Flexible Transparent Plastic Market

Flexible Transparent Plastic Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701485 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Flexible Transparent Plastic Market Size

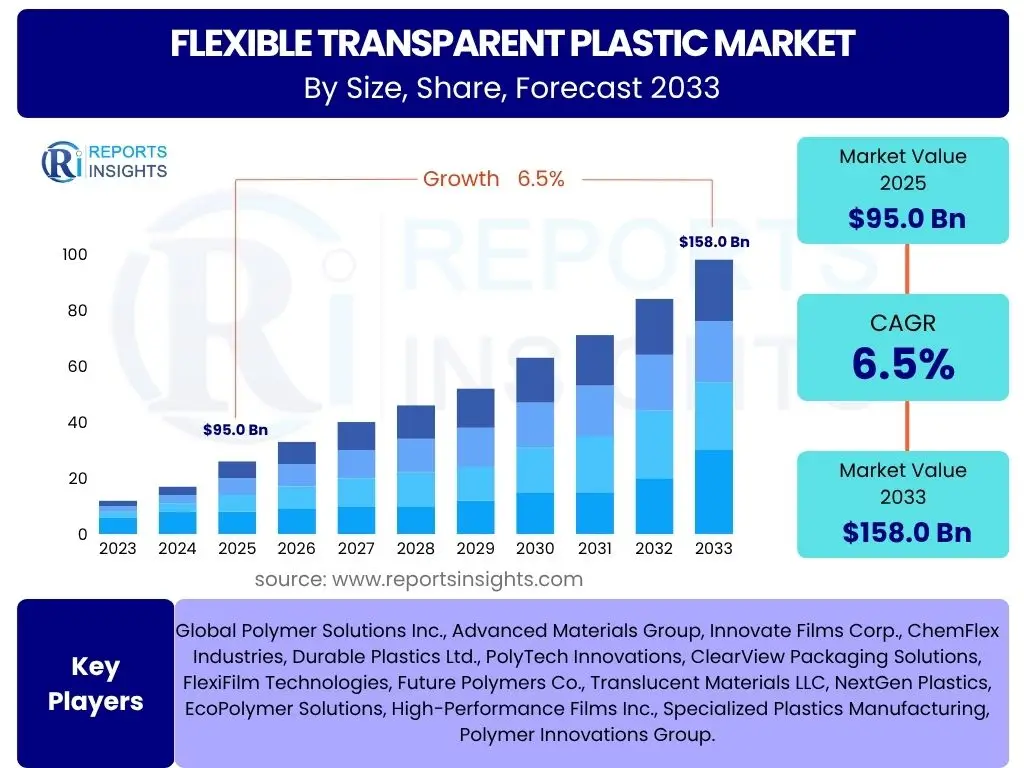

According to Reports Insights Consulting Pvt Ltd, The Flexible Transparent Plastic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2033. This robust growth trajectory is driven by escalating demand across diverse end-use industries, particularly packaging, automotive, and healthcare, where the unique properties of these materials offer significant advantages. The market is estimated at USD 95.0 Billion in 2025, reflecting a broad adoption of flexible transparent plastics for their durability, lightweight nature, and aesthetic appeal.

The expansion is further propelled by technological advancements in polymer science, leading to the development of enhanced barrier properties, improved recyclability, and sustainable alternatives. Innovation in manufacturing processes also contributes to cost-effectiveness and broader application potential. By the end of the forecast period in 2033, the market is projected to reach USD 158.0 Billion, underscoring its pivotal role in modern industrial applications and consumer product design.

Key Flexible Transparent Plastic Market Trends & Insights

The flexible transparent plastic market is currently undergoing significant transformation, primarily driven by shifting consumer preferences, stringent environmental regulations, and advancements in material science. Users frequently inquire about the trajectory of sustainability within this sector, recognizing the increasing pressure on industries to adopt eco-friendly solutions. This has led to a pronounced trend towards bio-based and recyclable plastic alternatives, aiming to mitigate the environmental impact of traditional plastics. Concurrently, the demand for high-performance packaging continues to surge, particularly in the food and beverage and pharmaceutical sectors, necessitating materials with superior barrier properties, extended shelf life capabilities, and enhanced aesthetic appeal. The integration of smart technologies into packaging also represents a burgeoning area of interest, promising improved traceability, consumer engagement, and anti-counterfeiting measures.

Another prominent trend involves the growing application of flexible transparent plastics in advanced display technologies and flexible electronics. As the world moves towards more portable and versatile electronic devices, the lightweight, durable, and optically clear properties of these plastics become indispensable. This includes their use in foldable screens, wearable devices, and solar panels, pushing the boundaries of material innovation. Furthermore, the automotive sector is increasingly adopting flexible transparent plastics for lightweighting initiatives, contributing to fuel efficiency and safety improvements through applications in interior components, glazing, and protective films. The intersection of these trends highlights a dynamic market where innovation in material composition and application diversity are key drivers of growth and competitiveness.

The market also observes a notable trend in customization and personalization, particularly within the consumer goods packaging segment. Brands are leveraging flexible transparent plastics to create visually appealing and unique packaging designs that stand out on shelves, offering opportunities for enhanced brand recognition and consumer engagement. This push for aesthetic appeal is balanced with the functional requirements of product protection and preservation, demonstrating the versatility and adaptability of these materials to evolving market demands. Moreover, the emphasis on supply chain efficiency and cost optimization is driving manufacturers to explore novel production techniques that reduce waste and improve throughput, further shaping the competitive landscape.

- Growing adoption of sustainable and recyclable polymer solutions.

- Increasing demand for high-barrier films in food and pharmaceutical packaging.

- Expansion into advanced electronics and flexible display technologies.

- Lightweighting initiatives in the automotive and aerospace industries.

- Development of smart packaging functionalities for enhanced consumer interaction.

- Rising demand for customized packaging solutions across consumer sectors.

- Integration of advanced manufacturing processes for improved material performance.

AI Impact Analysis on Flexible Transparent Plastic

The advent of Artificial Intelligence (AI) is poised to significantly revolutionize the flexible transparent plastic market, with common user inquiries focusing on its potential to optimize material development, enhance manufacturing efficiency, and enable predictive analytics for market trends. AI's capability to process vast datasets can accelerate the discovery of novel polymer compositions with desired properties, such as enhanced transparency, flexibility, or barrier performance, reducing the traditionally long and expensive R&D cycles. Furthermore, AI-driven simulations can predict material behavior under various conditions, enabling faster prototyping and reducing physical testing, thus streamlining the material innovation pipeline. This analytical power extends to optimizing raw material sourcing and inventory management, ensuring a more resilient and cost-effective supply chain.

In manufacturing, AI is transforming production lines through predictive maintenance, quality control, and process optimization. Users often express interest in how AI can minimize waste, improve product consistency, and increase throughput in plastic film extrusion and lamination processes. AI-powered vision systems can detect microscopic defects in real-time, preventing large batches of faulty products and significantly enhancing overall product quality. Machine learning algorithms can fine-tune operational parameters, such as temperature, pressure, and speed, to achieve optimal energy efficiency and material utilization. This leads to reduced operational costs and a lower environmental footprint, aligning with the industry's growing sustainability objectives.

Beyond material and production, AI's impact extends to market analysis and demand forecasting, addressing user questions about future market dynamics and strategic planning. AI tools can analyze complex market data, including consumer behavior, economic indicators, and regulatory changes, to provide precise demand forecasts, helping manufacturers align production with actual market needs. This predictive capability supports more informed decision-making regarding investment in new capacities, product diversification, and market entry strategies. Moreover, AI can enhance customer engagement through personalized product recommendations and responsive customer service, further strengthening market positions. The integration of AI therefore promises a more intelligent, efficient, and responsive flexible transparent plastic industry.

- Accelerated material discovery and polymer formulation through AI-driven R&D.

- Enhanced manufacturing efficiency and quality control via predictive analytics.

- Optimized supply chain management and raw material sourcing.

- Predictive maintenance reducing downtime and operational costs.

- Improved demand forecasting and market trend analysis for strategic planning.

- Potential for personalized product development and customer experience.

- Development of smart plastics with integrated AI capabilities for real-time monitoring.

Key Takeaways Flexible Transparent Plastic Market Size & Forecast

The flexible transparent plastic market is poised for substantial expansion, with a projected CAGR of 6.5% from 2025 to 2033, reaching USD 158.0 Billion by the end of the forecast period. A primary takeaway is the unwavering demand from the packaging sector, which continues to be the largest application area due to the material's protective properties, light weight, and visual appeal. This growth is further amplified by the increasing preference for convenient, single-serve, and on-the-go packaging solutions, particularly in emerging economies. The market’s resilience is also attributed to its critical role in other high-growth industries, including electronics, automotive, and healthcare, where functional performance and design flexibility are paramount.

Sustainability is emerging as a dominant factor shaping future market dynamics, presenting both a challenge and a significant opportunity. The industry's capacity to innovate towards more eco-friendly solutions, such as bio-based, biodegradable, and recyclable plastics, will be crucial for sustained growth and compliance with evolving global regulations. Companies investing in circular economy principles and advanced recycling technologies are likely to gain a competitive edge. Furthermore, the market's trajectory is heavily influenced by rapid technological advancements, including improvements in barrier technologies, optical clarity, and manufacturing efficiencies, which continually broaden the application scope and enhance material performance.

Geographically, Asia Pacific is expected to remain the dominant market, driven by its burgeoning manufacturing base, expanding consumer markets, and increasing disposable incomes. However, significant growth opportunities are also present in North America and Europe, propelled by innovation in specialty applications and a strong focus on sustainable solutions. The strategic alliances, mergers, and acquisitions among key players are indicative of a consolidating market aiming for greater economies of scale and diversified product portfolios. Overall, the market is characterized by a blend of strong demand, environmental imperatives, and continuous technological innovation, collectively fostering a robust growth outlook.

- Significant market expansion expected, reaching USD 158.0 Billion by 2033.

- Packaging sector remains the primary growth driver, led by convenience and protection needs.

- Sustainability initiatives, including bio-based and recyclable plastics, are critical for future growth.

- Technological advancements in material properties and manufacturing processes are key enablers.

- Asia Pacific retains market dominance, with strong growth also in developed regions.

- Diverse applications in electronics, automotive, and healthcare contribute significantly to demand.

- Industry consolidation and strategic partnerships are shaping the competitive landscape.

Flexible Transparent Plastic Market Drivers Analysis

The flexible transparent plastic market is primarily driven by the escalating demand for advanced packaging solutions across various industries. Consumers increasingly seek convenience, product visibility, and extended shelf life, which flexible transparent plastics inherently provide. The food and beverage sector, in particular, relies heavily on these materials for packaging fresh produce, ready-to-eat meals, and beverages, benefiting from their barrier properties against moisture and oxygen. Moreover, the pharmaceutical and healthcare industries are expanding their use of flexible transparent plastics for sterile packaging, medical devices, and drug delivery systems due to their inertness, lightness, and ease of sterilization. This broad application base ensures a sustained high demand.

Another significant driver is the continuous innovation in material science and processing technologies, which has led to the development of plastics with superior performance characteristics. Advances such as enhanced optical clarity, improved mechanical strength, better barrier properties, and increased heat resistance broaden the application scope of these materials. For instance, the development of multi-layer films and specialized coatings allows for highly tailored properties, meeting specific industry requirements for product protection and preservation. These technological leaps make flexible transparent plastics more versatile and competitive against traditional materials, fostering their adoption in new and existing markets.

Furthermore, the growing trend of lightweighting in the automotive and aerospace industries is a crucial catalyst. Flexible transparent plastics offer a lightweight alternative to glass and rigid plastics, contributing to reduced vehicle weight, which in turn improves fuel efficiency and lowers carbon emissions. Their impact resistance and design flexibility also enable innovative interior and exterior designs, enhancing both safety and aesthetics. The expansion of the electronics sector, particularly in flexible displays, wearable devices, and solar panels, also significantly contributes to market growth, as these applications critically depend on durable, lightweight, and optically clear materials. The confluence of these factors creates a powerful momentum for market expansion.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Flexible Packaging | +2.1% | Global, particularly APAC & North America | 2025-2033 |

| Technological Advancements in Material Science | +1.8% | North America, Europe, Asia Pacific | 2025-2033 |

| Lightweighting Trend in Automotive & Aerospace | +1.5% | Europe, North America, Japan | 2026-2033 |

| Growth of Electronics & Display Technologies | +1.3% | Asia Pacific (China, South Korea), North America | 2025-2033 |

| Rising Healthcare & Medical Applications | +1.0% | North America, Europe, Emerging Markets | 2025-2033 |

Flexible Transparent Plastic Market Restraints Analysis

Despite robust growth, the flexible transparent plastic market faces significant restraints, primarily stemming from escalating environmental concerns and stringent regulatory frameworks. The widespread visibility of plastic waste in oceans and landfills has intensified public and governmental pressure to reduce plastic consumption and enhance recycling efforts. Many countries are implementing bans or taxes on single-use plastics, directly impacting the demand for certain flexible transparent plastic products, particularly in packaging. This regulatory environment necessitates substantial investments in research and development for sustainable alternatives, which can be costly and challenging to scale, thereby slowing down market expansion in some segments.

Another considerable restraint is the fluctuating cost of raw materials, predominantly petrochemical derivatives. The price volatility of crude oil and natural gas, from which many polymers are derived, directly impacts the production costs of flexible transparent plastics. This instability can erode profit margins for manufacturers and lead to unpredictable pricing for end-users, hindering long-term planning and investment. Geopolitical tensions, supply chain disruptions, and global economic uncertainties further exacerbate raw material price fluctuations, adding a layer of complexity and risk to the market.

Furthermore, competition from alternative materials, such as glass, metal, and paper, especially in rigid packaging applications, poses a challenge. While flexible transparent plastics offer unique advantages, their suitability is not universal. In certain applications where durability, reusability, or specific aesthetic properties are prioritized, traditional materials may retain a competitive edge. The perceived difficulty in recycling certain multi-layer flexible plastic structures also presents a technical and economic barrier, pushing some industries towards mono-material or more easily recyclable options. Overcoming these restraints requires continuous innovation in material design, processing, and end-of-life solutions to maintain competitiveness and ensure sustainable growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Environmental Concerns & Regulatory Pressure | -1.9% | Europe, North America, Global | 2025-2033 |

| Volatility in Raw Material Prices | -1.5% | Global | 2025-2033 |

| Challenges in Recycling Multi-Layer Films | -1.2% | Europe, North America, Developing Economies | 2025-2033 |

| Competition from Alternative Packaging Materials | -0.8% | Global | 2025-2030 |

| Consumer Preference for Sustainable Non-Plastic Options | -0.7% | Developed Markets | 2026-2033 |

Flexible Transparent Plastic Market Opportunities Analysis

Significant opportunities exist within the flexible transparent plastic market, particularly in the development and widespread adoption of sustainable and bio-based polymers. As environmental regulations become stricter and consumer demand for eco-friendly products grows, investment in research and development for bioplastics, compostable films, and advanced chemical recycling technologies presents a lucrative avenue. Companies that successfully transition towards a circular economy model by offering fully recyclable or biodegradable flexible transparent plastic solutions will capture significant market share and build strong brand reputation. This shift not only addresses environmental concerns but also creates new market segments for innovative, green products across various applications, from food packaging to medical devices.

The expansion into emerging economies and underdeveloped regions offers another substantial growth opportunity. Rapid urbanization, increasing disposable incomes, and the growth of organized retail in countries across Asia Pacific, Latin America, and Africa are driving a surge in demand for packaged goods. These regions often lack extensive cold chain infrastructure, making flexible transparent plastics with superior barrier properties essential for preserving perishable items and extending shelf life. Manufacturers can leverage these burgeoning markets by offering cost-effective and culturally appropriate packaging solutions, tailored to local needs and logistical challenges. This geographical expansion diversifies revenue streams and reduces dependency on saturated mature markets.

Moreover, the integration of smart packaging technologies and functional films represents a high-potential segment for future innovation. Flexible transparent plastics can be engineered to incorporate features like QR codes for traceability, NFC tags for consumer interaction, temperature indicators, or anti-microbial properties. These intelligent functionalities enhance product safety, supply chain transparency, and consumer engagement, creating premium value-added products. The convergence of material science with digital technologies opens up new applications in logistics, healthcare, and consumer electronics, promising higher margins and differentiation. Furthermore, the ongoing demand for advanced materials in the medical and healthcare sectors for single-use devices, sterile barriers, and drug delivery systems, particularly in response to global health challenges, continues to present robust opportunities for specialized flexible transparent plastics.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Bio-based & Sustainable Plastics | +2.3% | Global, especially Europe & North America | 2025-2033 |

| Expansion into Emerging Economies | +1.8% | Asia Pacific, Latin America, Africa | 2025-2033 |

| Integration of Smart Packaging & Functional Films | +1.5% | North America, Europe, Asia Pacific | 2026-2033 |

| Growth in Medical & Pharmaceutical Applications | +1.2% | North America, Europe, Asia Pacific | 2025-2033 |

| Advancements in Recycling Technologies | +0.9% | Europe, North America | 2027-2033 |

Flexible Transparent Plastic Market Challenges Impact Analysis

The flexible transparent plastic market faces significant challenges related to waste management and the implementation of a comprehensive circular economy. A major hurdle is the complexity of recycling multi-layer flexible films, which are often composed of different polymer types laminated together. This makes mechanical recycling difficult and expensive, leading to a high proportion of these materials ending up in landfills or incineration facilities. Public and governmental pressure to address plastic pollution is intense, pushing the industry to develop economically viable and scalable recycling solutions, including chemical recycling, which are still in their nascent stages. Failure to address these end-of-life challenges could lead to further restrictive legislation and erode public trust, directly impacting market growth.

Another critical challenge is the intense competition and pricing pressure within the industry, particularly for commodity flexible transparent plastics. The market is characterized by a large number of players, leading to price wars and reduced profit margins. This competitive landscape necessitates continuous innovation to differentiate products, whether through enhanced material properties, unique designs, or sustainable attributes. Small and medium-sized enterprises often struggle to compete with the economies of scale enjoyed by larger corporations, making market consolidation a likely trend. Furthermore, the rising energy costs associated with plastic production and processing add another layer of financial burden, especially for energy-intensive manufacturing processes like film extrusion.

Moreover, regulatory compliance and the evolving landscape of chemical safety standards pose continuous challenges. Manufacturers must navigate a complex web of national and international regulations concerning food contact materials, chemical migration, and environmental emissions. Adhering to these standards requires significant investment in testing, certification, and process modifications. The constant evolution of these regulations means that manufacturers must remain agile and proactive in updating their product formulations and manufacturing practices. Any failure to comply can result in costly penalties, product recalls, and reputational damage. Geopolitical instability and trade barriers can also disrupt the supply chain of raw materials and finished goods, adding to the market's overall uncertainty and operational complexities.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Waste Management & Circular Economy Integration | -2.0% | Global, particularly Developed Economies | 2025-2033 |

| Intense Competition & Pricing Pressure | -1.6% | Global | 2025-2033 |

| Fluctuating Energy Costs | -1.1% | Global | 2025-2030 |

| Stringent & Evolving Regulatory Landscape | -0.9% | Europe, North America, APAC | 2025-2033 |

| Perception of Plastics & Public Backlash | -0.7% | Developed Markets | 2026-2033 |

Flexible Transparent Plastic Market - Updated Report Scope

This comprehensive market insights report provides a detailed analysis of the flexible transparent plastic market, covering its size, growth trends, key drivers, restraints, opportunities, and challenges. The scope encompasses a thorough examination of various product types, applications, and end-use industries across major global regions. The report leverages extensive primary and secondary research to deliver a holistic view of the market's current state and its projected trajectory from 2025 to 2033, offering strategic insights for stakeholders to make informed business decisions. It also includes an in-depth competitive landscape analysis, profiling key market participants and their strategies to navigate the evolving market dynamics and capitalize on emerging opportunities.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 95.0 Billion |

| Market Forecast in 2033 | USD 158.0 Billion |

| Growth Rate | 6.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Polymer Solutions Inc., Advanced Materials Group, Innovate Films Corp., ChemFlex Industries, Durable Plastics Ltd., PolyTech Innovations, ClearView Packaging Solutions, FlexiFilm Technologies, Future Polymers Co., Translucent Materials LLC, NextGen Plastics, EcoPolymer Solutions, High-Performance Films Inc., Specialized Plastics Manufacturing, Polymer Innovations Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The flexible transparent plastic market is intricately segmented across various dimensions, including material type, application, and end-use industry, providing a granular view of market dynamics and opportunities. This comprehensive segmentation allows for a precise understanding of demand patterns, technological advancements, and regulatory influences within specific niches. By analyzing these segments, stakeholders can identify high-growth areas, target specific customer needs, and develop tailored product offerings that align with market requirements. The predominant material types, such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), each possess distinct properties that make them suitable for diverse applications, driving their individual market trajectories.

Application-wise, packaging remains the largest and most dynamic segment, encompassing food and beverage, pharmaceutical, and consumer goods packaging. The demand for flexible transparent plastics in packaging is driven by their ability to provide excellent barrier properties, extend shelf life, and offer visual appeal, which are crucial for product safety and marketability. Beyond packaging, the materials find significant utility in the automotive industry for lightweighting and interior components, in electrical and electronics for flexible displays and components, and in healthcare for sterile medical devices and bags. Each application area is influenced by unique industry trends, regulatory standards, and technological advancements, shaping the adoption rates of flexible transparent plastics.

The end-use industry segmentation further refines the market understanding, categorizing demand from sectors such as consumer goods, industrial, medical, and electronics. The consumer goods sector, including food, beverages, and personal care products, relies heavily on these plastics for primary and secondary packaging due to their cost-effectiveness and versatility. The medical industry increasingly uses flexible transparent plastics for single-use devices, sterile pouches, and diagnostic kits, benefiting from their hygiene properties and chemical resistance. This multi-faceted segmentation highlights the broad utility and indispensable nature of flexible transparent plastics across the modern industrial landscape, demonstrating their adaptability to a wide array of functional and aesthetic requirements.

- By Type:

- Polyethylene (PE): Dominant in films, bags, and packaging due to flexibility and cost-effectiveness.

- Polypropylene (PP): Valued for high clarity, heat resistance, and stiffness, commonly used in food packaging and labels.

- Polyvinyl Chloride (PVC): Utilized in medical bags, films, and packaging for its clarity, barrier properties, and chemical resistance.

- Polyethylene Terephthalate (PET): Known for excellent clarity, strength, and barrier properties, prevalent in beverage bottles and films.

- Polyamide (PA) Nylon: Offers high strength, puncture resistance, and good barrier properties, suitable for food and industrial packaging.

- Polycarbonate (PC): Chosen for high impact resistance, optical clarity, and heat resistance, used in electronics and glazing.

- Polymethyl Methacrylate (PMMA) Acrylic: Exhibits superior optical clarity and weather resistance, applied in displays and lighting.

- Others: Includes specialized polymers like EVOH (Ethylene Vinyl Alcohol) for high barrier applications and PVDC (Polyvinylidene Chloride) for moisture and oxygen barriers.

- By Application:

- Packaging:

- Food & Beverage: Films for snacks, fresh produce, meat, dairy, and liquid pouches.

- Pharma & Healthcare: Blister packaging, sterile medical device packaging, IV bags, drug delivery systems.

- Consumer Goods: Films for personal care, home care, and cosmetic products.

- Industrial: Protective films, stretch and shrink films for industrial goods.

- Building & Construction: Glazing, protective films, roofing membranes, insulation films.

- Automotive: Interior components, lightweight glazing, protective films for surfaces.

- Electrical & Electronics: Flexible displays, touchscreens, optical films, component encapsulation.

- Healthcare & Medical: Surgical drapes, disposable gloves, diagnostic test strips, drug delivery patches.

- Agriculture: Greenhouse films, mulch films, protective covers.

- Others: Textiles, sporting goods, stationery, protective overlays.

- Packaging:

- By End-Use Industry:

- Consumer Goods: Packaging for everyday products, flexible consumer electronics.

- Industrial: Protective coatings, industrial films, components.

- Medical: Wide range of single-use and sterile products.

- Automotive: Interior trim, exterior films, lightweight panels.

- Packaging: Comprehensive solutions for all packaged goods.

- Electronics: Display screens, flexible circuits, protective films.

- Construction: Window films, architectural laminates, moisture barriers.

- Agriculture: Crop protection, water management, animal housing.

Regional Highlights

- North America: This region demonstrates a mature but highly innovative market for flexible transparent plastics. Driven by advancements in packaging technology, particularly in the food and beverage and pharmaceutical sectors, North America exhibits a strong demand for high-performance barrier films and sustainable packaging solutions. The emphasis on health and safety standards in the healthcare industry further propels the adoption of specialized flexible plastics for medical devices and sterile packaging. Furthermore, the region's robust automotive industry is increasingly integrating lightweight flexible plastics to enhance fuel efficiency and vehicle safety. Research and development in bio-based and recyclable materials are also prominent, positioning North America at the forefront of sustainable plastic innovation.

- Europe: Europe stands out with its stringent environmental regulations and a strong focus on circular economy principles, significantly influencing the flexible transparent plastic market. The region is a leader in adopting sustainable packaging solutions, driving demand for recycled content, bio-degradable plastics, and compostable films. Innovation in multi-layer film technologies for enhanced barrier properties in food packaging, coupled with advancements in smart packaging, is a key trend. The automotive and construction sectors also contribute substantially to market growth, seeking durable, lightweight, and energy-efficient plastic solutions. Collaborative efforts across the value chain, from material producers to brand owners, are crucial for achieving ambitious sustainability targets.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for flexible transparent plastics, primarily fueled by rapid industrialization, urbanization, and increasing disposable incomes in countries like China, India, and Southeast Asian nations. The burgeoning e-commerce sector and the expanding food processing industry are major drivers for packaging demand. Furthermore, APAC is a global manufacturing hub for electronics, including flexible displays and consumer devices, which extensively utilize transparent plastic films. While growth is robust, the region also faces significant challenges related to waste management and infrastructure, prompting investments in recycling technologies and sustainable practices to mitigate environmental impact.

- Latin America: The flexible transparent plastic market in Latin America is characterized by steady growth, driven by expanding middle-class populations, increased consumption of packaged goods, and the modernization of retail infrastructure. Countries such as Brazil, Mexico, and Argentina are key contributors, with rising demand from the food and beverage sector for convenience packaging. The region is gradually adopting more advanced packaging technologies, although cost-effectiveness remains a critical factor. Opportunities for market expansion exist in the agricultural sector, where transparent films are used for greenhouse applications and crop protection, as well as in the burgeoning healthcare industry.

- Middle East and Africa (MEA): The MEA region presents a developing market for flexible transparent plastics, influenced by economic diversification efforts, infrastructure development, and growing consumer markets. The Gulf Cooperation Council (GCC) countries, with their significant petrochemical capacities, are key producers of raw materials for plastics. Demand is primarily driven by the food packaging sector, especially for processed foods and beverages, along with applications in construction and agriculture. While the market is smaller compared to other regions, increasing foreign investments, expanding manufacturing bases, and improving logistical networks are creating new avenues for growth and the adoption of advanced plastic solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible Transparent Plastic Market.- Global Polymer Solutions Inc.

- Advanced Materials Group

- Innovate Films Corp.

- ChemFlex Industries

- Durable Plastics Ltd.

- PolyTech Innovations

- ClearView Packaging Solutions

- FlexiFilm Technologies

- Future Polymers Co.

- Translucent Materials LLC

- NextGen Plastics

- EcoPolymer Solutions

- High-Performance Films Inc.

- Specialized Plastics Manufacturing

- Polymer Innovations Group

- Flexible Packaging Enterprises

- Crystal Clear Polymers

- OptiFilm Solutions

- ProFlex Plastics

- Sustainable Film Alliance

Frequently Asked Questions

Analyze common user questions about the Flexible Transparent Plastic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current market size and projected growth rate of the Flexible Transparent Plastic Market?

The Flexible Transparent Plastic Market is estimated at USD 95.0 Billion in 2025 and is projected to reach USD 158.0 Billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period. This growth is driven by expanding applications across various industries and continuous material innovations.

Which key trends are shaping the Flexible Transparent Plastic Market?

Key trends include a strong emphasis on sustainability with the rise of bio-based and recyclable plastics, increasing demand for high-barrier films in packaging, the integration of smart technologies in packaging, and the expanding use in advanced flexible electronics and lightweighting applications within the automotive sector.

How is AI impacting the Flexible Transparent Plastic industry?

AI is transforming the industry by accelerating material discovery, optimizing manufacturing processes for efficiency and quality control, enabling predictive maintenance, and enhancing supply chain management. AI also contributes to more accurate demand forecasting and personalized product development, fostering a more intelligent and responsive market.

What are the primary drivers and restraints affecting market growth?

The market is primarily driven by increasing demand for flexible packaging, technological advancements in material science, and lightweighting trends in automotive and electronics. Major restraints include growing environmental concerns, stringent regulations on plastic waste, and volatility in raw material prices.

Which regions are key contributors to the Flexible Transparent Plastic Market?

Asia Pacific is the largest and fastest-growing market due to rapid industrialization and manufacturing growth. North America and Europe are significant contributors, driven by innovation, advanced applications, and a strong focus on sustainable solutions. Latin America and MEA are emerging markets with increasing demand.