Recovered Carbon Black Market

Recovered Carbon Black Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707297 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Recovered Carbon Black Market Size

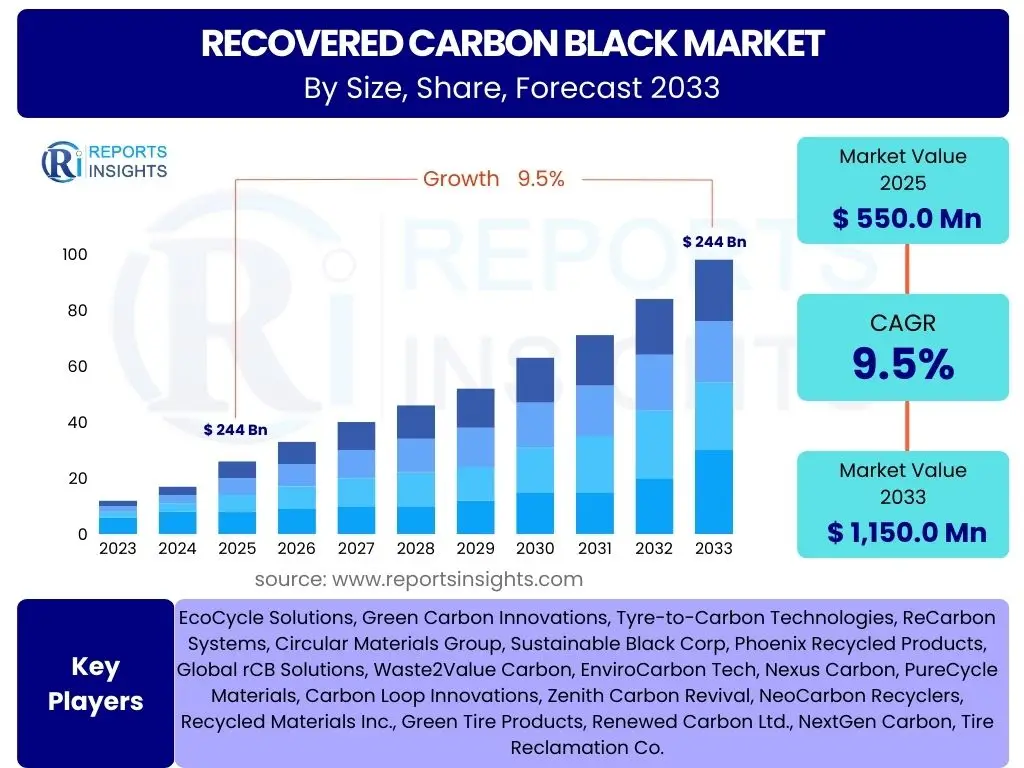

According to Reports Insights Consulting Pvt Ltd, The Recovered Carbon Black Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2033. The market is estimated at USD 550.0 million in 2025 and is projected to reach USD 1,150.0 million by the end of the forecast period in 2033.

Key Recovered Carbon Black Market Trends & Insights

The Recovered Carbon Black (rCB) market is experiencing significant evolution, driven by a global pivot towards sustainable manufacturing practices and circular economy principles. A primary trend involves the increasing adoption of rCB across diverse industries, moving beyond its traditional use in tire manufacturing to encompass applications in non-tire rubber products, plastics, coatings, and specialized industrial formulations. This expansion is largely fueled by heightened environmental awareness among consumers and stringent regulatory frameworks worldwide that promote waste recycling and mandate the use of recycled content.

Technological advancements in pyrolysis and other recovery processes are another critical trend, leading to improvements in the quality, consistency, and purity of rCB. These innovations are addressing historical challenges related to rCB's performance variability, making it a more viable and competitive alternative to virgin carbon black. Furthermore, strategic collaborations and partnerships across the value chain, from end-of-life tire collection to rCB producers and end-users, are accelerating market growth by ensuring a stable supply of raw materials and fostering greater market acceptance for rCB products.

Moreover, the focus on developing application-specific grades of rCB is gaining traction. Manufacturers are investing in research and development to tailor rCB properties such as particle size, surface area, and conductivity to meet the precise requirements of various end-use applications, thereby unlocking new market opportunities. The integration of digital technologies for supply chain optimization and quality control also represents an emerging trend, enhancing efficiency and reliability within the rCB ecosystem.

- Increasing adoption of circular economy principles across industries.

- Technological advancements in pyrolysis and purification leading to higher quality rCB.

- Expansion of rCB applications beyond tires to plastics, coatings, and industrial rubber.

- Growing focus on sustainability and environmental regulations driving demand.

- Development of application-specific rCB grades for enhanced performance.

- Strategic partnerships and collaborations enhancing supply chain efficiency and market acceptance.

AI Impact Analysis on Recovered Carbon Black

The integration of Artificial Intelligence (AI) and machine learning technologies holds transformative potential for the Recovered Carbon Black (rCB) market, addressing several key challenges and unlocking new efficiencies. Users frequently inquire about AI's role in optimizing the complex pyrolysis process, enhancing material quality consistency, and streamlining supply chain logistics. AI algorithms can analyze vast datasets from pyrolysis reactors, including temperature profiles, gas compositions, and product yields, to predict optimal operating parameters for maximizing rCB output and ensuring consistent quality, thereby reducing operational inefficiencies and waste.

Furthermore, AI is expected to revolutionize quality control and characterization of rCB. By applying machine vision and advanced analytical techniques, AI systems can rapidly assess particle size distribution, surface area, and other critical material properties, ensuring that each batch meets stringent specifications. This automation of quality assurance processes minimizes human error, accelerates product development cycles, and builds greater confidence among end-users regarding rCB's reliability as a substitute for virgin carbon black. The ability of AI to predict potential equipment failures and optimize maintenance schedules through predictive analytics also contributes to higher plant uptime and reduced operational costs.

In the realm of supply chain management, AI can significantly enhance the efficiency of raw material sourcing and logistics for end-of-life tires. AI-powered demand forecasting, route optimization, and inventory management systems can ensure a steady and cost-effective supply of feedstock to rCB producers, mitigating supply chain disruptions. Moreover, AI can assist in market analysis by identifying emerging trends, predicting demand shifts, and optimizing pricing strategies, providing companies with a competitive edge and fostering more agile business operations within the evolving rCB landscape.

- Optimization of pyrolysis processes for improved yield and efficiency.

- Enhanced quality control and material characterization through machine learning.

- Predictive maintenance for pyrolysis reactors and related machinery.

- Streamlined supply chain logistics and raw material sourcing.

- Advanced demand forecasting and market analysis for strategic planning.

Key Takeaways Recovered Carbon Black Market Size & Forecast

The Recovered Carbon Black (rCB) market is poised for robust growth over the forecast period, driven by a confluence of environmental imperatives, economic advantages, and technological advancements. A significant takeaway is the market's strong projected Compound Annual Growth Rate (CAGR), indicating increasing industrial acceptance and investment. This growth is underpinned by the rising global demand for sustainable materials and a heightened focus on circular economy models, making rCB an attractive alternative to traditional carbon black, particularly in industries striving for a reduced carbon footprint.

Another crucial insight is the expanding application landscape for rCB. While tire manufacturing remains a foundational segment, the market's future growth will increasingly depend on its penetration into non-tire rubber products, plastics, and coatings. This diversification signifies a maturing market where rCB is recognized for its versatility and performance attributes across a broader range of industrial applications. The continuous innovation in rCB production processes, which addresses historical challenges related to consistency and purity, is a critical enabler for this application expansion.

Furthermore, regulatory support and increasing corporate sustainability commitments are acting as powerful accelerators for market expansion. Governments globally are implementing policies that encourage waste tire recycling and the use of recycled content, thereby creating a favorable environment for rCB producers. The competitive pricing of rCB compared to virgin carbon black, coupled with its environmental benefits, positions it as a compelling choice for manufacturers seeking both economic and ecological advantages, collectively painting a positive outlook for market development.

- Strong market growth driven by sustainability and circular economy trends.

- Expanding applications beyond tires, especially in non-tire rubber, plastics, and coatings.

- Technological advancements improving rCB quality and consistency.

- Favorable regulatory environment and corporate sustainability goals boosting demand.

- Economic competitiveness of rCB compared to virgin carbon black.

Recovered Carbon Black Market Drivers Analysis

The Recovered Carbon Black (rCB) market is propelled by a robust set of drivers primarily centered on environmental sustainability, economic viability, and evolving industrial demands. A key driver is the escalating global emphasis on circular economy principles, which encourages the reuse of materials and reduction of waste. This societal and regulatory shift significantly boosts the demand for rCB as a sustainable alternative to virgin carbon black, enabling industries to meet their environmental, social, and governance (ESG) targets and reduce their carbon footprint.

Another significant driver is the increasing production of end-of-life tires (ELTs) globally, which serves as the primary feedstock for rCB production. With stricter regulations on tire disposal methods, such as landfill bans and incineration restrictions, the focus has shifted towards recycling and recovery, thereby ensuring a steady and growing supply of raw material for the rCB industry. This abundant and readily available feedstock mitigates supply chain risks and supports the scalability of rCB production facilities.

Moreover, the fluctuating and often high prices of crude oil, a key raw material for virgin carbon black, make rCB an economically attractive option for manufacturers. As industries seek cost-effective solutions without compromising performance, rCB offers a competitive pricing advantage, especially when coupled with its environmental benefits. The continuous advancements in pyrolysis technology also contribute to efficiency and quality improvements, making rCB more appealing to a broader range of applications and further driving market expansion.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing demand for sustainable and recycled materials | +2.5% | Global, particularly Europe, North America, APAC | 2025-2033 |

| Increasing volume of end-of-life tires (ELTs) | +1.8% | Global, especially China, India, USA | 2025-2030 |

| Fluctuating and high prices of virgin carbon black | +1.5% | Global | 2025-2033 |

| Supportive government regulations and policies on tire recycling | +1.2% | Europe, North America, Japan | 2025-2030 |

Recovered Carbon Black Market Restraints Analysis

Despite its significant growth potential, the Recovered Carbon Black (rCB) market faces several notable restraints that could temper its expansion. One primary challenge is the inconsistent quality and variability of rCB, largely due to the diverse composition of end-of-life tires (ELTs) and variations in pyrolysis processes. This inconsistency can make it difficult for rCB to consistently meet the stringent quality specifications required by certain high-performance applications, leading to slower adoption rates by some manufacturers who prioritize consistent material properties above all else.

Another significant restraint is the competitive pricing of virgin carbon black, especially when crude oil prices are low. While rCB offers environmental benefits, its cost-effectiveness can be challenged by the economies of scale and established supply chains of virgin carbon black producers. This price sensitivity, particularly in cost-conscious industries, can limit the willingness of some businesses to switch to rCB, despite its sustainability advantages, unless there are strong regulatory or consumer pressures.

Furthermore, the logistical complexities and high initial capital investment required for establishing efficient ELT collection, sorting, and pyrolysis infrastructure pose a barrier to entry and expansion for rCB producers. Ensuring a consistent, clean, and segregated supply of ELTs across various regions can be challenging, leading to supply chain bottlenecks. The need for significant upfront investment in advanced pyrolysis technology and processing facilities also limits the number of new market entrants and can slow down the overall scaling of the industry, particularly in developing regions with less established recycling infrastructure.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Inconsistent quality and performance of rCB compared to virgin carbon black | -1.8% | Global | 2025-2033 |

| Price competitiveness of virgin carbon black, especially during low oil prices | -1.5% | Global | 2025-2030 |

| High capital investment and logistical complexities for rCB production | -1.0% | Developing Regions, Emerging Markets | 2025-2030 |

| Limited awareness and market acceptance in certain industrial sectors | -0.8% | APAC, Latin America | 2028-2033 |

Recovered Carbon Black Market Opportunities Analysis

The Recovered Carbon Black (rCB) market is rich with opportunities, primarily driven by the expanding scope of its applications and the increasing global emphasis on sustainable solutions. A significant opportunity lies in the diversification of rCB usage beyond its conventional application in tires to encompass a broader spectrum of non-tire rubber products, plastics, coatings, and specialized industrial uses. As manufacturers in these sectors seek to integrate recycled content into their products to meet consumer demand and regulatory mandates, the market for tailor-made rCB grades with specific properties is expected to witness substantial growth, opening up new revenue streams for producers.

Moreover, technological advancements in pyrolysis and post-processing techniques present a critical opportunity to overcome current quality inconsistencies and enhance the performance attributes of rCB. Investments in research and development aimed at improving the purity, consistency, and particle morphology of rCB can unlock premium applications and command higher prices. Innovations such as advanced purification methods, surface modification techniques, and precise material characterization will be instrumental in positioning rCB as a direct, high-performance substitute for virgin carbon black in demanding applications, thereby expanding its market reach and value.

Strategic collaborations and partnerships across the value chain, from tire collection entities to rCB producers and end-use manufacturers, represent another major opportunity. Such alliances can ensure a stable and high-quality feedstock supply, facilitate market penetration, and accelerate the development of new rCB-based products. Furthermore, the burgeoning demand for sustainable solutions in emerging economies, coupled with growing environmental awareness and improving recycling infrastructure in these regions, offers significant untapped market potential for rCB producers looking to expand their geographical footprint and capture new customer segments.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into non-tire rubber, plastics, and coatings applications | +2.0% | Global, particularly North America, Europe, China | 2025-2033 |

| Technological advancements improving rCB quality and performance | +1.7% | Global | 2025-2033 |

| Strategic partnerships and collaborations across the value chain | +1.3% | Global | 2025-2030 |

| Untapped market potential in emerging economies with growing recycling infrastructure | +1.0% | India, Southeast Asia, Latin America | 2028-2033 |

Recovered Carbon Black Market Challenges Impact Analysis

The Recovered Carbon Black (rCB) market, despite its promising trajectory, confronts several significant challenges that necessitate strategic navigation for sustained growth. A primary challenge revolves around achieving consistent feedstock quality from end-of-life tires (ELTs). The heterogeneous nature of ELT streams, containing various tire types, non-rubber components, and contaminants, directly impacts the purity and performance consistency of the resulting rCB. This variability poses a hurdle for rCB producers aiming to supply materials that consistently meet stringent industrial specifications, particularly for high-value applications where material homogeneity is critical.

Another substantial challenge is the need for greater market acceptance and standardization of rCB products. Despite increasing environmental awareness, some end-use industries remain hesitant to fully adopt rCB due to perceived performance limitations or a lack of standardized testing protocols and specifications. Establishing industry-wide standards for rCB quality, properties, and applications is crucial to build confidence among potential users and facilitate broader market penetration. This requires collaborative efforts across the industry, including producers, regulatory bodies, and end-users, to develop universally recognized benchmarks.

Furthermore, scaling up production capacities to meet anticipated demand while maintaining economic viability and environmental compliance presents a considerable challenge. The initial investment in advanced pyrolysis technologies and related infrastructure can be substantial, and securing permits for large-scale operations can be complex due to regulatory hurdles and community concerns regarding processing facilities. Ensuring sustainable and cost-effective feedstock collection and logistics on a larger scale also adds to the operational complexities, requiring robust supply chain management solutions to overcome these scaling difficulties and capitalize on market opportunities.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Achieving consistent quality and purity of rCB from varied feedstock | -1.9% | Global | 2025-2033 |

| Lack of standardized specifications and testing methods for rCB | -1.4% | Global | 2025-2030 |

| Scaling up production capacity and associated capital investments | -1.1% | Global, particularly developing markets | 2025-2030 |

| Competition from established virgin carbon black suppliers and alternative fillers | -0.9% | Global | 2028-2033 |

Recovered Carbon Black Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Recovered Carbon Black (rCB) market, covering historical performance, current market dynamics, and future growth projections. It offers detailed insights into market size, segmentation by various criteria, regional analysis, competitive landscape, and key trends shaping the industry. The report aims to equip stakeholders with critical data and strategic intelligence to navigate the evolving market and identify lucrative opportunities for investment and growth.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 550.0 million |

| Market Forecast in 2033 | USD 1,150.0 million |

| Growth Rate | 9.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | EcoCycle Solutions, Green Carbon Innovations, Tyre-to-Carbon Technologies, ReCarbon Systems, Circular Materials Group, Sustainable Black Corp, Phoenix Recycled Products, Global rCB Solutions, Waste2Value Carbon, EnviroCarbon Tech, Nexus Carbon, PureCycle Materials, Carbon Loop Innovations, Zenith Carbon Revival, NeoCarbon Recyclers, Recycled Materials Inc., Green Tire Products, Renewed Carbon Ltd., NextGen Carbon, Tire Reclamation Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Recovered Carbon Black (rCB) market is comprehensively segmented to provide a granular view of its diverse applications, production methodologies, and end-use industries, enabling a deeper understanding of market dynamics and growth opportunities. This segmentation highlights the various avenues through which rCB is being integrated into industrial processes and products, reflecting its growing versatility and acceptance as a sustainable material. Each segment offers unique insights into demand patterns, technological preferences, and regional adoption rates, contributing to a holistic market overview.

The primary segmentation by application illustrates rCB's usage across major industries, with tire manufacturing historically being the largest consumer, gradually expanding into non-tire rubber products, plastics, and coatings due to increasing demand for recycled content. Segmentation by type differentiates between various recovery processes, primarily pyrolysis-based methods which dominate the market due to their efficiency and scalability. Furthermore, the segmentation by end-use industry provides a detailed look at sectors like automotive, industrial rubber, and construction, showcasing how different industries are incorporating rCB to meet their specific material and sustainability requirements, thereby driving specialized demand and innovation within the market.

- By Application:

- Tires

- Non-Tire Rubber

- Plastics

- Coatings

- Inks

- Others (e.g., Adhesives, Sealants)

- By Type:

- Pyrolysis-based Recovered Carbon Black

- Gasification-based Recovered Carbon Black

- Other Recycling Methods (e.g., De-vulcanization)

- By End-Use Industry:

- Automotive (Tires, Automotive Parts)

- Industrial Rubber Products (Belts, Hoses, Gaskets)

- Building & Construction (Roofing, Sealants)

- Paints & Coatings

- Consumer Goods

- Others (e.g., Wire & Cable, Sporting Goods)

Regional Highlights

- North America: The region is a significant market for rCB, driven by stringent environmental regulations, a robust automotive industry, and increasing corporate sustainability initiatives. The United States and Canada are leading the adoption, with strong investments in tire recycling infrastructure and a growing consumer preference for eco-friendly products. Innovation in pyrolysis technologies and strategic collaborations also contribute to market expansion.

- Europe: Europe stands as a pioneer in the circular economy, with favorable government policies and directives on waste management and recycling strongly propelling the rCB market. Countries like Germany, the UK, and France are at the forefront, emphasizing sustainable manufacturing processes and the integration of recycled materials in various industries. High awareness regarding carbon footprint reduction further fuels demand.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily due to the large volume of end-of-life tires generated, rapidly expanding manufacturing sectors, and increasing environmental concerns. China, India, and Japan are key contributors, with rising industrial production, growing automotive markets, and emerging government support for recycling initiatives creating substantial opportunities for rCB adoption.

- Latin America: This region presents emerging opportunities for the rCB market, driven by increasing industrialization, growing environmental awareness, and developing waste management infrastructures. Countries like Brazil and Mexico are witnessing a gradual shift towards sustainable practices in their manufacturing sectors, indicating potential for future growth in rCB adoption as recycling capabilities improve.

- Middle East and Africa (MEA): While currently a smaller market, MEA shows potential for rCB growth as industrial diversification and sustainable development initiatives gain traction. Investments in infrastructure and manufacturing, coupled with a nascent but growing focus on waste recycling, are expected to create future demand. The region's large vehicle fleets will eventually contribute to the supply of end-of-life tires.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recovered Carbon Black Market.- EcoCycle Solutions

- Green Carbon Innovations

- Tyre-to-Carbon Technologies

- ReCarbon Systems

- Circular Materials Group

- Sustainable Black Corp

- Phoenix Recycled Products

- Global rCB Solutions

- Waste2Value Carbon

- EnviroCarbon Tech

- Nexus Carbon

- PureCycle Materials

- Carbon Loop Innovations

- Zenith Carbon Revival

- NeoCarbon Recyclers

- Recycled Materials Inc.

- Green Tire Products

- Renewed Carbon Ltd.

- NextGen Carbon

- Tire Reclamation Co.

Frequently Asked Questions

Analyze common user questions about the Recovered Carbon Black market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Recovered Carbon Black (rCB)?

Recovered Carbon Black (rCB) is a sustainable material produced through the pyrolysis of end-of-life tires (ELTs). It serves as an environmentally friendly alternative or supplement to virgin carbon black, which is derived from fossil fuels. rCB helps reduce tire waste and lowers the carbon footprint of various manufactured products.

How is rCB produced, and what are its primary applications?

rCB is primarily produced by pyrolyzing end-of-life tires in an oxygen-free environment, which breaks down the rubber into oil, gas, and solid carbonaceous residue, which is then processed into rCB. Its primary applications include use in tires, non-tire rubber products (e.g., belts, hoses), plastics, coatings, and inks, providing reinforcement and pigment properties.

What are the key benefits of using Recovered Carbon Black?

The key benefits of using rCB include significant environmental advantages such as diverting waste tires from landfills, reducing greenhouse gas emissions compared to virgin carbon black production, and conserving fossil resources. Additionally, rCB often offers cost efficiencies and supports circular economy initiatives within industries.

What are the main challenges facing the rCB market?

The main challenges in the rCB market include ensuring consistent product quality due to feedstock variability, achieving broader market acceptance and standardization, and the high initial capital investment required for pyrolysis facilities. Competition from lower-priced virgin carbon black, especially during periods of low crude oil prices, also poses a challenge.

What is the future outlook for the Recovered Carbon Black market?

The future outlook for the Recovered Carbon Black market is highly positive, driven by increasing global demand for sustainable materials, stringent environmental regulations on waste tire disposal, and ongoing technological advancements improving rCB quality. The market is projected for substantial growth, with expanding applications across diverse industries seeking to enhance their sustainability profiles.