Robo advisory Market

Robo advisory Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701940 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Robo advisory Market Size

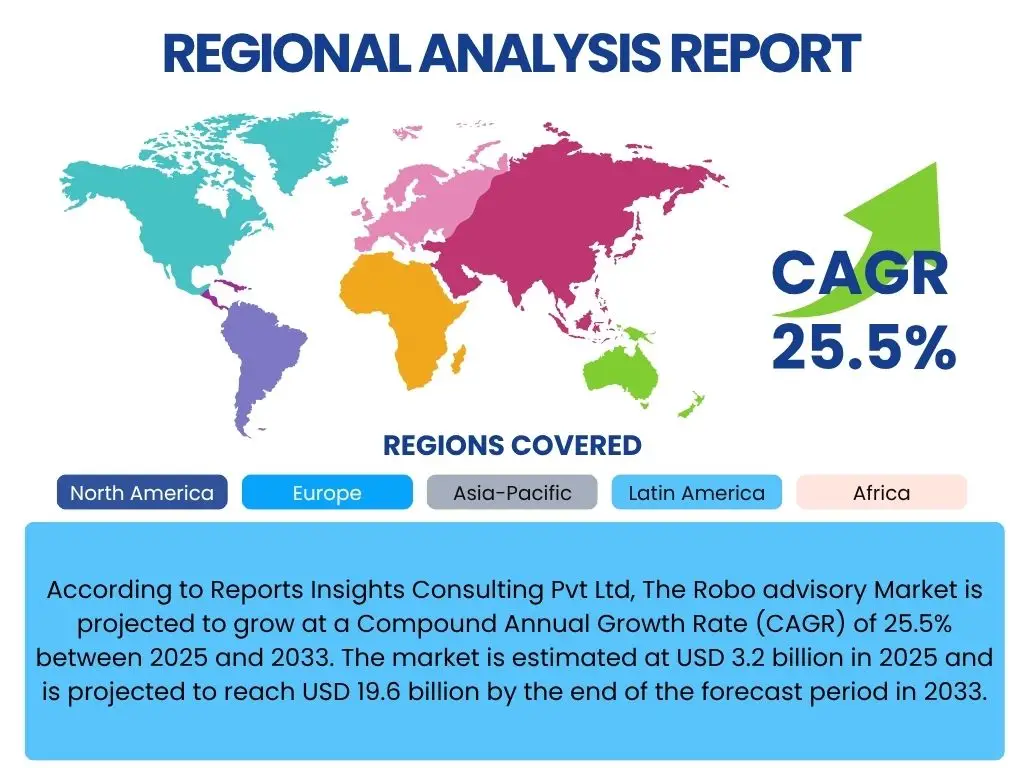

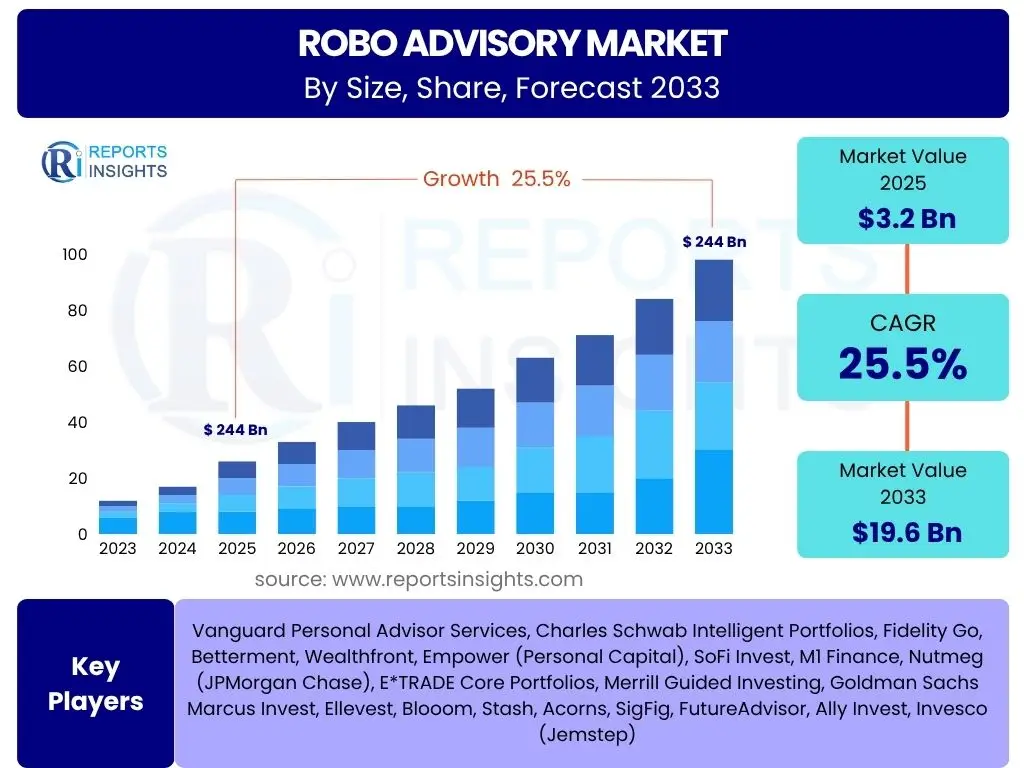

According to Reports Insights Consulting Pvt Ltd, The Robo advisory Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2025 and 2033. The market is estimated at USD 3.2 billion in 2025 and is projected to reach USD 19.6 billion by the end of the forecast period in 2033.

Key Robo advisory Market Trends & Insights

Users frequently inquire about the evolving landscape of the Robo advisory market, seeking to understand the most impactful developments and shifts. The market is currently experiencing significant transformation driven by technological advancements and changing client expectations. Key trends indicate a move towards more personalized, integrated, and accessible financial services, challenging traditional models and expanding the reach of wealth management.

There is a strong emphasis on digital convenience and cost-effectiveness, appealing to a broad demographic, including younger investors and those new to wealth management. Furthermore, the integration of sophisticated algorithms and data analytics is enhancing the capabilities of robo-advisors, moving beyond basic portfolio rebalancing to offer more comprehensive financial planning and goal-based investing. This evolution is reshaping how individuals manage their finances and interact with advisory services.

- Democratization of financial advice through lower entry barriers.

- Increased adoption of hybrid models combining AI with human oversight.

- Hyper-personalization of investment portfolios and financial plans.

- Expansion into niche markets such as ESG investing and cryptocurrency.

- Emphasis on holistic financial wellness, beyond just investments.

- Integration with broader fintech ecosystems and open banking initiatives.

- Rising demand for goal-based investing strategies.

AI Impact Analysis on Robo advisory

Common user questions regarding AI's influence on Robo advisory revolve around its capabilities in enhancing investment strategies, personalization, and efficiency, while also raising concerns about job displacement and the need for human touch. Artificial Intelligence is fundamentally transforming the robo-advisory landscape by enabling more sophisticated data analysis, predictive modeling, and automated decision-making. This allows for dynamic portfolio adjustments, personalized financial advice, and efficient risk management that would be difficult or impossible to achieve manually.

AI's role extends to improving client onboarding, refining user experience through intelligent interfaces, and providing continuous, real-time portfolio monitoring. While AI optimizes many operational aspects and can offer superior analytical power, there is a recognized need to balance automation with human expertise, particularly for complex financial situations or emotional support, leading to the rise of successful hybrid models. The ethical deployment of AI, data privacy, and algorithmic transparency remain critical areas of focus for market participants.

- Enhanced personalization through advanced data analytics and behavioral finance.

- Improved predictive capabilities for market trends and risk assessment.

- Automated portfolio rebalancing and tax-loss harvesting for optimal returns.

- Operational efficiency gains leading to lower costs for clients.

- Development of sophisticated chatbots and AI-powered customer service.

- Potential for real-time financial planning and advice delivery.

- Enabling of highly scalable wealth management solutions.

Key Takeaways Robo advisory Market Size & Forecast

Users frequently seek clear insights into what the projected market size and forecast truly signify for the future of financial advisory. The rapid growth trajectory of the Robo advisory market underscores a fundamental shift in how wealth management services are accessed and delivered. This significant expansion indicates a strong market acceptance driven by the demand for accessible, cost-effective, and technology-driven financial solutions, especially among digitally native generations.

The forecast highlights that robo-advisors are no longer a niche offering but are becoming a mainstream component of the financial services industry. Their projected growth is fueled by continuous innovation in AI and automation, expanding service offerings, and increasing trust from consumers. This trend suggests that financial institutions, both traditional and new entrants, must adapt their strategies to incorporate or compete with these automated platforms to remain relevant in the evolving financial landscape.

- Robust market expansion signals sustained demand for digital financial advice.

- Significant opportunity for new entrants and incumbents to scale operations.

- Technological advancements, particularly AI, will be central to future growth.

- Hybrid models are poised for increased adoption, balancing automation with human touch.

- Accessibility and cost-effectiveness remain key competitive advantages.

- The market is maturing, with increasing segmentation and specialization.

Robo advisory Market Drivers Analysis

The Robo advisory market's impressive growth trajectory is propelled by several potent drivers that reflect changing consumer preferences, technological advancements, and economic shifts. A primary driver is the increasing demand for cost-effective financial advice, which robo-advisors fulfill by leveraging automation to significantly reduce overheads compared to traditional human advisors. This affordability makes wealth management accessible to a broader demographic, including retail investors and those with smaller portfolios who were previously underserved.

Furthermore, the growing digital literacy and comfort with online platforms among consumers, especially millennials and Gen Z, contribute significantly to adoption. The convenience of managing investments through mobile apps and web platforms, coupled with the transparent and straightforward nature of robo-advisory services, resonates with a tech-savvy generation seeking efficiency and self-service options. Regulatory environments in various regions are also evolving to support fintech innovations, providing a conducive framework for robo-advisors to operate and expand, thereby fostering market confidence and growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Cost-Effective Financial Advice | +5.2% | Global, particularly Emerging Markets | Short to Medium Term (2025-2029) |

| Growing Digital Literacy and Adoption of Online Platforms | +4.8% | North America, Europe, Asia Pacific | Medium Term (2026-2031) |

| Advancements in Artificial Intelligence and Machine Learning | +6.0% | Global | Long Term (2028-2033) |

| Pandemic-Accelerated Shift Towards Digital Financial Services | +3.5% | Global | Short Term (2025-2027) |

| Rising Financial Inclusion Initiatives | +2.7% | Emerging Economies (APAC, LATAM, MEA) | Medium to Long Term (2027-2033) |

Robo advisory Market Restraints Analysis

Despite its significant growth, the Robo advisory market faces several inherent restraints that could potentially temper its expansion. A primary concern for many potential users is the perceived lack of human interaction and personalized guidance, especially for complex financial situations or during volatile market conditions. Investors with high net worth or intricate financial planning needs often prefer the nuanced advice and emotional intelligence that only a human advisor can provide, limiting the full penetration of pure robo-advisory models into these segments.

Another significant restraint is the lingering distrust in automated systems regarding financial decision-making, particularly concerning data security and the opaque nature of algorithms. Cybersecurity risks and the fear of algorithmic errors or biases can deter potential clients, necessitating robust security measures and greater transparency from robo-advisory platforms. Additionally, the fragmented and evolving regulatory landscape across different jurisdictions can pose challenges for market players seeking to expand globally, requiring adherence to diverse compliance requirements that can increase operational complexities and costs.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Perceived Lack of Human Interaction and Personalized Advice | -3.8% | Global, particularly Older Demographics | Medium to Long Term (2026-2033) |

| Cybersecurity Concerns and Data Privacy Risks | -4.1% | Global | Short to Medium Term (2025-2030) |

| Regulatory Uncertainty and Compliance Complexity | -2.9% | Europe, Asia Pacific (diverse regulations) | Medium Term (2025-2030) |

| Limited Scope for Complex Financial Needs | -2.0% | North America, Europe (HNWI segments) | Long Term (2028-2033) |

Robo advisory Market Opportunities Analysis

Significant opportunities exist within the Robo advisory market that can further accelerate its growth and expand its reach. The development and widespread adoption of hybrid models represent a compelling opportunity, allowing firms to combine the cost-effectiveness and scalability of automation with the personalized touch and complex problem-solving capabilities of human advisors. This approach caters to a broader spectrum of client needs, appealing to both tech-savvy individuals and those who still value personal consultation, thereby mitigating the restraint of perceived lack of human interaction.

Another promising avenue lies in the increasing demand for sustainable and ESG (Environmental, Social, and Governance) investing. As investor awareness and concern for social impact grow, robo-advisors can integrate sophisticated algorithms to curate portfolios aligned with specific ESG criteria, offering a niche yet rapidly expanding service. Furthermore, expansion into underserved markets, such as small and medium-sized enterprises (SMEs) requiring corporate finance or employee benefits planning, and younger demographics seeking early financial literacy and planning tools, presents substantial growth potential. Integration with broader financial ecosystems, including banking, lending, and insurance, also opens doors for comprehensive, holistic financial wellness platforms.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Adoption of Hybrid Robo-Advisory Models | +4.5% | Global, particularly Developed Markets | Short to Medium Term (2025-2030) |

| Increasing Demand for ESG and Sustainable Investing | +3.9% | Europe, North America | Medium to Long Term (2027-2033) |

| Expansion into Underserved Markets and Demographics | +3.2% | Asia Pacific, Latin America, Youth Segment | Medium to Long Term (2026-2033) |

| Integration with Broader Financial Ecosystems (e.g., Banking, Insurance) | +2.8% | Global | Long Term (2028-2033) |

Robo advisory Market Challenges Impact Analysis

The Robo advisory market, while dynamic and growing, faces several significant challenges that require strategic navigation for sustained success. Intense competition is a formidable challenge, with a crowded landscape of fintech startups, traditional financial institutions adapting their offerings, and tech giants potentially entering the space. This fierce competition leads to pressure on fees, requiring continuous innovation and differentiation to attract and retain clients, potentially impacting profitability for smaller players or those unable to scale efficiently.

Another critical challenge is maintaining customer engagement and trust in a purely digital environment. While initial adoption may be driven by convenience and cost, ensuring long-term loyalty requires more than just algorithmic portfolio management; it demands intuitive user experiences, responsive customer support, and clear communication, especially during market downturns. Attracting and retaining top talent, particularly those with expertise in both finance and advanced technology like AI and cybersecurity, also poses a significant hurdle, as these specialized skills are in high demand across various industries. Regulatory changes and compliance, especially across multiple jurisdictions, continue to be a moving target, demanding substantial resources and agile adaptation from robo-advisory firms.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition and Pressure on Fees | -4.5% | Global | Short to Medium Term (2025-2030) |

| Maintaining Customer Engagement and Trust in Digital Channels | -3.7% | Global | Medium Term (2026-2031) |

| Talent Acquisition and Retention in Niche Skillsets | -2.8% | North America, Europe | Long Term (2028-2033) |

| Evolving Regulatory Landscape and Compliance Burden | -3.0% | Global, particularly EU, Asia | Short to Medium Term (2025-2029) |

Robo advisory Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Robo advisory market, detailing its current size, historical performance, and future growth projections. It offers a meticulous breakdown of market dynamics, including key drivers, restraints, opportunities, and challenges influencing the industry landscape. The report delivers actionable insights through extensive segmentation analysis, covering various service types, models, end-users, asset classes, and deployment types. Furthermore, it highlights regional market performance, identifies key competitive strategies, and profiles leading market participants to offer a holistic understanding of the market ecosystem for strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.2 billion |

| Market Forecast in 2033 | USD 19.6 billion |

| Growth Rate | 25.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Vanguard Personal Advisor Services, Charles Schwab Intelligent Portfolios, Fidelity Go, Betterment, Wealthfront, Empower (Personal Capital), SoFi Invest, M1 Finance, Nutmeg (JPMorgan Chase), E*TRADE Core Portfolios, Merrill Guided Investing, Goldman Sachs Marcus Invest, Ellevest, Blooom, Stash, Acorns, SigFig, FutureAdvisor, Ally Invest, Invesco (Jemstep) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Robo advisory market is meticulously segmented to provide a granular understanding of its diverse components and target audiences. This segmentation allows for precise market sizing, trend identification, and strategic planning based on specific service offerings, technological models, client categories, and investment asset classes. Understanding these segments is crucial for market participants to identify lucrative niches, tailor their products, and effectively penetrate various market strata, ensuring that services align with distinct customer requirements and preferences across the financial spectrum.

- By Service Type: This segment includes specialized offerings like comprehensive financial planning, automated portfolio management, broader wealth management services, dedicated retirement planning, and efficient tax loss harvesting. Each service addresses specific client financial goals and needs.

- By Model Type: This categorizes robo-advisors based on their operational approach, distinguishing between pure robo-advisors, which are fully automated, and hybrid robo-advisors, which combine digital platforms with human advisor input for a balanced approach.

- By End-User: This segmentation focuses on the client base, including individual retail investors seeking basic investment guidance, high net worth individuals (HNWI) requiring more sophisticated and personalized wealth management solutions, and institutional investors looking for scalable advisory tools for large portfolios.

- By Asset Class: This segment delineates the types of assets managed by robo-advisors, such as equities, fixed income securities, exchange-traded funds (ETFs), mutual funds, and increasingly, alternative investments like real estate or cryptocurrencies.

- By Deployment Type: This refers to the technological infrastructure used, primarily distinguishing between cloud-based solutions, which offer scalability and accessibility, and on-premise solutions, often preferred by larger institutions for enhanced control and security.

Regional Highlights

- North America: Dominates the Robo advisory market, driven by high digital adoption rates, advanced financial infrastructure, and a strong presence of key market players, particularly in the United States and Canada. High financial literacy and a growing interest in self-directed and hybrid investment solutions further propel growth.

- Europe: Experiences significant growth, fueled by strong fintech innovation, increasing regulatory support for digital finance, and a growing consumer preference for cost-effective investment solutions. The United Kingdom, Germany, and the Nordic countries are at the forefront of adoption and technological development.

- Asia Pacific (APAC): Represents the fastest-growing region, characterized by a rapidly expanding middle class, increasing internet and smartphone penetration, and a substantial unbanked or underserved population seeking accessible financial services. Emerging economies like China and India are key growth engines.

- Latin America: Exhibits nascent but rapidly expanding adoption, driven by increasing smartphone penetration, a young demographic, and the need for greater financial inclusion. Countries like Brazil and Mexico are leading the digital transformation in financial services.

- Middle East and Africa (MEA): Shows emerging potential, particularly in the GCC countries, due to economic diversification initiatives, government support for digital transformation, and a growing affluent population seeking modern wealth management solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robo advisory Market.- Vanguard Personal Advisor Services

- Charles Schwab Intelligent Portfolios

- Fidelity Go

- Betterment

- Wealthfront

- Empower (Personal Capital)

- SoFi Invest

- M1 Finance

- Nutmeg (JPMorgan Chase)

- E*TRADE Core Portfolios

- Merrill Guided Investing

- Goldman Sachs Marcus Invest

- Ellevest

- Blooom

- Stash

- Acorns

- SigFig

- FutureAdvisor

- Ally Invest

- Invesco (Jemstep)

Frequently Asked Questions

Analyze common user questions about the Robo advisory market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a robo-advisor and how does it work?

A robo-advisor is a digital platform that provides automated, algorithm-driven financial planning services with little to no human supervision. It works by collecting information about your financial situation and risk tolerance through an online questionnaire, then uses algorithms to create and manage a diversified investment portfolio tailored to your goals.

Are robo-advisors suitable for all investors?

Robo-advisors are particularly suitable for new investors, those with smaller portfolios, and individuals who prefer a hands-off, low-cost approach to investing. While they offer excellent tools for basic financial planning and portfolio management, investors with complex financial situations, high net worth, or a strong preference for human interaction may find hybrid or traditional advisory services more appropriate.

What are the main benefits of using a robo-advisor?

The primary benefits of using a robo-advisor include lower fees compared to traditional financial advisors, greater accessibility to professional investment management, ease of use through digital platforms, automated portfolio rebalancing, and tax-loss harvesting capabilities. They democratize investment opportunities, making wealth management more affordable and convenient.

What are the potential risks or limitations of robo-advisors?

Potential risks and limitations include a lack of human personalized advice for complex situations, limited emotional support during market volatility, reliance on algorithms that may not capture unique individual nuances, and cybersecurity concerns. Some platforms may also offer a more limited range of investment products compared to traditional advisors.

How do hybrid robo-advisors differ from pure robo-advisors?

Pure robo-advisors offer fully automated, algorithm-driven services without human intervention. Hybrid robo-advisors, conversely, combine the efficiency and cost-effectiveness of automated platforms with the option of human financial advisor interaction. This blended model provides a balance of technology and personal guidance, catering to a wider range of investor preferences and needs.