Micro LED Display Market

Micro LED Display Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705683 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Micro LED Display Market Size

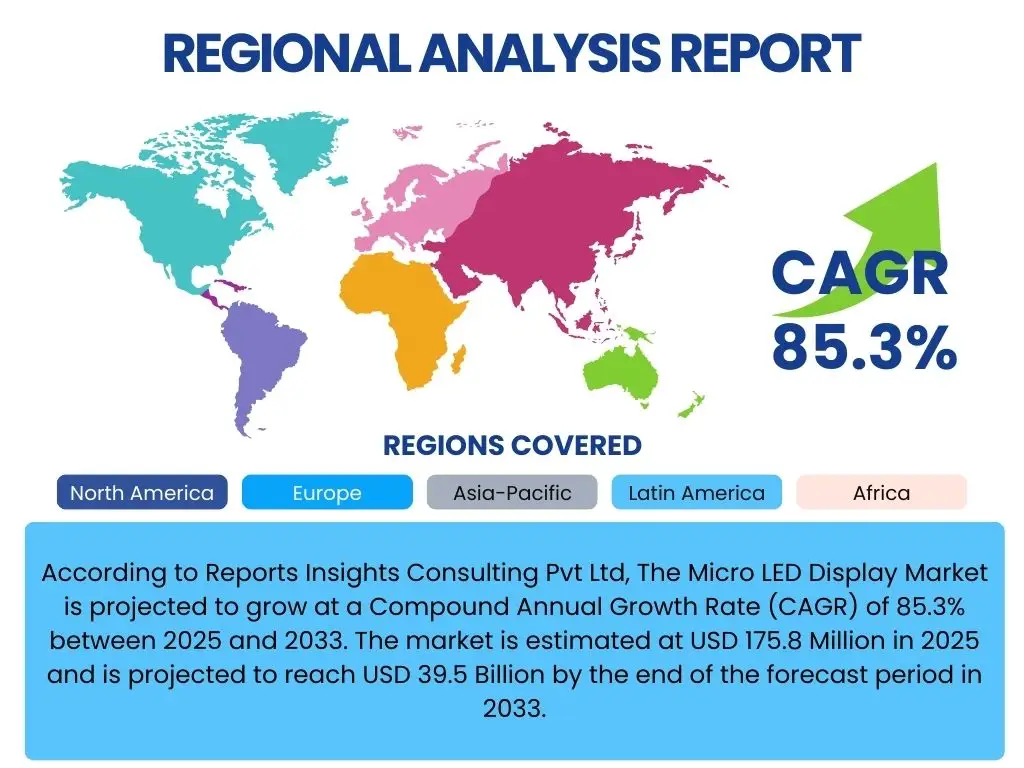

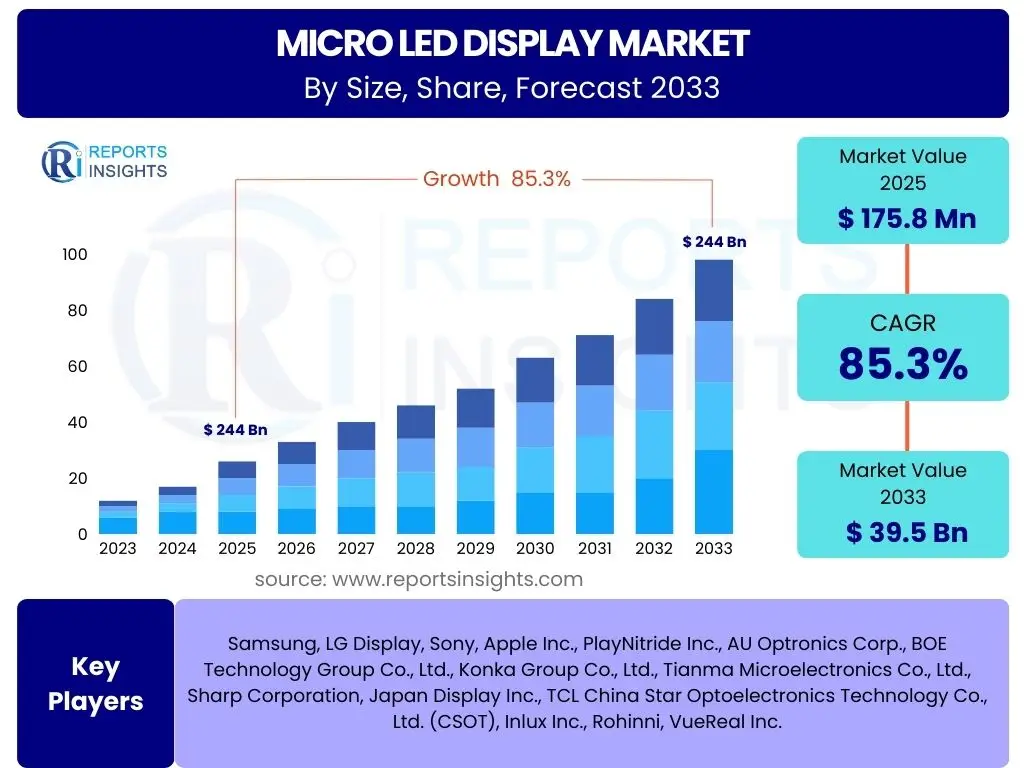

According to Reports Insights Consulting Pvt Ltd, The Micro LED Display Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 85.3% between 2025 and 2033. The market is estimated at USD 175.8 Million in 2025 and is projected to reach USD 39.5 Billion by the end of the forecast period in 2033.

Key Micro LED Display Market Trends & Insights

The Micro LED display market is experiencing rapid evolution driven by technological advancements and increasing demand for superior visual experiences. Key user inquiries frequently revolve around the commercial viability and adoption timelines of Micro LED technology across various sectors. Current trends indicate a significant push towards resolving manufacturing complexities, particularly regarding mass transfer processes and yield rates, which are critical for cost reduction and scalability. The market is also witnessing a surge in research and development aimed at improving efficiency, brightness, and color uniformity, addressing existing technical hurdles that have historically limited broader market penetration. Furthermore, strategic collaborations between display manufacturers, material suppliers, and end-product companies are becoming more prevalent, fostering an ecosystem conducive to innovation and market expansion.

Another prominent trend observed is the diversification of Micro LED applications beyond premium large-format displays. Users are increasingly interested in the potential integration of Micro LED into consumer electronics such as smartwatches, augmented reality (AR) headsets, and automotive displays, where their compact size, high brightness, and energy efficiency offer distinct advantages. The development of smaller pixel pitches and more robust encapsulation methods is enabling these miniature applications. Additionally, advancements in chip manufacturing, including the shift towards larger wafer sizes and enhanced epitaxy techniques, are contributing to improved production efficiencies and cost optimization. These trends collectively underscore a maturing market poised for significant growth as technical barriers are overcome and production scales increase.

- Advancements in mass transfer technology for higher yield rates.

- Increased focus on Micro LED integration in augmented reality (AR) and virtual reality (VR) devices.

- Expansion into premium consumer electronics and automotive displays.

- Development of larger wafer sizes and improved epitaxy for cost reduction.

- Strategic partnerships across the supply chain to accelerate commercialization.

- Growing investment in R&D for enhanced color uniformity and brightness.

AI Impact Analysis on Micro LED Display

The integration of Artificial Intelligence (AI) is set to profoundly impact the Micro LED display market, addressing several critical aspects from design and manufacturing to quality control and application development. User questions often center on how AI can accelerate the notoriously complex production processes and enhance the performance of Micro LED panels. AI-driven simulation and optimization tools are being employed to refine chip design, predict material behaviors, and optimize epitaxy processes, leading to higher efficiency and reduced material waste. Furthermore, AI-powered computer vision systems are revolutionizing quality inspection, enabling faster and more accurate detection of microscopic defects that are nearly impossible for human operators to identify, thereby improving overall yield rates and reducing production costs.

Beyond manufacturing, AI is also influencing the functionality and user experience of Micro LED products. In advanced display systems, AI algorithms can dynamically adjust display parameters such as brightness, contrast, and color temperature based on ambient lighting conditions or user preferences, optimizing visual quality and energy consumption. For AR/VR applications, AI assists in rendering complex graphics and processing sensor data to create more immersive and responsive experiences on Micro LED microdisplays. The capability of AI to analyze vast datasets from production lines allows for predictive maintenance, anticipating equipment failures before they occur, thus minimizing downtime and maximizing throughput. This multifaceted impact positions AI as a crucial enabler for the widespread adoption and continuous improvement of Micro LED technology.

- AI-driven optimization of Micro LED chip design and epitaxy processes.

- Enhanced quality control and defect detection through AI-powered vision systems.

- Predictive maintenance for manufacturing equipment, improving uptime and efficiency.

- Dynamic display adjustment for optimal visual performance and energy efficiency using AI.

- AI integration in AR/VR applications for enhanced rendering and immersive experiences.

- Streamlined supply chain management and inventory optimization through AI analytics.

Key Takeaways Micro LED Display Market Size & Forecast

The Micro LED display market is poised for exceptional growth, driven by its unique performance attributes and expanding application opportunities. Key insights frequently sought by users include the magnitude of this growth and the primary factors fueling it. The projected Compound Annual Growth Rate (CAGR) of 85.3% signifies a transformative period, reflecting the market's transition from nascent stages to rapid commercialization. This significant expansion is underpinned by ongoing breakthroughs in manufacturing techniques, particularly in mass transfer and yield improvement, which are steadily bringing down production costs and making Micro LED technology more accessible for broader applications. The market's potential to reach USD 39.5 Billion by 2033 from USD 175.8 Million in 2025 highlights a strong investor confidence and technological readiness.

The forecast also indicates a strategic shift in application focus, moving beyond ultra-premium large-format displays to encompass a wider range of consumer and industrial products. The superior brightness, contrast, energy efficiency, and extended lifespan of Micro LED displays make them highly desirable for emerging technologies such as augmented and virtual reality, advanced automotive dashboards, and high-resolution wearables. Furthermore, increasing investment in research and development by major technology players and government initiatives to foster advanced display technologies are crucial accelerators. These elements collectively paint a picture of a dynamic market set to redefine display standards across multiple industries in the coming decade.

- Exceptional market growth driven by technological maturity and application expansion.

- Significant cost reduction achieved through advancements in manufacturing processes.

- Increasing adoption across a diverse range of applications beyond large-format displays.

- Strong R&D investment and strategic collaborations accelerating market commercialization.

- The market is transitioning from niche to mainstream applications, promising substantial returns.

Micro LED Display Market Drivers Analysis

The Micro LED display market is experiencing significant momentum, propelled by several key drivers that leverage the technology's inherent advantages. A primary driver is the increasing demand for high-performance displays across various sectors, including premium televisions, augmented reality (AR)/virtual reality (VR) headsets, and automotive displays. Micro LEDs offer unparalleled brightness, contrast ratios, and power efficiency compared to conventional display technologies, making them ideal for these demanding applications where visual quality and energy consumption are paramount. Furthermore, their compact size and modular nature enable the creation of displays of virtually any shape or size, offering unprecedented design flexibility.

Another crucial driver is the ongoing miniaturization trend in consumer electronics and the growing popularity of wearable devices. Micro LEDs are particularly well-suited for these form factors due to their small pixel size, high pixel density, and robust construction. The automotive industry's pivot towards advanced in-car infotainment systems and heads-up displays (HUDs) also presents a substantial opportunity for Micro LED, given its readability in various lighting conditions and wide operating temperature range. Continued investment in research and development, coupled with strategic collaborations between display manufacturers and technology providers, further accelerates the commercialization and adoption of Micro LED technology, pushing down costs and improving production scalability.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Demand for High-Performance Displays | +15% | Global, particularly North America, APAC (Korea, Japan, China) | 2025-2033 |

| Miniaturization and Wearable Device Proliferation | +12% | Global, especially North America, Europe, APAC | 2026-2033 |

| Growth in AR/VR and Automotive Applications | +10% | North America, Europe, APAC (China, Japan) | 2027-2033 |

| Advancements in Manufacturing Processes (Mass Transfer) | +8% | APAC (China, Taiwan, Korea), North America | 2025-2030 |

| Energy Efficiency and Longer Lifespan Advantages | +7% | Global | 2025-2033 |

Micro LED Display Market Restraints Analysis

Despite the immense potential of Micro LED technology, several significant restraints are currently impeding its broader market adoption and growth. The most prominent challenge remains the exorbitantly high manufacturing cost. This is primarily due to the intricate and delicate mass transfer process, which involves precisely placing millions of microscopic LEDs onto a substrate. Achieving high yield rates for such a process, especially for large displays, is technically demanding and results in substantial production expenses, making Micro LED products prohibitively expensive for mass consumer markets.

Another key restraint is the complexity of achieving uniform color and brightness across large Micro LED panels. Variations in individual LED performance, coupled with the challenges of precisely controlling current at the micro-level, can lead to inconsistencies in the displayed image. Furthermore, the lack of standardized manufacturing processes and the nascent stage of the supply chain contribute to higher costs and slower development cycles. Competition from established and rapidly evolving display technologies, such as OLED and Mini-LED, which offer competitive performance at significantly lower price points, also acts as a restraint. These alternative technologies continue to improve, narrowing the performance gap while maintaining a substantial cost advantage, thereby forcing Micro LED manufacturers to rapidly innovate and scale production to compete effectively.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Manufacturing Costs (Mass Transfer, Yield) | -20% | Global | 2025-2029 |

| Technical Complexities (Color Uniformity, Defects) | -10% | Global | 2025-2028 |

| Competition from OLED and Mini-LED Technologies | -8% | Global | 2025-2033 |

| Lack of Standardized Production Processes | -5% | Global | 2025-2027 |

| Limited Supply Chain Infrastructure | -4% | Global | 2025-2027 |

Micro LED Display Market Opportunities Analysis

Despite existing challenges, the Micro LED display market is brimming with substantial opportunities that could accelerate its growth and widespread adoption. A significant opportunity lies in the expansion into high-value niche markets that demand superior display performance regardless of initial cost, such as professional cinematic displays, ultra-luxury home entertainment systems, and specialized industrial applications. As manufacturing processes mature and costs gradually decline, the technology can then penetrate broader consumer segments. The modularity of Micro LED panels also creates opportunities for creating innovative, large-format, bezel-less displays for commercial signage, control rooms, and public venues, offering unprecedented visual impact and customization.

Furthermore, the rapid evolution of augmented reality (AR) and virtual reality (VR) technologies presents a colossal opportunity for Micro LED. Micro LEDs are uniquely suited for AR/VR headsets due to their compact size, high pixel density (PPI), rapid response times, and exceptional brightness, which are crucial for rendering realistic virtual environments and achieving clear images in demanding optical systems. The automotive sector's shift towards sophisticated in-cabin displays and heads-up displays (HUDs) also represents a promising avenue, as Micro LEDs offer the necessary durability, wide viewing angles, and high luminosity required for vehicle environments. Strategic investments in research and development, coupled with government initiatives and cross-industry collaborations, are also fostering an environment ripe for innovation and market expansion, potentially leading to breakthroughs in cost-effective manufacturing and novel applications.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Premium & Niche Markets | +18% | North America, Europe, APAC (Japan, Korea) | 2025-2033 |

| Growth of AR/VR Applications | +15% | North America, Europe, APAC | 2026-2033 |

| Automotive Display Integration | +12% | Europe, North America, APAC (China, Germany) | 2027-2033 |

| Development of Cost-Effective Manufacturing Techniques | +10% | APAC (China, Taiwan, Korea), North America | 2028-2032 |

| Strategic Partnerships & Collaborations | +7% | Global | 2025-2030 |

Micro LED Display Market Challenges Impact Analysis

The Micro LED display market faces several formidable challenges that must be addressed for widespread commercial success. One of the most significant technical hurdles is the "mass transfer" process, which involves precisely picking and placing millions of microscopic LED chips onto a substrate. Current methods are slow, prone to defects, and have low yields, significantly driving up manufacturing costs and slowing down production. Achieving perfect pixel uniformity and eliminating defects (like dead pixels or color shifts) across large Micro LED panels remains a complex engineering feat, requiring extremely high precision and sophisticated quality control measures.

Another major challenge is the substantial upfront investment required for Micro LED research, development, and scaling of production facilities. The capital expenditure for equipment and specialized cleanroom environments is immense, posing a barrier to entry for new players and adding to the final product cost. Furthermore, the intellectual property landscape surrounding Micro LED technology is complex and fragmented, with numerous patents held by various companies, potentially leading to patent disputes and hindering cross-industry collaboration. The lack of an established, mature supply chain for specific components and materials also contributes to supply bottlenecks and higher costs, unlike the highly optimized supply chains for mature display technologies like LCD and OLED. Overcoming these challenges will require concerted effort, significant investment, and innovative solutions across the entire value chain.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Mass Transfer Technology Limitations | -18% | Global | 2025-2028 |

| High Research & Development (R&D) Investment | -12% | Global | 2025-2030 |

| Pixel Defects and Uniformity Issues | -9% | Global | 2025-2029 |

| Complex Intellectual Property Landscape | -7% | Global | 2025-2033 |

| Immature Supply Chain for Components | -5% | Global | 2025-2027 |

Micro LED Display Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Micro LED Display Market, encompassing market size, trends, drivers, restraints, opportunities, and challenges across various segments and key regions. It offers a strategic outlook on market dynamics, competitive landscape, and future growth trajectories from 2025 to 2033, with a detailed historical analysis from 2019 to 2023. The report is designed to assist stakeholders in understanding market potential, identifying growth avenues, and formulating informed business strategies based on robust data and expert insights.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 175.8 Million |

| Market Forecast in 2033 | USD 39.5 Billion |

| Growth Rate | 85.3% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Samsung, LG Display, Sony, Apple Inc., PlayNitride Inc., AU Optronics Corp., BOE Technology Group Co., Ltd., Konka Group Co., Ltd., Tianma Microelectronics Co., Ltd., Sharp Corporation, Japan Display Inc., TCL China Star Optoelectronics Technology Co., Ltd. (CSOT), Inlux Inc., Rohinni, VueReal Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Micro LED display market is segmented to provide a granular understanding of its diverse applications, end-use industries, and technological characteristics. This segmentation allows for precise analysis of market dynamics, identifying specific growth drivers and opportunities within each category. The varying requirements across different applications, from ultra-small microdisplays for AR/VR headsets to large-format public displays, necessitate distinct technological approaches and market strategies. Understanding these segments is crucial for stakeholders to tailor product development, marketing efforts, and investment decisions effectively.

Each segment presents unique growth prospects and challenges, influencing the overall market trajectory. For instance, the consumer electronics segment, particularly smartwatches and AR/VR, is expected to drive significant adoption due to the inherent advantages of Micro LED in terms of power efficiency and pixel density. Meanwhile, the automotive sector is a long-term opportunity, demanding high reliability and broad operating temperatures. Analyzing these segments by size, type, and underlying technology provides a comprehensive view of the market's evolving landscape and helps identify the most promising areas for future investment and innovation.

- By Application:

- Television

- Smartwatch

- Automotive

- AR/VR

- Smartphone

- Digital Signage

- Others (e.g., Medical Devices, Military Displays)

- By End-Use Industry:

- Consumer Electronics

- Automotive

- Entertainment & Sports

- Retail

- Others (e.g., Aerospace & Defense, Healthcare)

- By Panel Size:

- Small-sized (less than 5 inches)

- Medium-sized (5 to 20 inches)

- Large-sized (above 20 inches)

- By Type:

- Display Panels

- Lighting Solutions

- By Display Technology:

- Active Matrix

- Passive Matrix

Regional Highlights

- North America: This region is a significant hub for Micro LED research and development, particularly for AR/VR and specialized enterprise applications. High disposable income and a strong presence of technology giants drive early adoption of premium display technologies. Investment in startups focusing on advanced display solutions is also prominent, contributing to regional market growth.

- Europe: Europe is characterized by a strong automotive industry and a growing demand for high-end consumer electronics. This region is expected to witness substantial Micro LED adoption in luxury vehicles, professional displays, and niche consumer segments. Regulatory support for energy-efficient technologies also plays a role in fostering market growth.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, driven by its robust manufacturing capabilities, large consumer electronics market, and increasing investment in advanced display technologies from countries like South Korea, China, and Taiwan. These nations are at the forefront of Micro LED production, aiming for mass commercialization and cost reduction. The immense demand for smartphones, televisions, and wearables further fuels market expansion.

- Latin America: While a nascent market for Micro LED, Latin America shows potential for growth, particularly in the premium consumer electronics segment and commercial display applications in urban centers. Economic development and increasing technological awareness are key factors that will drive gradual adoption.

- Middle East and Africa (MEA): The MEA region is expected to experience slower but steady growth, primarily driven by investments in digital signage for smart city initiatives and entertainment venues in wealthier nations. Limited manufacturing capabilities mean reliance on imports, but increasing infrastructure development offers long-term potential for display integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Micro LED Display Market.- Samsung

- LG Display

- Sony

- Apple Inc.

- PlayNitride Inc.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- Konka Group Co., Ltd.

- Tianma Microelectronics Co., Ltd.

- Sharp Corporation

- Japan Display Inc.

- TCL China Star Optoelectronics Technology Co., Ltd. (CSOT)

- Inlux Inc.

- Rohinni

- VueReal Inc.

Frequently Asked Questions

What is Micro LED technology?

Micro LED is an emerging flat-panel display technology that uses arrays of microscopic LEDs, typically 100 micrometers or less, to form individual pixel elements. Unlike traditional LCDs that use a backlight or OLEDs that use organic light-emitting materials, Micro LEDs are inorganic and self-emissive, providing superior brightness, contrast, color accuracy, and energy efficiency.

What are the primary advantages of Micro LED displays?

Micro LED displays offer several key advantages including extremely high brightness levels, true black representation due to individual pixel control, exceptional contrast ratios, wide viewing angles, faster response times, and significantly longer lifespans compared to OLEDs. They also have higher energy efficiency and are more durable due to their inorganic material composition.

What are the main challenges facing Micro LED adoption?

The primary challenges include the high manufacturing cost, particularly related to the precise mass transfer of millions of microscopic LEDs onto a substrate. Other challenges involve achieving perfect pixel uniformity, overcoming yield issues during production, and intense competition from more mature and cost-effective display technologies like OLED and Mini-LED.

Which applications are most promising for Micro LED technology?

Highly promising applications for Micro LED include premium large-format televisions, augmented reality (AR) and virtual reality (VR) headsets due to their high pixel density and brightness, advanced automotive displays, smartwatches, and specialized professional displays like commercial signage and control room monitors.

When is Micro LED technology expected to become mainstream?

While currently in the early commercialization phase for niche and high-end markets, Micro LED technology is projected to become more mainstream in select consumer electronics segments by the late 2020s and early 2030s. This timeline is contingent on significant advancements in mass production techniques, leading to substantial cost reductions and improved manufacturing yields.