High purity Dicyclopentadiene Market

High purity Dicyclopentadiene Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707440 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

High purity Dicyclopentadiene Market Size

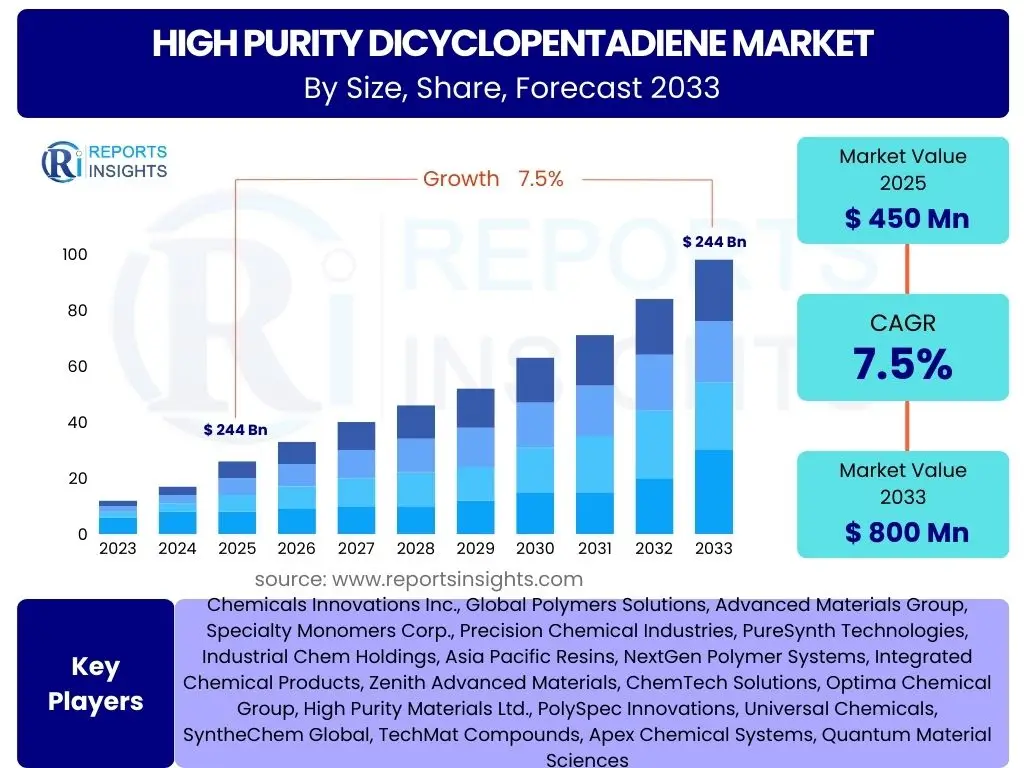

According to Reports Insights Consulting Pvt Ltd, The High purity Dicyclopentadiene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2033. The market is estimated at USD 450 Million in 2025 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Key High purity Dicyclopentadiene Market Trends & Insights

User inquiries frequently focus on the evolving landscape of the High purity Dicyclopentadiene (HP DCPD) market, seeking information on emerging applications, advancements in production techniques, and shifts in demand patterns. Analysis reveals a consistent interest in the material's role in next-generation technologies and the sustainability aspects of its manufacturing and utilization. The market is increasingly influenced by technological innovation, supply chain optimization, and the adoption of high-performance materials across diverse industries, leading to a dynamic environment for HP DCPD stakeholders. This includes a growing emphasis on ultra-high purity grades for specialized electronics and optical applications.

Further insights indicate a trend towards vertical integration among key players, aiming to secure raw material supply and enhance control over the purification process. The development of new polymerization catalysts and advanced manufacturing processes is also a significant area of focus, enabling the production of more consistent and higher-quality HP DCPD. Furthermore, the market is witnessing increased research and development efforts aimed at expanding HP DCPD's utility in novel composites and functional materials, which are crucial for high-growth sectors. The convergence of these trends suggests a market poised for sustained expansion driven by both established and nascent applications.

- Increasing demand from advanced electronics and optical applications.

- Growing adoption in high-performance composites and specialty polymers.

- Development of sustainable and energy-efficient purification processes.

- Emphasis on ultra-high purity grades for critical end-uses.

- Strategic partnerships and collaborations across the value chain.

AI Impact Analysis on High purity Dicyclopentadiene

User queries regarding the impact of Artificial Intelligence (AI) on the High purity Dicyclopentadiene (HP DCPD) market predominantly center on optimizing production processes, enhancing quality control, and accelerating research and development. Stakeholders are keen to understand how AI can reduce impurities, improve yield, and predict market fluctuations. The integration of AI and machine learning algorithms is anticipated to revolutionize synthesis pathways and purification techniques, leading to more efficient and cost-effective production of HP DCPD. This technological evolution holds the potential to significantly impact operational efficiencies and product consistency, addressing complex challenges in chemical manufacturing.

AI's influence extends beyond the immediate production line, encompassing supply chain management and demand forecasting for HP DCPD. Advanced analytical models powered by AI can analyze vast datasets to identify optimal sourcing strategies, predict material shortages, and anticipate demand shifts, thereby enabling more resilient and responsive supply chains. Furthermore, AI-driven simulations and computational chemistry are expected to expedite the discovery of new applications and derivative products for HP DCPD, fostering innovation and market expansion. The long-term impact includes a more data-driven approach to market analysis and strategic planning within the HP DCPD sector, enhancing competitive advantage.

- Optimization of chemical synthesis and purification parameters.

- Enhanced quality control through predictive analytics and anomaly detection.

- Streamlined supply chain management and demand forecasting.

- Accelerated R&D for new HP DCPD applications and derivatives.

- Predictive maintenance for production equipment, minimizing downtime.

Key Takeaways High purity Dicyclopentadiene Market Size & Forecast

Analysis of common user questions concerning key takeaways from the High purity Dicyclopentadiene (HP DCPD) market size and forecast highlights a strong interest in growth drivers, critical application segments, and regional market dynamics. Users consistently seek concise insights into where the market is headed, what factors will most significantly influence its trajectory, and which geographical areas present the most substantial opportunities. The overall sentiment suggests a recognition of HP DCPD as a strategic material for high-tech industries, with its growth closely tied to advancements in electronics, optics, and high-performance materials. The emphasis is on understanding the fundamental elements shaping market expansion and value creation.

Further examination reveals that stakeholders prioritize information on the longevity of demand for HP DCPD across its diverse uses, the potential for new market entries, and the impact of technological shifts on future demand. The forecast indicates sustained growth, underpinned by its irreplaceable role in specialized polymers and composites. Key takeaways emphasize the balance between established industrial applications and emerging high-growth niches, demonstrating the material's versatility. Understanding the interplay of these factors is crucial for strategic planning and investment decisions within the HP DCPD market, ensuring preparedness for future market evolution.

- Robust growth driven by expanding applications in high-tech sectors.

- Asia Pacific anticipated to remain the dominant and fastest-growing region.

- Technological advancements in purification are crucial for market competitiveness.

- Demand for ultra-high purity grades is increasing, commanding premium prices.

- Long-term market stability supported by diverse and expanding end-uses.

High purity Dicyclopentadiene Market Drivers Analysis

The High purity Dicyclopentadiene (HP DCPD) market is primarily driven by the escalating demand from advanced material industries, where its unique chemical properties are indispensable. The rapid expansion of the electronics sector, particularly in the production of optical lenses, LEDs, and specialized circuit boards, necessitates materials with superior thermal stability, transparency, and electrical insulation properties, qualities inherent to HP DCPD. Furthermore, the increasing adoption of high-performance composites in aerospace, automotive, and wind energy applications fuels the demand for HP DCPD as a critical monomer for reaction injection molding (RIM) and resin transfer molding (RTM) processes, enabling the fabrication of lightweight and durable components. The drive towards miniaturization and enhanced performance in various end-products directly correlates with the need for high-purity chemical inputs, making HP DCPD a vital component.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing demand from advanced electronics | +1.8% | Asia Pacific, North America | Short to Mid-term (2025-2030) |

| Expansion of high-performance composites market | +1.5% | Europe, North America, China | Mid to Long-term (2027-2033) |

| Technological advancements in polymer synthesis | +1.2% | Global | Short to Mid-term (2025-2030) |

| Increasing adoption in optical and medical devices | +0.8% | North America, Europe, Japan | Mid to Long-term (2028-2033) |

High purity Dicyclopentadiene Market Restraints Analysis

Despite robust demand, the High purity Dicyclopentadiene (HP DCPD) market faces several significant restraints that could impede its growth trajectory. The volatility of raw material prices, particularly for dicyclopentadiene (DCPD), which is a byproduct of petrochemical cracking, poses a challenge. Fluctuations in crude oil prices directly impact the cost of DCPD, subsequently affecting the profitability and pricing strategies for HP DCPD manufacturers. Additionally, the complex and energy-intensive purification processes required to achieve high purity grades contribute to high production costs. These elevated costs can limit the widespread adoption of HP DCPD in price-sensitive applications, pushing industries to seek more economical alternatives or less stringent purity requirements where feasible. The niche nature of many HP DCPD applications means that market growth can also be constrained by the slower adoption rates of the end-technologies themselves.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility of raw material prices (DCPD) | -1.3% | Global | Short to Mid-term (2025-2030) |

| High production costs associated with purification | -1.0% | Global | Mid to Long-term (2027-2033) |

| Availability of substitute materials in certain applications | -0.7% | North America, Europe | Mid-term (2026-2031) |

| Stringent environmental regulations on chemical production | -0.5% | Europe, North America, Japan | Long-term (2029-2033) |

High purity Dicyclopentadiene Market Opportunities Analysis

Significant opportunities exist within the High purity Dicyclopentadiene (HP DCPD) market, primarily driven by ongoing research and development activities and the emergence of new application areas. The increasing focus on lightweight materials in the automotive and aerospace industries for fuel efficiency and emission reduction presents a substantial avenue for HP DCPD, particularly in the production of advanced composite parts via efficient molding processes. Furthermore, the burgeoning demand for highly transparent and heat-resistant polymers in optical lenses, specialized packaging, and medical devices offers a fertile ground for HP DCPD derivatives. Innovation in polymerization catalysts and synthesis techniques also creates opportunities to develop novel HP DCPD-based materials with enhanced properties, broadening their utility and market appeal.

Beyond traditional applications, the potential for HP DCPD in 3D printing and additive manufacturing is an emerging opportunity, enabling the creation of complex geometries with superior mechanical properties. The development of bio-based or sustainably sourced DCPD variants could also unlock new market segments by addressing growing environmental concerns and regulatory pressures. Strategic collaborations between chemical manufacturers and end-use industries to co-develop tailored HP DCPD solutions represent another critical opportunity, fostering product innovation and market penetration. These avenues suggest a dynamic future for HP DCPD, marked by diversification and value addition across various high-growth sectors.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into new 3D printing/additive manufacturing materials | +1.6% | Global | Mid to Long-term (2027-2033) |

| Growth in specialized optical and medical device components | +1.4% | North America, Europe, East Asia | Short to Mid-term (2025-2030) |

| Development of sustainable production methods | +1.0% | Europe, North America | Mid to Long-term (2028-2033) |

| Increasing adoption in high-performance coatings and adhesives | +0.9% | Global | Short to Mid-term (2026-2031) |

High purity Dicyclopentadiene Market Challenges Impact Analysis

The High purity Dicyclopentadiene (HP DCPD) market is confronted by several notable challenges that require strategic navigation. Achieving and maintaining ultra-high purity levels in DCPD production is technically demanding and capital-intensive, leading to significant manufacturing complexities and specialized equipment requirements. This inherent difficulty in purification processes can limit the number of market entrants and increase the barrier to entry, potentially hindering market expansion. Furthermore, the specialized nature of HP DCPD's applications means that its market size is relatively smaller compared to commodity chemicals, making it more susceptible to demand fluctuations within specific end-use industries. The dependence on a byproduct from the petrochemical industry also presents supply chain vulnerabilities, as the availability and cost of crude DCPD can be influenced by broader energy market dynamics and cracker operational rates.

Another significant challenge revolves around the safe handling, storage, and transportation of HP DCPD, given its chemical properties and regulatory frameworks. Stringent environmental and health regulations concerning volatile organic compounds (VOCs) and chemical manufacturing processes necessitate substantial investments in compliance and waste management, adding to operational costs. The competitive landscape, while niche, requires continuous innovation and product differentiation to maintain market share, as even minor quality deviations can impact performance in sensitive applications. Addressing these challenges effectively will be paramount for sustained growth and profitability in the HP DCPD market, requiring a combination of technological advancements, supply chain optimization, and regulatory adherence.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Technical complexity and cost of ultra-purification | -1.2% | Global | Short to Mid-term (2025-2030) |

| Dependence on petrochemical feedstock availability | -0.9% | Global | Short-term (2025-2027) |

| Stringent regulatory landscape for chemical manufacturing | -0.8% | Europe, North America, Japan | Mid to Long-term (2027-2033) |

| Niche market size and sensitivity to end-use demand shifts | -0.6% | Global | Short to Mid-term (2026-2031) |

High purity Dicyclopentadiene Market - Updated Report Scope

This comprehensive market research report on High purity Dicyclopentadiene (HP DCPD) provides an in-depth analysis of market size, trends, drivers, restraints, opportunities, and challenges across various segments and regions. It encompasses a detailed examination of the competitive landscape, highlighting key players and their strategic initiatives. The report aims to offer actionable insights for stakeholders, enabling informed decision-making and strategic planning in this specialized chemical market. The scope includes historical data, current market conditions, and future projections, offering a holistic view of the industry's trajectory. It integrates qualitative assessments with quantitative market sizing and forecasting, ensuring a robust and reliable analysis of the HP DCPD sector's potential and dynamics.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 7.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Chemicals Innovations Inc., Global Polymers Solutions, Advanced Materials Group, Specialty Monomers Corp., Precision Chemical Industries, PureSynth Technologies, Industrial Chem Holdings, Asia Pacific Resins, NextGen Polymer Systems, Integrated Chemical Products, Zenith Advanced Materials, ChemTech Solutions, Optima Chemical Group, High Purity Materials Ltd., PolySpec Innovations, Universal Chemicals, SyntheChem Global, TechMat Compounds, Apex Chemical Systems, Quantum Material Sciences |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The High purity Dicyclopentadiene (HP DCPD) market is meticulously segmented to provide a granular understanding of its diverse applications and market dynamics. This segmentation facilitates a deeper analysis of specific growth drivers, market trends, and competitive landscapes within each category. The purity grade serves as a fundamental differentiator, as ultra-high purity HP DCPD commands premium pricing and is essential for sensitive applications like optics and electronics, while high-purity grades cater to broader industrial uses such as specialty resins and composites. Application and end-use industry segmentations reveal the critical roles HP DCPD plays in modern manufacturing, from lightweight automotive components to advanced medical devices, highlighting its versatility and strategic importance across various high-value sectors. Understanding these segments is crucial for identifying precise market opportunities and developing targeted strategies.

- By Purity Grade:

- Ultra-High Purity (99.9% and above): Used in highly sensitive applications where even trace impurities can impact performance, such as precision optical lenses, advanced electronic encapsulants, and specialized medical implants.

- High Purity (99.0% - 99.8%): Applied in areas requiring strong performance but with slightly less stringent purity demands, including various specialty resins, certain composite structures, and select industrial coatings.

- By Application:

- Optical Lenses & Films: Driven by demand for lightweight, high-refractive index materials in cameras, eyeglasses, and display technologies.

- Specialty Resins & Polymers (e.g., COC/COP): Critical for cyclic olefin copolymers/polymers, known for their excellent optical clarity, chemical resistance, and dielectric properties, used in packaging, medical, and optical storage.

- Advanced Composites (e.g., Automotive, Aerospace, Wind Energy): Essential for Reaction Injection Molding (RIM) and Resin Transfer Molding (RTM) processes to produce lightweight, high-strength parts.

- Medical Devices: Utilized in biocompatible materials for surgical instruments, laboratory equipment, and drug delivery systems.

- Electronics & Semiconductors: Applied in insulating materials, encapsulants, and substrates for electronic components due to its low dielectric constant and high heat resistance.

- Others (e.g., Adhesives, Coatings): Niche applications requiring specific bonding or protective properties.

- By End-Use Industry:

- Automotive: For lightweighting and structural components.

- Aerospace & Defense: High-performance composites for aircraft and defense applications.

- Electronics: Components, encapsulants, and substrates.

- Healthcare: Medical devices, pharmaceutical packaging.

- Optics: Lenses, films, and optical fibers.

- Construction: Specialty coatings and composite structural elements.

- Wind Energy: Blades and structural components for turbines.

- Others: Including consumer goods and industrial machinery.

Regional Highlights

- Asia Pacific (APAC): Positioned as the largest and fastest-growing market for High purity Dicyclopentadiene, primarily driven by robust manufacturing sectors in China, Japan, South Korea, and India. Rapid expansion in electronics, automotive, and renewable energy industries, coupled with significant investments in R&D, are propelling demand for HP DCPD in the region. The presence of numerous end-use manufacturers and a growing middle class further contribute to this dominance.

- North America: A mature market characterized by high adoption of advanced materials in aerospace, defense, and specialized electronics. Innovation in high-performance composites and medical device manufacturing sustains consistent demand. Strict regulatory frameworks and a focus on high-quality, specialized products drive the need for ultra-high purity grades.

- Europe: Exhibits steady growth, fueled by the region's strong automotive, aerospace, and renewable energy sectors. Emphasis on sustainable materials and circular economy principles is encouraging research into eco-friendly HP DCPD production methods and applications. Germany, France, and the UK are key contributors to market demand.

- Latin America: An emerging market with growing industrialization, particularly in automotive and construction. While smaller in scale, increasing investments in infrastructure and manufacturing are expected to drive gradual growth for HP DCPD in various industrial applications.

- Middle East and Africa (MEA): Currently a smaller market, but with potential growth stemming from diversification efforts in industrial sectors and investments in infrastructure. The region's petrochemical industry could also play a role in raw material supply for DCPD production in the future.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High purity Dicyclopentadiene Market.- Chemicals Innovations Inc.

- Global Polymers Solutions

- Advanced Materials Group

- Specialty Monomers Corp.

- Precision Chemical Industries

- PureSynth Technologies

- Industrial Chem Holdings

- Asia Pacific Resins

- NextGen Polymer Systems

- Integrated Chemical Products

- Zenith Advanced Materials

- ChemTech Solutions

- Optima Chemical Group

- High Purity Materials Ltd.

- PolySpec Innovations

- Universal Chemicals

- SyntheChem Global

- TechMat Compounds

- Apex Chemical Systems

- Quantum Material Sciences

Frequently Asked Questions

Analyze common user questions about the High purity Dicyclopentadiene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of High purity Dicyclopentadiene?

High purity Dicyclopentadiene (HP DCPD) is primarily used in the production of advanced materials for optical lenses, specialty resins and polymers (like COC/COP), high-performance composites for automotive and aerospace, and components for electronics and medical devices. Its unique properties, such as excellent optical clarity, high heat resistance, and good dielectric properties, make it crucial for these specialized applications.

Which purity grades of DCPD are relevant in the market?

The market primarily differentiates between Ultra-High Purity (99.9% and above) and High Purity (99.0% - 99.8%) Dicyclopentadiene. Ultra-high purity grades are essential for sensitive applications like optics and semiconductors, where even minor impurities can degrade performance. High purity grades cater to broader industrial applications such as specialty resins and composites.

What factors are driving the growth of the HP DCPD market?

The market growth is driven by increasing demand from advanced electronics, the expanding high-performance composites market (especially in automotive and aerospace for lightweighting), and technological advancements in polymer synthesis that leverage HP DCPD's unique properties. Growth in specialized optical and medical device components also contributes significantly.

What are the main challenges facing High purity Dicyclopentadiene producers?

Key challenges include the technical complexity and high cost associated with achieving and maintaining ultra-high purity levels during production. Additionally, the market faces restraints from the volatility of raw material prices (DCPD) and stringent environmental regulations on chemical manufacturing. The relatively niche market size also makes it sensitive to demand shifts in specific end-use industries.

Which region holds the largest market share for High purity Dicyclopentadiene?

Asia Pacific currently holds the largest market share and is projected to be the fastest-growing region. This is attributed to the robust expansion of electronics, automotive, and renewable energy sectors in countries like China, Japan, and South Korea, which are major consumers of HP DCPD in their manufacturing processes.