Pharmaceutical Excipient for Oral Formulation Market

Pharmaceutical Excipient for Oral Formulation Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704989 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Pharmaceutical Excipient for Oral Formulation Market Size

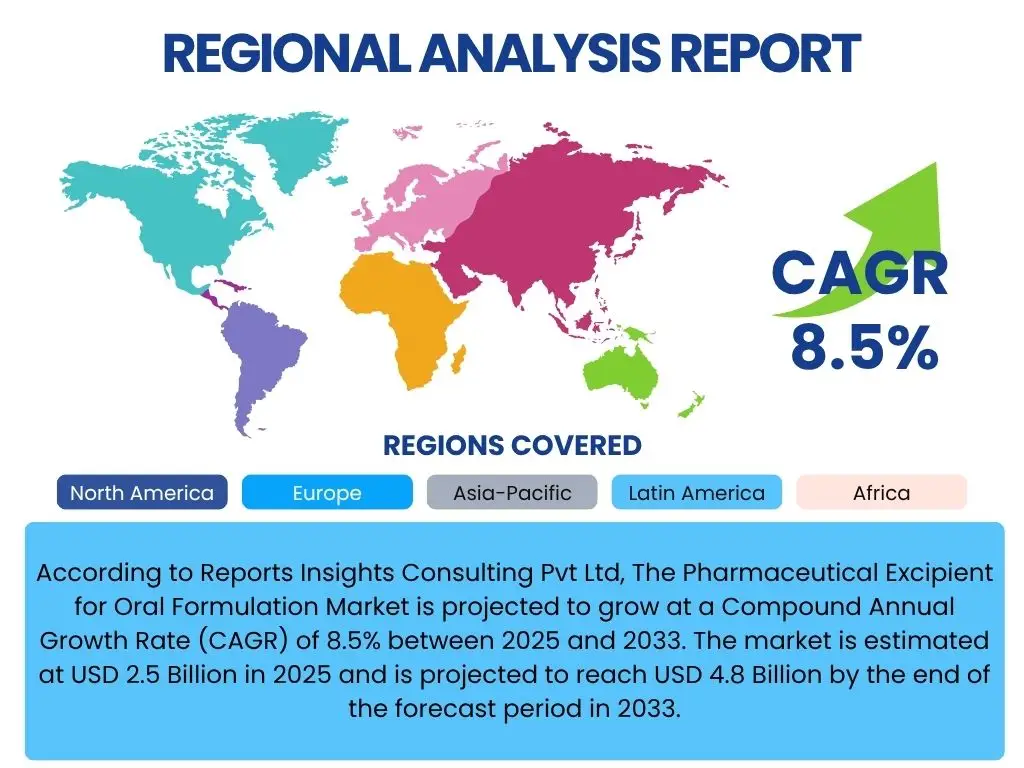

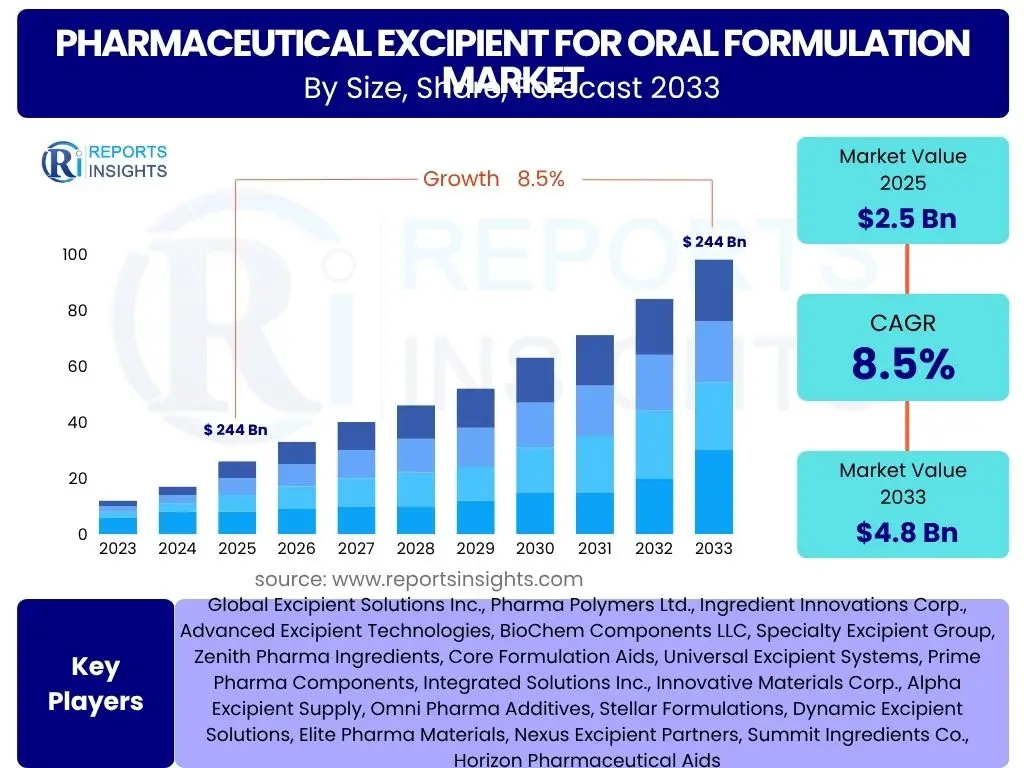

According to Reports Insights Consulting Pvt Ltd, The Pharmaceutical Excipient for Oral Formulation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at USD 2.5 Billion in 2025 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

Key Pharmaceutical Excipient for Oral Formulation Market Trends & Insights

The Pharmaceutical Excipient for Oral Formulation Market is currently experiencing a dynamic shift, driven by advancements in drug delivery systems and an increasing focus on patient-centric formulations. Key trends highlight the growing demand for highly functional excipients that offer enhanced solubility, bioavailability, and targeted release profiles for complex active pharmaceutical ingredients (APIs). There is a significant move towards co-processed excipients, which provide synergistic properties, simplifying manufacturing processes and improving tabletability or flow characteristics. Furthermore, sustainability considerations and the development of greener excipients are gaining traction, reflecting broader industry commitments to environmental responsibility.

Another prominent trend involves the customization of excipient properties to suit specific drug characteristics and patient needs, particularly in pediatric and geriatric formulations. This includes the development of taste-masking agents, orally disintegrating tablet (ODT) excipients, and excipients suitable for personalized medicine applications like 3D printing. Regulatory frameworks are also evolving, pushing for stricter quality control and detailed characterization of excipients, which in turn drives innovation in excipient manufacturing and testing technologies. The convergence of these factors is fostering a competitive landscape where excipient suppliers are increasingly investing in research and development to meet sophisticated pharmaceutical requirements.

- Shift towards highly functional excipients for improved drug delivery.

- Increased adoption of co-processed excipients for enhanced manufacturability.

- Growing emphasis on patient-centric formulations, including pediatric and geriatric applications.

- Rising demand for sustainable and bio-derived excipient options.

- Advancements in excipient characterization and quality control technologies.

- Development of excipients for novel drug delivery systems like 3D printing.

AI Impact Analysis on Pharmaceutical Excipient for Oral Formulation

Artificial Intelligence (AI) is poised to significantly transform the Pharmaceutical Excipient for Oral Formulation market by optimizing discovery, development, and manufacturing processes. Users are increasingly seeking to understand how AI can streamline excipient selection, predict their performance in complex formulations, and accelerate the overall drug development timeline. The application of AI algorithms, particularly machine learning, can analyze vast datasets of excipient properties, drug characteristics, and formulation outcomes, identifying optimal combinations that might be missed through traditional trial-and-error methods. This predictive capability promises to reduce the time and cost associated with formulation development, leading to faster market entry for new oral drug products.

Beyond initial discovery and selection, AI's influence extends to process optimization and quality control within excipient manufacturing. AI-powered systems can monitor production parameters in real-time, predict potential deviations, and ensure consistent excipient quality, addressing common concerns regarding batch-to-batch variability. Furthermore, AI can aid in predicting drug stability with different excipient combinations, enhancing shelf-life and reducing wastage. While initial implementation may involve significant investment in data infrastructure and AI expertise, the long-term benefits in terms of efficiency, reduced development cycles, and improved product quality are expected to drive widespread adoption across the excipient and pharmaceutical industries, fundamentally altering how oral formulations are designed and produced.

- Accelerated excipient discovery and selection through predictive modeling.

- Optimization of formulation compositions for improved drug performance.

- Enhanced quality control and consistency in excipient manufacturing.

- Predictive analytics for drug stability and shelf-life determination.

- Streamlined regulatory documentation and compliance processes.

- Reduced development costs and timelines for oral drug products.

Key Takeaways Pharmaceutical Excipient for Oral Formulation Market Size & Forecast

The Pharmaceutical Excipient for Oral Formulation market is exhibiting robust growth, underscored by the increasing global demand for oral solid dosage forms and continuous innovation in excipient functionalities. A primary takeaway is the significant expansion projected between 2025 and 2033, driven by the rising prevalence of chronic diseases, a growing geriatric population, and the convenience associated with oral drug administration. The market's upward trajectory is also sustained by the relentless pursuit of novel drug delivery solutions, which necessitates specialized and high-performance excipients capable of addressing complex solubility and bioavailability challenges.

Furthermore, the market's evolution points towards a greater emphasis on strategic partnerships and collaborations between excipient manufacturers and pharmaceutical companies to co-develop tailored solutions. This collaborative approach is vital for addressing specific formulation hurdles and for accelerating the commercialization of new drug entities. The forecast also highlights the increasing regional divergence in growth, with emerging economies in Asia Pacific showing substantial potential due to expanding pharmaceutical manufacturing capabilities and improving healthcare infrastructure. Overall, the market remains highly innovative, responsive to regulatory changes, and critical to the success of oral pharmaceutical product development.

- Robust market growth expected, driven by increasing oral drug demand.

- Significant opportunities in functional and specialized excipients.

- Growing importance of co-development and partnerships in the value chain.

- Asia Pacific identified as a key growth region for excipient consumption.

- Continued innovation is crucial for addressing complex drug delivery challenges.

- Market resilience linked to essential role in pharmaceutical formulation.

Pharmaceutical Excipient for Oral Formulation Market Drivers Analysis

The Pharmaceutical Excipient for Oral Formulation market is propelled by several robust drivers, primarily the escalating global demand for oral solid dosage forms, which remain the preferred method of drug administration due to patient convenience, cost-effectiveness, and ease of self-medication. This preference is particularly strong among the aging global population, who often require multiple medications and benefit from simpler dosing regimens. Advances in pharmaceutical research and development, leading to a surge in complex and poorly soluble active pharmaceutical ingredients (APIs), necessitate the development and utilization of highly functional and specialized excipients that can enhance drug solubility, bioavailability, and stability, thereby expanding the therapeutic efficacy of new drug candidates.

Furthermore, the increasing prevalence of chronic diseases globally, such as diabetes, cardiovascular conditions, and various cancers, translates directly into a higher volume of prescribed oral medications. This sustained demand fuels the need for a diverse range of excipients. Concurrently, the growth of the generics and biosimilars market, driven by patent expirations and the push for affordable healthcare, also contributes significantly. Generic manufacturers often rely on well-characterized and cost-effective excipients to replicate branded formulations, ensuring bioequivalence and consistent quality. These factors collectively create a strong and continuous demand for advanced oral excipients.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Oral Solid Dosage Forms | +1.8% | Global, particularly North America, Europe, Asia Pacific | 2025-2033 |

| Rising Prevalence of Chronic Diseases and Geriatric Population | +1.5% | Global, significant in developed nations | 2025-2033 |

| Growth in the Generics and Biosimilars Market | +1.2% | Asia Pacific, Latin America, North America | 2025-2033 |

| Technological Advancements in Excipient Functionality | +1.0% | North America, Europe | 2025-2033 |

| Focus on Patient Compliance and Convenient Drug Delivery | +0.8% | Global | 2025-2033 |

Pharmaceutical Excipient for Oral Formulation Market Restraints Analysis

Despite the positive growth trajectory, the Pharmaceutical Excipient for Oral Formulation market faces notable restraints, primarily centered around stringent regulatory requirements and the high cost associated with excipient development and approval. The regulatory landscape for pharmaceutical excipients is complex and continuously evolving, demanding extensive data on safety, efficacy, and consistent quality. Obtaining approvals for novel excipients involves lengthy and expensive toxicological studies, clinical trials, and detailed documentation, which can deter innovation and limit the introduction of new products. Manufacturers must adhere to Good Manufacturing Practices (GMP) and maintain rigorous quality control, adding to operational overheads.

Another significant restraint is the intellectual property (IP) challenges and the relatively low profit margins for certain commodity excipients. While specialty excipients command higher prices, many conventional excipients are subject to intense price competition, particularly from manufacturers in emerging economies. This can limit the capital available for research and development within the excipient industry. Furthermore, the global supply chain for excipients can be vulnerable to disruptions, including raw material availability, geopolitical events, and transportation challenges, which can impact production schedules and increase costs for pharmaceutical manufacturers. These factors collectively pose challenges to market expansion and profitability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Regulatory Requirements and Approval Processes | -0.9% | Global, particularly developed regions | 2025-2033 |

| High Development and Manufacturing Costs | -0.7% | Global | 2025-2033 |

| Supply Chain Vulnerabilities and Raw Material Price Volatility | -0.5% | Global | 2025-2033 |

| Intellectual Property Concerns and Imitation Risks | -0.4% | Global | 2025-2033 |

Pharmaceutical Excipient for Oral Formulation Market Opportunities Analysis

Significant opportunities exist within the Pharmaceutical Excipient for Oral Formulation market, driven by the continuous need for innovative solutions in drug delivery and formulation. A key opportunity lies in the development of novel excipients that can address the challenges posed by poorly soluble and highly potent APIs. This includes excipients for amorphous solid dispersions, self-emulsifying drug delivery systems (SMEDDS), and other advanced formulation techniques aimed at enhancing bioavailability. The increasing focus on personalized medicine and 3D printing of pharmaceuticals also presents a burgeoning opportunity for specialized excipients that can be tailored for specific patient needs or complex dosage forms, allowing for greater customization and improved therapeutic outcomes.

Furthermore, the growing demand for excipients suitable for biopharmaceutical formulations, particularly oral delivery of peptides and proteins, represents a high-value segment. As the biologics market expands, so too does the need for excipients that can protect these sensitive molecules from degradation in the gastrointestinal tract. Emerging markets, particularly in Asia Pacific and Latin America, offer substantial growth potential due to expanding pharmaceutical manufacturing bases, increasing healthcare expenditure, and a rising patient population. These regions present opportunities for both established and new excipient manufacturers to scale operations and cater to a rapidly developing pharmaceutical industry. The trend towards sustainable and green chemistry in excipient manufacturing also offers a distinct competitive advantage for companies investing in environmentally friendly production processes and bio-based materials.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Novel Excipients for Poorly Soluble APIs | +1.3% | Global, strong in developed markets | 2025-2033 |

| Growth in Biologics and Personalized Medicine Formulations | +1.1% | North America, Europe, Asia Pacific | 2025-2033 |

| Untapped Potential in Emerging Markets (APAC, LatAm) | +0.9% | Asia Pacific, Latin America, MEA | 2025-2033 |

| Adoption of Sustainable and Green Excipient Technologies | +0.7% | Europe, North America | 2025-2033 |

| Application in Advanced Drug Delivery Systems (e.g., 3D Printing) | +0.5% | Global, R&D focused regions | 2025-2033 |

Pharmaceutical Excipient for Oral Formulation Market Challenges Impact Analysis

The Pharmaceutical Excipient for Oral Formulation market faces several significant challenges that can impact its growth and operational efficiency. One primary challenge is the increasing complexity of drug formulations, particularly with the rise of highly potent, sensitive, or poorly soluble APIs. This necessitates excipients with highly specific and often multi-functional properties, demanding extensive research and development and rigorous testing to ensure compatibility and stability, which adds considerable time and cost to the development cycle. Ensuring batch-to-batch consistency and high-quality standards across diverse manufacturing sites globally also presents a continuous challenge, requiring sophisticated quality assurance systems and experienced personnel.

Another formidable challenge is the pressure from pharmaceutical companies to reduce formulation costs while maintaining high quality and performance. This puts excipient manufacturers under constant pressure to optimize production processes, source raw materials cost-effectively, and innovate without significantly increasing prices. Furthermore, the harmonization of global regulatory standards for excipients remains an ongoing challenge. While efforts are being made, differing regulatory requirements across countries can complicate market entry and increase the administrative burden for excipient suppliers operating internationally. The need for specialized technical expertise in excipient science and regulatory affairs also poses a talent acquisition challenge for companies in this sector.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complexity of Drug Formulations and API Characteristics | -0.8% | Global | 2025-2033 |

| Stringent Quality Control and Batch Consistency Requirements | -0.6% | Global | 2025-2033 |

| Cost Pressures from Pharmaceutical Manufacturers | -0.5% | Global | 2025-2033 |

| Lack of Global Regulatory Harmonization for Excipients | -0.4% | Global | 2025-2033 |

| Need for Specialized Technical Expertise and Talent Acquisition | -0.3% | Global | 2025-2033 |

Pharmaceutical Excipient for Oral Formulation Market - Updated Report Scope

This report provides a comprehensive analysis of the Pharmaceutical Excipient for Oral Formulation Market, offering insights into market size, growth drivers, restraints, opportunities, and competitive landscape. It covers a detailed segmentation analysis across various types of excipients, their applications in different oral dosage forms, and regional market dynamics. The study also includes an in-depth examination of the impact of emerging technologies like Artificial Intelligence and sustainability trends on the market trajectory. The report is designed to assist stakeholders in making informed strategic decisions by providing a forward-looking perspective on the industry's future.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | 8.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Excipient Solutions Inc., Pharma Polymers Ltd., Ingredient Innovations Corp., Advanced Excipient Technologies, BioChem Components LLC, Specialty Excipient Group, Zenith Pharma Ingredients, Core Formulation Aids, Universal Excipient Systems, Prime Pharma Components, Integrated Solutions Inc., Innovative Materials Corp., Alpha Excipient Supply, Omni Pharma Additives, Stellar Formulations, Dynamic Excipient Solutions, Elite Pharma Materials, Nexus Excipient Partners, Summit Ingredients Co., Horizon Pharmaceutical Aids |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Pharmaceutical Excipient for Oral Formulation Market is meticulously segmented to provide a granular understanding of its diverse components, aiding in targeted market strategies and product development. The primary segmentation is by Product Type, distinguishing between various functional categories such as binders, fillers, disintegrants, lubricants, and coating agents, each playing a crucial role in the final drug formulation. This classification helps in identifying demand patterns for specific excipient functionalities and their impact on drug performance and manufacturability.

Further segmentation by Origin (Natural, Synthetic, Semi-synthetic) reflects the sourcing and chemical complexity of excipients, influencing cost, regulatory acceptance, and sustainability profiles. The market is also analyzed by Functionality, differentiating between conventional excipients that provide basic bulk and form, and functional excipients that offer enhanced properties like solubility enhancement, taste masking, or controlled release. Finally, the segmentation by Formulation Type (Tablets, Capsules, Liquid Orals, etc.) and Application areas (Cardiovascular, Oncology, Neurology, etc.) provides a comprehensive view of how excipients are utilized across the broad spectrum of oral pharmaceutical products and therapeutic areas, highlighting high-growth application segments.

- By Product Type: Binders, Fillers & Diluents, Disintegrants, Lubricants, Glidants, Colorants & Flavoring Agents, Preservatives, Sweeteners, Solubilizers & Surfactants, Coating Agents, Others.

- By Origin: Natural Excipients, Synthetic Excipients, Semi-synthetic Excipients.

- By Functionality: Functional Excipients, Conventional Excipients.

- By Formulation Type: Tablets, Capsules, Liquid Orals (Solutions, Suspensions, Syrups), Powders & Granules, Others.

- By Application: Cardiovascular, Oncology, Neurology, Pain Management, Infectious Diseases, Gastrointestinal, Respiratory, Pediatrics, Geriatrics, Others.

Regional Highlights

- North America: This region holds a significant share of the market, driven by a well-established pharmaceutical industry, high R&D investments, and a strong focus on advanced drug delivery systems. The presence of major pharmaceutical companies and stringent regulatory standards also contribute to the demand for high-quality and functional excipients.

- Europe: Europe is another key market, characterized by robust pharmaceutical manufacturing, a strong generics industry, and continuous innovation in excipient technology. Regulatory bodies like the European Medicines Agency (EMA) ensure high standards for excipient quality and safety, fostering a demand for specialized products.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC benefits from expanding healthcare infrastructure, increasing pharmaceutical production capabilities, and a rising patient population. Countries like China, India, and Japan are becoming global hubs for pharmaceutical manufacturing and research, driving substantial growth in excipient consumption.

- Latin America: This region demonstrates steady growth, propelled by improving healthcare access, increasing government healthcare spending, and a developing pharmaceutical sector. The demand for affordable generics and growing local manufacturing contribute to excipient market expansion.

- Middle East and Africa (MEA): While currently a smaller market, MEA is projected to exhibit moderate growth due to increasing investments in healthcare infrastructure, rising prevalence of chronic diseases, and efforts to reduce reliance on imported pharmaceuticals, leading to localized manufacturing and subsequent excipient demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Excipient for Oral Formulation Market.- Global Excipient Solutions Inc.

- Pharma Polymers Ltd.

- Ingredient Innovations Corp.

- Advanced Excipient Technologies

- BioChem Components LLC

- Specialty Excipient Group

- Zenith Pharma Ingredients

- Core Formulation Aids

- Universal Excipient Systems

- Prime Pharma Components

- Integrated Solutions Inc.

- Innovative Materials Corp.

- Alpha Excipient Supply

- Omni Pharma Additives

- Stellar Formulations

- Dynamic Excipient Solutions

- Elite Pharma Materials

- Nexus Excipient Partners

- Summit Ingredients Co.

- Horizon Pharmaceutical Aids

Frequently Asked Questions

What are pharmaceutical excipients for oral formulations?

Pharmaceutical excipients for oral formulations are inactive substances used alongside active pharmaceutical ingredients (APIs) in drug products. They serve various functions such as binding, filling, disintegrating, coating, or enhancing solubility, ultimately facilitating drug delivery, improving stability, and ensuring manufacturability of oral dosage forms like tablets, capsules, and liquids.

Why are excipients important in oral drug formulations?

Excipients are crucial for oral drug formulations because they provide bulk to low-dose APIs, enable proper processing during manufacturing, control the release of the drug, enhance bioavailability, protect the drug from degradation, and improve patient compliance through taste masking or ease of administration. Without excipients, many oral drugs would be impossible to formulate effectively or safely.

What are the key trends driving the excipient market?

Key trends include the growing demand for functional excipients that address complex APIs (e.g., poor solubility), the rise of co-processed excipients for improved manufacturing efficiency, the increasing focus on patient-centric formulations (e.g., for pediatric/geriatric patients), and the adoption of sustainable and bio-derived excipient materials. Digitalization and AI in formulation development are also emerging trends.

Which regions are leading the market for oral excipients?

North America and Europe currently lead the market due to established pharmaceutical industries and high R&D investments. However, Asia Pacific is projected to be the fastest-growing region, driven by expanding pharmaceutical manufacturing, rising healthcare expenditure, and a large patient population in countries like China and India.

What challenges do excipient manufacturers face?

Excipient manufacturers face challenges such as stringent and evolving regulatory requirements, high costs associated with research, development, and approval of new excipients, maintaining consistent quality across global supply chains, and intense price competition for conventional excipients. The complexity of new drug formulations also demands increasingly sophisticated excipient solutions.