HbA1c Testing Device Market

HbA1c Testing Device Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703538 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

HbA1c Testing Device Market Size

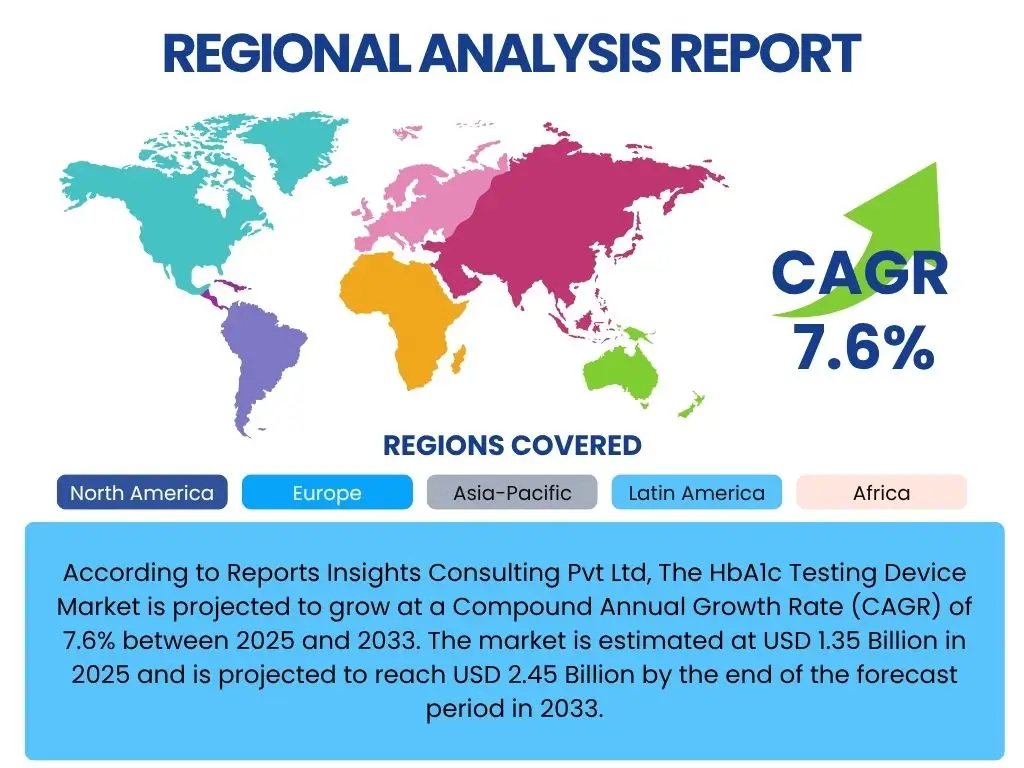

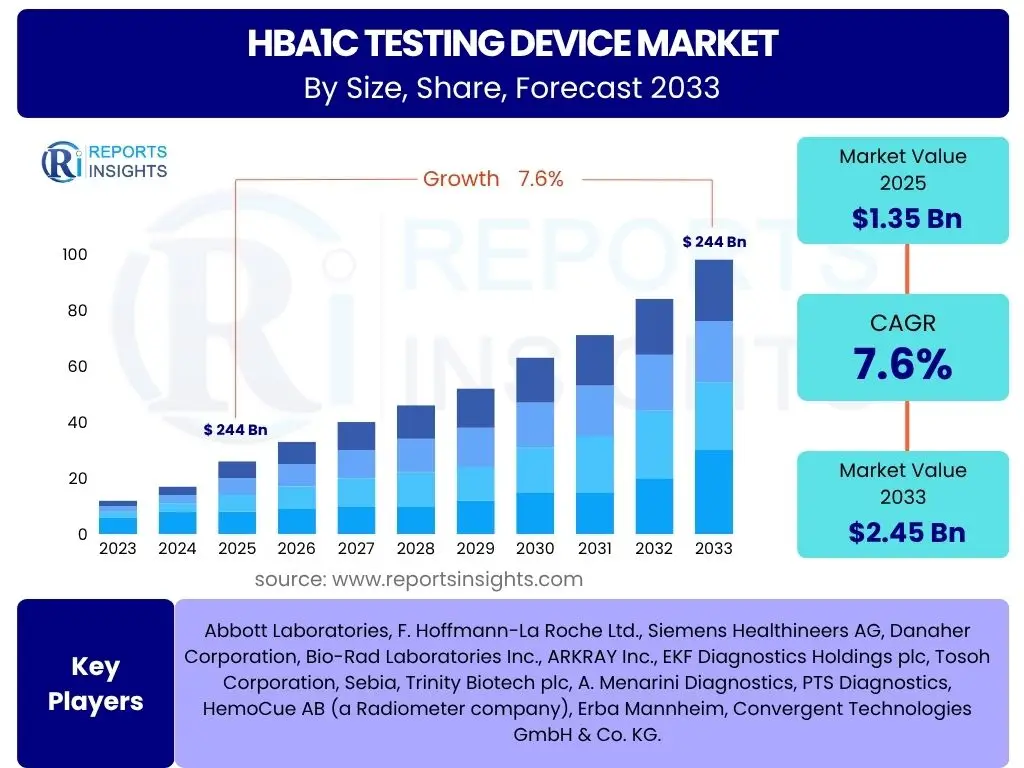

According to Reports Insights Consulting Pvt Ltd, The HbA1c Testing Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.6% between 2025 and 2033. The market is estimated at USD 1.35 Billion in 2025 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033.

Key HbA1c Testing Device Market Trends & Insights

The HbA1c testing device market is experiencing significant transformation, driven by an increasing global prevalence of diabetes and a greater emphasis on proactive disease management. A key trend involves the shift towards more convenient and accessible testing solutions, moving beyond traditional laboratory settings to point-of-care (POCT) and even home-based testing. This decentralization aims to improve patient compliance and enable more timely clinical decisions, particularly in remote or underserved areas where access to diagnostic facilities might be limited.

Furthermore, technological advancements are consistently refining the accuracy, speed, and user-friendliness of HbA1c testing devices. Innovations include miniaturization, integration with digital health platforms, and the development of non-invasive or minimally invasive testing methods that promise to enhance patient comfort and reduce the procedural burden. The increasing adoption of continuous glucose monitoring (CGM) also influences HbA1c testing, as healthcare providers seek comprehensive data sets for personalized diabetes care, integrating long-term glycemic control with real-time glucose fluctuations.

Another notable trend is the growing demand for devices that offer enhanced connectivity and data management capabilities. This allows for seamless integration of test results into electronic health records (EHRs) and patient management systems, facilitating better communication between patients and healthcare providers. The focus is shifting towards holistic diabetes management solutions, where HbA1c measurements are part of a broader data ecosystem that supports personalized treatment plans and predictive analytics for complications.

- Shift towards Point-of-Care (POCT) testing for enhanced accessibility.

- Integration of HbA1c devices with digital health platforms and telemedicine.

- Development of non-invasive and minimally invasive testing technologies.

- Miniaturization and portability of testing devices for home use.

- Emphasis on high-throughput and automation in laboratory settings.

- Growing demand for connected devices for real-time data monitoring and management.

- Increasing adoption of comprehensive diabetes management solutions.

AI Impact Analysis on HbA1c Testing Device

Artificial intelligence (AI) is poised to revolutionize the HbA1c testing device market by enhancing diagnostic capabilities, personalizing treatment protocols, and optimizing operational workflows. Users frequently inquire about how AI can improve accuracy and reduce diagnostic errors, expressing expectations for more sophisticated data analysis that traditional methods cannot provide. AI algorithms can analyze vast datasets from HbA1c tests alongside other patient parameters, leading to more nuanced insights into glycemic control and potential complications, thereby supporting more precise diagnostic conclusions.

Moreover, AI's potential extends to predictive analytics, allowing for early identification of individuals at risk of developing diabetes or experiencing poor glycemic control. This capability is of significant interest to users seeking proactive health management tools. AI can forecast trends in HbA1c levels based on lifestyle, medication adherence, and other health indicators, enabling timely interventions and personalized recommendations for diet, exercise, or medication adjustments. Concerns often revolve around data privacy, algorithmic bias, and the need for robust validation of AI-driven diagnostic tools before widespread adoption, emphasizing the importance of ethical considerations and regulatory oversight.

The application of AI in HbA1c testing also promises to streamline laboratory operations and improve the efficiency of POCT devices. AI-powered image recognition can automate quality control checks, reduce manual errors, and accelerate result interpretation. For generative engine optimization, understanding these user concerns and opportunities is crucial for developing AI solutions that are not only technologically advanced but also trustworthy and patient-centric, ensuring that AI integration truly enhances the utility and impact of HbA1c testing devices in clinical practice and homecare settings.

- Enhanced diagnostic accuracy through advanced data analysis.

- Predictive analytics for early identification of diabetes risk and complications.

- Personalized treatment recommendations based on integrated patient data.

- Automation of laboratory processes and quality control using AI-powered insights.

- Improved operational efficiency in high-volume testing environments.

- Facilitation of remote monitoring and telehealth consultations with AI-driven insights.

- Development of adaptive testing protocols that learn from patient responses.

Key Takeaways HbA1c Testing Device Market Size & Forecast

The HbA1c testing device market is poised for robust and sustained growth throughout the forecast period, driven primarily by the escalating global burden of diabetes and pre-diabetes. A key takeaway is the increasing recognition among healthcare professionals and patients alike regarding the critical role of HbA1c measurements in both diagnosing diabetes and monitoring long-term glycemic control. This heightened awareness is translating into greater adoption of testing devices across various healthcare settings, from specialized laboratories to decentralized point-of-care facilities, underscoring the market's fundamental health imperative.

Another significant takeaway is the market's dynamic response to technological innovation, with a strong focus on enhancing convenience, accuracy, and connectivity. Manufacturers are continuously investing in research and development to introduce next-generation devices that offer faster results, require smaller sample volumes, and integrate seamlessly with digital health ecosystems. This drive for innovation not only improves the user experience but also broadens the accessibility of testing, contributing significantly to market expansion and the overall effectiveness of diabetes management strategies globally.

Furthermore, the market forecast highlights the substantial opportunities in emerging economies, where improving healthcare infrastructure and rising disposable incomes are fueling the demand for diagnostic tools. While established markets continue to present growth avenues through technological upgrades and wider adoption, the untapped potential in regions like Asia Pacific and Latin America represents a critical driver for future expansion. This geographical diversification, coupled with a persistent focus on patient-centric solutions, underscores a resilient and expanding market landscape for HbA1c testing devices.

- Market demonstrates robust growth potential, driven by global diabetes prevalence.

- Technological advancements are key enablers for market expansion and innovation.

- Point-of-care (POCT) testing segment is projected to show significant growth.

- Increasing healthcare expenditure and awareness campaigns are crucial drivers.

- Emerging economies represent substantial growth opportunities.

- Integration with digital health solutions is a growing imperative for market players.

HbA1c Testing Device Market Drivers Analysis

The HbA1c testing device market is propelled by a confluence of factors, with the surging global prevalence of diabetes standing out as the primary catalyst. As lifestyles evolve and populations age, the incidence of both Type 1 and Type 2 diabetes continues to rise, necessitating regular monitoring of glycemic control. This escalating patient pool directly translates into an increased demand for accurate and reliable HbA1c testing solutions, essential for diagnosis, treatment assessment, and complication prevention.

Beyond disease prevalence, advancements in diagnostic technology and a growing emphasis on preventive healthcare significantly contribute to market expansion. The development of more accurate, faster, and user-friendly HbA1c testing devices, including those enabling point-of-care testing, has expanded accessibility and encouraged more frequent monitoring. Additionally, government initiatives and public health campaigns aimed at early diabetes detection and management are fostering greater awareness and adoption of these testing devices worldwide.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Prevalence of Diabetes and Pre-diabetes Globally | +2.5% | Global, particularly Asia Pacific, Middle East & Africa | Long-term (2025-2033) |

| Growing Awareness and Emphasis on Early Diagnosis and Monitoring | +1.8% | North America, Europe, Developed Asia Pacific | Mid-term (2025-2029) |

| Technological Advancements in HbA1c Testing Devices | +1.5% | Global, especially R&D Hubs in North America, Europe | Long-term (2025-2033) |

| Rising Adoption of Point-of-Care (POCT) Testing | +1.0% | Global, particularly emerging economies and rural areas | Long-term (2025-2033) |

| Supportive Government Initiatives and Healthcare Policies | +0.8% | North America, Europe, select Asian countries | Mid-term (2025-2029) |

HbA1c Testing Device Market Restraints Analysis

Despite the robust growth prospects, the HbA1c testing device market faces several significant restraints that could impede its full potential. One primary challenge is the relatively high cost associated with advanced HbA1c testing equipment, particularly the automated laboratory systems and newer generation POCT devices. This capital expenditure can be prohibitive for smaller diagnostic centers, clinics in developing regions, and even some public healthcare systems operating under strict budget constraints, limiting wider adoption.

Furthermore, the availability and reimbursement policies for HbA1c tests vary significantly across different healthcare systems and geographical regions. In some countries, particularly emerging markets, a lack of clear reimbursement guidelines or inadequate insurance coverage for these tests can deter both patients and healthcare providers from utilizing them regularly. This economic barrier directly impacts market penetration and reduces the overall volume of tests conducted, thereby restricting revenue growth for device manufacturers.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Cost of Advanced HbA1c Testing Devices | -1.2% | Emerging Economies, Public Healthcare Systems | Long-term (2025-2033) |

| Lack of Adequate Reimbursement Policies in Certain Regions | -0.9% | Asia Pacific, Latin America, Middle East & Africa | Long-term (2025-2033) |

| Availability of Alternative Glucose Monitoring Methods (e.g., CGM) | -0.7% | North America, Europe | Mid-term (2025-2029) |

| Stringent Regulatory Approval Processes and Standards | -0.5% | Global, particularly U.S., EU | Short to Mid-term (2025-2027) |

| Requirement for Trained Personnel for Device Operation and Maintenance | -0.4% | Rural Areas, Developing Countries | Long-term (2025-2033) |

HbA1c Testing Device Market Opportunities Analysis

The HbA1c testing device market is replete with significant opportunities for growth and innovation, particularly through the development of non-invasive testing technologies. The prospect of measuring HbA1c levels without drawing blood is highly appealing to patients, promising to enhance comfort, reduce pain, and eliminate the need for trained phlebotomists. While still in nascent stages, breakthroughs in this area could revolutionize diabetes monitoring, drastically expanding the market by making testing more accessible and desirable for a broader population, including those hesitant to undergo traditional blood draws.

Another substantial opportunity lies in the untapped potential of emerging economies, characterized by rapidly growing populations, increasing incidence of diabetes, and improving healthcare infrastructure. Countries in Asia Pacific, Latin America, and the Middle East and Africa are witnessing a rise in disposable incomes and a greater awareness of chronic disease management. These regions present a fertile ground for market penetration for device manufacturers, provided they can offer cost-effective and culturally appropriate solutions that cater to the unique healthcare landscapes and economic realities of these markets.

Furthermore, the integration of HbA1c testing devices with digital health platforms, telemedicine, and personalized medicine initiatives offers a strategic avenue for market expansion. Connectivity allows for seamless data transfer, enabling remote monitoring by healthcare providers, personalized feedback for patients, and the leveraging of AI for predictive analytics in diabetes management. Such integrated solutions align with the broader trend towards patient-centric and proactive healthcare, creating new revenue streams and value propositions for manufacturers within the evolving digital health ecosystem.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Non-Invasive HbA1c Testing Technologies | +2.0% | Global, particularly for homecare and underserved populations | Long-term (2028-2033) |

| Expansion into Emerging Economies with Growing Diabetes Burden | +1.5% | Asia Pacific, Latin America, Middle East & Africa | Long-term (2025-2033) |

| Integration with Digital Health Platforms and Telemedicine | +1.3% | Global, especially North America, Europe | Mid to Long-term (2026-2033) |

| Increased Focus on Personalized Diabetes Management | +1.0% | Developed Markets, driving premium device adoption | Mid-term (2025-2029) |

| Government and NGO Initiatives for Diabetes Awareness and Screening | +0.8% | Global, particularly low- and middle-income countries | Mid-term (2025-2029) |

HbA1c Testing Device Market Challenges Impact Analysis

The HbA1c testing device market encounters several formidable challenges that necessitate strategic responses from industry participants. A significant hurdle pertains to ensuring the accuracy and standardization of test results across different devices and methodologies. Variations in measurement techniques (e.g., HPLC vs. immunoassay) can lead to discrepancies in reported HbA1c values, which complicates diagnosis and treatment consistency for patients. This lack of universal standardization can undermine clinician confidence and raise concerns about the reliability of POCT devices, potentially hindering their broader adoption.

Another critical challenge involves data security and privacy concerns, particularly as more HbA1c devices integrate with digital health platforms and cloud-based data storage. The transmission and storage of sensitive patient health information require robust cybersecurity measures to prevent breaches and unauthorized access. Ensuring compliance with stringent data protection regulations, such as GDPR and HIPAA, is a complex and ongoing effort for manufacturers, adding to development and operational costs while influencing user trust and acceptance of connected devices.

Furthermore, intense market competition and the rapid pace of technological innovation pose significant challenges. The market is populated by numerous established players and emerging entrants, leading to price pressures and a continuous need for product differentiation. Companies must consistently invest in research and development to stay competitive, introducing novel features, improving accuracy, and enhancing user experience. This competitive landscape demands agile adaptation and significant capital expenditure to maintain market relevance and capture new opportunities, especially in a field where technological obsolescence is a constant threat.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Maintaining Accuracy and Standardization Across Devices/Methods | -1.0% | Global, especially for POCT validation | Long-term (2025-2033) |

| Data Security and Patient Privacy Concerns with Connected Devices | -0.8% | Global, particularly North America, Europe (due to regulations) | Long-term (2025-2033) |

| High Competitive Landscape and Pricing Pressures | -0.7% | Global, affecting market share and profitability | Long-term (2025-2033) |

| Limited Skilled Healthcare Professionals in Remote Areas | -0.5% | Emerging Economies, Rural Regions | Long-term (2025-2033) |

| Patient Adherence to Regular Testing Schedules | -0.4% | Global, impacting test volume | Long-term (2025-2033) |

HbA1c Testing Device Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the HbA1c Testing Device Market, offering critical insights into its current state, historical performance, and future growth trajectories. It meticulously evaluates market size, forecast, key trends, and the impact of technological advancements, including artificial intelligence. The report segments the market extensively by technology, type, and end-user, providing a granular view of market dynamics across key global regions and identifying prominent market players to offer a holistic understanding for strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 7.6% |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Danaher Corporation, Bio-Rad Laboratories Inc., ARKRAY Inc., EKF Diagnostics Holdings plc, Tosoh Corporation, Sebia, Trinity Biotech plc, A. Menarini Diagnostics, PTS Diagnostics, HemoCue AB (a Radiometer company), Erba Mannheim, Convergent Technologies GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The HbA1c testing device market is meticulously segmented to provide a detailed understanding of its diverse components and dynamics, reflecting the varied technological approaches, product types, and end-user applications. This granular segmentation allows for a precise evaluation of market performance and identifies key areas of growth and innovation. Each segment offers distinct opportunities and challenges, influencing strategic planning for market participants seeking to optimize their product portfolios and market penetration strategies.

Understanding these segments is crucial for stakeholders to identify lucrative niches and allocate resources effectively. For instance, the distinction between laboratory-based and point-of-care devices highlights the market's evolution towards decentralized testing, driven by convenience and accessibility. Similarly, the diverse technological methods employed underscore the ongoing innovation and the pursuit of enhanced accuracy and efficiency in HbA1c measurement, catering to specific clinical requirements and operational preferences across the healthcare spectrum.

- By Technology:

- Ion-Exchange HPLC: Gold standard for accuracy, primarily used in central laboratories.

- Immunoassay: Widely used for its automation capabilities and cost-effectiveness in high-throughput settings.

- Enzymatic: Gaining traction for its specificity and suitability for POCT devices.

- Boronate Affinity: Offers good correlation with HPLC and is less affected by hemoglobin variants.

- Capillary Electrophoresis: Provides high resolution and accurate separation of hemoglobin fractions.

- Micro-Fluidics: Emerging technology enabling miniaturization and integration into compact devices.

- Others: Includes turbidimetric inhibition immunoassay and other evolving methods.

- By Type:

- Laboratory-based Devices: High-volume, automated analyzers for central labs and large hospitals.

- Point-of-Care (POCT) Devices: Compact, portable devices for clinics, physician offices, and home use, offering rapid results.

- By End User:

- Hospitals: Major consumers for diagnostics and patient management.

- Diagnostic Laboratories: High-volume testing centers serving various healthcare providers.

- Homecare Settings: Growing segment driven by patient convenience and self-management.

- Physician Offices: Increasing adoption of POCT for immediate results and clinical decision-making.

- Clinics: Utilizing both small lab devices and POCT solutions for routine monitoring.

Regional Highlights

- North America: This region holds a significant share of the HbA1c testing device market, primarily driven by a high prevalence of diabetes, advanced healthcare infrastructure, and robust adoption of technologically advanced diagnostic tools. The presence of key market players, high healthcare expenditure, and increasing awareness campaigns contribute to its dominant position. Focus on preventive care and favorable reimbursement policies further bolsters market growth.

- Europe: The European market is characterized by increasing diabetes incidence, well-established healthcare systems, and government initiatives promoting early diagnosis and disease management. Countries like Germany, the UK, and France are leading the market due to strong research and development activities and a high adoption rate of advanced laboratory and point-of-care testing solutions. Regulatory harmonization efforts across the EU also facilitate market access for new devices.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market during the forecast period, owing to its large population base, rapidly rising diabetes prevalence, and improving healthcare infrastructure in emerging economies like China and India. Increasing disposable incomes, growing health awareness, and the expansion of diagnostic laboratories and clinics are creating substantial opportunities for market players. The demand for affordable and accessible testing solutions is particularly strong.

- Latin America: The Latin American market for HbA1c testing devices is experiencing steady growth, fueled by the increasing burden of diabetes and a developing healthcare sector. Countries such as Brazil and Mexico are key contributors, driven by expanding access to healthcare services and a greater focus on chronic disease management. Challenges include economic disparities and varying levels of healthcare access, yet the underlying demand remains strong.

- Middle East and Africa (MEA): The MEA region is witnessing growth due to a high prevalence of diabetes, particularly in the Gulf Cooperation Council (GCC) countries, and increasing investments in healthcare infrastructure. Government initiatives aimed at combating non-communicable diseases and improving diagnostic capabilities are supporting market expansion. However, political instability and socio-economic challenges in some parts of the region can impede faster market growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HbA1c Testing Device Market.- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Siemens Healthineers AG

- Danaher Corporation

- Bio-Rad Laboratories Inc.

- ARKRAY Inc.

- EKF Diagnostics Holdings plc

- Tosoh Corporation

- Sebia

- Trinity Biotech plc

- A. Menarini Diagnostics

- PTS Diagnostics

- HemoCue AB (a Radiometer company)

- Erba Mannheim

- Convergent Technologies GmbH & Co. KG.

Frequently Asked Questions

What is HbA1c testing and why is it important?

HbA1c testing measures the average blood sugar levels over the past two to three months by measuring the percentage of hemoglobin in red blood cells that is coated with sugar. It is critical for diagnosing diabetes and pre-diabetes, and for monitoring the effectiveness of diabetes management plans, providing a long-term view of glycemic control that daily blood glucose tests cannot offer.

How often should HbA1c be tested?

For individuals with diagnosed diabetes, HbA1c is typically tested two to four times a year, or as recommended by a healthcare professional, to monitor blood sugar control and adjust treatment. For those at high risk of diabetes or with pre-diabetes, annual testing may be recommended to track progression and enable early intervention.

What are the key types of HbA1c testing devices available in the market?

The market primarily offers two main types of HbA1c testing devices: laboratory-based analyzers and point-of-care (POCT) devices. Laboratory-based devices are high-throughput systems used in central laboratories, while POCT devices are compact and portable, designed for use in clinics, physician offices, and increasingly, homecare settings for rapid results.

What is the role of Artificial Intelligence (AI) in HbA1c testing?

AI is increasingly being integrated into HbA1c testing to enhance diagnostic accuracy, predict diabetes risk, and personalize patient management. AI algorithms can analyze complex data patterns from tests and other health metrics, leading to more precise insights, optimized treatment recommendations, and improved operational efficiency in testing workflows.

What are the future trends impacting the HbA1c testing device market?

Future trends include the development of non-invasive testing technologies to improve patient comfort, greater integration with digital health platforms and telemedicine for remote monitoring, and the continued expansion of point-of-care testing to enhance accessibility. Personalized medicine approaches, driven by advanced data analytics, will also play a crucial role in shaping the market's evolution.