Fluidized Catalytic Cracking Catalyst Market

Fluidized Catalytic Cracking Catalyst Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700506 | Last Updated : July 25, 2025 |

Format : ![]()

![]()

![]()

![]()

Fluidized Catalytic Cracking Catalyst Market Size

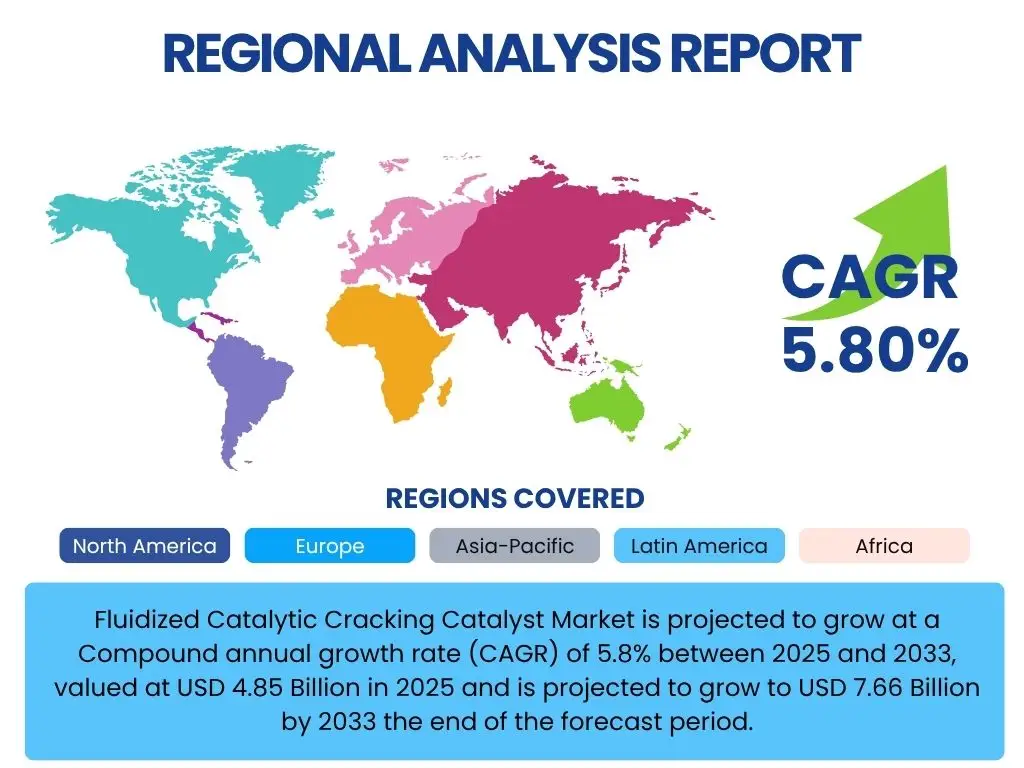

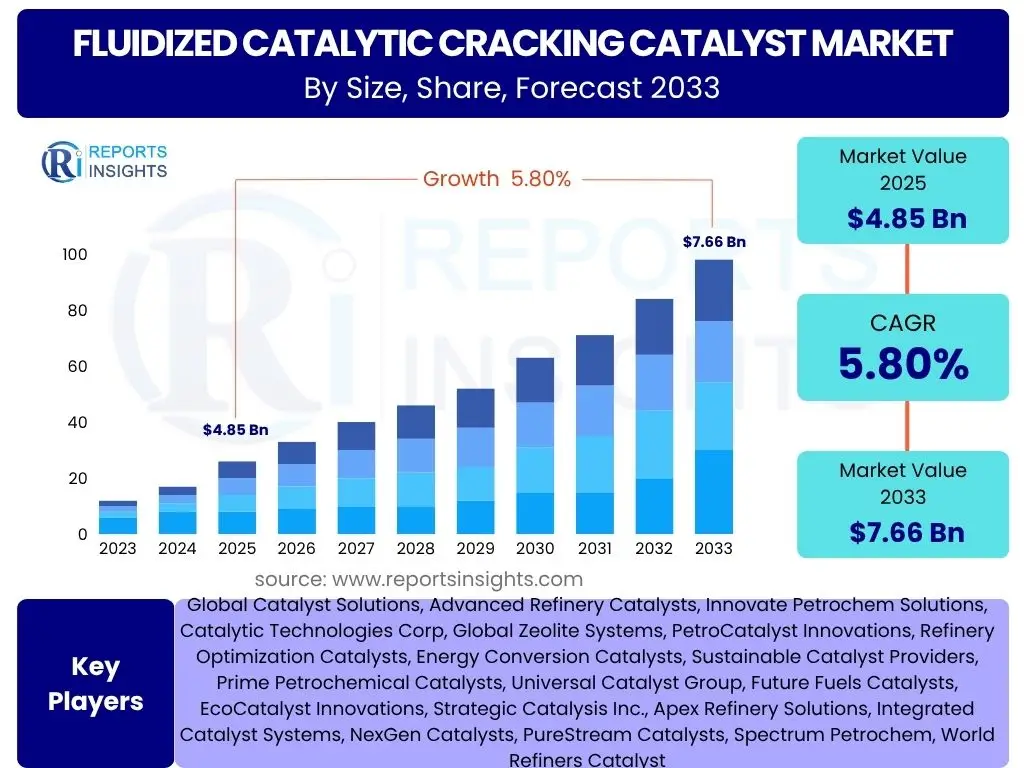

Fluidized Catalytic Cracking Catalyst Market is projected to grow at a Compound annual growth rate (CAGR) of 5.8% between 2025 and 2033, valued at USD 4.85 Billion in 2025 and is projected to grow to USD 7.66 Billion by 2033 the end of the forecast period.

Key Fluidized Catalytic Cracking Catalyst Market Trends & Insights

The Fluidized Catalytic Cracking Catalyst market is shaped by several dynamic trends reflecting advancements and evolving industry demands, focusing on enhanced yield, environmental compliance, and operational efficiency.

- Increasing demand for cleaner fuels driving adoption of advanced catalyst formulations.

- Growing focus on petrochemical production from FCC units, shifting catalyst development.

- Technological advancements in catalyst design, including novel zeolites and matrix compositions.

- Emphasis on circular economy principles influencing catalyst recycling and regeneration practices.

- Regional shifts in refining capacity, particularly towards Asia Pacific and the Middle East.

AI Impact Analysis on Fluidized Catalytic Cracking Catalyst

Artificial Intelligence (AI) is beginning to exert a transformative influence on the Fluidized Catalytic Cracking Catalyst market, primarily through optimizing catalyst performance, predictive maintenance, and accelerating R&D cycles. Its application promises enhanced operational efficiency and resource utilization.

- AI-driven optimization of FCC unit operations for improved catalyst activity and selectivity.

- Predictive analytics for catalyst deactivation, enabling proactive catalyst management.

- Accelerated R&D through AI-powered material design and simulation of novel catalyst formulations.

- Enhanced supply chain management and demand forecasting for catalyst manufacturing and distribution.

- Real-time monitoring and anomaly detection in FCC processes to prevent off-spec production and reduce catalyst loss.

Key Takeaways Fluidized Catalytic Cracking Catalyst Market Size & Forecast

- The market is poised for steady growth, driven by increasing energy demands and the global shift towards cleaner fuel standards.

- Technological innovations in catalyst chemistry are crucial for meeting evolving refinery needs, particularly for higher propylene and gasoline yields.

- Asia Pacific is expected to remain a dominant region due to expanding refining capacities and burgeoning fuel consumption.

- Sustainability initiatives, including lower emissions and efficient resource utilization, are increasingly influencing catalyst development and adoption.

- The integration of advanced analytics and AI will significantly enhance operational efficiencies and optimize catalyst performance in FCC units.

Fluidized Catalytic Cracking Catalyst Market Drivers Analysis

The Fluidized Catalytic Cracking (FCC) catalyst market is fundamentally driven by the expanding global demand for refined petroleum products, particularly gasoline and diesel, which are essential for transportation and industrial sectors. As global population and economic activities continue to rise, the consumption of these fuels escalates, directly impacting the operational needs of refineries worldwide. This sustained demand necessitates continuous operation and optimization of FCC units, which are central to converting heavy crude oil fractions into valuable light-end products. Therefore, the efficiency and performance of FCC catalysts become paramount in maximizing product yields and meeting the volume requirements of the market.

Furthermore, stringent environmental regulations aimed at reducing sulfur content and other pollutants in fuels are significantly influencing the demand for advanced FCC catalysts. Governments and regulatory bodies globally are implementing stricter emission standards to combat air pollution and climate change, compelling refineries to invest in catalysts that can produce cleaner-burning fuels. These catalysts are designed to improve desulfurization capabilities, reduce NOx and SOx emissions, and enhance the octane rating of gasoline without increasing harmful byproducts. The continuous evolution of these environmental mandates ensures a persistent need for innovative catalyst solutions that enable refineries to comply with regulations while maintaining profitability.

The increasing emphasis on petrochemical production from FCC units also serves as a strong driver for market growth. Traditionally focused on fuel production, many refineries are now adapting their FCC processes to produce higher yields of light olefins, such as propylene and butylene, which are critical building blocks for the petrochemical industry. This strategic shift is driven by the growing demand for polymers, plastics, and various chemical intermediates. Consequently, there is a rising demand for FCC catalysts specifically engineered to maximize olefin selectivity and yield, thereby expanding the application scope and market potential for these specialized catalyst formulations.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Global Demand for Refined Petroleum Products | +1.5% | Global, particularly Asia Pacific, North America, Middle East | Short to Long-term |

| Stringent Environmental Regulations for Cleaner Fuels | +1.2% | Europe, North America, China, India | Medium to Long-term |

| Increasing Focus on Petrochemical Production from FCC Units | +1.0% | Asia Pacific, Middle East, North America | Medium to Long-term |

| Technological Advancements in Catalyst Formulations | +0.8% | Global | Short to Medium-term |

Fluidized Catalytic Cracking Catalyst Market Restraints Analysis

The Fluidized Catalytic Cracking (FCC) catalyst market faces significant restraints from the volatile and often declining prices of crude oil, which directly impact the profitability of refineries. When crude oil prices are low, refining margins can shrink, leading to reduced operational expenditure on catalysts or delayed investments in new, more expensive catalyst technologies. Furthermore, economic slowdowns and geopolitical instabilities can disrupt global oil supply and demand dynamics, creating uncertainty for refiners and dampening their willingness to procure advanced catalyst solutions. This volatility can lead to conservative spending patterns, thereby limiting market growth for premium catalyst products.

Another notable restraint is the increasing global push towards renewable energy sources and electric vehicles (EVs). As nations commit to decarbonization goals and invest heavily in sustainable energy infrastructure, the long-term demand for traditional petroleum-based fuels is anticipated to plateau or even decline in certain regions. This structural shift in the global energy landscape poses a significant challenge for the FCC catalyst market, as the primary application for these catalysts is petroleum refining. While the transition will be gradual, the long-term outlook of reduced reliance on fossil fuels could constrain market expansion, compelling catalyst manufacturers to diversify their product portfolios or focus on niche applications.

The high capital investment required for new FCC unit construction and upgrades also acts as a significant barrier. Building or significantly modernizing an FCC unit involves substantial financial outlay, including the cost of catalysts, equipment, and associated infrastructure. This high entry barrier can deter new players from entering the refining sector or existing refiners from undertaking major expansion projects, especially in economically challenging periods. Consequently, the limited number of new FCC installations or major upgrades directly impacts the volume growth of the FCC catalyst market, as catalyst consumption is directly tied to the operational capacity of these units.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in Crude Oil Prices and Refining Margins | -0.8% | Global | Short to Medium-term |

| Growing Shift Towards Renewable Energy and Electric Vehicles | -0.7% | Europe, North America, Japan, China | Medium to Long-term |

| High Capital Investment for New FCC Unit Construction | -0.5% | Global | Medium to Long-term |

Fluidized Catalytic Cracking Catalyst Market Opportunities Analysis

The Fluidized Catalytic Cracking (FCC) catalyst market is presented with significant opportunities through the increasing demand for high-octane gasoline and light olefins in emerging economies. Countries in Asia Pacific, Latin America, and Africa are experiencing rapid industrialization and urbanization, leading to a surge in vehicle ownership and an expanding middle class. This demographic and economic shift translates into a higher consumption of gasoline and a growing need for petrochemical feedstock for various industries. Consequently, refineries in these regions are either expanding existing FCC capacities or constructing new units, creating a robust demand for advanced catalysts capable of efficiently converting heavy feedstock into high-value products, including high-octane gasoline and valuable petrochemicals like propylene.

Another promising opportunity lies in the development and commercialization of catalysts that can process unconventional feedstocks, such as bio-oil and plastics waste. As global efforts to promote sustainability and circular economy principles intensify, there is a growing interest in utilizing non-petroleum-based inputs in existing refinery processes. FCC technology is uniquely positioned to handle diverse feedstocks, and catalyst manufacturers are actively researching and developing formulations optimized for these novel inputs. Catalysts capable of efficiently converting bio-oils into transportation fuels or depolymerizing plastic waste into chemical monomers present a significant growth avenue, aligning the industry with environmental goals and diversifying its feedstock base beyond crude oil.

Furthermore, the continuous advancements in catalyst regeneration and recycling technologies offer a compelling opportunity for market players to enhance sustainability and cost-effectiveness. Efficient regeneration processes can extend the lifespan of catalysts, reduce waste generation, and lower operational costs for refineries. Innovations in recycling aim to recover valuable components from spent catalysts, minimizing environmental impact and creating a closed-loop system. Companies investing in these technologies can offer more sustainable solutions, gain a competitive edge, and appeal to environmentally conscious customers. This trend also supports the broader industry goal of reducing its carbon footprint and promoting resource efficiency, thereby opening new markets for greener catalyst solutions.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for High-Octane Gasoline and Light Olefins in Emerging Economies | +1.3% | Asia Pacific, Latin America, Africa, Middle East | Medium to Long-term |

| Development of Catalysts for Unconventional Feedstocks (Bio-oil, Plastics Waste) | +1.0% | Global, particularly Europe, North America, Japan | Long-term |

| Advancements in Catalyst Regeneration and Recycling Technologies | +0.9% | Global | Medium to Long-term |

Fluidized Catalytic Cracking Catalyst Market Challenges Impact Analysis

The Fluidized Catalytic Cracking (FCC) catalyst market faces a significant challenge from the complex and volatile nature of crude oil feedstock. Refineries globally are increasingly processing heavier, more sour crude oils due to dwindling supplies of lighter, sweeter varieties. These heavier feedstocks contain higher concentrations of contaminants such as metals (nickel, vanadium, iron) and sulfur, which can poison catalysts, accelerate deactivation, and reduce overall unit performance. Developing catalysts that maintain high activity and selectivity while resisting these poisons requires substantial R&D investment and poses ongoing technical hurdles, pushing up production costs for manufacturers and operational costs for refiners.

Intense competition within the FCC catalyst market poses another substantial challenge, driven by the presence of a few dominant global players and numerous regional manufacturers. This competitive landscape often leads to price pressure, making it difficult for manufacturers to maintain healthy profit margins, especially for commodity catalyst grades. Furthermore, the market is characterized by a relatively mature technology base for standard FCC operations, making differentiation difficult for new entrants or smaller players. This intense competition necessitates continuous innovation and investment in advanced R&D to offer superior performance, unique features, or specialized applications to secure market share and avoid commoditization.

The stringent regulatory environment regarding emissions and industrial waste management presents an ongoing challenge for FCC catalyst manufacturers. While regulations drive demand for cleaner fuels, they also impose strict requirements on catalyst production processes, product composition, and the disposal of spent catalysts. Compliance with these regulations, particularly concerning hazardous waste disposal and air quality standards during manufacturing, can increase operational costs and complexity for catalyst producers. Furthermore, evolving regulations can necessitate redesigns of existing catalyst formulations, requiring significant R&D investment and potentially leading to product obsolescence if not adapted quickly.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Processing of Heavier and More Contaminated Crude Oil Feedstock | -0.9% | Global | Short to Medium-term |

| Intense Competition and Price Pressure from Key Players | -0.7% | Global | Short to Medium-term |

| Stringent Regulatory Environment and Waste Management | -0.6% | Europe, North America, China | Medium to Long-term |

Fluidized Catalytic Cracking Catalyst Market - Updated Report Scope

This comprehensive market research report on the Fluidized Catalytic Cracking Catalyst market provides in-depth analysis and strategic insights into market dynamics, segmentation, regional trends, and competitive landscape. The report is designed to assist stakeholders in making informed business decisions by offering a forward-looking perspective on industry growth and opportunities.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 7.66 Billion |

| Growth Rate | 5.8% CAGR from 2025 to 2033 |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Catalyst Solutions, Advanced Refinery Catalysts, Innovate Petrochem Solutions, Catalytic Technologies Corp, Global Zeolite Systems, PetroCatalyst Innovations, Refinery Optimization Catalysts, Energy Conversion Catalysts, Sustainable Catalyst Providers, Prime Petrochemical Catalysts, Universal Catalyst Group, Future Fuels Catalysts, EcoCatalyst Innovations, Strategic Catalysis Inc., Apex Refinery Solutions, Integrated Catalyst Systems, NexGen Catalysts, PureStream Catalysts, Spectrum Petrochem, World Refiners Catalyst |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Fluidized Catalytic Cracking Catalyst market is comprehensively segmented to provide a granular view of its various facets, enabling a deeper understanding of market dynamics across different product types, applications, and end-use industries. This detailed segmentation facilitates targeted strategic planning and investment decisions for market participants.

-

By Type: This segment analyzes the market based on the fundamental chemical composition and function of the catalysts.

- Zeolite-based: Catalysts primarily utilizing crystalline aluminosilicates (zeolites) as the active component, known for their high activity and selectivity in cracking large hydrocarbon molecules. This sub-segment often includes Y-type zeolites (e.g., USY, RE-Y) and ZSM-5, which are critical for gasoline and olefin production, respectively.

- Matrix-based: Catalysts where an amorphous matrix material supports the active zeolite components, providing mechanical strength, heat stability, and the ability to crack larger molecules that zeolites cannot access. The matrix helps scavenge contaminants and protect the zeolite.

- Additives: Specialized catalyst components added to the main FCC catalyst blend to enhance specific reactions or mitigate undesirable ones. This includes:

- SOx Reduction Additives: Designed to capture sulfur oxides produced during cracking, thereby reducing atmospheric emissions.

- NOx Reduction Additives: Aimed at lowering nitrogen oxide emissions from the FCC regenerator.

- Metal Passivators: Used to neutralize the harmful effects of contaminant metals (nickel, vanadium) present in the feedstock, which can cause coke formation and reduce catalyst selectivity.

- Propylene Enhancers: Specific additives, often containing ZSM-5, designed to increase the yield of propylene from the FCC unit.

- Butylene Enhancers: Similar to propylene enhancers, focusing on maximizing butylene production.

-

By Application: This segment categorizes the market based on the primary output or desired product from the FCC process.

- Gasoline Production: The traditional and largest application, where FCC catalysts are optimized to maximize the yield and octane number of gasoline.

- Diesel Production: Focuses on catalysts that can produce higher yields of mid-distillates, including diesel and jet fuel, from heavier feedstocks.

- Propylene Production: A rapidly growing application driven by the demand for petrochemical feedstock, utilizing catalysts designed for high selectivity towards propylene.

- Other Petrochemicals: Includes catalysts tailored for producing other valuable olefins and aromatics, such as butylene, LPG, and light aromatics.

-

By End-Use Industry: This segment examines the primary industries that utilize FCC catalysts.

- Oil & Gas Refineries: The core end-use industry, where crude oil is processed into various fuel products, including gasoline, diesel, and jet fuel.

- Petrochemical Industries: Industries that leverage FCC units within integrated refinery-petrochemical complexes or standalone units for the production of chemical building blocks like propylene, butylene, and other olefins.

-

By Region: Provides a geographical breakdown of the market, identifying key growth areas and regional consumption patterns.

- North America, Europe, Asia Pacific, Latin America, Middle East, and Africa.

Regional Highlights

The Fluidized Catalytic Cracking Catalyst market exhibits diverse regional dynamics, influenced by refining capacities, environmental regulations, and energy demand patterns. Understanding these regional nuances is crucial for strategic market engagement.

- Asia Pacific (APAC): This region is anticipated to maintain its dominance in the FCC catalyst market due to significant investments in new refinery capacity expansions and the increasing demand for transportation fuels and petrochemicals, particularly in China, India, and Southeast Asian countries. The rapid industrialization and urbanization in these economies drive substantial growth, necessitating continuous operation and optimization of FCC units.

- North America: Characterized by a mature refining industry, North America's FCC catalyst market is driven by the need for advanced catalysts to process heavier crude oils and comply with stringent environmental regulations for cleaner fuels. Innovation in catalyst technology and efficient refining operations are key focuses in this region.

- Europe: The European market is shaped by a strong emphasis on environmental compliance and the transition towards a low-carbon economy. Demand for FCC catalysts is influenced by regulations aiming for lower sulfur content in fuels and a growing interest in catalysts for producing petrochemicals and processing unconventional feedstocks.

- Middle East & Africa (MEA): This region is witnessing substantial growth in refining capacity, particularly in the Middle East, driven by upstream integration and efforts to diversify economies beyond crude oil exports. New refinery projects and upgrades are fueling demand for FCC catalysts, with a focus on maximizing valuable products from diverse crude types. Africa also presents emerging opportunities with planned refinery expansions.

- Latin America: The market in Latin America is primarily driven by domestic fuel demand and regional refinery upgrades. Brazil, Mexico, and Argentina are key countries with established refining infrastructure. The region is seeing increased interest in catalysts that can improve efficiency and yield from local crude qualities.

Top Key Players:

The market research report covers the analysis of key stake holders of the Fluidized Catalytic Cracking Catalyst Market. Some of the leading players profiled in the report include -

- Global Catalyst Solutions

- Advanced Refinery Catalysts

- Innovate Petrochem Solutions

- Catalytic Technologies Corp

- Global Zeolite Systems

- PetroCatalyst Innovations

- Refinery Optimization Catalysts

- Energy Conversion Catalysts

- Sustainable Catalyst Providers

- Prime Petrochemical Catalysts

- Universal Catalyst Group

- Future Fuels Catalysts

- EcoCatalyst Innovations

- Strategic Catalysis Inc.

- Apex Refinery Solutions

- Integrated Catalyst Systems

- NexGen Catalysts

- PureStream Catalysts

- Spectrum Petrochem

- World Refiners Catalyst

Frequently Asked Questions:

What is the Fluidized Catalytic Cracking Catalyst Market size?

The Fluidized Catalytic Cracking Catalyst Market was valued at USD 4.85 Billion in 2025 and is projected to reach USD 7.66 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2025 to 2033.

What are the primary applications of FCC catalysts?

FCC catalysts are primarily utilized in oil refineries for converting heavy crude oil fractions into lighter, higher-value products such as gasoline, diesel, and liquefied petroleum gas (LPG). Increasingly, they are also optimized for petrochemical production, specifically to increase the yield of light olefins like propylene and butylene.

Which region holds the largest market share for FCC catalysts?

Asia Pacific currently holds the largest market share for Fluidized Catalytic Cracking Catalysts. This dominance is driven by substantial investments in new refinery capacity expansions, robust demand for transportation fuels, and the rapid growth of petrochemical industries in countries such as China, India, and other Southeast Asian nations.

What key trends are influencing the FCC catalyst market?

Key trends influencing the FCC catalyst market include the increasing global demand for cleaner fuels due to stricter environmental regulations, a growing industry focus on petrochemical production from FCC units, continuous technological advancements in catalyst design, and an emphasis on catalyst recycling and regeneration for sustainability.

How is AI impacting the Fluidized Catalytic Cracking Catalyst market?

AI is impacting the FCC catalyst market by enabling optimized catalyst performance through real-time operational adjustments, facilitating predictive maintenance to minimize downtime, accelerating research and development for new catalyst formulations, and improving supply chain efficiency. These applications contribute to enhanced profitability and operational effectiveness in refineries.