High Performance Polymer Market

High Performance Polymer Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707081 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

High Performance Polymer Market Size

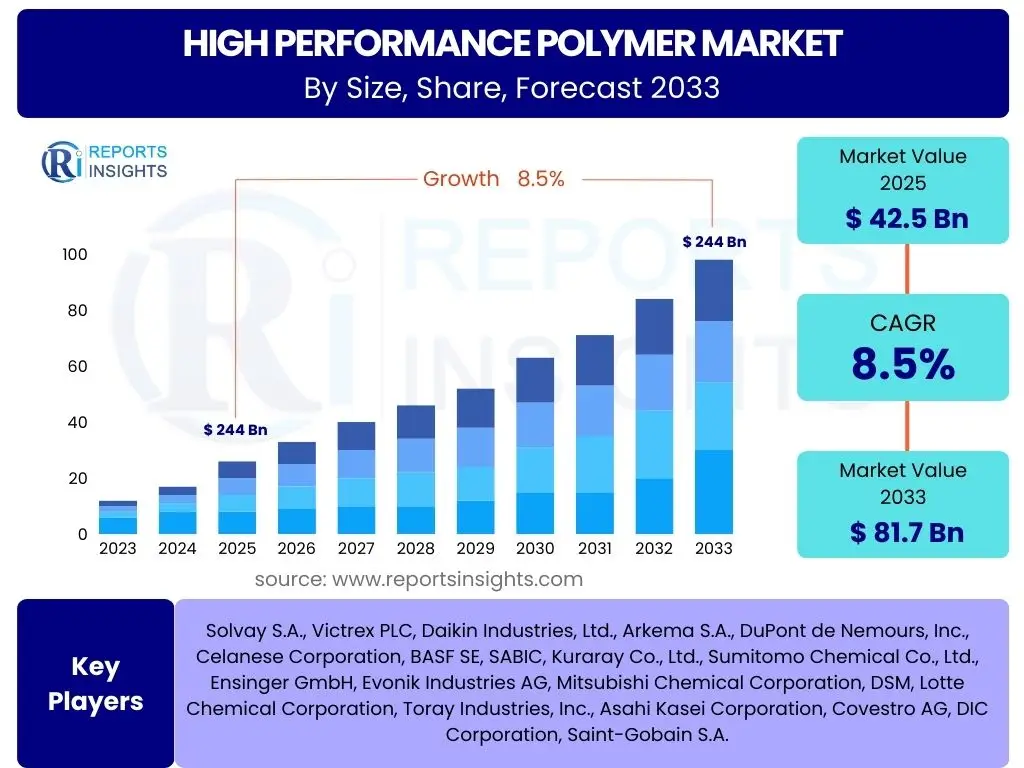

According to Reports Insights Consulting Pvt Ltd, The High Performance Polymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at USD 42.5 billion in 2025 and is projected to reach USD 81.7 billion by the end of the forecast period in 2033.

Key High Performance Polymer Market Trends & Insights

The High Performance Polymer (HPP) market is currently undergoing significant transformation, driven by a confluence of technological advancements and evolving industry demands. A primary trend observed is the increasing emphasis on lightweighting and fuel efficiency across various sectors, particularly in automotive, aerospace, and defense. This necessitates the adoption of materials that offer superior strength-to-weight ratios and thermal stability compared to traditional metals, directly boosting the demand for HPPs. Furthermore, the push towards sustainability and circular economy principles is catalyzing innovation in bio-based and recyclable HPPs, aligning with global environmental regulations and consumer preferences.

Another prominent trend is the expansion of HPP applications into new and niche markets. The burgeoning electric vehicle (EV) market, for instance, requires advanced materials for battery components, thermal management systems, and lightweight structural parts, all of which are increasingly being fulfilled by HPPs. Similarly, the medical sector's demand for biocompatible and sterilizable materials for implants and surgical instruments is creating a robust growth avenue. The market is also witnessing a trend towards advanced manufacturing techniques such as 3D printing, which benefits from the unique properties of HPPs, enabling the production of complex geometries with high performance characteristics.

- Increasing adoption of lightweight materials in automotive and aerospace.

- Growing demand for HPPs in electric vehicles (EVs) for battery and thermal management.

- Rising focus on sustainable and bio-based high performance polymers.

- Expansion of HPP applications in medical devices and implants due to biocompatibility.

- Integration of HPPs with advanced manufacturing processes like 3D printing.

- Development of HPPs with enhanced thermal, chemical, and mechanical properties.

- Shift towards miniaturization in electronics, driving demand for high-performance dielectric materials.

AI Impact Analysis on High Performance Polymer

Artificial Intelligence (AI) is set to revolutionize the High Performance Polymer (HPP) market by fundamentally transforming material discovery, design, and manufacturing processes. Users are keenly interested in how AI can accelerate the notoriously lengthy and costly R&D cycles for new HPPs, envisioning AI-driven simulations to predict material properties and optimize formulations with unprecedented accuracy. This includes utilizing machine learning algorithms to analyze vast datasets of material characteristics, synthesis parameters, and performance metrics, thereby identifying novel HPP structures with desired attributes more efficiently than traditional empirical methods. The integration of AI promises to unlock new material combinations and functionalities previously deemed too complex or time-consuming to explore.

Beyond material innovation, AI's impact extends to optimizing production and supply chain efficiencies within the HPP industry. Concerns and expectations revolve around leveraging AI for predictive maintenance of manufacturing equipment, enhancing process control to reduce waste and improve product consistency, and optimizing supply chain logistics from raw material procurement to finished product distribution. AI-powered quality control systems can identify defects early in the production cycle, ensuring higher standards and reducing costly recalls. While the potential for increased efficiency and accelerated innovation is high, questions also arise regarding the necessary data infrastructure, computational resources, and specialized talent required to fully harness AI's capabilities in this complex materials science domain.

- Accelerated material discovery and design through AI-driven simulations and predictive modeling.

- Optimization of HPP synthesis and manufacturing processes for improved efficiency and yield.

- Enhanced quality control and defect detection using AI-powered vision systems.

- Predictive maintenance for HPP production equipment, reducing downtime.

- Intelligent supply chain management for raw materials and finished HPP products.

- Customization and personalization of HPP formulations based on specific application requirements.

- Reduced R&D costs and time-to-market for novel high performance polymers.

Key Takeaways High Performance Polymer Market Size & Forecast

The High Performance Polymer (HPP) market is poised for robust growth through 2033, driven by increasing adoption across critical industries and continuous material innovation. A primary takeaway from the market size and forecast analysis is the significant value proposition HPPs offer in addressing modern industrial challenges, particularly in sectors demanding lightweighting, enhanced durability, and extreme performance under harsh conditions. The projected substantial growth in market value underscores the expanding replacement of traditional materials with HPPs in high-value applications, indicating a fundamental shift in material preferences across global manufacturing and engineering.

Furthermore, the sustained Compound Annual Growth Rate (CAGR) highlights the resilience and expanding utility of HPPs, even amidst economic fluctuations. This consistent upward trajectory is heavily influenced by the accelerating pace of technological development, the escalating demand for sustainable solutions, and the critical role HPPs play in emerging industries such as electric vehicles, advanced electronics, and personalized medicine. The market's future growth will be heavily dependent on ongoing research and development into new polymer chemistries and processing techniques, enabling HPPs to meet increasingly stringent performance requirements and broaden their application scope. The robust forecast confirms the HPP market as a high-potential segment within the broader advanced materials industry.

- The High Performance Polymer market is projected for significant growth, nearly doubling its value between 2025 and 2033.

- Strong demand from automotive, aerospace, medical, and electronics sectors is a key growth driver.

- Innovation in sustainable and bio-based HPPs is critical for future market expansion.

- Advancements in processing technologies, including 3D printing, are enabling new applications.

- HPPs are increasingly replacing traditional materials due to superior performance characteristics.

- The market's resilience and consistent growth forecast indicate sustained industry confidence and investment.

High Performance Polymer Market Drivers Analysis

The High Performance Polymer (HPP) market is primarily driven by the escalating demand for advanced materials capable of withstanding extreme conditions while offering superior mechanical and chemical properties. Industries such as automotive and aerospace are consistently pushing for lighter, stronger, and more fuel-efficient components, which HPPs can provide due to their exceptional strength-to-weight ratio and high thermal stability. The global imperative for reduced carbon emissions and enhanced energy efficiency also fuels the adoption of HPPs, as they contribute to vehicle lightweighting and improved operational performance in various applications.

Another significant driver is the rapid expansion of the electrical and electronics sector, where HPPs are crucial for insulating components, connectors, and casings that require high dielectric strength, heat resistance, and dimensional stability. Furthermore, the medical device industry's stringent requirements for biocompatibility, sterilizability, and chemical resistance for implants and surgical instruments are increasingly met by specialized HPPs. The continuous technological advancements in manufacturing processes, including additive manufacturing (3D printing), also expand the scope and feasibility of using HPPs for complex, high-precision parts, further accelerating market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing demand for lightweight materials in Automotive & Aerospace | +2.1% | North America, Europe, Asia Pacific | 2025-2033 |

| Growing adoption in Electrical & Electronics for high-performance applications | +1.8% | Asia Pacific (especially China, South Korea), North America | 2025-2033 |

| Rising demand from the Medical & Healthcare sector for biocompatible materials | +1.5% | North America, Europe | 2025-2030 |

| Technological advancements in HPP manufacturing and processing (e.g., 3D printing) | +1.2% | Global | 2027-2033 |

| Stringent environmental regulations promoting durable and recyclable materials | +0.9% | Europe, North America, Japan | 2025-2033 |

High Performance Polymer Market Restraints Analysis

Despite the robust growth prospects, the High Performance Polymer (HPP) market faces several significant restraints that could impede its full potential. A primary challenge is the inherently high cost associated with HPPs, both in terms of raw material procurement and complex manufacturing processes. This high cost often acts as a barrier to entry for new applications or limits their widespread adoption in price-sensitive industries, compelling manufacturers to seek more economical alternatives even if they offer slightly lower performance characteristics. The specialized production facilities and advanced technological expertise required for HPP synthesis further contribute to their premium pricing.

Another significant restraint is the complex processing requirements of certain HPPs, such as the need for high processing temperatures, specialized equipment, and precise control over manufacturing parameters to achieve optimal material properties. This complexity can lead to higher production costs, increased energy consumption, and a steeper learning curve for manufacturers transitioning from conventional polymers. Furthermore, the limited availability of certain specialized monomers and raw materials, coupled with a highly consolidated supply chain, can lead to supply chain vulnerabilities and price volatility, particularly during periods of high demand or geopolitical instability. These factors collectively present hurdles to the broader market penetration of HPPs.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High cost of High Performance Polymers (raw materials and manufacturing) | -1.5% | Global | 2025-2033 |

| Complex processing requirements and specialized equipment needs | -1.2% | Global | 2025-2030 |

| Limited availability of specialized monomers and raw material supply chain volatility | -0.8% | Global | 2026-2032 |

| Intense competition from conventional engineering plastics and metals in certain applications | -0.7% | Asia Pacific, Emerging Economies | 2025-2033 |

High Performance Polymer Market Opportunities Analysis

The High Performance Polymer (HPP) market is presented with numerous opportunities driven by emerging technologies and evolving industry needs. A significant opportunity lies in the burgeoning electric vehicle (EV) market, where HPPs are vital for lightweighting structural components, insulating high-voltage systems, and managing thermal loads in battery packs. The shift towards electrification in automotive and aerospace sectors creates a long-term demand for materials that offer superior performance, durability, and safety under extreme conditions, which HPPs are uniquely positioned to address. This represents a substantial growth avenue beyond traditional internal combustion engine applications.

Another promising opportunity involves the increasing adoption of additive manufacturing (3D printing) technologies. HPPs with specific thermal and mechanical properties are highly sought after for producing complex, high-performance parts via 3D printing in industries such as aerospace, medical, and industrial manufacturing. This allows for rapid prototyping, design flexibility, and on-demand production of highly customized components, opening up new application possibilities. Furthermore, the growing global emphasis on sustainability presents an opportunity for innovation in bio-based HPPs and advanced recycling technologies, appealing to environmentally conscious consumers and regulations. Developing HPPs with enhanced recyclability or derived from renewable resources can secure a competitive edge and tap into a growing green market segment.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of Electric Vehicle (EV) market and advanced battery technologies | +1.8% | Global, especially China, Europe, North America | 2025-2033 |

| Growth of Additive Manufacturing (3D Printing) applications for high-performance parts | +1.5% | North America, Europe, Asia Pacific | 2026-2033 |

| Development of sustainable and bio-based High Performance Polymers | +1.3% | Europe, North America | 2027-2033 |

| Increasing use in next-generation consumer electronics and smart devices | +1.0% | Asia Pacific | 2025-2030 |

| Emerging applications in renewable energy (solar, wind) and specialized industrial equipment | +0.8% | Global | 2028-2033 |

High Performance Polymer Market Challenges Impact Analysis

The High Performance Polymer (HPP) market faces several critical challenges that require strategic navigation to sustain growth. One major hurdle is the intense competition from alternative materials, including advanced metals, ceramics, and even lower-cost engineering plastics, which are continuously improving their performance characteristics and cost-effectiveness. This competition necessitates continuous innovation and differentiation for HPP manufacturers to justify their higher price points and maintain market share, especially in applications where performance requirements are less extreme.

Another significant challenge is the complex regulatory landscape, particularly concerning environmental and health standards for chemical substances. Compliance with evolving global regulations regarding chemical registration, waste management, and the use of certain additives can increase operational costs, limit product formulations, and delay market entry for new HPPs. Furthermore, the relatively low volume production of certain highly specialized HPPs compared to commodity polymers can lead to higher per-unit costs and make it challenging to achieve economies of scale, impacting overall profitability and market accessibility. Investing in new R&D and processing capabilities to overcome these challenges is crucial for long-term success.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Competition from alternative materials (advanced metals, ceramics, lower-cost plastics) | -1.3% | Global | 2025-2033 |

| Complex and evolving regulatory frameworks (environmental, health, safety) | -1.0% | Europe, North America, Japan | 2025-2033 |

| Achieving economies of scale for niche HPPs due to low volume production | -0.9% | Global | 2025-2030 |

| Technological expertise gap in processing and application development in emerging markets | -0.6% | Emerging Economies | 2025-2033 |

High Performance Polymer Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the High Performance Polymer market, covering historical data, current market dynamics, and future projections. It delivers critical insights into market size, growth drivers, restraints, opportunities, and challenges affecting the industry from 2019 to 2033. The report meticulously segments the market by product type, application, and end-use industry, offering a granular view of market trends and competitive landscapes across key geographies. Furthermore, it incorporates an AI impact analysis and an updated competitive assessment to provide a holistic understanding of the market's trajectory.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 42.5 Billion |

| Market Forecast in 2033 | USD 81.7 Billion |

| Growth Rate | 8.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Solvay S.A., Victrex PLC, Daikin Industries, Ltd., Arkema S.A., DuPont de Nemours, Inc., Celanese Corporation, BASF SE, SABIC, Kuraray Co., Ltd., Sumitomo Chemical Co., Ltd., Ensinger GmbH, Evonik Industries AG, Mitsubishi Chemical Corporation, DSM, Lotte Chemical Corporation, Toray Industries, Inc., Asahi Kasei Corporation, Covestro AG, DIC Corporation, Saint-Gobain S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The High Performance Polymer (HPP) market is broadly segmented by type, application, form, and processing technology, reflecting the diverse range of materials and their specialized uses across various industries. Each segmentation provides critical insights into specific market dynamics, technological advancements, and growth drivers. Understanding these segments is crucial for stakeholders to identify niche markets, assess competitive landscapes, and formulate targeted strategies, as the performance requirements and market values vary significantly across different HPP types and their end-use applications.

- By Type: This segment includes Fluoropolymers (e.g., PTFE, PVDF), Polyamide-imides (PAI), Polyetheretherketone (PEEK), Polyphenylene Sulfide (PPS), Polyimides (PI), Polybenzimidazoles (PBI), Polyetherimide (PEI), Liquid Crystal Polymers (LCP), Polyphthalamide (PPA), and other specialized HPPs. Each type possesses unique properties suitable for distinct applications.

- By Application: Key applications span Automotive, Aerospace & Defense, Medical, Electrical & Electronics, Industrial, Consumer Goods, and Energy sectors. These industries leverage HPPs for their lightweight, high-strength, thermal stability, and chemical resistance attributes, replacing traditional materials.

- By Form: HPPs are available in various forms such as Pellets/Granules (for molding/extrusion), Powder (for coatings, additive manufacturing), Films/Sheets (for insulation, membranes), Fibers (for composites, textiles), and other specialized shapes. The form dictates the processing method and final product configuration.

- By Processing Technology: Common processing methods include Injection Molding, Extrusion, Compression Molding, 3D Printing/Additive Manufacturing, and Machining. The choice of technology depends on the HPP type, desired part complexity, and production volume, with additive manufacturing emerging as a key growth area.

Regional Highlights

- North America: This region is a significant market for High Performance Polymers, driven by strong demand from the aerospace, medical, and automotive sectors. The presence of major HPP manufacturers and R&D centers, coupled with stringent performance and safety regulations, supports market growth. Increasing adoption of HPPs in electric vehicles and advanced manufacturing further fuels regional expansion.

- Europe: Europe represents a mature yet innovative market for HPPs, with robust demand from the automotive, industrial, and electrical & electronics industries. Strict environmental regulations and a strong focus on sustainability are propelling the development and adoption of bio-based and recyclable HPPs. Germany, France, and the UK are key contributors to market growth, driven by advanced engineering and manufacturing capabilities.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for High Performance Polymers, primarily due to the rapid industrialization, burgeoning manufacturing sector, and increasing disposable incomes in countries like China, India, Japan, and South Korea. The region's dominance in electronics manufacturing and the expanding automotive sector are key drivers. Investments in infrastructure development and renewable energy also contribute to HPP demand.

- Latin America: This region shows steady growth in HPP adoption, particularly in automotive and industrial applications. Increased foreign direct investment in manufacturing and a growing focus on improving industrial efficiency are contributing factors. Brazil and Mexico are leading the market in this region.

- Middle East and Africa (MEA): The MEA region is an emerging market for HPPs, with growth driven by investments in oil & gas, infrastructure, and diversification of economies away from traditional energy sectors. The demand for durable and high-temperature resistant materials in challenging operating environments supports HPP consumption, albeit from a smaller base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Performance Polymer Market.- Solvay S.A.

- Victrex PLC

- Daikin Industries, Ltd.

- Arkema S.A.

- DuPont de Nemours, Inc.

- Celanese Corporation

- BASF SE

- SABIC

- Kuraray Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Ensinger GmbH

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- DSM

- Lotte Chemical Corporation

- Toray Industries, Inc.

- Asahi Kasei Corporation

- Covestro AG

- DIC Corporation

- Saint-Gobain S.A.

Frequently Asked Questions

What is a High Performance Polymer (HPP)?

High Performance Polymers (HPPs) are a class of engineering plastics characterized by superior mechanical properties, thermal stability, and chemical resistance compared to conventional polymers. They are designed to operate reliably under extreme conditions, making them suitable for demanding applications in industries like aerospace, automotive, medical, and electronics.

Which industries are the primary consumers of High Performance Polymers?

The primary consumers of High Performance Polymers include the automotive sector (for lightweighting and engine components), aerospace and defense (for structural and interior parts), medical (for implants and surgical instruments), electrical and electronics (for insulation and connectors), and various industrial applications requiring high durability and chemical resistance.

What are the key drivers for the High Performance Polymer market growth?

Key drivers include the increasing demand for lightweight and fuel-efficient materials in automotive and aerospace, growing adoption in electric vehicles, stringent performance requirements in the medical and electronics sectors, and advancements in manufacturing technologies like 3D printing that expand application possibilities for HPPs.

What are the main challenges facing the High Performance Polymer market?

Major challenges include the inherently high cost of HPPs, complex processing requirements, intense competition from alternative materials, and a complex regulatory environment. These factors can limit widespread adoption and increase production complexities for manufacturers.

How is Artificial Intelligence (AI) impacting the High Performance Polymer market?

AI is impacting the HPP market by accelerating material discovery, optimizing polymer design and formulation, enhancing manufacturing process efficiency through predictive analytics, and improving quality control. AI-driven simulations can significantly reduce R&D cycles and costs for new HPPs.