Industrial Hemp in Automotive Market

Industrial Hemp in Automotive Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702914 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Industrial Hemp in Automotive Market Size

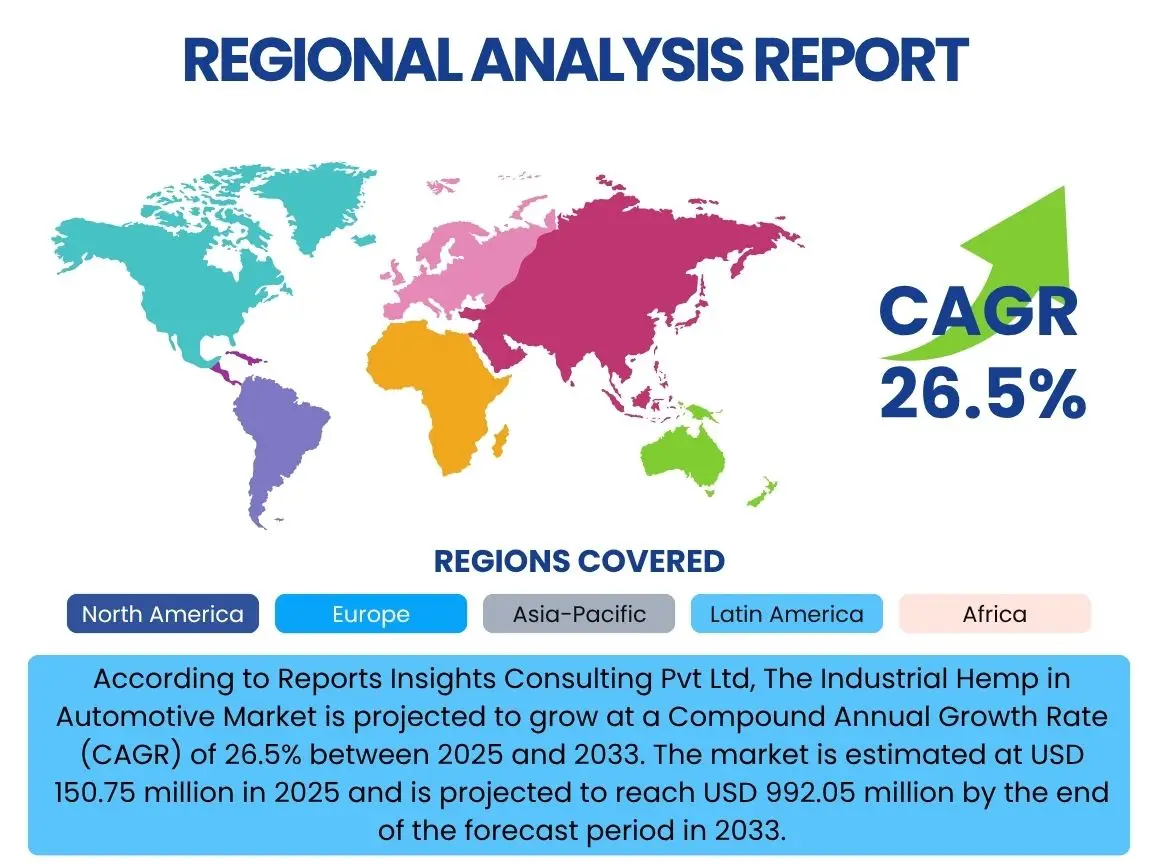

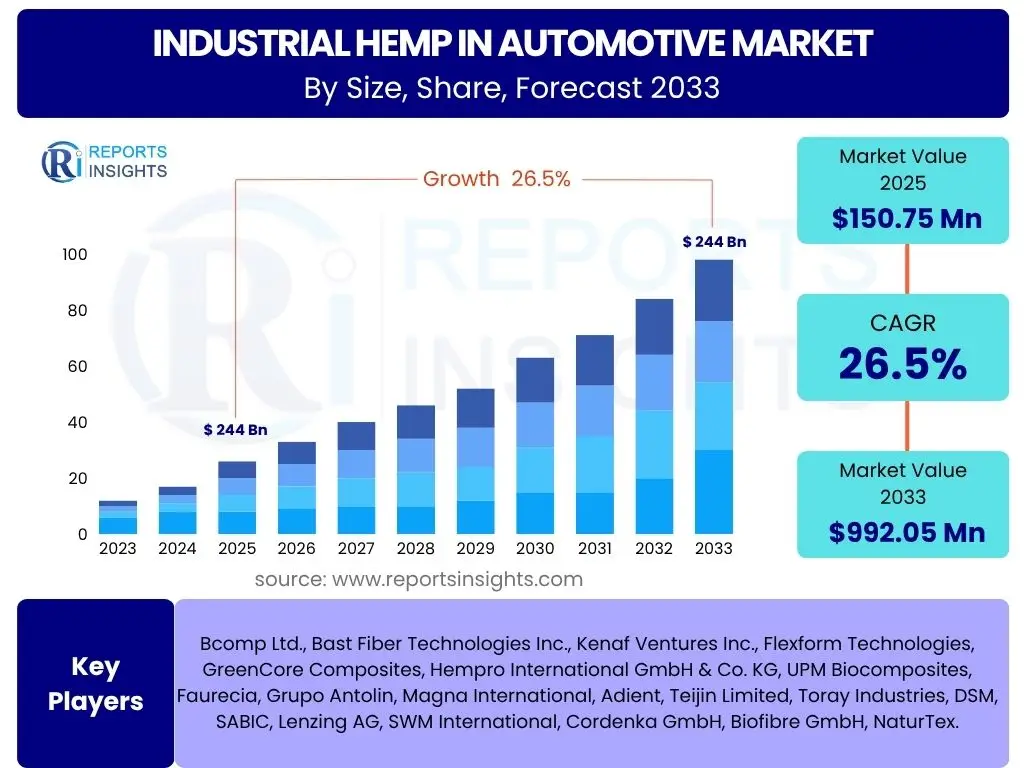

According to Reports Insights Consulting Pvt Ltd, The Industrial Hemp in Automotive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 26.5% between 2025 and 2033. The market is estimated at USD 150.75 million in 2025 and is projected to reach USD 992.05 million by the end of the forecast period in 2033.

Key Industrial Hemp in Automotive Market Trends & Insights

The Industrial Hemp in Automotive market is undergoing a significant transformation driven by increasing demand for sustainable and lightweight materials. Users frequently inquire about the specific applications and the drivers behind this shift. Key trends indicate a robust move towards natural fiber composites replacing traditional materials like fiberglass and plastics, primarily due to their environmental benefits, superior strength-to-weight ratio, and improved acoustic damping properties. This transition is not merely about eco-friendliness but also about enhancing vehicle performance through weight reduction, which directly contributes to better fuel efficiency and reduced emissions. Furthermore, advancements in processing technologies are making hemp-based materials more competitive in terms of cost and scalability, fostering wider adoption across various automotive components.

- Growing adoption of bio-composites in vehicle interior components such as door panels, dashboards, and seatbacks.

- Increasing research and development into hemp-based lightweight structural components for improved fuel efficiency.

- Rising consumer preference and regulatory pressures for sustainable and eco-friendly vehicle manufacturing.

- Development of advanced hemp fiber treatments enhancing material properties like fire resistance and durability.

- Expansion of strategic partnerships between hemp material suppliers and major automotive original equipment manufacturers (OEMs).

AI Impact Analysis on Industrial Hemp in Automotive

Common user questions regarding AI's impact on the Industrial Hemp in Automotive sector often revolve around its potential to optimize material properties, streamline manufacturing processes, and enhance supply chain efficiency. AI and machine learning algorithms are proving instrumental in predicting and tailoring the mechanical and chemical properties of hemp fibers and composites, ensuring they meet rigorous automotive standards. This includes optimizing fiber length, resin compatibility, and processing parameters to achieve desired strength, stiffness, and impact resistance. Additionally, AI-driven analytics can significantly improve the efficiency of hemp cultivation, processing, and logistics, reducing waste and ensuring a consistent supply of raw materials. Predictive maintenance in manufacturing lines using AI also minimizes downtime, further accelerating the integration of hemp components into vehicle production.

- AI-driven material science for optimizing hemp fiber properties and composite formulations, predicting performance characteristics.

- Machine learning algorithms enhancing quality control and defect detection during the manufacturing of hemp-based components.

- Predictive analytics improving supply chain management for industrial hemp, ensuring consistent raw material availability and logistics efficiency.

- AI-enabled design optimization tools for creating lighter, stronger, and more efficient automotive parts using hemp composites.

- Automation and robotics integrated with AI for precise and high-volume production of hemp-based automotive components.

Key Takeaways Industrial Hemp in Automotive Market Size & Forecast

Users frequently seek a concise summary of the market's trajectory and its most compelling aspects. The primary takeaway from the Industrial Hemp in Automotive market size and forecast is its significant growth potential, driven by the automotive industry's increasing focus on sustainability, lightweighting, and circular economy principles. The market's robust Compound Annual Growth Rate (CAGR) indicates a strong willingness from automakers to integrate bio-based materials as viable alternatives to traditional petroleum-derived plastics and metals. This expansion is further supported by technological advancements in material science and processing, which are overcoming historical limitations and making hemp components economically competitive and performance-efficient. The long-term outlook highlights hemp as a critical component in the future of environmentally responsible automotive manufacturing.

- The market is poised for substantial growth, reflecting a strong shift towards sustainable materials in automotive manufacturing.

- Lightweighting initiatives remain a core driver, as hemp composites contribute significantly to fuel efficiency and reduced emissions.

- Technological innovations in hemp processing and composite manufacturing are accelerating market adoption and expanding application areas.

- Increasing regulatory support for bio-based and recyclable materials is providing a favorable environment for market expansion.

- The economic viability and performance benefits of hemp materials are becoming increasingly recognized by major automotive players.

Industrial Hemp in Automotive Market Drivers Analysis

The market for industrial hemp in automotive applications is experiencing robust growth, primarily propelled by a confluence of environmental, economic, and performance-related factors. Automakers are under immense pressure to meet stringent global emissions standards and reduce their carbon footprint, making sustainable materials like hemp an attractive solution. Beyond environmental compliance, the inherent properties of hemp, such as its high strength-to-weight ratio and natural sound-damping capabilities, offer significant performance advantages. These benefits translate into lighter vehicles, which improve fuel efficiency and electric vehicle range, and enhanced cabin acoustics, contributing to overall vehicle comfort and driving experience.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations and Emission Standards | +8.5% | Europe, North America, Asia Pacific | Long-term (2025-2033) |

| Increasing Demand for Lightweight and High-Performance Materials | +7.2% | Global | Mid-to-Long term (2027-2033) |

| Growing Consumer Preference for Sustainable and Eco-Friendly Vehicles | +5.8% | North America, Europe | Mid-to-Long term (2026-2033) |

| Technological Advancements in Hemp Processing and Composite Manufacturing | +4.0% | Global | Short-to-Mid term (2025-2029) |

Industrial Hemp in Automotive Market Restraints Analysis

Despite the promising outlook, the Industrial Hemp in Automotive market faces several impediments that could temper its growth trajectory. Persistent regulatory complexities and the historical stigma associated with cannabis, even industrial hemp (which contains negligible THC), pose significant hurdles for cultivation, processing, and broad market acceptance in some regions. Furthermore, the existing infrastructure for large-scale hemp fiber processing and conversion into automotive-grade materials is still developing, leading to potential supply chain bottlenecks and higher initial production costs compared to established petroleum-based alternatives. Overcoming these restraints will require concerted efforts in policy reform, infrastructure investment, and public education to fully unlock the market's potential.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Regulatory Complexities and Perceived Stigma of Hemp | -4.5% | Global (especially Asia & parts of North America) | Short-to-Mid term (2025-2028) |

| Limited Processing Infrastructure and Supply Chain Maturity | -3.8% | Regional (Developing economies) | Mid-term (2026-2030) |

| Performance Limitations (e.g., impact resistance for structural parts) | -2.0% | Global | Mid-to-Long term (2027-2033) |

| Competition from Established Synthetic and Conventional Materials | -1.5% | Global | Long-term (2029-2033) |

Industrial Hemp in Automotive Market Opportunities Analysis

The industrial hemp in automotive market presents numerous opportunities for innovation and expansion, driven by evolving material science and shifting industry priorities. A significant avenue for growth lies in the continuous development of advanced hemp-based composites, particularly those engineered for enhanced performance characteristics like increased strength, durability, and moisture resistance, making them suitable for a broader range of automotive components beyond current interior applications. Furthermore, the pursuit of circular economy models in the automotive sector opens doors for hemp, a highly renewable and biodegradable resource, to be integrated into end-of-life vehicle strategies. Strategic collaborations between hemp growers, material processors, and automotive manufacturers can accelerate the adoption of these innovative solutions and establish new market niches.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Advanced Hemp-Based Composites and Nanomaterials | +6.5% | Global | Long-term (2028-2033) |

| Expansion of Applications Beyond Interior Components (e.g., semi-structural parts) | +5.0% | Global | Mid-to-Long term (2027-2033) |

| Increased Investment in Sustainable Material R&D by Automotive OEMs | +4.2% | North America, Europe, Asia Pacific | Mid-term (2026-2031) |

| Leveraging Hemp for Circular Economy Initiatives in Automotive Manufacturing | +3.0% | Europe, North America | Long-term (2029-2033) |

Industrial Hemp in Automotive Market Challenges Impact Analysis

While the industrial hemp in automotive market shows considerable promise, it must navigate several significant challenges to achieve its full potential. A primary challenge is ensuring the consistent supply and standardized quality of industrial hemp fibers, which can vary significantly based on cultivation practices, regional climate, and processing methods. This variability can hinder widespread adoption by an industry that demands highly precise and reliable material specifications. Additionally, the initial capital investment required for establishing dedicated hemp fiber processing facilities and integrating these materials into existing automotive manufacturing lines can be substantial, posing a barrier for smaller players. Addressing these issues through collaborative efforts and technological advancements will be crucial for sustained market growth.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Ensuring Consistent Quality and Supply Chain Stability of Hemp Fibers | -3.0% | Global | Short-to-Mid term (2025-2029) |

| High Initial Investment in Research, Development, and Infrastructure | -2.5% | Global | Short-to-Mid term (2025-2028) |

| Need for Standardization and Certification for Automotive Applications | -1.8% | Global | Mid-term (2026-2030) |

| Limited Awareness and Education Among Traditional Automotive Stakeholders | -1.0% | Regional (Emerging markets) | Long-term (2028-2033) |

Industrial Hemp in Automotive Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Industrial Hemp in Automotive market, offering critical insights into its current size, historical trends, and future growth projections. The scope includes detailed segmentation across various types, applications, and regional markets, alongside a thorough examination of the competitive landscape. It also highlights key drivers, restraints, opportunities, and challenges shaping the industry, incorporating the impact of emerging technologies like AI. The report serves as an invaluable resource for stakeholders seeking to understand market dynamics, identify growth avenues, and formulate strategic business decisions within this rapidly evolving sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 150.75 Million |

| Market Forecast in 2033 | USD 992.05 Million |

| Growth Rate | 26.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Bcomp Ltd., Bast Fiber Technologies Inc., Kenaf Ventures Inc., Flexform Technologies, GreenCore Composites, Hempro International GmbH & Co. KG, UPM Biocomposites, Faurecia, Grupo Antolin, Magna International, Adient, Teijin Limited, Toray Industries, DSM, SABIC, Lenzing AG, SWM International, Cordenka GmbH, Biofibre GmbH, NaturTex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Industrial Hemp in Automotive market is comprehensively segmented to provide a granular understanding of its diverse applications and material types. This segmentation allows for precise analysis of market performance across different product categories and vehicle types, highlighting specific growth areas and emerging niches. Understanding these segments is crucial for identifying key growth drivers, competitive landscapes within sub-markets, and opportunities for product innovation and market penetration for both existing players and new entrants in the bio-based materials sector.

- By Type: Focuses on the various forms of processed hemp used, including natural fiber composites (the most common), hemp bioplastics, hemp textiles, and derivatives from hemp seed oil for specialized applications.

- By Application: Differentiates the end-use parts within a vehicle, such as interior components (e.g., door panels, dashboards), exterior non-structural components, under-the-hood components, and materials for insulation and sound dampening.

- By Component: Categorizes the raw material forms, including fibers, resins (often bio-based), and various additives that enhance material properties.

- By Vehicle Type: Distinguishes adoption rates and specific material requirements across passenger cars, commercial vehicles, and the rapidly growing electric vehicle segment, which particularly benefits from lightweighting.

Regional Highlights

- North America: Driven by increasing consumer awareness for sustainability, rising R&D investments in bio-composites, and supportive regulatory frameworks in some states. The presence of major automotive OEMs and a focus on lightweighting for fuel efficiency and EV range propels market growth.

- Europe: A leading region due to stringent environmental regulations, robust circular economy initiatives, and high adoption rates of sustainable materials in the automotive industry. Government incentives and strong public demand for eco-friendly vehicles further accelerate market expansion.

- Asia Pacific (APAC): Emerging as a high-growth region, characterized by a burgeoning automotive manufacturing base, increasing environmental concerns, and growing investments in green technologies. Countries like China, Japan, and India are exploring industrial hemp's potential for cost-effective and sustainable automotive solutions.

- Latin America: Showing nascent growth, primarily influenced by global sustainability trends and a gradual shift towards adopting bio-based materials. Market development is contingent on establishing robust supply chains and overcoming regulatory hurdles.

- Middle East and Africa (MEA): Currently a smaller market, but with growing interest in diversifying economies and embracing sustainable industrial practices. Future growth is anticipated with increasing environmental awareness and potential investment in automotive manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Hemp in Automotive Market.- Bcomp Ltd.

- Bast Fiber Technologies Inc.

- Kenaf Ventures Inc.

- Flexform Technologies

- GreenCore Composites

- Hempro International GmbH & Co. KG

- UPM Biocomposites

- Faurecia

- Grupo Antolin

- Magna International

- Adient

- Teijin Limited

- Toray Industries

- DSM

- SABIC

- Lenzing AG

- SWM International

- Cordenka GmbH

- Biofibre GmbH

- NaturTex

Frequently Asked Questions

What are the primary applications of industrial hemp in the automotive industry?

Industrial hemp is primarily used in automotive applications for interior components such as door panels, dashboards, seatbacks, and headliners. It is also increasingly found in exterior non-structural components and for insulation and sound dampening due to its lightweight and acoustical properties.

Why are automakers increasingly adopting industrial hemp materials?

Automakers are adopting industrial hemp due to its environmental benefits, including biodegradability and lower carbon footprint, and its performance advantages such as a high strength-to-weight ratio, which contributes to lighter vehicles, improved fuel efficiency, and extended electric vehicle range.

What are the key environmental benefits of using hemp in car manufacturing?

The key environmental benefits include reduced reliance on petroleum-based plastics, lower energy consumption during production, significant carbon sequestration during hemp cultivation, and the biodegradability of hemp-based components at the end of a vehicle's life cycle.

What challenges does the industrial hemp in automotive market currently face?

Key challenges include regulatory complexities and the historical stigma of hemp, ensuring consistent quality and stable supply chains for automotive-grade fibers, high initial investment costs for processing infrastructure, and the need for standardized material specifications.

How large is the industrial hemp in automotive market projected to grow by 2033?

The Industrial Hemp in Automotive Market is projected to reach USD 992.05 million by the end of 2033, growing at a Compound Annual Growth Rate (CAGR) of 26.5% from its estimated value of USD 150.75 million in 2025.