Iron Ore Market

Iron Ore Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707570 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Iron Ore Market Size

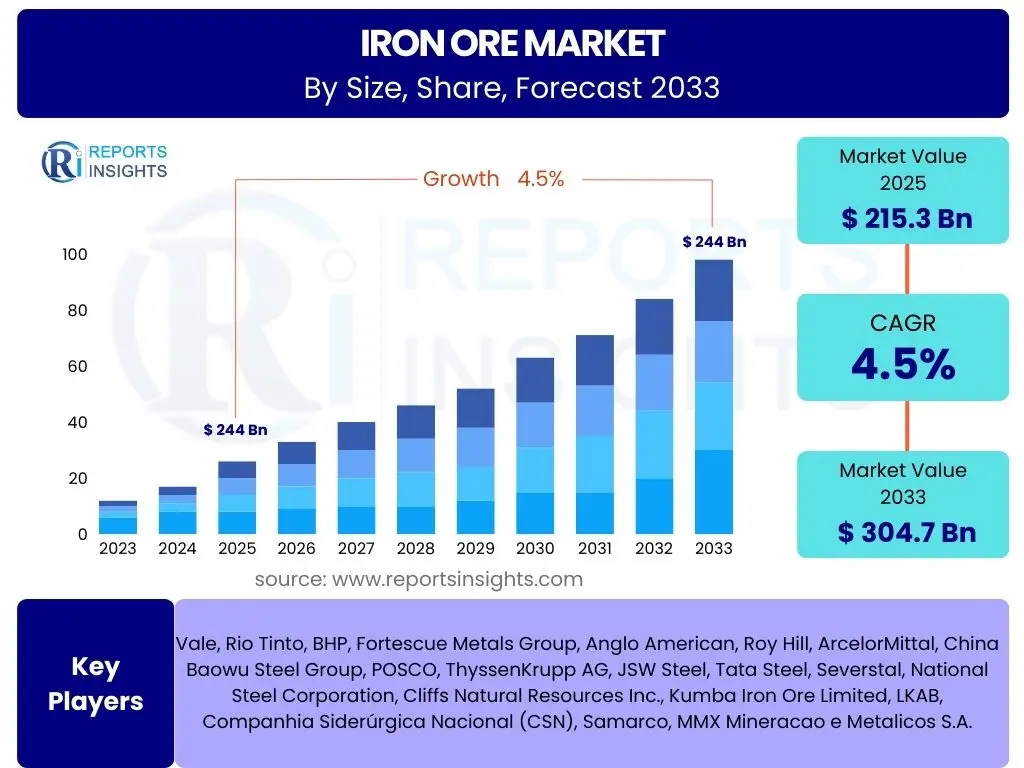

According to Reports Insights Consulting Pvt Ltd, The Iron Ore Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2033. The market is estimated at USD 215.3 Billion in 2025 and is projected to reach USD 304.7 Billion by the end of the forecast period in 2033.

Key Iron Ore Market Trends & Insights

The global iron ore market is experiencing significant shifts driven by evolving industrial demands and increasing environmental consciousness. A prominent trend is the accelerating push towards decarbonization within the steel industry, which is the primary consumer of iron ore. This trend is fostering innovation in "green steel" production methods, potentially altering the demand profile for specific ore grades and processing technologies. Furthermore, technological advancements in mining, including automation, digitalization, and data analytics, are enhancing operational efficiency and safety across mining operations globally.

Another crucial insight revolves around supply chain resilience and diversification. Recent global events have highlighted vulnerabilities in concentrated supply chains, prompting stakeholders to explore new sources and logistical pathways to ensure consistent supply. This focus on resilience is complemented by a growing emphasis on Environmental, Social, and Governance (ESG) criteria, influencing investment decisions, operational practices, and corporate strategies within the iron ore sector. Price volatility remains a persistent feature of the market, driven by a complex interplay of supply-demand dynamics, geopolitical events, and macroeconomic factors, requiring robust risk management strategies from producers and consumers alike.

- Decarbonization and the rise of green steel initiatives are reshaping demand patterns.

- Increased adoption of advanced mining technologies like automation and AI for efficiency and safety.

- Focus on supply chain diversification and resilience due to geopolitical and logistical challenges.

- Growing emphasis on Environmental, Social, and Governance (ESG) standards across the value chain.

- Persistent price volatility influenced by global economic conditions and supply-demand imbalances.

AI Impact Analysis on Iron Ore

Artificial intelligence (AI) is set to profoundly transform the iron ore industry by enhancing operational efficiency, optimizing resource utilization, and improving safety protocols. Common user inquiries often revolve around how AI can contribute to predictive maintenance, reducing costly downtime of heavy machinery, and optimizing processing plants for maximum yield. AI-driven solutions are being deployed to analyze vast datasets from sensors and equipment, enabling real-time adjustments and proactive interventions. This leads to more efficient energy consumption, reduced waste, and a lower operational footprint, addressing critical industry concerns about profitability and environmental impact.

Furthermore, AI plays a pivotal role in geological exploration and resource modeling, improving the accuracy of identifying new deposits and optimizing mine planning. Users are keen to understand AI's capability in automating complex mining tasks, such as autonomous drilling and hauling, which not only boosts productivity but also removes human operators from hazardous environments, thereby significantly enhancing safety. While the initial investment in AI infrastructure can be substantial, the long-term benefits in terms of cost reduction, increased throughput, and improved decision-making are compelling, making AI a strategic imperative for leading iron ore producers.

- AI-driven predictive maintenance optimizes equipment uptime and reduces operational costs.

- Enhanced geological exploration and resource modeling through AI algorithms for improved accuracy.

- Automation of mining operations (e.g., autonomous vehicles) leading to higher productivity and safety.

- Real-time data analytics from AI systems for process optimization in beneficiation plants.

- Improved safety protocols through AI-powered monitoring and hazard detection.

Key Takeaways Iron Ore Market Size & Forecast

The iron ore market is poised for steady growth through 2033, primarily propelled by continued urbanization, industrial expansion, and significant global infrastructure development, particularly in emerging economies. The forecasted market expansion underscores the commodity's fundamental role in the global steel industry, which remains integral to construction, manufacturing, and transportation sectors. While traditional demand drivers persist, the industry's future trajectory is increasingly intertwined with the global transition towards a low-carbon economy, necessitating adaptation and innovation.

Despite the positive growth outlook, the market faces inherent challenges such as price volatility, stringent environmental regulations, and the long-term pressure to decarbonize production. The successful navigation of these challenges will depend on strategic investments in advanced technologies, sustainable mining practices, and diversification of market access. Overall, the market is characterized by a balance of robust underlying demand and a complex landscape of operational, environmental, and geopolitical factors shaping its evolution.

- Market growth primarily driven by global steel demand, urbanization, and infrastructure development.

- Significant potential exists in emerging economies due to ongoing industrialization.

- Decarbonization pressures are a critical factor influencing future investment and operational strategies.

- Technological advancements and sustainable practices are crucial for long-term market stability and competitiveness.

- Price fluctuations and geopolitical factors remain key risks influencing market dynamics.

Iron Ore Market Drivers Analysis

The global iron ore market is propelled by several fundamental drivers that underpin its demand and growth trajectory. The most significant of these is the persistent and increasing global demand for steel, a material indispensable for various industries including construction, automotive, machinery, and infrastructure. As economies worldwide continue to develop and populations grow, the need for new buildings, transportation networks, and industrial facilities translates directly into a demand for steel, and consequently, for iron ore. This core demand is particularly robust in developing nations undergoing rapid urbanization and industrialization.

Beyond traditional industrial growth, emerging drivers such as the global transition to renewable energy infrastructure are also contributing to iron ore demand. Projects involving wind turbines, solar farms, and related grid expansions require substantial amounts of steel, thereby creating a new avenue for iron ore consumption. Furthermore, continuous technological advancements in mining and processing techniques are making operations more efficient and economically viable, allowing producers to extract and process ore more effectively, thus supporting the supply side of the market and meeting growing demand sustainably.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Steel Demand | +1.5% | APAC, Global | Long-term |

| Infrastructure Development | +1.2% | Developing Nations, Global | Mid-term |

| Urbanization & Industrialization | +1.0% | Asia, Africa | Long-term |

| Renewable Energy Transition | +0.8% | Global | Long-term |

| Technological Advancements in Mining | +0.5% | Global | Mid-term |

Iron Ore Market Restraints Analysis

Despite robust demand, the iron ore market faces significant restraints that can impede its growth and introduce volatility. Environmental regulations, particularly those aimed at reducing carbon emissions and mitigating mining's ecological footprint, pose considerable challenges. Countries and regions, especially in Europe and North America, are implementing stricter policies on air quality, water management, and land reclamation, which can increase operational costs, limit expansion possibilities, and necessitate significant capital investments in compliance technologies. These regulations can also lead to project delays or cancellations, affecting supply stability.

Another critical restraint is the inherent price volatility of iron ore. As a commodity, its prices are highly susceptible to global economic cycles, geopolitical tensions, and supply-demand imbalances, leading to unpredictable revenue streams for producers and cost uncertainties for consumers. Furthermore, supply chain disruptions, whether due to natural disasters, pandemics, or geopolitical conflicts, can significantly impact the transportation and delivery of iron ore, leading to shortages and elevated prices. High capital expenditure requirements for new mining projects and ongoing operations also act as a restraint, making market entry challenging and limiting investment in expansion, especially for smaller players.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Environmental Regulations | -1.0% | EU, North America, Australia | Long-term |

| Price Volatility | -0.8% | Global | Short-term |

| Geopolitical Instability & Trade Barriers | -0.7% | Global | Mid-term |

| High Capital Expenditure | -0.5% | Global | Long-term |

| Supply Chain Disruptions | -0.4% | Global | Short-to-Mid-term |

Iron Ore Market Opportunities Analysis

The iron ore market presents several promising opportunities for growth and innovation. One of the most significant is the accelerating adoption of green steel initiatives, particularly in developed economies. As the steel industry seeks to reduce its carbon footprint, there is a growing demand for higher-grade iron ore and innovative processing methods that enable cleaner steel production, such as direct reduced iron (DRI) using hydrogen. This shift creates opportunities for producers capable of supplying premium ore or investing in technologies that support these sustainable processes, offering a competitive advantage and access to new markets driven by environmental mandates.

Furthermore, the continued expansion and industrialization of emerging markets, particularly in Asia, Africa, and Latin America, represent substantial opportunities. These regions are undergoing rapid infrastructure development and urbanization, fueling a sustained demand for steel and, consequently, iron ore. Investment in technological innovation, including advanced automation, artificial intelligence, and data analytics in mining operations, offers another avenue for growth. These technologies can significantly enhance efficiency, reduce costs, improve safety, and optimize resource recovery, contributing to long-term profitability and market resilience. Additionally, the exploration and development of new iron ore deposits, especially in regions with untapped potential, can secure future supply and diversify global sources.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Green Steel Initiatives | +1.2% | EU, North America, Japan, South Korea | Long-term |

| Expansion in Emerging Markets | +1.0% | APAC, Africa, Latin America | Long-term |

| Technological Innovation & Automation | +0.9% | Global | Mid-term |

| Recycling & Circular Economy Adoption | +0.7% | Global, Developed Economies | Long-term |

| New Deposit Discoveries | +0.5% | Africa, South America, Australia | Long-term |

Iron Ore Market Challenges Impact Analysis

The iron ore market faces several significant challenges that necessitate strategic responses from industry players. The escalating pressure for decarbonization is perhaps the most profound. With the steel industry being a major emitter of greenhouse gases, there is immense pressure to reduce emissions across the entire value chain, including iron ore mining and processing. This requires substantial investment in new, cleaner technologies and potentially shifts in the types of ore or processing methods preferred, posing a complex transition for established operations and supply chains.

Another critical challenge is the depletion of high-grade iron ore reserves in traditional mining regions, leading to reliance on lower-grade ores that require more energy and resources for beneficiation. This trend increases production costs and exacerbates environmental impacts. Furthermore, the industry contends with persistent labor shortages, particularly for skilled technical and operational roles, impacting productivity and increasing wage costs. Social license to operate issues, stemming from community concerns about environmental impact, land use, and indigenous rights, can lead to project delays or even cancellations, creating uncertainty for mining companies. Lastly, the inherent logistics and transportation costs associated with moving a bulk commodity like iron ore from mines to ports and then to international markets remain a constant challenge, influenced by fuel prices and global shipping rates.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Decarbonization Pressure | -1.5% | Global | Long-term |

| Depleting High-Grade Ore Reserves | -1.0% | Global | Long-term |

| Labor Shortages & Skill Gaps | -0.8% | Developed Nations, Mining Regions | Mid-term |

| Social License to Operate Issues | -0.6% | Specific Mining Regions | Long-term |

| Logistics & Transportation Costs | -0.4% | Global | Short-to-Mid-term |

Iron Ore Market - Updated Report Scope

This comprehensive market research report offers an in-depth analysis of the global iron ore market, providing a detailed overview of its current size, historical performance from 2019 to 2023, and a robust forecast spanning 2025 to 2033. The report meticulously dissects market dynamics, identifying key drivers, restraints, opportunities, and challenges that shape the industry's trajectory. It further segments the market by various criteria, including ore type, grade, end-use industry, and mining method, offering a granular view of demand and supply patterns across different applications.

Geographical insights are a core component, highlighting regional trends and the significance of major producing and consuming nations across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The report also provides profiles of leading market participants, offering strategic insights into their business models, product portfolios, and competitive positioning. This holistic approach ensures that stakeholders, from investors to industry operators, gain actionable intelligence to inform their strategic decisions in a complex and evolving market landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 215.3 Billion |

| Market Forecast in 2033 | USD 304.7 Billion |

| Growth Rate | 4.5% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Vale, Rio Tinto, BHP, Fortescue Metals Group, Anglo American, Roy Hill, ArcelorMittal, China Baowu Steel Group, POSCO, ThyssenKrupp AG, JSW Steel, Tata Steel, Severstal, National Steel Corporation, Cliffs Natural Resources Inc., Kumba Iron Ore Limited, LKAB, Companhia Siderúrgica Nacional (CSN), Samarco, MMX Mineracao e Metalicos S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The iron ore market is comprehensively segmented to provide a detailed understanding of its diverse facets and varying demand dynamics. This segmentation allows for a granular analysis of market trends, consumer preferences, and technological shifts across different categories. The primary segmentation includes analysis by type of iron ore, categorizing it into widely recognized forms such as Hematite, Magnetite, Limonite, and Siderite, each possessing distinct chemical compositions and industrial applications. Understanding the prevalence and utilization of these types is crucial for both producers and consumers in the value chain.

Further segmentation is conducted by the grade of iron ore (high grade, medium grade, low grade), reflecting the iron content and purity, which directly influences its processing requirements and end-use suitability. The market is also analyzed based on end-use industry, with steel production being the dominant segment, followed by construction, general metallurgy, and other specialized applications. Lastly, the market is segmented by mining method, differentiating between open-pit mining and underground mining, each with unique operational characteristics, cost structures, and environmental footprints. This multi-faceted segmentation provides a robust framework for market assessment and strategic planning.

- By Type:

- Hematite

- Magnetite

- Limonite

- Siderite

- By Grade:

- High Grade

- Medium Grade

- Low Grade

- By End-Use Industry:

- Steel Production

- Construction

- Metallurgy

- Others

- By Mining Method:

- Open-Pit Mining

- Underground Mining

Regional Highlights

- Asia Pacific (APAC): Dominates the iron ore market due to massive steel production in China and India, driven by rapid urbanization, industrialization, and infrastructure development. Australia, a key producer, plays a crucial role in supplying this region.

- Latin America: A significant global supplier, with Brazil being a major producer. The region's market is characterized by large-scale mining operations and export-oriented strategies, serving global steel markets.

- North America: Exhibits stable demand primarily from the domestic steel industry, with a focus on high-quality iron ore for integrated steel mills. Investments in advanced mining technologies and decarbonization efforts are growing.

- Europe: Characterized by a strong emphasis on sustainable steel production and increasing demand for higher-grade iron ore. The region's market dynamics are influenced by stringent environmental regulations and the push for green steel.

- Middle East and Africa (MEA): Emerging as a region with significant untapped iron ore reserves and potential for new mining developments. Demand is growing from regional infrastructure projects and expanding steel production capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Iron Ore Market.- Vale

- Rio Tinto

- BHP

- Fortescue Metals Group

- Anglo American

- Roy Hill

- ArcelorMittal

- China Baowu Steel Group

- POSCO

- ThyssenKrupp AG

- JSW Steel

- Tata Steel

- Severstal

- National Steel Corporation

- Cliffs Natural Resources Inc.

- Kumba Iron Ore Limited

- LKAB

- Companhia Siderúrgica Nacional (CSN)

- Samarco

- MMX Mineracao e Metalicos S.A.

Frequently Asked Questions

What are the primary drivers of growth in the Iron Ore market?

The primary drivers include robust global steel demand, fueled by urbanization, industrialization, and significant infrastructure development, particularly in emerging economies. Additionally, the increasing demand for steel in renewable energy infrastructure projects and advancements in mining technologies contribute to market growth.

What are the major challenges faced by the Iron Ore industry?

Key challenges include stringent environmental regulations and the pressure for decarbonization in steel production, inherent price volatility of the commodity, depletion of high-grade ore reserves, labor shortages, and potential social license to operate issues in mining regions.

How is AI impacting the Iron Ore sector?

AI is transforming the iron ore sector through enhanced operational efficiency via predictive maintenance, optimized resource utilization in processing plants, improved safety through autonomous mining equipment, and more accurate geological exploration and mine planning. It enables data-driven decision-making across the value chain.

Which regions are key players in the Iron Ore market?

Asia Pacific, particularly China and India, is the largest consumer and a significant producer. Latin America (Brazil) and Australia are major global suppliers. North America and Europe maintain stable demand and focus on quality and sustainable practices, while Africa holds substantial untapped reserves.

What is the significance of green steel initiatives for iron ore producers?

Green steel initiatives are highly significant as they drive demand for higher-grade iron ore and innovative processing methods like Direct Reduced Iron (DRI) using hydrogen, which require cleaner inputs. This shift pushes iron ore producers to invest in sustainable mining practices and provide materials that facilitate low-carbon steel production.