Power Cutter Market

Power Cutter Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702104 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Power Cutter Market Size

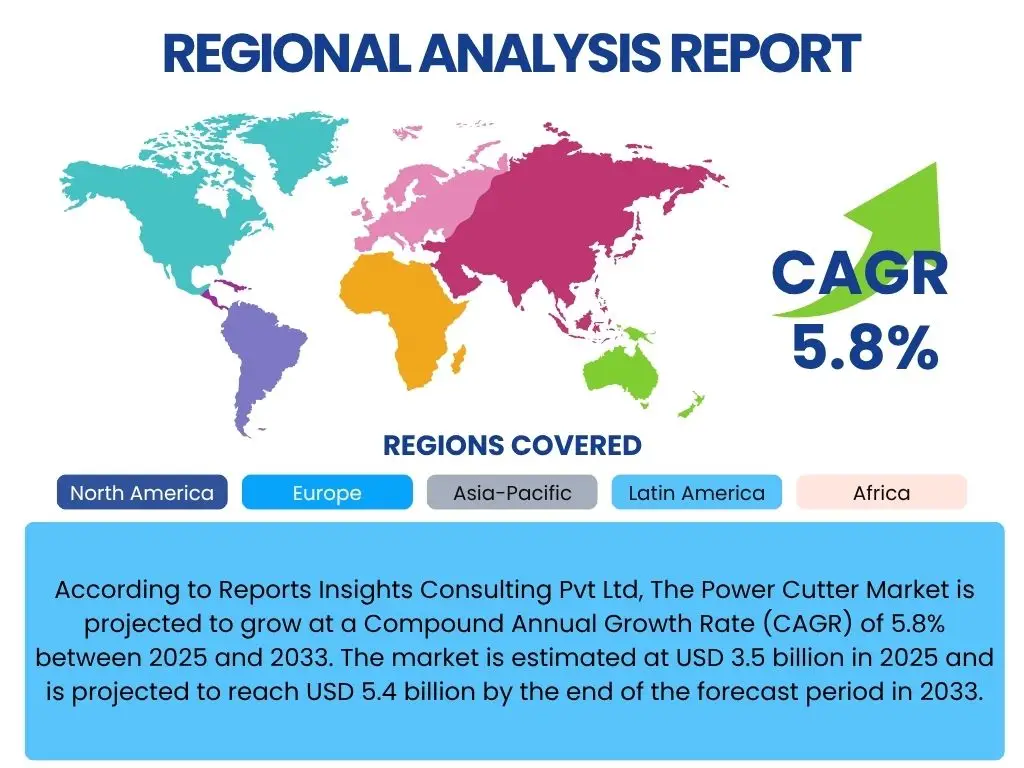

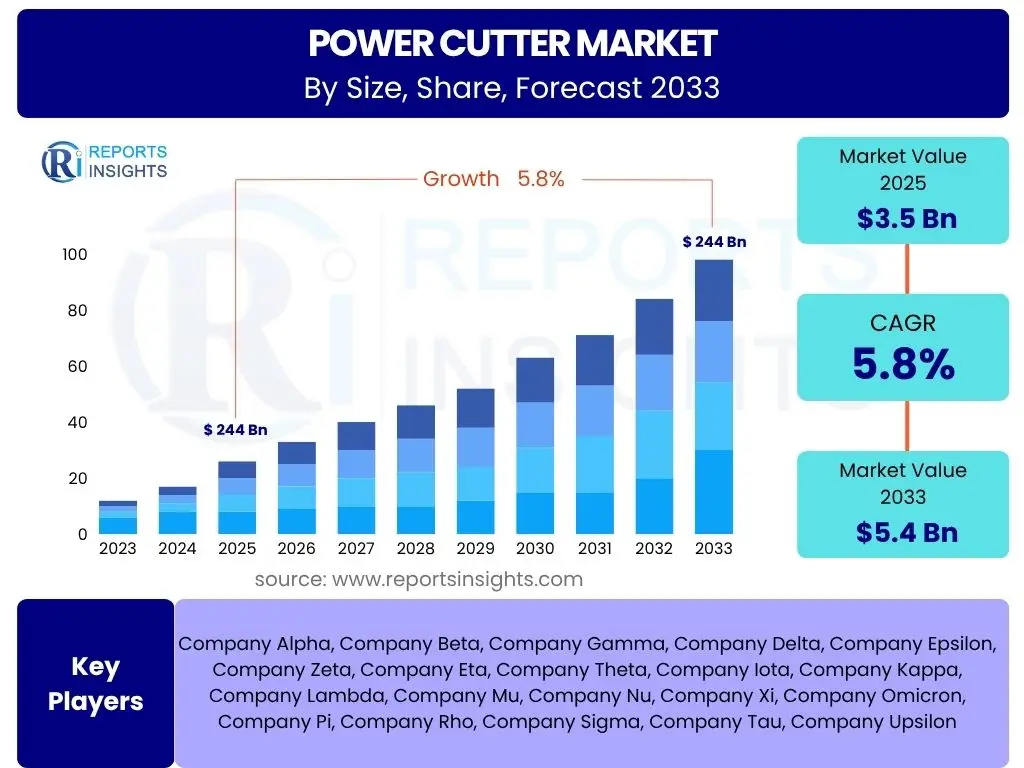

According to Reports Insights Consulting Pvt Ltd, The Power Cutter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. The market is estimated at USD 3.5 billion in 2025 and is projected to reach USD 5.4 billion by the end of the forecast period in 2033.

Key Power Cutter Market Trends & Insights

The Power Cutter market is currently experiencing dynamic shifts driven by advancements in material science and increasing demand from diverse end-user industries. Users frequently inquire about the impact of technological innovation, particularly concerning improved portability, reduced emissions, and enhanced safety features. There is a clear interest in how power cutters are evolving to handle new construction materials and stricter environmental regulations. Furthermore, the market is observing a rising adoption of cordless solutions, reflecting a broader industry trend towards greater operational flexibility and user convenience on job sites, while traditional fuel-powered cutters continue to dominate high-power applications due to their robust performance capabilities.

Another significant trend gaining momentum is the integration of smart technologies. This includes digital interfaces for precise control, IoT connectivity for remote monitoring, and advanced diagnostics for predictive maintenance. Such innovations are crucial for enhancing operational efficiency and extending the lifespan of power cutting equipment. The focus on sustainability is also shaping market development, with manufacturers investing in quieter, more energy-efficient models and exploring alternative power sources. These trends indicate a market moving towards more intelligent, environmentally conscious, and user-friendly solutions to meet the complex demands of modern construction and industrial applications.

- Increasing adoption of cordless and battery-powered power cutters.

- Development of advanced diamond blade technologies for diverse materials.

- Integration of smart features, IoT, and telematics for enhanced monitoring.

- Growing emphasis on ergonomic design and improved safety mechanisms.

- Demand for low-emission and eco-friendly power cutter models.

- Rising popularity of rental services for specialized power cutting equipment.

AI Impact Analysis on Power Cutter

User queries regarding the impact of Artificial Intelligence (AI) on the Power Cutter market often revolve around how AI can enhance precision, improve operational safety, and optimize maintenance schedules. AI's role is increasingly critical in processing real-time data from sensors embedded in power cutters to provide operators with immediate feedback, ensuring optimal cutting parameters for different materials and scenarios. This capability is vital for minimizing material waste and achieving superior finish quality, which are paramount in precision-dependent applications such as specialized demolition or intricate structural modifications. The integration of AI also addresses concerns about operator skill levels by offering intelligent assistance and guidance, thereby broadening the accessibility of advanced cutting techniques.

Furthermore, AI significantly contributes to the predictive maintenance landscape for power cutting equipment. By analyzing historical usage patterns, vibration data, and motor performance metrics, AI algorithms can accurately forecast component wear and potential failures. This allows for proactive maintenance scheduling, minimizing costly downtime and extending the operational life of the equipment, a key concern for large construction firms and equipment rental companies. The long-term implications include AI-driven design optimizations, where AI simulates various design iterations to enhance tool durability, efficiency, and ergonomic properties, leading to the development of next-generation power cutters that are safer, more efficient, and more reliable than current models.

- AI-driven precision cutting for enhanced accuracy and reduced material waste.

- Predictive maintenance analytics to optimize equipment uptime and reduce repair costs.

- Real-time operational feedback and intelligent guidance for improved safety.

- AI-powered design optimization for enhanced tool durability and ergonomics.

- Automated anomaly detection and shut-off systems for operator protection.

Key Takeaways Power Cutter Market Size & Forecast

User inquiries about the Power Cutter market size and forecast consistently highlight a strong interest in understanding the primary growth drivers, the impact of emerging technologies, and the regional disparities in market development. The overarching takeaway is that the market is poised for steady growth, predominantly fueled by global infrastructure investments and a continuous uptick in construction and renovation activities across both developed and developing economies. There is a clear recognition that advancements in power source technology, particularly battery efficiency and portability, are significant catalysts for expansion, influencing purchase decisions and shaping the competitive landscape.

Moreover, the forecast indicates a strategic shift towards more specialized and high-performance power cutters designed for specific materials and applications, moving beyond general-purpose tools. This specialization is driven by the increasing complexity of construction projects and the demand for higher efficiency and precision. Geographically, while established markets continue to show stable demand, emerging economies are expected to exhibit higher growth rates due to rapid urbanization and industrialization. The market’s resilience against economic fluctuations will largely depend on its adaptability to new material challenges and its capacity to integrate smart, sustainable solutions.

- Steady growth driven by global construction and infrastructure development.

- Significant impact of cordless technology on market expansion and user convenience.

- Increasing demand for specialized power cutters for diverse material applications.

- Emerging economies presenting robust growth opportunities due to urbanization.

- Focus on enhanced safety features and ergonomic designs as key purchasing criteria.

Power Cutter Market Drivers Analysis

The Power Cutter market is significantly propelled by a robust increase in global construction activities, encompassing both new infrastructure development and extensive renovation projects. Governments worldwide are investing heavily in urban development, transportation networks, and residential and commercial building construction, which inherently drives demand for efficient cutting tools across various materials. This sustained growth in the construction sector acts as a foundational driver, requiring high-performance tools capable of cutting concrete, asphalt, metal, and stone with precision and speed.

Technological advancements also play a pivotal role, with innovations in battery technology leading to more powerful and longer-lasting cordless power cutters. These advancements offer greater flexibility and convenience on job sites where power access might be limited, appealing to a wider range of users from professional contractors to the burgeoning DIY segment. Furthermore, the growing trend of urbanization in developing countries and the necessity for efficient demolition and retrofitting in mature markets further stimulate the need for advanced power cutting equipment, ensuring continuous market expansion.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing global construction and infrastructure development | +1.5% | Global, particularly Asia Pacific (China, India), North America, Europe | Short-term to Long-term (2025-2033) |

| Technological advancements in battery and motor efficiency | +1.2% | North America, Europe, Asia Pacific (Japan, South Korea) | Mid-term (2025-2029) |

| Growth in renovation, demolition, and maintenance activities | +1.0% | North America, Europe, Latin America | Short-term to Mid-term (2025-2030) |

| Rising demand from the DIY and residential sectors | +0.8% | North America, Europe, select parts of Asia Pacific | Short-term to Mid-term (2025-2030) |

Power Cutter Market Restraints Analysis

Despite robust growth drivers, the Power Cutter market faces several significant restraints that could impede its expansion. One primary concern is the relatively high initial investment cost associated with professional-grade power cutting equipment. Specialized cutters, particularly those designed for heavy-duty industrial applications or incorporating advanced features, represent a substantial capital outlay for contractors and construction firms. This high entry barrier can deter smaller businesses or individual contractors, especially in price-sensitive emerging markets, limiting broader adoption and market penetration, despite the long-term efficiency benefits.

Moreover, stringent safety regulations and environmental norms in various regions pose significant challenges for manufacturers and users. Compliance with emission standards, noise limits, and occupational safety requirements necessitates continuous investment in research and development to design more environmentally friendly and safer tools. These regulatory pressures can increase manufacturing costs and operational complexities, potentially leading to higher product prices for end-users. Furthermore, the availability of skilled labor trained in the safe and efficient operation of power cutters remains a concern, particularly for advanced and high-powered models, impacting productivity and increasing the risk of accidents on job sites.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High initial investment and maintenance costs of advanced equipment | -0.7% | Global, particularly emerging markets | Short-term to Long-term (2025-2033) |

| Stringent safety regulations and environmental compliance standards | -0.5% | North America, Europe, developed Asia Pacific countries | Mid-term to Long-term (2025-2033) |

| Shortage of skilled labor for operating specialized power cutters | -0.4% | Global, particularly in regions with rapid infrastructure growth | Short-term to Mid-term (2025-2030) |

Power Cutter Market Opportunities Analysis

The Power Cutter market is presented with significant opportunities for growth, particularly through the development and adoption of advanced materials. As construction and manufacturing industries increasingly utilize high-strength alloys, composite materials, and reinforced concrete, there is a growing demand for specialized cutting tools capable of handling these challenging substances efficiently and precisely. This drives innovation in blade technology, motor power, and tool design, opening new revenue streams for manufacturers who can cater to these niche, high-value applications. The continuous evolution of material science ensures a persistent need for evolving cutting solutions.

Another major opportunity lies in the expansion into emerging economies. Countries in Asia Pacific, Latin America, and the Middle East and Africa are undergoing rapid urbanization, industrialization, and infrastructure development. These regions represent largely untapped markets with immense potential for growth, as their construction sectors mature and adopt more advanced equipment. Furthermore, the integration of smart technologies and the Internet of Things (IoT) into power cutters presents a transformative opportunity. Features like remote diagnostics, usage tracking, and predictive maintenance capabilities can enhance operational efficiency, reduce downtime, and offer value-added services, thereby improving overall customer satisfaction and creating new service-based business models.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of specialized cutters for advanced and composite materials | +1.3% | Global, particularly in specialized construction and industrial sectors | Mid-term to Long-term (2027-2033) |

| Expansion into emerging economies with rapid infrastructure growth | +1.1% | Asia Pacific (Southeast Asia, India), Latin America, MEA | Short-term to Long-term (2025-2033) |

| Integration of smart technologies, IoT, and telematics for enhanced functionality | +0.9% | North America, Europe, developed Asia Pacific | Mid-term (2026-2031) |

| Growth of the power tool rental market and equipment leasing | +0.6% | Global, particularly in cost-conscious regions | Short-term to Mid-term (2025-2030) |

Power Cutter Market Challenges Impact Analysis

The Power Cutter market is confronted by intense competition, a pervasive challenge that often leads to price wars and reduced profit margins for manufacturers. The market is saturated with both established global players and numerous regional manufacturers, all vying for market share. This competitive pressure necessitates continuous innovation and differentiation, forcing companies to invest heavily in research and development, marketing, and robust distribution networks. Without unique selling propositions or superior product performance, companies risk losing their competitive edge and market position to rivals offering more cost-effective or technologically advanced solutions.

Supply chain disruptions represent another significant challenge, particularly highlighted by recent global events. Volatility in raw material prices, such as steel and other metals essential for blades and machine components, along with disruptions in logistics and manufacturing due to geopolitical tensions or natural disasters, can severely impact production schedules and lead to increased costs. Furthermore, the rapid pace of technological obsolescence demands that manufacturers constantly update their product lines. Tools that are not equipped with the latest advancements in battery life, motor efficiency, or safety features quickly become outdated, creating pressure for continuous investment in R&D to remain relevant and competitive in a fast-evolving market landscape.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense market competition and price sensitivity | -0.8% | Global | Short-term to Long-term (2025-2033) |

| Supply chain disruptions and raw material price volatility | -0.6% | Global | Short-term to Mid-term (2025-2028) |

| Rapid technological obsolescence requiring constant innovation | -0.5% | Global | Mid-term to Long-term (2026-2033) |

| Increasing environmental concerns and demand for sustainable alternatives | -0.3% | Europe, North America | Mid-term to Long-term (2027-2033) |

Power Cutter Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the global Power Cutter market, covering historical data, current market dynamics, and future projections from 2025 to 2033. The scope includes a detailed examination of market size, growth drivers, restraints, opportunities, and challenges across various segments and key regions. It also incorporates an impact analysis of emerging technologies and a competitive landscape assessment of leading industry players, offering strategic insights for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 5.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Company Alpha, Company Beta, Company Gamma, Company Delta, Company Epsilon, Company Zeta, Company Eta, Company Theta, Company Iota, Company Kappa, Company Lambda, Company Mu, Company Nu, Company Xi, Company Omicron, Company Pi, Company Rho, Company Sigma, Company Tau, Company Upsilon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Power Cutter market is meticulously segmented to provide a granular understanding of its diverse applications and operational requirements. This segmentation allows for precise market analysis, identifying key growth areas and niche demands within the broader industry. Each segment is characterized by unique technical specifications, power requirements, and end-user preferences, reflecting the varied needs of construction, demolition, and industrial professionals. The divisions by type, power source, application, end-user industry, and distribution channel are crucial for market players to develop targeted strategies and product offerings.

Analyzing the market by type helps differentiate between handheld versatility, walk-behind stability for larger projects, and stationary precision for workshop environments. The power source segmentation is vital, reflecting the ongoing transition from traditional gasoline and hydraulic systems to more environmentally friendly and convenient electric (corded and cordless) and pneumatic options. Furthermore, understanding the application-specific demands, such as cutting different materials like concrete, metal, or asphalt, is paramount for manufacturers to optimize blade technology and tool performance. The end-user industry perspective ensures that product development aligns with the specific safety standards, operational scales, and durability requirements of sectors ranging from heavy construction to residential DIY projects, while distribution channels shed light on procurement preferences.

- By Type:

- Handheld: Versatile for smaller tasks and accessible spaces.

- Walk-behind: Designed for larger, floor-level cutting operations, often requiring higher power.

- Stationary: For precision cutting in controlled environments, commonly used in manufacturing or prefabrication.

- By Power Source:

- Electric:

- Corded: Consistent power for continuous operation.

- Cordless/Battery: Offers portability and freedom of movement, gaining significant traction.

- Hydraulic: High power for heavy-duty applications, often used with specialized equipment.

- Pneumatic: Utilizes compressed air, suitable for specific industrial settings.

- Gasoline: Traditional choice for maximum power and outdoor use where electricity is limited.

- Electric:

- By Application:

- Concrete Cutting: Dominant application, crucial for construction and demolition.

- Metal Cutting: For fabrication, demolition, and industrial repair.

- Asphalt Cutting: Essential for road construction and repair.

- Stone Cutting: Used in masonry, landscaping, and construction.

- Tile Cutting: For precision work in flooring and wall installations.

- Wood Cutting: Primarily for heavy-duty timber applications beyond standard saws.

- Demolition: Broad application requiring robust and powerful tools.

- By End-User Industry:

- Construction: Primary consumer, encompassing residential, commercial, and infrastructure projects.

- Renovation: Growing segment, focused on existing structure modifications.

- Demolition: Specialized segment requiring powerful and durable equipment.

- Mining: For rock and material extraction, requiring heavy-duty tools.

- Metal Fabrication: Precision cutting in manufacturing processes.

- Automotive: Specific cutting tasks in vehicle production and repair.

- DIY/Residential: Increasing adoption of user-friendly power cutters for home projects.

- Utilities: For maintaining and repairing infrastructure like pipes and cables.

- By Distribution Channel:

- Offline: Traditional sales through specialty stores, hardware stores, and distributors.

- Online: E-commerce platforms providing wider reach and convenience.

Regional Highlights

- North America: The North American power cutter market is characterized by a mature construction industry and a strong emphasis on safety regulations and advanced technology adoption. Significant investments in infrastructure development, coupled with a robust residential and commercial building sector, drive consistent demand. The region is a key adopter of cordless and smart power cutting solutions, with a high preference for durable, efficient, and ergonomically designed tools. The United States and Canada are leading the market due to extensive renovation activities and a growing rental equipment market.

- Europe: Europe exhibits a diverse market, with Western European countries focusing on sustainable and low-emission power cutters, driven by stringent environmental regulations. Germany, the UK, and France are prominent markets due to their advanced construction techniques and emphasis on highly efficient and precise tools. Eastern Europe is experiencing growth propelled by new infrastructure projects and increasing adoption of modern construction practices. The European market also shows a strong inclination towards premium products and integrated digital solutions for job site management.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for power cutters, fueled by rapid urbanization, massive infrastructure projects (e.g., smart cities, transportation networks), and burgeoning construction industries in countries like China, India, and Southeast Asian nations. The demand is high for both high-power industrial tools and versatile handheld options. While price sensitivity remains a factor, there is a growing trend towards quality and efficiency, leading to increased adoption of advanced battery-powered and hydraulically driven cutters.

- Latin America: The Latin American market for power cutters is experiencing steady growth, primarily driven by investments in public infrastructure, mining, and residential construction projects across countries like Brazil, Mexico, and Argentina. Economic stability in key countries is fostering an environment for increased construction expenditure. While price remains a significant consideration, there is a growing awareness and demand for more reliable and efficient tools, contributing to the gradual shift towards higher quality equipment and an expanding rental market.

- Middle East and Africa (MEA): The MEA region presents substantial opportunities for the power cutter market, largely due to ambitious mega-projects in the construction and infrastructure sectors, particularly in the GCC countries (e.g., UAE, Saudi Arabia) and parts of Africa. Diversification efforts away from oil economies are driving significant investments in real estate, tourism infrastructure, and industrial development. The demand is predominantly for heavy-duty and robust power cutters capable of withstanding harsh environmental conditions and meeting the demands of large-scale, complex projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Power Cutter Market.- Company Alpha

- Company Beta

- Company Gamma

- Company Delta

- Company Epsilon

- Company Zeta

- Company Eta

- Company Theta

- Company Iota

- Company Kappa

- Company Lambda

- Company Mu

- Company Nu

- Company Xi

- Company Omicron

- Company Pi

- Company Rho

- Company Sigma

- Company Tau

- Company Upsilon

Frequently Asked Questions

What is a power cutter used for?

A power cutter, also known as a cut-off saw or concrete saw, is a versatile handheld or walk-behind machine primarily used for cutting hard materials like concrete, asphalt, metal, stone, and various masonry products. It is indispensable in construction, demolition, renovation, and utility maintenance for tasks such as creating openings, cutting pipes, or making precise cuts in road surfaces.

What are the main types of power cutters available?

Power cutters are broadly categorized by their power source and form factor. Common types include gasoline-powered for heavy-duty outdoor use, electric (corded and cordless battery-powered) for indoor and smaller jobs, hydraulic for high-power industrial applications, and pneumatic for specific workshop environments. They are also classified as handheld, walk-behind, or stationary based on their operational design.

How do battery-powered power cutters compare to gasoline models?

Battery-powered power cutters offer advantages such as lower noise, zero emissions, reduced vibration, and greater portability compared to gasoline models. While gasoline cutters traditionally provide more sustained power for demanding tasks, advancements in battery technology are rapidly closing the power gap, making cordless options increasingly viable for a wider range of applications, especially where emissions and noise are a concern.

What safety precautions should be taken when operating a power cutter?

Operating a power cutter requires strict adherence to safety protocols. Essential precautions include wearing appropriate Personal Protective Equipment (PPE) such as eye protection, hearing protection, gloves, and sturdy footwear. Operators must ensure proper ventilation, maintain a secure grip, be aware of kickback risks, and follow manufacturer guidelines for maintenance and blade replacement. Training on safe operation is crucial before use.

What is the future outlook for the power cutter market?

The power cutter market is expected to grow steadily, driven by global infrastructure development and the increasing adoption of advanced technologies. Future trends include further development of high-performance battery systems, integration of smart features for enhanced precision and diagnostics, and a growing emphasis on ergonomic designs and sustainable, low-emission models. Specialization for new, challenging materials will also shape market evolution.