Robo-advisor Market

Robo-advisor Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_678247 | Last Updated : July 21, 2025 |

Format : ![]()

![]()

![]()

![]()

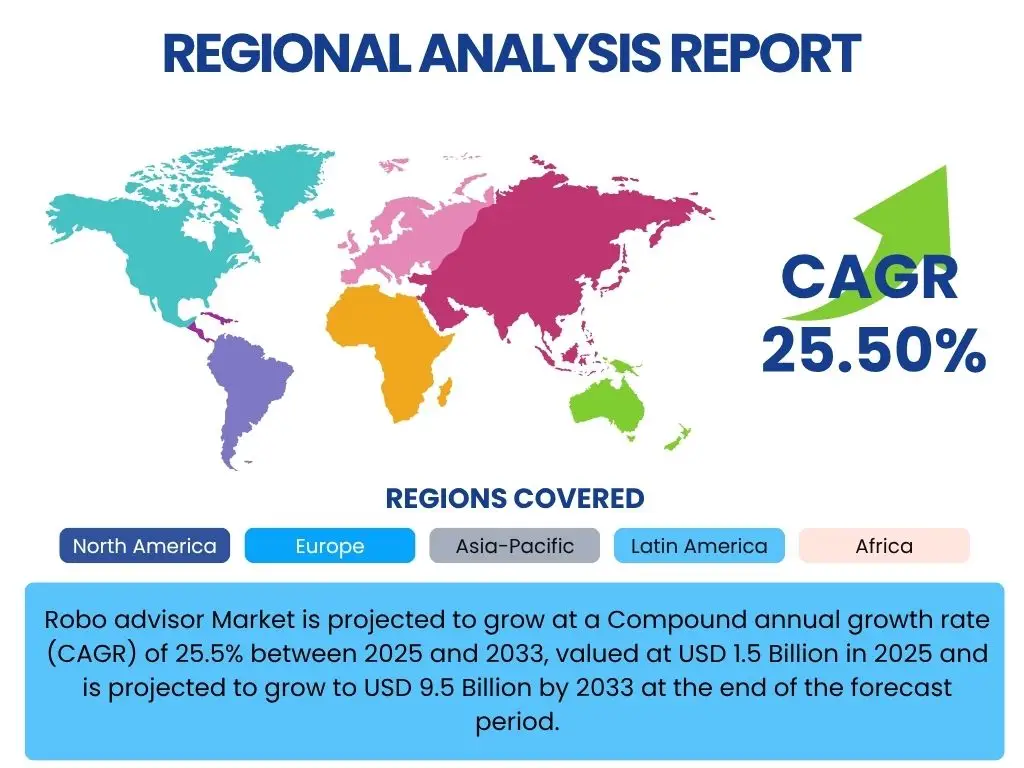

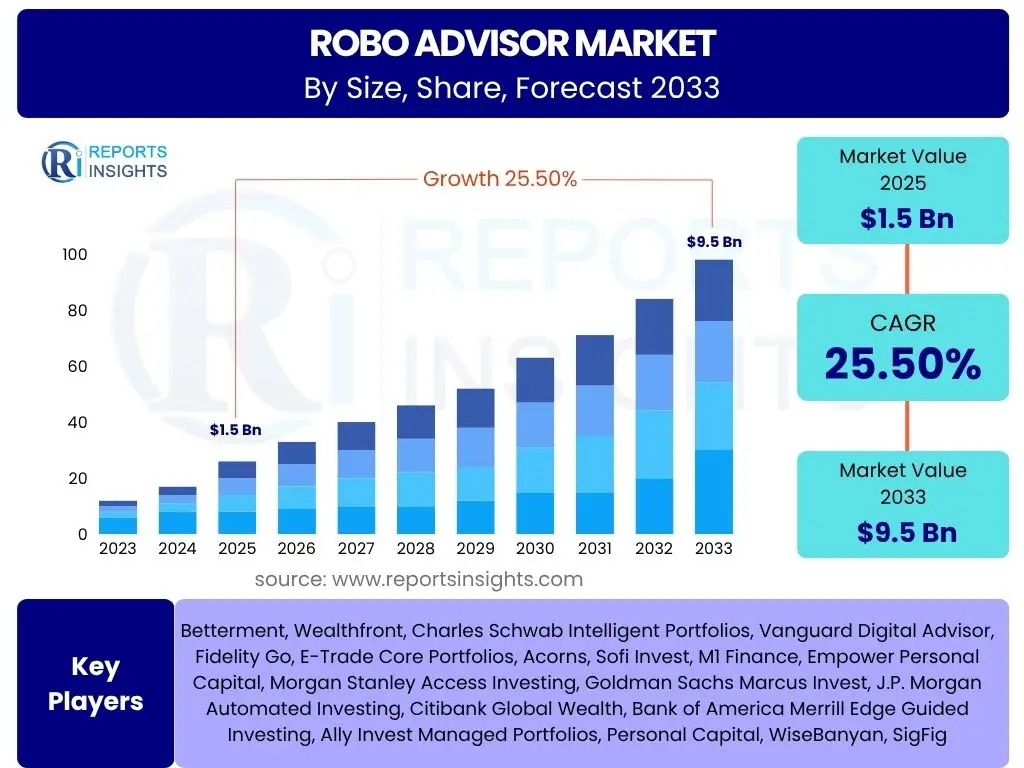

Robo-advisor Market is projected to grow at a Compound annual growth rate (CAGR) of 25.5% between 2025 and 2033, valued at USD 1.5 billion in 2025 and is projected to grow by USD 9.5 billion by 2033, the end of the forecast period.

Key Robo-advisor Market Trends & Insights

The robo-advisor market is experiencing dynamic shifts driven by evolving investor preferences, technological advancements, and a growing emphasis on accessible financial services. Key trends highlight a move towards more sophisticated, personalized, and integrated digital wealth management solutions that cater to a broader demographic. These trends underscore the market's maturity and its increasing role in democratizing financial advice.

- Increasing demand for personalized investment strategies.

- Growing adoption of hybrid models combining digital and human advice.

- Expansion into niche markets like ESG (Environmental, Social, and Governance) investing.

- Integration of advanced analytics for predictive insights.

- Rising focus on financial planning beyond just investment management.

- Cross-border expansion and localization of services.

- Emphasis on user experience and mobile-first platforms.

AI Impact Analysis on Robo-advisor

Artificial Intelligence (AI) stands as a foundational technology driving the evolution of robo-advisory platforms, enhancing their capabilities from basic automated portfolio management to highly sophisticated, predictive, and personalized financial guidance. AI's pervasive influence is transforming how investment decisions are made, how clients are serviced, and how operational efficiencies are achieved within the robo-advisor ecosystem. Its impact spans across various functions, making robo-advisors smarter, more responsive, and more accessible to a wider array of investors.

- Enhanced personalization through behavioral economics and predictive analytics.

- Automated portfolio rebalancing and tax-loss harvesting for optimized returns.

- Improved risk assessment and dynamic asset allocation based on real-time data.

- Advanced fraud detection and security protocols.

- Natural Language Processing (NLP) for intelligent client interactions and chatbots.

- Streamlined onboarding processes and continuous client engagement.

- Development of sophisticated financial planning tools and simulations.

Key Takeaways Robo-advisor Market Size & Forecast

- The global robo-advisor market is anticipated to reach a substantial valuation of USD 9.5 billion by 2033.

- The market is projected to expand at an impressive Compound Annual Growth Rate (CAGR) of 25.5% from 2025 to 2033.

- In 2025, the market size is estimated to be USD 1.5 billion, indicating a strong foundation for future growth.

- This significant growth trajectory highlights the increasing adoption of automated investment solutions worldwide.

- The forecast underscores a clear shift towards digital wealth management platforms as preferred investment vehicles.

- The market's expansion is driven by factors such as cost-effectiveness, accessibility, and technological advancements in financial technology.

Robo-advisor Market Drivers Impact Analysis

The growth of the robo-advisor market is significantly propelled by several key drivers that address fundamental shifts in investor behavior, technological capabilities, and economic realities. These drivers collectively contribute to the increasing attractiveness and adoption of automated investment platforms. The desire for more affordable, accessible, and efficient financial services underpins much of this momentum, pushing both new entrants and traditional financial institutions to embrace digital solutions.

Technological advancements, particularly in artificial intelligence and machine learning, are continuously refining robo-advisor capabilities, offering more sophisticated portfolio management and personalized advice. This evolution, coupled with a growing digitally native population and a heightened awareness of financial planning, ensures a robust demand environment for robo-advisory services. The market's expansion is not merely a trend but a fundamental reorientation of wealth management services towards a more inclusive and tech-driven future, making financial guidance available to a broader segment of the population.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Low-Cost Investment Solutions | +7.2% | Global, particularly North America, Europe, Asia Pacific | Short to Medium Term |

| Growing Adoption of Digital Platforms and Mobile Connectivity | +6.5% | Global, especially emerging markets in APAC and Latin America | Short to Medium Term |

| Technological Advancements in AI and Machine Learning | +5.8% | North America, Europe, China, India | Medium to Long Term |

| Rising Financial Literacy and Awareness Among Younger Generations | +4.0% | Global, with strong influence in developed economies | Medium Term |

| Supportive Regulatory Frameworks and Fintech Innovation Hubs | +2.0% | UK, Singapore, Switzerland, Australia, parts of EU | Medium to Long Term |

Robo-advisor Market Restraints Impact Analysis

While the robo-advisor market exhibits strong growth, it is not without its limitations and obstacles that could temper its expansion. These restraints often revolve around investor perceptions, regulatory complexities, and the inherent differences in service offerings compared to traditional financial advisory models. Addressing these challenges is crucial for sustained market development and widespread acceptance. Factors such as a preference for human interaction, particularly among high-net-worth individuals, and concerns over data security present notable hurdles.

Furthermore, the evolving and sometimes ambiguous regulatory landscape in different jurisdictions can create barriers to entry and expansion for robo-advisor firms. Despite their advantages, robo-advisors must continually build trust and demonstrate their value proposition effectively, especially when competing with long-established human advisor relationships. Overcoming these restraints will require innovation in service delivery, robust security measures, and proactive engagement with regulators to foster a more conducive operating environment.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Preference for Human Interaction and Personalized Advice | -4.5% | Global, particularly among high-net-worth individuals and older demographics | Medium to Long Term |

| Regulatory Uncertainty and Compliance Challenges | -3.0% | Europe (MiFID II), specific Asian markets, emerging economies | Short to Medium Term |

| Security and Data Privacy Concerns | -2.5% | Global, increasingly prominent due to data breaches | Short to Medium Term |

| Limited Service Offerings Compared to Traditional Advisors | -1.5% | Global, impacts clients requiring complex financial planning | Medium Term |

Robo-advisor Market Opportunities Impact Analysis

The robo-advisor market is poised for significant growth, driven by a myriad of emerging opportunities that capitalize on evolving market needs, technological advancements, and untapped demographic segments. These opportunities suggest a broadening scope for robo-advisors beyond basic investment management, encompassing a more holistic approach to financial well-being. The potential to serve traditionally underserved markets, combined with advancements in artificial intelligence and data analytics, creates fertile ground for innovation and expansion.

Furthermore, strategic partnerships with traditional financial institutions and the development of specialized services for niche investor needs present avenues for substantial market penetration. As digital literacy increases globally and investors seek more personalized yet cost-effective solutions, robo-advisors are uniquely positioned to capture new market share. Leveraging these opportunities will require agility, continuous innovation, and a keen understanding of diverse client requirements, enabling the market to realize its full growth potential and reshape the landscape of personal finance.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into New Demographics (Mass Affluent, Underserved Markets) | +6.8% | Emerging economies (APAC, Latin America, Africa), younger generations in developed markets | Medium to Long Term |

| Integration with Broader Financial Planning and Wealth Management Services | +5.5% | Global, especially North America and Europe | Medium Term |

| Development of Specialized Robo-advisory Services (e.g., ESG, Retirement Planning) | +4.2% | Global, driven by conscious investing trends and demographic shifts | Short to Medium Term |

| Strategic Partnerships with Traditional Financial Institutions | +3.0% | North America, Europe, Japan, Australia | Medium Term |

| Geographic Expansion into Untapped or Underpenetrated Markets | +2.5% | Southeast Asia, Middle East, parts of Latin America and Africa | Medium to Long Term |

Robo-advisor Market Challenges Impact Analysis

Despite significant opportunities, the robo-advisor market faces several persistent challenges that demand strategic attention from market participants. These challenges range from intense competition and the need for continuous technological innovation to building and maintaining client trust in a largely automated environment. Overcoming these hurdles is essential for firms aiming to sustain growth and secure a dominant position in this evolving financial landscape.

Moreover, the market must navigate the complexities of client acquisition and retention, particularly as the novelty of digital advisory services matures. Adapting to evolving regulatory requirements across diverse geographies also presents a substantial operational challenge. Successfully addressing these issues will require a blend of technological prowess, robust marketing strategies, and a deep understanding of client needs and expectations, ensuring that robo-advisors remain a viable and trusted option for investors globally.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition from New Entrants and Established Players | -4.0% | Global, particularly competitive in mature markets like North America | Short to Medium Term |

| Client Acquisition and Retention in a Crowded Market | -3.5% | Global, applies to all market players | Short to Medium Term |

| Maintaining Trust and Credibility in Automated Services | -2.8% | Global, crucial for client adoption | Medium to Long Term |

| Adapting to Evolving Technological Landscapes and User Expectations | -2.0% | Global, especially in tech-savvy regions | Short to Medium Term |

Robo-advisor Market - Updated Report Scope

This comprehensive market research report on the Robo-advisor Market provides an in-depth analysis of industry trends, market dynamics, and future growth projections. It serves as a vital resource for stakeholders seeking to understand the current landscape and capitalize on emerging opportunities. The report encompasses detailed segmentation, regional insights, competitive analysis of key players, and an updated scope designed to offer a holistic view of this rapidly evolving sector. It aims to equip business professionals and decision-makers with actionable intelligence to navigate the complexities and capitalize on the immense potential of the robo-advisory space.

| Report Attributes | Report Details |

|---|---|

| Report Name | Robo-advisor Market |

| Market Size in 2025 | USD 1.5 billion |

| Market Forecast in 2033 | USD 9.5 billion |

| Growth Rate | CAGR of 25.5% from 2025 to 2033 |

| Number of Pages | 180 |

| Key Companies Covered | Betterment, FutureAdvisor, Personal Capital, Vanguard Personal Advisor, Wealthfront, WiseBanyan, SigFig Wealth Management, Schwab Intelligent Portfolios, SoFi Wealth, Wealthsimple, Ellevest |

| Segments Covered | By Type, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Customization Scope | Avail customised purchase options to meet your exact research needs. Request For Customization |

Segmentation Analysis

Market Product Type Segmentation:- Free

- Charge

- Healthcare

- Retail

- Education

- Others

Regional Highlights

- North America: This region stands as the leading market for robo-advisors, largely due to its early adoption of fintech, high digital literacy rates, and a robust regulatory environment that supports innovation. The presence of major market players and a significant population seeking cost-effective investment solutions further solidify its dominance. The United States, in particular, is a hotbed for robo-advisory innovation and adoption.

- Europe: Europe represents a significant market with diverse growth patterns across its sub-regions. Countries like the UK, Germany, and Switzerland are witnessing substantial adoption, driven by evolving regulatory frameworks (such as MiFID II encouraging transparency and lower fees) and a growing demand for accessible digital wealth management. Nordic countries also show high digital penetration and readiness for robo-advisory services.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the robo-advisor market. This growth is fueled by a rapidly expanding middle class, increasing internet and smartphone penetration, and a burgeoning affluent population looking for efficient investment tools. Countries like China, India, Singapore, and Australia are at the forefront, with supportive government initiatives and a high propensity for digital adoption.

- Latin America: While still nascent, the Latin American market is exhibiting promising growth. Increasing financial inclusion efforts, growing digital infrastructure, and a young, tech-savvy demographic are contributing to the rising interest in robo-advisory services. Countries like Brazil and Mexico are emerging as key potential markets.

- Middle East and Africa (MEA): The MEA region is experiencing gradual adoption, driven by government-led digital transformation initiatives and an increasing awareness of financial planning. Although smaller in market share, the region presents long-term opportunities as economic diversification and digital infrastructure development continue.

Top Key Players:

The market research report covers the analysis of key stake holders of the Robo-advisor Market. Some of the leading players profiled in the report include -:- Betterment

- FutureAdvisor

- Personal Capital

- Vanguard Personal Advisor

- Wealthfront

- WiseBanyan

- SigFig Wealth Management

- Schwab Intelligent Portfolios

- SoFi Wealth

- Wealthsimple

- Ellevest

Frequently Asked Questions:

What is a robo-advisor?

A robo-advisor is an automated digital platform that provides algorithm-driven financial planning services with little to no human supervision. These platforms use computer algorithms to manage investment portfolios based on an investor's goals, risk tolerance, and time horizon, typically at a lower cost than traditional human financial advisors. They automate various tasks, including portfolio rebalancing, tax-loss harvesting, and asset allocation, making investment management accessible and efficient for a broad range of individuals.

How do robo-advisors work?

Robo-advisors typically begin by asking clients to complete an online questionnaire to assess their financial goals, risk tolerance, investment horizon, and existing assets. Based on this information, the platform's algorithms construct a diversified investment portfolio, usually consisting of exchange-traded funds (ETFs) or mutual funds, tailored to the client's profile. These platforms then automate the management of the portfolio, including regular rebalancing to maintain the target asset allocation and sometimes optimizing for tax efficiency. Clients can typically monitor their investments through user-friendly online dashboards or mobile applications.

What are the primary benefits of using a robo-advisor?

The primary benefits of using a robo-advisor include significantly lower fees compared to traditional financial advisors, greater accessibility to professional investment management services, and enhanced convenience through digital platforms. Robo-advisors offer diversified portfolios, automated rebalancing, and often tax-loss harvesting, which can improve after-tax returns. Their data-driven, emotion-free approach helps in consistent investment decisions, making them ideal for new investors, those with smaller portfolios, or individuals seeking a hands-off investment approach.

Are robo-advisors secure and regulated?

Yes, reputable robo-advisors are generally secure and regulated. In many major markets, they are subject to regulatory oversight by financial authorities, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the UK, similar to traditional financial advisors. They employ robust cybersecurity measures, including encryption and multi-factor authentication, to protect client data and funds. Additionally, client accounts are typically protected by investor protection schemes, such as SIPC in the U.S., which safeguards against the loss of cash and securities in case of a firm's failure, though it does not protect against market fluctuations.

Who should consider using a robo-advisor?

Robo-advisors are an excellent option for individuals who are new to investing, have limited capital to start, or prefer a low-cost, hands-off approach to managing their investments. They are also suitable for those who are comfortable with digital platforms and do not require extensive personalized human interaction for financial advice. Millennials and Gen Z, who are tech-savvy and often prioritize convenience and affordability, typically find robo-advisors particularly appealing. However, even experienced investors seeking to automate portfolio management or optimize tax strategies can benefit from their services.