Electric Vehicle Battery Recycling Market

Electric Vehicle Battery Recycling Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702575 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Electric Vehicle Battery Recycling Market Size

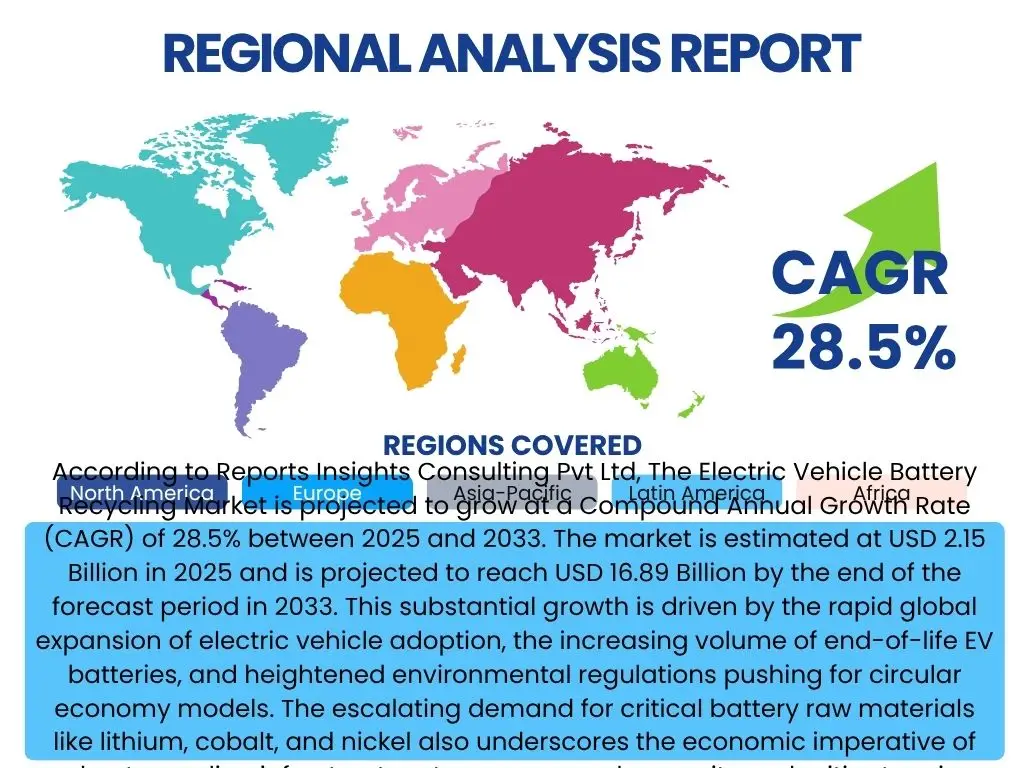

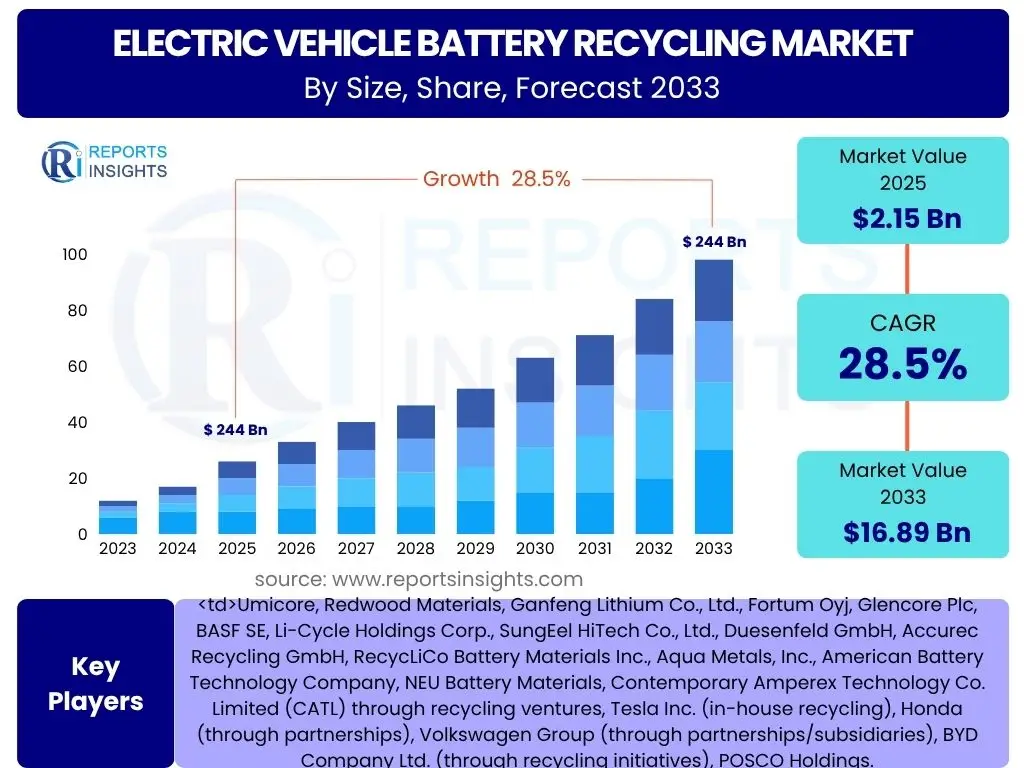

According to Reports Insights Consulting Pvt Ltd, The Electric Vehicle Battery Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2033. The market is estimated at USD 2.15 Billion in 2025 and is projected to reach USD 16.89 Billion by the end of the forecast period in 2033. This substantial growth is driven by the rapid global expansion of electric vehicle adoption, the increasing volume of end-of-life EV batteries, and heightened environmental regulations pushing for circular economy models. The escalating demand for critical battery raw materials like lithium, cobalt, and nickel also underscores the economic imperative of robust recycling infrastructure to ensure supply security and mitigate price volatility.

Key Electric Vehicle Battery Recycling Market Trends & Insights

The Electric Vehicle Battery Recycling market is undergoing rapid transformation, driven by an anticipated surge in end-of-life battery volumes and the imperative for sustainable resource management. Common user inquiries often center on emerging technologies, regulatory frameworks, and supply chain dynamics. A prominent trend is the shift towards more efficient and environmentally friendly recycling processes, such as hydrometallurgy and direct recycling, which promise higher material recovery rates and lower energy consumption compared to traditional pyrometallurgy. Furthermore, there is a growing emphasis on establishing robust, localized recycling infrastructure to reduce transportation costs and enhance supply chain resilience. The development of standardized battery designs and labeling for easier dismantling and recycling is also gaining traction globally.

Another significant insight revolves around the increasing collaboration across the EV value chain, involving automakers, battery manufacturers, and recycling companies. These partnerships aim to create closed-loop systems, ensuring that valuable materials from spent batteries are re-integrated into new battery production, thereby reducing reliance on virgin materials. The focus on second-life applications for EV batteries, where batteries are repurposed for less demanding uses like stationary energy storage before full recycling, represents a crucial step in extending their economic lifespan and optimizing resource utilization. This holistic approach addresses both environmental concerns and the economic viability of recycling operations, making it a critical component of the future sustainable energy landscape.

- Advanced hydrometallurgical and direct recycling processes are gaining prominence due to higher recovery efficiencies and environmental benefits.

- Development of robust, localized recycling infrastructure is a key focus to enhance supply chain resilience and reduce logistics costs.

- Growing emphasis on closed-loop material cycles, integrating recycled materials back into new battery production.

- Increasing strategic collaborations between EV manufacturers, battery producers, and recycling firms.

- Exploration and implementation of second-life applications for EV batteries, extending their utility before end-of-life recycling.

- Standardization of battery designs and labeling for improved recyclability and dismantling efficiency.

- Rising regulatory pressure and government incentives promoting battery recycling and sustainable practices.

AI Impact Analysis on Electric Vehicle Battery Recycling

User inquiries frequently explore how artificial intelligence can revolutionize the Electric Vehicle Battery Recycling sector, particularly concerning efficiency, safety, and material recovery. AI's integration is anticipated to significantly enhance various stages of the recycling process, from initial battery diagnostics to optimizing material separation. For instance, AI-powered vision systems can accurately identify battery chemistries and components, enabling precise sorting and dismantling. This precision is crucial for maximizing the yield of valuable materials and minimizing contamination, which are common challenges in current recycling operations. Furthermore, AI algorithms can analyze vast datasets from battery usage, predicting end-of-life more accurately, thus facilitating more efficient collection and processing logistics.

Beyond sorting and logistics, AI plays a pivotal role in optimizing the chemical processes involved in recycling, such as hydrometallurgy. Machine learning models can predict optimal reagent concentrations, reaction times, and temperature profiles, leading to higher recovery rates for critical metals like lithium, cobalt, and nickel, while simultaneously reducing energy consumption and waste generation. AI also contributes to enhanced safety protocols by monitoring hazardous conditions and predicting equipment failures in recycling facilities, thereby preventing accidents. The ability of AI to analyze complex material compositions and predict optimal processing pathways makes it an indispensable tool for achieving higher efficiency, sustainability, and economic viability in the evolving EV battery recycling ecosystem.

- AI-powered vision systems enhance automated sorting and identification of battery types and components, improving material purity.

- Predictive analytics optimize battery collection and logistics by forecasting end-of-life timing and volumes.

- Machine learning algorithms enhance process control in hydrometallurgical and pyrometallurgical operations, optimizing reagent use and recovery rates.

- AI improves safety by monitoring operational parameters and predicting potential hazards or equipment failures in recycling facilities.

- Data analytics and AI facilitate better material tracking and transparency across the entire battery supply chain.

- AI aids in the design of more recyclable batteries by simulating dismantling processes and material separation efficiencies.

Key Takeaways Electric Vehicle Battery Recycling Market Size & Forecast

Common user questions regarding market takeaways often focus on the most impactful conclusions and implications for future development. A primary takeaway is the unprecedented growth trajectory of the EV Battery Recycling market, which is directly correlated with the accelerating adoption of electric vehicles globally. This growth signifies not only a burgeoning industry but also a critical component of achieving sustainable transportation and energy independence through circular economy principles. The market's expansion is further solidified by increasing regulatory support and the strategic recognition of recycled materials as a secure domestic source for essential battery components, reducing reliance on volatile international supply chains.

Another key insight is the rapid technological evolution within the recycling sector, moving towards more advanced and environmentally conscious methods. This innovation is crucial for making recycling economically viable at scale and for extracting high-purity materials suitable for re-entry into battery manufacturing. The market is also characterized by a strong push for collaborative ecosystems, where stakeholders from mining to manufacturing to recycling work together to optimize the entire battery lifecycle. These collaborations, coupled with investments in infrastructure and R&D, underscore the market's commitment to transforming battery waste into a valuable resource, ensuring both environmental stewardship and long-term economic prosperity.

- The Electric Vehicle Battery Recycling market is poised for exponential growth, driven by escalating EV sales and the impending wave of end-of-life batteries.

- Recycling is critical for establishing a sustainable, circular economy for electric vehicles, reducing environmental impact and resource depletion.

- Technological advancements, particularly in hydrometallurgy and direct recycling, are vital for improving material recovery rates and process efficiencies.

- Increasing government regulations and incentives are accelerating the development of robust recycling infrastructure and encouraging industry participation.

- Strategic partnerships and collaborations across the EV value chain are essential for creating efficient closed-loop material systems.

- The market contributes significantly to national raw material security by providing a reliable, domestic source of critical battery minerals.

Electric Vehicle Battery Recycling Market Drivers Analysis

The Electric Vehicle Battery Recycling market is propelled by a confluence of powerful drivers, primarily the exponential growth in electric vehicle sales worldwide. As the global fleet of EVs expands, the volume of batteries reaching their end-of-life stage is projected to skyrocket, creating an immense and sustained demand for recycling services. This growth is further amplified by stringent environmental regulations and government mandates in key regions like Europe, North America, and Asia, which are increasingly promoting circular economy principles and setting ambitious recycling targets for EV batteries. These regulations compel manufacturers and consumers alike to consider the end-of-life management of batteries, directly stimulating investment and innovation in the recycling sector.

Economic factors also play a significant role as drivers. The rising prices and geopolitical sensitivities surrounding critical battery raw materials such as lithium, cobalt, and nickel make recycling an economically attractive proposition. Recovering these valuable metals from spent batteries offers a more secure and often more cost-effective alternative to traditional mining, reducing reliance on volatile global supply chains. Furthermore, growing consumer and corporate awareness regarding sustainability and corporate social responsibility is pushing companies to adopt eco-friendlier practices, including battery recycling. The continuous advancements in recycling technologies, leading to higher recovery rates and purer materials, also enhance the overall economic viability and attractiveness of the recycling market, encouraging further investment and scaling of operations.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Exponential Growth in Electric Vehicle Sales | +8.5% | Global, particularly China, Europe, North America | Short to Long-term (2025-2033) |

| Stringent Environmental Regulations and Policies | +7.0% | Europe, North America, Japan, South Korea | Medium to Long-term (2025-2033) |

| Rising Prices and Supply Chain Volatility of Critical Raw Materials | +6.0% | Global | Short to Medium-term (2025-2029) |

| Advancements in Battery Recycling Technologies | +4.5% | Global, especially developed economies | Medium to Long-term (2026-2033) |

| Increasing Focus on Circular Economy and Sustainability Goals | +2.5% | Global, driven by corporate and consumer demand | Long-term (2027-2033) |

Electric Vehicle Battery Recycling Market Restraints Analysis

Despite its robust growth potential, the Electric Vehicle Battery Recycling market faces several significant restraints that could impede its expansion. One primary challenge is the high capital investment required to establish and operate state-of-the-art recycling facilities. The complex nature of EV batteries, with their diverse chemistries and designs, necessitates specialized equipment and processes, leading to substantial initial setup costs that can deter new entrants and limit rapid scaling. Furthermore, the logistical complexities associated with collecting, transporting, and storing hazardous end-of-life batteries across vast geographical areas pose considerable challenges. Ensuring safe handling and compliance with varying hazardous waste regulations adds to the operational burden and overall cost, particularly in regions with nascent EV adoption.

Another major restraint is the current limited volume of end-of-life EV batteries available for recycling. While EV sales are skyrocketing, the average lifespan of an EV battery (typically 8-15 years) means that the large-scale influx of batteries needing recycling is still a few years away. This creates a supply-demand imbalance in the short term, making it difficult for recycling companies to operate at full capacity and achieve economies of scale, thus impacting their profitability. Moreover, the lack of standardized battery designs across different manufacturers complicates the recycling process, requiring extensive manual sorting and specialized processing lines for various battery types. This heterogeneity increases operational costs and reduces efficiency, hindering the streamlined development of a comprehensive recycling infrastructure globally.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment and Operational Costs | -4.0% | Global, particularly emerging markets | Short to Medium-term (2025-2029) |

| Logistical Challenges and Safety Concerns in Battery Transportation | -3.5% | Global, especially across borders | Short to Medium-term (2025-2030) |

| Limited Volume of End-of-Life EV Batteries in Early Stages | -3.0% | Global, more pronounced in newer EV markets | Short-term (2025-2027) |

| Lack of Standardized Battery Designs and Chemistries | -2.0% | Global | Long-term (2028-2033) |

Electric Vehicle Battery Recycling Market Opportunities Analysis

The Electric Vehicle Battery Recycling market presents significant opportunities for growth and innovation, primarily driven by the increasing global emphasis on sustainable resource management and circular economy principles. A key opportunity lies in the continuous development and commercialization of advanced recycling technologies, particularly hydrometallurgical and direct recycling methods. These technologies offer higher recovery rates of critical battery materials with lower environmental footprints compared to traditional methods, thus enhancing the economic viability and environmental attractiveness of recycled products. Investing in R&D for these cutting-edge processes can unlock significant competitive advantages and market share. Furthermore, the burgeoning demand for critical minerals like lithium, cobalt, and nickel for new battery production provides a robust economic incentive for recycling, as it offers a more secure and often more sustainable domestic supply source than traditional mining.

Another substantial opportunity resides in the expansion into new geographical markets, particularly in emerging economies where EV adoption is accelerating but recycling infrastructure is still nascent. Establishing collection networks and recycling facilities in these regions can tap into future battery volumes and support the local EV ecosystem. The development of innovative business models, such as Battery-as-a-Service (BaaS) and second-life applications for EV batteries, creates new revenue streams and extends the overall value chain before ultimate recycling. These models encourage better battery management and facilitate efficient collection. Moreover, strategic collaborations between battery manufacturers, automakers, and recycling companies are pivotal. Forming alliances can streamline the entire battery lifecycle, from design for recyclability to end-of-life processing, creating integrated and efficient closed-loop supply chains that capture maximum value from spent batteries.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Advancements in Recycling Technologies (e.g., Hydrometallurgy, Direct Recycling) | +5.5% | Global | Medium to Long-term (2026-2033) |

| Growing Demand for Recycled Critical Battery Materials | +4.0% | Global | Short to Long-term (2025-2033) |

| Expansion into Emerging EV Markets with Nascent Recycling Infrastructure | +3.0% | Southeast Asia, Latin America, Middle East, Africa | Medium to Long-term (2027-2033) |

| Development of Second-Life Applications and Battery-as-a-Service Models | +2.5% | Global | Medium to Long-term (2026-2033) |

Electric Vehicle Battery Recycling Market Challenges Impact Analysis

The Electric Vehicle Battery Recycling market faces a range of complex challenges that require innovative solutions and concerted efforts from stakeholders. One significant hurdle is the inherent safety concerns associated with handling and transporting spent EV batteries. These batteries can pose risks due to residual charge, potential for thermal runaway, and the presence of toxic electrolytes, necessitating highly specialized equipment, training, and strict adherence to safety protocols. Ensuring compliance with diverse and often evolving hazardous materials regulations across different regions adds to the operational complexity and cost. Without robust safety measures, the widespread adoption of efficient collection and recycling networks could be significantly hindered.

Another prominent challenge is the economic viability, particularly for smaller recycling operations or in regions with lower volumes of end-of-life batteries. The profitability of recycling largely depends on the market prices of recovered materials and the economies of scale achieved through high throughput. Fluctuations in raw material prices can render recycling less competitive than virgin material extraction, especially when collection and processing costs are high. Furthermore, achieving the required purity levels for recycled materials to be re-integrated into new battery manufacturing processes remains a technical challenge. Battery manufacturers often demand extremely high purity, which current recycling technologies sometimes struggle to consistently deliver without additional, costly refining steps. Finally, the fragmented nature of battery designs and chemistries across various EV models complicates standardized, automated recycling processes, leading to increased manual labor and reduced efficiency, posing a continuous challenge for large-scale, cost-effective operations.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Safety Concerns During Handling, Storage, and Transportation | -3.0% | Global | Short to Medium-term (2025-2029) |

| Economic Viability and Profitability in Fluctuating Raw Material Markets | -2.5% | Global | Short to Medium-term (2025-2029) |

| Achieving High Purity Standards for Recycled Materials | -2.0% | Global, particularly in advanced manufacturing hubs | Medium to Long-term (2026-2033) |

| Regulatory Inconsistencies and Lack of Global Standardization | -1.5% | Global, particularly across different trade blocs | Long-term (2028-2033) |

Electric Vehicle Battery Recycling Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Electric Vehicle Battery Recycling Market, offering critical insights into its current state, future growth prospects, and the underlying dynamics shaping its evolution. The scope encompasses detailed market sizing and forecasting, a thorough examination of key market trends, an assessment of the impact of artificial intelligence on recycling processes, and an exhaustive analysis of market drivers, restraints, opportunities, and challenges. The report segments the market by battery type, recycling process, material recovered, and end-use application, providing a granular view of various sub-sectors. It also offers extensive regional breakdowns, highlighting key country-level developments and regulatory landscapes. Furthermore, the report profiles leading market players, offering competitive intelligence and strategic insights for stakeholders across the entire EV battery value chain.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 16.89 Billion |

| Growth Rate | 28.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Umicore, Redwood Materials, Ganfeng Lithium Co., Ltd., Fortum Oyj, Glencore Plc, BASF SE, Li-Cycle Holdings Corp., SungEel HiTech Co., Ltd., Duesenfeld GmbH, Accurec Recycling GmbH, RecycLiCo Battery Materials Inc., Aqua Metals, Inc., American Battery Technology Company, NEU Battery Materials, Contemporary Amperex Technology Co. Limited (CATL) through recycling ventures, Tesla Inc. (in-house recycling), Honda (through partnerships), Volkswagen Group (through partnerships/subsidiaries), BYD Company Ltd. (through recycling initiatives), POSCO Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Electric Vehicle Battery Recycling market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation allows for targeted analysis of specific market niches, technological approaches, and material flows within the recycling ecosystem. Understanding these segments is crucial for stakeholders to identify growth areas, optimize operational strategies, and address specific challenges inherent to different battery types, recycling processes, or end-use applications. This granular perspective enables more precise market forecasting and strategic planning, fostering a robust and efficient circular economy for EV batteries.

- By Battery Type: This segment analyzes the market based on the chemical composition of EV batteries.

- Lithium-Ion (Li-ion): Dominant battery chemistry in modern EVs, comprising various subtypes (NMC, LFP, NCA, LMO), representing the largest share of the recycling market due to high energy density and widespread adoption.

- Nickel-Metal Hydride (NiMH): Used in some hybrid electric vehicles (HEVs), with distinct recycling requirements for nickel and rare earth elements.

- Lead-Acid: Historically used in some automotive applications, though less common in modern BEVs, with established recycling processes.

- By Recycling Process: This segmentation focuses on the technological methods employed for battery recycling.

- Pyrometallurgy: High-temperature smelting process that recovers metals but typically destroys organic components and requires further refining for high-purity materials.

- Hydrometallurgy: Chemical leaching process that dissolves metals from battery waste, allowing for selective extraction and higher purity recovery, often more environmentally friendly.

- Direct Recycling: A nascent process aimed at preserving the cathode structure, offering potential for significant cost and energy savings, though currently challenged by battery heterogeneity.

- Other Mechanical & Chemical Methods: Includes mechanical shredding, crushing, and other specialized chemical treatments for initial separation or specific material recovery.

- By Material Recovered: This segment categorizes the market based on the valuable elements extracted from spent batteries.

- Lithium: A critical component for cathodes and electrolytes, increasingly vital for new battery production.

- Cobalt: Essential for cathode stability and energy density, often recovered due to its high value.

- Nickel: Key material in high-performance cathodes (NMC, NCA), recovered for its energy density contribution.

- Manganese: Used in some cathode chemistries (LMO, LFP), recovered for cost-effectiveness and resource conservation.

- Copper: Recovered from current collectors and wiring components due to its high conductivity and value.

- Aluminum: Present in current collectors and battery casings, recovered for its light weight and widespread industrial use.

- Other Materials: Includes graphite, iron, plastics, and various electrolytes and binders, recovered to minimize waste and enhance circularity.

- By End-Use Application: This segment delineates the market based on the types of electric vehicles or mobility solutions.

- Electric Cars (Passenger EVs): The largest segment, driven by global passenger vehicle electrification trends.

- Electric Buses: Growing segment with large battery packs, presenting significant recycling opportunities.

- Electric Two-Wheelers & Three-Wheelers: Common in Asian markets, contributing a high volume of smaller batteries.

- Commercial Vehicles: Including electric trucks and vans, an emerging segment with increasing battery demand.

- Industrial Vehicles: Such as forklifts and material handling equipment, adopting electrification.

- Other Mobility Applications: Includes electric boats, aircraft, and specialized electric vehicles.

Regional Highlights

- Asia Pacific (APAC): Dominates the Electric Vehicle Battery Recycling market, primarily due to China's leading position in EV manufacturing and adoption. The region accounts for the largest share of EV battery production and consumption, leading to a significant volume of end-of-life batteries. Countries like South Korea and Japan are also investing heavily in advanced recycling technologies and establishing comprehensive regulatory frameworks to support a circular economy for batteries. Increasing domestic demand for critical materials further propels recycling efforts.

- Europe: Exhibits robust growth driven by ambitious environmental regulations, such as the EU Battery Regulation, which mandates high recycling efficiencies and sets targets for recycled content in new batteries. Strong government incentives and a focus on building a localized battery value chain are accelerating the development of advanced recycling infrastructure and fostering collaborations between automakers and recycling companies across the continent. Germany, France, and Scandinavia are at the forefront of this regional development.

- North America: Experiencing substantial growth in EV adoption and domestic battery manufacturing, leading to increased investment in recycling capacity. Government initiatives like the Inflation Reduction Act (IRA) in the United States provide significant incentives for establishing local recycling facilities and securing critical minerals domestically, reducing reliance on foreign supply chains. Canada is also emerging as a key player, leveraging its abundant mineral resources and commitment to sustainable practices.

- Latin America: An emerging market for EV battery recycling, characterized by nascent EV adoption but significant potential for growth. The focus is on developing initial collection and logistics infrastructure, often through partnerships with international recycling companies. The presence of critical mineral reserves in some countries may also foster future integrated battery supply chains.

- Middle East and Africa (MEA): Currently represents a smaller share of the market but holds long-term potential as EV adoption slowly increases and sustainability initiatives gain traction. Investment in renewable energy projects and the development of battery manufacturing capabilities in some parts of the region could spur the growth of the recycling sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Vehicle Battery Recycling Market.- Umicore

- Redwood Materials

- Ganfeng Lithium Co., Ltd.

- Fortum Oyj

- Glencore Plc

- BASF SE

- Li-Cycle Holdings Corp.

- SungEel HiTech Co., Ltd.

- Duesenfeld GmbH

- Accurec Recycling GmbH

- RecycLiCo Battery Materials Inc.

- Aqua Metals, Inc.

- American Battery Technology Company

- NEU Battery Materials

- Contemporary Amperex Technology Co. Limited (CATL) through recycling ventures

- Tesla Inc. (in-house recycling)

- Honda (through partnerships)

- Volkswagen Group (through partnerships/subsidiaries)

- BYD Company Ltd. (through recycling initiatives)

- POSCO Holdings

Frequently Asked Questions

What is Electric Vehicle Battery Recycling?

Electric Vehicle Battery Recycling is the process of recovering valuable materials, such as lithium, cobalt, nickel, and copper, from spent or end-of-life electric vehicle batteries. This process typically involves collection, dismantling, and then chemical or mechanical methods to separate and purify the constituent elements for re-use in new battery production or other industries, thus promoting a circular economy and reducing reliance on virgin raw materials.

Why is Electric Vehicle Battery Recycling important?

EV battery recycling is crucial for several reasons: it mitigates environmental impact by preventing hazardous waste from landfills; it reduces the need for new mining of critical raw materials, addressing supply chain vulnerabilities and geopolitical risks; and it supports the long-term sustainability of the electric vehicle industry by establishing a closed-loop system for battery components. This ensures resource security and fosters environmental responsibility.

What are the main methods for Electric Vehicle Battery Recycling?

The primary methods for EV battery recycling are pyrometallurgy, hydrometallurgy, and direct recycling. Pyrometallurgy uses high heat to recover metals, often through smelting. Hydrometallurgy employs chemical solutions to dissolve and extract specific metals, yielding higher purity. Direct recycling aims to restore cathode materials without completely breaking them down, offering the most energy-efficient and potentially cost-effective method for future battery recycling.

What are the challenges in Electric Vehicle Battery Recycling?

Key challenges in EV battery recycling include the high capital investment for recycling facilities, logistical complexities and safety concerns in transporting hazardous spent batteries, the diverse chemistries and designs of different battery types complicating uniform processing, and the need to achieve very high purity levels for recycled materials to be re-integrated into new battery production. Economic viability can also be impacted by fluctuating raw material prices and the initial limited volume of end-of-life batteries.

What are the future trends in Electric Vehicle Battery Recycling?

Future trends in EV battery recycling include the widespread adoption of advanced hydrometallurgical and direct recycling technologies for improved efficiency and environmental performance. There will be an increased focus on establishing localized, integrated recycling supply chains, fostering strategic collaborations between automakers and recyclers, and expanding second-life applications for batteries. Furthermore, battery design for recyclability and the integration of AI for process optimization will become increasingly prevalent.