Food Certification Market

Food Certification Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704997 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Food Certification Market Size

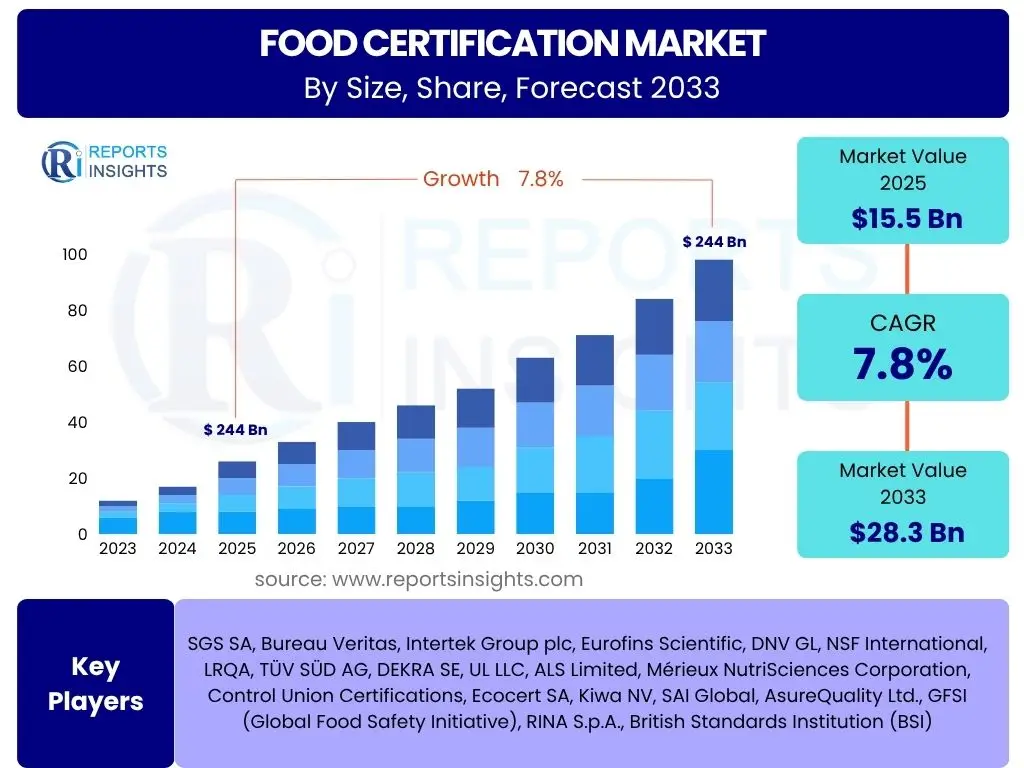

According to Reports Insights Consulting Pvt Ltd, The Food Certification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 28.3 Billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by increasing consumer demand for verified food safety and quality, alongside the continuous evolution of international regulatory frameworks.

The substantial expansion of the food certification market is a direct reflection of heightened global awareness regarding foodborne illnesses and quality standards. As supply chains become increasingly complex and globalized, the need for robust, independent verification processes has become paramount. This market size projection underscores the critical role certification plays in building consumer trust and facilitating international trade, indicating a sustained upward trend in the adoption of various food safety and quality schemes.

Key Food Certification Market Trends & Insights

User inquiries frequently highlight the dynamic evolution of the Food Certification market, focusing on emerging regulatory shifts, the impact of technological advancements, and changing consumer expectations. Common questions revolve around how digital transformation is shaping certification processes, the growing emphasis on sustainability and ethical sourcing, and the increasing demand for specific dietary and allergen-free certifications. These trends collectively underscore a market moving towards greater transparency, efficiency, and responsiveness to both regulatory mandates and informed consumer preferences.

- Digitalization and Traceability: Growing adoption of blockchain and IoT for enhanced supply chain visibility and immutable record-keeping.

- Sustainability and Ethical Sourcing Certifications: Rising demand for certifications related to environmental impact, fair labor practices, and animal welfare.

- Increased Focus on Allergen Management: Stricter regulations and consumer awareness driving specialized allergen-free and cross-contamination prevention certifications.

- Harmonization of Global Standards: Efforts towards international alignment of food safety and quality standards to facilitate trade and reduce compliance burden.

- Personalized Nutrition and Niche Market Growth: Expansion of certifications for organic, non-GMO, plant-based, halal, kosher, and other specialized dietary claims.

- Remote Auditing and Virtual Inspections: Accelerated use of remote technologies for audits, driven by efficiency needs and global accessibility.

AI Impact Analysis on Food Certification

Common user questions regarding AI's impact on food certification often explore its potential to enhance efficiency, accuracy, and predictive capabilities, while also considering concerns about data privacy, algorithmic bias, and the potential displacement of human expertise. Stakeholders are keen to understand how AI can streamline complex auditing processes, improve risk assessment, and offer deeper insights from vast datasets, thereby revolutionizing traditional certification methodologies. The discourse also includes questions on the integration challenges and the necessity for robust regulatory frameworks to govern AI applications in this critical sector.

- Enhanced Data Analysis: AI algorithms can quickly process large volumes of data from various sources (e.g., sensor data, supply chain records, lab results) to identify anomalies and predict potential food safety risks, leading to more proactive certification efforts.

- Automated Compliance Checks: AI-powered systems can automate the review of documentation, regulatory compliance, and audit reports, reducing manual errors and speeding up the certification process.

- Improved Traceability and Supply Chain Monitoring: AI, when integrated with technologies like blockchain, can provide real-time, end-to-end visibility of food products, ensuring authenticity and compliance throughout the supply chain, from farm to fork.

- Predictive Risk Assessment: AI models can analyze historical data, environmental factors, and market trends to forecast potential contamination events or compliance failures, enabling targeted inspections and preventive measures by certification bodies.

- Optimized Audit Planning and Resource Allocation: AI can assist certification bodies in optimizing audit schedules, allocating auditors based on risk profiles, and identifying areas requiring closer scrutiny, thereby increasing efficiency and reducing operational costs.

- Fraud Detection: AI can detect patterns indicative of fraudulent activities or mislabeling by analyzing vast datasets, safeguarding the integrity of certified products and consumer trust.

Key Takeaways Food Certification Market Size & Forecast

Inquiries about the key takeaways from the Food Certification market size and forecast consistently focus on identifying the primary growth drivers, the most promising segments, and the implications for businesses operating within the food industry. Users are interested in understanding the long-term viability of the market, the role of consumer preferences in shaping its trajectory, and the essential strategies for companies looking to gain a competitive edge. The overarching theme is the recognition of certification as an indispensable component of food safety and quality assurance, with its growth inextricably linked to global health and trade dynamics.

- Mandatory Safety and Quality Standards: The market’s robust growth is fundamentally driven by increasingly stringent government regulations and global trade agreements that necessitate verifiable food safety and quality standards across all stages of the food supply chain.

- Rising Consumer Awareness: Informed consumers are demanding greater transparency and assurance regarding the origin, safety, and production methods of their food, fueling the demand for third-party certifications beyond basic regulatory compliance.

- Globalization of Food Trade: As food products traverse international borders with greater frequency, the need for universally recognized and trusted certifications becomes critical for market access and mitigating risks associated with diverse regulatory environments.

- Technological Integration: The market is poised for significant transformation through the adoption of digital technologies such as blockchain, IoT, and AI, which promise to enhance the efficiency, accuracy, and traceability of certification processes, making them more robust and reliable.

- Emerging Market Opportunities: Developing regions, with their expanding food processing industries and increasing integration into global supply chains, present substantial growth opportunities for food certification services, driven by evolving regulatory landscapes and rising consumer purchasing power.

Food Certification Market Drivers Analysis

The Food Certification market is significantly propelled by several key drivers that reflect a global emphasis on food safety, quality, and sustainability. These drivers interact to create a robust demand environment for certification services, underscoring their vital role in securing consumer confidence and facilitating international trade. As regulatory bodies worldwide continue to tighten food safety standards, and as consumers become more discerning about their food choices, the impetus for robust certification mechanisms becomes even more pronounced, driving consistent market expansion.

Furthermore, the increasing complexity of global food supply chains necessitates comprehensive certification to ensure traceability and compliance across diverse geographical and operational landscapes. This complexity, coupled with the rising incidence of foodborne diseases and contamination scandals, reinforces the critical need for independent third-party verification. The combined effect of regulatory push, consumer pull, and supply chain intricacies creates a powerful and sustained demand for food certification services.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Consumer Awareness of Food Safety and Quality | +2.1% | Global, particularly North America, Europe, Asia Pacific | Short to Medium Term (2025-2029) |

| Increasing Stringency of Food Safety Regulations and Standards | +1.8% | Global, especially EU, US, China, India | Medium to Long Term (2025-2033) |

| Rising Global Food Trade and Export Requirements | +1.5% | All major trading blocs and exporting nations | Medium Term (2026-2031) |

| Demand for Certified Organic, Non-GMO, and Specialty Products | +1.3% | North America, Europe, Developed Asia Pacific | Short to Medium Term (2025-2029) |

| Food Industry Focus on Risk Management and Supply Chain Transparency | +1.1% | Global, large multinational food companies | Medium Term (2026-2031) |

Food Certification Market Restraints Analysis

Despite its significant growth, the Food Certification market faces several notable restraints that could temper its expansion. One primary challenge is the high cost associated with obtaining and maintaining various certifications, which can be particularly burdensome for small and medium-sized enterprises (SMEs). This financial barrier often limits their ability to compete in markets where certified products are preferred, potentially slowing the overall adoption rate of certification services in certain segments.

Another critical restraint is the lack of universal harmonization among global food safety and quality standards. The existence of multiple, often overlapping, and sometimes conflicting certification schemes can create confusion, increase administrative overhead, and complicate international trade. This fragmentation necessitates multiple certifications for products entering different markets, adding complexity and cost for manufacturers and exporters, thereby acting as a bottleneck to streamlined global food commerce and certification growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Cost of Certification and Compliance for SMEs | -1.2% | Developing Regions, SMEs globally | Short to Medium Term (2025-2030) |

| Lack of Harmonization and Varying Global Standards | -0.9% | Global, for companies involved in international trade | Medium to Long Term (2026-2033) |

| Complexity of Global Supply Chains and Data Management | -0.7% | Global, large multinational food companies | Medium Term (2026-2031) |

| Limited Awareness and Enforcement in Developing Regions | -0.6% | Parts of Asia, Africa, Latin America | Medium to Long Term (2027-2033) |

Food Certification Market Opportunities Analysis

The Food Certification market is ripe with opportunities driven by evolving consumer preferences and technological advancements. The increasing global demand for specialized food products, such as organic, non-GMO, gluten-free, halal, and kosher, presents significant growth avenues for certification bodies. As consumers become more health-conscious and ethically minded, the need for independent verification of these claims becomes paramount, creating distinct market niches for tailored certification services.

Furthermore, the ongoing digitalization of food supply chains and the emergence of advanced technologies like blockchain, Artificial Intelligence, and the Internet of Things offer transformative opportunities. These technologies can enhance the efficiency, transparency, and integrity of the certification process, enabling real-time monitoring, predictive risk assessment, and immutable record-keeping. The integration of such innovations can streamline audits, reduce costs, and provide greater assurance to both consumers and regulators, thereby expanding the scope and value of food certification services globally.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration of Digital Technologies (Blockchain, AI, IoT) | +1.9% | Global, technologically advanced regions | Medium to Long Term (2027-2033) |

| Growing Demand for Specialized and Niche Food Certifications | +1.6% | North America, Europe, Developed Asia Pacific | Short to Medium Term (2025-2030) |

| Expansion into Emerging Markets and Developing Economies | +1.4% | Asia Pacific, Latin America, Middle East & Africa | Medium to Long Term (2026-2033) |

| Increased Focus on Environmental, Social, and Governance (ESG) Certifications | +1.0% | Global, especially corporate and conscious consumer markets | Medium Term (2026-2031) |

Food Certification Market Challenges Impact Analysis

The Food Certification market is not without its significant challenges, primarily stemming from the pervasive issue of fraudulent certifications and the broader challenge of maintaining consumer and industry trust. The existence of counterfeit certificates or misrepresentation of compliance can severely undermine the credibility of legitimate certification bodies and erode confidence in certified products. This challenge necessitates constant vigilance, advanced verification technologies, and stringent enforcement mechanisms to protect the integrity of the market.

Another significant hurdle is the constantly evolving regulatory landscape. Food safety and quality standards are subject to frequent updates and amendments, often varying significantly across different jurisdictions. This dynamic environment requires certification bodies and food businesses to continuously adapt their processes and invest in ongoing training and compliance updates, posing operational complexities and cost implications. Furthermore, securing and protecting sensitive data within increasingly digitalized certification systems presents an ongoing cybersecurity challenge that demands robust solutions to prevent breaches and maintain confidentiality.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Risk of Fraudulent Certifications and Maintaining Trust | -1.0% | Global, particularly in less regulated markets | Short to Medium Term (2025-2030) |

| Evolving Regulatory Landscape and Compliance Complexity | -0.8% | Global, especially in multinational operations | Medium Term (2026-2031) |

| Shortage of Skilled Auditors and Technical Experts | -0.6% | Global, particularly specialized certification areas | Short to Medium Term (2025-2029) |

| Data Security and Privacy Concerns in Digitalization | -0.5% | Global, with increasing adoption of digital platforms | Medium Term (2026-2031) |

Food Certification Market - Updated Report Scope

This report provides an in-depth analysis of the Food Certification Market, offering a comprehensive overview of its size, growth trajectories, and influential factors. It dissects the market into various segments, examining their individual contributions and future potential. The scope encompasses detailed analyses of market drivers, restraints, opportunities, and challenges, providing a holistic perspective for stakeholders. Furthermore, the report delves into regional dynamics and profiles key market players, delivering actionable insights for strategic decision-making and market positioning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 28.3 Billion |

| Growth Rate | 7.8% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | SGS SA, Bureau Veritas, Intertek Group plc, Eurofins Scientific, DNV GL, NSF International, LRQA, TÜV SÜD AG, DEKRA SE, UL LLC, ALS Limited, Mérieux NutriSciences Corporation, Control Union Certifications, Ecocert SA, Kiwa NV, SAI Global, AsureQuality Ltd., GFSI (Global Food Safety Initiative), RINA S.p.A., British Standards Institution (BSI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Food Certification market is comprehensively segmented to provide a granular understanding of its diverse components and their respective growth drivers. These segments highlight the varied needs within the food industry, ranging from fundamental safety standards to specialized dietary and ethical claims, reflecting the complex landscape of food production, distribution, and consumption. Analyzing these segments individually offers insights into specific market dynamics and opportunities.

The segmentation allows for a detailed examination of how different types of certification schemes, applications, service types, and end-users contribute to the overall market growth. This multi-dimensional approach helps in identifying high-growth areas, understanding client-specific demands, and recognizing the evolving role of certification services across the entire food value chain, from raw material sourcing to final product consumption.

- By Type: This segment includes a wide array of certification standards and schemes that cater to different aspects of food safety, quality, and specific attributes. Categories like ISO 22000 focus on food safety management systems, HACCP on hazard analysis and critical control points, while BRCGS, FSSC 22000, and SQF are industry-recognized global standards. Specialty certifications such as Halal, Kosher, Organic, Non-GMO, Gluten-Free, Vegan, Fair Trade, IFS, and GlobalG.A.P. address specific consumer demands and ethical considerations, each serving a distinct market niche.

- By Application: This segmentation categorizes the market based on the types of food products that undergo certification. Key applications include Meat Poultry and Seafood, which demand stringent hygiene and safety protocols due to their perishability; Dairy and Dairy Products, requiring specific quality and processing certifications; Beverages, covering both alcoholic and non-alcoholic drinks; Processed Food, a broad category with diverse certification needs; Fresh Produce, focusing on Good Agricultural Practices and pesticide residue limits; and Others, encompassing categories like Bakery and Confectionery, each with unique certification requirements.

- By Service Type: This segment delineates the various services offered by certification bodies. Auditing services involve systematic evaluations of food safety management systems and operational compliance. Testing services encompass laboratory analyses to verify product specifications, detect contaminants, and ensure nutritional accuracy. Certification services represent the core offering, providing official recognition of compliance with established standards. Training & Advisory services support food businesses in understanding and implementing standards, preparing them for successful certification.

- By End-User: This segment identifies the primary clients of food certification services. Food Manufacturers, including producers of raw ingredients and finished goods, are major users to ensure product safety and market access. Food Retailers leverage certifications to assure consumers of product quality and build brand trust. Food Service Providers, such as restaurants and caterers, require certification for ingredient sourcing and operational hygiene. Government & Regulatory Bodies utilize certification schemes for oversight and enforcement of food safety laws, while Others include entities like import/export agencies and supply chain logistics providers.

Regional Highlights

- North America: This region stands as a prominent market for food certification, driven by stringent regulatory frameworks, high consumer awareness regarding food safety, and a robust demand for organic and specialty food products. The presence of major food processing industries and a strong emphasis on supply chain transparency further contribute to market growth.

- Europe: Europe represents a mature and highly regulated market, with comprehensive food safety legislation and a strong preference for certified quality and sustainable products. Countries within the European Union adhere to rigorous standards like HACCP, ISO 22000, and specific organic certifications, making it a leading region in terms of certification adoption and innovation.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate due to rapid industrialization, increasing urbanization, rising disposable incomes, and a growing middle class demanding safer and higher-quality food. Expanding food processing sectors, rising international trade, and increasing awareness of foodborne illnesses in countries like China and India are propelling the market.

- Latin America: This region is experiencing steady growth, fueled by increasing exports of agricultural and processed food products to global markets, which necessitates adherence to international certification standards. Rising consumer awareness and evolving domestic food safety regulations are also contributing factors.

- Middle East and Africa (MEA): The MEA region is witnessing emergent growth, particularly driven by the increasing demand for Halal certified products across Islamic countries. Growing tourism, investments in food processing infrastructure, and improving food safety standards are creating new opportunities for certification services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Certification Market.- SGS SA

- Bureau Veritas

- Intertek Group plc

- Eurofins Scientific

- DNV GL

- NSF International

- LRQA

- TÜV SÜD AG

- DEKRA SE

- UL LLC

- ALS Limited

- Mérieux NutriSciences Corporation

- Control Union Certifications

- Ecocert SA

- Kiwa NV

- SAI Global

- AsureQuality Ltd.

- GFSI (Global Food Safety Initiative)

- RINA S.p.A.

- British Standards Institution (BSI)

Frequently Asked Questions

What is food certification and why is it important?

Food certification is a process by which an independent third-party organization verifies that a food product, system, or process meets specific predefined standards. It is crucial because it assures consumers of product safety, quality, and authenticity, facilitates international trade by demonstrating compliance with global standards, and helps food businesses mitigate risks, build trust, and gain a competitive advantage.

What are the major types of food certifications available?

Major types of food certifications include foundational safety standards like HACCP, ISO 22000, FSSC 22000, BRCGS, and SQF, which focus on hazard control and management systems. Additionally, there are specialized certifications for specific attributes such as Organic, Non-GMO, Gluten-Free, Halal, Kosher, Vegan, and Fair Trade, addressing diverse consumer preferences and ethical considerations.

How long does the food certification process typically take?

The duration of the food certification process varies significantly depending on the type of certification, the complexity of the food operation, the readiness of the organization, and the efficiency of the certification body. It can range from a few weeks for simpler certifications to several months or even a year for comprehensive or highly complex schemes, involving stages like application, audit, corrective actions, and final review.

What is the role of technology in modern food certification?

Technology plays a transformative role in modern food certification by enhancing traceability, efficiency, and data integrity. Innovations like blockchain provide immutable records of food origin and journey, IoT sensors enable real-time monitoring of conditions, and AI assists in predictive risk assessment and automated compliance checks, leading to more robust, transparent, and proactive certification processes.

How do food certifications benefit consumers and businesses?

For consumers, food certifications provide assurance of safety, quality, and specific product claims, enabling informed purchasing decisions and building trust. For businesses, certifications enhance market access, strengthen brand reputation, improve operational efficiency, reduce the risk of recalls, comply with regulatory requirements, and open opportunities in global markets, ultimately contributing to increased competitiveness and profitability.