| Compliance with Evolving Regulations | -0.4% | Europe, North America | Continuous (2025-2033) |

Rolling Mill Roll Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Rolling Mill Roll market, offering insights into its current state, historical performance, and future projections. The scope encompasses detailed market sizing, growth drivers, restraints, opportunities, and challenges affecting the industry from 2019 to 2033. It includes extensive segmentation analysis by roll type, material, application, and end-use industry, alongside a thorough regional breakdown covering major geographies. The report further profiles key market players, providing a competitive landscape assessment and strategic insights for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 4.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Roll Manufacturer A, Global Roll Solutions, Precision Roll Works, Universal Rolling Technologies, Advanced Roll Systems, Innovate Rolls Inc., Steel Roll Dynamics, Mega Roll Corp., Zenith Roll Industries, Elite Roll Forging, Specialized Rollers Ltd., Future Roll Innovations, DuraRoll Systems, Superior Roll Products, Continental Roll Manufacturing, Premier Roll Services, Dynamic Roll Co., Vanguard Rolltech, Optimum Roll Solutions, Prime Metal Rolls |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Rolling Mill Roll market is extensively segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for precise analysis of various product types, materials, applications, and end-use industries, reflecting the complex and specialized nature of the rolling process. Each segment presents unique characteristics in terms of demand, technological requirements, and market dynamics, contributing to a comprehensive overview of the industry landscape. Understanding these segments is crucial for manufacturers, suppliers, and investors to identify lucrative opportunities and tailor their strategies effectively.

- By Type:

- Work Rolls: Directly contact the metal to deform it.

- Backup Rolls: Provide support to work rolls, preventing deflection.

- Intermediate Rolls: Used in 4-high and 6-high mills, positioned between work and backup rolls.

- Straightening Rolls: Used to straighten rolled products.

- Guiding Rolls: Guide the material through the rolling process.

- Finishing Rolls: Used in the final stages of rolling for precise dimensions and surface finish.

- Roughing Rolls: Used in the initial stages of rolling to reduce material thickness.

- By Material:

- Cast Iron Rolls:

- Chilled Cast Iron

- Nodular Cast Iron (Spheroidal Graphite Cast Iron)

- High Chromium Cast Iron

- Adamite Rolls

- Cast Steel Rolls:

- High Carbon Steel Rolls

- High Speed Steel (HSS) Rolls

- Forged Steel Rolls

- Tungsten Carbide Rolls

- Others:

- Ceramic Rolls

- Composite Rolls

- Cast Iron Rolls:

- By Application:

- Hot Rolling Mills: For high-temperature deformation of metals.

- Cold Rolling Mills: For room-temperature deformation, achieving better surface finish and dimensional accuracy.

- Universal Rolling Mills: For rolling wide flange beams and structural shapes.

- Section Mills: For producing angles, channels, and beams.

- Plate Mills: For producing metal plates.

- Strip Mills: For producing metal strips.

- Bar Mills: For producing round, square, or hexagonal bars.

- Wire Rod Mills: For producing wire rods.

- Seamless Pipe Mills: For manufacturing seamless pipes and tubes.

- By End-Use Industry:

- Steel Industry: Primary consumer of rolling mill rolls.

- Non-Ferrous Metal Industry:

- Aluminum Industry

- Copper Industry

- Titanium Industry

- Automotive Industry: For manufacturing car body panels, chassis components.

- Construction Industry: For rebar, structural steel.

- Machinery & Equipment Manufacturing: For various machine components.

- Energy Sector: For pipes in oil & gas, components in power generation.

- Other Manufacturing Industries.

Regional Highlights

The global Rolling Mill Roll market exhibits significant regional variations in demand, production capabilities, and growth drivers. Asia Pacific, particularly countries like China, India, Japan, and South Korea, dominates the market due to robust industrialization, massive infrastructure development projects, and a high concentration of steel and non-ferrous metal production facilities. China stands as the largest consumer and producer, driven by its massive construction and manufacturing sectors, while India's rapidly expanding economy and government initiatives like "Make in India" are fostering substantial growth in its metal industries. This region is characterized by both high-volume production of standard rolls and increasing adoption of advanced materials for higher performance applications.

Europe represents a mature market characterized by a strong emphasis on technological innovation, high-quality products, and stringent environmental regulations. Countries such as Germany, Italy, and France are home to advanced steel mills and specialized roll manufacturers that focus on high-performance and precision-engineered rolls. The region's automotive and machinery manufacturing sectors consistently demand advanced rolled products, driving the need for sophisticated rolling mill rolls. The focus here is not merely on volume but on developing sustainable manufacturing processes and longer-lasting rolls that contribute to operational efficiency and reduced carbon footprint.

North America, led by the United States, is another significant market with a strong focus on advanced manufacturing, specialized metal production, and ongoing modernization of its industrial base. The region's demand for rolling mill rolls is driven by a resilient automotive sector, aerospace, and general manufacturing industries, which require high-quality and precision-rolled materials. Investments in smart factory initiatives and automation are also influencing the market, leading to increased demand for rolls that can integrate with advanced monitoring and control systems. The Latin America and Middle East & Africa (MEA) regions are emerging markets, with growth tied to their respective infrastructure investments, oil & gas expansions, and industrial diversification efforts, presenting future growth opportunities for roll manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rolling Mill Roll Market.- Roll Manufacturer A

- Global Roll Solutions

- Precision Roll Works

- Universal Rolling Technologies

- Advanced Roll Systems

- Innovate Rolls Inc.

- Steel Roll Dynamics

- Mega Roll Corp.

- Zenith Roll Industries

- Elite Roll Forging

- Specialized Rollers Ltd.

- Future Roll Innovations

- DuraRoll Systems

- Superior Roll Products

- Continental Roll Manufacturing

- Premier Roll Services

- Dynamic Roll Co.

- Vanguard Rolltech

- Optimum Roll Solutions

- Prime Metal Rolls

Frequently Asked Questions

What are the primary types of rolling mill rolls?

The primary types of rolling mill rolls include work rolls, which directly deform the metal; backup rolls, which support the work rolls; and intermediate rolls, used in multi-roll configurations. Other types include straightening, guiding, finishing, and roughing rolls, each serving a specific function in the rolling process.

Which materials are commonly used for manufacturing rolling mill rolls?

Common materials include various types of cast iron (chilled, nodular, high chromium, adamite),cast steel (high carbon, high speed steel), forged steel, and advanced materials like tungsten carbide. The choice of material depends on the application's specific requirements for hardness, wear resistance, and toughness.

How do hot and cold rolling processes differ in terms of roll requirements?

Hot rolling mills typically use rolls designed for high temperatures and heavy deformation, often made of cast steel or certain cast irons. Cold rolling mills require rolls with superior surface finish and dimensional accuracy, frequently using forged steel or tungsten carbide rolls to achieve the desired product quality without heating the metal.

What is the impact of Industry 4.0 on the Rolling Mill Roll market?

Industry 4.0 significantly impacts the market by promoting the integration of smart technologies, such as IoT sensors for real-time monitoring of roll performance, and AI for predictive maintenance and optimized roll design. This leads to increased efficiency, reduced downtime, and the development of more intelligent and durable rolls.

What are the key factors driving the growth of the Rolling Mill Roll market?

Key growth drivers include the continuous expansion of the global steel and non-ferrous metal industries, rapid infrastructure development and urbanization in emerging economies, increasing demand for high-performance and specialized rolled products from sectors like automotive and aerospace, and technological advancements in metallurgy and roll manufacturing processes.