Liquid Process Filter Market

Liquid Process Filter Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707119 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Liquid Process Filter Market Size

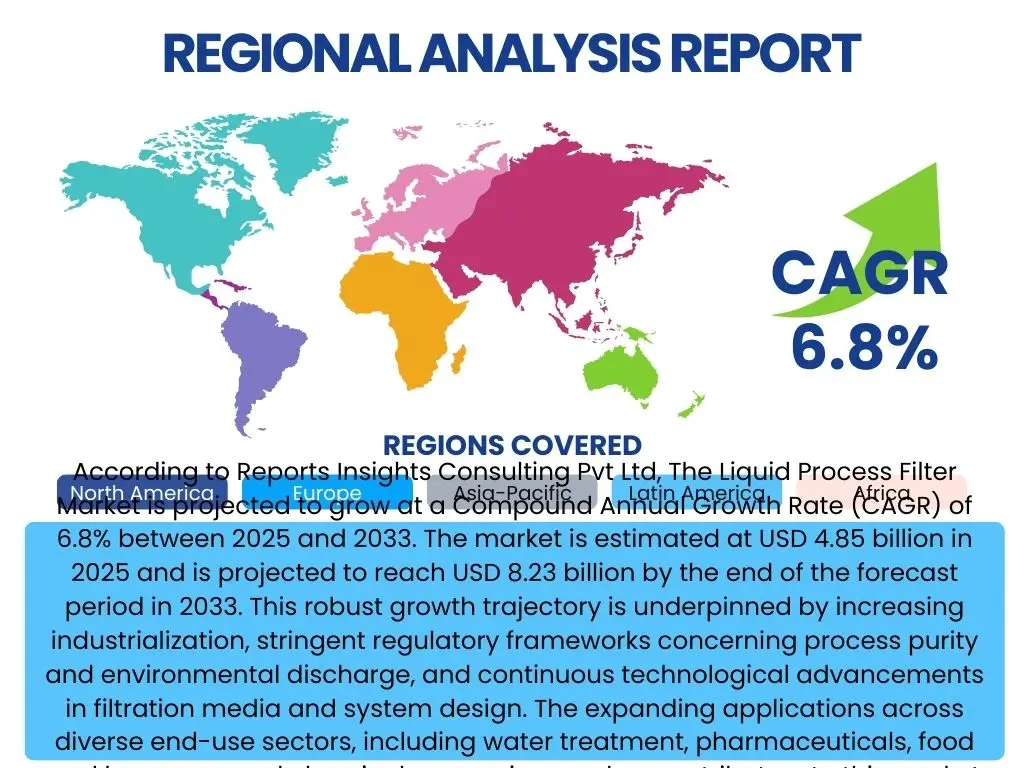

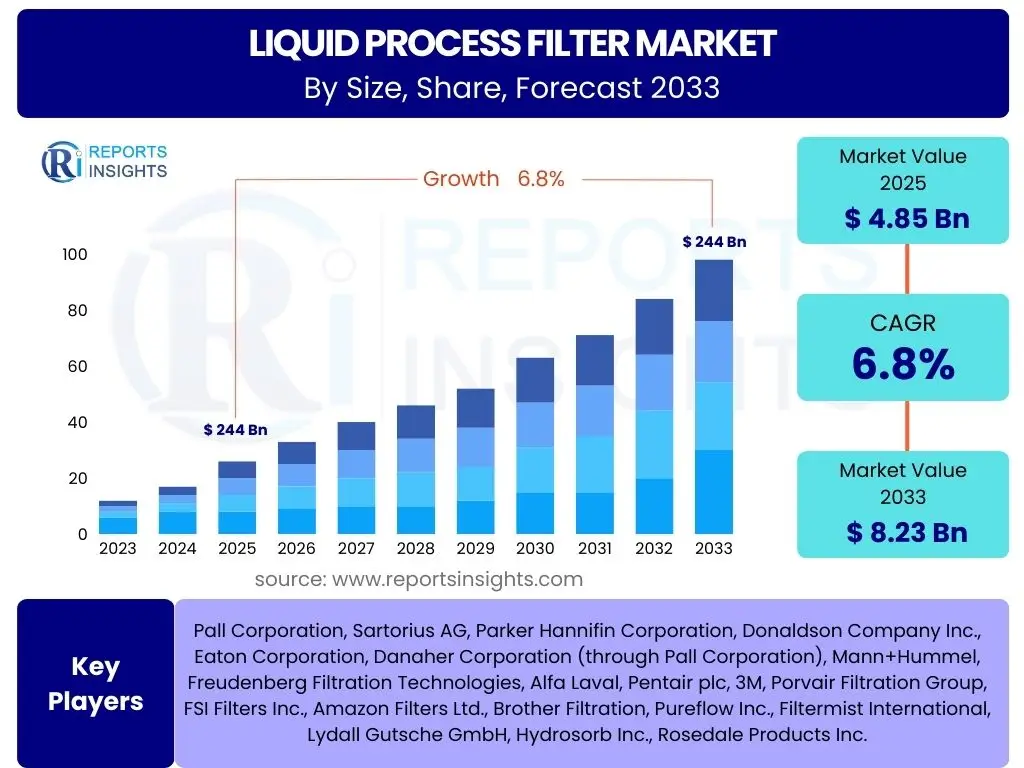

According to Reports Insights Consulting Pvt Ltd, The Liquid Process Filter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 4.85 billion in 2025 and is projected to reach USD 8.23 billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing industrialization, stringent regulatory frameworks concerning process purity and environmental discharge, and continuous technological advancements in filtration media and system design. The expanding applications across diverse end-use sectors, including water treatment, pharmaceuticals, food and beverage, and chemical processing, are key contributors to this market expansion.

The consistent demand for high-quality filtration solutions to meet escalating purity standards in manufacturing processes and to comply with environmental protection mandates drives the market's upward trend. Furthermore, the global emphasis on resource efficiency and sustainable industrial practices is propelling the adoption of advanced liquid process filters that offer superior performance, longer operational lifespans, and reduced waste generation. These factors collectively contribute to the sustained demand and value appreciation of the liquid process filter market over the forecast period.

Key Liquid Process Filter Market Trends & Insights

User inquiries regarding the Liquid Process Filter market frequently focus on emerging technologies, sustainability initiatives, and the impact of digitalization on filter performance and management. The market is witnessing a significant shift towards more efficient, intelligent, and environmentally friendly filtration solutions. There is a growing emphasis on filters that not only meet stringent purity requirements but also contribute to lower operational costs, reduced energy consumption, and minimal waste. This includes the development of self-cleaning filters, smart sensors for real-time monitoring, and membranes with enhanced selectivity and durability.

Furthermore, the industry is increasingly embracing sustainable practices, leading to the development of recyclable and biodegradable filter materials, as well as processes that minimize water and energy footprints. Digital integration, particularly through the Internet of Things (IoT) and advanced analytics, is transforming how filtration systems are monitored, maintained, and optimized. These trends collectively underscore a market moving towards greater sophistication, sustainability, and operational intelligence, driven by both regulatory pressures and economic incentives for efficiency.

- Increased adoption of membrane filtration technologies for higher separation efficiency.

- Growing demand for intelligent and automated filtration systems with IoT integration.

- Emphasis on sustainable and eco-friendly filter materials and disposal methods.

- Development of self-cleaning and backwashable filters to reduce maintenance.

- Customization and modularity in filter design for diverse industrial applications.

- Hybrid filtration systems combining multiple filtration techniques for optimal results.

AI Impact Analysis on Liquid Process Filter

Common user questions regarding AI's impact on Liquid Process Filters revolve around its potential to enhance operational efficiency, predictive maintenance capabilities, and overall system optimization. Users are keen to understand how AI can move filtration systems from reactive to proactive management. AI-powered analytics can process vast amounts of data from sensors embedded in filtration units, identifying patterns that indicate potential failures, optimal replacement times, or deviations from ideal operating conditions, thereby significantly reducing downtime and operational costs.

The integration of artificial intelligence is poised to revolutionize the design, operation, and maintenance of liquid process filters. AI algorithms can optimize filtration processes by predicting contaminant loads, adjusting flow rates, and recommending optimal filter change-out schedules, leading to enhanced performance and extended filter lifespan. This smart approach to filtration not only improves efficiency and reduces waste but also provides real-time insights for better decision-making, offering a significant competitive advantage to industries that adopt these advanced solutions. The shift towards AI-driven filtration systems represents a key evolution in industrial processing, promising greater precision and reliability.

- Predictive maintenance for filter replacement and system upkeep, minimizing downtime.

- Real-time process optimization through intelligent monitoring and control of filtration parameters.

- Enhanced quality control by detecting impurities and anomalies more accurately.

- Improved energy efficiency through AI-driven adjustments to pump speeds and filtration cycles.

- Automated anomaly detection and fault diagnosis in complex filtration systems.

- Data-driven insights for filter design and material selection, leading to more effective products.

Key Takeaways Liquid Process Filter Market Size & Forecast

User inquiries concerning key takeaways from the Liquid Process Filter market size and forecast highlight an interest in understanding the primary growth drivers, the most promising application areas, and the geographical regions expected to exhibit significant expansion. The market's robust projected growth underscores a pervasive need for advanced filtration solutions across a wide spectrum of industries. This growth is predominantly fueled by stringent regulatory requirements for product purity and environmental discharge, coupled with the rapid industrialization in developing economies and the continuous advancement of filtration technologies.

A significant takeaway is the increasing emphasis on efficiency and sustainability, driving innovation towards self-cleaning, energy-efficient, and environmentally friendly filter designs. The pharmaceutical and biotechnology sectors, alongside the booming food and beverage industry, are poised to be major demand generators, given their critical need for ultra-pure liquids. Geographically, Asia Pacific is anticipated to emerge as a dominant market, propelled by its expanding manufacturing base and increasing investments in water and wastewater treatment infrastructure, making it a pivotal region for market stakeholders to focus on.

- The market exhibits substantial growth driven by regulatory compliance and industrial expansion.

- Technological innovation in filter media and intelligent systems is a primary growth catalyst.

- Asia Pacific is set to be a leading region due to rapid industrialization and infrastructure development.

- Pharmaceutical, food and beverage, and water treatment sectors are key demand drivers.

- Sustainability and operational efficiency are becoming paramount in filter design and adoption.

- Increasing adoption of advanced filtration methods like membrane separation.

Liquid Process Filter Market Drivers Analysis

The Liquid Process Filter Market is significantly propelled by a confluence of factors, primarily stringent regulatory frameworks and the rapid pace of industrialization across various sectors. Governments and environmental agencies globally are imposing increasingly strict regulations on industrial effluents, product purity, and workplace safety. This necessitates the widespread adoption of advanced filtration solutions to ensure compliance, thereby preventing pollution and safeguarding public health. Industries are compelled to invest in superior filtration technologies to meet these rigorous standards, which directly fuels market demand.

Furthermore, the continuous expansion of key end-use industries such as pharmaceuticals, biotechnology, food and beverage, chemicals, and water and wastewater treatment contributes substantially to market growth. As these industries scale up their operations and introduce new products, the demand for precise and efficient liquid process filters escalates. Technological advancements, including the development of new materials, more efficient membrane technologies, and smart filtration systems, also act as significant drivers by offering improved performance, cost-effectiveness, and operational intelligence, making advanced filtration solutions more attractive and accessible to a broader range of industrial users.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Regulatory Compliance and Standards | +1.5% | Global, particularly North America, Europe, China | Short to Mid-term (2025-2030) |

| Rapid Industrialization and Urbanization | +1.2% | Asia Pacific (China, India), Latin America | Mid to Long-term (2026-2033) |

| Growing Demand for Clean Water & Wastewater Treatment | +1.0% | Global, especially emerging economies | Mid to Long-term (2026-2033) |

| Expansion of Pharmaceutical & Biotechnology Industries | +0.8% | North America, Europe, Asia Pacific | Short to Mid-term (2025-2030) |

| Technological Advancements in Filtration Media and Systems | +0.7% | Global | Continuous (2025-2033) |

| Increasing Focus on Product Quality and Purity | +0.6% | Global, especially Food & Beverage, Chemical | Short to Mid-term (2025-2030) |

| Aging Infrastructure in Developed Economies | +0.5% | North America, Europe | Mid-term (2027-2031) |

Liquid Process Filter Market Restraints Analysis

Despite robust growth drivers, the Liquid Process Filter Market faces certain restraints that could temper its expansion. One significant hurdle is the high initial capital investment required for advanced filtration systems. Industries, particularly small and medium-sized enterprises (SMEs), might find it challenging to allocate substantial budgets for sophisticated filtration equipment, especially when considering the costs associated with installation, commissioning, and ancillary infrastructure. This high upfront cost can lead to a slower adoption rate in some segments or regions.

Furthermore, the operational and maintenance costs associated with filter replacement and disposal pose another restraint. Filters have a finite lifespan, and their periodic replacement contributes to ongoing operational expenses. Additionally, the proper disposal of spent filters, especially those containing hazardous contaminants, can be complex, costly, and environmentally challenging, often requiring specialized waste management procedures. These recurring expenditures can deter some end-users from upgrading or expanding their filtration capacities, thereby exerting a moderate negative impact on the market's overall growth trajectory. The availability of alternative purification methods, while often less effective for specific applications, also presents a competitive challenge to market penetration.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment and Operational Costs | -0.8% | Global, particularly SMEs in emerging markets | Short to Mid-term (2025-2029) |

| Complexities and Costs of Filter Disposal | -0.6% | Global, especially regions with strict environmental laws | Mid to Long-term (2027-2033) |

| Availability of Alternative Purification Technologies | -0.5% | Global | Continuous (2025-2033) |

| Lack of Awareness and Technical Expertise | -0.4% | Developing Regions (Africa, parts of Latin America) | Mid-term (2026-2030) |

Liquid Process Filter Market Opportunities Analysis

The Liquid Process Filter Market is ripe with significant opportunities, particularly stemming from the increasing focus on sustainability and the circular economy. There is a growing demand for filtration solutions that not only purify liquids but also facilitate resource recovery, minimize waste generation, and reduce environmental footprints. This includes the development of more durable, regenerable, and recyclable filter media, as well as systems designed for lower energy consumption and reduced chemical use. Companies investing in such eco-friendly innovations are well-positioned to capture a substantial share of the market, aligning with global corporate social responsibility objectives and regulatory incentives.

Emerging economies present another substantial opportunity due to their rapid industrialization and burgeoning populations. Countries in Asia Pacific, Latin America, and the Middle East and Africa are witnessing significant investments in manufacturing, infrastructure, and urban development, all of which necessitate robust liquid filtration solutions for various applications, including industrial process water, wastewater treatment, and potable water supply. Furthermore, the advent of smart technologies and the Internet of Things (IoT) provides opportunities for developing advanced, data-driven filtration systems capable of predictive maintenance, real-time monitoring, and optimized performance. These intelligent solutions offer enhanced efficiency and cost savings, appealing to industries seeking operational excellence and leveraging technological advancements to improve their processes and meet evolving demands.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand from Emerging Economies | +1.3% | Asia Pacific (China, India), Latin America, MEA | Mid to Long-term (2026-2033) |

| Development of Smart and IoT-enabled Filtration Systems | +1.0% | Global | Continuous (2025-2033) |

| Increasing Focus on Sustainable and Eco-friendly Solutions | +0.9% | Global, particularly Europe, North America | Short to Mid-term (2025-2030) |

| Rise in Applications in Niche and Specialized Industries | +0.7% | Global | Mid-term (2027-2031) |

| Upgrades and Replacement of Aging Infrastructure | +0.6% | Developed Economies (North America, Europe) | Long-term (2028-2033) |

Liquid Process Filter Market Challenges Impact Analysis

The Liquid Process Filter Market faces several challenges that require innovative solutions and strategic approaches from market players. One significant challenge is managing the disposal of spent filters, which often contain concentrated contaminants. This not only presents an environmental concern but also incurs substantial disposal costs for industries, particularly when dealing with hazardous materials. Companies are pressured to develop more sustainable end-of-life solutions for filters, including options for recycling, regeneration, or safer incineration, to mitigate the environmental footprint and operational burden.

Another challenge stems from the intense market competition and the fragmented nature of the industry. The presence of numerous global and regional players leads to pricing pressures and a constant need for differentiation through technological innovation and superior customer service. Furthermore, the high energy consumption associated with some filtration processes, especially those involving high-pressure systems like reverse osmosis, poses an operational challenge. Industries are increasingly seeking energy-efficient filtration solutions to reduce their carbon footprint and operational expenses. Addressing these multifaceted challenges will be crucial for sustainable growth and market leadership in the liquid process filter industry.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Waste Management and Disposal of Spent Filters | -0.7% | Global | Continuous (2025-2033) |

| High Energy Consumption of Certain Filtration Processes | -0.5% | Global | Short to Mid-term (2025-2030) |

| Intense Market Competition and Price Sensitivity | -0.4% | Global | Continuous (2025-2033) |

| Technological Obsolescence and Need for Constant Innovation | -0.3% | Global | Continuous (2025-2033) |

Liquid Process Filter Market - Updated Report Scope

This comprehensive report delves into the intricate dynamics of the Liquid Process Filter market, providing an in-depth analysis of its current size, historical performance, and future growth projections up to 2033. It meticulously examines key market trends, identifies the underlying drivers and restraints, and highlights significant opportunities and challenges shaping the industry landscape. The report also offers a detailed segmentation analysis, breaking down the market by various types, materials, applications, and end-use industries, alongside a thorough regional assessment to provide a holistic view of the market's global footprint and growth potential.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 4.85 billion |

| Market Forecast in 2033 | USD 8.23 billion |

| Growth Rate | 6.8% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Pall Corporation, Sartorius AG, Parker Hannifin Corporation, Donaldson Company Inc., Eaton Corporation, Danaher Corporation (through Pall Corporation), Mann+Hummel, Freudenberg Filtration Technologies, Alfa Laval, Pentair plc, 3M, Porvair Filtration Group, FSI Filters Inc., Amazon Filters Ltd., Brother Filtration, Pureflow Inc., Filtermist International, Lydall Gutsche GmbH, Hydrosorb Inc., Rosedale Products Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Liquid Process Filter Market is comprehensively segmented to provide a granular understanding of its diverse components and their respective market dynamics. This segmentation facilitates a detailed analysis of specific product types, materials, applications, and end-use industries, allowing stakeholders to identify niche opportunities and tailor strategies effectively. The market is broadly categorized by filter type, including bag, cartridge, and membrane filters, each catering to different levels of filtration efficiency and application requirements. Material-wise, filters range from polymers and metals to ceramics, reflecting diverse operational conditions and chemical compatibilities. Applications cover a spectrum from basic particulate removal to complex liquid-liquid and gas-liquid separations, crucial for maintaining product purity and operational integrity across various industrial processes.

Further segmentation by end-use industry highlights the pervasive demand for liquid process filters across critical sectors such as chemicals, food and beverage, pharmaceuticals, water treatment, and oil and gas. Each industry presents unique filtration challenges and demands specialized solutions, driving innovation in filter design and functionality. For instance, the pharmaceutical industry requires sterile filtration for sensitive products, while water treatment focuses on removing a wide range of contaminants from municipal and industrial wastewater. This detailed breakdown ensures that market participants can accurately assess demand patterns, competitive landscapes, and growth prospects within each specific segment, fostering informed decision-making and strategic market penetration.

- By Type:

- Bag Filters: Cost-effective for high flow rates and gross filtration.

- Cartridge Filters: Versatile, precise filtration for various applications, available in depth and pleated configurations.

- Strainers: Basic filtration for removing larger particles, protecting downstream equipment.

- Basket Filters: Used for batch processing or where frequent cleaning is required, offering large holding capacity.

- Depth Filters: Capture contaminants throughout the filter media, suitable for high dirt-holding capacity.

- Membrane Filters: Provide highly efficient filtration for sub-micron particle removal and sterile applications.

- Microfiltration (MF)

- Ultrafiltration (UF)

- Nanofiltration (NF)

- Reverse Osmosis (RO)

- Automatic Filters: Self-cleaning filters for continuous operation and reduced manual intervention.

- Other Types: Include sand filters for coarse filtration and activated carbon filters for adsorption.

- By Filter Material:

- Polymer Filters: Widely used for chemical compatibility and cost-effectiveness (e.g., Polypropylene, PTFE, PVDF).

- Metal Filters: Durable and heat-resistant, used for high-temperature or corrosive applications (e.g., Stainless Steel).

- Ceramic Filters: Excellent chemical resistance and thermal stability, suitable for aggressive environments.

- Fiberglass Filters: Effective for high-efficiency particulate air (HEPA) and liquid filtration.

- Activated Carbon: Primarily used for adsorption of dissolved organic compounds and odor removal.

- Others: Materials like cellulose and diatomaceous earth for specific applications.

- By Application:

- Particulate Removal: Standard application for removing solid impurities from liquids.

- Liquid-Liquid Separation: Separating immiscible liquids.

- Gas-Liquid Separation: Removing liquid droplets from gas streams.

- Sterile Filtration: Critical for pharmaceutical and biotechnology industries to remove microorganisms.

- Cross-Flow Filtration: Minimizes filter fouling, suitable for high-solids applications.

- Dead-End Filtration: All fluid flows through the filter medium, used for batch processes.

- By End-Use Industry:

- Chemical & Petrochemical: For process purity, wastewater treatment, and solvent recovery.

- Food & Beverage: Essential for product clarity, taste, and safety (e.g., water, dairy, beverages, oils).

- Pharmaceutical & Biotechnology: Critical for sterile processes, drug formulation, and active pharmaceutical ingredient (API) production.

- Water & Wastewater Treatment: Municipal and industrial water purification, ensuring environmental compliance.

- Oil & Gas: Filtration of drilling fluids, produced water, and refined products.

- Power Generation: Water treatment for boilers and cooling systems.

- Metals & Mining: Effluent treatment and process fluid purification.

- Paints, Coatings & Inks: Ensuring product consistency and preventing defects.

- Electronics & Semiconductors: Ultra-pure water and chemical filtration for manufacturing.

- Automotive: Filtration of paints, coolants, and wastewater in manufacturing plants.

- Others: Including textiles, pulp & paper, and cosmetics for various process needs.

Regional Highlights

The global Liquid Process Filter market demonstrates significant regional variations driven by differing industrial landscapes, regulatory environments, and economic development stages. North America and Europe are mature markets, characterized by stringent environmental regulations, high adoption rates of advanced filtration technologies, and significant R&D investments. These regions focus heavily on upgrading existing infrastructure, enhancing energy efficiency, and adopting smart filtration solutions for complex industrial processes. The demand is particularly strong in the pharmaceutical, biotechnology, and food & beverage sectors, driven by the need for ultra-pure products and adherence to strict quality controls. Innovation and automation are key themes in these regions, pushing the market towards more sophisticated and integrated systems.

Asia Pacific, however, represents the fastest-growing market for liquid process filters, propelled by rapid industrialization, urbanization, and increasing investments in manufacturing and infrastructure development, particularly in China and India. The burgeoning populations and expanding industrial bases in these countries are generating immense demand for clean water, wastewater treatment, and process fluid purification across numerous sectors, including chemicals, power generation, and electronics. While cost-effectiveness remains a significant consideration, there is a growing awareness and adoption of advanced filtration solutions to meet escalating environmental standards and improve product quality. This region is poised to dominate the market in terms of volume and new installations over the forecast period.

Latin America, the Middle East, and Africa (MEA) are emerging markets with considerable growth potential. Latin America's market growth is influenced by its expanding manufacturing sector and increasing investments in water infrastructure, particularly in countries like Brazil and Mexico. The MEA region is driven by significant investments in oil and gas, petrochemicals, and water desalination projects, especially in the Gulf Cooperation Council (GCC) countries, where water scarcity necessitates advanced treatment technologies. While these regions may experience slower adoption rates of high-end technologies compared to developed markets, the foundational demand for basic and mid-range filtration solutions is robust and growing, presenting long-term opportunities for market players.

- North America:

- Dominant market share due to stringent regulations in pharmaceutical, food and beverage, and chemical industries.

- High adoption of advanced and automated filtration systems.

- Significant investment in R&D for innovative filter media and technologies.

- United States and Canada are key contributors.

- Europe:

- Strong regulatory emphasis on environmental protection and water quality.

- Focus on sustainable and energy-efficient filtration solutions.

- Germany, the UK, and France are leading markets with established industrial bases.

- Increasing demand from biotechnology and specialty chemical sectors.

- Asia Pacific (APAC):

- Fastest-growing market attributed to rapid industrialization and urbanization.

- Massive investments in water and wastewater treatment infrastructure.

- China and India are major growth engines, driven by expanding manufacturing.

- Growing awareness of industrial pollution control and product purity.

- Latin America:

- Emerging market with increasing industrial activity and infrastructure development.

- Brazil and Mexico are key markets with growing demand from food processing, chemical, and oil & gas sectors.

- Investments in water treatment and agricultural processing contribute to market growth.

- Middle East and Africa (MEA):

- Growth driven by significant investments in oil and gas, petrochemicals, and desalination plants.

- Water scarcity issues propel demand for advanced water treatment technologies.

- Saudi Arabia, UAE, and South Africa are prominent markets.

- Increasing industrial diversification also contributes to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Process Filter Market.- Pall Corporation

- Sartorius AG

- Parker Hannifin Corporation

- Donaldson Company Inc.

- Eaton Corporation

- Mann+Hummel

- Freudenberg Filtration Technologies

- Alfa Laval

- Pentair plc

- 3M

- Porvair Filtration Group

- FSI Filters Inc.

- Amazon Filters Ltd.

- Brother Filtration

- Pureflow Inc.

- Filtermist International

- Lydall Gutsche GmbH

- Hydrosorb Inc.

- Rosedale Products Inc.

- Graver Technologies LLC

Frequently Asked Questions

What is a liquid process filter?

A liquid process filter is a device designed to remove impurities, particles, or unwanted components from a liquid stream during an industrial process. These filters ensure product purity, protect downstream equipment, and aid in environmental compliance by treating effluents. They are crucial for maintaining quality and efficiency in various manufacturing and treatment operations.

How do liquid process filters work?

Liquid process filters operate by allowing liquid to pass through a porous medium that traps solid particles or separates immiscible liquids. The mechanism can involve surface filtration (where particles are caught on the filter surface) or depth filtration (where particles are trapped within the filter matrix). Filtration can also occur through membrane separation based on pore size, or by adsorption using materials like activated carbon.

What industries commonly use liquid process filters?

Liquid process filters are essential in a wide array of industries, including chemical and petrochemical, food and beverage, pharmaceutical and biotechnology, water and wastewater treatment, oil and gas, power generation, electronics and semiconductors, and paints and coatings. Any industry requiring precise liquid purification, product quality, or environmental discharge compliance utilizes these filters.

What are the primary types of liquid process filters?

The primary types include bag filters, cartridge filters (depth and pleated), strainers, basket filters, and various membrane filters (microfiltration, ultrafiltration, nanofiltration, reverse osmosis). Each type is selected based on factors such as required purity level, particle size, flow rate, liquid characteristics, and operational cost considerations.

What is the future outlook for liquid filtration technology?

The future of liquid filtration technology is characterized by a strong emphasis on sustainability, automation, and intelligent systems. Innovations will focus on more efficient membrane technologies, self-cleaning filters, development of smart filters with IoT integration for predictive maintenance, and materials that are recyclable or have extended lifespans, contributing to reduced operational costs and environmental impact.