Industrial Synthetic Diamond Market

Industrial Synthetic Diamond Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703859 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Industrial Synthetic Diamond Market Size

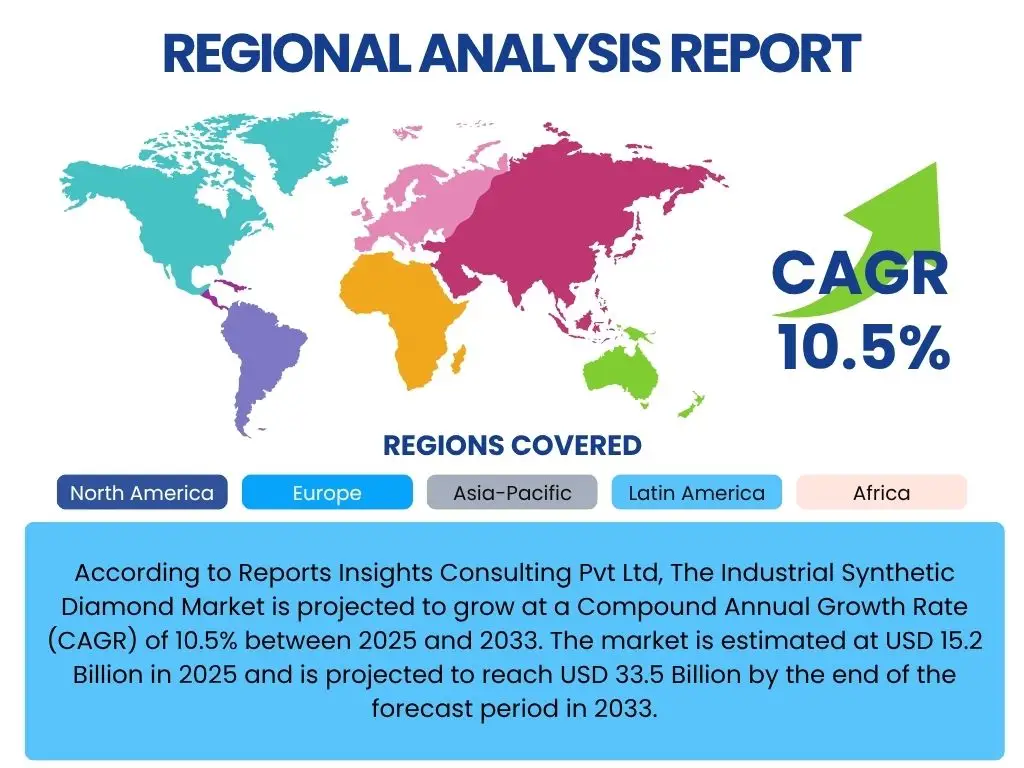

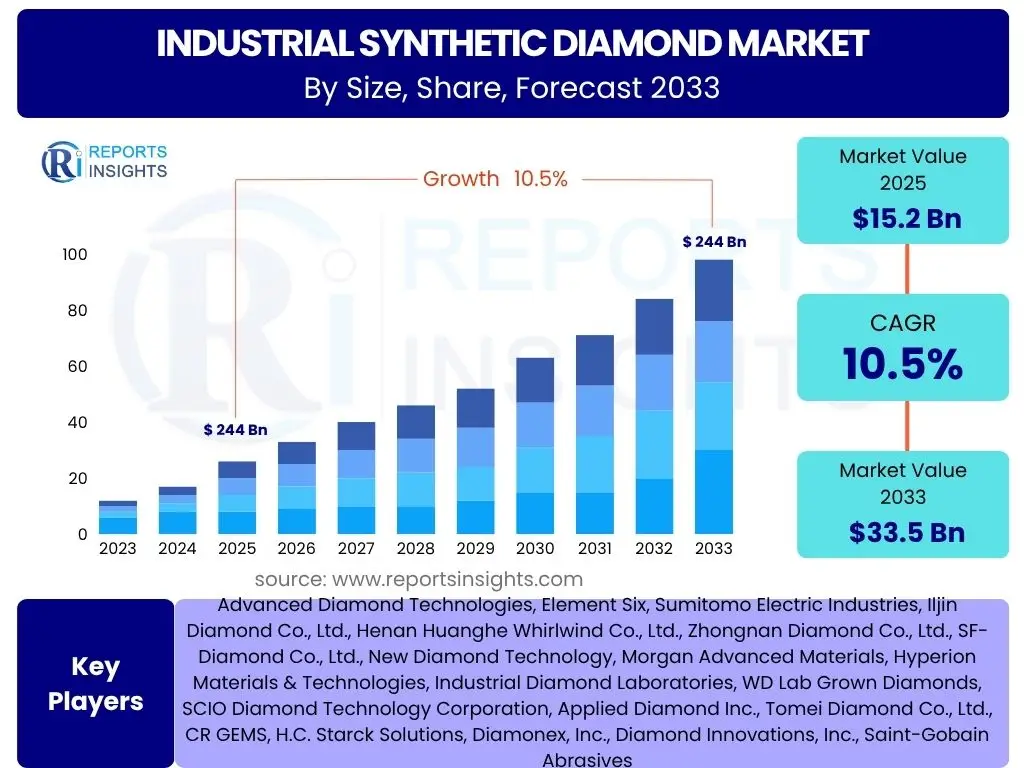

According to Reports Insights Consulting Pvt Ltd, The Industrial Synthetic Diamond Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2033. The market is estimated at USD 15.2 Billion in 2025 and is projected to reach USD 33.5 Billion by the end of the forecast period in 2033.

Key Industrial Synthetic Diamond Market Trends & Insights

The industrial synthetic diamond market is experiencing dynamic shifts driven by advancements in manufacturing technologies and expanding application portfolios. Stakeholders frequently inquire about the primary forces shaping market expansion and the adoption of synthetic diamonds across diverse industrial sectors. Key trends include the increasing preference for high-performance materials in critical applications, driven by their superior hardness, thermal conductivity, and chemical inertness compared to traditional alternatives.

Technological innovations in High-Pressure/High-Temperature (HPHT) and Chemical Vapor Deposition (CVD) methods are continuously improving diamond quality, size, and cost-effectiveness, making them more accessible for broader industrial use. This has led to a significant shift from natural industrial diamonds to synthetic variants due to their consistent properties and controlled production environments. Furthermore, a growing emphasis on sustainable manufacturing practices is favoring synthetic production, which often has a lower environmental footprint compared to conventional diamond mining.

The market is also witnessing a surge in research and development activities focused on novel applications in emerging fields, such as quantum computing, advanced optics, and medical devices. This diversification beyond traditional abrasive and cutting tools applications signifies a robust long-term growth trajectory for the industrial synthetic diamond sector, attracting substantial investment and fostering competitive innovation.

- Growing adoption in advanced manufacturing and high-tech industries.

- Continuous technological advancements in HPHT and CVD synthesis methods.

- Increasing demand for superior material properties in extreme environments.

- Shift towards sustainable and ethically sourced materials.

- Expansion into new applications like quantum computing, photonics, and biomedical.

- Strategic investments in research and development for customized diamond properties.

- Rising cost-effectiveness and scalability of synthetic diamond production.

AI Impact Analysis on Industrial Synthetic Diamond

User inquiries frequently concern the transformative potential of Artificial Intelligence (AI) across the industrial synthetic diamond value chain. AI is increasingly pivotal in optimizing various stages of synthetic diamond production, from raw material selection and synthesis parameter control to quality assurance and supply chain management. The application of machine learning algorithms allows for predictive modeling of growth conditions, leading to enhanced crystal quality and reduced production cycle times, thereby addressing concerns about efficiency and consistency.

AI's influence extends to material discovery and design, where algorithms can rapidly analyze vast datasets of material properties and predict novel diamond structures with specific functionalities. This accelerates the development of advanced synthetic diamonds tailored for specialized applications, fulfilling the demand for custom solutions. Furthermore, AI-driven automation in manufacturing processes, including precision cutting and polishing, contributes to higher yields and reduced waste, optimizing overall operational expenditure.

The integration of AI also enhances supply chain visibility and demand forecasting, enabling manufacturers to respond more agilely to market fluctuations and consumer needs. This data-driven approach minimizes inventory costs and improves logistical efficiency, directly impacting profitability and market responsiveness. Consequently, AI is not merely an enabling technology but a fundamental catalyst for innovation and competitive advantage within the industrial synthetic diamond sector.

- Optimization of synthesis parameters for improved crystal quality and yield.

- Accelerated material discovery and design for novel diamond properties.

- Enhanced quality control and defect detection through computer vision.

- Predictive maintenance for production equipment, reducing downtime.

- Supply chain optimization and demand forecasting for efficient resource allocation.

- Automation of post-synthesis processes like cutting, grinding, and polishing.

Key Takeaways Industrial Synthetic Diamond Market Size & Forecast

Common user questions regarding the industrial synthetic diamond market size and forecast often focus on understanding the primary growth drivers and the long-term sustainability of market expansion. A key takeaway is the robust growth trajectory, propelled by escalating demand from high-tech sectors that increasingly rely on synthetic diamonds for their unparalleled properties. The forecast indicates significant opportunities for market participants, particularly those investing in advanced synthesis technologies and application diversification.

Another crucial insight is the increasing industrial preference for synthetic variants over natural diamonds due to superior control over material properties, consistent supply, and competitive pricing. This shift underscores a broader trend towards engineered materials designed for specific performance requirements. Furthermore, the market's resilience is bolstered by its foundational role in numerous critical industries, including electronics, automotive, and healthcare, making it less susceptible to economic downturns that might impact other sectors.

The strategic importance of research and development in unlocking new applications and improving production efficiency cannot be overstated. Companies that continuously innovate in synthesis methods and explore novel uses for synthetic diamonds are poised for sustained leadership and market capture. The strong projected CAGR affirms that industrial synthetic diamonds are not just a niche product but a foundational material driving innovation across the global industrial landscape.

- Substantial market expansion driven by diversified industrial applications.

- Technological advancements in synthesis methods are key to future growth.

- Growing preference for synthetic diamonds due to consistent quality and cost-effectiveness.

- Electronics and automotive sectors are major demand drivers.

- Significant investment in research and development is crucial for competitive advantage.

- Sustainability aspects of synthetic production are enhancing market appeal.

Industrial Synthetic Diamond Market Drivers Analysis

The industrial synthetic diamond market is primarily propelled by a confluence of factors including the increasing demand for high-performance materials across diverse industrial sectors. As industries such as electronics, automotive, and aerospace seek materials with exceptional hardness, thermal conductivity, and electrical insulation properties, synthetic diamonds emerge as a preferred solution. Their superior characteristics enable higher efficiency and longevity in tools and components, contributing significantly to operational improvements for end-users.

Technological advancements in the synthesis processes, particularly in High-Pressure/High-Temperature (HPHT) and Chemical Vapor Deposition (CVD) methods, have made synthetic diamonds more accessible and cost-effective. These innovations allow for the production of larger, purer, and more customizable diamonds, expanding their applicability beyond traditional abrasive uses into high-tech domains. The ability to tailor diamond properties for specific applications further fuels their adoption, creating new market opportunities.

Moreover, the growing awareness and preference for ethically sourced and environmentally responsible materials are contributing to the increased demand for synthetic diamonds. Unlike natural diamond mining, synthetic production often involves less environmental disruption and is free from the ethical concerns sometimes associated with mined diamonds. This sustainability factor resonates with corporate social responsibility initiatives and consumer preferences, enhancing the market's appeal.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand from Electronics and Semiconductor Industries | +0.8% | Asia Pacific, North America, Europe | Short to Medium-term (2025-2029) |

| Technological Advancements in Synthesis Processes (HPHT, CVD) | +0.7% | Global | Medium to Long-term (2027-2033) |

| Rising Adoption in Cutting and Abrasive Tools Due to Superior Performance | +0.6% | Asia Pacific, Europe | Short-term (2025-2027) |

| Growing Focus on Sustainable and Ethically Sourced Materials | +0.5% | North America, Europe | Medium to Long-term (2028-2033) |

Industrial Synthetic Diamond Market Restraints Analysis

Despite robust growth, the industrial synthetic diamond market faces certain restraints that could temper its expansion. One significant hurdle is the high initial capital investment required for establishing and scaling up synthetic diamond production facilities. The specialized equipment, advanced technology, and high energy consumption associated with both HPHT and CVD methods necessitate substantial financial outlays, which can be a barrier for new entrants or smaller players.

Another restraint involves the potential for price volatility, particularly as more manufacturers enter the market and production capacities increase. While synthetic diamonds generally offer cost advantages over natural ones for industrial applications, oversupply or intense competition could lead to downward pressure on prices, impacting profit margins for producers. This necessitates continuous innovation and differentiation to maintain competitive pricing strategies.

Furthermore, the market acceptance in certain niche or traditional sectors might still lag, particularly where natural diamonds have historically dominated and established supply chains are deeply entrenched. Overcoming existing perceptions and demonstrating the consistent superior performance and economic benefits of synthetic alternatives requires significant marketing efforts and education. These factors collectively pose challenges that market participants must strategically address to ensure sustained growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Capital Investment for Production Facilities | -0.4% | Global, particularly emerging economies | Short to Medium-term (2025-2028) |

| Potential Price Volatility Due to Increased Production Capacity | -0.3% | Global | Medium-term (2026-2030) |

| Competition from Traditional Abrasives and Industrial Materials | -0.2% | Asia Pacific, Europe | Short to Medium-term (2025-2029) |

| Intellectual Property Challenges and Counterfeit Products | -0.1% | Global | Long-term (2029-2033) |

Industrial Synthetic Diamond Market Opportunities Analysis

Significant opportunities abound within the industrial synthetic diamond market, largely stemming from the continuous discovery of novel applications in high-growth technological sectors. The unique properties of synthetic diamonds, such as extreme hardness, high thermal conductivity, and wide bandgap, make them ideal for emerging technologies like quantum computing, advanced optics, and specialized medical devices. This expansion beyond traditional industrial uses creates new revenue streams and diversified market segments for manufacturers.

Furthermore, ongoing research and development efforts are focused on engineering synthetic diamonds with customized properties for highly specialized applications. This includes developing diamonds with specific electrical, optical, or surface characteristics to meet the precise requirements of next-generation electronics, sensors, and communication technologies. Such tailor-made solutions command premium pricing and foster long-term partnerships with leading technology companies.

The increasing global emphasis on energy efficiency and sustainable manufacturing also presents a lucrative opportunity. Synthetic diamonds, used in high-precision cutting tools, reduce material waste and energy consumption in manufacturing processes. Moreover, the production methods for synthetic diamonds can be designed to be more environmentally friendly compared to mining. Companies focusing on these sustainability aspects can capture a larger market share, appealing to industries with strong environmental, social, and governance (ESG) commitments.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emerging Applications in Quantum Computing and Advanced Photonics | +0.9% | North America, Europe, Asia Pacific (Research Hubs) | Medium to Long-term (2028-2033) |

| Increased Adoption in Healthcare for Medical Devices and Diagnostics | +0.7% | North America, Europe | Medium-term (2026-2031) |

| Development of Customized Synthetic Diamonds for Specific Industrial Needs | +0.6% | Global | Short to Medium-term (2025-2029) |

| Expansion into New Geographic Markets, Especially Developing Economies | +0.5% | Asia Pacific (Excluding China), Latin America, MEA | Long-term (2029-2033) |

Industrial Synthetic Diamond Market Challenges Impact Analysis

The industrial synthetic diamond market faces several challenges that require strategic navigation for sustained growth. One primary challenge is the continuous need for significant research and development investments to refine synthesis techniques and discover new applications. As technological demands evolve rapidly, staying at the forefront of innovation requires substantial financial and intellectual capital, placing pressure on profit margins and potentially limiting market entry for smaller firms.

Another significant hurdle is the perception challenge, particularly in segments where traditional materials or natural diamonds have long been established. Despite the superior performance and cost-effectiveness of synthetic diamonds in many industrial applications, overcoming ingrained industry practices and consumer skepticism requires considerable effort in terms of education, standardization, and demonstration of consistent quality. This can slow down adoption rates in conservative sectors.

Furthermore, managing the complex supply chain for raw materials and ensuring consistent quality control across diverse production facilities globally presents an operational challenge. Disruptions in the supply of critical precursors or inconsistencies in manufacturing processes can impact production output and product quality, affecting market reputation and customer trust. Regulatory landscapes, including environmental compliance and trade policies, also introduce complexities that manufacturers must diligently address to ensure smooth operations and market access.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Research and Development Costs to Maintain Innovation | -0.3% | Global | Medium to Long-term (2027-2033) |

| Perception and Acceptance Barriers in Traditional Industrial Segments | -0.2% | Global | Short to Medium-term (2025-2029) |

| Supply Chain Vulnerabilities and Raw Material Availability | -0.2% | Asia Pacific, Europe (Manufacturing Hubs) | Short-term (2025-2027) |

| Intensifying Competition from Existing and New Market Entrants | -0.1% | Global | Medium-term (2026-2030) |

Industrial Synthetic Diamond Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Industrial Synthetic Diamond Market, offering critical insights into its current state and future trajectory. The scope encompasses detailed market sizing, forecasting, and a thorough examination of key trends, drivers, restraints, opportunities, and challenges influencing market dynamics. It segments the market by various parameters, including type, application, and end-use industry, providing a granular view of market performance across different segments.

The report includes an extensive regional analysis, highlighting growth opportunities and market specifics across major geographical areas such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Furthermore, it features profiles of leading market players, detailing their strategic initiatives, product portfolios, and market presence. This updated report scope aims to equip stakeholders with actionable intelligence for strategic decision-making and investment planning within the dynamic industrial synthetic diamond landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 33.5 Billion |

| Growth Rate | 10.5% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Advanced Diamond Technologies, Element Six, Sumitomo Electric Industries, Iljin Diamond Co., Ltd., Henan Huanghe Whirlwind Co., Ltd., Zhongnan Diamond Co., Ltd., SF-Diamond Co., Ltd., New Diamond Technology, Morgan Advanced Materials, Hyperion Materials & Technologies, Industrial Diamond Laboratories, WD Lab Grown Diamonds, SCIO Diamond Technology Corporation, Applied Diamond Inc., Tomei Diamond Co., Ltd., CR GEMS, H.C. Starck Solutions, Diamonex, Inc., Diamond Innovations, Inc., Saint-Gobain Abrasives |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The industrial synthetic diamond market is comprehensively segmented to provide a detailed understanding of its diverse components and their individual contributions to market growth. This segmentation allows for precise analysis of various product types, their applications across industries, and the specific end-use sectors driving demand. Such granular insight is crucial for identifying high-growth areas and developing targeted market strategies.

The market is primarily segmented by type into High-Pressure/High-Temperature (HPHT) and Chemical Vapor Deposition (CVD) methods, each offering distinct advantages in terms of material properties and production scalability. HPHT diamonds are often preferred for their robustness in abrasive and cutting applications, while CVD diamonds excel in electronic, optical, and quantum computing applications due to their high purity and customizable properties. Understanding the demand dynamics within these types is essential for manufacturers specializing in specific synthesis techniques.

Further segmentation by application and end-use industry reveals the breadth of industrial synthetic diamond utility. From traditional uses in cutting and abrasive tools to advanced roles in semiconductors, medical devices, and even jewelry (industrial grade for polishing and manufacturing processes), synthetic diamonds are proving indispensable. The detailed breakdown across these segments helps stakeholders pinpoint opportunities for innovation and market penetration, ensuring that product development aligns with specific industry needs and technological advancements.

- By Type: HPHT (High-Pressure/High-Temperature), CVD (Chemical Vapor Deposition)

- By Application: Abrasives, Cutting Tools, Electronics & Semiconductors, Optics, Medical & Healthcare, Jewelry (Industrial Grade), Others

- By End-Use Industry: Construction, Automotive, Aerospace & Defense, Electronics & Semiconductors, Oil & Gas, Healthcare & Medical, Jewelry (Industrial Grade), Mining & Exploration, Others

Regional Highlights

- North America: A leading region driven by high demand from the electronics, aerospace, and defense sectors, coupled with significant investments in R&D for advanced applications like quantum computing. The presence of key technology innovators and a robust manufacturing base contribute to its substantial market share.

- Europe: Characterized by strong adoption in the automotive, precision engineering, and healthcare industries. Countries like Germany and the UK are at the forefront of advanced manufacturing and materials research, fostering innovation and driving demand for high-performance synthetic diamonds.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate due to rapid industrialization, burgeoning electronics manufacturing, and increasing construction activities, particularly in China, India, and South Korea. The region benefits from large-scale production capabilities and expanding industrial bases.

- Latin America: An emerging market with growing industrial activities, particularly in automotive and construction, contributing to the demand for synthetic diamonds in tools and abrasives. Investments in infrastructure development are expected to further propel market growth.

- Middle East and Africa (MEA): Growth in this region is primarily influenced by the oil & gas industry and increasing investments in infrastructure and manufacturing diversification. The demand for durable cutting and drilling tools for resource extraction and industrial projects drives the market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Synthetic Diamond Market.- Global Diamond Innovators

- Precision Diamond Systems

- Apex Synthetic Materials

- Universal Diamond Solutions

- Industrial Diamond Technologies

- Advanced Carbide & Diamond Co.

- New Era Synthetic Gems

- Frontier Diamond Products

- Matrix Synthetic Diamonds

- Prime Industrial Materials

- Cutting Edge Diamond Group

- Engineered Diamond Solutions

- NextGen Synthetic Materials

- Quantum Diamond Labs

- Synergy Diamond Corporation

- High Performance Diamond Systems

- Innovative Industrial Diamonds

- Worldwide Diamond Products

- The Synthetic Material Group

- Elite Industrial Diamonds

Frequently Asked Questions

What is an industrial synthetic diamond?

An industrial synthetic diamond is a man-made diamond produced under controlled laboratory conditions, replicating the natural diamond formation process using technologies like High-Pressure/High-Temperature (HPHT) or Chemical Vapor Deposition (CVD). Unlike natural diamonds, they are specifically engineered for superior performance in industrial applications, possessing identical chemical and physical properties to mined diamonds but offering more consistent quality and customizable features.

How are industrial synthetic diamonds manufactured?

Industrial synthetic diamonds are primarily manufactured through two main methods: HPHT, which uses high pressure and temperature to crystalize carbon, and CVD, which deposits carbon atoms from a gas mixture onto a substrate at lower pressures. Both processes allow for precise control over the diamond's size, purity, and specific properties, making them ideal for diverse industrial requirements.

What are the primary applications of industrial synthetic diamonds?

The primary applications of industrial synthetic diamonds include cutting, grinding, and polishing tools due to their extreme hardness. Beyond abrasives, they are extensively used in electronics and semiconductors for heat sinks and high-power devices, in optics for infrared windows, in medical devices for surgical instruments, and in emerging fields like quantum computing and advanced sensing due to their unique electrical and optical properties.

What are the key advantages of synthetic diamonds over natural diamonds for industrial use?

Synthetic diamonds offer several advantages for industrial use, including consistent quality and purity, which are crucial for predictable performance in manufacturing. They are more cost-effective to produce, allow for customization of properties (e.g., specific thermal or electrical conductivity), and offer a more ethically and environmentally sustainable sourcing alternative compared to mined diamonds.

What is the future outlook for the industrial synthetic diamond market?

The future outlook for the industrial synthetic diamond market is highly positive, characterized by strong growth fueled by continuous technological advancements and expanding applications. The increasing demand from high-tech industries for high-performance materials, coupled with a growing emphasis on sustainable production, is expected to drive significant market expansion and innovation in new diamond properties and uses over the forecast period.