Gluten Feed Market

Gluten Feed Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701530 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Gluten Feed Market Size

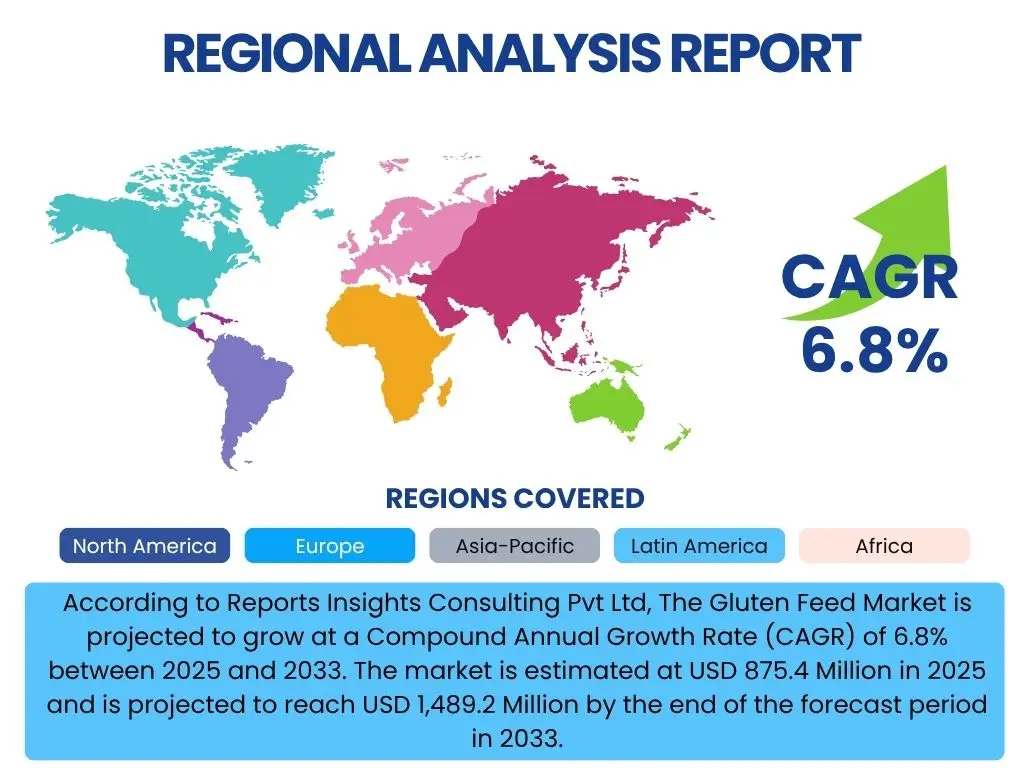

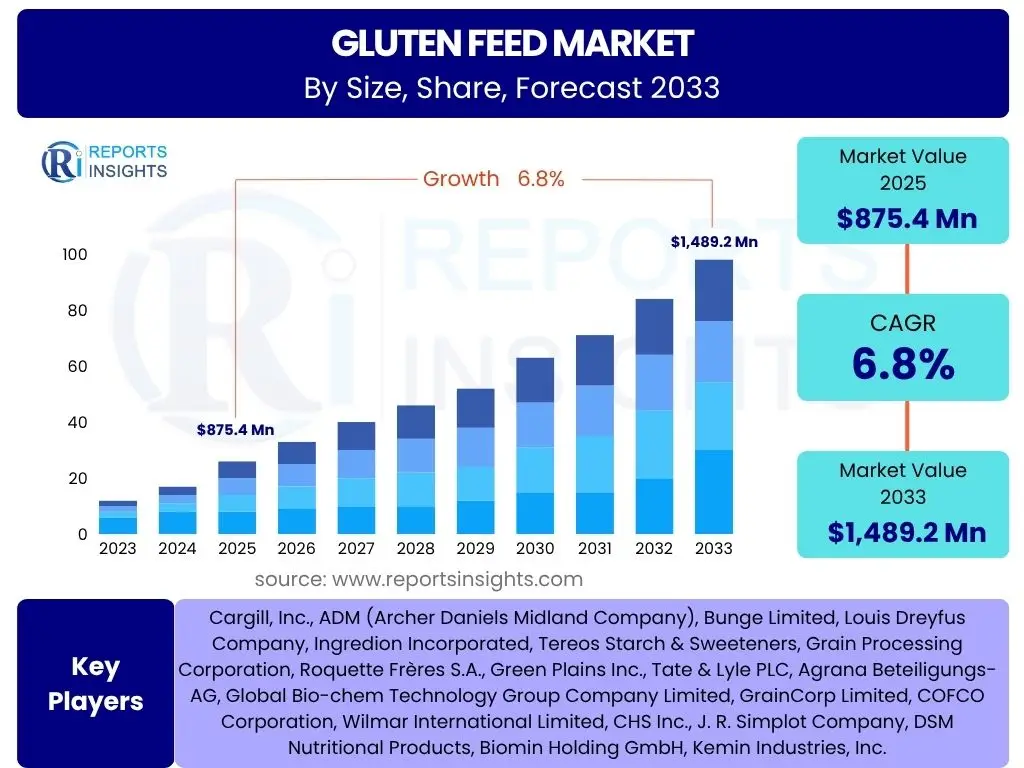

According to Reports Insights Consulting Pvt Ltd, The Gluten Feed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 875.4 Million in 2025 and is projected to reach USD 1,489.2 Million by the end of the forecast period in 2033.

Key Gluten Feed Market Trends & Insights

The global gluten feed market is experiencing dynamic shifts, primarily driven by the escalating demand for animal protein and the continuous expansion of the livestock industry. Users frequently inquire about the innovative applications of gluten feed beyond traditional livestock, its role in sustainable agriculture, and the evolving nutritional requirements for animal health. Key trends point towards enhanced processing techniques to improve digestibility and nutrient content, increasing adoption in diversified animal feed formulations including aquaculture, and a growing emphasis on optimizing feed conversion ratios through cost-effective and nutrient-rich by-products.

Furthermore, the market is witnessing a move towards greater efficiency in resource utilization within the food processing industry, with gluten feed standing out as a valuable co-product. There is also a notable trend in research and development aimed at fortifying gluten feed with additional vitamins, minerals, or amino acids to create specialized animal nutrition products. This aligns with a broader industry push for sustainable practices, minimizing waste, and maximizing the value derived from agricultural outputs.

- Increasing demand for animal protein globally, particularly in emerging economies.

- Growing adoption of gluten feed as a cost-effective and protein-rich ingredient in livestock and aquaculture feed.

- Advancements in feed formulation technologies enhancing the nutritional profile and digestibility of gluten feed.

- Rising focus on sustainable agricultural practices and the utilization of by-products from the starch industry.

- Diversification of application areas, including pet food and specialized animal nutrition.

AI Impact Analysis on Gluten Feed

User inquiries frequently center on how artificial intelligence (AI) can revolutionize the production, distribution, and utilization of gluten feed. The primary concerns and expectations revolve around AI's ability to optimize feed formulations, predict market demand and supply fluctuations, and enhance quality control throughout the supply chain. AI-driven analytics are expected to lead to more precise nutritional management for livestock, reducing waste and improving overall animal health and productivity, thereby directly influencing the demand and value proposition of gluten feed.

AI's influence extends to process optimization in corn and wheat processing plants, potentially improving the efficiency of gluten feed extraction and quality consistency. Predictive modeling can assist producers in managing inventory, optimizing logistics, and responding proactively to market shifts, such as changes in raw material prices or demand from different animal sectors. The integration of AI in supply chain management can also contribute to greater transparency and traceability, addressing consumer and regulatory requirements for feed ingredients.

- AI-powered optimization of animal feed formulations, enhancing nutritional balance and cost-effectiveness.

- Predictive analytics for more accurate supply chain management and demand forecasting for gluten feed.

- Automated quality control systems leveraging AI for consistent product quality and safety.

- Enhanced efficiency in the production process of gluten feed through AI-driven operational insights.

- Development of smart farming systems utilizing AI to monitor livestock health and optimize feed intake, indirectly boosting demand for quality ingredients like gluten feed.

Key Takeaways Gluten Feed Market Size & Forecast

Common user questions regarding the Gluten Feed market size and forecast often focus on identifying the primary growth engines, the regions expected to exhibit significant expansion, and the underlying factors contributing to the market's long-term sustainability. Insights reveal that the consistent growth of the global livestock and aquaculture industries is the predominant driver, supported by the cost-efficiency and high nutritional value gluten feed offers as an animal feed ingredient. The forecast indicates sustained expansion, with emerging economies playing a crucial role in driving demand due to increasing meat and dairy consumption.

Furthermore, the market's trajectory is reinforced by ongoing innovations in feed science and the increasing emphasis on utilizing by-products for economic and environmental benefits. Stakeholders are keen on understanding where the most lucrative investment opportunities lie, with a clear focus on regions experiencing rapid industrialization of animal farming. The market's resilience is also attributed to its versatility across different animal species, ensuring a broad and stable demand base.

- The market is poised for robust growth, driven primarily by the escalating global demand for animal protein and subsequent expansion of the livestock industry.

- Gluten feed remains a highly cost-effective and nutrient-dense alternative to traditional feed ingredients, ensuring its sustained market relevance.

- Significant growth opportunities exist in emerging economies, particularly in Asia Pacific and Latin America, owing to rising disposable incomes and changing dietary patterns.

- Technological advancements in feed processing and formulation will continue to enhance the quality and applicability of gluten feed, fostering wider adoption.

- The market's stability is underpinned by its critical role in sustainable agriculture, transforming co-products into valuable feed resources.

Gluten Feed Market Drivers Analysis

The gluten feed market is propelled by a confluence of factors, primarily stemming from the global animal agriculture sector. The ever-increasing human population and rising disposable incomes, particularly in developing nations, are directly contributing to a surge in demand for meat, dairy, and aquaculture products. This, in turn, necessitates a consistent and efficient supply of animal feed, making gluten feed a critical component due to its protein and energy content. Its cost-effectiveness compared to other high-protein feed ingredients also makes it an attractive option for livestock producers looking to optimize production costs.

Moreover, growing awareness among farmers and feed manufacturers about balanced animal nutrition is driving the incorporation of diverse ingredients like gluten feed into feed formulations. The industry's push for sustainable practices, including the efficient utilization of by-products from the starch and ethanol industries, further bolsters the demand for gluten feed as a valuable co-product. Regulatory frameworks that support responsible waste management and circular economy principles also implicitly favor the use of such recycled nutrients in the feed chain.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing livestock and aquaculture industries | +1.2% | Global, particularly Asia Pacific & Latin America | Mid to Long-term (2025-2033) |

| Rising demand for animal protein | +1.0% | Global, especially China, India, Brazil | Mid to Long-term (2025-2033) |

| Cost-effectiveness compared to alternative feed proteins | +0.8% | Global | Short to Mid-term (2025-2029) |

| Increased focus on sustainable feed ingredients | +0.7% | North America, Europe, China | Mid to Long-term (2027-2033) |

| Advancements in animal nutrition research | +0.6% | Global | Long-term (2028-2033) |

Gluten Feed Market Restraints Analysis

Despite robust growth drivers, the gluten feed market faces certain restraints that could impede its full potential. The primary challenge stems from the inherent volatility in raw material prices, particularly corn, which is a major source for gluten feed production. Fluctuations in corn yields due to weather patterns, geopolitical events, and biofuel demand can directly impact the cost and availability of gluten feed, introducing uncertainty for producers and buyers alike. This price instability can make long-term planning challenging and may encourage some feed manufacturers to seek more stable alternatives.

Another significant restraint is the increasing availability and development of alternative feed ingredients, including novel proteins and synthetic amino acids. As research continues to yield new and potentially more efficient feed components, gluten feed might face intensified competition, leading to pressure on its market share or pricing. Furthermore, occasional supply chain disruptions, whether due to logistics, trade policies, or unforeseen global events, can temporarily hinder the smooth flow of gluten feed from producers to end-users, affecting market stability and regional pricing disparities.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in corn prices | -0.8% | Global, particularly North America, South America | Short to Mid-term (2025-2029) |

| Availability of alternative feed ingredients | -0.6% | Global | Mid to Long-term (2027-2033) |

| Supply chain and logistics challenges | -0.4% | Regional, specific trade routes | Short-term (2025-2027) |

| Perception of by-product quality | -0.3% | Specific consumer markets, developed regions | Mid-term (2026-2030) |

Gluten Feed Market Opportunities Analysis

Significant opportunities abound in the gluten feed market, particularly in expanding its application beyond traditional livestock. The burgeoning aquaculture industry, for instance, presents a substantial avenue for growth, as gluten feed can serve as a valuable protein source for various aquatic species. Innovations in processing technologies are enabling the production of higher-quality and more specialized gluten feed products, catering to specific nutritional requirements of different animal types, thereby opening new premium segments. Furthermore, the global drive towards sustainable food systems and waste reduction strongly favors the increased utilization of co-products like gluten feed, aligning with environmental goals and creating a positive market narrative.

Market penetration in developing regions, where animal farming is rapidly professionalizing and expanding, offers another lucrative opportunity. These regions often seek cost-effective yet nutritious feed solutions to support their growing animal protein production. Moreover, strategic partnerships between gluten feed producers and large-scale animal farms or feed manufacturers can foster stability and open new distribution channels. The increasing research into enhancing the digestibility and amino acid profile of gluten feed also presents opportunities for product differentiation and increased market value, ensuring its competitive edge against synthetic or more expensive protein sources.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into aquaculture feed applications | +0.9% | Asia Pacific, Latin America, Europe | Mid to Long-term (2026-2033) |

| Growth in pet food segment | +0.7% | North America, Europe | Mid-term (2027-2031) |

| Technological advancements for enhanced nutrient profile | +0.6% | Global | Long-term (2028-2033) |

| Untapped markets in developing countries | +0.8% | Africa, Southeast Asia | Mid to Long-term (2026-2033) |

| Increased emphasis on circular economy principles | +0.5% | Global | Long-term (2029-2033) |

Gluten Feed Market Challenges Impact Analysis

The gluten feed market faces several challenges that require strategic navigation. One key hurdle is the intense competition from a wide array of substitute feed ingredients, ranging from soybean meal and fish meal to various agricultural by-products. This competitive landscape puts constant pressure on pricing and market share, necessitating continuous innovation in production efficiency and product quality for gluten feed manufacturers. Maintaining consistent product quality and nutrient composition is another significant challenge, as variability in raw material sources and processing techniques can lead to inconsistencies that impact its appeal to discerning feed formulators.

Furthermore, logistics and storage pose considerable challenges, particularly for bulk materials like gluten feed. Efficient transportation networks and appropriate storage facilities are crucial to prevent spoilage and maintain quality, especially across diverse geographical regions. Trade barriers and tariffs, which can fluctuate due to geopolitical tensions or protectionist policies, can also disrupt global supply chains and impact the competitiveness of imported gluten feed in certain markets. Overcoming these challenges will require robust supply chain management, investment in technology, and adaptability to evolving market dynamics and regulations.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense competition from substitute feed ingredients | -0.7% | Global | Mid to Long-term (2025-2033) |

| Maintaining consistent product quality and nutrient profile | -0.5% | Global | Short to Mid-term (2025-2029) |

| Logistics, transportation, and storage complexities | -0.4% | Regional, specific large markets | Short-term (2025-2027) |

| Trade policies and import/export regulations | -0.3% | Specific trade blocs, major importing/exporting nations | Short to Mid-term (2025-2029) |

Gluten Feed Market - Updated Report Scope

This comprehensive market research report delves into the intricate dynamics of the global Gluten Feed market, offering a detailed analysis of its current size, historical performance, and future growth projections. It provides an in-depth exploration of key market trends, growth drivers, inherent restraints, emerging opportunities, and significant challenges impacting the industry. The report segments the market by various parameters including product type, application, form, and distribution channel, providing granular insights into each segment's contribution and potential. Furthermore, a thorough regional analysis covers major geographies, highlighting their unique market characteristics and growth trajectories. The study also profiles key market players, assessing their strategies, market positioning, and recent developments to offer a holistic understanding of the competitive landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 875.4 Million |

| Market Forecast in 2033 | USD 1,489.2 Million |

| Growth Rate | 6.8% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Inc., ADM (Archer Daniels Midland Company), Bunge Limited, Louis Dreyfus Company, Ingredion Incorporated, Tereos Starch & Sweeteners, Grain Processing Corporation, Roquette Frères S.A., Green Plains Inc., Tate & Lyle PLC, Agrana Beteiligungs-AG, Global Bio-chem Technology Group Company Limited, GrainCorp Limited, COFCO Corporation, Wilmar International Limited, CHS Inc., J. R. Simplot Company, DSM Nutritional Products, Biomin Holding GmbH, Kemin Industries, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Gluten Feed market is extensively segmented to provide a nuanced understanding of its various components and their respective contributions to the overall market dynamics. This segmentation is crucial for stakeholders to identify specific growth areas, target niche applications, and develop tailored strategies. The market is primarily broken down by the type of grain from which the gluten feed is derived, the end-use application in animal nutrition, the physical form in which it is supplied, and the channels through which it reaches the market.

Each segment holds unique characteristics and growth potentials. For instance, corn gluten feed dominates the market due to the widespread availability of corn and its established use, while the rapidly expanding aquaculture sector is significantly driving the application segment. Understanding these intricate segmentations allows for precise market forecasting and strategic planning, highlighting areas of high growth and potential investment across the value chain, from raw material processing to final feed formulation and distribution.

- By Type:

- Corn Gluten Feed: Dominant segment due to vast corn processing industry, high protein and energy content.

- Wheat Gluten Feed: Significant in regions with large wheat processing, offering alternative nutrient profiles.

- Barley Gluten Feed: Niche but growing, utilized where barley is a primary crop.

- By Application:

- Ruminant Feed: Largest application, crucial for cattle, sheep, and goats.

- Swine Feed: Important for pig nutrition, contributing to growth and feed efficiency.

- Poultry Feed: Widely used for chickens, turkeys, and ducks for protein and energy.

- Aquaculture Feed: Rapidly growing segment for fish and shrimp farming.

- Pet Food: Emerging application for various domestic animals.

- By Form:

- Pellets: Preferred for ease of handling, storage, and reduced dust.

- Powder: Used in specific formulations or where fine mixing is required.

- Crumbles: Often used for younger animals or specific feed types.

- By Distribution Channel:

- Direct Sales: Large volume sales directly to major feed manufacturers or large farms.

- Indirect Sales: Through distributors and retailers catering to smaller farms and diverse markets.

Regional Highlights

- North America: A mature market driven by large-scale livestock farming, advanced feed manufacturing infrastructure, and a strong emphasis on feed efficiency. The U.S. remains a key producer and consumer, leveraging its extensive corn industry. Innovations in animal nutrition and sustainable practices continue to shape the regional market.

- Europe: Characterized by stringent regulations on animal feed quality and safety, leading to demand for high-quality, traceable gluten feed. The region focuses on optimizing existing livestock operations and increasingly incorporates by-products to meet sustainability goals. Germany, France, and the Netherlands are significant markets.

- Asia Pacific (APAC): The fastest-growing region, fueled by expanding populations, rising disposable incomes, and a monumental increase in meat and dairy consumption. Countries like China, India, and Southeast Asian nations are witnessing rapid industrialization of animal agriculture, driving immense demand for cost-effective protein sources like gluten feed. Aquaculture expansion is a major contributor here.

- Latin America: Experiences substantial growth due to vast agricultural resources and a burgeoning livestock industry, particularly in Brazil and Argentina. The region serves as a significant producer and consumer, driven by both domestic demand and export opportunities for animal products.

- Middle East and Africa (MEA): An emerging market with growing demand influenced by increasing population, urbanization, and investments in modern farming techniques. While smaller in scale currently, the region presents long-term growth potential as food security initiatives and agricultural development gain momentum.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gluten Feed Market.- Cargill, Inc.

- ADM (Archer Daniels Midland Company)

- Bunge Limited

- Louis Dreyfus Company

- Ingredion Incorporated

- Tereos Starch & Sweeteners

- Grain Processing Corporation

- Roquette Frères S.A.

- Green Plains Inc.

- Tate & Lyle PLC

- Agrana Beteiligungs-AG

- Global Bio-chem Technology Group Company Limited

- GrainCorp Limited

- COFCO Corporation

- Wilmar International Limited

- CHS Inc.

- J. R. Simplot Company

- DSM Nutritional Products

- Biomin Holding GmbH

- Kemin Industries, Inc.

Frequently Asked Questions

What is gluten feed and what are its primary uses?

Gluten feed is a nutritious co-product derived from the wet milling of corn or wheat, primarily after starch and gluten extraction. It is rich in protein, fiber, and energy, making it a valuable and cost-effective ingredient predominantly used in animal feed formulations for ruminants, poultry, swine, and increasingly in aquaculture and pet food.

What factors are driving the growth of the Gluten Feed market?

The market's growth is primarily driven by the escalating global demand for animal protein, leading to significant expansion in the livestock and aquaculture industries. Additionally, its cost-effectiveness compared to other protein sources, coupled with a growing focus on sustainable utilization of agricultural by-products, further fuels market expansion.

Which regions are key contributors to the Gluten Feed market, and why?

North America and Europe are major contributors due to well-established animal agriculture sectors and advanced feed industries. However, Asia Pacific is the fastest-growing region, propelled by rapid industrialization of farming and increasing meat consumption in countries like China and India, making it a critical growth hub.

How does AI impact the Gluten Feed market?

AI is increasingly impacting the gluten feed market through optimized feed formulation for improved animal nutrition and reduced waste. It also aids in predictive analytics for supply chain management, quality control automation, and market forecasting, contributing to greater efficiency and responsiveness across the industry.

What are the main challenges facing the Gluten Feed market?

Key challenges include the volatility of raw material prices (especially corn), intense competition from various substitute feed ingredients, maintaining consistent product quality, and navigating complex logistics and trade policies. Overcoming these requires continuous innovation and robust supply chain strategies.