Palm Oil Market

Palm Oil Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707373 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Palm Oil Market Size

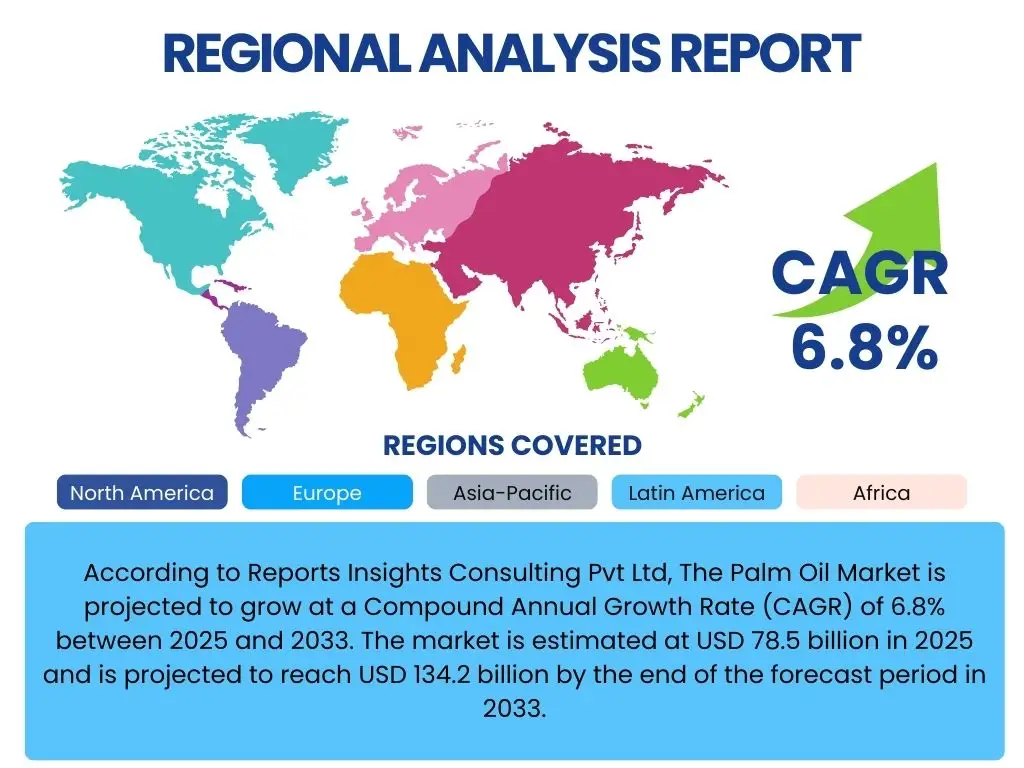

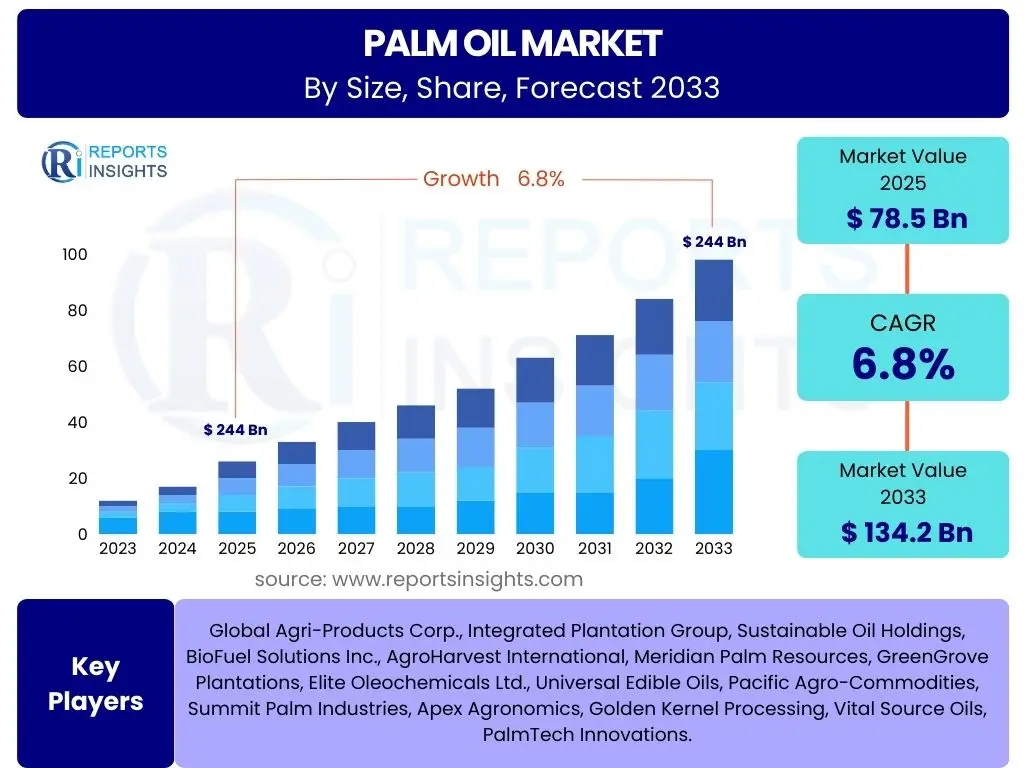

According to Reports Insights Consulting Pvt Ltd, The Palm Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 78.5 billion in 2025 and is projected to reach USD 134.2 billion by the end of the forecast period in 2033.

Key Palm Oil Market Trends & Insights

The global Palm Oil market is experiencing significant shifts driven by evolving consumer preferences, sustainability demands, and technological advancements. Key trends revolve around the increasing adoption of certified sustainable palm oil (CSPO) to address environmental concerns, particularly deforestation and biodiversity loss. Furthermore, the market is witnessing innovation in product development, including fractionation for specialized applications and the exploration of novel uses beyond food, such as in biofuels and oleochemicals. Price volatility, geopolitical factors, and changing trade policies also continually shape market dynamics, requiring industry participants to adapt swiftly to maintain competitiveness and ensure supply chain resilience.

Consumer awareness regarding the health implications of palm oil, coupled with a growing demand for transparency in food sourcing, influences purchasing decisions and forces manufacturers to provide clearer labeling and sustainable alternatives. The expansion of palm oil cultivation into new regions, albeit with strict regulatory oversight, represents another emerging trend aimed at diversifying supply sources and mitigating risks associated with over-reliance on traditional production hubs. This complex interplay of environmental, economic, and social factors defines the current trajectory and future outlook of the palm oil industry, emphasizing the critical balance between production efficiency and responsible resource management.

- Increasing adoption of Certified Sustainable Palm Oil (CSPO).

- Growth in demand for palm oil in the oleochemicals sector.

- Expansion of palm oil use in the biodiesel and biofuel industries.

- Development of advanced fractionation and processing technologies.

- Rising consumer demand for transparency and traceability in supply chains.

- Focus on yield improvement and land efficiency in cultivation.

- Strategic investments in new processing facilities in emerging markets.

- Evolving regulatory landscapes concerning imports and sustainability standards.

AI Impact Analysis on Palm Oil

The integration of Artificial intelligence (AI) is set to significantly transform the palm oil industry, addressing challenges ranging from sustainable cultivation to supply chain efficiency. Users frequently inquire about AI's potential to enhance yield prediction, monitor deforestation, and optimize resource allocation. AI-powered analytics can process vast datasets from satellite imagery, drone surveillance, and IoT sensors to provide real-time insights into plantation health, pest detection, and water management, thereby minimizing waste and increasing productivity. This capability is crucial for promoting sustainable practices and demonstrating compliance with environmental regulations, responding directly to public and regulatory pressures.

Beyond cultivation, AI is poised to revolutionize the palm oil supply chain through predictive logistics, demand forecasting, and automated quality control. Concerns often center on the accessibility and cost of implementing such advanced technologies, particularly for smallholder farmers who form a significant portion of the production base. However, collaborative initiatives and the development of user-friendly AI tools could bridge this gap. AI’s capacity to enhance transparency by tracking palm oil from farm to fork through blockchain integration is also a key expectation, contributing to greater accountability and consumer trust in a sector often scrutinized for its environmental footprint. The potential for AI to foster a more resilient, efficient, and sustainable palm oil industry is immense, promising both economic and ecological benefits.

- Enhanced yield prediction and crop monitoring through satellite imagery and drone data analysis.

- Automated detection of pests and diseases, enabling targeted interventions and reduced chemical use.

- Optimized resource management, including water and fertilizer application, via precision agriculture.

- Real-time deforestation monitoring and compliance verification using AI-powered image recognition.

- Supply chain optimization and traceability improvements through predictive analytics and blockchain integration.

- Improved quality control and grading of palm oil products using machine vision.

- Development of AI-driven tools for smallholder farmers to improve productivity and sustainability.

- Predictive maintenance for processing machinery, reducing downtime and operational costs.

Key Takeaways Palm Oil Market Size & Forecast

The Palm Oil market is poised for robust growth through 2033, driven by sustained global demand for edible oils, increasing applications in biofuels, and the versatile nature of palm derivatives in various industries. A significant takeaway is the market's trajectory towards a more sustainable production model, with certified palm oil gaining prominence due to stringent environmental regulations and rising consumer awareness. Despite ongoing challenges related to deforestation and land use, the industry's commitment to innovation and efficiency is expected to underpin this growth, ensuring palm oil remains a critical global commodity. The substantial projected increase in market valuation underscores its indispensable role in the global economy.

Another crucial insight is the dynamic interplay between supply-side improvements and demand-side shifts. Efforts to enhance yield through advanced agricultural practices and the expansion into new cultivation areas, while balancing ecological concerns, are vital for meeting future demand. Concurrently, evolving dietary trends and the expanding use of palm oil in non-food applications, such as cosmetics and pharmaceuticals, will continue to diversify its market footprint. Stakeholders must prioritize sustainable sourcing, transparent supply chains, and technological adoption to capitalize on growth opportunities and mitigate risks, positioning the industry for long-term viability and responsible expansion within the projected forecast period.

- Market projected to grow significantly, reaching USD 134.2 billion by 2033.

- CAGR of 6.8% indicates strong, consistent growth over the forecast period.

- Sustainability initiatives, particularly CSPO, are critical for future market acceptance and expansion.

- Diversification of applications beyond food, into biofuels and oleochemicals, is a major growth driver.

- Technological advancements in cultivation and processing are essential for efficiency and environmental stewardship.

- Regulatory frameworks and consumer preferences increasingly dictate market direction.

Palm Oil Market Drivers Analysis

The primary drivers propelling the Palm Oil market forward include the ever-increasing global population and the corresponding rise in demand for affordable edible oils. Palm oil's cost-effectiveness, high yield per hectare compared to other vegetable oils, and versatile applications across food, oleochemical, and energy sectors make it an attractive and essential commodity. Furthermore, the burgeoning demand for biofuels globally, especially in regions committed to renewable energy targets, significantly contributes to palm oil consumption, establishing it as a key component in sustainable energy solutions and diversifying its market utility beyond traditional food uses.

Economic growth in developing nations, particularly in Asia and Africa, is also a substantial driver, as rising disposable incomes lead to increased consumption of processed foods, which frequently contain palm oil. The expansion of the oleochemical industry, utilizing palm oil as a feedstock for products like detergents, cosmetics, and lubricants, further solidifies its market position. These multifaceted demands underscore palm oil's pivotal role in global supply chains, ensuring sustained growth as economies develop and consumer needs evolve.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Global Population & Edible Oil Demand | +2.5% | Asia Pacific, Africa, Latin America | Short to Long-term (2025-2033) |

| Increasing Applications in Biofuels | +1.8% | Europe, Southeast Asia, Brazil | Medium to Long-term (2026-2033) |

| Expansion of Oleochemical Industry | +1.2% | Global, especially China, India | Short to Medium-term (2025-2030) |

| Cost-Effectiveness & High Yield of Palm Oil | +1.0% | Global | Long-term (2025-2033) |

Palm Oil Market Restraints Analysis

Despite its significant market drivers, the Palm Oil market faces substantial restraints, primarily centered around environmental concerns such as deforestation, biodiversity loss, and greenhouse gas emissions associated with plantation expansion. These issues have led to widespread negative public perception and stringent regulatory pressures from importing countries and sustainability advocacy groups. The resulting boycotts and anti-palm oil campaigns, particularly in developed regions like Europe, constrain market access and demand, forcing producers to invest heavily in sustainable certification, which adds to operational costs and complexity.

Another significant restraint is the volatility of palm oil prices, influenced by geopolitical tensions, weather patterns, and global supply-demand imbalances, which can impact profitability for producers and pricing stability for consumers. Additionally, health-related controversies regarding saturated fat content, though often debated, continue to influence consumer preferences and drive demand for alternative oils in certain segments. These factors collectively necessitate a strategic shift towards responsible production, supply chain transparency, and effective communication to mitigate the adverse impacts of these critical restraints on market growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Environmental & Sustainability Concerns (Deforestation, Biodiversity Loss) | -1.5% | Europe, North America, Southeast Asia (Producers) | Long-term (2025-2033) |

| Negative Public Perception & Consumer Boycotts | -1.0% | Europe, North America | Short to Medium-term (2025-2030) |

| Price Volatility & Geopolitical Instability | -0.8% | Global | Short-term (2025-2027) |

| Strict Regulatory Standards & Import Restrictions | -0.7% | European Union, United States | Medium-term (2026-2031) |

Palm Oil Market Opportunities Analysis

The Palm Oil market presents numerous growth opportunities, particularly in the expansion of certified sustainable palm oil (CSPO) production and market penetration. As global awareness of environmental responsibility increases, demand for ethically sourced and sustainably produced palm oil is on the rise, creating a premium market segment for certified products. This shift encourages investments in sustainable practices, technological advancements for traceability, and collaboration across the value chain to meet stringent certification standards, positioning companies that embrace these changes for long-term competitive advantage and enhanced brand reputation.

Emerging markets in Africa, Latin America, and parts of Asia offer significant untapped potential for palm oil consumption due to increasing urbanization, population growth, and evolving dietary habits. These regions present opportunities for market entry and expansion, particularly for food applications and the growing oleochemical sector. Furthermore, ongoing research and development into novel applications of palm oil, such as advanced biofuels, bioplastics, and pharmaceutical ingredients, hold promise for diversifying revenue streams and reducing reliance on traditional segments, fostering innovation and securing future market growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increased Adoption of Certified Sustainable Palm Oil (CSPO) | +1.5% | Global, particularly Europe, North America | Medium to Long-term (2026-2033) |

| Growth in Emerging Economies | +1.2% | Africa, Latin America, Southeast Asia | Long-term (2027-2033) |

| Innovation in Biofuel and Oleochemical Applications | +1.0% | Global | Medium to Long-term (2026-2033) |

| Technological Advancements in Yield & Processing Efficiency | +0.8% | Southeast Asia, South America | Short to Medium-term (2025-2030) |

Palm Oil Market Challenges Impact Analysis

The Palm Oil market faces substantial challenges, prominently including persistent land use conflicts and social issues in production regions. Expansion of palm oil plantations often encroaches on indigenous lands and leads to displacement, sparking protests and legal disputes that can disrupt supply chains and damage corporate reputations. These socio-economic complexities require careful negotiation and adherence to human rights standards, posing a significant hurdle for sustainable growth and investor confidence, particularly for companies operating in sensitive ecological and social environments.

Climate change poses another critical challenge, with unpredictable weather patterns, droughts, and floods impacting palm oil yields and increasing the risk of crop failures. This directly affects supply stability and global prices, making long-term planning difficult for producers. Furthermore, labor shortages and ethical labor practices, including concerns over migrant workers' rights and child labor, remain a pervasive issue in some producing countries. Addressing these challenges necessitates robust corporate social responsibility initiatives, adaptive agricultural practices, and collaborative efforts across the industry to ensure fair and sustainable production, mitigating both environmental and social risks for market participants.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Land Use Conflicts & Social Issues | -1.2% | Southeast Asia, South America | Long-term (2025-2033) |

| Impacts of Climate Change on Yields | -1.0% | Global Production Regions | Medium to Long-term (2026-2033) |

| Labor Shortages & Ethical Labor Practices | -0.7% | Southeast Asia | Short to Medium-term (2025-2030) |

| Intensifying Competition from Alternative Oils | -0.5% | Global | Long-term (2027-2033) |

Palm Oil Market - Updated Report Scope

This comprehensive market research report on the Palm Oil market provides an in-depth analysis of its current state, historical performance, and future growth trajectory. It meticulously segments the market by product type, application, end-use industry, and regional distribution, offering a detailed understanding of the forces driving and restraining its expansion. The report highlights key market trends, competitive landscapes, and the strategic initiatives undertaken by leading players to maintain their market position and capitalize on emerging opportunities within the palm oil ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 78.5 billion |

| Market Forecast in 2033 | USD 134.2 billion |

| Growth Rate | 6.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Agri-Products Corp., Integrated Plantation Group, Sustainable Oil Holdings, BioFuel Solutions Inc., AgroHarvest International, Meridian Palm Resources, GreenGrove Plantations, Elite Oleochemicals Ltd., Universal Edible Oils, Pacific Agro-Commodities, Summit Palm Industries, Apex Agronomics, Golden Kernel Processing, Vital Source Oils, PalmTech Innovations. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Palm Oil market is meticulously segmented to provide a granular view of its diverse applications and product forms, which is crucial for understanding its pervasive influence across various industries. This segmentation highlights the distinct characteristics and growth patterns of each component, enabling stakeholders to identify specific market niches and strategic entry points. From its raw form as Crude Palm Oil to highly refined derivatives, each segment caters to unique industrial requirements, reflecting the versatility and adaptability of palm oil as a global commodity and its integral role in the supply chains of numerous sectors worldwide.

The segmentation by application further delineates the extensive reach of palm oil, encompassing staple food items, a wide array of oleochemical products, and its growing importance in renewable energy. Analyzing these segments provides insights into demand drivers, regulatory influences, and the competitive landscape within each specific market. This detailed breakdown allows for a comprehensive assessment of the market's structure, offering valuable foresight into emerging trends and investment opportunities across its expansive value chain.

- By Product Type:

- Crude Palm Oil (CPO): The raw form, primarily used for further refining.

- Refined Palm Oil (RPO): Processed for direct consumption or industrial use, including cooking oil, food manufacturing.

- Palm Kernel Oil (PKO): Derived from the kernel, distinct fatty acid profile, used in confectionery, cosmetics, detergents.

- Palm Fatty Acid Distillate (PFAD): A byproduct of refining CPO, used in soaps, animal feed, and biodiesel.

- By Application:

- Food & Beverages: Dominant segment, includes edible oils, confectionery, baked goods, dairy, margarine, snack foods.

- Oleochemicals: Essential for manufacturing soaps, detergents, cosmetics, personal care products, lubricants, and surfactants.

- Biofuels & Energy: Growing segment driven by renewable energy policies and demand for biodiesel.

- Animal Feed: Used as an energy source in livestock feed formulations.

- Other Industrial Applications: Covers various uses in pharmaceuticals, textiles, and other chemical processes.

- By End-Use Industry:

- Food Service: Restaurants, cafes, and commercial kitchens utilizing palm oil for cooking.

- Retail: Packaged palm oil products sold directly to consumers.

- Industrial Manufacturing: Large-scale use in food processing, chemical production, and other industrial applications.

- Automotive: Primarily for biodiesel in the transport sector.

- Pharmaceuticals: Minor but growing use in certain pharmaceutical formulations.

- Textiles: Used in some textile processing applications.

Regional Highlights

- Asia Pacific (APAC): Dominates the global Palm Oil market in both production and consumption. Indonesia and Malaysia are the largest producers, accounting for over 85% of global output. India and China are the leading importers and consumers due to their large populations and growing food industries. The region also sees increasing domestic demand for biofuels and oleochemicals.

- Europe: A significant importer of palm oil, with a strong focus on certified sustainable palm oil (CSPO) due to stringent environmental regulations and consumer pressure. Demand is high in the food sector (confectionery, baked goods) and the oleochemical industry. European Union policies on biofuels also influence palm oil imports for energy purposes.

- North America: A key market for palm oil, particularly in the food processing industry and oleochemicals. While production is minimal, demand for sustainably sourced palm oil is increasing. Regulations and consumer awareness drive the adoption of CSPO, influencing import patterns and product formulations.

- Latin America: Emerging as a growing producer region, with countries like Colombia, Ecuador, and Brazil increasing their cultivation. The region focuses on expanding sustainable production practices and caters to both domestic and export markets, including growing demand for biofuels.

- Middle East and Africa (MEA): Represents a rapidly growing consumption market, driven by population growth, urbanization, and increasing demand for edible oils and processed foods. Imports are substantial, and there is a rising interest in local palm oil production to reduce reliance on imports and improve food security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Palm Oil Market.- Global Agri-Products Corp.

- Integrated Plantation Group

- Sustainable Oil Holdings

- BioFuel Solutions Inc.

- AgroHarvest International

- Meridian Palm Resources

- GreenGrove Plantations

- Elite Oleochemicals Ltd.

- Universal Edible Oils

- Pacific Agro-Commodities

- Summit Palm Industries

- Apex Agronomics

- Golden Kernel Processing

- Vital Source Oils

- PalmTech Innovations

- EcoCrop Solutions

- Harvest Pride Commodities

- Tropical AgriVentures

- Grand Oleo Chemicals

- Future Foods & Oils

Frequently Asked Questions

What is palm oil primarily used for?

Palm oil is a highly versatile vegetable oil primarily used in food products like cooking oils, baked goods, and confectionery. It is also extensively utilized in non-food applications such as cosmetics, detergents, and increasingly, in the production of biofuels due to its efficiency and cost-effectiveness.

Is palm oil consumption sustainable?

The sustainability of palm oil is a complex issue. While historically linked to deforestation, the industry is increasingly moving towards certified sustainable palm oil (CSPO) production, governed by standards from organizations like the Roundtable on Sustainable Palm Oil (RSPO), aiming to ensure environmentally responsible and socially beneficial practices.

What are the main health concerns associated with palm oil?

Palm oil contains a high proportion of saturated fats. While some studies suggest it can be part of a balanced diet, concerns often revolve around its potential impact on cholesterol levels. However, its specific fatty acid composition differs from other saturated fats, and it also contains beneficial antioxidants like Vitamin E.

How do palm oil prices fluctuate, and what drives them?

Palm oil prices are highly volatile, influenced by factors such as global crude oil prices (due to biofuel demand), weather patterns in major producing regions affecting yields, government policies on tariffs and subsidies, and the supply-demand balance of other competing vegetable oils like soybean and sunflower oil.

What role does technology play in the future of palm oil production?

Technology, particularly AI and precision agriculture, is crucial for the future of palm oil. It enables enhanced yield prediction, real-time monitoring of plantation health, efficient resource management, and improved traceability. These innovations are vital for boosting productivity while simultaneously addressing sustainability challenges and ensuring responsible cultivation practices.