Gallium Nitride Substrate Market

Gallium Nitride Substrate Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701120 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Gallium Nitride Substrate Market Size

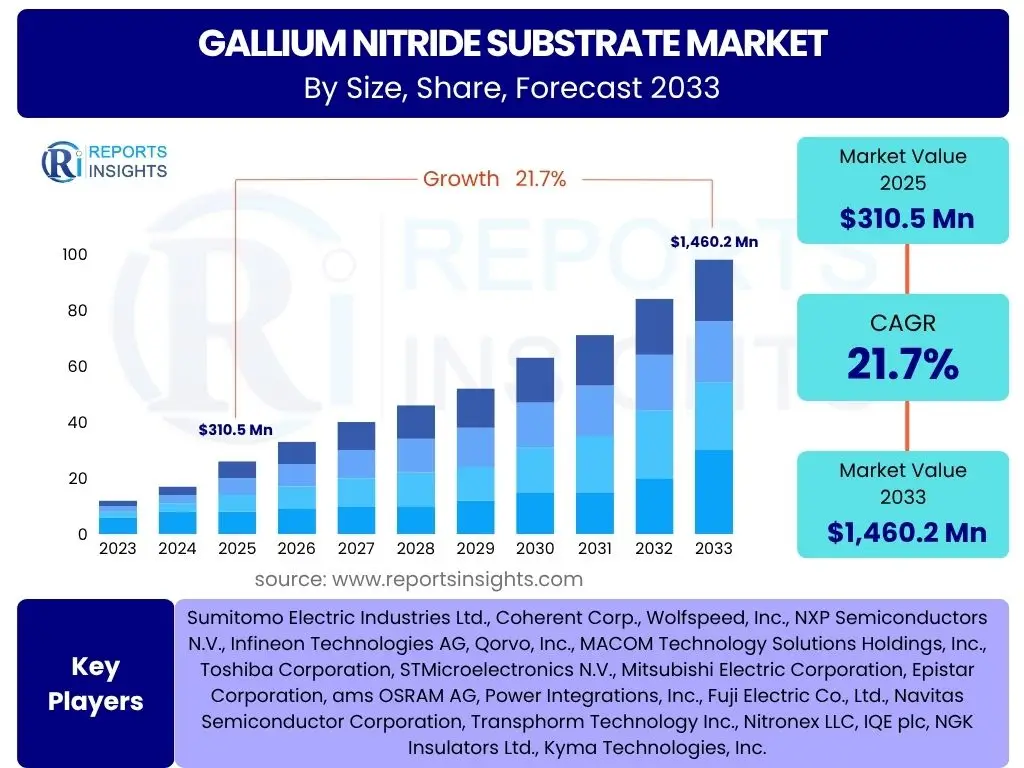

According to Reports Insights Consulting Pvt Ltd, The Gallium Nitride Substrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.7% between 2025 and 2033. The market is estimated at USD 310.5 Million in 2025 and is projected to reach USD 1,460.2 Million by the end of the forecast period in 2033.

Key Gallium Nitride Substrate Market Trends & Insights

The Gallium Nitride (GaN) substrate market is experiencing a fundamental transformation driven by the superior inherent properties of GaN, including its high breakdown voltage, high electron mobility, and excellent thermal conductivity. These characteristics enable the development of power devices and RF components that are significantly more efficient, compact, and operate at higher frequencies and temperatures than traditional silicon-based counterparts. This paradigm shift is critically enabling the next generation of high-performance electronics across multiple industries, signaling a sustained growth trajectory for GaN substrates.

Specific application areas are serving as primary catalysts for market expansion. The global rollout of 5G infrastructure, demanding high-frequency and high-power amplification, is a major driver, with GaN RF devices offering unmatched performance in base stations and telecommunication equipment. Concurrently, the accelerating adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is fueling demand for GaN in on-board chargers, inverters, and DC-DC converters due to its ability to reduce power loss and improve system efficiency, thereby extending battery range and reducing vehicle weight. Furthermore, the proliferation of GaN in consumer electronics, particularly for fast chargers and power adapters for laptops and smartphones, underscores its miniaturization and efficiency benefits.

Beyond applications, advancements in manufacturing technologies are significantly influencing market trends. The industry is actively pursuing the development of larger GaN-on-Silicon (GaN-on-Si) wafers, moving from 6-inch to 8-inch and even 12-inch capabilities, which promises to reduce manufacturing costs substantially and enhance scalability. Improvements in epitaxial growth techniques for GaN layers on various substrates, including silicon, silicon carbide (SiC), and sapphire, are leading to higher material quality and reduced defect densities. These technological evolutions, coupled with increasing investments in GaN foundries and supply chain optimization, are making GaN a more viable and competitive alternative to traditional semiconductor materials.

- Escalating adoption in 5G telecommunication infrastructure for efficient RF devices.

- Rising demand from electric vehicle (EV) and hybrid electric vehicle (HEV) sectors for power electronics.

- Growing integration of GaN in consumer electronics for compact and efficient fast chargers.

- Advancements in GaN-on-Silicon (GaN-on-Si) technology enabling larger wafer sizes and cost reduction.

- Increasing research and development in GaN-on-GaN substrates for superior performance in specialized applications.

AI Impact Analysis on Gallium Nitride Substrate

Artificial Intelligence (AI) and Machine Learning (ML) are progressively transforming various stages of the Gallium Nitride (GaN) substrate and device lifecycle, from fundamental research and material design to advanced manufacturing and performance optimization. In the design and R&D phases, AI algorithms can simulate and predict material properties, identify optimal crystal growth conditions, and design complex device structures with unprecedented speed and accuracy. This accelerates the discovery of new GaN material compositions and device architectures, significantly reducing the traditionally lengthy and resource-intensive experimental trial-and-error processes, thereby bringing new GaN innovations to market faster.

Within manufacturing, AI plays a crucial role in enhancing the efficiency, quality, and yield of GaN substrate and device fabrication. AI-powered predictive analytics can monitor real-time data from epitaxial growth reactors and fabrication lines to detect anomalies, anticipate equipment failures, and optimize process parameters for improved uniformity and reduced defect rates. Automated optical inspection systems utilizing AI for pattern recognition can rapidly identify microscopic defects on GaN wafers, ensuring higher quality control and minimizing waste. This intelligent automation leads to more consistent product quality and lower production costs, which are critical for the broader adoption of GaN technology.

Furthermore, the increasing demand for AI-driven applications, particularly in areas like edge computing, high-performance computing, and data centers, inherently drives the need for more efficient and high-density power solutions that GaN can provide. As AI models become more complex and data-intensive, the energy consumption of computing infrastructure rises, making GaN’s superior power efficiency paramount. Simultaneously, AI can be applied to optimize the energy management systems where GaN devices are deployed, creating a synergistic relationship where AI not only benefits from GaN's capabilities but also helps to improve its deployment and operational efficiency in complex power systems.

- AI accelerates material design and optimization for GaN crystal growth.

- Machine Learning enhances defect detection and yield improvement in GaN fabrication.

- Predictive analytics optimize manufacturing processes for improved GaN substrate quality.

- AI-driven applications increase demand for high-efficiency GaN power solutions.

- AI assists in optimizing thermal management and power delivery in GaN-based systems.

Key Takeaways Gallium Nitride Substrate Market Size & Forecast

The Gallium Nitride (GaN) substrate market is poised for robust expansion, driven by its intrinsic advantages over conventional silicon in applications requiring high power density, high frequency operation, and superior energy efficiency. The projected significant Compound Annual Growth Rate (CAGR) through 2033 underscores a clear industry pivot towards wide bandgap semiconductors to meet the escalating demands of next-generation electronic systems. This growth is fundamentally underpinned by GaN’s ability to enable smaller, lighter, and more efficient power converters and RF components, which are critical for innovation across diverse high-growth sectors.

A pivotal takeaway is the strategic importance of scaling manufacturing capabilities and reducing production costs to fully unlock GaN’s market potential. The continuous development of larger diameter GaN-on-Silicon (GaN-on-Si) wafers, along with improvements in epitaxy and defect control, is essential for achieving cost parity and higher throughput. These advancements are vital for transitioning GaN from niche high-performance applications to mainstream adoption in high-volume markets such as consumer electronics and electric vehicles, where cost-effectiveness and scalability are paramount considerations for manufacturers.

Moreover, the market's trajectory will be heavily influenced by ongoing innovation in materials science and device architecture, as well as the forging of strategic collaborations across the value chain, from substrate manufacturers to device designers and end-use application developers. Such partnerships are crucial for accelerating R&D, overcoming technical hurdles, and ensuring a seamless integration of GaN technology into new products and systems. This holistic approach, combining technological breakthroughs with market-driven alliances, will be instrumental in sustaining the market’s momentum and cementing GaN’s position as a foundational material for future power and RF electronics.

- Strong market growth is anticipated due to GaN's superior electrical and thermal properties.

- Cost reduction and scalability of GaN-on-Silicon are critical for widespread adoption.

- Demand from 5G, EVs, and fast chargers is a primary growth engine.

- Continuous innovation in material science and device design is essential for market expansion.

- Strategic collaborations across the value chain will drive technological advancements and market penetration.

Gallium Nitride Substrate Market Drivers Analysis

The Gallium Nitride (GaN) substrate market is experiencing significant growth propelled by several robust drivers, primarily the burgeoning demand for high-performance and energy-efficient electronic devices across various sectors. The inherent advantages of GaN, such as its higher electron mobility, larger bandgap, and superior thermal conductivity compared to silicon, make it an ideal material for developing next-generation power electronics and radio frequency (RF) devices. These properties enable the creation of more compact, lighter, and highly efficient systems, which are becoming indispensable in modern technological advancements and applications, fueling a continuous shift away from traditional silicon-based solutions.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Deployment of 5G Infrastructure | +5.2% | Asia Pacific, North America, Europe | Short to Mid-term (2025-2029) |

| Growing Adoption of Electric Vehicles (EVs) | +4.8% | Europe, North America, China, Japan | Mid to Long-term (2026-2033) |

| Increasing Demand for Power-Efficient Consumer Electronics | +4.5% | Asia Pacific (especially China), North America | Short-term (2025-2027) |

| Expansion of Data Centers and Cloud Computing | +3.9% | North America, Europe, Asia Pacific | Mid-term (2027-2030) |

| Advancements in Renewable Energy Systems | +3.3% | Europe, North America, India, Australia | Mid to Long-term (2028-2033) |

Gallium Nitride Substrate Market Restraints Analysis

Despite its significant advantages and promising growth trajectory, the Gallium Nitride (GaN) substrate market faces several notable restraints that could temper its expansion. One of the primary limiting factors is the relatively high manufacturing cost associated with GaN substrates, particularly pure GaN bulk substrates, compared to the well-established and highly optimized silicon manufacturing processes. This cost differential can be a significant barrier to entry and widespread adoption in cost-sensitive applications. Furthermore, challenges related to scaling up production to meet high-volume demands and the complexities in achieving large-area, defect-free GaN substrates also pose considerable hurdles to market acceleration.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Manufacturing Cost of GaN Substrates | -3.5% | Global | Short to Mid-term (2025-2029) |

| Limited Availability of Large-Diameter GaN Wafers | -3.0% | Global | Short to Mid-term (2025-2028) |

| Complexities in Epitaxial Growth and Defect Control | -2.8% | Global | Mid-term (2027-2031) |

| Intense Competition from Silicon (Si) and Silicon Carbide (SiC) | -2.5% | Global | Short to Mid-term (2025-2030) |

| Lack of Standardized Manufacturing Processes | -2.0% | Global | Mid-term (2027-2032) |

Gallium Nitride Substrate Market Opportunities Analysis

The Gallium Nitride (GaN) substrate market is brimming with opportunities stemming from its potential to displace traditional semiconductor materials in a growing array of high-performance applications. Significant avenues for growth lie in the continuous innovation in material science, particularly in developing larger and more cost-effective GaN-on-Silicon (GaN-on-Si) substrates, which can leverage existing silicon fabrication infrastructure. Beyond current applications, the exploration of new end-use industries, coupled with increasing investments in research and development, presents substantial opportunities for market expansion and diversification. The push for global energy efficiency and the miniaturization of electronic devices further amplify these prospects.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Larger and Lower-Cost GaN-on-Si Wafers | +4.0% | Global | Mid to Long-term (2027-2033) |

| Emergence of New Applications in IoT, Smart Grid, and Industrial Power | +3.7% | North America, Europe, Asia Pacific | Mid to Long-term (2028-2033) |

| Increasing Government Support and R&D Funding | +3.5% | North America, Europe, Japan, South Korea | Short to Mid-term (2025-2029) |

| Strategic Partnerships and Collaborations Across the Value Chain | +3.2% | Global | Mid-term (2026-2030) |

| Advancements in GaN-on-GaN Substrates for High-Performance Devices | +3.0% | Global | Long-term (2030-2033) |

Gallium Nitride Substrate Market Challenges Impact Analysis

The Gallium Nitride (GaN) substrate market faces several significant challenges that could impede its growth and widespread adoption. Key among these is the inherent material quality issue, specifically the high density of defects such as dislocations and cracks that can occur during the epitaxial growth of GaN layers, especially on dissimilar substrates like silicon or sapphire. These defects can degrade device performance, reliability, and yield, presenting a considerable hurdle for manufacturers aiming for high-volume production of high-quality devices. Addressing these material science challenges requires ongoing research and substantial investment, impacting production efficiency and cost-effectiveness.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Defect Density in GaN Epitaxial Layers | -2.9% | Global | Short to Mid-term (2025-2029) |

| Challenges in Thermal Management of GaN Devices | -2.7% | Global | Mid-term (2026-2030) |

| Difficulty in Achieving Cost Parity with Silicon Devices | -2.5% | Global | Mid to Long-term (2027-2033) |

| Scalability Issues for High-Volume Manufacturing | -2.3% | Global | Short to Mid-term (2025-2028) |

| Intellectual Property (IP) and Patent Landscape Complexity | -1.8% | Global | Long-term (2029-2033) |

Gallium Nitride Substrate Market - Updated Report Scope

This comprehensive market research report on the Gallium Nitride Substrate Market provides an in-depth analysis of market size, trends, drivers, restraints, opportunities, and challenges across various segments and key geographies. It offers a detailed forecast from 2025 to 2033, examining the technological advancements and strategic initiatives shaping the industry. The report covers crucial aspects such as the impact of emerging technologies like AI, competitive landscape analysis, and a thorough segmentation by type, application, and end-use industry, providing actionable insights for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 310.5 Million |

| Market Forecast in 2033 | USD 1,460.2 Million |

| Growth Rate | 21.7% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Electric Industries Ltd., Coherent Corp., Wolfspeed, Inc., NXP Semiconductors N.V., Infineon Technologies AG, Qorvo, Inc., MACOM Technology Solutions Holdings, Inc., Toshiba Corporation, STMicroelectronics N.V., Mitsubishi Electric Corporation, Epistar Corporation, ams OSRAM AG, Power Integrations, Inc., Fuji Electric Co., Ltd., Navitas Semiconductor Corporation, Transphorm Technology Inc., Nitronex LLC, IQE plc, NGK Insulators Ltd., Kyma Technologies, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Gallium Nitride (GaN) substrate market is meticulously segmented to provide a granular understanding of its diverse applications, technological underpinnings, and industrial adoption patterns. This segmentation allows for precise analysis of market dynamics, revealing how various substrate types cater to specific performance requirements across different end-use sectors, and highlighting the critical interplay between material science innovations and industry-specific demands. Understanding these distinct segments is crucial for stakeholders to identify growth opportunities and develop targeted strategies within this rapidly evolving semiconductor landscape.

- By Type

- GaN-on-Sapphire

- GaN-on-Silicon (GaN-on-Si)

- GaN-on-Silicon Carbide (GaN-on-SiC)

- Bulk GaN (GaN-on-GaN)

- Others

- By Application

- Power Electronics

- Power Adapters

- EV Power Systems

- Renewable Energy Inverters

- Industrial Power Supplies

- Data Center Power

- Radio Frequency (RF) Devices

- 5G Base Stations

- Radar Systems

- Satellite Communications

- Cable TV Amplifiers

- Opto-semiconductors

- LEDs

- Laser Diodes

- UV-LEDs

- Light Emitting Diodes (LEDs)

- Lasers

- Power Electronics

- By End-Use Industry

- Automotive

- Consumer Electronics

- Information Technology and Telecommunications (IT & Telecom)

- Defense & Aerospace

- Energy & Utilities

- Healthcare

- Industrial

Regional Highlights

- North America: This region is a significant hub for research and development in GaN technology, particularly for defense and aerospace applications, as well as the rapidly growing electric vehicle sector. The presence of key technology innovators and a strong emphasis on high-performance computing and data centers drive demand for GaN power solutions.

- Europe: Europe demonstrates strong leadership in automotive electronics, industrial power applications, and renewable energy systems. The region's commitment to reducing carbon emissions and enhancing energy efficiency positions it as a key market for GaN adoption in electric vehicles, charging infrastructure, and smart grid technologies.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for GaN substrates, fueled by extensive consumer electronics manufacturing capabilities, rapid 5G network deployment, and increasing electric vehicle production, especially in China, Japan, and South Korea. The region's vast manufacturing base and burgeoning demand for efficient power solutions contribute significantly to market expansion.

- Latin America: While an emerging market, Latin America shows increasing potential for GaN adoption, particularly driven by expanding telecommunications infrastructure and growing interest in renewable energy projects. Investment in advanced technologies is gradually increasing across the region.

- Middle East and Africa (MEA): The MEA region is experiencing growth in its telecommunications sector, with ongoing investments in 5G networks, which bodes well for GaN RF device adoption. Additionally, the region's focus on diversifying its energy sources could spur demand for GaN in renewable energy applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gallium Nitride Substrate Market.- Sumitomo Electric Industries Ltd.

- Coherent Corp.

- Wolfspeed, Inc.

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Qorvo, Inc.

- MACOM Technology Solutions Holdings, Inc.

- Toshiba Corporation

- STMicroelectronics N.V.

- Mitsubishi Electric Corporation

- Epistar Corporation

- ams OSRAM AG

- Power Integrations, Inc.

- Fuji Electric Co., Ltd.

- Navitas Semiconductor Corporation

- Transphorm Technology Inc.

- Nitronex LLC

- IQE plc

- NGK Insulators Ltd.

- Kyma Technologies, Inc.

Frequently Asked Questions

Analyze common user questions about the Gallium Nitride Substrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Gallium Nitride Substrate and its primary uses?

Gallium Nitride (GaN) substrate is a semiconductor material known for its wide bandgap, high electron mobility, and excellent thermal conductivity. These properties make it ideal for high-power, high-frequency, and high-temperature applications. Its primary uses include power electronics (e.g., fast chargers, electric vehicle inverters, data center power supplies), radio frequency (RF) devices (e.g., 5G base stations, radar systems), and opto-semiconductors (e.g., LEDs, laser diodes).

What is driving the growth of the GaN Substrate market?

The GaN substrate market is driven by increasing global demand for energy-efficient power conversion solutions and high-performance RF devices. Key drivers include the rapid deployment of 5G telecommunication infrastructure, the accelerating adoption of electric vehicles, the growing market for compact and efficient consumer electronics (like fast chargers), and the expansion of data centers seeking to reduce power consumption and cooling requirements.

What are the main challenges facing the GaN Substrate industry?

The primary challenges include the relatively high manufacturing cost of GaN substrates compared to silicon, the technical complexities associated with achieving large-diameter, defect-free GaN wafers, and managing the thermal characteristics of GaN devices in high-power applications. Additionally, maintaining material quality during epitaxial growth and fierce competition from established silicon and silicon carbide technologies pose ongoing hurdles.

How does GaN compare to Silicon (Si) or Silicon Carbide (SiC)?

GaN outperforms Silicon (Si) in high-frequency and high-power density applications due to its higher breakdown voltage, faster switching speeds, and superior efficiency, enabling smaller and lighter components. Compared to Silicon Carbide (SiC), GaN generally offers higher switching speeds at lower voltages, making it preferred for high-frequency RF applications and consumer electronics. SiC, conversely, often excels in very high-voltage and high-current power applications, forming a complementary rather than direct competitive relationship.

Which regions are key players in the GaN Substrate market?

The Asia Pacific (APAC) region is the largest and fastest-growing market, driven by its extensive consumer electronics manufacturing, rapid 5G infrastructure rollout, and increasing EV production in countries like China, Japan, and South Korea. North America is a significant market due to strong R&D in defense and advanced computing. Europe is also a key player, particularly in automotive and industrial power electronics, emphasizing energy efficiency and renewable energy integration.