Perfume and Fragrance Packaging Market

Perfume and Fragrance Packaging Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702325 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Perfume and Fragrance Packaging Market Size

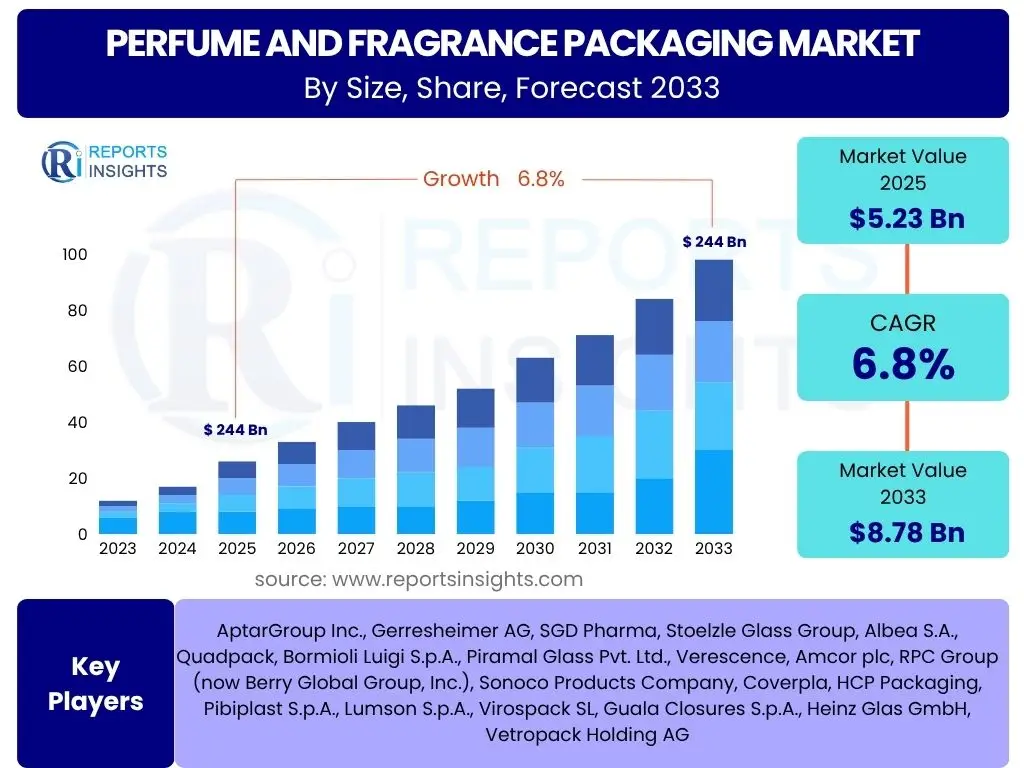

According to Reports Insights Consulting Pvt Ltd, The Perfume and Fragrance Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 5.23 billion in 2025 and is projected to reach USD 8.78 billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the escalating global demand for luxury goods, coupled with evolving consumer preferences towards sustainable and aesthetically appealing packaging solutions. The market's expansion is further bolstered by the increasing penetration of e-commerce channels, which necessitates robust and innovative packaging to ensure product integrity and enhance brand presentation during transit.

Key Perfume and Fragrance Packaging Market Trends & Insights

Common user inquiries concerning the Perfume and Fragrance Packaging market frequently revolve around its dynamic shifts and emerging patterns. Users often seek to understand how global consumer preferences, technological advancements, and sustainability mandates are reshaping the industry. A recurring theme is the impact of premiumization and personalization on packaging design, alongside the growing importance of eco-friendly materials and production processes. Additionally, there is significant interest in the influence of digital commerce on packaging functionalities, such as durability for shipping and enhanced unboxing experiences.

The market is currently witnessing a pronounced shift towards sustainable packaging solutions, driven by heightened environmental awareness among consumers and stringent regulatory pressures. Brands are increasingly investing in recyclable, refillable, and biodegradable materials, moving away from single-use plastics. Concurrently, the demand for personalized and premium packaging continues to surge, as consumers seek unique and exclusive products that reflect their identity. This trend encourages innovation in design, material finishes, and customizable elements, fostering a sense of luxury and individuality.

- Emphasis on sustainable and eco-friendly materials such as recycled glass, post-consumer recycled (PCR) plastics, and biodegradable compounds.

- Growing demand for personalized and customizable packaging options, including bespoke designs, engraving, and limited-edition releases.

- Rise of refillable and reusable packaging systems to reduce waste and promote circular economy principles.

- Integration of smart packaging technologies, such as NFC/QR codes, for enhanced consumer engagement, brand authenticity, and traceability.

- Increased focus on minimalist and elegant designs that convey luxury and sophistication, often featuring clean lines and premium finishes.

- Development of robust and e-commerce-friendly packaging to ensure product safety and enhance the unboxing experience for online purchases.

AI Impact Analysis on Perfume and Fragrance Packaging

User questions regarding the impact of Artificial Intelligence (AI) on Perfume and Fragrance Packaging often center on its potential to revolutionize design, production efficiency, and supply chain management. Consumers and industry professionals alike are curious about how AI can contribute to more sustainable practices, enhance personalization capabilities, and optimize material usage. There is also interest in AI's role in predicting consumer trends and streamlining the entire packaging lifecycle from concept to delivery.

AI's influence is becoming increasingly significant in the Perfume and Fragrance Packaging sector, primarily by enhancing design innovation and operational efficiencies. AI-powered design tools can analyze vast datasets of consumer preferences, visual trends, and material properties to generate novel packaging concepts that resonate with target audiences and optimize material use. Furthermore, AI algorithms are being deployed to predict demand patterns, thereby optimizing inventory management and reducing waste in the production process. This leads to more responsive and sustainable supply chains.

Beyond design and supply chain, AI is transforming quality control and consumer engagement. Machine vision systems, powered by AI, can detect minute defects in packaging components with unparalleled accuracy, ensuring consistent product quality. AI-driven analytics also provide deeper insights into consumer behavior and preferences, enabling brands to tailor packaging strategies for maximum impact. This data-driven approach supports more informed decision-making and fosters greater efficiency across the value chain.

- AI-driven generative design for rapid prototyping and optimization of packaging aesthetics and structural integrity.

- Predictive analytics for demand forecasting and inventory management, reducing overproduction and waste.

- Automated quality control systems using AI-powered computer vision to detect defects in real-time.

- Optimization of manufacturing processes through AI, leading to increased efficiency and reduced energy consumption.

- Personalization at scale by analyzing consumer data to recommend or design custom packaging elements.

- Supply chain optimization, including route planning and risk assessment, for more efficient and resilient logistics.

Key Takeaways Perfume and Fragrance Packaging Market Size & Forecast

Common inquiries about key takeaways from the Perfume and Fragrance Packaging market size and forecast consistently highlight the pivotal role of sustainability and consumer experience in driving market dynamics. Users seek to understand the primary growth drivers, the most impactful restraining factors, and the emerging opportunities that will shape the industry over the forecast period. There is a strong emphasis on identifying actionable insights that can inform strategic business decisions and capital allocation.

The market is poised for robust growth, largely fueled by rising disposable incomes, urbanization, and a burgeoning global middle class that increasingly invests in personal care and luxury fragrances. The shift towards premium and personalized packaging is a significant revenue driver, compelling brands to innovate beyond conventional designs. However, the industry must navigate challenges such as fluctuating raw material costs and complex regulatory landscapes, especially concerning environmental compliance, which can impact profitability and operational flexibility.

Despite these challenges, opportunities abound in the development of novel sustainable materials, advanced manufacturing technologies, and smart packaging solutions. The integration of digital tools for design and consumer engagement also presents a fertile ground for differentiation and market expansion. Successful market participants will be those who can effectively balance aesthetic appeal, functional performance, and environmental responsibility, while also adapting swiftly to evolving consumer demands and technological advancements.

- The market exhibits substantial growth potential, driven by global demand for premium and luxury fragrances.

- Sustainability is no longer a niche but a core requirement, influencing material choices and production methods across the board.

- Technological advancements, particularly in automation and AI, are set to redefine design, manufacturing, and supply chain efficiencies.

- E-commerce channels are transforming packaging requirements, emphasizing durability and enhanced unboxing experiences.

- Consumer preference for customization and unique aesthetic appeal is pushing innovation in packaging design and finishes.

Perfume and Fragrance Packaging Market Drivers Analysis

The Perfume and Fragrance Packaging market is propelled by several robust drivers, fundamentally linked to evolving consumer lifestyles, global economic shifts, and advancements in packaging technology. A significant driver is the increasing purchasing power in emerging economies, which translates into higher expenditure on personal care and luxury items, including fragrances. This demographic shift, coupled with the rapid urbanization worldwide, fuels the demand for premium packaging that aligns with aspirational brand images and diverse cultural preferences.

Furthermore, the continuous innovation in product offerings within the fragrance industry, from new scent profiles to limited-edition releases, necessitates equally innovative and diverse packaging solutions. Brands are constantly striving to differentiate their products through unique designs, materials, and finishing touches, turning packaging into a crucial marketing tool. The rise of e-commerce has also reshaped packaging requirements, demanding designs that are not only aesthetically pleasing but also robust enough to withstand the rigors of shipping, while simultaneously enhancing the unboxing experience for online consumers.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Disposable Income and Urbanization | +1.8% | Asia Pacific (China, India), Latin America | Medium-term (3-5 years) |

| Growing Demand for Luxury and Premium Fragrances | +1.5% | North America, Europe, Middle East | Long-term (5+ years) |

| Expansion of E-commerce Platforms | +1.2% | Global, particularly North America, Europe, Asia Pacific | Short-term (1-3 years) |

| Increased Focus on Product Differentiation and Brand Image | +1.0% | Global | Medium-term (3-5 years) |

| Innovation in Packaging Materials and Design | +0.8% | Global | Short-term (1-3 years) |

Perfume and Fragrance Packaging Market Restraints Analysis

Despite its promising growth trajectory, the Perfume and Fragrance Packaging market faces several significant restraints that can impede its expansion. One primary concern is the volatility in raw material prices, particularly for glass, plastics, and metals. Fluctuations in the cost of these essential components can directly impact manufacturing expenses, subsequently affecting product pricing and profit margins for packaging suppliers and fragrance brands alike. This unpredictability necessitates flexible sourcing strategies and efficient cost management.

Another considerable restraint involves the increasingly stringent environmental regulations and sustainability mandates imposed by governments and international bodies. While crucial for environmental protection, these regulations often necessitate substantial investments in new technologies, materials, and production processes to ensure compliance. Adapting to evolving recycling infrastructure requirements and limitations can also pose a challenge, especially in regions with nascent waste management systems. Furthermore, intense competition among packaging manufacturers can lead to price wars, exerting downward pressure on market revenues and potentially stifling innovation for smaller players.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Raw Material Prices (Glass, Plastics, Metals) | -1.3% | Global | Short-term (1-3 years) |

| Stringent Environmental Regulations and Sustainability Mandates | -1.1% | Europe, North America | Medium-term (3-5 years) |

| High Capital Investment for Advanced Technologies | -0.9% | Global, particularly developing regions | Long-term (5+ years) |

| Competition from Counterfeit Products | -0.7% | Asia Pacific, Latin America | Medium-term (3-5 years) |

| Logistical and Supply Chain Disruptions | -0.5% | Global | Short-term (1-3 years) |

Perfume and Fragrance Packaging Market Opportunities Analysis

Significant opportunities are emerging within the Perfume and Fragrance Packaging market, largely driven by consumer demand for sustainable solutions and innovative designs. The growing consumer preference for eco-friendly products creates a substantial market for packaging made from recycled content, biodegradable materials, and refillable systems. Brands that proactively invest in and promote these sustainable alternatives can gain a competitive edge and appeal to an increasingly environmentally conscious consumer base, fostering brand loyalty and expanding market share.

Furthermore, technological advancements present a myriad of opportunities for enhancing packaging functionality and aesthetics. The integration of smart packaging technologies, such as Near Field Communication (NFC) tags, QR codes, and augmented reality (AR) experiences, offers new avenues for consumer engagement, brand storytelling, and product authentication. These innovations can transform the unboxing experience into an interactive journey, fostering deeper connections between brands and consumers. The continued expansion of e-commerce also creates an ongoing need for packaging solutions optimized for shipping, focusing on durability, reduced waste, and attractive presentation upon arrival, thereby opening up new design and material opportunities.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Sustainable and Eco-friendly Packaging | +1.6% | Global, particularly Europe, North America | Long-term (5+ years) |

| Rise of Personalized and Customized Packaging Solutions | +1.4% | North America, Europe | Medium-term (3-5 years) |

| Integration of Smart Packaging Technologies | +1.2% | Global | Medium-term (3-5 years) |

| Expansion in Emerging Markets (e.g., APAC, LATAM) | +1.0% | Asia Pacific (China, India), Latin America | Long-term (5+ years) |

| Focus on Refillable and Reusable Packaging Models | +0.9% | Europe, North America | Short-term (1-3 years) |

Perfume and Fragrance Packaging Market Challenges Impact Analysis

The Perfume and Fragrance Packaging market faces several notable challenges that require strategic navigation for sustained growth. One significant hurdle is the complexity of global supply chains, which can be susceptible to geopolitical events, natural disasters, or pandemics. Such disruptions can lead to material shortages, production delays, and increased logistical costs, impacting the timely delivery of packaging components and finished products to market. Managing these risks necessitates diversified sourcing and robust contingency planning.

Another critical challenge is the evolving consumer preference towards minimalism and a reduced environmental footprint, which sometimes translates into a desire for less packaging or entirely different delivery formats. While this aligns with sustainability goals, it can challenge traditional packaging design and material consumption models. Furthermore, ensuring the authenticity and anti-counterfeiting measures for luxury fragrance packaging remains a persistent challenge, requiring continuous investment in security features and sophisticated tracking technologies to protect brand integrity and consumer trust in a highly competitive market.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Fluctuating Raw Material Availability and Costs | -1.0% | Global | Short-term (1-3 years) |

| Complexity of Recycling Infrastructure and Waste Management | -0.8% | Global, particularly developing regions | Medium-term (3-5 years) |

| Intensifying Competition and Price Pressures | -0.7% | Global | Long-term (5+ years) |

| Consumer Preference for Minimalist or Reduced Packaging | -0.6% | North America, Europe | Medium-term (3-5 years) |

| Ensuring Brand Authenticity and Combating Counterfeiting | -0.5% | Global, particularly emerging markets | Long-term (5+ years) |

Perfume and Fragrance Packaging Market - Updated Report Scope

This comprehensive report delves into the intricate dynamics of the global Perfume and Fragrance Packaging market, offering an in-depth analysis of its current landscape and future growth trajectories. The scope encompasses detailed market sizing, forecasting, and a thorough examination of key trends, drivers, restraints, opportunities, and challenges shaping the industry. It provides a granular view across various segments, including material types, product formats, and end-user applications, alongside a robust regional analysis to highlight geographical nuances. The report also profiles leading market players, offering insights into their strategic initiatives and competitive positioning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 5.23 Billion |

| Market Forecast in 2033 | USD 8.78 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | AptarGroup Inc., Gerresheimer AG, SGD Pharma, Stoelzle Glass Group, Albea S.A., Quadpack, Bormioli Luigi S.p.A., Piramal Glass Pvt. Ltd., Verescence, Amcor plc, RPC Group (now Berry Global Group, Inc.), Sonoco Products Company, Coverpla, HCP Packaging, Pibiplast S.p.A., Lumson S.p.A., Virospack SL, Guala Closures S.p.A., Heinz Glas GmbH, Vetropack Holding AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Perfume and Fragrance Packaging market is extensively segmented to provide a nuanced understanding of its various facets, allowing for targeted strategic planning and market penetration. These segmentations are crucial for identifying specific growth pockets, understanding consumer preferences, and tailoring product offerings. The market is primarily categorized by material type, reflecting the shift towards sustainable and diverse packaging options. Additionally, segmentation by product type distinguishes between primary packaging, which directly contains the fragrance, and secondary packaging, which offers external protection and branding.

Further granular analysis is conducted based on capacity, catering to different product sizes and consumer usage patterns, from travel-sized vials to large-volume bottles. The end-user segment differentiates between premium and mass-market fragrances, acknowledging their distinct packaging requirements and consumer bases. Finally, segmentation by application considers various fragrance concentrations and product formats, ensuring a comprehensive view of the market's structure and the specific demands arising from each category.

- By Material:

- Glass

- Plastic (PP, PET, HDPE)

- Metal (Aluminum, Tin)

- Paper & Paperboard

- Others (Wood, Ceramic)

- By Product Type:

- Primary Packaging

- Bottles

- Jars

- Vials

- Atomizers

- Caps & Closures

- Pumps

- Sprayers

- Secondary Packaging

- Boxes

- Cartons

- Pouches

- Wraps

- Primary Packaging

- By Capacity:

- Up to 50 ml

- 51-100 ml

- Above 100 ml

- By End-User:

- Premium Fragrances

- Mass Fragrances

- By Application:

- Eau de Parfum

- Eau de Toilette

- Eau de Cologne

- Others (Body Mists, Attars)

Regional Highlights

- North America: This region is characterized by a strong consumer preference for luxury and high-end fragrances, driving demand for premium and aesthetically sophisticated packaging. The increasing adoption of e-commerce also necessitates robust and innovative packaging solutions for safe delivery and enhanced unboxing experiences. Significant investments in sustainable packaging technologies and materials are observed, reflecting growing environmental consciousness among consumers and brands.

- Europe: As a historical hub for perfumery, Europe remains a dominant market, with France, Italy, and Germany being key contributors. The region exhibits a strong emphasis on design innovation, craftsmanship, and adherence to stringent environmental regulations. There is a pioneering spirit in developing circular economy models, including refillable and reusable packaging systems, which significantly influences market trends globally.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, propelled by rising disposable incomes, rapid urbanization, and an expanding middle class in countries like China and India. This growth fuels a surging demand for both mass-market and aspirational luxury fragrances. The region is increasingly focusing on localizing packaging solutions and adopting sustainable practices, though infrastructure for recycling still varies.

- Latin America: This region presents considerable growth opportunities, driven by a young population and evolving consumer preferences for personal grooming products. Brazil and Mexico are key markets, showing an increasing appetite for diverse fragrance options. The market is adapting to economic fluctuations, with a growing demand for cost-effective yet visually appealing packaging, alongside a rising interest in natural and ethically sourced materials.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is renowned for its high consumption of luxury and traditional oud-based fragrances. This drives a significant demand for opulent, elaborate, and highly customized packaging that often incorporates intricate designs and premium finishes. The market in Africa is still nascent but shows potential with increasing urbanization and rising living standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perfume and Fragrance Packaging Market.- AptarGroup Inc.

- Gerresheimer AG

- SGD Pharma

- Stoelzle Glass Group

- Albea S.A.

- Quadpack

- Bormioli Luigi S.p.A.

- Piramal Glass Pvt. Ltd.

- Verescence

- Amcor plc

- Berry Global Group, Inc. (formerly RPC Group)

- Sonoco Products Company

- Coverpla

- HCP Packaging

- Pibiplast S.p.A.

- Lumson S.p.A.

- Virospack SL

- Guala Closures S.p.A.

- Heinz Glas GmbH

- Vetropack Holding AG

Frequently Asked Questions

What is the projected growth rate for the Perfume and Fragrance Packaging Market?

The Perfume and Fragrance Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033, driven by increasing global demand for fragrances and innovation in packaging solutions.

What are the primary trends shaping the Perfume and Fragrance Packaging market?

Key trends include a strong emphasis on sustainable and eco-friendly materials, a growing demand for personalized and premium packaging, the adoption of refillable systems, and the integration of smart packaging technologies for enhanced consumer engagement.

How is AI impacting the Perfume and Fragrance Packaging industry?

AI is transforming the industry by enabling generative design for innovative packaging concepts, optimizing manufacturing processes and supply chains through predictive analytics, and enhancing quality control with AI-powered vision systems for defect detection.

Which materials are predominantly used in fragrance packaging?

Glass is the most common material due to its inertness and premium aesthetic, followed by various plastics (PP, PET, HDPE) for versatility and lighter weight, and metals (aluminum, tin) for closures and specific designs. Paper and paperboard are widely used for secondary packaging.

What are the biggest opportunities for growth in the Perfume and Fragrance Packaging market?

Significant opportunities lie in the development of innovative sustainable packaging solutions, capitalizing on the increasing consumer demand for eco-friendly products. Additionally, the expansion of e-commerce and the integration of smart technologies offer new avenues for market differentiation and consumer interaction.