Animal Compound Feed Market

Animal Compound Feed Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706144 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Animal Compound Feed Market Size

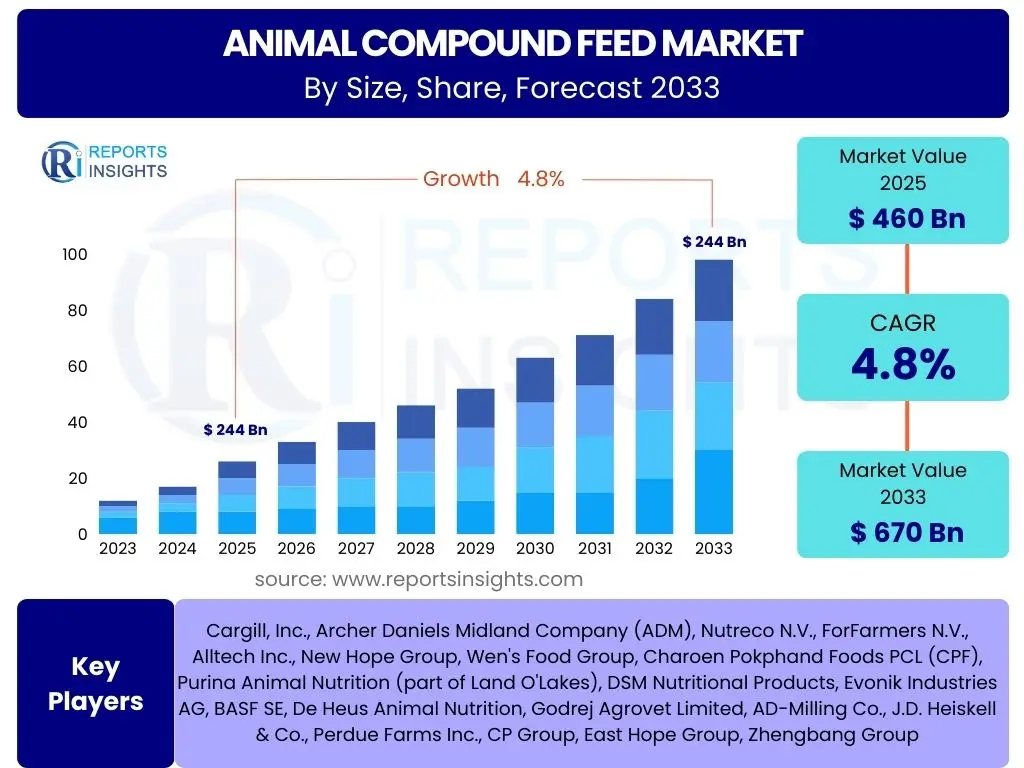

According to Reports Insights Consulting Pvt Ltd, The Animal Compound Feed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2033. The market is estimated at USD 460 Billion in 2025 and is projected to reach USD 670 Billion by the end of the forecast period in 2033.

Key Animal Compound Feed Market Trends & Insights

The animal compound feed market is experiencing a dynamic transformation driven by evolving consumer demands, technological advancements, and a heightened focus on sustainability. Key user inquiries frequently center on how these shifts influence feed formulation, production practices, and supply chain management. There is significant interest in understanding the adoption of alternative protein sources, the role of precision nutrition in optimizing animal performance and health, and the growing emphasis on feed safety and traceability. Furthermore, discussions often revolve around the impact of digitalization and automation on feed manufacturing efficiency and quality control, alongside the increasing push for environmentally friendly production methods and reduced antibiotic use.

The global shift towards sustainable animal protein production necessitates innovative feed solutions that minimize environmental impact while maximizing nutritional efficiency. This includes exploring novel ingredients and optimizing nutrient utilization to reduce waste and greenhouse gas emissions. Additionally, the industrialization of livestock and aquaculture operations in developing economies is fueling demand for high-quality, scientifically formulated compound feeds, pushing manufacturers to invest in research and development to meet diverse animal nutritional requirements across different life stages and production systems.

- Rising demand for sustainable and alternative protein sources in animal diets, including insect meal, algae, and microbial proteins.

- Increasing adoption of precision nutrition techniques and customized feed formulations for improved animal health, performance, and reduced input costs.

- Growing emphasis on feed safety, traceability, and the use of natural feed additives to minimize antibiotic growth promoters.

- Technological integration, including automation, IoT, and data analytics, in feed mills for enhanced operational efficiency and quality control.

- Expansion of aquaculture and poultry sectors, driving demand for specialized and high-performance compound feeds.

- Focus on gut health and immunity through functional feed ingredients like prebiotics, probiotics, and essential oils.

AI Impact Analysis on Animal Compound Feed

User inquiries concerning Artificial Intelligence (AI) in the animal compound feed sector frequently explore its potential to revolutionize feed formulation, supply chain optimization, and animal health management. Key themes include the benefits of AI-driven predictive analytics for ingredient sourcing and pricing, its application in optimizing nutrient profiles for specific animal needs, and its role in enhancing overall operational efficiency within feed mills. There are also notable concerns regarding data privacy, the initial investment required for AI infrastructure, and the need for skilled personnel to manage and interpret AI-generated insights, highlighting a cautious yet optimistic outlook on its transformative capabilities.

AI's influence extends beyond mere efficiency gains, offering unprecedented opportunities for personalization and responsiveness in feed production. By analyzing vast datasets related to animal genetics, environmental conditions, and raw material availability, AI algorithms can predict optimal feed formulations that enhance growth rates, improve feed conversion ratios, and bolster disease resistance. This advanced analytical capability not only leads to significant cost savings for producers but also contributes to more sustainable agricultural practices by minimizing waste and maximizing resource utilization throughout the animal protein value chain.

- Optimizing feed formulations: AI algorithms analyze vast datasets to create precise, cost-effective, and nutritionally balanced feed recipes.

- Predictive analytics for raw material sourcing: AI predicts price fluctuations and availability of ingredients, enabling strategic procurement.

- Enhanced supply chain management: AI optimizes logistics, inventory management, and distribution, reducing waste and improving delivery times.

- Disease detection and prevention: AI-powered monitoring systems can identify early signs of illness in livestock, leading to targeted nutritional interventions.

- Improved animal performance and health: AI personalizes feeding regimes based on individual animal data, maximizing growth and well-being.

- Automated quality control: AI vision systems and sensors detect contaminants or inconsistencies in feed production, ensuring product safety and quality.

Key Takeaways Animal Compound Feed Market Size & Forecast

The analysis of common user questions regarding the animal compound feed market size and forecast reveals a strong interest in understanding the underlying drivers of growth, the resilience of the market against external shocks, and the long-term sustainability outlook. Users frequently inquire about the impact of demographic shifts, particularly global population growth and increasing per capita meat consumption, on future demand. Additionally, there is curiosity about how technological advancements in feed production and animal husbandry will influence market expansion, alongside concerns about geopolitical stability and regulatory environments affecting trade and raw material supply. The overall sentiment points towards a robust and expanding market, underpinned by fundamental demand for animal protein.

The forecast period indicates a steady and significant expansion of the market, primarily fueled by the continued industrialization of livestock farming across emerging economies and the consistent innovation in feed science. While challenges such as raw material price volatility and disease outbreaks persist, the market demonstrates adaptability through diversification of feed ingredients and adoption of advanced production techniques. The emphasis on efficiency, animal welfare, and environmental sustainability is not merely a trend but a fundamental pillar supporting the sustained growth trajectory, ensuring that compound feed remains a critical component of global food security.

- Consistent market growth: The animal compound feed market is projected for robust expansion, driven by increasing global demand for animal protein.

- Significant value increase: The market is expected to grow from USD 460 Billion in 2025 to USD 670 Billion by 2033, demonstrating substantial revenue potential.

- Key growth drivers: Population growth, rising disposable incomes, and the industrialization of livestock farming are primary contributors to market expansion.

- Technological advancements: Innovations in feed formulation, processing, and nutrient utilization are pivotal in enhancing market value and efficiency.

- Focus on sustainability: Growing consumer and regulatory pressure for sustainable animal protein production is shaping feed ingredient choices and production methods.

- Emerging market opportunities: Rapid growth in Asia Pacific, Latin America, and Africa presents significant opportunities for market players.

Animal Compound Feed Market Drivers Analysis

The animal compound feed market's robust growth is primarily propelled by an escalating global demand for animal protein, driven by population growth and rising disposable incomes, particularly in developing economies. As urbanization increases and dietary preferences shift towards meat, dairy, and aquaculture products, the need for efficient and high-quality feed solutions becomes paramount. The industrialization and commercialization of livestock farming further amplify this demand, as large-scale operations rely heavily on scientifically formulated compound feeds to optimize animal health, growth rates, and productivity, ensuring a consistent and reliable supply of animal products to consumers.

Beyond direct consumption, increasing awareness among farmers and producers regarding the economic benefits of optimized animal nutrition also acts as a significant driver. High-quality compound feeds lead to improved feed conversion ratios, reduced disease incidence, and enhanced overall animal performance, translating into greater profitability for the livestock sector. Furthermore, advancements in animal genetics and breeding programs necessitate specialized nutritional support, pushing the demand for tailored compound feed solutions that can maximize the genetic potential of modern animal breeds, thus contributing significantly to the market's upward trajectory.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Global Demand for Animal Protein | +1.2% | Asia Pacific, Latin America, Middle East | Long-term (2025-2033) |

| Industrialization of Livestock and Aquaculture | +1.0% | China, India, Brazil, Southeast Asia | Medium-term (2025-2029) |

| Growing Awareness of Animal Nutrition & Health | +0.8% | North America, Europe, Developed Asia | Medium-term (2026-2030) |

| Technological Advancements in Feed Production | +0.7% | Global, particularly developed regions | Long-term (2025-2033) |

Animal Compound Feed Market Restraints Analysis

The animal compound feed market faces significant restraints, primarily stemming from the volatility and increasing prices of raw materials. Key ingredients such as corn, soybean meal, and fishmeal are susceptible to price fluctuations influenced by weather patterns, geopolitical events, trade policies, and global supply-demand dynamics. This volatility directly impacts production costs for feed manufacturers, potentially squeezing profit margins and leading to higher end-product prices, which can dampen demand from livestock farmers. Furthermore, the reliance on a few major commodity crops for feed production exposes the market to supply chain risks and can limit innovation in alternative ingredients, hindering diversification efforts.

Stringent regulatory frameworks concerning feed safety, environmental impact, and antibiotic use also present considerable hurdles. While these regulations are crucial for consumer safety and sustainable practices, they often lead to increased compliance costs, require significant investment in research and development for new formulations, and can restrict the use of certain additives or ingredients. Disease outbreaks in livestock, such as African Swine Fever or Avian Influenza, can severely impact animal populations, leading to reduced feed consumption and significant economic losses for the entire value chain. These factors collectively contribute to market instability and can impede the steady growth of the animal compound feed sector.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Raw Material Prices | -0.9% | Global, particularly import-reliant regions | Short-to-Medium term (2025-2028) |

| Stringent Regulatory Frameworks | -0.7% | Europe, North America, Japan | Long-term (2025-2033) |

| Outbreaks of Animal Diseases | -0.6% | Specific affected regions (e.g., Asia for ASF) | Short-term (localized, impactful) |

| Environmental Concerns & Pressure on Livestock Farming | -0.5% | Europe, North America | Long-term (2027-2033) |

Animal Compound Feed Market Opportunities Analysis

The animal compound feed market is poised for significant growth through numerous emerging opportunities. A primary area of potential lies in the increasing demand for specialized and functional feeds, which cater to specific animal life stages, health conditions, or production goals. This includes feeds for enhanced immunity, improved gut health, or specific nutrient profiles for high-yield livestock. As consumers become more conscious of animal welfare and the nutritional quality of their food, there is a growing market for feeds that support sustainable farming practices, antibiotic-free production, and organic certification, presenting premium market segments for innovative manufacturers.

Furthermore, the exploration and adoption of novel and sustainable feed ingredients present a substantial opportunity to diversify raw material sourcing, reduce reliance on conventional crops, and improve environmental footprints. Ingredients such as insect proteins, algae, single-cell proteins, and by-products from the food industry offer alternatives that can enhance nutritional value while addressing sustainability concerns. Expansion into untapped or emerging markets, particularly in Africa and parts of Asia, also represents a significant growth avenue, as these regions experience rapid urbanization and increasing per capita meat consumption, driving the need for advanced feed solutions and modern farming practices.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Demand for Specialized & Functional Feeds | +1.1% | Global, particularly developed markets | Long-term (2025-2033) |

| Development of Sustainable & Novel Feed Ingredients | +0.9% | Europe, North America, Innovating countries | Medium-to-Long term (2026-2033) |

| Expansion into Emerging Economies | +0.8% | Africa, Southeast Asia, Latin America | Long-term (2025-2033) |

| Integration of Digitalization & Precision Farming | +0.7% | Global, particularly large-scale operations | Medium-to-Long term (2027-2033) |

Animal Compound Feed Market Challenges Impact Analysis

The animal compound feed market is confronted with several significant challenges that can impede its growth and stability. One prominent challenge is the increasing concern regarding antimicrobial resistance (AMR) in livestock, which is leading to stricter regulations on the use of antibiotics as growth promoters in feed. This necessitates substantial investment in research and development to find effective natural alternatives and adapt feed formulations, posing a compliance burden and potential cost increases for manufacturers. Additionally, consumer perceptions and evolving dietary preferences, such as the growing interest in plant-based diets, could gradually shift demand away from traditional animal protein sources, indirectly impacting the feed market in the long term, particularly in developed regions.

Supply chain disruptions, whether due to geopolitical conflicts, extreme weather events, or pandemics, pose a continuous threat to the consistent availability and pricing of raw materials. The global nature of feed ingredient sourcing means that localized disruptions can have ripple effects across the entire market, leading to shortages and significant price hikes. Furthermore, intense competition among feed manufacturers, coupled with pressure from integrated livestock producers to reduce feed costs, can lead to downward pressure on profit margins. Managing these complex challenges requires robust risk management strategies, continuous innovation, and a strong focus on operational resilience to maintain market competitiveness and ensure sustained growth.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Antimicrobial Resistance Concerns & Regulations | -0.8% | Europe, North America, Australia | Long-term (2025-2033) |

| Supply Chain Disruptions & Logistics Costs | -0.7% | Global | Short-to-Medium term (2025-2028) |

| Competition from Alternative Protein Sources | -0.6% | Developed countries | Long-term (2028-2033) |

| High Capital Investment for Modernization | -0.5% | Global, particularly smaller players | Medium-to-Long term (2026-2033) |

Animal Compound Feed Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Animal Compound Feed Market, encompassing historical data, current market dynamics, and future projections. The report offers detailed insights into market size, growth drivers, restraints, opportunities, and challenges. It segmentally analyzes the market by animal type, ingredient, form, and region, providing a granular view of market performance and trends. A dedicated section highlights the impact of emerging technologies like AI, while also profiling key market players, offering strategic intelligence for stakeholders and investors seeking to understand and capitalize on the evolving landscape of the global animal compound feed industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 460 Billion |

| Market Forecast in 2033 | USD 670 Billion |

| Growth Rate | 4.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Inc., Archer Daniels Midland Company (ADM), Nutreco N.V., ForFarmers N.V., Alltech Inc., New Hope Group, Wen's Food Group, Charoen Pokphand Foods PCL (CPF), Purina Animal Nutrition (part of Land O'Lakes), DSM Nutritional Products, Evonik Industries AG, BASF SE, De Heus Animal Nutrition, Godrej Agrovet Limited, AD-Milling Co., J.D. Heiskell & Co., Perdue Farms Inc., CP Group, East Hope Group, Zhengbang Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The animal compound feed market is extensively segmented to provide a granular understanding of its diverse components and driving forces. These segments are primarily categorized by animal type, ingredient composition, and physical form, each reflecting unique demands and production considerations within the global animal nutrition industry. Understanding these segmentations is crucial for market participants to identify niche opportunities, tailor product offerings, and develop targeted marketing strategies.

The segmentation by animal type distinguishes between feeds for poultry, ruminants, swine, aquaculture, and pets, reflecting the specific nutritional requirements and growth patterns of each species. Ingredient segmentation examines the prevalence and demand for cereals, oilseed meals, and various additives, highlighting trends in raw material sourcing and the development of functional feed components. Form-based segmentation categorizes products by their physical presentation, such as pellets, mash, or crumbles, which influence palatability, handling, and storage. These detailed breakdowns allow for a comprehensive assessment of market dynamics across different sub-sectors, aiding strategic planning and investment decisions.

- By Animal Type:

- Poultry (Broiler, Layer, Turkey, Duck)

- Ruminants (Cattle, Dairy Cows, Sheep, Goats)

- Swine

- Aquaculture (Fish, Shrimp, Prawn)

- Pets (Dogs, Cats)

- Others (Equine, Specialty Animals)

- By Ingredient:

- Cereals (Corn, Wheat, Barley)

- Oilseed Meal (Soybean Meal, Rapeseed Meal, Sunflower Meal)

- Additives (Vitamins, Amino Acids, Antibiotics, Enzymes, Antioxidants, Prebiotics & Probiotics, Minerals, Sweeteners)

- Supplements

- By-products (Meat and Bone Meal, Fish Meal)

- Others (Fats & Oils, Hay, Silage)

- By Form:

- Pellets

- Mash

- Crumbles

- Cubes

- Others (Liquid, Granules)

- By Type of Feed:

- Starters

- Growers

- Finishers

- Breeders

- Lactation Feed

Regional Highlights

- Asia Pacific (APAC): The largest and fastest-growing market, driven by rapid population growth, increasing disposable incomes, and the industrialization of livestock and aquaculture farming, especially in China, India, and Southeast Asian countries. Significant demand for poultry and swine feed.

- North America: A mature market characterized by advanced farming practices, a strong focus on precision nutrition, and high adoption of feed additives. Demand is stable for ruminant, poultry, and swine feed, with a growing pet food segment.

- Europe: Known for stringent regulations on feed safety, environmental sustainability, and reduced antibiotic use. The market is driven by demand for high-quality, specialized feeds and innovative feed additives, with a strong emphasis on animal welfare.

- Latin America: A rapidly expanding market, especially in Brazil and Argentina, fueled by significant beef and poultry production for both domestic consumption and export. Investments in modern farming techniques and feed infrastructure are increasing.

- Middle East and Africa (MEA): An emerging market with substantial growth potential due to increasing urbanization, rising demand for animal protein, and efforts to enhance food security. Investments in poultry and aquaculture sectors are key drivers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Compound Feed Market.- Cargill, Inc.

- Archer Daniels Midland Company (ADM)

- Nutreco N.V.

- ForFarmers N.V.

- Alltech Inc.

- New Hope Group

- Wen's Food Group

- Charoen Pokphand Foods PCL (CPF)

- Purina Animal Nutrition (part of Land O'Lakes)

- DSM Nutritional Products

- Evonik Industries AG

- BASF SE

- De Heus Animal Nutrition

- Godrej Agrovet Limited

- AD-Milling Co.

- J.D. Heiskell & Co.

- Perdue Farms Inc.

- CP Group

- East Hope Group

- Zhengbang Group

Frequently Asked Questions

What is the projected growth rate for the Animal Compound Feed Market?

The Animal Compound Feed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2033, driven by increasing demand for animal protein and advancements in feed technology.

Which factors are primarily driving the Animal Compound Feed Market's expansion?

Key drivers include rising global demand for animal protein due to population growth, the industrialization of livestock and aquaculture, and growing awareness among farmers about the benefits of optimized animal nutrition for improved productivity and health.

What impact does AI have on the Animal Compound Feed Market?

AI significantly impacts the market by optimizing feed formulations, enabling predictive analytics for raw material sourcing, enhancing supply chain management, and improving disease detection and prevention in livestock, leading to greater efficiency and precision.

What are the main challenges faced by the Animal Compound Feed Market?

Major challenges include the volatility of raw material prices, stringent regulatory frameworks concerning feed safety and antibiotic use, the risk of animal disease outbreaks, and the increasing concern over antimicrobial resistance (AMR).

Which regions are key contributors to the Animal Compound Feed Market?

Asia Pacific is the largest and fastest-growing market, while North America and Europe are mature markets with advanced practices. Latin America and the Middle East & Africa represent rapidly emerging markets with significant growth potential.