Lubricating Oil Additive Market

Lubricating Oil Additive Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706271 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Lubricating Oil Additive Market Size

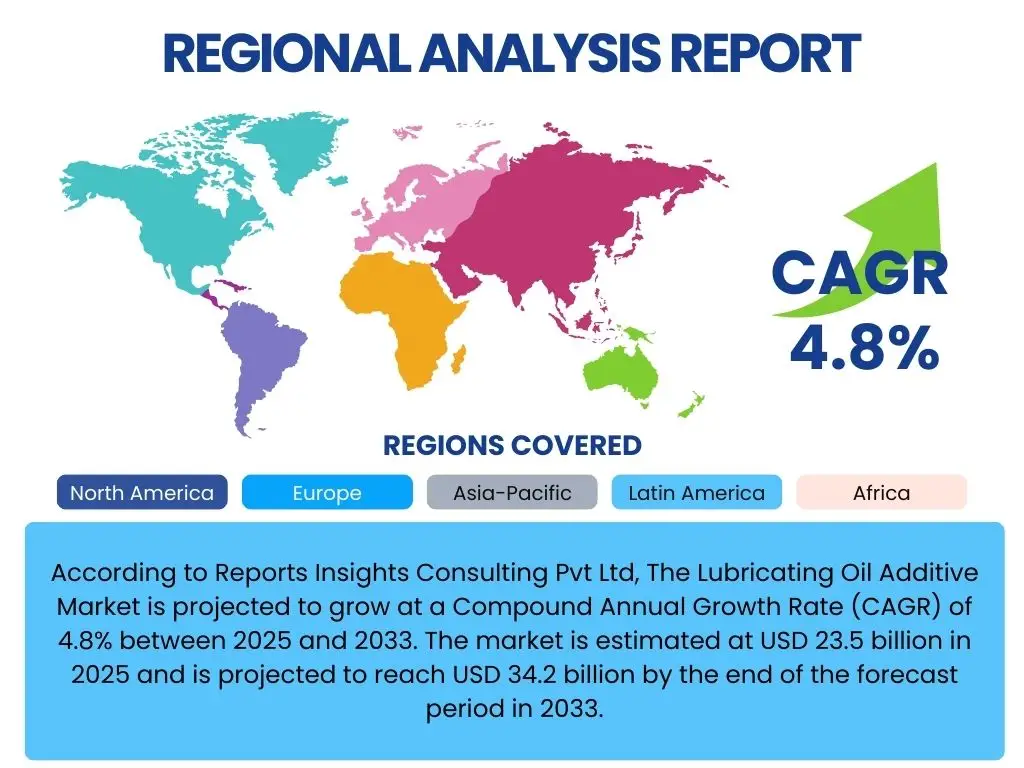

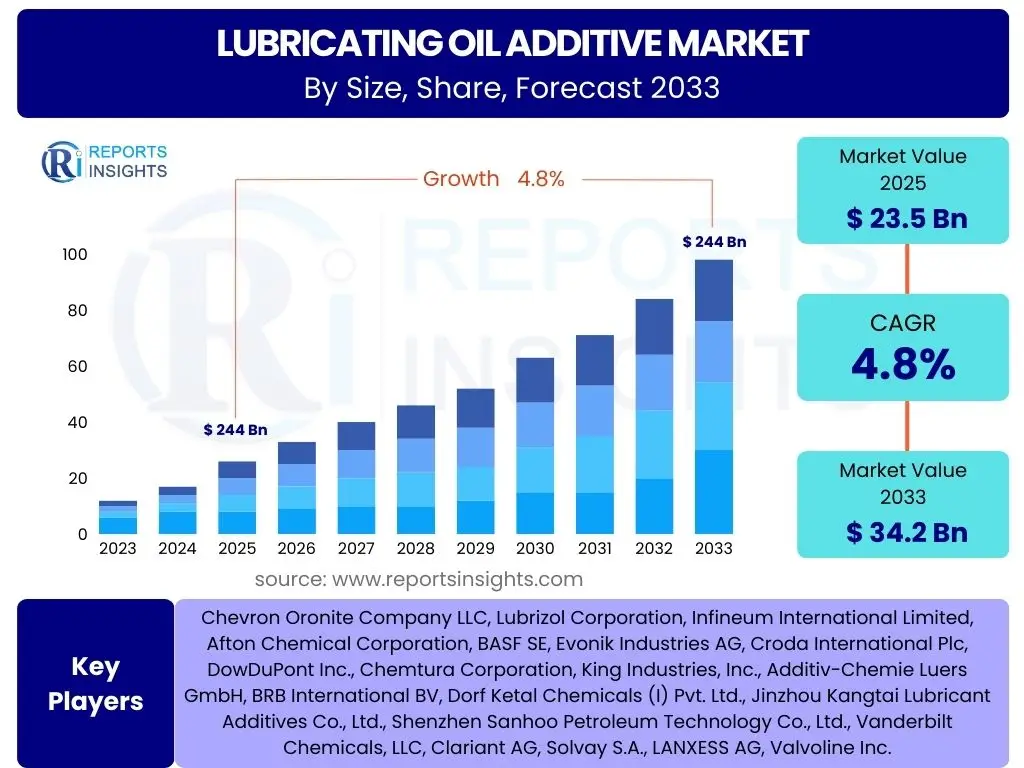

According to Reports Insights Consulting Pvt Ltd, The Lubricating Oil Additive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2033. The market is estimated at USD 23.5 billion in 2025 and is projected to reach USD 34.2 billion by the end of the forecast period in 2033.

Key Lubricating Oil Additive Market Trends & Insights

User inquiries frequently highlight the evolving landscape of the lubricating oil additive market, driven by stringent environmental regulations, technological advancements in engine and machinery design, and the increasing demand for high-performance lubricants. A significant trend observed is the shift towards multi-functional additive packages that offer enhanced protection, fuel efficiency, and extended drain intervals, addressing the complex requirements of modern industrial and automotive applications. Furthermore, there is growing interest in sustainable and bio-based additives, reflecting a broader industry commitment to environmental responsibility.

The market is also influenced by the accelerating pace of digitalization and automation across various industries, necessitating lubricants with specialized properties to support advanced machinery and robotics. This has led to an emphasis on additives that can withstand extreme conditions, prevent wear under high stress, and maintain performance over longer operational periods. The convergence of these factors is shaping product development and market strategies, pushing manufacturers to innovate constantly to meet diverse and evolving end-user demands.

- Increasing demand for high-performance and fuel-efficient lubricants in automotive and industrial sectors.

- Rising adoption of multi-functional additive packages to meet stringent emission standards and extended drain intervals.

- Growing focus on developing sustainable and bio-based lubricating oil additives.

- Digitalization and automation in manufacturing driving demand for specialized lubricants with enhanced properties.

- Shift towards Group II and Group III base oils, necessitating compatible additive technologies.

AI Impact Analysis on Lubricating Oil Additive

Common user questions regarding AI's influence on the lubricating oil additive market revolve around its potential to revolutionize formulation, predictive maintenance, and supply chain optimization. There is a strong expectation that AI will enable more efficient R&D processes, allowing for the rapid screening of potential additive components and the precise tailoring of formulations to specific performance requirements. Users are also keen to understand how AI-driven predictive analytics can enhance asset reliability by optimizing lubricant performance and identifying potential issues before they lead to costly downtime.

Concerns often include the ethical implications of AI, data security, and the need for skilled professionals to manage and interpret AI-generated insights. Nevertheless, the overarching sentiment is one of optimism regarding AI's capacity to drive innovation, improve operational efficiencies, and contribute to more sustainable practices within the lubricating oil additive industry. AI is anticipated to foster a new era of smart lubrication solutions, leading to better product development and application.

- AI-driven optimization of additive formulations, reducing R&D cycles and costs.

- Enhanced predictive maintenance for industrial machinery through AI-powered lubricant analysis.

- Improved supply chain efficiency and demand forecasting using AI algorithms.

- Automated quality control and performance monitoring of additives in real-time.

- Development of smart lubricants that adapt to operational conditions based on AI insights.

Key Takeaways Lubricating Oil Additive Market Size & Forecast

User inquiries frequently aim to grasp the fundamental growth drivers and critical factors shaping the lubricating oil additive market's trajectory over the forecast period. A central insight is the consistent growth propelled by increasing vehicle parc globally, the expansion of industrial manufacturing, and ongoing infrastructure development, all of which necessitate robust lubrication solutions. The market's resilience is further supported by the continuous innovation in additive technologies, designed to meet stricter regulatory demands for reduced emissions and improved energy efficiency, ensuring sustained demand for high-performance products.

Another key takeaway is the escalating importance of regional market dynamics, particularly in emerging economies where industrialization and urbanization are rapid. These regions represent significant growth opportunities, even as mature markets focus on premium, specialized, and environmentally compliant additives. The interplay between regulatory pressures, technological advancements, and economic growth will continue to define the competitive landscape and overall market expansion.

- Steady market expansion driven by growth in automotive and industrial sectors worldwide.

- Technological advancements in additive chemistry are crucial for meeting evolving performance standards and environmental regulations.

- Emerging economies in Asia Pacific and Latin America are poised for significant growth due to industrialization.

- Increasing demand for multi-functional and sustainable additives to enhance lubricant performance and reduce environmental impact.

- Market resilience despite economic fluctuations, underpinned by essential demand across diverse end-use applications.

Lubricating Oil Additive Market Drivers Analysis

The lubricating oil additive market is significantly propelled by several key factors, primarily the sustained growth of the automotive industry and the increasing global vehicle production. Modern engines, both internal combustion and hybrid, demand sophisticated lubricants that can withstand extreme operating conditions, requiring a higher concentration of advanced additives for optimal performance and longevity. Simultaneously, the robust expansion of industrial sectors, including manufacturing, construction, and power generation, fuels the demand for high-performance industrial lubricants, which in turn drives the consumption of various additive types.

Stringent environmental regulations aimed at reducing emissions and improving fuel efficiency also act as a powerful driver. These regulations compel lubricant manufacturers to develop new formulations that comply with evolving standards, leading to the increased adoption of advanced and specialized additives such. Additionally, the growing focus on extending equipment lifespan and reducing maintenance costs across various industries contributes to the demand for superior lubricating solutions, further boosting the market for high-quality additives.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Automotive Industry & Vehicle Production | +1.5% | Global, particularly Asia Pacific (China, India), North America | Short to Medium Term (2025-2029) |

| Rapid Industrialization & Infrastructure Development | +1.2% | Asia Pacific, Latin America, Middle East & Africa | Medium to Long Term (2027-2033) |

| Stringent Emission Regulations & Fuel Efficiency Standards | +1.0% | Europe, North America, China, India | Ongoing (2025-2033) |

| Increasing Demand for High-Performance Lubricants | +0.8% | Global | Ongoing (2025-2033) |

| Focus on Extended Drain Intervals & Equipment Longevity | +0.7% | North America, Europe, Developed Asia Pacific | Medium Term (2026-2030) |

Lubricating Oil Additive Market Restraints Analysis

Despite robust growth drivers, the lubricating oil additive market faces notable restraints, primarily the volatility in raw material prices. Additives are derived from petrochemicals, and their production costs are highly susceptible to fluctuations in crude oil prices, which can impact profitability and pricing strategies for manufacturers. This unpredictability makes long-term planning challenging and can lead to increased operational costs, potentially curbing market expansion.

Another significant restraint is the increasing stringency of environmental regulations concerning the chemical composition and disposal of lubricants. While some regulations drive demand for specific additives, others impose limitations on the use of certain chemicals, requiring costly reformulations and compliance efforts. The growing adoption of electric vehicles (EVs) also poses a long-term challenge, as EVs require different types of lubricants with reduced volumes of traditional engine oil additives, potentially impacting the demand for conventional additive packages in the future.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Raw Material Prices (Petrochemicals) | -0.9% | Global | Ongoing (2025-2033) |

| Stringent Environmental Regulations on Additive Composition | -0.8% | Europe, North America, Japan | Ongoing (2025-2033) |

| Increasing Adoption of Electric Vehicles (EVs) | -0.7% | Global, particularly developed economies | Medium to Long Term (2028-2033) |

| Slower Growth in Mature Markets Due to Saturation | -0.5% | North America, Western Europe | Ongoing (2025-2033) |

| High Research & Development Costs for New Formulations | -0.4% | Global | Ongoing (2025-2033) |

Lubricating Oil Additive Market Opportunities Analysis

Significant opportunities are emerging in the lubricating oil additive market, driven by the increasing demand for high-performance and specialty lubricants across diverse applications. The rapid industrialization and urbanization in developing economies, particularly in the Asia Pacific and Latin American regions, present substantial untapped potential for market expansion. As these regions experience growth in manufacturing, automotive production, and infrastructure development, the need for robust and efficient lubrication solutions escalates, creating a fertile ground for additive suppliers.

Furthermore, the growing focus on sustainability and environmental concerns is opening avenues for the development and adoption of bio-based and environmentally friendly additives. This trend is not only driven by regulatory pressures but also by increasing consumer and industry preference for greener solutions. Opportunities also exist in the development of specialized additives for niche applications, such as wind turbines, data centers, and advanced robotics, which require lubricants with unique properties to ensure optimal performance and extended lifespan under specific operating conditions.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Demand in Emerging Economies | +1.3% | Asia Pacific (China, India, Southeast Asia), Latin America | Medium to Long Term (2026-2033) |

| Development of Bio-based & Sustainable Additives | +1.0% | Global, particularly Europe, North America | Ongoing (2025-2033) |

| Growth of Specialty Lubricants for Niche Applications | +0.9% | Global | Short to Medium Term (2025-2029) |

| Technological Advancements in Additive Chemistry | +0.7% | Global | Ongoing (2025-2033) |

| Increased Adoption of Multi-functional Additive Packages | +0.6% | Global | Short to Medium Term (2025-2029) |

Lubricating Oil Additive Market Challenges Impact Analysis

The lubricating oil additive market faces several significant challenges that could impede its growth trajectory. Intense competition among key players, coupled with the fragmented nature of the market, leads to pricing pressures and reduced profit margins. Companies must continuously innovate and differentiate their products to maintain market share, which often entails substantial investment in research and development. This competitive landscape makes it difficult for new entrants to penetrate and for existing players to expand without significant strategic efforts.

Furthermore, the complexity of developing new additive formulations that meet increasingly stringent performance and environmental specifications presents a considerable technical challenge. Balancing performance requirements with cost-effectiveness and regulatory compliance demands extensive R&D, specialized expertise, and lengthy approval processes. The fluctuating availability and pricing of raw materials, many of which are petrochemical derivatives, also pose a consistent challenge, impacting production costs and supply chain stability. These factors collectively contribute to a demanding operational environment for additive manufacturers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition & Price Pressures | -0.8% | Global | Ongoing (2025-2033) |

| Complexity of New Additive Formulation & Testing | -0.7% | Global | Ongoing (2025-2033) |

| Fluctuating Raw Material Supply & Costs | -0.6% | Global | Ongoing (2025-2033) |

| Need for Sustainable & Environmentally Compliant Solutions | -0.5% | Europe, North America | Ongoing (2025-2033) |

| Impact of Geopolitical Instabilities on Supply Chains | -0.4% | Global | Short to Medium Term (2025-2027) |

Lubricating Oil Additive Market - Updated Report Scope

This market research report provides an in-depth analysis of the global lubricating oil additive market, offering comprehensive insights into market size, growth trends, key drivers, restraints, opportunities, and challenges from 2025 to 2033. It details market segmentation by type, application, and end-use, alongside a thorough regional analysis covering major geographies. The report further examines the competitive landscape, profiling leading companies and their strategic initiatives, and assesses the impact of emerging technologies such as Artificial Intelligence on market dynamics. The objective is to provide stakeholders with actionable intelligence for informed decision-making and strategic planning within the evolving lubricant additive industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 23.5 Billion |

| Market Forecast in 2033 | USD 34.2 Billion |

| Growth Rate | 4.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Chevron Oronite Company LLC, Lubrizol Corporation, Infineum International Limited, Afton Chemical Corporation, BASF SE, Evonik Industries AG, Croda International Plc, DowDuPont Inc., Chemtura Corporation, King Industries, Inc., Additiv-Chemie Luers GmbH, BRB International BV, Dorf Ketal Chemicals (I) Pvt. Ltd., Jinzhou Kangtai Lubricant Additives Co., Ltd., Shenzhen Sanhoo Petroleum Technology Co., Ltd., Vanderbilt Chemicals, LLC, Clariant AG, Solvay S.A., LANXESS AG, Valvoline Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The lubricating oil additive market is broadly segmented by type, application, and end-use industry, reflecting the diverse requirements and functionalities across various sectors. Each segment addresses specific performance needs, ranging from preventing wear and corrosion to improving viscosity and fuel efficiency. This multi-faceted segmentation allows for a granular understanding of market dynamics, enabling stakeholders to identify precise growth pockets and tailor product development strategies to meet specific demand characteristics.

Understanding these segments is crucial for market participants to navigate the complex landscape, as different end-use industries and applications necessitate unique additive formulations. For instance, the automotive sector demands additives optimized for engine protection and emission reduction, while industrial applications require solutions for heavy machinery and extreme operating conditions. This detailed segmentation underscores the specialized nature of the lubricating oil additive market and its critical role in enhancing machinery performance and longevity across a wide array of global industries.

- By Type:

- Dispersants

- Detergents

- Anti-wear & Extreme Pressure (EP) Additives

- Corrosion Inhibitors

- Antioxidants

- Viscosity Index Improvers

- Pour Point Depressants

- Friction Modifiers

- Other Additives (e.g., Emulsifiers, Demulsifiers, Biocides)

- By Application:

- Engine Oil Additives

- Gear Oil Additives

- Hydraulic Oil Additives

- Metalworking Fluid Additives

- Transmission Fluid Additives

- Grease Additives

- Other Industrial Oil Additives (e.g., Compressor Oil, Turbine Oil, Transformer Oil)

- By End-Use Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles, Motorcycles)

- Industrial (Manufacturing, Construction, Mining, Power Generation, Marine, Aerospace, Agriculture)

- Marine

- Power Generation

- Others

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to rapid industrialization, burgeoning automotive production in countries like China and India, and significant infrastructure development, leading to high demand for both automotive and industrial lubricants.

- North America: Characterized by a mature but high-value market, driven by demand for high-performance and specialty additives for advanced automotive technologies and sophisticated industrial machinery, alongside stringent environmental regulations.

- Europe: A key region focused on technological innovation and environmental compliance, driving the adoption of premium, fuel-efficient, and sustainable lubricating oil additives, particularly in automotive and specialized industrial sectors.

- Latin America: Exhibiting steady growth attributed to increasing industrial activities, expanding vehicle parc, and investments in energy and mining sectors, creating a rising demand for a wide range of lubricant additives.

- Middle East & Africa (MEA): Growth spurred by ongoing infrastructure projects, expansion of the oil & gas industry, and developing automotive markets, contributing to the demand for conventional and specialized additives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lubricating Oil Additive Market.- Chevron Oronite Company LLC

- Lubrizol Corporation

- Infineum International Limited

- Afton Chemical Corporation

- BASF SE

- Evonik Industries AG

- Croda International Plc

- DowDuPont Inc.

- King Industries, Inc.

- Additiv-Chemie Luers GmbH

- BRB International BV

- Dorf Ketal Chemicals (I) Pvt. Ltd.

- Jinzhou Kangtai Lubricant Additives Co., Ltd.

- Shenzhen Sanhoo Petroleum Technology Co., Ltd.

- Vanderbilt Chemicals, LLC

- Clariant AG

- Solvay S.A.

- LANXESS AG

- Valvoline Inc.

Frequently Asked Questions

What are lubricating oil additives?

Lubricating oil additives are chemical compounds added to base oils to enhance their inherent properties or impart new ones, improving the overall performance, durability, and efficiency of lubricants. They protect engines and machinery from wear, corrosion, oxidation, and sludge formation, extending the lifespan of equipment and ensuring optimal operation.

Why are lubricating oil additives important?

Additives are crucial for modern lubricants as they enable the oils to withstand extreme temperatures, pressures, and contaminants, thereby preventing equipment failure and reducing maintenance costs. They are essential for meeting stringent performance standards, improving fuel economy, and complying with environmental regulations.

What are the primary types of lubricating oil additives?

Key types include dispersants, which keep contaminants suspended; detergents, which clean surfaces; anti-wear and extreme pressure (EP) additives, which protect against metal-to-metal contact; antioxidants, which prevent oil degradation; and viscosity index improvers, which maintain oil thickness across temperature ranges.

Which factors drive the growth of the lubricating oil additive market?

The market is primarily driven by global growth in the automotive and industrial sectors, increasing demand for high-performance lubricants, stringent environmental regulations pushing for advanced formulations, and the continuous need for extended equipment lifespan and reduced operational costs.

What are the future trends in the lubricating oil additive market?

Future trends include a growing emphasis on sustainable and bio-based additives, increasing adoption of multi-functional additive packages, the impact of digitalization and AI on formulation and predictive maintenance, and the development of specialized additives for emerging applications like electric vehicles and advanced robotics.