PGM Catalyst Market

PGM Catalyst Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702933 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

PGM Catalyst Market Size

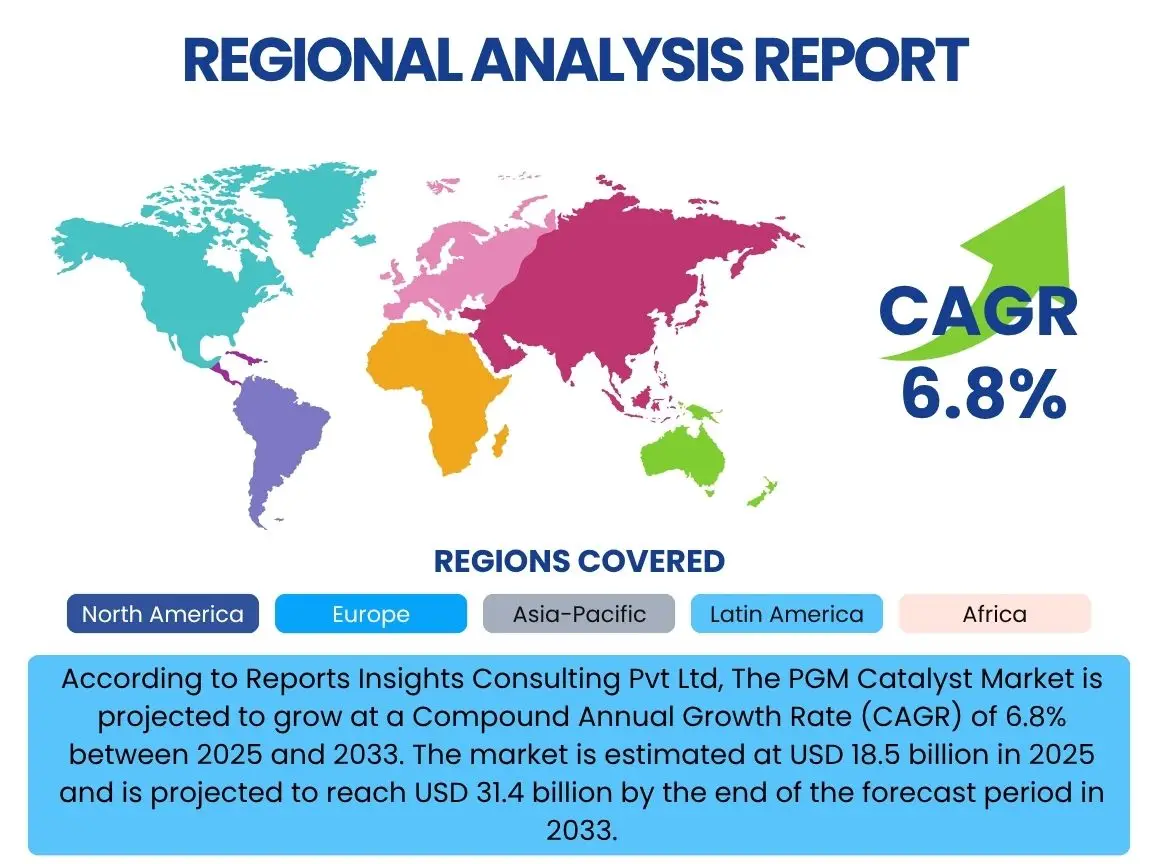

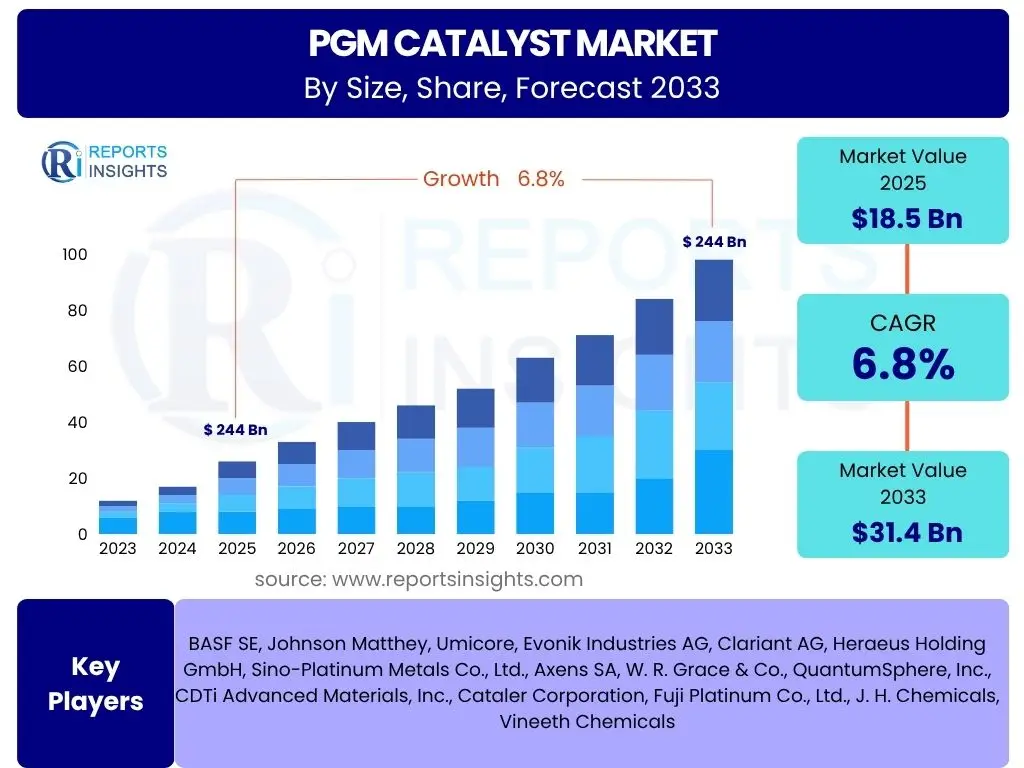

According to Reports Insights Consulting Pvt Ltd, The PGM Catalyst Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 18.5 billion in 2025 and is projected to reach USD 31.4 billion by the end of the forecast period in 2033.

Key PGM Catalyst Market Trends & Insights

The PGM Catalyst market is experiencing dynamic shifts, primarily driven by evolving global environmental regulations and technological advancements. Key user inquiries often focus on how tightening emission standards, particularly in the automotive sector, are influencing demand and innovation in catalyst design. There is also significant interest in the role of industrial expansion, especially in emerging economies, and the impact of PGM price fluctuations on market stability and supply chain strategies.

Furthermore, users frequently ask about the emergence of novel catalyst technologies, efforts to reduce PGM loading, and the growing emphasis on circular economy principles through enhanced recycling and recovery processes. The push towards sustainable manufacturing and the exploration of alternative, more cost-effective materials are also central themes, reflecting a broader industry movement towards efficiency and environmental responsibility.

- Strict global emission regulations, such as Euro 7 and CAFE standards, are driving increased adoption of PGM catalysts in vehicles.

- Growth in the chemical and petrochemical industries is fueling demand for PGM catalysts in various industrial processes.

- Fluctuations in Platinum Group Metal (PGM) prices necessitate strategic procurement and hedging by market participants.

- Increasing focus on developing advanced catalyst formulations to optimize performance and reduce PGM content.

- Rising investment in PGM recycling and recovery technologies to promote a circular economy and address supply security concerns.

- Expansion of the hydrogen economy, particularly fuel cells, presents new applications for PGM catalysts.

AI Impact Analysis on PGM Catalyst

Common user questions related to AI's impact on PGM catalysts revolve around its potential to revolutionize research and development, optimize manufacturing processes, and enhance supply chain resilience. Users are keen to understand how artificial intelligence and machine learning can accelerate the discovery of new catalyst materials with improved efficiency or reduced PGM content. The application of AI in predictive modeling for catalyst performance and lifespan, along with its role in optimizing reaction parameters, is also a significant area of interest.

Beyond R&D and manufacturing, there is curiosity about AI's capacity to streamline PGM recycling operations by improving sorting and recovery rates, thus contributing to sustainable resource management. Furthermore, the ability of AI to provide predictive insights into PGM market dynamics, including supply and demand forecasting, is seen as crucial for navigating price volatility and ensuring supply chain stability within this critical industry.

- AI-driven computational chemistry accelerates the discovery and design of novel PGM catalyst formulations, reducing R&D cycles.

- Machine learning algorithms optimize manufacturing processes, improving catalyst yield, quality, and consistency while minimizing waste.

- Predictive analytics powered by AI enhances forecasting of PGM supply and demand, aiding strategic procurement and inventory management.

- AI applications in recycling facilities can improve the efficiency and purity of PGM recovery from spent catalysts, boosting circularity.

- Real-time monitoring and predictive maintenance of catalytic converters in vehicles or industrial plants using AI can extend their operational life.

Key Takeaways PGM Catalyst Market Size & Forecast

The PGM Catalyst market is poised for significant and sustained growth throughout the forecast period, primarily propelled by the unwavering global commitment to environmental protection and the ongoing expansion of key industrial sectors. Stakeholders frequently inquire about the primary growth engines, indicating a strong interest in the sustained demand from the automotive industry due to stricter emissions standards, as well as the robust requirements from chemical and petrochemical processing. The market's resilience is further underscored by continuous innovation aimed at optimizing catalyst performance and reducing reliance on high PGM loadings.

A key insight from market analysis is the increasing strategic importance of PGM recycling and recovery technologies, driven by both economic incentives and sustainability mandates. This trend is vital for mitigating supply chain risks associated with finite PGM resources and volatile pricing. The market's future trajectory will also be shaped by the emergence of new applications, such as those within the burgeoning hydrogen economy, presenting diversified growth avenues beyond traditional sectors.

- The PGM catalyst market demonstrates robust growth, primarily fueled by stringent environmental regulations globally.

- Automotive catalytic converters remain the dominant application, with increasing demand driven by rising vehicle production and tighter emission standards.

- Industrial applications in chemical, petrochemical, and pharmaceutical sectors represent a significant and expanding segment.

- Technological advancements are focused on enhancing catalyst efficiency, durability, and reducing PGM content for cost-effectiveness.

- The circular economy model is gaining traction, with increasing emphasis on PGM recycling and recovery to ensure sustainable supply.

PGM Catalyst Market Drivers Analysis

The PGM catalyst market is predominantly driven by a confluence of regulatory pressures and expanding industrial requirements. Environmental mandates globally, particularly those pertaining to vehicular emissions and industrial pollution, necessitate the widespread adoption of high-performance catalysts containing PGMs. These regulations, aimed at mitigating air pollution and achieving cleaner air quality standards, compel manufacturers across various sectors to integrate advanced catalytic solutions into their processes and products.

Moreover, the continuous growth of key end-use industries, including automotive, chemical processing, and petrochemical refining, inherently fuels the demand for PGM catalysts. As these industries expand their production capacities and introduce new processes, the consumption of catalysts for synthesis, purification, and pollution abatement concurrently rises. Innovation in catalyst design and manufacturing processes also acts as a driver, leading to more efficient and durable catalysts that meet evolving industry needs.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stricter Emission Regulations | +1.5-2.0% | Global (Europe, Asia Pacific, North America) | Short to Long Term (2025-2033) |

| Growth in Automotive Production | +1.0-1.5% | Asia Pacific (China, India), North America, Europe | Mid Term (2025-2030) |

| Expansion of Chemical & Petrochemical Industries | +0.8-1.2% | Asia Pacific, Middle East & Africa, North America | Mid to Long Term (2025-2033) |

| Technological Advancements in Catalyst Design | +0.7-1.0% | Global | Long Term (2028-2033) |

PGM Catalyst Market Restraints Analysis

Despite robust growth prospects, the PGM catalyst market faces several notable restraints that could temper its expansion. One of the most significant challenges is the inherent price volatility of Platinum Group Metals. These precious metals are subject to fluctuating market prices influenced by geopolitical events, mining strikes, and economic conditions, which can directly impact the manufacturing cost of catalysts and subsequently, their adoption rates, especially in cost-sensitive applications.

Furthermore, the development and increasing adoption of alternative catalyst materials or technologies that either reduce PGM content or eliminate their need entirely pose a long-term restraint. While PGMs offer superior catalytic properties, research into base metal catalysts or other non-PGM alternatives is ongoing, driven by cost reduction and sustainability goals. Supply chain disruptions, often linked to the concentrated nature of PGM mining operations, also present a persistent challenge, potentially affecting raw material availability and market stability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| PGM Price Volatility | -1.0-1.5% | Global | Short to Mid Term (2025-2028) |

| Development of Alternative Catalyst Materials | -0.8-1.2% | Global | Mid to Long Term (2027-2033) |

| Supply Chain Disruptions & Geopolitical Risks | -0.5-0.9% | Global (South Africa, Russia) | Short Term (2025-2027) |

| High Initial Investment in Catalyst Technologies | -0.3-0.6% | Emerging Economies | Mid Term (2025-2030) |

PGM Catalyst Market Opportunities Analysis

The PGM catalyst market is presented with several promising opportunities that could accelerate its growth trajectory. The burgeoning hydrogen economy, encompassing fuel cells for transportation and stationary power, represents a significant new application area for PGM catalysts. As global efforts intensify to transition towards cleaner energy sources, the demand for efficient catalysts in hydrogen production, storage, and utilization is expected to surge, opening up entirely new revenue streams for PGM catalyst manufacturers.

Furthermore, advancements in PGM recycling and urban mining technologies offer a dual opportunity: enhancing the circularity of these valuable metals and securing a more sustainable supply. Investments in sophisticated recovery processes can reduce reliance on primary mining, mitigate environmental impact, and potentially stabilize raw material costs. Additionally, the increasing focus on sustainable chemical processes and green chemistry initiatives creates demand for PGM catalysts that enable more environmentally friendly and energy-efficient industrial reactions, providing a pathway for market expansion into novel, high-value applications.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth of Hydrogen Economy & Fuel Cells | +1.2-1.8% | Europe, North America, Asia Pacific (Japan, South Korea) | Long Term (2028-2033) |

| Advancements in PGM Recycling Technologies | +0.9-1.4% | Global | Mid to Long Term (2027-2033) |

| Demand for Green & Sustainable Chemical Processes | +0.7-1.1% | Europe, North America | Mid Term (2025-2030) |

| Untapped Potential in Emerging Applications | +0.5-0.8% | Asia Pacific, Latin America, MEA | Long Term (2028-2033) |

PGM Catalyst Market Challenges Impact Analysis

The PGM catalyst market faces several inherent challenges that require strategic navigation by industry participants. One significant challenge is the ongoing pressure from increasingly stringent environmental regulations. While these regulations drive demand, they also necessitate continuous innovation and significant R&D investment to meet stricter standards for emission reduction and process efficiency, often requiring complex and costly catalyst formulations. This can lead to higher operational costs for manufacturers and end-users alike.

Furthermore, intellectual property protection in the highly specialized field of catalyst technology is a considerable concern. Developing proprietary catalyst formulations requires extensive research and financial commitment, and safeguarding these innovations from infringement is crucial for maintaining competitive advantage. Managing the waste and end-of-life catalysts also presents an environmental and logistical challenge, requiring robust collection, processing, and recycling infrastructure to minimize environmental impact and recover valuable PGMs efficiently.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental & Regulatory Compliance | -0.8-1.2% | Global | Short to Long Term (2025-2033) |

| High R&D Costs for Advanced Catalyst Development | -0.6-1.0% | Global | Mid Term (2025-2030) |

| Intellectual Property Protection & Competition | -0.4-0.7% | Global | Long Term (2025-2033) |

| Managing Waste & End-of-Life Catalyst Recycling | -0.3-0.5% | Global | Mid Term (2025-2030) |

PGM Catalyst Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the PGM Catalyst market, delivering critical insights into market size, growth drivers, restraints, opportunities, and challenges. It encompasses a detailed examination of various market segments, including different PGM types, applications across diverse industries, and catalyst forms. The scope extends to a thorough regional analysis, highlighting market dynamics and growth prospects across major geographical areas, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Furthermore, the report offers a competitive landscape analysis, profiling key companies operating in the PGM Catalyst market, their strategic initiatives, product portfolios, and market positioning. Special attention is given to emerging trends, such as the impact of artificial intelligence on catalyst research and manufacturing, and the increasing focus on circular economy principles through advanced recycling technologies. This structured approach aims to provide stakeholders with actionable intelligence for strategic decision-making and investment planning within the PGM catalyst industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 31.4 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Johnson Matthey, Umicore, Evonik Industries AG, Clariant AG, Heraeus Holding GmbH, Sino-Platinum Metals Co., Ltd., Axens SA, W. R. Grace & Co., QuantumSphere, Inc., CDTi Advanced Materials, Inc., Cataler Corporation, Fuji Platinum Co., Ltd., J. H. Chemicals, Vineeth Chemicals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The PGM Catalyst market is meticulously segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for precise analysis of demand patterns, technological preferences, and regional consumption trends. The market is primarily categorized by the type of Platinum Group Metal used, reflecting the unique catalytic properties and applications of each metal, such as platinum, palladium, and rhodium, which dominate specific industrial processes and emission control technologies.

Further segmentation is performed based on application, delineating the market's reliance on sectors like automotive, chemical processing, and pharmaceuticals, each with distinct requirements for catalyst performance and durability. The form of the catalyst, whether honeycomb, pellet, or powder, also represents a critical segmentation, influencing manufacturing processes and end-use effectiveness. This multi-dimensional segmentation facilitates a comprehensive assessment of market dynamics and future growth opportunities across various industrial landscapes.

- By Type:

- Platinum

- Palladium

- Rhodium

- Ruthenium

- Iridium

- Osmium

- By Application:

- Automotive

- Gasoline Vehicles

- Diesel Vehicles

- Chemical Processing

- Petrochemical

- Fine Chemicals

- Bulk Chemicals

- Pharmaceutical

- Environmental (Industrial Emissions Control)

- Oil & Gas

- Others (e.g., Fuel Cells, Electronics)

- Automotive

- By Form:

- Honeycomb

- Pellet

- Powder

Regional Highlights

-

North America: The North American PGM catalyst market is driven by stringent environmental regulations, particularly those concerning vehicle emissions and industrial air pollution. The mature automotive industry in the United States and Canada, coupled with a robust chemical and petrochemical sector, ensures consistent demand for PGM catalysts. Innovations in catalyst recycling and the adoption of advanced manufacturing processes also characterize this region.

- United States: Largest market due to high vehicle parc and industrial activity.

- Canada: Significant demand driven by mining and oil & gas sectors, alongside automotive.

-

Europe: Europe stands as a leader in the adoption of advanced emission control technologies and sustainable industrial practices. Strict Euro emission standards for vehicles and comprehensive environmental policies for industrial facilities are key drivers. The region is also at the forefront of the hydrogen economy, with growing investments in fuel cell technology and green hydrogen production, which presents new growth avenues for PGM catalysts.

- Germany: Strong automotive manufacturing base and chemical industry.

- France: Significant chemical and pharmaceutical sector.

- UK: Focus on sustainable technologies and automotive industry.

-

Asia Pacific (APAC): The APAC region represents the largest and fastest-growing market for PGM catalysts, fueled by rapid industrialization, increasing vehicle production, and improving living standards. Countries like China and India are experiencing significant growth in automotive sales and expanding chemical and petrochemical industries. The region is also witnessing increased governmental focus on pollution control, which is accelerating the adoption of PGM catalysts.

- China: Dominant market due to vast automotive production and industrial expansion.

- India: Rapidly growing automotive and industrial sectors with evolving emission norms.

- Japan: Advanced automotive technology and strong chemical industry, high recycling rates.

- South Korea: Significant automotive and electronics manufacturing.

-

Latin America: The PGM catalyst market in Latin America is characterized by evolving emission regulations and growing automotive production, particularly in Brazil and Mexico. While historically less stringent, environmental norms are gradually tightening, increasing the demand for catalytic converters. The expansion of the petrochemical and mining industries also contributes to regional market growth.

- Brazil: Largest automotive market in the region, driving catalyst demand.

- Mexico: Significant automotive manufacturing hub and growing industrial sector.

-

Middle East & Africa (MEA): The MEA PGM catalyst market is primarily driven by the expansion of the oil & gas and petrochemical industries, especially in the Gulf Cooperation Council (GCC) countries. These sectors require PGM catalysts for various refining and chemical synthesis processes. While the automotive market is smaller compared to other regions, growing environmental awareness and improving regulations are gradually increasing demand for emission control catalysts.

- Saudi Arabia: Large petrochemical sector.

- South Africa: Significant PGM mining operations, influencing supply dynamics.

- UAE: Growing industrial base and infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PGM Catalyst Market.- BASF SE

- Johnson Matthey

- Umicore

- Evonik Industries AG

- Clariant AG

- Heraeus Holding GmbH

- Sino-Platinum Metals Co., Ltd.

- Axens SA

- W. R. Grace & Co.

- QuantumSphere, Inc.

- CDTi Advanced Materials, Inc.

- Cataler Corporation

- Fuji Platinum Co., Ltd.

- J. H. Chemicals

- Vineeth Chemicals

- Tanaka Kikinzoku Kogyo K.K.

- Solvay S.A.

- Honeywell International Inc.

- Dow Inc.

- Sumitomo Metal Mining Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the PGM Catalyst market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are PGM catalysts primarily used for?

PGM catalysts are predominantly utilized in automotive catalytic converters to reduce harmful emissions from vehicle exhaust, converting pollutants into less toxic substances. Beyond the automotive sector, they are extensively used in various industrial applications, including chemical and petrochemical processing for synthesis, purification, and environmental control, as well as in pharmaceuticals for active ingredient production.

What are the main drivers of growth in the PGM Catalyst market?

The primary drivers of growth in the PGM Catalyst market include increasingly stringent global environmental regulations, particularly those mandating lower vehicle emissions and industrial pollutant discharge. Additionally, the continuous growth and expansion of the global automotive industry and the chemical, petrochemical, and pharmaceutical manufacturing sectors significantly contribute to the rising demand for these essential catalysts.

How does PGM price volatility impact the market?

Price volatility of Platinum Group Metals like platinum, palladium, and rhodium can significantly impact the PGM Catalyst market by influencing manufacturing costs and profit margins for catalyst producers. Fluctuations in PGM prices often lead to increased uncertainty for buyers and sellers, affecting procurement strategies, supply chain stability, and the overall competitiveness of PGM-based catalytic solutions against alternative materials.

Which regions are key players in the PGM Catalyst market?

Key regions dominating the PGM Catalyst market include Asia Pacific, particularly China and India, due to their rapidly expanding automotive and industrial sectors. North America and Europe also hold substantial market shares, driven by mature industries, strict environmental regulations, and significant research and development activities in catalyst technology and recycling. Latin America and the Middle East & Africa represent emerging markets with growing potential.

What innovations are shaping the future of PGM catalyst technology?

Innovations shaping the future of PGM catalyst technology include the development of catalysts with reduced PGM content to lower costs and reliance on precious metals, while maintaining or enhancing performance. There's a strong focus on advanced recycling technologies to improve PGM recovery rates and promote a circular economy. Additionally, research into AI-driven catalyst design and the application of PGMs in emerging fields like hydrogen fuel cells are defining future advancements.