Lubricant Market

Lubricant Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703518 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Lubricant Market Size

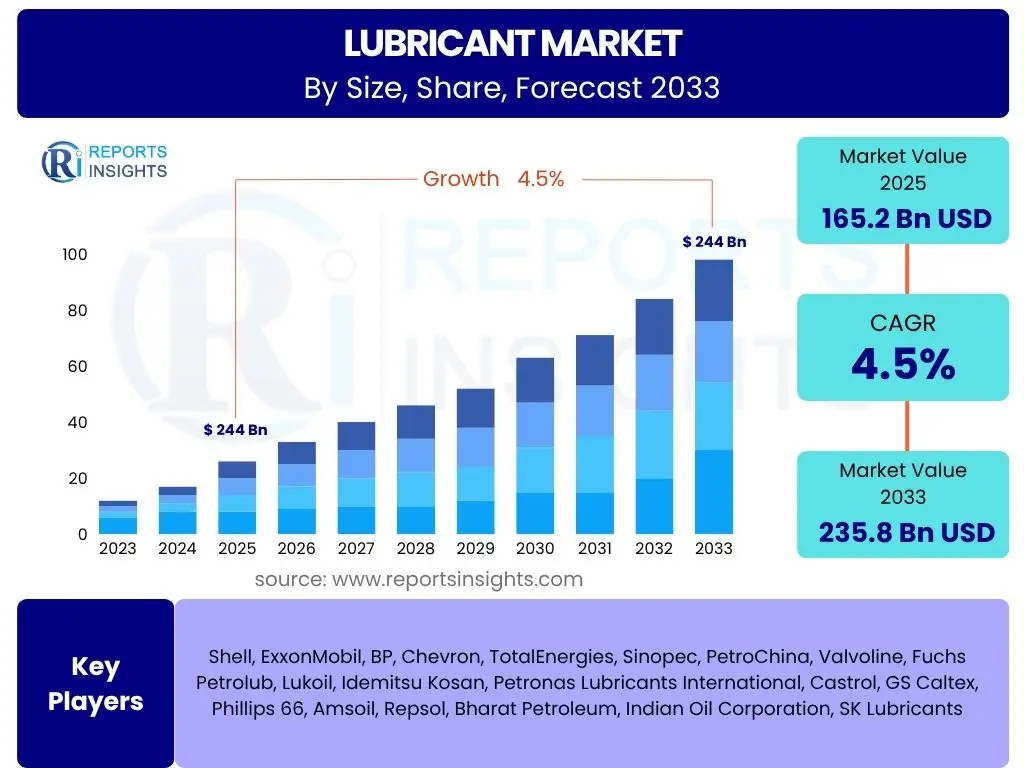

According to Reports Insights Consulting Pvt Ltd, The Lubricant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2033. The market is estimated at 165.2 Billion USD in 2025 and is projected to reach 235.8 Billion USD by the end of the forecast period in 2033.

Key Lubricant Market Trends & Insights

User inquiries frequently focus on the evolving landscape of the lubricant market, seeking to understand the significant shifts in product development, consumer demand, and technological integration. The primary areas of interest revolve around the increasing adoption of high-performance lubricants, the push towards sustainable and environmentally friendly solutions, and the impact of electric vehicles on traditional lubricant applications. Furthermore, there is considerable curiosity regarding the regional dynamics influencing market growth and the role of digitalization in manufacturing and distribution processes.

Current market insights highlight a robust demand for synthetic and semi-synthetic lubricants due to their superior performance characteristics and extended drain intervals, particularly in the automotive and industrial sectors. Additionally, the growing emphasis on environmental sustainability is accelerating the development and adoption of bio-based lubricants, although their market penetration remains lower than conventional types. Digital transformation is also playing a crucial role, with advancements in sensor technologies and data analytics enabling predictive maintenance and optimized lubricant management across various industries.

- Increasing demand for high-performance and specialty lubricants.

- Growing focus on sustainable and bio-based lubricant formulations.

- Shift towards synthetic and semi-synthetic lubricants in automotive and industrial applications.

- Integration of digitalization and IoT for lubricant monitoring and predictive maintenance.

- Impact of electric vehicle (EV) proliferation on traditional internal combustion engine (ICE) lubricant demand.

- Consolidation among market players and strategic partnerships for technology development.

- Rising industrialization and infrastructure development in emerging economies.

AI Impact Analysis on Lubricant

Common user questions regarding AI's impact on the lubricant sector primarily concern its application in product development, operational efficiency, and market forecasting. Users are keen to understand how AI can optimize lubricant formulations for specific applications, predict equipment failures to enhance maintenance strategies, and streamline supply chain logistics. There is also interest in AI's potential to improve quality control and reduce waste in the manufacturing process, alongside its role in personalizing customer service and market analysis.

The integration of Artificial Intelligence is poised to significantly transform the lubricant industry across its value chain. AI algorithms can analyze vast datasets from equipment performance, environmental conditions, and material properties to develop novel lubricant formulations with enhanced performance characteristics and longer lifespans. Furthermore, in manufacturing, AI-powered systems can optimize production processes, identify anomalies, and ensure consistent product quality, leading to reduced operational costs and improved yield. This technological adoption also facilitates more accurate market predictions and personalized customer engagement, offering a competitive edge to companies embracing these advanced capabilities.

- Optimized lubricant formulation and R&D through data-driven insights.

- Enhanced predictive maintenance and equipment longevity using AI analytics.

- Streamlined supply chain and inventory management via AI forecasting.

- Improved quality control and manufacturing process optimization.

- Personalized customer solutions and data-driven marketing strategies.

Key Takeaways Lubricant Market Size & Forecast

User queries frequently seek a concise understanding of the most critical insights derived from the lubricant market's size and forecast. The primary interests revolve around identifying the core drivers of projected growth, understanding the resilience of the market against potential disruptions, and recognizing the major segments poised for expansion. Additionally, there is a strong desire to grasp the overarching strategic implications for businesses operating within or looking to enter the lubricant industry, especially concerning long-term investment and innovation priorities.

The lubricant market is set for consistent growth through 2033, primarily propelled by ongoing industrial expansion and a rising global vehicle parc, despite the gradual shift towards electric vehicles. The market's resilience is underpinned by the essential role of lubricants across diverse industrial applications, from manufacturing to energy, ensuring sustained demand. Key growth segments are expected to be high-performance synthetic lubricants and bio-based variants, driven by performance demands and increasing environmental consciousness. Strategic focus for market participants should thus center on innovation in sustainable formulations and advanced lubricant solutions to capture emerging opportunities and navigate evolving regulatory landscapes.

- Stable growth projected, driven by industrial and automotive sectors.

- Synthetic and bio-based lubricants are key growth segments.

- Environmental regulations and sustainability initiatives are reshaping product development.

- Technological advancements in base oils and additives will be critical for market leadership.

- Asia Pacific remains a dominant and high-growth region.

Lubricant Market Drivers Analysis

The lubricant market's expansion is significantly propelled by several fundamental factors across global economies. These drivers collectively contribute to increased demand for various types of lubricants, ranging from conventional mineral oil-based products to advanced synthetics and emerging bio-based formulations. The ongoing industrialization in developing nations, coupled with continuous innovation in engine technologies and machinery, necessitates lubricants that offer enhanced performance, protection, and efficiency. This persistent demand underscores the critical role lubricants play in maintaining operational continuity and optimizing asset lifespan across diverse sectors.

Key drivers include the robust growth in the automotive sector, particularly the rising vehicle production and increasing average age of vehicles on the road, which sustains demand for engine oils and transmission fluids. Similarly, the expanding manufacturing and construction industries globally fuel the need for industrial lubricants essential for machinery operation. Furthermore, the stringent regulatory environment pushing for improved energy efficiency and reduced emissions indirectly drives the adoption of higher-performance, more advanced lubricants that can meet these demanding specifications. The continuous evolution of machinery and industrial processes also creates a perpetual need for specialized lubricants, tailored to specific operational requirements and extreme conditions.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Automotive Production & Sales | +0.8% | Global, particularly Asia Pacific | Mid-term (3-5 years) |

| Rapid Industrialization & Infrastructure Development | +0.7% | Emerging Economies (China, India, Southeast Asia) | Long-term (5+ years) |

| Increasing Demand for High-Performance Lubricants | +0.6% | North America, Europe, Developed Asia Pacific | Mid-term (3-5 years) |

| Stringent Regulations on Fuel Efficiency & Emissions | +0.5% | Global, particularly Europe & North America | Short-term (1-3 years) |

Lubricant Market Restraints Analysis

While the lubricant market exhibits strong growth potential, it is also subject to several significant restraints that can impede its overall expansion. These challenges often stem from external market forces, regulatory pressures, and evolving technological landscapes, posing considerable hurdles for manufacturers and distributors alike. Addressing these restraints requires strategic adaptation, including investment in research and development, diversification of product portfolios, and careful navigation of geopolitical and economic shifts.

Prominent restraints include the volatility of crude oil prices, which directly impacts the cost of base oils and additives, subsequently affecting production costs and profit margins. Environmental regulations, increasingly stringent worldwide, compel manufacturers to invest heavily in research for biodegradable and less toxic lubricant formulations, adding to operational expenses. Furthermore, the accelerating global shift towards electric vehicles, particularly in developed economies, presents a long-term challenge to the demand for traditional automotive lubricants, necessitating a re-evaluation of product strategies. Economic downturns or slow industrial growth in key regions can also significantly dampen demand for industrial lubricants, impacting market revenues.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Fluctuating Crude Oil Prices | -0.4% | Global | Short-term (1-3 years) |

| Stringent Environmental Regulations | -0.3% | Europe, North America, China | Mid-term (3-5 years) |

| Rise in Electric Vehicle (EV) Adoption | -0.2% | Developed Economies, particularly Europe & North America | Long-term (5+ years) |

| Slowdown in Industrial Production in Developed Regions | -0.1% | Europe, North America, Japan | Short-term (1-3 years) |

Lubricant Market Opportunities Analysis

Amidst market challenges and evolving landscapes, numerous strategic opportunities are emerging that can drive significant growth and innovation within the lubricant sector. These opportunities often arise from technological advancements, unmet market needs, and a global pivot towards sustainability. Capitalizing on these areas requires proactive investment in research, agile market responsiveness, and the cultivation of strategic partnerships to leverage new capabilities and access untapped consumer bases.

A key opportunity lies in the burgeoning market for bio-based and sustainable lubricants, driven by increasing environmental consciousness and regulatory pressures for greener industrial practices. This segment offers significant growth potential as industries seek to reduce their carbon footprint. The expansion of niche applications for high-performance synthetic lubricants, such as in aerospace, wind energy, and specialized manufacturing, also presents lucrative avenues for market players. Furthermore, the digitalization of industries globally, particularly through Industry 4.0 initiatives, creates demand for smart lubricants and integrated lubrication management solutions. Emerging economies, with their ongoing industrialization and increasing vehicle populations, continue to offer substantial opportunities for market penetration and expansion, particularly in the mid-range and value segments.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development & Adoption of Bio-based Lubricants | +0.9% | Global, particularly Europe & North America | Long-term (5+ years) |

| Growth in Niche & Specialized Applications | +0.7% | Developed Markets | Mid-term (3-5 years) |

| Technological Advancements in Additives & Base Oils | +0.6% | Global | Mid-term (3-5 years) |

| Expansion in Emerging Markets (Industrial & Automotive) | +0.8% | Asia Pacific, Latin America, MEA | Long-term (5+ years) |

Lubricant Market Challenges Impact Analysis

The lubricant market, while dynamic, faces several significant challenges that necessitate adaptive strategies from industry participants. These challenges often involve complex interactions between economic factors, technological shifts, and intense market competition, making strategic planning crucial for sustained profitability and market share. Navigating these complexities requires continuous innovation, operational efficiency, and a deep understanding of evolving customer needs and regulatory environments.

One primary challenge is the intense competition from both global giants and regional players, leading to price pressures and reduced margins, particularly in commoditized segments. The rapid pace of technological advancements, especially in engine and machinery design, demands continuous investment in research and development to produce lubricants that meet new specifications and performance requirements. Furthermore, the increasing complexity of supply chains, coupled with geopolitical uncertainties, poses significant logistical and cost challenges for raw material sourcing and product distribution. Managing the environmental impact of lubricant production and disposal, alongside adhering to increasingly strict regulations, adds another layer of complexity and cost for manufacturers. The long-term shift towards alternative energy vehicles also presents a strategic challenge for the automotive lubricant segment, requiring diversification and adaptation.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition & Price Volatility | -0.5% | Global | Short-term (1-3 years) |

| Evolving Technological Specifications & R&D Costs | -0.3% | Global | Mid-term (3-5 years) |

| Supply Chain Disruptions & Raw Material Scarcity | -0.4% | Global | Short-term (1-3 years) |

| Disposal & Environmental Compliance Costs | -0.2% | Europe, North America | Long-term (5+ years) |

Lubricant Market - Updated Report Scope

This report provides a comprehensive analysis of the global Lubricant Market, offering detailed insights into market size, growth trends, key drivers, restraints, opportunities, and challenges. It encompasses an in-depth segmentation analysis across various lubricant types, applications, and end-use industries, alongside a thorough regional assessment to highlight market dynamics and growth prospects across major geographies. The scope includes historical data, current market estimations, and future projections, aiming to equip stakeholders with critical information for strategic decision-making and competitive positioning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | 165.2 Billion USD |

| Market Forecast in 2033 | 235.8 Billion USD |

| Growth Rate | 4.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Shell, ExxonMobil, BP, Chevron, TotalEnergies, Sinopec, PetroChina, Valvoline, Fuchs Petrolub, Lukoil, Idemitsu Kosan, Petronas Lubricants International, Castrol, GS Caltex, Phillips 66, Amsoil, Repsol, Bharat Petroleum, Indian Oil Corporation, SK Lubricants |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The global lubricant market is comprehensively segmented to provide a granular view of its diverse components and their respective growth trajectories. This segmentation allows for a detailed understanding of how different product types, applications, base oils, and end-use industries contribute to the overall market landscape. Each segment is driven by unique demand patterns, technological advancements, and regulatory environments, influencing market size and growth rates across regions.

Analyzing these segments reveals critical insights into consumer preferences and industrial requirements. For instance, the dominance of automotive lubricants is evident, but the industrial sector's diversity, ranging from heavy manufacturing to specialized energy applications, drives a wide array of specific lubricant demands. The base oil type significantly dictates performance characteristics and cost, while the shift towards synthetic and bio-based lubricants highlights a growing emphasis on efficiency and sustainability. Understanding these intricate segment dynamics is essential for market players to develop targeted strategies and optimize their product portfolios for competitive advantage.

- By Type: Mineral Oil Lubricants, Synthetic Lubricants, Semi-Synthetic Lubricants, Bio-based Lubricants.

- By Application: Automotive Lubricants (Passenger Cars, Commercial Vehicles, Motorcycles), Industrial Lubricants (Manufacturing, Metalworking, Construction, Energy & Power, Mining, Marine, Chemicals, Food & Beverages, Others).

- By Base Oil: Group I, Group II, Group III, Group IV (PAO), Group V (Esters, PAGs, etc.).

- By End-Use Industry: Automotive, Industrial, Marine, Aerospace, Oil & Gas, Power Generation, Agriculture.

Regional Highlights

The global lubricant market exhibits significant regional disparities in terms of market size, growth rates, and prevailing trends, largely influenced by industrialization levels, automotive parc sizes, regulatory frameworks, and economic development. Each region presents unique opportunities and challenges, making a localized approach critical for market success. Understanding these regional nuances allows businesses to tailor their strategies, product offerings, and distribution networks to effectively penetrate and expand within specific geographies.

Asia Pacific is consistently highlighted as the largest and fastest-growing market, primarily driven by rapid industrialization, burgeoning automotive production, and substantial infrastructure development in countries like China and India. North America and Europe represent mature markets characterized by a strong emphasis on high-performance synthetic lubricants, stringent environmental regulations, and a growing demand for specialized industrial lubricants. Latin America and the Middle East & Africa (MEA) offer considerable growth potential fueled by expanding industrial bases, increasing vehicle populations, and investments in oil & gas and mining sectors, although economic and political stability can influence market dynamics in these regions.

- Asia Pacific (APAC): Dominates the market share due to rapid industrial growth, expanding automotive sector, and significant infrastructure development in countries such as China, India, and Southeast Asian nations. This region is also seeing increasing adoption of advanced lubricants.

- North America: Characterized by high demand for high-performance and synthetic lubricants, driven by a mature automotive industry and advanced manufacturing sectors. Strict environmental regulations also promote the adoption of eco-friendly lubricant solutions.

- Europe: A mature market with strong emphasis on environmental compliance, driving demand for fuel-efficient and low-emission lubricants. Germany, France, and the UK are key contributors, with robust automotive and industrial bases.

- Latin America: Presents significant growth opportunities driven by increasing industrial activities, particularly in Brazil and Mexico, and a growing vehicle parc. Economic stability and foreign investment play crucial roles in market expansion.

- Middle East & Africa (MEA): Growth is propelled by investments in the oil & gas, mining, and construction sectors. Expanding industrial hubs and increasing vehicle ownership contribute to a steady demand for lubricants across various applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lubricant Market.- Shell

- ExxonMobil

- BP

- Chevron

- TotalEnergies

- Sinopec

- PetroChina

- Valvoline

- Fuchs Petrolub

- Lukoil

- Idemitsu Kosan

- Petronas Lubricants International

- Castrol

- GS Caltex

- Phillips 66

- Amsoil

- Repsol

- Bharat Petroleum

- Indian Oil Corporation

- SK Lubricants

Frequently Asked Questions

What is the projected growth rate of the Lubricant Market?

The Lubricant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2033, reaching an estimated value of 235.8 Billion USD by 2033.

What are the primary drivers for the Lubricant Market's expansion?

Key drivers include the expanding automotive production and sales, rapid industrialization and infrastructure development in emerging economies, increasing demand for high-performance lubricants, and stringent regulations on fuel efficiency and emissions.

How is the rise of electric vehicles impacting the Lubricant Market?

The increasing adoption of electric vehicles presents a long-term restraint for traditional automotive lubricants, as EVs require different types of fluids and in lesser quantities. This shift is driving innovation in specialty EV fluids and prompting market diversification.

Which region holds the largest share in the Lubricant Market?

Asia Pacific is the largest and fastest-growing region in the Lubricant Market, driven by robust industrialization, significant automotive growth, and extensive infrastructure development in countries like China and India.

What role does sustainability play in the future of the Lubricant Market?

Sustainability is a crucial factor, driving the development and adoption of bio-based and environmentally friendly lubricants. Increasing environmental regulations and corporate social responsibility initiatives are accelerating the shift towards greener formulations, presenting significant opportunities for innovation.