Pharmaceutical Ethanol Market

Pharmaceutical Ethanol Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700966 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Pharmaceutical Ethanol Market Size

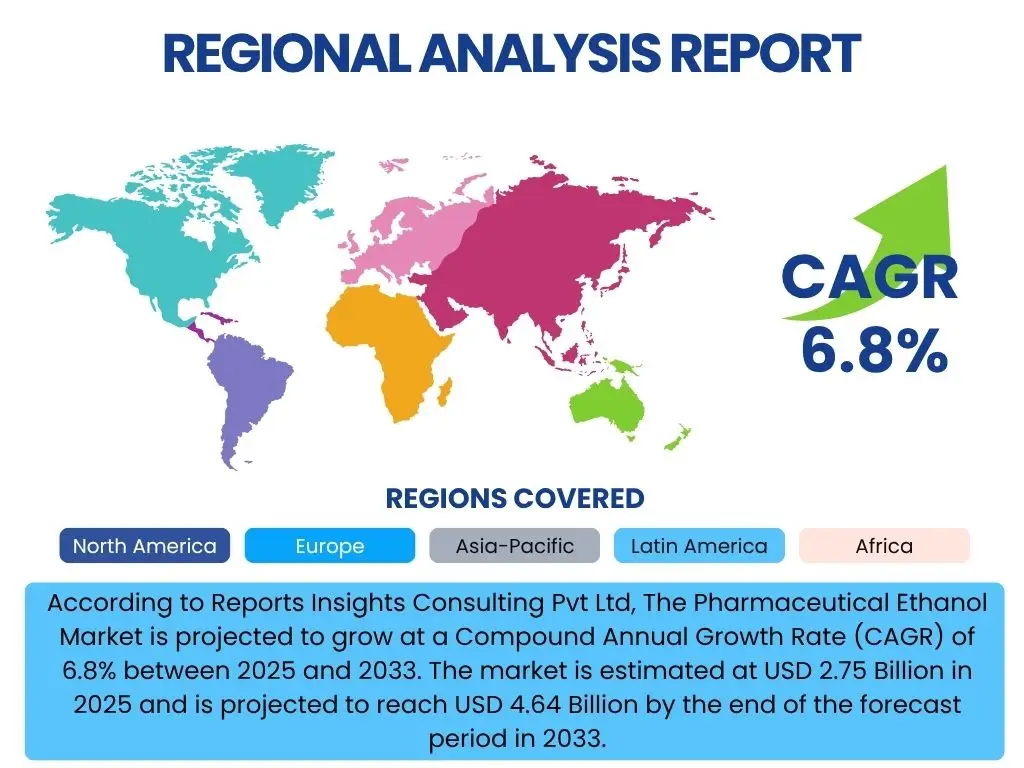

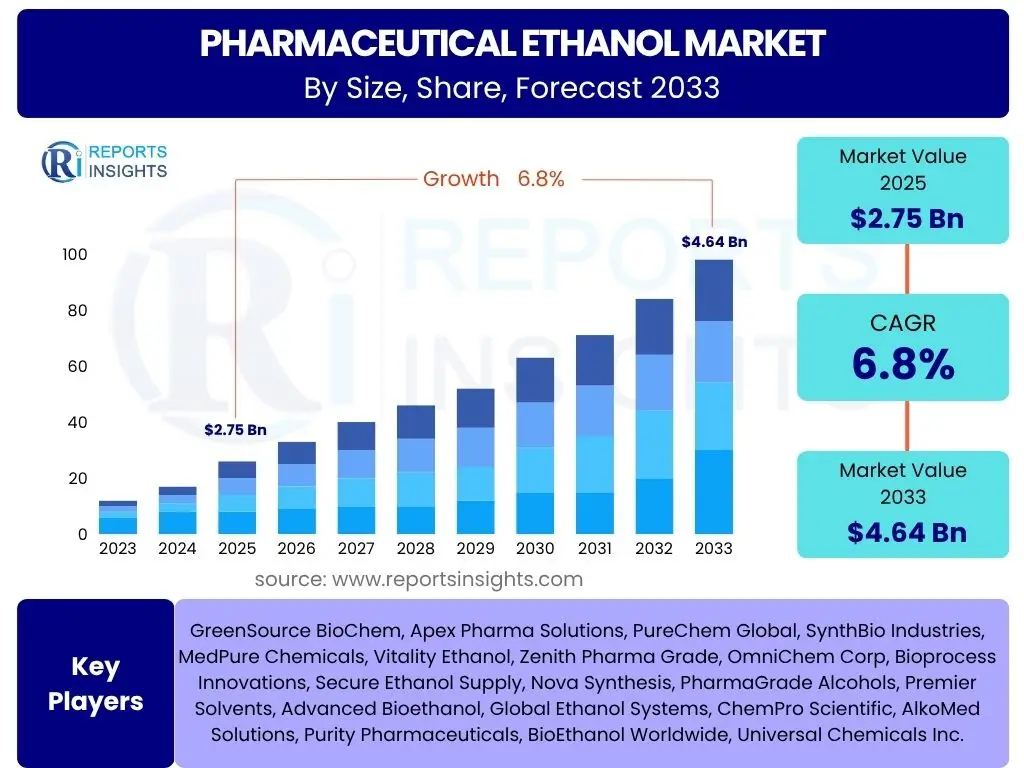

According to Reports Insights Consulting Pvt Ltd, The Pharmaceutical Ethanol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 2.75 Billion in 2025 and is projected to reach USD 4.64 Billion by the end of the forecast period in 2033.

Key Pharmaceutical Ethanol Market Trends & Insights

The Pharmaceutical Ethanol market is undergoing significant transformations driven by a confluence of evolving healthcare demands, technological advancements, and increasing regulatory scrutiny. A primary trend observed is the escalating demand for high-purity ethanol, especially in the production of biopharmaceuticals and advanced drug formulations, where impurities can compromise product integrity and patient safety. This emphasis on purity is pushing manufacturers to adopt more refined distillation and purification techniques, leading to innovations in production processes.

Furthermore, there is a noticeable shift towards sustainable sourcing and production methods for pharmaceutical ethanol. With growing environmental consciousness and stringent corporate social responsibility mandates, companies are increasingly exploring bio-based ethanol derived from renewable resources like cellulosic biomass, rather than traditional grain or molasses-based sources. This trend not only aligns with sustainability goals but also offers potential long-term stability in raw material supply, reducing reliance on volatile agricultural markets. The integration of digital technologies, particularly in supply chain management, is also gaining traction, enhancing traceability and efficiency from source to end-user, ensuring product authenticity and regulatory compliance.

- Increasing demand for high-purity and absolute ethanol grades.

- Growing focus on sustainable and bio-based ethanol production.

- Rising adoption of pharmaceutical ethanol in vaccine manufacturing and biopharmaceuticals.

- Implementation of advanced quality control and traceability technologies.

- Expansion of pharmaceutical manufacturing capacities in emerging economies.

AI Impact Analysis on Pharmaceutical Ethanol

Artificial intelligence (AI) is poised to significantly transform various facets of the pharmaceutical ethanol market, from raw material procurement to product distribution and quality assurance. Users frequently inquire about AI's potential to optimize manufacturing processes, predict supply chain disruptions, and enhance the purity and consistency of ethanol. AI-driven predictive analytics can forecast demand fluctuations, allowing manufacturers to adjust production schedules proactively and minimize waste, thereby improving operational efficiency and reducing costs. Furthermore, AI can process vast datasets from production lines to identify subtle anomalies, leading to superior quality control and ensuring compliance with stringent pharmaceutical standards, which is crucial for ethanol used in drug formulation.

Beyond manufacturing, AI holds immense potential in research and development within the pharmaceutical sector, indirectly influencing the demand for specific grades of ethanol. AI algorithms can accelerate drug discovery processes, leading to new pharmaceutical products that may require ethanol as a solvent, excipient, or extraction agent. In supply chain management, AI can optimize logistics, track shipments in real-time, and even predict potential geopolitical or environmental disruptions, enabling robust contingency planning. This enhanced resilience and efficiency in the supply chain ensure a consistent and reliable supply of pharmaceutical-grade ethanol to drug manufacturers, addressing concerns about raw material security and delivery timeliness.

- Optimized production processes through predictive analytics and machine learning.

- Enhanced quality control and impurity detection using AI-powered sensors and data analysis.

- Improved supply chain resilience and logistics management for raw materials and finished products.

- Accelerated research and development in drug formulation and solvent applications.

- Real-time demand forecasting and inventory management for pharmaceutical ethanol.

Key Takeaways Pharmaceutical Ethanol Market Size & Forecast

The Pharmaceutical Ethanol market is positioned for steady growth through 2033, driven primarily by the expanding global pharmaceutical industry, particularly the robust growth in biopharmaceuticals and vaccine production. Users commonly seek insights into which market segments will offer the most significant growth opportunities and the underlying factors influencing this trajectory. The forecast indicates sustained demand for high-purity ethanol as an essential ingredient in various pharmaceutical applications, including active pharmaceutical ingredient (API) synthesis, drug formulation, and as a critical solvent and disinfectant in healthcare settings. This growth is further bolstered by increasing healthcare expenditure and a heightened focus on hygiene and sterilization, especially in post-pandemic scenarios.

Key takeaways also highlight the increasing importance of regional market dynamics, with Asia Pacific expected to emerge as a significant growth hub due to burgeoning pharmaceutical manufacturing capacities and rising healthcare investments. The competitive landscape is characterized by a mix of established global players and regional manufacturers, with strategic collaborations and technological advancements being crucial for market penetration and sustainability. Moreover, the shift towards environmentally friendly and sustainable production methods will increasingly influence market share and consumer preference. Understanding these key elements is vital for stakeholders to navigate the market effectively, identify lucrative opportunities, and mitigate potential risks associated with supply chain volatility and regulatory changes.

- Steady market expansion fueled by a growing global pharmaceutical sector.

- High-purity and absolute ethanol grades will witness strong demand.

- Significant growth opportunities in emerging economies, particularly Asia Pacific.

- Increasing emphasis on sustainable sourcing and production methods.

- Continuous innovation in production technologies and quality assurance.

Pharmaceutical Ethanol Market Drivers Analysis

The Pharmaceutical Ethanol market is propelled by several robust drivers stemming from the global healthcare landscape and advancements in pharmaceutical manufacturing. The expansion of the global pharmaceutical industry, marked by increasing investments in research and development and a rising number of drug approvals, directly correlates with a higher demand for pharmaceutical-grade ethanol as a critical solvent, excipient, and raw material in drug synthesis. Furthermore, the burgeoning biopharmaceutical sector, which relies heavily on high-purity solvents for cell culture and protein purification, significantly contributes to the market's growth. The recent global health crises have also underscored the indispensable role of ethanol in the production of sanitizers and disinfectants, driving a sustained demand for its pharmaceutical grade.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Global Pharmaceutical Industry | +2.1% | Global, particularly North America, Europe, Asia Pacific | Long-term (2025-2033) |

| Rising Demand for Biopharmaceuticals and Vaccines | +1.8% | Global, particularly developed regions | Medium-to-Long-term (2025-2033) |

| Increased Focus on Hygiene and Disinfection | +1.5% | Global, particularly emerging economies | Medium-term (2025-2030) |

| Advancements in Drug Delivery Systems | +1.0% | North America, Europe | Long-term (2028-2033) |

Pharmaceutical Ethanol Market Restraints Analysis

Despite promising growth prospects, the Pharmaceutical Ethanol market faces certain restraints that could impede its trajectory. One significant challenge is the volatility of raw material prices, primarily agricultural commodities like corn, sugarcane, and molasses, which are used to produce bio-based ethanol. Fluctuations in these prices, influenced by weather patterns, geopolitical events, and agricultural policies, directly impact the production cost of ethanol, potentially eroding profit margins for manufacturers and leading to price instability for end-users. Furthermore, the stringent regulatory landscape governing pharmaceutical-grade materials, including strict purity standards and Good Manufacturing Practice (GMP) guidelines, imposes significant compliance costs and operational complexities on manufacturers, acting as a barrier to entry for new players and increasing overheads for existing ones.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Raw Material Prices | -1.2% | Global, particularly regions reliant on agricultural inputs | Short-to-Medium-term (2025-2030) |

| Stringent Regulatory Compliance and Standards | -1.0% | Global, particularly Europe and North America | Long-term (Ongoing) |

| Competition from Alternative Solvents | -0.8% | Global, particularly in specific pharmaceutical applications | Medium-to-Long-term (2025-2033) |

| Environmental Concerns and Disposal Regulations | -0.7% | Global, particularly developed regions | Medium-to-Long-term (2027-2033) |

Pharmaceutical Ethanol Market Opportunities Analysis

The Pharmaceutical Ethanol market presents several lucrative opportunities for growth and innovation. The increasing demand from emerging economies, particularly in Asia Pacific, Latin America, and Africa, offers significant untapped potential. These regions are witnessing rapid expansion of their pharmaceutical industries, driven by improving healthcare infrastructure, rising disposable incomes, and increasing prevalence of chronic diseases, creating a fertile ground for market penetration for pharmaceutical-grade ethanol. Moreover, the continuous advancements in drug delivery systems, such as transdermal patches, inhalers, and sustained-release formulations, often necessitate high-purity ethanol as a key component, opening new avenues for specialized product development and application.

Another prominent opportunity lies in the growing emphasis on bio-based and sustainable products. Companies that invest in environmentally friendly production methods and can demonstrate a reduced carbon footprint are likely to gain a competitive edge and appeal to an increasingly eco-conscious market. Furthermore, strategic collaborations and partnerships between ethanol manufacturers and pharmaceutical companies can foster innovation, ensure stable supply chains, and enable the development of tailored ethanol grades for specific therapeutic applications, enhancing market resilience and competitiveness.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Pharmaceutical Markets | +1.7% | Asia Pacific, Latin America, MEA | Long-term (2025-2033) |

| Growing Demand for Bio-based and Sustainable Ethanol | +1.4% | Global, particularly Europe and North America | Medium-to-Long-term (2026-2033) |

| Technological Advancements in Drug Delivery | +1.1% | Global, R&D-intensive regions | Long-term (2027-2033) |

| Strategic Partnerships and Collaborations | +0.9% | Global | Medium-to-Long-term (2025-2033) |

Pharmaceutical Ethanol Market Challenges Impact Analysis

The Pharmaceutical Ethanol market faces distinct challenges that require strategic navigation by industry players. Maintaining consistently high purity and quality standards across production batches is a perpetual challenge, given the stringent requirements of the pharmaceutical industry where even trace impurities can lead to product recalls or adverse health effects. This necessitates continuous investment in advanced purification technologies and rigorous quality control protocols. Furthermore, global supply chain disruptions, stemming from geopolitical tensions, natural disasters, or pandemics, pose a significant threat to the consistent availability and timely delivery of raw materials and finished ethanol products. Such disruptions can lead to production delays, increased costs, and ultimately impact drug manufacturing schedules.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Maintaining High Purity and Quality Standards | -1.3% | Global | Ongoing |

| Global Supply Chain Vulnerabilities and Disruptions | -1.1% | Global | Short-to-Medium-term (2025-2028) |

| Evolving Regulatory Landscape and Compliance Burden | -0.9% | Global, particularly Europe, North America, China | Ongoing |

| Competition from Illicit or Substandard Products | -0.6% | Emerging markets | Ongoing |

Pharmaceutical Ethanol Market - Updated Report Scope

This comprehensive market research report delves into the Pharmaceutical Ethanol market, offering a detailed analysis of its current landscape, historical performance, and future growth projections. It provides an in-depth understanding of market dynamics, including key drivers, restraints, opportunities, and challenges. The scope encompasses detailed segmentation analysis by purity, source, application, and end-use, alongside extensive regional insights. The report further profiles leading market players, offering strategic intelligence and competitive analysis to assist stakeholders in making informed business decisions and navigating the evolving market environment effectively.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.75 Billion |

| Market Forecast in 2033 | USD 4.64 Billion |

| Growth Rate | 6.8% CAGR |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | GreenSource BioChem, Apex Pharma Solutions, PureChem Global, SynthBio Industries, MedPure Chemicals, Vitality Ethanol, Zenith Pharma Grade, OmniChem Corp, Bioprocess Innovations, Secure Ethanol Supply, Nova Synthesis, PharmaGrade Alcohols, Premier Solvents, Advanced Bioethanol, Global Ethanol Systems, ChemPro Scientific, AlkoMed Solutions, Purity Pharmaceuticals, BioEthanol Worldwide, Universal Chemicals Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Pharmaceutical Ethanol market is extensively segmented to provide a granular view of its diverse applications and sources, reflecting the varied requirements of the global pharmaceutical industry. This comprehensive segmentation allows for a detailed analysis of demand patterns across different purity levels, enabling manufacturers to tailor their production to specific industry needs. Furthermore, distinguishing between synthetic and bio-based sources provides insights into the evolving landscape of sustainable sourcing and the impact of raw material availability on market dynamics. The application and end-use segments offer a clear understanding of where pharmaceutical ethanol is primarily consumed, from drug manufacturing to research and clinical settings, highlighting areas of high growth potential.

Understanding these segments is crucial for market participants to identify niche opportunities, allocate resources effectively, and develop targeted marketing strategies. For instance, the demand for absolute ethanol (99.5% purity and above) is critically high in sensitive pharmaceutical processes where even minimal water content is detrimental, such as in certain active pharmaceutical ingredient (API) syntheses and vaccine productions. Conversely, denatured ethanol, while still pharmaceutical grade, caters to applications where a bitterant or denaturant is added to prevent human consumption, often used in external disinfectants and certain laboratory reagents. This multi-faceted segmentation underscores the complexity and specialized nature of the pharmaceutical ethanol market, requiring a nuanced approach to market analysis and business development.

- By Purity:

- Absolute Ethanol: Characterized by purity levels typically above 99.5%, essential for applications where water content is highly undesirable, such as certain pharmaceutical formulations and sensitive chemical syntheses.

- Denatured Ethanol: Contains additives (denaturants) to make it unfit for human consumption, primarily used in external applications like disinfectants, sanitizers, and laboratory reagents.

- Rectified Spirit: Usually around 95% ethanol by volume, commonly used as a solvent in pharmaceutical preparations and tinctures.

- By Source:

- Synthetic Ethanol: Produced from petrochemical feedstocks, offering consistent quality and supply but facing increasing environmental scrutiny.

- Bio-based Ethanol: Derived from renewable biomass sources, including:

- Grain-based: Produced from corn, wheat, or other grains, a traditional and widely adopted source.

- Molasses-based: Fermented from sugarcane or beet molasses, prevalent in sugar-producing regions.

- Cellulosic: Emerging source from non-food biomass like agricultural waste and wood chips, promising higher sustainability.

- By Application:

- Solvents: Widely used as a solvent in the extraction, purification, and synthesis of various pharmaceutical compounds, including APIs.

- Disinfectants: A primary component in hand sanitizers, surface disinfectants, and sterilizing agents for medical equipment and premises.

- Excipients: Utilized in drug formulations to dissolve, suspend, or emulsify active ingredients, enhancing drug stability and bioavailability.

- Extraction: Employed in the extraction of active compounds from natural sources, such as herbal extracts and active pharmaceutical ingredients.

- Chemical Synthesis: An important building block in the synthesis of various pharmaceutical intermediates and fine chemicals.

- By End-Use:

- Pharmaceutical Manufacturing: The largest end-use segment, encompassing the production of medicines, vaccines, and biologics.

- Research & Development: Used in laboratories for experiments, sample preparation, and various analytical procedures.

- Hospitals & Clinics: Essential for medical sterilization, disinfection, and as an antiseptic.

- Compounding Pharmacies: Utilized in the preparation of customized medications for patients.

Regional Highlights

Geographically, the Pharmaceutical Ethanol market displays varied growth dynamics influenced by regional pharmaceutical industry growth, regulatory frameworks, and raw material availability. North America and Europe represent mature markets characterized by stringent regulatory environments, advanced pharmaceutical manufacturing capabilities, and significant investments in biopharmaceutical research and development. These regions command a substantial share due to the presence of key market players, high adoption of advanced drug formulations, and robust healthcare expenditure. The demand here is consistently high for absolute and high-purity ethanol grades, driven by the innovation in complex drug molecules and vaccine production.

Asia Pacific is projected to be the fastest-growing region, propelled by the rapid expansion of the pharmaceutical sector in countries like China, India, and Japan. Factors contributing to this growth include increasing foreign direct investment in healthcare infrastructure, rising prevalence of chronic diseases, growing population, and the emergence of these countries as global manufacturing hubs for generic drugs and APIs. Latin America and the Middle East & Africa (MEA) are also expected to witness steady growth, driven by improving healthcare access, government initiatives to boost domestic pharmaceutical production, and increasing awareness regarding hygiene and sanitation. The regional analysis underscores the strategic importance of localized production and distribution networks to meet diverse market demands and navigate specific regulatory landscapes.

- North America: Dominant market share attributed to advanced healthcare infrastructure, high R&D spending, and the presence of major pharmaceutical companies. Stringent regulatory standards drive demand for high-purity ethanol.

- Europe: Stable growth driven by well-established pharmaceutical and biotechnology industries, strong regulatory oversight, and a focus on sustainable sourcing. Germany, France, and the UK are key contributors.

- Asia Pacific (APAC): Expected to be the fastest-growing region due to expanding pharmaceutical manufacturing bases, increasing healthcare expenditure, and a large patient pool in countries like China, India, and Japan.

- Latin America: Emerging market with growing investments in healthcare and pharmaceutical production, particularly in Brazil and Mexico, creating new demand avenues.

- Middle East & Africa (MEA): Gradual growth anticipated with improving healthcare infrastructure, increasing prevalence of non-communicable diseases, and government initiatives to diversify economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Ethanol Market.- GreenSource BioChem

- Apex Pharma Solutions

- PureChem Global

- SynthBio Industries

- MedPure Chemicals

- Vitality Ethanol

- Zenith Pharma Grade

- OmniChem Corp

- Bioprocess Innovations

- Secure Ethanol Supply

- Nova Synthesis

- PharmaGrade Alcohols

- Premier Solvents

- Advanced Bioethanol

- Global Ethanol Systems

- ChemPro Scientific

- AlkoMed Solutions

- Purity Pharmaceuticals

- BioEthanol Worldwide

- Universal Chemicals Inc.

Frequently Asked Questions

What is pharmaceutical ethanol primarily used for?

Pharmaceutical ethanol is extensively used as a solvent in drug manufacturing, an excipient in drug formulations, a disinfectant in healthcare settings, and an extraction agent for active pharmaceutical ingredients. Its high purity ensures safety and efficacy in medical applications.

What is the projected growth rate of the Pharmaceutical Ethanol Market?

The Pharmaceutical Ethanol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033, driven by expanding pharmaceutical industries and increasing demand for high-purity solvents.

Which regions are key contributors to the Pharmaceutical Ethanol Market?

North America and Europe are major markets due to their advanced pharmaceutical industries. Asia Pacific is poised for the fastest growth, driven by significant expansion in manufacturing capabilities and healthcare investments in countries like China and India.

What are the main drivers for the Pharmaceutical Ethanol Market?

Key drivers include the global expansion of the pharmaceutical industry, rising demand for biopharmaceuticals and vaccines, increasing focus on hygiene and disinfection, and advancements in drug delivery systems requiring high-purity ethanol.

How does sustainability impact the Pharmaceutical Ethanol Market?

Sustainability is increasingly important, driving a shift towards bio-based ethanol derived from renewable resources like cellulosic biomass. Manufacturers are investing in eco-friendly production methods to meet regulatory demands and consumer preferences for greener products.