Fraud Detection and Prevention Market

Fraud Detection and Prevention Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703885 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Fraud Detection and Prevention Market Size

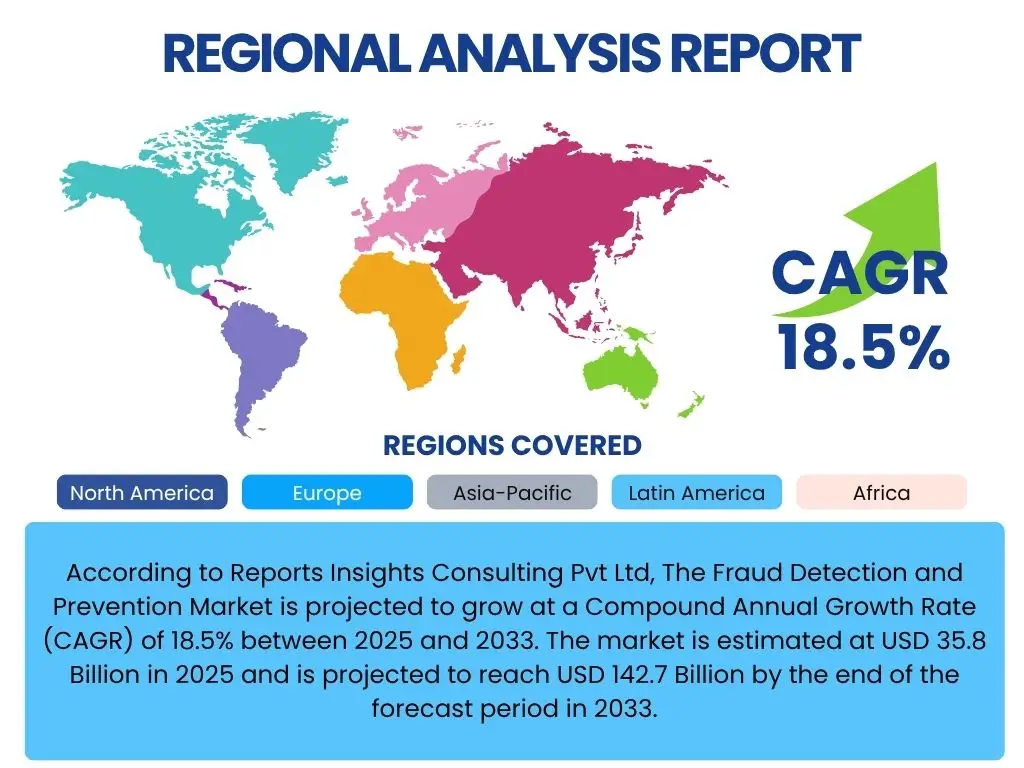

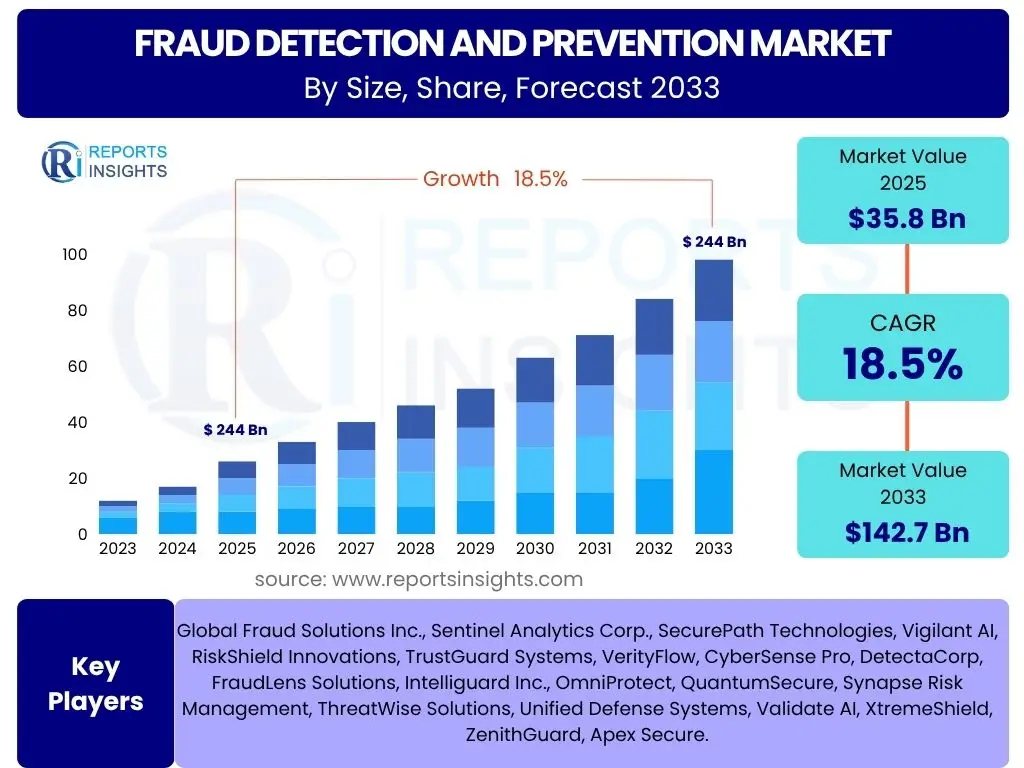

According to Reports Insights Consulting Pvt Ltd, The Fraud Detection and Prevention Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 35.8 Billion in 2025 and is projected to reach USD 142.7 Billion by the end of the forecast period in 2033.

Key Fraud Detection and Prevention Market Trends & Insights

The Fraud Detection and Prevention market is currently undergoing significant transformation driven by the escalating sophistication of cyber threats and the rapid digitalization of economies globally. User inquiries frequently highlight the shift towards proactive and real-time detection mechanisms, moving away from traditional reactive approaches. There is a strong emphasis on leveraging advanced analytics, machine learning, and artificial intelligence to identify intricate fraud patterns and anomalies across vast datasets. Furthermore, the integration of biometric authentication and behavioral analytics is gaining traction, promising enhanced security without compromising user experience. The market is also responding to stringent regulatory demands, compelling organizations to adopt more robust and compliant fraud prevention solutions.

- Increased adoption of AI and Machine Learning for predictive analytics and anomaly detection.

- Shift towards real-time fraud detection capabilities across multiple transaction channels.

- Growing demand for cloud-based fraud detection and prevention solutions due to scalability and flexibility.

- Rising prominence of behavioral biometrics and multifactor authentication for enhanced security.

- Emphasis on cross-channel fraud prevention strategies to combat sophisticated attack vectors.

- Development of explainable AI (XAI) models to improve transparency and trust in automated decisions.

- Expansion of fraud detection solutions into new industry verticals beyond traditional financial services.

AI Impact Analysis on Fraud Detection and Prevention

User queries regarding the impact of Artificial Intelligence (AI) on fraud detection and prevention frequently revolve around its transformative potential, operational efficiency, and ethical considerations. Users are keen to understand how AI can improve detection accuracy, reduce false positives, and adapt to evolving fraud schemes. There are also concerns about the black-box nature of some AI models, the need for data privacy, and the potential for AI to be exploited by fraudsters. The overarching expectation is that AI will enable more autonomous, scalable, and sophisticated fraud prevention systems, fundamentally reshaping the landscape of risk management. Its ability to process and analyze massive datasets at speeds unachievable by human analysts positions AI as a cornerstone technology for future-proof fraud defenses.

- Enhanced accuracy and speed in identifying fraudulent activities through advanced pattern recognition.

- Significant reduction in false positives, leading to improved operational efficiency and customer satisfaction.

- Enables predictive analytics to anticipate future fraud trends and proactively mitigate risks.

- Facilitates real-time anomaly detection across vast and complex datasets.

- Automates repetitive tasks, freeing up human analysts to focus on complex investigations.

- Supports dynamic risk scoring and adaptive authentication mechanisms.

- Presents new challenges related to data bias, ethical AI deployment, and the potential for adversarial AI attacks.

Key Takeaways Fraud Detection and Prevention Market Size & Forecast

Common user questions regarding key takeaways from the Fraud Detection and Prevention market size and forecast consistently point towards the strategic imperative for organizations to invest in advanced fraud prevention technologies. The market's robust projected growth signifies a global acknowledgment of the escalating threat of financial crime and cyber fraud. Key insights reveal that digital transformation initiatives, while offering significant business opportunities, simultaneously expand the attack surface for fraudsters, making robust detection and prevention mechanisms indispensable. Furthermore, the forecast underscores the increasing role of data analytics and AI in creating resilient fraud ecosystems, moving beyond compliance-driven approaches to proactive risk management. This dynamic growth is a clear indicator that fraud detection is no longer merely a cost center but a critical component of business continuity and trust.

- The market is poised for substantial growth, driven by increasing digital transactions and sophisticated fraud schemes.

- Strategic investment in AI and machine learning technologies is crucial for effective fraud prevention.

- Emphasis on real-time capabilities and cross-channel integration is becoming a market differentiator.

- Regulatory pressures and evolving compliance landscapes are significant drivers for solution adoption.

- The balance between enhanced security and seamless user experience remains a key focus for innovation.

- Organizations are prioritizing proactive fraud detection to minimize financial losses and reputational damage.

Fraud Detection and Prevention Market Drivers Analysis

The Fraud Detection and Prevention market is significantly propelled by several macro-economic and technological factors. The pervasive digitalization across all sectors, from e-commerce to banking and healthcare, has created unprecedented opportunities for fraudsters, concurrently driving the demand for advanced security solutions. As transactions increasingly migrate online and mobile platforms, the volume and complexity of potential fraud vectors multiply, necessitating sophisticated detection tools that can operate in real-time environments. This digital shift, combined with the global proliferation of smartphones and internet access, broadens the potential attack surface for malicious actors.

Another major driver is the escalating financial losses incurred by businesses and consumers due to fraudulent activities. These losses, coupled with the severe reputational damage that can result from security breaches, compel organizations to invest heavily in robust fraud prevention frameworks. Furthermore, the stringent and evolving regulatory landscape across various regions, such as GDPR, PSD2, and various industry-specific compliance mandates, imposes significant pressure on entities to implement advanced fraud detection systems to avoid hefty penalties and legal repercussions. The continuous innovation in AI and machine learning technologies also acts as a driver, offering more effective and adaptive solutions that can counter sophisticated fraud techniques.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Digitalization and Online Transactions | +0.8% | Global, particularly APAC and North America | Short to Long-term |

| Rising Sophistication of Fraudulent Activities | +0.7% | Global | Short to Mid-term |

| Growing Financial Losses due to Fraud | +0.6% | North America, Europe | Short to Mid-term |

| Stringent Regulatory Compliance Requirements | +0.5% | Europe, North America, parts of APAC | Mid to Long-term |

| Adoption of Advanced Technologies like AI and ML | +0.9% | Global | Short to Long-term | Expansion of E-commerce and Mobile Payments | +0.7% | APAC, Latin America, MEA | Short to Mid-term |

Fraud Detection and Prevention Market Restraints Analysis

Despite the strong growth trajectory, the Fraud Detection and Prevention market faces several inherent restraints that could impede its full potential. One significant challenge is the high cost associated with the initial implementation and ongoing maintenance of advanced fraud detection systems. This can be particularly prohibitive for small and medium-sized enterprises (SMEs) that may lack the financial resources or technical expertise required to deploy complex solutions. The need for continuous updates, integration with legacy systems, and specialized personnel also contributes to the total cost of ownership, making it a significant barrier to entry for some organizations.

Another critical restraint involves the complexity of integrating new fraud detection solutions with existing IT infrastructures. Many organizations operate with disparate systems and data silos, which can make seamless integration a laborious and time-consuming process. This often leads to delays in deployment, increased project costs, and potential operational disruptions. Furthermore, concerns regarding data privacy and security, especially with stricter regulations like GDPR and CCPA, pose a challenge. Organizations must navigate the delicate balance between utilizing vast amounts of customer data for fraud analysis and ensuring compliance with privacy laws, which can restrict data collection and sharing capabilities essential for effective detection.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Implementation and Maintenance Costs | -0.6% | Global, particularly emerging economies | Short to Mid-term |

| Complexity of Integration with Existing Systems | -0.5% | Global | Short to Mid-term |

| Data Privacy and Security Concerns | -0.4% | Europe, North America | Mid to Long-term |

| Shortage of Skilled Professionals | -0.3% | Global | Long-term |

| Balancing Security with User Experience | -0.2% | Global | Short to Mid-term | Increased False Positives with AI/ML | -0.3% | Global | Short-term |

Fraud Detection and Prevention Market Opportunities Analysis

The Fraud Detection and Prevention market is ripe with opportunities driven by technological advancements and evolving market needs. One significant area of opportunity lies in the burgeoning demand for cloud-based fraud detection solutions. Cloud deployment offers scalability, flexibility, and reduced infrastructure costs, making advanced capabilities accessible to a broader range of organizations, including SMEs. This shift facilitates faster deployment and enables continuous updates, ensuring systems remain effective against evolving threats. Furthermore, the increasing adoption of AI and machine learning models that offer explainability (XAI) presents a crucial opportunity. As regulatory bodies and users demand transparency in automated decision-making, solutions providing clear insights into their fraud detection logic will gain a competitive edge.

Another substantial opportunity exists in the expansion of fraud detection capabilities into new and emerging industry verticals beyond the traditional financial services and retail sectors. Sectors such as healthcare, automotive, telecommunications, and government agencies are increasingly becoming targets for sophisticated fraud, creating a growing need for specialized fraud prevention tools tailored to their unique operational contexts. Moreover, the move towards proactive risk management and continuous monitoring, rather than reactive responses to incidents, opens avenues for providers offering comprehensive risk assessment and prevention platforms. The growing trend of partnerships and collaborations between technology providers, financial institutions, and cybersecurity firms to create integrated, end-to-end fraud prevention ecosystems also presents a lucrative pathway for market expansion and innovation.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Adoption of Cloud-based Solutions | +0.7% | Global | Short to Mid-term |

| Demand for Explainable AI (XAI) in Fraud Analytics | +0.6% | North America, Europe | Mid to Long-term |

| Expansion into New Industry Verticals | +0.8% | Global, particularly APAC | Mid to Long-term |

| Emphasis on Proactive Risk Management | +0.5% | Global | Short to Mid-term |

| Managed Security Services and Outsourcing | +0.4% | North America, Europe | Short to Mid-term | Leveraging Blockchain for Enhanced Security | +0.3% | Global, nascent stages | Long-term |

Fraud Detection and Prevention Market Challenges Impact Analysis

The Fraud Detection and Prevention market faces persistent challenges that necessitate continuous innovation and adaptation from solution providers. A primary challenge is the constantly evolving nature of fraud techniques. Fraudsters are highly adaptive, leveraging new technologies and exploiting emerging vulnerabilities, making it difficult for prevention systems to keep pace. This requires constant updates, sophisticated threat intelligence, and a proactive stance from organizations, which can be resource-intensive. The globalized nature of digital transactions also means that fraud can originate from anywhere, complicating detection and attribution, especially across different jurisdictions with varying legal frameworks.

Another significant hurdle is the challenge of data silos and fragmented information within organizations. Many enterprises collect vast amounts of data, but it often resides in disparate systems, making it difficult to achieve a holistic view necessary for comprehensive fraud detection. Integrating these diverse data sources and ensuring data quality are complex tasks that can undermine the effectiveness of even the most advanced analytical tools. Moreover, striking the right balance between robust security measures and maintaining a seamless user experience is a delicate challenge. Overly stringent authentication processes or frequent fraud alerts can lead to customer frustration and abandonment, while lax security exposes organizations to significant risks. Finding this equilibrium requires sophisticated risk-based authentication and adaptive security protocols.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Evolving and Sophisticated Fraud Techniques | -0.7% | Global | Ongoing |

| Data Silos and Integration Complexities | -0.5% | Global | Mid to Long-term |

| Balancing Security with User Experience | -0.4% | Global | Ongoing |

| Lack of Skilled Cybersecurity Professionals | -0.3% | Global | Long-term |

| Regulatory Compliance and Cross-border Data Flows | -0.2% | Europe, North America, APAC | Ongoing | Adoption Resistance in Traditional Sectors | -0.3% | Emerging Markets | Mid-term |

Fraud Detection and Prevention Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Fraud Detection and Prevention market, covering its size, growth trends, key drivers, restraints, opportunities, and challenges. It offers a detailed segmentation analysis, regional insights, and profiles of leading market players, aimed at providing stakeholders with a clear understanding of the market landscape from 2019 to 2033, with a specific focus on the forecast period from 2025 to 2033. The report also highlights the significant impact of Artificial Intelligence and Machine Learning on the market's evolution.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 35.8 Billion |

| Market Forecast in 2033 | USD 142.7 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Fraud Solutions Inc., Sentinel Analytics Corp., SecurePath Technologies, Vigilant AI, RiskShield Innovations, TrustGuard Systems, VerityFlow, CyberSense Pro, DetectaCorp, FraudLens Solutions, Intelliguard Inc., OmniProtect, QuantumSecure, Synapse Risk Management, ThreatWise Solutions, Unified Defense Systems, Validate AI, XtremeShield, ZenithGuard, Apex Secure. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Fraud Detection and Prevention market is segmented across several dimensions to provide a granular view of its dynamics and growth pockets. These segmentations are crucial for understanding the diverse needs of different industries and organizations, as well as the technological preferences driving adoption. The solutions segment highlights the array of tools available, from sophisticated analytics platforms to robust authentication mechanisms, while deployment modes differentiate between flexible cloud-based offerings and traditional on-premises installations. Organization size impacts technology adoption, with large enterprises often requiring comprehensive, scalable solutions and SMEs seeking cost-effective, manageable options. Lastly, industry verticals dictate specific fraud challenges and the tailored solutions required to address them effectively.

- By Solution:

- Fraud Analytics

- Authentication

- Reporting

- Case Management

- Other Solutions (e.g., Compliance Management, Identity Verification)

- By Deployment Mode:

- Cloud

- On-premises

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- Retail and E-commerce

- Telecommunications

- Healthcare

- Government

- Real Estate

- Manufacturing

- Other Verticals (e.g., Travel and Transportation, Energy and Utilities)

Regional Highlights

- North America: This region dominates the Fraud Detection and Prevention market, driven by the presence of major technology providers, high adoption rates of advanced technologies, and stringent regulatory frameworks. The United States and Canada are leading the charge with significant investments in AI and machine learning for fraud analytics, particularly within the BFSI and e-commerce sectors. The increasing sophistication of cybercrime and a mature digital infrastructure further contribute to market growth.

- Europe: Europe is a significant market, propelled by robust regulatory initiatives such as GDPR and PSD2, which mandate strong customer authentication and fraud prevention measures. Countries like the United Kingdom, Germany, and France are at the forefront, witnessing high demand for real-time fraud detection and compliance-focused solutions. The region's emphasis on data privacy and consumer protection influences the development of ethical AI-driven fraud solutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid digitalization, burgeoning e-commerce industries, and increasing mobile payment adoption in emerging economies like China, India, and Southeast Asian countries. While opportunities are vast, the region faces challenges related to diverse regulatory landscapes and varying levels of technological maturity. However, growing awareness of financial crime and government initiatives to promote digital security are key growth enablers.

- Latin America: This region experiences substantial growth in the fraud detection market due to increasing internet penetration, expanding digital payment ecosystems, and a rising awareness of cyber fraud. Countries such as Brazil and Mexico are investing in solutions to combat credit card fraud, identity theft, and money laundering. Economic volatility and developing regulatory frameworks present both challenges and opportunities for market participants.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth, primarily driven by significant investments in digital transformation across the BFSI and telecommunications sectors. Countries like the UAE and Saudi Arabia are leading the adoption of advanced fraud detection technologies to secure their rapidly expanding digital infrastructures and smart city initiatives. The need to combat financial crime and ensure regulatory compliance is a key factor influencing market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fraud Detection and Prevention Market.- SecureFlow Technologies

- Vigilant AI Solutions

- RiskShield Innovations

- TrustGuard Systems

- CyberSense Pro

- DetectaCorp

- FraudLens Solutions

- Intelliguard Inc.

- OmniProtect Solutions

- QuantumSecure

- Synapse Risk Management

- ThreatWise Solutions

- Unified Defense Systems

- Validate AI

- XtremeShield Security

- ZenithGuard Technologies

- Global Fraud Solutions Inc.

- Sentinel Analytics Corp.

- Apex Secure Innovations

- Pinnacle Risk Management

Frequently Asked Questions

What is the projected growth rate of the Fraud Detection and Prevention Market?

The Fraud Detection and Prevention Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033, reaching USD 142.7 Billion by 2033.

How is AI impacting fraud detection and prevention?

AI significantly enhances fraud detection by improving accuracy, reducing false positives, enabling real-time anomaly detection, and providing predictive capabilities to anticipate new fraud schemes. It also automates tasks, freeing analysts for complex investigations.

What are the primary drivers for the Fraud Detection and Prevention Market?

Key drivers include increasing digitalization, rising sophistication of fraudulent activities, growing financial losses due to fraud, stringent regulatory requirements, and the widespread adoption of advanced technologies like AI and machine learning.

What challenges does the market face?

Challenges include the constantly evolving nature of fraud techniques, complexities of data integration and silos, the need to balance robust security with positive user experience, and the shortage of skilled cybersecurity professionals.

Which industries are showing the most demand for fraud detection solutions?

The BFSI (Banking, Financial Services, and Insurance) sector leads in demand, followed by Retail and E-commerce, Telecommunications, and Healthcare, all experiencing a significant increase in fraud attempts due to digital transformation.