Pharmaceutical Robot Market

Pharmaceutical Robot Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705001 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Pharmaceutical Robot Market Size

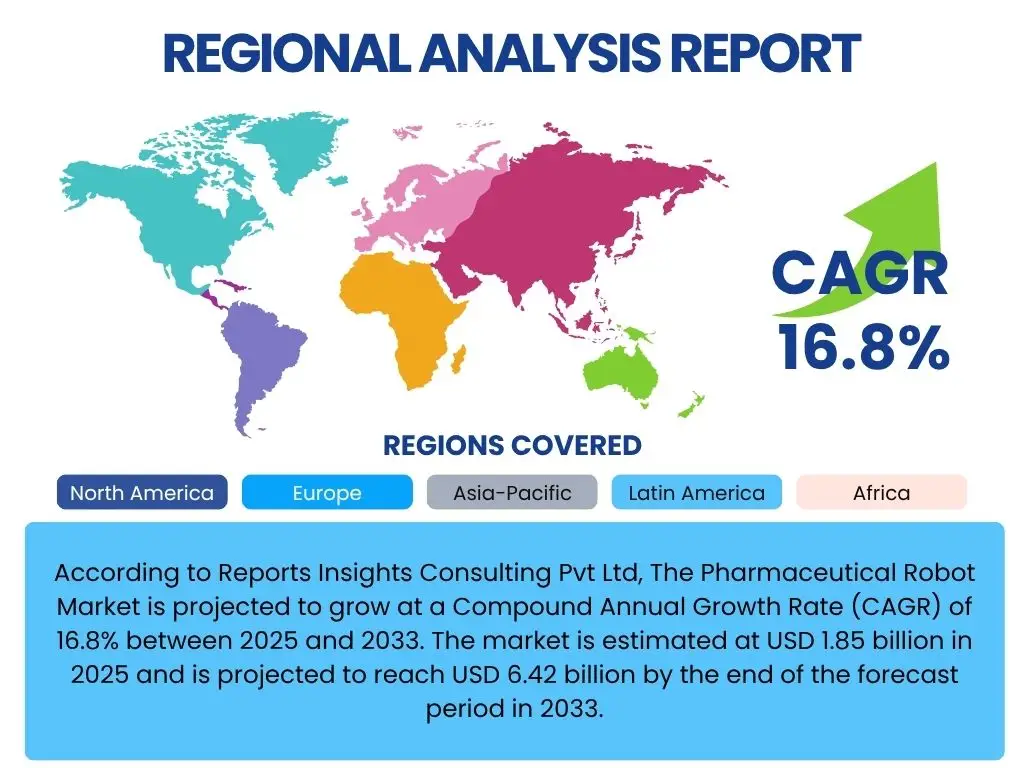

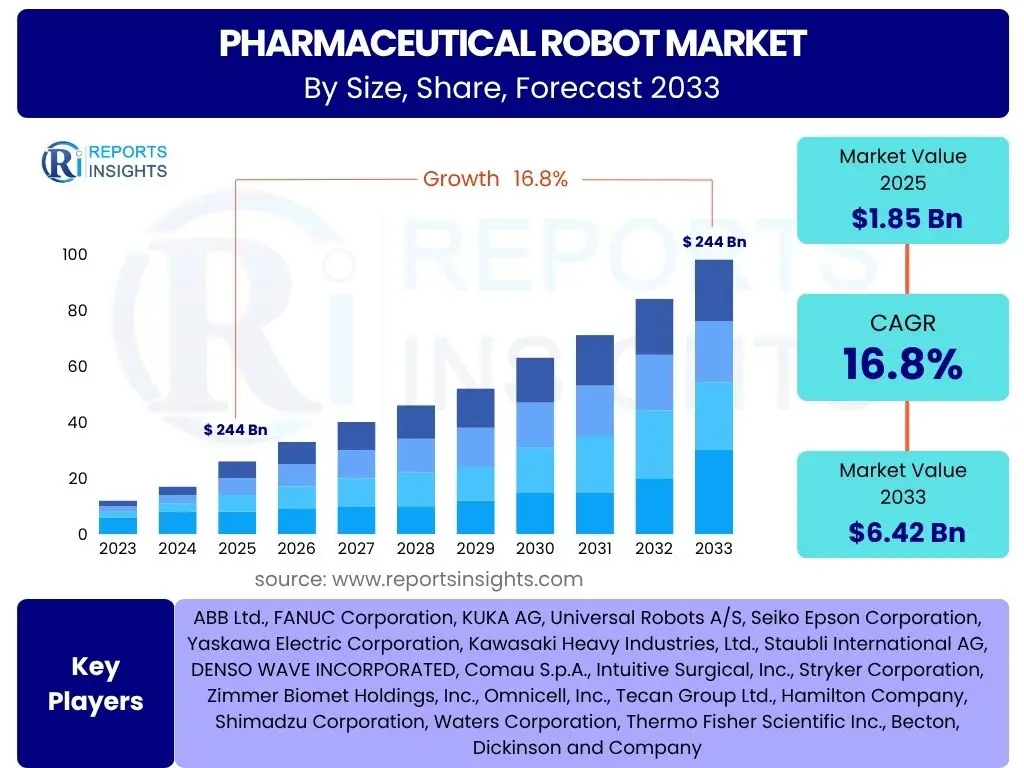

According to Reports Insights Consulting Pvt Ltd, The Pharmaceutical Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.8% between 2025 and 2033. The market is estimated at USD 1.85 billion in 2025 and is projected to reach USD 6.42 billion by the end of the forecast period in 2033.

Key Pharmaceutical Robot Market Trends & Insights

The pharmaceutical robot market is experiencing significant transformation, driven by a confluence of technological advancements, evolving regulatory landscapes, and increasing demands for efficiency and precision in drug manufacturing and research. Key user inquiries often revolve around the overarching themes shaping this growth, particularly the shift towards advanced automation and the integration of smart technologies. Insights indicate a strong trajectory towards the adoption of collaborative robots and AI-driven systems that promise to revolutionize traditional pharmaceutical operations by enhancing throughput, reducing human error, and ensuring higher standards of product quality and safety.

Another prominent area of interest among stakeholders concerns the practical implementation and scalability of robotic solutions within existing pharmaceutical infrastructures. The market is witnessing a notable trend towards modular and flexible robotic systems that can be easily integrated into diverse workflows, from drug discovery and laboratory automation to packaging, sterile compounding, and quality control. This adaptability is crucial for pharmaceutical companies aiming to modernize their facilities without complete overhauls, allowing for phased adoption and optimized return on investment. Furthermore, the emphasis on data analytics and connectivity is paramount, as companies seek to leverage robotic systems for comprehensive process monitoring and optimization.

The ongoing push for personalized medicine and the rapid development of biologics and cell & gene therapies are also fundamentally reshaping the demand for pharmaceutical robots. These highly sensitive and complex processes require unparalleled precision, sterility, and traceability, which conventional manual methods often struggle to provide consistently. Robots offer the ideal solution for handling delicate materials, executing intricate procedures, and maintaining strict aseptic conditions, thereby becoming indispensable tools in the future of advanced therapeutic manufacturing. This trend highlights a critical need for specialized robotic applications capable of navigating the unique challenges posed by these innovative drug modalities.

- Increasing adoption of collaborative robots (cobots) for human-robot interaction in labs and manufacturing.

- Rising demand for automation in high-throughput screening and drug discovery processes.

- Integration of artificial intelligence and machine learning for enhanced robotic precision, adaptability, and predictive maintenance.

- Growing focus on sterile compounding and aseptic processing applications for robots.

- Expansion of robotic solutions into personalized medicine and advanced therapy medicinal products (ATMPs) manufacturing.

- Development of cloud-connected robotic systems for remote monitoring and data analytics.

- Miniaturization and modular design of robotic systems for greater flexibility and easier integration.

AI Impact Analysis on Pharmaceutical Robot

Artificial intelligence is profoundly transforming the capabilities and applications of pharmaceutical robots, addressing common user questions about enhanced efficiency, accuracy, and autonomy. AI algorithms enable robots to learn from their environments, adapt to variable conditions, and optimize complex processes in real-time. This translates into significant improvements in tasks such as pipetting, sample handling, and quality control, where AI-powered vision systems can detect minute imperfections with unprecedented precision. The ability of AI to analyze vast datasets also allows robots to contribute to predictive maintenance, minimizing downtime and ensuring continuous operation in critical pharmaceutical production lines.

Furthermore, AI facilitates greater autonomy and decision-making capabilities in robotic systems, which is a major concern for users looking to reduce human intervention and potential contamination risks. AI-driven robots can independently navigate laboratory environments, identify and rectify errors, and even optimize experimental parameters based on real-time data feedback. This level of intelligent automation is crucial for accelerating drug discovery timelines, improving reproducibility of results, and ensuring compliance with stringent regulatory standards. The integration of AI also supports the development of more versatile and multi-functional robots capable of performing a wider array of tasks, thereby maximizing their utility within a pharmaceutical setting.

The impact extends to complex applications like personalized medicine, where AI-enabled robots can handle intricate and highly individualized workflows, from cell processing to aseptic filling. Users frequently inquire about the reliability and safety of AI-driven systems, and continuous advancements in AI ethics and robust validation frameworks are addressing these concerns. By automating data interpretation and offering predictive insights, AI not only enhances the physical execution of tasks by robots but also transforms the strategic planning and operational intelligence of pharmaceutical manufacturing and research, driving higher throughput and improved outcomes.

- Enabling advanced perception and object recognition for precise handling of delicate samples and vials.

- Facilitating adaptive learning for robots to optimize movement paths and task execution in dynamic environments.

- Powering predictive maintenance of robotic systems, reducing downtime and operational costs.

- Improving quality control through AI-driven vision systems for defect detection and anomaly identification.

- Enhancing autonomous decision-making in complex laboratory automation workflows.

- Optimizing drug discovery processes by analyzing high-throughput screening data and suggesting new compounds.

- Supporting real-time process optimization and self-correction in manufacturing lines.

Key Takeaways Pharmaceutical Robot Market Size & Forecast

The Pharmaceutical Robot Market is poised for substantial growth, reflecting a fundamental shift towards automation and digital transformation within the global pharmaceutical industry. User inquiries consistently highlight the critical role of robotics in addressing persistent industry challenges such as rising labor costs, the imperative for enhanced product quality, and the increasing complexity of drug development and manufacturing processes. The forecast indicates a robust Compound Annual Growth Rate, underscoring the escalating investment by pharmaceutical companies in advanced robotic solutions to maintain competitive advantages and meet stringent regulatory demands.

A significant takeaway is the expanding scope of robotic applications beyond traditional packaging and material handling. There is a clear trend towards the integration of robots into highly specialized and critical areas, including sterile compounding, personalized medicine, and biopharmaceutical production. This expansion is driven by the unparalleled precision, consistency, and sterility that robots offer, which are vital for these sensitive operations. Furthermore, the market's trajectory suggests a move towards more intelligent, connected, and collaborative robotic systems, hinting at a future where human-robot cooperation becomes a standard in pharmaceutical workflows.

The substantial projected market valuation by 2033 reinforces the notion that pharmaceutical robots are no longer just an emerging technology but a foundational element of modern pharmaceutical infrastructure. Companies are recognizing the long-term value proposition, including reduced operational costs, increased throughput, and improved safety profiles. This robust growth forecast signals ample opportunities for technology providers and system integrators to innovate and expand their offerings, catering to a burgeoning demand for sophisticated, purpose-built robotic solutions across the entire pharmaceutical value chain, from R&D to final product delivery.

- Significant market growth driven by automation needs in pharmaceutical manufacturing and R&D.

- Shift towards high-precision and sterile applications, including personalized medicine and biopharmaceutical production.

- Increasing investment in collaborative robots and AI-powered automation to enhance efficiency and reduce human error.

- Robust adoption across various segments from drug discovery to packaging and quality control.

- Strong financial outlook indicates high potential for innovation and expansion for technology providers.

Pharmaceutical Robot Market Drivers Analysis

The Pharmaceutical Robot Market is propelled by several compelling drivers that collectively underscore the industry's imperative to enhance efficiency, safety, and compliance. The escalating demand for higher precision and throughput in drug discovery and manufacturing processes is a primary catalyst. Traditional manual methods are increasingly insufficient to meet the rigorous quality standards and accelerating production schedules required by global pharmaceutical markets, prompting a widespread adoption of robotic automation. This includes everything from automated pipetting and sample handling in laboratories to high-speed packaging and sterile filling on production lines, where robots ensure unmatched accuracy and reproducibility.

Another significant driver is the persistent pressure to reduce operational costs and mitigate the risks associated with human error and contamination. Robots offer a consistent, tireless, and contamination-free alternative to human labor in environments demanding aseptic conditions, such as sterile compounding and cell & gene therapy manufacturing. Furthermore, the global aging population and the associated rise in chronic diseases are fueling the demand for new pharmaceutical products, necessitating faster R&D cycles and more efficient production methods. Robotics plays a crucial role in accelerating these processes by automating repetitive tasks, thereby freeing human experts to focus on more complex, value-added activities.

Finally, the advent of Industry 4.0 principles, characterized by smart factories, interconnected systems, and data-driven decision-making, significantly boosts the adoption of pharmaceutical robots. Regulatory bodies are also continuously tightening standards for drug safety and quality, requiring pharmaceutical companies to implement more robust and traceable manufacturing processes. Robots, with their inherent ability to perform tasks consistently and record every action, are instrumental in achieving compliance and demonstrating adherence to Good Manufacturing Practices (GMP). This confluence of operational, economic, and regulatory pressures firmly positions robotics as an indispensable technology in the modern pharmaceutical landscape.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Automation in Drug Discovery & R&D | +3.5% | North America, Europe, APAC | Short-term to Mid-term (2025-2029) |

| Growing Need for Precision & Accuracy in Manufacturing | +2.8% | Global | Mid-term to Long-term (2027-2033) |

| Rising Labor Costs & Shortages in Pharmaceutical Industry | +2.0% | North America, Europe, Japan | Short-term to Mid-term (2025-2030) |

| Stringent Regulatory Requirements & Quality Control Needs | +1.7% | Global | Ongoing |

| Technological Advancements in Robotics & AI | +2.2% | Global | Long-term (2028-2033) |

| Expansion of Biopharmaceuticals & Personalized Medicine | +2.5% | North America, Europe, China | Mid-term to Long-term (2027-2033) |

Pharmaceutical Robot Market Restraints Analysis

Despite the robust growth trajectory, the Pharmaceutical Robot Market faces several significant restraints that could potentially temper its expansion. One of the primary barriers is the substantial initial capital investment required for acquiring and implementing robotic systems. This high upfront cost can be prohibitive, especially for small to medium-sized pharmaceutical companies or those with limited access to capital, making it challenging for them to justify the immediate return on investment. The complexity of integrating these advanced systems with existing legacy infrastructure and processes also adds to the overall cost and time commitment, creating a considerable hurdle for widespread adoption.

Another critical restraint involves the shortage of skilled personnel required to operate, program, and maintain these sophisticated robotic systems. While robots reduce the need for manual labor in repetitive tasks, they create a demand for highly specialized engineers and technicians with expertise in robotics, automation, and pharmaceutical processes. The scarcity of such talent can lead to operational inefficiencies, increased training costs, and slower adoption rates, particularly in regions where educational infrastructure for advanced manufacturing is less developed. This human capital gap poses a significant challenge to maximizing the potential benefits of robotic automation.

Furthermore, regulatory complexities and the inherent resistance to change within conservative pharmaceutical environments can act as significant impediments. The strict regulatory frameworks governing pharmaceutical manufacturing, while promoting quality, can also slow down the adoption of new, unproven technologies. The validation and qualification processes for robotic systems within GMP environments are rigorous and time-consuming, requiring extensive documentation and testing. Additionally, a lingering perception of job displacement due to automation can lead to internal resistance from the workforce, which necessitates careful change management strategies to ensure successful implementation and acceptance of robotic solutions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment Costs | -2.0% | Global, particularly emerging markets | Short-term to Mid-term (2025-2030) |

| Lack of Skilled Workforce for Operation & Maintenance | -1.5% | Global, varies by region | Mid-term (2026-2031) |

| Integration Complexities with Legacy Systems | -1.2% | Established markets with older infrastructure | Short-term to Mid-term (2025-2029) |

| Regulatory Hurdles & Validation Challenges | -1.0% | Global | Ongoing |

| Resistance to Change within Traditional Pharmaceutical Environments | -0.8% | Global | Long-term (2028-2033) |

Pharmaceutical Robot Market Opportunities Analysis

The Pharmaceutical Robot Market is rich with emerging opportunities driven by innovation, expanding applications, and geographical growth. A significant opportunity lies in the burgeoning field of personalized medicine, cell & gene therapies, and biopharmaceuticals. These advanced therapies require extremely precise, sterile, and consistent handling that conventional methods struggle to provide. Robots are uniquely positioned to meet these demands, offering controlled environments, micro-level precision, and traceability essential for the manufacturing and packaging of highly sensitive and valuable drug products. This niche but rapidly growing segment presents a fertile ground for specialized robotic solutions and substantial market expansion.

Geographical expansion into emerging markets, particularly in Asia Pacific, Latin America, and the Middle East, represents another lucrative opportunity. As healthcare infrastructure develops and pharmaceutical manufacturing capabilities grow in these regions, there will be an increasing demand for automation to meet local and global quality standards while managing rising labor costs. Governments in these areas are often keen to adopt advanced manufacturing technologies to boost their domestic pharmaceutical industries, creating supportive environments for robotic integration. This offers market players significant avenues for market penetration and establishing new revenue streams.

Furthermore, the continuous advancements in robotics, artificial intelligence, and machine learning are creating opportunities for developing more sophisticated, versatile, and cost-effective robotic systems. The rise of collaborative robots (cobots), which can work safely alongside human operators, lowers the barrier to entry for many companies by reducing the need for extensive safety guarding and facilitating more flexible workflows. Innovation in areas such as modular design, cloud connectivity, and enhanced sensor technologies will further broaden the applicability of robots across the pharmaceutical value chain, from R&D laboratories to complex manufacturing lines, fostering new use cases and driving sustained market growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Biopharmaceuticals & Personalized Medicine | +3.0% | North America, Europe, APAC | Mid-term to Long-term (2027-2033) |

| Growth in Emerging Markets (e.g., APAC, LATAM) | +2.5% | Asia Pacific, Latin America, MEA | Mid-term (2026-2031) |

| Development of More Affordable & Versatile Collaborative Robots | +2.0% | Global | Short-term to Mid-term (2025-2029) |

| Integration with Advanced Technologies (AI, IoT, Cloud) | +1.8% | Global | Long-term (2028-2033) |

| Increasing Focus on Remote Operations & Automation in Small Labs | +1.5% | Global | Mid-term (2026-2031) |

Pharmaceutical Robot Market Challenges Impact Analysis

The Pharmaceutical Robot Market faces several critical challenges that demand strategic responses from industry stakeholders. A primary challenge revolves around the significant data security and intellectual property concerns associated with highly automated and connected robotic systems. As robots become more integrated into critical pharmaceutical processes, handling sensitive drug formulations and research data, they become potential targets for cyber-attacks. Ensuring robust cybersecurity measures and protecting proprietary information is paramount, requiring substantial investment in secure network infrastructures and compliance with stringent data protection regulations, which can add complexity and cost to implementations.

Another substantial challenge is the lack of industry-wide standardization for robotic system integration and communication protocols. The diverse range of robot manufacturers, software platforms, and laboratory equipment often leads to compatibility issues and complex, time-consuming integration efforts. This absence of universal standards can hinder seamless data exchange, interoperability, and scalability across different pharmaceutical facilities or research consortia. Developing and adhering to common protocols would significantly streamline deployment, reduce costs, and accelerate the widespread adoption of robotic automation, but achieving such consensus remains an ongoing hurdle.

Furthermore, the rapid pace of technological advancements in robotics and automation presents a double-edged sword, creating a challenge of rapid obsolescence. Pharmaceutical companies investing in state-of-the-art robotic systems face the risk that their equipment may quickly become outdated as newer, more efficient, or more capable models emerge. This necessitates careful planning for future upgrades, modular designs, and flexible architectures to ensure long-term viability and return on investment. Balancing the adoption of cutting-edge technology with the need for long-term operational stability and cost-effectiveness remains a perpetual challenge in this dynamic market.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Data Security & Intellectual Property Concerns | -1.8% | Global | Ongoing |

| Lack of Standardization & Interoperability | -1.5% | Global | Mid-term (2026-2031) |

| High Cost of Customization & Integration | -1.2% | Global, particularly smaller enterprises | Short-term to Mid-term (2025-2029) |

| Rapid Technological Obsolescence | -1.0% | Global | Long-term (2028-2033) |

| Validation & Regulatory Compliance for New Systems | -0.9% | Global | Ongoing |

Pharmaceutical Robot Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Pharmaceutical Robot Market, meticulously examining its current landscape, growth trajectory, and future outlook. The scope encompasses detailed segmentation by robot type, application, end-use, and component, offering granular insights into the various sub-sectors driving market expansion. It also provides a thorough regional analysis, highlighting key growth pockets and investment opportunities across major geographical segments, enabling stakeholders to make informed strategic decisions.

The report includes a rigorous assessment of market drivers, restraints, opportunities, and challenges, providing a holistic view of the forces shaping the industry. Furthermore, it incorporates an extensive competitive landscape analysis, profiling leading companies and their strategic initiatives, product portfolios, and market presence. The insights derived from this report are designed to assist pharmaceutical companies, robot manufacturers, automation solution providers, investors, and regulatory bodies in understanding market dynamics, identifying emerging trends, and capitalizing on growth prospects within this evolving sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 6.42 Billion |

| Growth Rate | 16.8% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., FANUC Corporation, KUKA AG, Universal Robots A/S, Seiko Epson Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Staubli International AG, DENSO WAVE INCORPORATED, Comau S.p.A., Intuitive Surgical, Inc., Stryker Corporation, Zimmer Biomet Holdings, Inc., Omnicell, Inc., Tecan Group Ltd., Hamilton Company, Shimadzu Corporation, Waters Corporation, Thermo Fisher Scientific Inc., Becton, Dickinson and Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Pharmaceutical Robot Market is meticulously segmented to provide a granular understanding of its diverse landscape and growth drivers across various dimensions. This comprehensive segmentation allows for an in-depth analysis of specific market niches, enabling stakeholders to identify high-growth areas and tailor their strategies accordingly. By breaking down the market based on robot type, application, end-use, and component, the report offers detailed insights into the dynamics of each category, illustrating how different technological advancements and industry demands contribute to overall market expansion.

Understanding these segments is crucial for both market players and new entrants to grasp the intricacies of demand and supply within the pharmaceutical automation ecosystem. For instance, the type of robot adopted often dictates the precision and complexity of tasks it can perform, while the application segment highlights the specific processes being automated. End-use segmentation reveals the primary adopters of these technologies, from large pharmaceutical corporations to smaller research institutions, each with distinct needs and investment capacities. The component analysis, on the other hand, provides insights into the technological building blocks and supply chain dynamics of robotic systems.

This multi-dimensional segmentation is vital for effective market forecasting, competitive positioning, and product development. It aids in identifying emerging trends within sub-segments, such as the increasing demand for collaborative robots in laboratory settings or the specialized requirements for robots in cell and gene therapy manufacturing. By analyzing these segments comprehensively, the report provides a clear roadmap for navigating the complexities of the Pharmaceutical Robot Market and leveraging specific growth opportunities.

- By Robot Type: Includes Articulated Robots (versatile, multi-axis), SCARA Robots (high-speed, precise), Delta Robots (high-speed, pick-and-place), Collaborative Robots (cobots, human-safe interaction), Cartesian Robots (linear motion, large workspaces), and others (e.g., Cylindrical, Spherical).

- By Application: Covers Drug Discovery & Research (screening, sample prep), Laboratory Automation (pipetting, plate handling), Packaging & Inspection (labeling, quality checks), Sterile Compounding & Filling (aseptic environments), Material Handling & Logistics (transport, storage), Quality Control & Testing (analytical support), Formulation & Dispensing (precise ingredient mixing), and other specialized uses.

- By End-Use: Categorizes key consumers such as Pharmaceutical Companies (manufacturing, R&D), Biotechnology Companies (biologics, gene therapy), Contract Research Organizations (CROs), Contract Manufacturing Organizations (CMOs), Research & Academic Institutes (basic research, academic labs), and Hospitals & Pharmacies (compounding pharmacies, hospital labs).

- By Component: Details the constituent parts including Robot Arms, Controllers (for programming and motion control), End Effectors (various grippers, tools), Sensors (for vision, force, proximity), Software (for programming, simulation, data analysis), Vision Systems (for guidance, inspection), and Other Components (e.g., drives, cables, safety systems).

Regional Highlights

- North America: This region dominates the pharmaceutical robot market, driven by significant investments in pharmaceutical R&D, advanced healthcare infrastructure, and the early adoption of automation technologies. The presence of numerous leading pharmaceutical and biotechnology companies, coupled with a strong emphasis on personalized medicine and high-throughput screening, fuels the demand for sophisticated robotic solutions. Stringent regulatory frameworks and high labor costs further incentivize automation, ensuring sustained growth in this region.

- Europe: Europe represents another key market, characterized by its mature pharmaceutical industry and a proactive approach towards Industry 4.0 initiatives. Countries like Germany, Switzerland, and the UK are at the forefront of robotic adoption in pharmaceutical manufacturing and research. The region benefits from robust government funding for R&D, a strong focus on quality and compliance, and a growing demand for biopharmaceuticals, all contributing to the steady uptake of robotic systems across the value chain.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate in the pharmaceutical robot market. This rapid expansion is attributed to the burgeoning pharmaceutical industries in countries like China, India, and Japan, which are increasing their manufacturing capacities and modernizing facilities. Rising healthcare expenditures, increasing contract manufacturing activities, and a growing focus on improving product quality and efficiency are driving the adoption of automation. Government initiatives to promote advanced manufacturing also play a crucial role in accelerating market growth here.

- Latin America: This region is experiencing steady growth, fueled by improving healthcare infrastructure and increasing investments in domestic pharmaceutical production. Countries such as Brazil and Mexico are emerging as key markets, as pharmaceutical companies seek to enhance manufacturing efficiency and meet growing local demand. While still developing compared to more mature markets, the increasing awareness of automation benefits and the push for competitive manufacturing drive the adoption of pharmaceutical robots.

- Middle East and Africa (MEA): The MEA region is witnessing gradual adoption of pharmaceutical robots, primarily driven by investments in healthcare modernization and efforts to establish local pharmaceutical manufacturing capabilities. Gulf Cooperation Council (GCC) countries are leading this trend, with a focus on diversifying their economies and building robust healthcare ecosystems. Challenges such as high initial investment costs and the need for specialized skills remain, but the long-term potential for automation in this developing pharmaceutical landscape is promising.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Robot Market.- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Universal Robots A/S

- Seiko Epson Corporation

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Staubli International AG

- DENSO WAVE INCORPORATED

- Comau S.p.A.

- Intuitive Surgical, Inc.

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Omnicell, Inc.

- Tecan Group Ltd.

- Hamilton Company

- Shimadzu Corporation

- Waters Corporation

- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company

Frequently Asked Questions

What is the current market size of the Pharmaceutical Robot Market?

The Pharmaceutical Robot Market is estimated at USD 1.85 billion in 2025, demonstrating significant ongoing investment and adoption within the global pharmaceutical industry.

What is the projected growth rate for the Pharmaceutical Robot Market?

The Pharmaceutical Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.8% between 2025 and 2033, indicating robust expansion driven by increasing automation needs.

What are the key applications of robots in the pharmaceutical industry?

Key applications include drug discovery and research, laboratory automation, packaging and inspection, sterile compounding and filling, material handling, and quality control, enhancing precision and efficiency across various processes.

How does AI impact pharmaceutical robots?

AI significantly enhances pharmaceutical robots by enabling advanced perception, adaptive learning, predictive maintenance, and autonomous decision-making, leading to improved accuracy, efficiency, and real-time process optimization.

Which regions are leading in the adoption of pharmaceutical robots?

North America and Europe currently lead in pharmaceutical robot adoption due to advanced infrastructure and high R&D investments, while the Asia Pacific region is projected for the highest growth due to expanding manufacturing capabilities and modernization efforts.