Automotive Carbon Thermoplastic Market

Automotive Carbon Thermoplastic Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706970 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive Carbon Thermoplastic Market Size

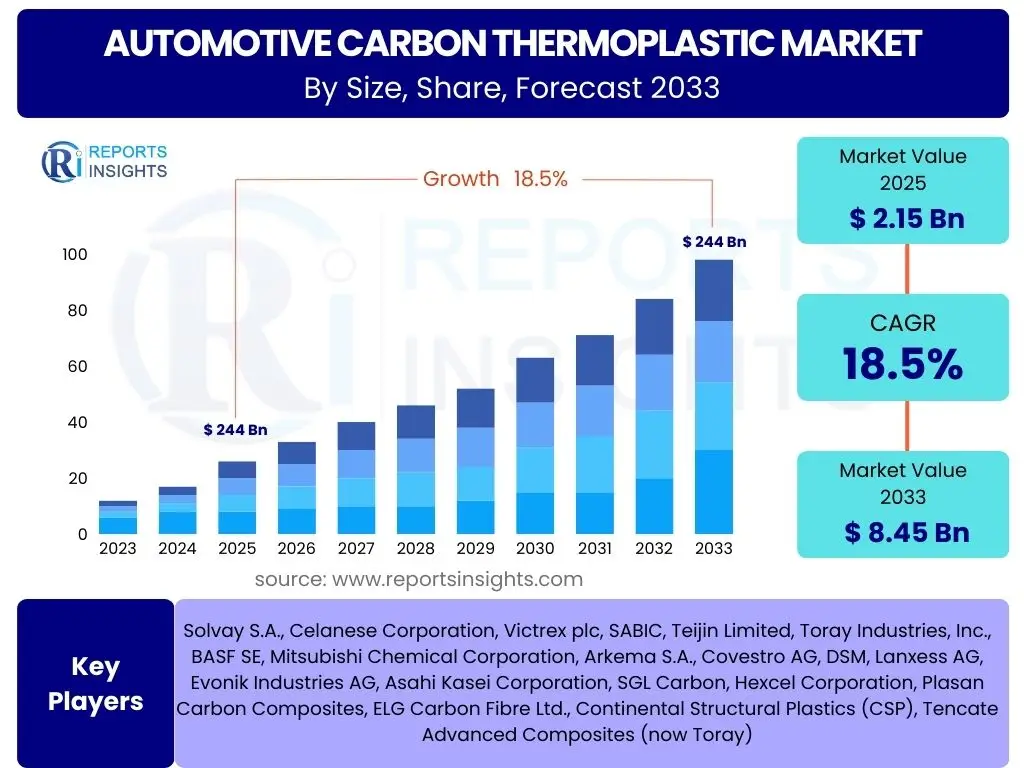

According to Reports Insights Consulting Pvt Ltd, The Automotive Carbon Thermoplastic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 2.15 Billion in 2025 and is projected to reach USD 8.45 Billion by the end of the forecast period in 2033.

The burgeoning demand for lightweight materials in the automotive industry, primarily driven by stringent emission regulations and the rapid electrification of vehicles, is a significant catalyst for this robust growth. Carbon thermoplastics offer an exceptional strength-to-weight ratio, enabling vehicle manufacturers to reduce overall vehicle mass, which directly translates into improved fuel efficiency for internal combustion engine (ICE) vehicles and extended range for electric vehicles (EVs). This inherent advantage positions carbon thermoplastics as a critical material in the ongoing transformation of the automotive sector.

Furthermore, advancements in manufacturing technologies, such as automated fiber placement, injection molding, and additive manufacturing techniques tailored for these advanced composites, are contributing to increased adoption. These technologies enable higher production rates and more complex component designs, making carbon thermoplastics a viable alternative to traditional metallic structures. The ability to produce high-performance parts with reduced cycle times and lower energy consumption compared to thermoset composites further enhances their attractiveness to original equipment manufacturers (OEMs).

Key Automotive Carbon Thermoplastic Market Trends & Insights

User inquiries frequently focus on the transformative shifts impacting material selection in the automotive sector, with a keen interest in how carbon thermoplastics align with future vehicle architectures and sustainability goals. Key questions revolve around the influence of electric vehicle proliferation, the drive for enhanced performance and safety, and the industry's push towards more sustainable and circular material economies. There is also significant curiosity regarding manufacturing innovations that promise to make these advanced materials more cost-effective and scalable for mass production.

The market is currently undergoing a significant evolution, propelled by a confluence of technological advancements and changing industry demands. One prominent trend is the increasing integration of carbon thermoplastics in structural battery enclosures and crash management systems for electric vehicles, where their lightweighting capabilities and energy absorption properties are highly advantageous. This application area is experiencing exponential growth, distinguishing carbon thermoplastics from traditional materials. Another critical trend is the development of thermoplastic matrices with improved high-temperature performance, creep resistance, and chemical stability, enabling their use in more demanding under-the-hood and powertrain applications, which were previously dominated by metals or thermosets.

Furthermore, the focus on recyclability and circular economy principles is shaping material development and processing techniques. Carbon thermoplastics, unlike their thermoset counterparts, offer the potential for remolding and recycling, which is becoming a non-negotiable criterion for many automotive manufacturers aiming to meet sustainability targets. This has spurred innovation in recycling processes and the development of recycled carbon fiber-reinforced thermoplastic compounds. Concurrent advancements in rapid manufacturing processes, such as thermoplastic composite overmolding and automated preform manufacturing, are enhancing production efficiency and reducing cycle times, making the large-scale adoption of these materials more economically viable for high-volume automotive platforms.

- Growing adoption in Electric Vehicle (EV) battery structures and chassis for range extension.

- Development of high-performance thermoplastic matrices for elevated temperature applications.

- Increasing emphasis on recyclable and sustainable carbon thermoplastic solutions.

- Advancements in automated manufacturing processes for high-volume production.

- Integration of multi-material designs leveraging thermoplastic composites for optimized performance.

- Expansion of applications beyond structural components to interior and exterior parts.

AI Impact Analysis on Automotive Carbon Thermoplastic

User questions related to the impact of AI on the Automotive Carbon Thermoplastic market often explore its potential to revolutionize material design, optimize manufacturing processes, and enhance supply chain efficiency. There's a strong interest in how AI can accelerate the discovery of new material formulations, predict material performance under various conditions, and streamline complex production workflows. Concerns frequently include the data requirements for effective AI implementation and the integration challenges with existing industrial systems.

Artificial intelligence is poised to significantly transform the Automotive Carbon Thermoplastic market across several critical dimensions, from material discovery and design to manufacturing optimization and quality control. In the realm of material science, AI algorithms can rapidly analyze vast datasets of material properties, predict the performance of novel thermoplastic composite formulations, and even suggest new material combinations with desired characteristics. This capability significantly accelerates the R&D cycle, reducing the time and cost associated with experimental trials and enabling engineers to virtually prototype and iterate on material compositions before physical production, thereby unlocking hitherto unexplored material capabilities and applications.

Furthermore, AI-driven solutions are enhancing the efficiency and precision of manufacturing processes for carbon thermoplastics. Machine learning algorithms can optimize parameters for injection molding, compression molding, and automated fiber placement, ensuring consistent product quality, minimizing waste, and maximizing throughput. Predictive maintenance using AI can anticipate equipment failures, reducing downtime and operational costs. In quality control, computer vision systems powered by AI can detect microscopic defects in composite laminates or molded parts with unprecedented accuracy and speed, ensuring that only components meeting stringent automotive standards proceed to assembly. This comprehensive impact across the value chain positions AI as a crucial enabler for the widespread adoption and performance enhancement of carbon thermoplastics in the automotive industry.

- Accelerated material discovery and optimization through AI-driven simulations and data analysis.

- Enhanced manufacturing process control and efficiency via AI-powered predictive analytics for molding and layup.

- Improved quality assurance and defect detection in composite parts using AI-based computer vision.

- Supply chain optimization and predictive logistics for raw materials and finished components.

- Automated design for manufacturability (DFM) and performance prediction for complex composite structures.

Key Takeaways Automotive Carbon Thermoplastic Market Size & Forecast

Common user questions regarding key takeaways from the Automotive Carbon Thermoplastic market size and forecast reveal a focus on understanding the primary growth drivers, the longevity of market expansion, and the critical factors that will shape its trajectory over the coming decade. Users are keen to identify the most promising application areas and technological advancements that underpin the projected market expansion, alongside potential challenges that could influence growth rates.

The Automotive Carbon Thermoplastic market is on an accelerated growth trajectory, primarily fueled by the automotive industry's relentless pursuit of lightweighting to meet stringent fuel efficiency standards and the rapidly expanding market for electric vehicles. The forecasted substantial CAGR indicates a strong belief in the material's transformative potential to enhance vehicle performance, safety, and energy efficiency. This growth is not merely incremental but represents a fundamental shift in material preferences within automotive manufacturing, moving away from traditional metals towards advanced composites that offer superior strength-to-weight ratios and design flexibility. The market's expansion is also significantly influenced by ongoing innovations in composite manufacturing technologies, which are making these materials more cost-effective and suitable for high-volume production, addressing historical barriers to widespread adoption.

A significant takeaway is the pivotal role of sustainability and circular economy principles in driving future market development. As automotive OEMs commit to ambitious environmental targets, the inherent recyclability of thermoplastic composites, in contrast to thermosets, presents a compelling advantage. This focus on life-cycle management is prompting increased investment in recycling infrastructure and the development of composite materials that can be easily recovered and reused. Moreover, the diversification of applications beyond primary structural components into interior, exterior, and even powertrain elements signifies a maturing market where carbon thermoplastics are recognized for their versatility and performance across various vehicle parts. The market's future will be heavily shaped by continued R&D in both material science and processing techniques, further enabling performance enhancements and cost reductions.

- Strong market growth driven by EV adoption and lightweighting mandates.

- Significant potential for design freedom and functional integration due to thermoplastic properties.

- Increasing importance of recyclability and sustainability in material selection.

- Advancements in manufacturing technologies are critical enablers for broader market penetration.

- Diversification of applications across various vehicle segments is expanding the addressable market.

Automotive Carbon Thermoplastic Market Drivers Analysis

The Automotive Carbon Thermoplastic market is experiencing robust growth driven by several compelling factors, fundamentally reshaping material selection in vehicle manufacturing. The overarching global imperative for reduced carbon emissions and enhanced fuel economy has propelled lightweighting to the forefront of automotive design. Carbon thermoplastics, with their superior strength-to-weight ratio compared to traditional metallic materials, offer a direct pathway to achieving these objectives. This material class enables vehicle manufacturers to significantly reduce the overall mass of components, thereby improving fuel efficiency in internal combustion engine vehicles and extending the range of electric vehicles, which is critical for consumer acceptance and regulatory compliance.

Beyond the environmental and performance benefits, the increasing demand for high-performance vehicles and electric mobility solutions is a substantial driver. As automotive designs become more complex and require components with exceptional mechanical properties, resistance to fatigue, and crashworthiness, carbon thermoplastics emerge as ideal candidates. Their ability to be easily molded into intricate shapes and integrated into multi-material designs offers unparalleled design flexibility, allowing engineers to innovate without compromising structural integrity. This versatility, combined with advancements in processing technologies that enable faster production cycles and greater automation, further solidifies their position as a preferred material for next-generation automotive platforms.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Automotive Emission Regulations & Fuel Economy Standards | +5.5% | North America, Europe, Asia Pacific (especially China) | Short to Medium-term (2025-2030) |

| Rapid Growth of Electric Vehicles (EVs) & Demand for Range Extension | +6.0% | Global, particularly China, Europe, North America | Medium to Long-term (2025-2033) |

| Increasing Demand for Lightweight Materials for Performance & Safety | +4.0% | Global | Short to Long-term (2025-2033) |

| Technological Advancements in Composite Manufacturing Processes | +3.0% | Europe, North America, Japan | Short to Medium-term (2025-2030) |

Automotive Carbon Thermoplastic Market Restraints Analysis

Despite the compelling advantages, the Automotive Carbon Thermoplastic market faces several significant restraints that could temper its growth trajectory. One of the primary inhibitors is the relatively high cost associated with carbon fibers and high-performance thermoplastic resins compared to traditional automotive materials like steel or aluminum. While the long-term benefits of lightweighting and performance gains are clear, the initial material and processing costs can be a barrier for mass-market vehicle segments, particularly for OEMs operating on tight profit margins. This economic consideration necessitates a careful cost-benefit analysis and often limits the application of these advanced materials to premium, luxury, or high-performance vehicle models.

Another considerable restraint is the complexity and specialized nature of manufacturing processes required for carbon thermoplastic composites. While advancements are being made, techniques such as high-temperature molding, precise fiber placement, and efficient bonding methods demand significant capital investment in machinery, tooling, and skilled labor. This complexity can translate into higher production costs and longer development cycles, especially for high-volume automotive production lines where rapid cycle times are paramount. Furthermore, the limited availability of high-volume, cost-effective production methods, although improving, still poses a challenge for widespread adoption across all vehicle platforms.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Material and Manufacturing Costs Compared to Traditional Materials | -3.5% | Global, particularly emerging economies | Short to Medium-term (2025-2030) |

| Complexity of Manufacturing Processes & Limited High-Volume Production Capacity | -2.0% | Global | Short to Medium-term (2025-2030) |

| Challenges in Recycling Infrastructure and Cost-Effective Recycling Methods | -1.5% | Global | Medium to Long-term (2027-2033) |

| Competition from Alternative Lightweight Materials (e.g., Advanced High-Strength Steels, Aluminum Alloys) | -1.0% | Global | Short to Medium-term (2025-2030) |

Automotive Carbon Thermoplastic Market Opportunities Analysis

Despite existing restraints, the Automotive Carbon Thermoplastic market is ripe with significant opportunities that are set to drive substantial growth and innovation over the forecast period. The most prominent opportunity lies in the burgeoning electric vehicle (EV) sector. As EVs continue to gain market share, the need for enhanced battery range and structural integrity becomes paramount. Carbon thermoplastics, offering exceptional lightweighting potential, are ideal for reducing the overall weight of EV battery enclosures, body-in-white structures, and other components, directly contributing to extended driving range and improved energy efficiency. This critical application area provides a massive, expanding market for thermoplastic composites, positioning them as a key enabler for the EV revolution.

Furthermore, ongoing advancements in material science and manufacturing processes present considerable opportunities for market expansion. The development of more cost-effective carbon fibers, innovative thermoplastic resin formulations with enhanced performance characteristics (e.g., higher temperature resistance, improved impact strength), and rapid manufacturing techniques such as continuous fiber thermoplastic composites (CFRTP) production and advanced automated fiber placement (AFP) are making these materials more accessible and economically viable for a wider range of automotive applications. These technological leaps are enabling the production of complex, integrated structures with shorter cycle times, reducing the barriers to adoption for mass-produced vehicles. The increasing focus on material recyclability and circular economy principles also opens avenues for innovation in developing sustainable thermoplastic composite solutions, appealing to environmentally conscious consumers and meeting future regulatory demands.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expanding Applications in Electric Vehicle (EV) Structural & Battery Components | +7.0% | Global, particularly Asia Pacific (China), Europe, North America | Medium to Long-term (2025-2033) |

| Development of More Cost-Effective Manufacturing Technologies | +4.5% | Europe, North America, Japan | Medium-term (2027-2032) |

| Growing Demand for Sustainable & Recyclable Automotive Materials | +3.0% | Europe, North America | Long-term (2030-2033) |

| Integration of Multi-material Designs & Functional Composites | +2.5% | Global | Medium to Long-term (2027-2033) |

Automotive Carbon Thermoplastic Market Challenges Impact Analysis

While opportunities abound, the Automotive Carbon Thermoplastic market must navigate several significant challenges that could impede its full potential. One of the primary hurdles remains the relatively high cost of raw materials, specifically high-grade carbon fibers and specialized thermoplastic resins. This cost often makes carbon thermoplastic composites a premium solution, limiting their widespread adoption in economy and mid-range vehicle segments. While R&D efforts are focused on cost reduction, achieving price parity with conventional metallic materials, or even advanced steels and aluminum alloys, for all applications remains a substantial challenge. This cost sensitivity can delay investment decisions from OEMs, especially in a highly competitive automotive market where cost efficiency is paramount.

Another critical challenge involves the complexities associated with joining and bonding carbon thermoplastic components to dissimilar materials or to other composite parts within a multi-material vehicle structure. Unlike traditional metals which can be easily welded, composite materials often require specialized adhesive bonding, mechanical fastening, or advanced joining techniques, which can add complexity to the assembly process, increase production time, and require specific expertise and equipment. Ensuring long-term durability, crashworthiness, and repairability of these complex joints under various operational conditions presents an ongoing engineering challenge. Furthermore, the lack of standardized testing methods and regulatory frameworks for new composite applications can create hurdles for faster market penetration, as industry stakeholders require robust validation and certification processes to ensure safety and performance standards are met.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Cost Competitiveness Against Established Materials | -2.5% | Global | Short to Medium-term (2025-2030) |

| Complexities in Joining and Repair of Composite Structures | -2.0% | Global | Short to Medium-term (2025-2030) |

| Lack of Standardization in Design and Testing Methodologies | -1.5% | Global | Medium-term (2027-2032) |

| Supply Chain Vulnerabilities for High-Performance Raw Materials | -1.0% | Global | Short-term (2025-2027) |

Automotive Carbon Thermoplastic Market - Updated Report Scope

This comprehensive report delves into the Automotive Carbon Thermoplastic Market, providing an in-depth analysis of its current landscape, historical performance, and future growth trajectories. The scope encompasses detailed market sizing, segmentation by various criteria including resin type, fiber type, manufacturing process, application, and vehicle type, along with a thorough regional assessment. It highlights key market drivers, restraints, opportunities, and challenges influencing market dynamics, offering a strategic outlook for industry stakeholders. The report also includes competitive intelligence on leading market players and examines emerging trends and technological advancements, such as the impact of AI, that are shaping the industry's evolution, all designed to offer actionable insights for strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 8.45 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Solvay S.A., Celanese Corporation, Victrex plc, SABIC, Teijin Limited, Toray Industries, Inc., BASF SE, Mitsubishi Chemical Corporation, Arkema S.A., Covestro AG, DSM, Lanxess AG, Evonik Industries AG, Asahi Kasei Corporation, SGL Carbon, Hexcel Corporation, Plasan Carbon Composites, ELG Carbon Fibre Ltd., Continental Structural Plastics (CSP), Tencate Advanced Composites (now Toray) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automotive Carbon Thermoplastic market is meticulously segmented to provide a granular understanding of its diverse applications, material compositions, and manufacturing approaches. This segmentation allows for a detailed analysis of market dynamics within specific product categories and end-use applications, highlighting areas of high growth potential and strategic importance. The market is primarily broken down by resin type, distinguishing between high-performance thermoplastics like PEEK, PPS, and PA, and more general-purpose polymers like PP, each offering distinct properties and cost profiles tailored for various automotive requirements.

Further segmentation by fiber type (short, long, and continuous carbon fibers) reflects the differing mechanical properties and manufacturing processes associated with each, from injection molding for short fibers to advanced automated techniques for continuous fibers used in structural applications. Manufacturing process segmentation, including compression molding, injection molding, thermoforming, and additive manufacturing, provides insights into the technological landscape and production efficiencies. Application-based segmentation, spanning structural, interior, exterior, powertrain, and under-the-hood components, demonstrates the versatility and expanding utility of carbon thermoplastics across different parts of a vehicle. Finally, vehicle type segmentation, encompassing passenger, commercial, electric, and hybrid vehicles, underscores the market's alignment with prevailing automotive industry trends and future mobility solutions.

- By Resin Type:

- Polyamide (PA)

- Polyether Ether Ketone (PEEK)

- Polyphenylene Sulfide (PPS)

- Polypropylene (PP)

- Other High-Performance Thermoplastics (e.g., PEKK, PSU, PEI)

- By Fiber Type:

- Short Carbon Fiber

- Long Carbon Fiber

- Continuous Carbon Fiber

- By Manufacturing Process:

- Compression Molding

- Injection Molding

- Thermoforming

- Additive Manufacturing

- Automated Fiber Placement (AFP) / Automated Tape Laying (ATL)

- Others (e.g., Resin Transfer Molding for Thermoplastics)

- By Application:

- Structural Components

- Chassis

- Body-in-White (BIW)

- B-Pillars

- Door Frames

- Subframes

- Interior Components

- Seat Frames

- Dashboard Supports

- Pedal Boxes

- Interior Panels

- Exterior Components

- Bumpers

- Hoods

- Doors

- Spoilers

- Fenders

- Rocker Panels

- Powertrain Components

- Engine Brackets

- Transmission Covers

- Drive Shafts

- Under-the-Hood Components

- Air Intake Manifolds

- Engine Covers

- Battery Housings

- Structural Components

- By Vehicle Type:

- Passenger Vehicles

- Sedans

- SUVs

- Hatchbacks

- Sports Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

- Passenger Vehicles

Regional Highlights

- North America: The North American market for automotive carbon thermoplastics is characterized by a strong emphasis on meeting stringent emissions standards and a growing adoption of electric vehicles, particularly in the United States and Canada. Major automotive OEMs and Tier 1 suppliers in this region are actively investing in research and development to integrate lightweight materials into their vehicle platforms to enhance fuel efficiency and extend EV range. The demand is particularly pronounced in the premium and luxury vehicle segments, as well as in new electric vehicle startups, where the cost premium for carbon thermoplastics can be more readily absorbed. Government incentives for EV adoption and investments in advanced manufacturing technologies further stimulate market growth, with a focus on structural components and battery enclosures.

- Europe: Europe stands as a pioneering region for automotive carbon thermoplastic adoption, driven by aggressive CO2 emission reduction targets and a robust innovation ecosystem. Countries like Germany, France, and the UK are at the forefront of developing advanced composite manufacturing techniques and implementing lightweighting strategies across their diverse automotive industries. The region exhibits high demand for both high-performance and recyclable thermoplastic composite solutions, reflecting a strong commitment to sustainability and circular economy principles. Major European automotive manufacturers are increasingly using carbon thermoplastics in body-in-white structures, chassis components, and interior applications for both traditional and electrified vehicle models. Collaborative research initiatives between industry and academia are common, fostering a continuous pipeline of material and process innovations.

- Asia Pacific (APAC): The Asia Pacific region, led by China, Japan, and South Korea, represents the largest and fastest-growing market for automotive carbon thermoplastics. This growth is primarily fueled by the region's dominant position in global automotive production, particularly the booming electric vehicle market in China. Stringent environmental regulations in major Asian economies, coupled with a surging demand for fuel-efficient and high-performance vehicles, are driving the adoption of lightweight materials. Japanese and South Korean manufacturers are known for their advanced material science capabilities and are actively integrating carbon thermoplastics into their vehicle designs. China, with its massive EV production capacity, is a key consumer and innovator, focusing on scalable and cost-effective production methods to utilize these materials in mass-market EVs. Investments in local manufacturing infrastructure for advanced composites are also on the rise, reducing reliance on imports.

- Latin America: The Latin American market for automotive carbon thermoplastics is currently in its nascent stages but shows promising growth potential, largely influenced by manufacturing trends in North America and Europe. Countries like Brazil and Mexico, with their significant automotive manufacturing bases, are beginning to explore and adopt lightweight materials to enhance vehicle performance and meet evolving environmental standards. The primary drivers include the export-oriented nature of their automotive industries, which must comply with international regulations, and a gradual increase in demand for more fuel-efficient and technologically advanced vehicles domestically. Adoption is slower due to cost considerations and less developed domestic supply chains for advanced materials, but strategic investments in automotive production facilities and a growing awareness of lightweighting benefits are expected to accelerate market penetration in the medium to long term.

- Middle East and Africa (MEA): The Middle East and Africa market for automotive carbon thermoplastics is relatively small but is anticipated to grow as the automotive industry in the region develops and diversifies. Countries like South Africa and some Gulf nations are investing in automotive manufacturing and assembly plants. The demand for advanced lightweight materials is driven by the region's increasing vehicle parc, a growing preference for technologically advanced vehicles, and nascent efforts to improve fuel efficiency and reduce emissions. While local production of carbon thermoplastics is limited, increasing imports of vehicles incorporating these materials and potential future investments in local composite manufacturing facilities could stimulate market expansion. The market remains highly dependent on global automotive trends and the economic diversification efforts within the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Carbon Thermoplastic Market.- Solvay S.A.

- Celanese Corporation

- Victrex plc

- SABIC

- Teijin Limited

- Toray Industries, Inc.

- BASF SE

- Mitsubishi Chemical Corporation

- Arkema S.A.

- Covestro AG

- DSM

- Lanxess AG

- Evonik Industries AG

- Asahi Kasei Corporation

- SGL Carbon

- Hexcel Corporation

- Plasan Carbon Composites

- ELG Carbon Fibre Ltd.

- Continental Structural Plastics (CSP)

- Tencate Advanced Composites

Frequently Asked Questions

What is Automotive Carbon Thermoplastic?

Automotive Carbon Thermoplastic refers to advanced composite materials made by reinforcing thermoplastic polymers with carbon fibers. These materials offer an exceptional strength-to-weight ratio, high stiffness, impact resistance, and the ability to be thermoformed and recycled, making them ideal for lightweighting in vehicle manufacturing.

Why is carbon thermoplastic used in the automotive industry?

It is primarily used to reduce vehicle weight, which improves fuel efficiency in traditional cars and extends battery range in electric vehicles. Its high strength and stiffness contribute to enhanced safety, while its moldability allows for complex part integration and design flexibility, meeting modern automotive performance and aesthetic demands.

What are the primary applications of carbon thermoplastics in vehicles?

Key applications include structural components like chassis, body-in-white elements, and battery enclosures for EVs due to their crashworthiness and lightweighting benefits. They are also increasingly used in exterior parts such as hoods and bumpers, as well as interior components like seat frames and dashboard supports.

What are the main advantages of carbon thermoplastics over thermoset composites?

Carbon thermoplastics offer significant advantages, including superior impact resistance, shorter manufacturing cycle times due to their ability to be reshaped upon heating, and critically, recyclability, which aligns with growing sustainability mandates and circular economy objectives. They also typically have longer shelf lives before processing.

What is the projected growth rate for the Automotive Carbon Thermoplastic market?

The Automotive Carbon Thermoplastic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033, driven by increasing EV adoption and stringent lightweighting regulations.