Metal Detector in Food Market

Metal Detector in Food Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706083 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Metal Detector in Food Market Size

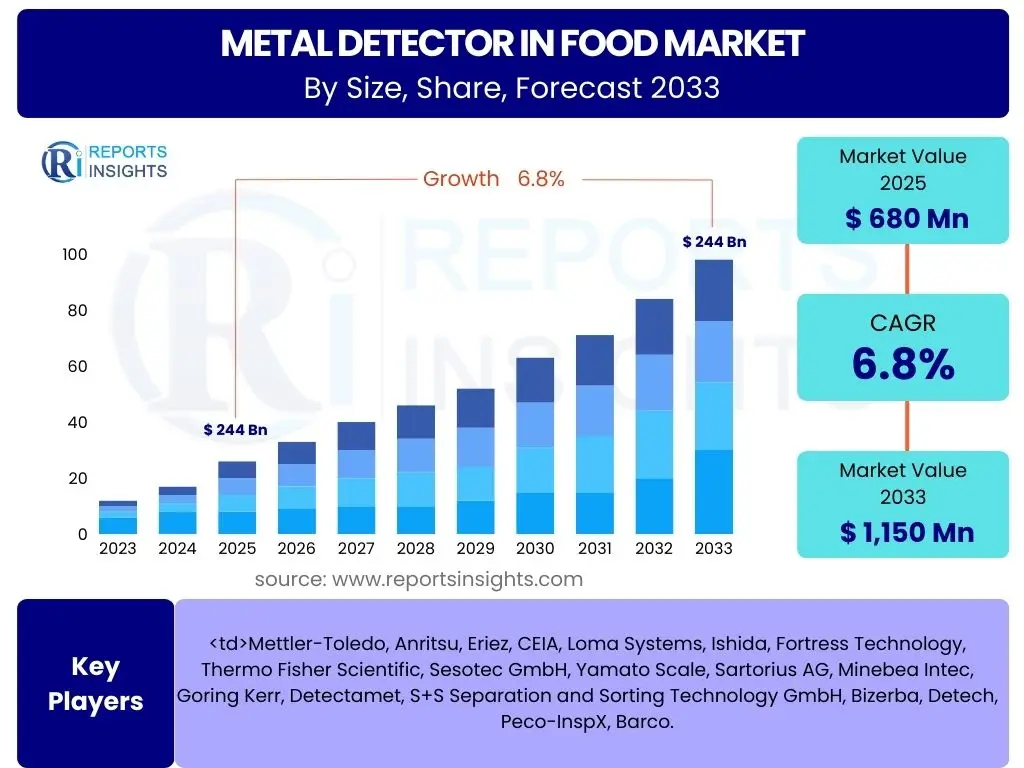

According to Reports Insights Consulting Pvt Ltd, The Metal Detector in Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 680 Million in 2025 and is projected to reach USD 1,150 Million by the end of the forecast period in 2033.

Key Metal Detector in Food Market Trends & Insights

Common user inquiries regarding market trends often revolve around technological advancements, regulatory shifts, and operational efficiency. The market is increasingly driven by the imperative for enhanced food safety and quality assurance, leading to the adoption of more sophisticated detection technologies. Furthermore, there is a clear trend towards integrating metal detection systems with broader factory automation and data analytics platforms, providing comprehensive oversight and improved traceability. Users are keen to understand how these trends translate into more reliable and cost-effective food processing operations.

The industry is witnessing significant evolution in metal detection capabilities, moving beyond basic contaminant identification to predictive analytics and real-time process adjustments. This technological progression is vital for meeting stringent global food safety standards and consumer expectations for safe food products. The emphasis is on reducing false rejects, improving detection sensitivity for minute contaminants, and streamlining operational workflows to maximize production efficiency without compromising safety.

- Increased demand for higher sensitivity and accuracy in contaminant detection.

- Integration with Industry 4.0 and Internet of Things (IoT) for enhanced monitoring and data analytics.

- Shift towards multi-frequency detection systems to improve detection across diverse product types.

- Focus on user-friendly interfaces, remote diagnostics, and predictive maintenance capabilities.

- Growing adoption of X-ray inspection technology, often complementing traditional metal detection systems.

- Development of compact and customizable solutions for varied production environments.

- Emphasis on hygienic designs to meet stringent sanitary standards in food processing.

AI Impact Analysis on Metal Detector in Food

User questions regarding the impact of Artificial Intelligence (AI) on metal detectors in the food industry frequently concern improvements in detection accuracy, reduction in false positives, and automation of quality control processes. There is a strong interest in how AI can move these systems from reactive anomaly detection to proactive predictive analysis, thereby optimizing production lines. Concerns often include the cost of implementing AI-driven systems and the technical expertise required for their operation and maintenance.

AI's influence is poised to transform metal detection by enabling systems to learn from vast datasets, differentiate between product effects and actual contaminants more effectively, and provide real-time insights into production quality. This capability extends beyond simple detection to encompass predictive maintenance, allowing for scheduled interventions that minimize downtime and operational disruptions. The technology facilitates a more intelligent and responsive approach to food safety, ensuring higher product integrity and regulatory compliance. Moreover, AI can assist in automating calibration and optimizing system parameters, significantly reducing human error and enhancing overall performance.

- Enhanced detection algorithms for improved accuracy and reduced false reject rates by distinguishing between product effect and actual contaminants.

- Predictive maintenance capabilities for metal detection equipment, minimizing downtime and optimizing operational efficiency.

- Real-time data analysis and reporting for continuous process optimization and compliance monitoring.

- Automated system calibration and parameter adjustments, leading to consistent performance and simplified operation.

- Improved anomaly detection and classification, allowing for more precise identification of foreign objects.

- Optimization of production line flow by providing insights into contaminant trends and sources.

Key Takeaways Metal Detector in Food Market Size & Forecast

Common user questions about the key takeaways from the Metal Detector in Food market size and forecast often focus on growth drivers, investment opportunities, and long-term market stability. Users seek concise summaries of what these market dynamics imply for stakeholders, including manufacturers, food processors, and technology providers. The insights highlight critical factors influencing market expansion and the strategic implications for businesses operating within or looking to enter this sector.

The market's sustained growth is primarily fueled by an escalating global emphasis on food safety and increasingly stringent regulatory frameworks worldwide. This regulatory push, coupled with rising consumer awareness regarding foodborne contaminants, creates a perpetual demand for advanced detection solutions. Furthermore, continuous technological innovation in metal detection, including advancements in multi-frequency capabilities and integration with smart factory ecosystems, is a significant accelerator. This ensures that the market remains dynamic, offering continuous opportunities for product development and market penetration, particularly in regions undergoing rapid industrialization and modernization of their food processing sectors.

- The market is set for robust growth, driven primarily by tightening global food safety regulations and increasing consumer awareness of product integrity.

- Technological advancements, including multi-frequency detection and AI integration, are enhancing system capabilities and driving adoption across various food sectors.

- Significant opportunities exist in emerging economies due to their expanding food processing industries and evolving regulatory landscapes.

- The trend towards automation and data-driven quality control in food manufacturing strongly supports the continued demand for sophisticated metal detection systems.

- Investment in research and development for improved sensitivity, reduced false positives, and seamless integration will be crucial for competitive advantage.

- The market is resilient, with growth underpinned by essential food safety requirements that transcend economic fluctuations.

Metal Detector in Food Market Drivers Analysis

The Metal Detector in Food Market is primarily propelled by a confluence of regulatory pressures, rising consumer safety concerns, and rapid technological evolution. Governments globally are implementing and enforcing stricter food safety standards, compelling food manufacturers to adopt advanced contaminant detection systems. Concurrently, consumers are increasingly demanding high-quality, safe food products, which puts additional pressure on the industry to ensure product integrity. These factors create a strong, foundational demand for reliable metal detection solutions across the entire food supply chain.

Furthermore, the escalating incidence of food recalls due to foreign material contamination underscores the critical necessity of robust detection equipment. Each recall event highlights the financial, reputational, and health risks associated with inadequate safety measures, prompting companies to invest proactively in preventative technologies. The continuous innovation in metal detector capabilities, offering higher sensitivity, better discrimination, and seamless integration with production lines, also serves as a significant driver, making these systems more attractive and effective for diverse food processing applications.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stricter Food Safety Regulations and Standards | +2.5% | Global, particularly North America, Europe, Asia Pacific | Long-term (2025-2033) |

| Rising Incidence of Food Contamination and Recalls | +1.8% | Global, with pronounced impact in developed markets | Mid-term (2025-2029) |

| Technological Advancements in Detection Systems | +1.5% | Global, with early adoption in technologically advanced regions | Long-term (2025-2033) |

| Increasing Consumer Awareness and Demand for Safe Food | +1.0% | Global, especially in urban and affluent areas | Long-term (2025-2033) |

Metal Detector in Food Market Restraints Analysis

Despite significant growth drivers, the Metal Detector in Food Market faces several restraints that could impede its full potential. A primary constraint is the high initial capital investment required for acquiring advanced metal detection systems. For small and medium-sized enterprises (SMEs) or businesses with limited budgets, the cost of purchasing, installing, and integrating these sophisticated machines can be a substantial barrier, leading to slower adoption rates in certain segments or regions. This cost factor extends beyond the purchase price to include installation, calibration, and ongoing maintenance expenses, collectively posing a financial challenge.

Another significant restraint is the operational challenge associated with false rejection rates. While modern metal detectors are highly sensitive, they can sometimes trigger false alarms due to factors like product effect (the inherent conductivity or moisture content of the food product) or environmental interference. These false rejects lead to unnecessary product waste, reduced throughput, and increased operational costs. Mitigating false positives often requires complex calibration and specialized operator training, adding to the operational burden and potentially deterring some manufacturers from investing in higher-sensitivity systems or pushing for optimized performance that truly reduces waste without compromising safety.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Capital Investment and Installation Costs | -1.2% | Global, particularly impacting SMEs in developing regions | Long-term (2025-2033) |

| Complexity of System Integration with Existing Production Lines | -0.8% | Global, more pronounced in facilities with legacy equipment | Mid-term (2025-2029) |

| Challenges in Reducing False Rejection Rates | -0.7% | Global, impacting operational efficiency across all sectors | Long-term (2025-2033) |

Metal Detector in Food Market Opportunities Analysis

The Metal Detector in Food Market presents several compelling opportunities for growth and innovation. A significant avenue lies in the expansion into developing economies, where burgeoning food processing industries are rapidly adopting international food safety standards. As these regions experience economic growth and increased industrialization, the demand for reliable contaminant detection equipment rises, creating new, untapped markets. Companies that can offer cost-effective and adaptable solutions tailored to the specific needs and infrastructure limitations of these regions stand to gain a substantial competitive advantage and market share.

Furthermore, the ongoing integration of metal detection systems with Industry 4.0 technologies, such as the Internet of Things (IoT) and cloud-based data analytics, represents a transformative opportunity. This connectivity enables real-time monitoring, predictive maintenance, and comprehensive data collection, which can significantly enhance operational efficiency and compliance. Developing and offering customized solutions for niche food applications or specific production environments, such as those handling highly viscous products or very small package sizes, also opens up specialized market segments. These tailored solutions address unique challenges, providing higher value and fostering stronger client relationships. Innovation in multi-frequency and advanced software capabilities will be key to capitalizing on these opportunities.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging and Developing Economies | +1.5% | Asia Pacific, Latin America, Middle East & Africa | Long-term (2025-2033) |

| Integration with IoT, AI, and Cloud-Based Platforms | +1.2% | Global, especially in technologically advanced markets | Long-term (2025-2033) |

| Growing Demand for Customized and Application-Specific Solutions | +0.9% | Global, driven by diverse food processing needs | Mid-term (2025-2029) |

Metal Detector in Food Market Challenges Impact Analysis

The Metal Detector in Food Market faces several notable challenges that impact its growth trajectory and operational efficiency. One significant challenge is maintaining detection accuracy across a wide variety of food matrices, which often possess varying conductivity, moisture content, and temperature profiles. This phenomenon, known as "product effect," can significantly reduce a metal detector's sensitivity or lead to an increase in false rejections, thereby hindering operational efficiency and increasing product waste. Overcoming product effect requires advanced multi-frequency technologies and sophisticated algorithms, which can add to the complexity and cost of the systems.

Another prominent challenge is the shortage of skilled labor required for the proper operation, calibration, and maintenance of advanced metal detection equipment. As systems become more technologically sophisticated, the need for trained personnel who can interpret data, troubleshoot issues, and ensure optimal performance becomes critical. The continuous evolution of contaminant types and sizes, along with new packaging materials, also presents a perpetual challenge. Manufacturers must constantly innovate and adapt their detection technologies to keep pace with these emerging threats, requiring ongoing research and development investments and rapid deployment of updated solutions to remain effective in safeguarding food products and ensuring compliance with dynamic regulatory landscapes.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Maintaining Detection Accuracy with Diverse Food Matrices (Product Effect) | -1.0% | Global, affecting all food processing sectors | Long-term (2025-2033) |

| Shortage of Skilled Labor for Operation and Maintenance | -0.9% | Global, particularly in regions with less developed technical education | Long-term (2025-2033) |

| Evolving Contaminant Types and Sizes Requiring Continuous R&D | -0.7% | Global, impacting technology development and adoption | Long-term (2025-2033) |

Metal Detector in Food Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Metal Detector in Food Market, encompassing historical data, current market dynamics, and future projections. It delivers critical insights into market size, growth trends, key drivers, restraints, opportunities, and challenges affecting the industry. The report also offers detailed segmentation analysis by type, application, end-use industry, and technology, alongside a thorough regional assessment, ensuring a holistic view of the market landscape. Profiles of leading market players are included to provide competitive intelligence and strategic positioning within the sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 680 Million |

| Market Forecast in 2033 | USD 1,150 Million |

| Growth Rate | 6.8% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Mettler-Toledo, Anritsu, Eriez, CEIA, Loma Systems, Ishida, Fortress Technology, Thermo Fisher Scientific, Sesotec GmbH, Yamato Scale, Sartorius AG, Minebea Intec, Goring Kerr, Detectamet, S+S Separation and Sorting Technology GmbH, Bizerba, Detech, Peco-InspX, Barco. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Metal Detector in Food Market is comprehensively segmented to provide a granular understanding of its diverse components and their respective contributions to the overall market dynamics. This segmentation facilitates a deeper analysis of specific product types, application areas, and end-use industries, highlighting varying adoption rates and technological preferences across different sectors. Understanding these segments is crucial for identifying niche opportunities, tailoring product development, and devising effective market entry strategies.

The analysis extends to differentiating technologies, recognizing that advancements in detection methodologies significantly influence market growth and system capabilities. Each segment is examined to reveal its growth potential, key trends, and the factors driving its specific trajectory within the broader food safety landscape. This detailed breakdown ensures that stakeholders can pinpoint areas of high demand and areas requiring further technological innovation or market penetration efforts. The insights derived from this segmentation are vital for strategic planning and resource allocation.

- By Type:

- Conveyor-based Metal Detectors: Widely used for packaged or loose products on conveyor lines.

- Gravity-feed Metal Detectors: Ideal for bulk, free-falling products like powders and granules.

- Pipeline Metal Detectors: Designed for pumpable products such as liquids, slurries, and pastes.

- Handheld Metal Detectors: Primarily used for spot checks and quality control in specific areas.

- Tabletop Metal Detectors: Compact units suitable for small-scale operations or quality assurance checks.

- By Application:

- Meat, Poultry, and Seafood Products: Critical for detecting bone fragments and processing equipment wear.

- Bakery and Confectionery Products: Essential for identifying metallic inclusions from mixing or baking.

- Dairy Products: Used for fluid and solid dairy items to ensure purity.

- Fruits and Vegetables: Addresses potential contaminants from harvesting and processing.

- Processed Food: A broad category including ready meals, snacks, and frozen foods.

- Beverages: Ensures the absence of metallic particles in liquid products.

- Others: Encompasses various other food items such as grains, spices, and pet food.

- By End-Use Industry:

- Food Processing Facilities: The largest segment, covering diverse manufacturing plants.

- Food Packaging Operations: Integration into packaging lines to ensure final product safety.

- Food Retail and Distribution Centers: Used for incoming goods inspection and quality assurance.

- By Technology:

- Balanced Coil Technology: The most common and versatile technology for general purpose detection.

- Ferrous in Foil Technology: Specialized for detecting ferrous metals in aluminum-foiled products.

- Multi-Frequency Technology: Offers enhanced detection capabilities and reduced product effect.

- Others: Includes specialized technologies like ultra-high frequency or pulsed induction for specific applications.

Regional Highlights

The Metal Detector in Food Market exhibits distinct growth patterns and maturity levels across different geographical regions, influenced by varying regulatory landscapes, industrial development, and consumer awareness. North America and Europe represent mature markets characterized by stringent food safety regulations and a high adoption rate of advanced food processing technologies. These regions continuously invest in upgrades and sophisticated detection systems to comply with evolving standards and maintain high levels of consumer confidence. The presence of major market players and early technology adopters further reinforces their market leadership. Manufacturers in these regions often focus on integrating smart technologies and enhancing system intelligence to optimize operational efficiency and reduce false positives.

Asia Pacific (APAC) is projected to be the fastest-growing market, driven by rapid industrialization, increasing urbanization, and a growing middle class with rising disposable incomes, leading to higher consumption of processed and packaged foods. This region is witnessing significant investments in food processing infrastructure, along with a gradual adoption of international food safety standards, creating substantial demand for metal detection equipment. Countries like China, India, and Japan are at the forefront of this growth. Latin America and the Middle East & Africa (MEA) are emerging markets, where increasing awareness about food safety, coupled with developing regulatory frameworks and expanding food processing industries, is stimulating market growth. While these regions may face challenges related to initial investment costs and technological expertise, the long-term potential for market expansion remains significant, fueled by economic development and the globalization of food safety norms.

- North America: Dominates the market due to stringent food safety regulations, high consumer awareness, and significant investments in advanced food processing technologies. The region's focus is on integrating smart solutions and enhancing automation.

- Europe: A mature market with robust regulatory frameworks like HACCP and BRC, driving continuous demand for high-performance metal detection systems. Emphasis on hygienic design and reduction of product waste.

- Asia Pacific (APAC): Expected to be the fastest-growing region, propelled by rapid economic growth, increasing processed food consumption, and rising adoption of international food safety standards in countries like China, India, and Japan.

- Latin America: Exhibits steady growth as food processing industries expand and governments implement more comprehensive food safety policies. Opportunities exist for adaptable and cost-effective solutions.

- Middle East and Africa (MEA): An emerging market with increasing investments in food manufacturing infrastructure and growing awareness of food safety, leading to a rising demand for reliable detection equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Detector in Food Market.- Mettler-Toledo

- Anritsu

- Eriez

- CEIA

- Loma Systems

- Ishida

- Fortress Technology

- Thermo Fisher Scientific

- Sesotec GmbH

- Yamato Scale

- Sartorius AG

- Minebea Intec

- Goring Kerr

- Detectamet

- S+S Separation and Sorting Technology GmbH

- Bizerba

- Detech

- Peco-InspX

- Barco

Frequently Asked Questions

Analyze common user questions about the Metal Detector in Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of metal detectors in the food industry?

The primary function of metal detectors in the food industry is to identify and remove metallic foreign objects, such as stainless steel, ferrous metals, and non-ferrous metals, from food products during the processing and packaging stages. This ensures product safety, protects consumers from harm, and helps food manufacturers comply with stringent safety regulations and quality standards, thereby preventing costly product recalls and brand damage.

How do metal detectors enhance food safety compliance?

Metal detectors enhance food safety compliance by serving as a critical control point (CCP) in Hazard Analysis and Critical Control Points (HACCP) plans. They provide a reliable method to consistently inspect every product for metallic contamination, documenting the inspection process for audit trails. This proactive approach helps manufacturers meet global regulatory requirements, adhere to industry best practices, and demonstrate due diligence in ensuring product integrity and consumer safety.

What are the key types of metal detectors used in food processing?

Key types of metal detectors used in food processing include conveyor-based systems for packaged or loose products, gravity-feed systems for bulk dry goods, pipeline detectors for liquid or slurry products, and tabletop or handheld units for specialized applications. Each type is designed to efficiently inspect food products at different stages of the production process, accommodating various product forms and line speeds to ensure comprehensive contamination control.

How does Artificial Intelligence (AI) improve metal detection in food?

Artificial Intelligence (AI) improves metal detection in food by enabling systems to learn and adapt, leading to enhanced accuracy and reduced false rejections. AI-powered algorithms can differentiate more effectively between product effect (natural signals from the food itself) and actual metallic contaminants. This allows for more precise detection, real-time optimization of system settings, predictive maintenance of equipment, and comprehensive data analysis for improved operational efficiency and quality control.

What are the main factors driving the growth of the metal detector in food market?

The main factors driving the growth of the metal detector in food market include the increasing stringency of global food safety regulations, the rising incidence of food contamination and product recalls, and heightened consumer awareness regarding food quality and safety. Additionally, continuous technological advancements in detection capabilities, coupled with the growing demand for processed and packaged foods worldwide, further stimulate market expansion.