Protein Powder Market

Protein Powder Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702762 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Protein Powder Market Size

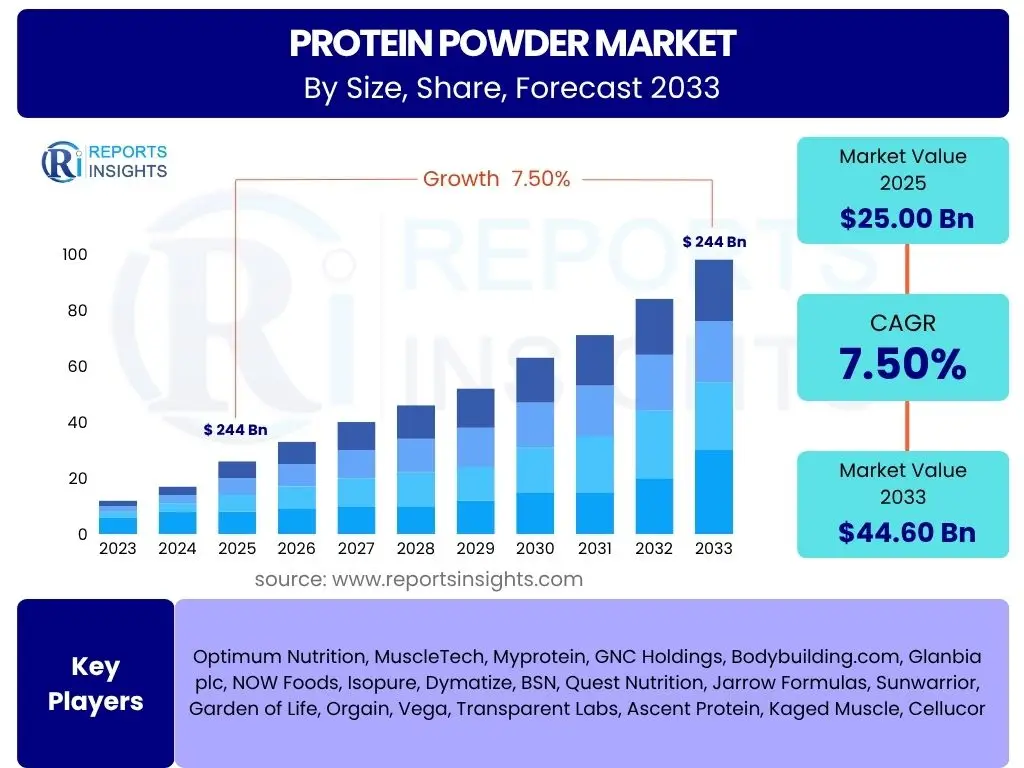

According to Reports Insights Consulting Pvt Ltd, The Protein Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2033. The market is estimated at USD 25.00 billion in 2025 and is projected to reach USD 44.60 billion by the end of the forecast period in 2033.

Key Protein Powder Market Trends & Insights

The protein powder market is currently shaped by a confluence of evolving consumer preferences, scientific advancements, and a growing global focus on health and wellness. Key trends indicate a significant shift towards plant-based protein sources, driven by dietary choices, ethical considerations, and sustainability concerns. Consumers are increasingly seeking personalized nutrition solutions, leading to a demand for a wider variety of protein types, flavors, and formulations tailored to specific health goals, such as weight management, muscle gain, or general well-being. Furthermore, the integration of protein powders into daily diets beyond just athletic performance, expanding into general health, functional foods, and convenient meal replacements, is a prominent trend.

Another crucial insight is the rising awareness regarding gut health and the role of protein in conjunction with other beneficial ingredients like probiotics and digestive enzymes. This has led to the development of enhanced protein formulations designed for better absorption and overall digestive comfort. The market is also experiencing innovation in delivery formats, moving beyond traditional tubs to include single-serve sachets, ready-to-drink options, and fortified food products, catering to busy lifestyles and on-the-go consumption. Additionally, transparent labeling, clean ingredient profiles, and ethically sourced components are becoming non-negotiable for discerning consumers, compelling manufacturers to adhere to higher standards of production and disclosure.

- Growing consumer emphasis on health, fitness, and preventive nutrition.

- Significant surge in demand for plant-based protein powders, including pea, rice, and soy.

- Increased adoption of protein supplements by general consumers, not just athletes.

- Innovation in flavor profiles, textures, and ingredient combinations.

- Focus on clean labels, natural ingredients, and absence of artificial additives.

- Development of specialized protein formulations for specific demographics (e.g., seniors, women, children).

- Expansion of ready-to-drink (RTD) protein beverages and fortified food products.

- Rise of personalized nutrition approaches influencing product development.

- Greater emphasis on sustainable sourcing and ethical production practices.

AI Impact Analysis on Protein Powder

Artificial intelligence is poised to revolutionize the protein powder market across various stages of the value chain, from raw material sourcing to consumer engagement. In product development, AI algorithms can analyze vast datasets of nutritional science, consumer preferences, and ingredient interactions to identify novel protein sources, optimize formulations for taste, texture, and bioavailability, and predict market success. This capability significantly accelerates the research and development cycle, allowing companies to bring highly innovative and precisely targeted products to market more rapidly. Furthermore, AI can aid in quality control and supply chain management by predicting demand fluctuations, optimizing inventory levels, and ensuring the quality and traceability of ingredients, thereby reducing waste and enhancing efficiency.

From a consumer perspective, AI-powered applications are enabling hyper-personalization, offering dietary recommendations and protein supplement suggestions based on individual physiological data, activity levels, and health goals. This includes AI-driven chatbots providing instant nutritional advice or virtual coaches guiding supplement intake. In manufacturing, AI can optimize production processes, predict equipment maintenance needs, and enhance operational efficiency, leading to cost reductions and improved product consistency. The integration of AI also extends to marketing and sales, where it can analyze consumer behavior to create more effective promotional strategies and identify emerging market niches. The overall impact of AI is expected to foster a more responsive, efficient, and consumer-centric protein powder industry.

- AI-driven optimization of protein formulation and product development.

- Enhanced personalization of protein recommendations based on individual data.

- Improved supply chain efficiency and raw material sourcing through predictive analytics.

- Automated quality control and impurity detection in manufacturing processes.

- Predictive modeling for consumer preferences and market demand forecasting.

- AI-powered chatbots and virtual assistants for personalized consumer support and education.

- Optimized marketing strategies and targeted advertising based on AI insights into consumer behavior.

- Potential for robotic automation in protein powder production and packaging.

Key Takeaways Protein Powder Market Size & Forecast

The protein powder market is experiencing robust and sustained growth, driven by an expanding consumer base that extends beyond traditional athletes to include mainstream health-conscious individuals and an aging population. The projected market size indicates significant investment opportunities and a dynamic landscape characterized by product diversification and innovation. This growth is underpinned by a global shift towards proactive health management and the recognition of protein's fundamental role in achieving various wellness objectives, from muscle synthesis and weight management to immune support and satiety. Manufacturers are increasingly focusing on developing functional protein products that address specific health concerns, further broadening market appeal.

The forecast period suggests that while traditional protein sources like whey will remain prominent, the rapid ascent of plant-based alternatives will be a defining characteristic, necessitating strategic adaptation from market players. Regional disparities in growth rates and consumer preferences will require tailored market penetration strategies. Furthermore, technological advancements, including the application of AI, are expected to significantly influence product development, manufacturing efficiency, and consumer engagement, shaping the competitive dynamics. Companies that prioritize innovation, sustainability, and consumer-centric approaches are well-positioned to capture a larger share of this burgeoning market.

- Consistent and strong market growth projected through 2033.

- Expansion of protein powder consumption beyond sports enthusiasts to general wellness.

- Significant opportunities in plant-based and specialized protein formulations.

- Technological integration (e.g., AI) will drive innovation and efficiency.

- Demand for clean label, transparent, and sustainably sourced products is increasing.

- Emerging markets offer substantial growth potential.

- Market competition will intensify with new entrants and product diversification.

Protein Powder Market Drivers Analysis

The global protein powder market is significantly propelled by several key drivers that reflect evolving consumer attitudes towards health and wellness. A primary driver is the rising awareness among general consumers regarding the benefits of protein in daily diets, extending beyond muscle building to include weight management, satiety, and overall nutritional well-being. This expanded understanding has broadened the market's demographic reach beyond athletes and bodybuilders to include individuals seeking healthy lifestyles, seniors aiming to combat sarcopenia, and those with dietary restrictions.

Another substantial driver is the increasing popularity of plant-based diets and veganism. As more consumers adopt these dietary preferences for health, ethical, and environmental reasons, the demand for non-dairy protein powders such as pea, rice, soy, and hemp protein has surged. This trend is fostering innovation in taste, texture, and nutritional profiles of plant-based offerings, making them more appealing to a wider audience. Furthermore, the growth of the fitness and sports nutrition industry globally, coupled with a rising disposable income in emerging economies, is fueling greater consumption of protein supplements to support athletic performance and recovery.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Health & Wellness Awareness | +2.0% | Global, particularly North America, Europe, APAC | Short to Long-term |

| Rising Demand for Plant-Based Proteins | +1.5% | Global, especially Western Europe, North America | Medium to Long-term |

| Expansion of Sports & Fitness Industry | +1.0% | Global, particularly emerging economies like India, China | Medium to Long-term |

| Increased Focus on Personalized Nutrition | +0.8% | North America, Western Europe | Medium to Long-term |

| Convenience & On-the-Go Consumption Trends | +0.5% | Urban areas globally | Short to Medium-term |

Protein Powder Market Restraints Analysis

Despite the strong growth trajectory, the protein powder market faces several restraints that could potentially impede its expansion. One significant challenge is the relatively high cost of premium protein powders, especially specialized or organic varieties, which can be a barrier to entry for price-sensitive consumers. This economic factor may limit wider adoption in developing regions or among lower-income demographics, favoring more conventional food sources of protein.

Another restraint is the proliferation of misleading claims and unsubstantiated health benefits associated with some protein products, leading to consumer skepticism and distrust. Regulatory scrutiny regarding product labeling, ingredient purity, and marketing practices is increasing, and non-compliance can result in product recalls or damage to brand reputation. Furthermore, potential side effects from excessive consumption, such as digestive issues or kidney strain, although often exaggerated, contribute to negative perceptions and may deter new users. The availability of diverse alternative protein sources from whole foods also presents a competitive challenge, as consumers may opt for natural food options over processed supplements.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Product Cost | -0.7% | Global, particularly developing economies | Short to Medium-term |

| Misleading Marketing & Consumer Skepticism | -0.5% | Global | Short to Medium-term |

| Stringent Regulatory Landscape | -0.4% | North America, Europe | Medium-term |

| Availability of Whole Food Protein Alternatives | -0.3% | Global | Long-term |

Protein Powder Market Opportunities Analysis

The protein powder market is rich with opportunities stemming from evolving consumer needs and technological advancements. A significant opportunity lies in the development of highly specialized protein formulations targeting specific health conditions or demographic groups, such as protein for gut health, bone density support, or products tailored for geriatric nutrition. This niche segmentation allows for premium pricing and fosters brand loyalty by addressing unmet needs in the market. The integration of functional ingredients like prebiotics, probiotics, vitamins, and minerals into protein powders can create enhanced health benefits, appealing to a broader wellness-focused consumer base.

Another promising avenue is the expansion into emerging markets, particularly in Asia Pacific and Latin America, where rising disposable incomes, increasing urbanization, and growing awareness of health and fitness are driving demand. Educating consumers in these regions about the benefits of protein supplementation through targeted marketing campaigns can unlock substantial growth. Furthermore, leveraging e-commerce platforms and direct-to-consumer (DTC) models provides an effective way to reach a wider audience, reduce distribution costs, and offer personalized product experiences, capitalizing on the digital transformation of consumer purchasing habits. Strategic partnerships with fitness centers, nutritionists, and healthcare providers can also create new distribution channels and enhance market penetration.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Product Innovation (Functional & Specialized Proteins) | +1.2% | Global | Medium to Long-term |

| Expansion into Emerging Markets | +1.0% | Asia Pacific, Latin America, Middle East & Africa | Long-term |

| Growth of E-commerce & Direct-to-Consumer Channels | +0.9% | Global | Short to Medium-term |

| Strategic Partnerships & Collaborations | +0.6% | Global | Medium-term |

| Sustainable & Ethical Sourcing Initiatives | +0.4% | North America, Europe | Long-term |

Protein Powder Market Challenges Impact Analysis

The protein powder market faces several challenges that require strategic navigation to sustain growth. One significant challenge is intense market competition, characterized by a large number of established players and new entrants, leading to price wars and the need for continuous differentiation. This competitive pressure can compress profit margins and necessitate substantial investments in marketing and product innovation to maintain market share. Ensuring consistent quality and preventing contamination across the supply chain, especially for globally sourced ingredients, is another persistent challenge. Incidents of product adulteration or mislabeling can severely damage brand reputation and erode consumer trust.

Regulatory hurdles and varying national standards for food supplements pose a complex challenge for manufacturers operating internationally. Compliance with diverse labeling requirements, ingredient restrictions, and health claim regulations adds to operational costs and can hinder market access. Furthermore, shifting consumer perceptions and health trends mean that companies must remain agile to adapt their product portfolios. For example, a sudden shift away from dairy-based proteins could impact manufacturers heavily invested in whey production. Finally, managing raw material price volatility, particularly for agricultural commodities like milk or plant-based sources, can impact production costs and profitability, making long-term planning difficult.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition & Price Wars | -0.8% | Global | Short to Medium-term |

| Supply Chain Disruptions & Raw Material Volatility | -0.6% | Global | Short-term |

| Regulatory Compliance & Varying Standards | -0.5% | North America, Europe, Asia Pacific | Long-term |

| Maintaining Quality Control & Preventing Contamination | -0.4% | Global | Ongoing |

Protein Powder Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the global protein powder market, offering critical insights into its current size, historical performance, and future growth projections up to 2033. The scope includes a detailed examination of market drivers, restraints, opportunities, and challenges that are shaping the industry landscape. It delves into a granular segmentation analysis by product type, application, distribution channel, and end-user, providing a holistic view of key market dynamics across various categories. Furthermore, the report offers extensive regional insights, highlighting major growth pockets and regulatory environments in key geographical areas. Competitive landscape analysis, including profiles of leading market participants, ensures stakeholders gain a complete understanding of industry positioning and strategic trends.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 25.00 billion |

| Market Forecast in 2033 | USD 44.60 billion |

| Growth Rate | 7.5% CAGR |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Optimum Nutrition, MuscleTech, Myprotein, GNC Holdings, Bodybuilding.com, Glanbia plc, NOW Foods, Isopure, Dymatize, BSN, Quest Nutrition, Jarrow Formulas, Sunwarrior, Garden of Life, Orgain, Vega, Transparent Labs, Ascent Protein, Kaged Muscle, Cellucor |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The protein powder market is meticulously segmented to provide a comprehensive understanding of its diverse facets, reflecting the varied needs and preferences of consumers. This segmentation allows for targeted product development, marketing strategies, and investment decisions, ensuring that manufacturers can cater to specific market niches effectively. The primary segmentations include product type, which differentiates between animal-based (like whey, casein) and an increasingly popular array of plant-based proteins (such as pea, soy, rice, and hemp), each with unique nutritional profiles and consumer appeal. Application segmentation highlights the diverse uses of protein powder, ranging from traditional sports nutrition and weight management to functional foods, clinical nutrition, and infant formulas, showcasing its versatility across different consumer health objectives.

Further granularity is achieved through segmentation by distribution channel, distinguishing between the rapidly growing online retail sector and traditional offline retail outlets like supermarkets, specialty stores, and pharmacies. This distinction is crucial for understanding consumer purchasing habits and optimizing supply chain logistics. Finally, end-user segmentation categorizes consumers based on their specific needs and demographic profiles, including athletes and bodybuilders, recreational and lifestyle users, the geriatric population, and those with medical conditions. This multi-dimensional segmentation is essential for market players to identify high-growth segments, understand competitive dynamics within each category, and formulate strategies for sustainable expansion in the global protein powder market.

- By Product Type:

- Whey Protein (Concentrate, Isolate, Hydrolyzed)

- Casein Protein

- Soy Protein

- Pea Protein

- Rice Protein

- Hemp Protein

- Other Plant-Based Proteins

- Other Animal-Based Proteins

- By Application:

- Sports Nutrition

- Functional Food & Beverages

- Weight Management

- Clinical Nutrition

- Infant Nutrition

- Other Applications

- By Distribution Channel:

- Online Retail (E-commerce Websites, Company-owned Websites)

- Offline Retail (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Specialty Stores, Others)

- By End-User:

- Athletes & Bodybuilders

- Recreational & Lifestyle Users

- Geriatric Population

- Children & Adolescents

- Medical Patients

Regional Highlights

- North America: This region holds a significant share of the protein powder market, driven by a high prevalence of health-conscious consumers, a well-established fitness industry, and the strong presence of major market players. The United States and Canada lead in consumption, with increasing demand for plant-based and functional protein products. Innovations in flavors, product formats, and clean label products are key trends here. The region benefits from high disposable incomes and a strong awareness of dietary supplements.

- Europe: Europe is a mature market experiencing steady growth, largely due to rising interest in sports nutrition and active lifestyles across countries like the UK, Germany, and France. There's a growing preference for natural and organic protein powders, alongside a focus on sustainable sourcing. Regulatory frameworks are stringent, emphasizing product safety and transparency, which shapes product development and market entry strategies. Southern and Eastern European countries are showing increasing adoption rates.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and a burgeoning middle class in countries like China, India, Japan, and Australia. The increasing awareness of health and fitness, coupled with a growing youth population and influence of Western dietary trends, is driving demand. There's a significant opportunity for both traditional and plant-based protein powders, with a particular emphasis on convenient and fortified food applications tailored to local tastes.

- Latin America: This region, particularly Brazil and Mexico, demonstrates substantial growth potential due to increasing health consciousness, a rising incidence of lifestyle diseases, and a developing sports and fitness culture. Economic growth and improving access to nutritional information are contributing factors. While still developing, the market is attractive for companies offering value-for-money products and those that can adapt to local dietary preferences and distribution challenges.

- Middle East and Africa (MEA): The MEA region is an emerging market for protein powders, driven by increasing health awareness, a growing young population, and a rising prevalence of non-communicable diseases prompting healthier lifestyle choices. The Gulf Cooperation Council (GCC) countries show higher per capita spending on health supplements due to higher disposable incomes. Challenges include cultural dietary preferences, regulatory complexities, and the need for greater consumer education, but the long-term growth prospects are promising.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protein Powder Market.- Optimum Nutrition

- MuscleTech

- Myprotein

- GNC Holdings

- Bodybuilding.com

- Glanbia plc

- NOW Foods

- Isopure

- Dymatize

- BSN

- Quest Nutrition

- Jarrow Formulas

- Sunwarrior

- Garden of Life

- Orgain

- Vega

- Transparent Labs

- Ascent Protein

- Kaged Muscle

- Cellucor

Frequently Asked Questions

What is the projected growth rate for the Protein Powder Market?

The Protein Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2033, indicating robust expansion.

What are the primary drivers of growth in the Protein Powder Market?

Key drivers include increasing health and wellness awareness, the surging demand for plant-based proteins, the expansion of the global sports and fitness industry, and a growing focus on personalized nutrition.

How is AI impacting the Protein Powder Market?

AI is transforming the market through optimized product formulation, personalized consumer recommendations, enhanced supply chain efficiency, and advanced quality control, leading to more innovative and consumer-centric products.

Which regions offer the most significant growth opportunities for protein powder manufacturers?

Asia Pacific (APAC) is projected as the fastest-growing region due to rising disposable incomes and increasing health awareness, alongside sustained growth in North America and Europe.

What types of protein powders are most in demand?

While whey protein remains popular, there is a significant and rapidly growing demand for plant-based protein powders such as pea, soy, rice, and hemp, driven by dietary preferences and sustainability concerns.