Digital Transformation in Banking and Finance Market

Digital Transformation in Banking and Finance Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703928 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Digital Transformation in Banking and Finance Market Size

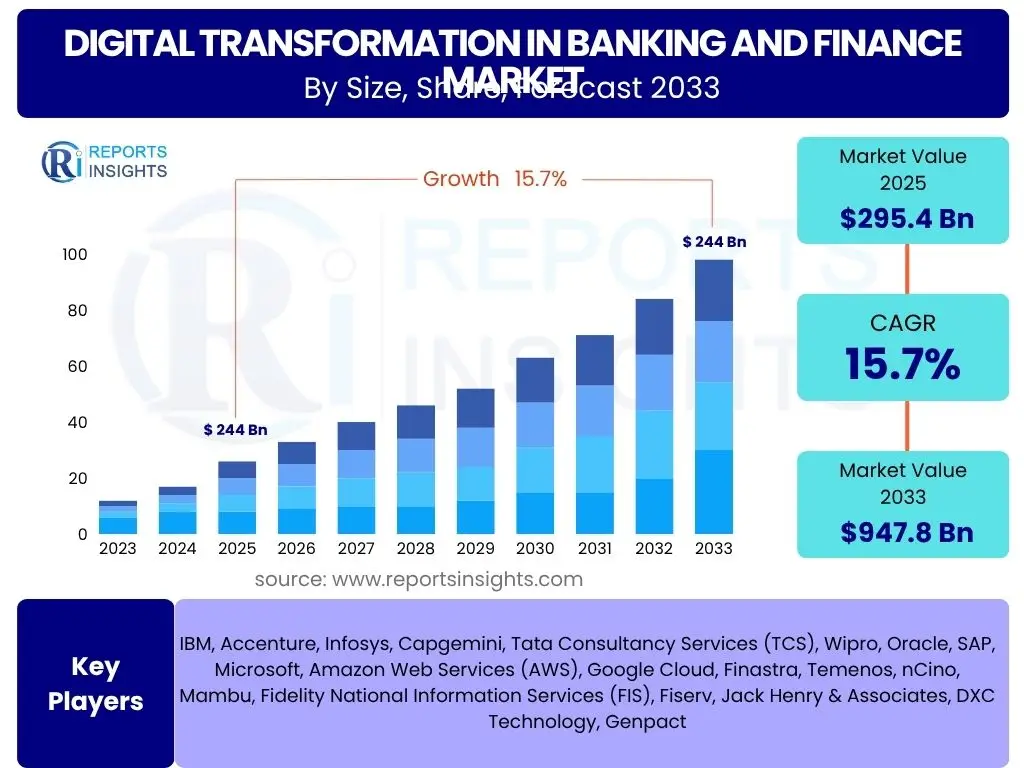

According to Reports Insights Consulting Pvt Ltd, The Digital Transformation in Banking and Finance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.7% between 2025 and 2033. This robust growth trajectory underscores the banking and finance sector's accelerating commitment to leveraging advanced technologies for enhanced operational efficiency, improved customer experience, and competitive advantage. The market's expansion is driven by a confluence of factors including evolving customer expectations, the imperative for cost optimization, and the need to adapt to a dynamic regulatory landscape.

The market is estimated at USD 295.4 Billion in 2025, reflecting the substantial investments already made by financial institutions globally into digital infrastructure and innovative solutions. This initial valuation highlights the foundational phase of digital adoption, where banks and financial entities have begun to integrate core digital capabilities across various business functions.

By the end of the forecast period in 2033, the market is projected to reach USD 947.8 Billion. This significant increase signals a sustained and intensified push towards comprehensive digital integration, encompassing everything from front-end customer interfaces to back-office automation and data-driven decision-making. The projected growth indicates that digital transformation will transition from an optional enhancement to a fundamental prerequisite for survival and prosperity within the global financial ecosystem.

Key Digital Transformation in Banking and Finance Market Trends & Insights

Common inquiries about trends in the Digital Transformation in Banking and Finance market often revolve around the most impactful technologies, shifts in customer engagement, and the evolving competitive landscape. Users are keen to understand how financial institutions are modernizing their operations, what strategies are proving most effective, and how these changes are redefining service delivery and market dynamics. The pervasive theme is one of innovation-driven evolution, where digital capabilities are no longer just an add-on but are becoming the core of financial services.

Insights reveal a strong emphasis on hyper-personalization, driven by advanced analytics and artificial intelligence, allowing financial institutions to offer tailored products and services. Another significant trend is the proliferation of embedded finance, integrating financial services seamlessly into non-financial platforms, thereby expanding reach and convenience. The imperative for robust cybersecurity measures continues to rise in parallel with increased digitalization, as financial institutions face sophisticated threats to data integrity and customer trust.

Furthermore, the market is witnessing a profound shift towards cloud-native architectures, enabling greater agility, scalability, and cost-efficiency. The adoption of open banking initiatives and API-driven ecosystems is facilitating greater collaboration between traditional financial players and innovative fintechs, fostering a more interconnected and dynamic financial landscape. These trends collectively underscore a transformation beyond mere digitalization, moving towards truly intelligent, interconnected, and customer-centric financial services.

- Hyper-personalization through AI and advanced analytics for tailored customer experiences.

- Expansion of Embedded Finance, integrating financial services into non-banking platforms.

- Accelerated adoption of Cloud-Native Architectures for scalability and efficiency.

- Growth of Open Banking and API-driven ecosystems fostering collaboration.

- Enhanced focus on Cybersecurity and Fraud Detection with AI and machine learning.

- Emergence of Metaverse and Web3 technologies exploring new customer engagement channels.

- Emphasis on Environmental, Social, and Governance (ESG) considerations in digital strategies.

AI Impact Analysis on Digital Transformation in Banking and Finance

User inquiries concerning AI's impact on Digital Transformation in Banking and Finance frequently center on its practical applications, efficiency gains, and potential risks. Users seek to understand how AI is redefining customer interactions, streamlining complex processes, and influencing decision-making. There is a strong interest in AI's role in fraud detection, risk management, and the delivery of highly personalized financial advice, highlighting expectations for both operational improvements and enhanced service offerings.

The influence of AI extends across virtually every facet of banking and finance, from front-office customer engagement to back-office operational efficiencies. AI-powered chatbots and virtual assistants are revolutionizing customer service, providing instant support and personalized guidance, thereby improving satisfaction and reducing operational costs. In the realm of risk management, AI algorithms can analyze vast datasets to detect anomalies, predict market trends, and assess creditworthiness with unprecedented accuracy, leading to more informed and proactive decision-taking.

Furthermore, AI is instrumental in combating financial crime through sophisticated fraud detection systems that learn from patterns to identify suspicious activities in real-time. It enables hyper-personalization of financial products and services, allowing institutions to anticipate customer needs and offer bespoke solutions. While significant opportunities exist, concerns around data privacy, algorithmic bias, and the ethical implications of autonomous decision-making remain critical areas of focus for financial institutions adopting AI.

- Enhanced Fraud Detection and Prevention: AI algorithms analyze transaction patterns to identify and flag suspicious activities in real-time.

- Personalized Customer Experiences: AI powers recommendation engines, tailored product offerings, and proactive customer support via chatbots and virtual assistants.

- Automated Customer Service: AI-driven chatbots handle routine inquiries, freeing human agents for complex issues and improving response times.

- Improved Risk Management and Credit Scoring: AI models analyze extensive data to assess creditworthiness, predict market fluctuations, and manage portfolio risks more accurately.

- Operational Efficiency and Automation: Robotic Process Automation (RPA) combined with AI automates repetitive tasks, reducing manual errors and operational costs in back-office functions.

- Data Analytics and Insights: AI tools process vast datasets to uncover actionable insights, inform strategic decisions, and optimize business processes.

- Compliance and Regulatory Adherence: AI assists in monitoring transactions for compliance, identifying potential violations, and streamlining reporting processes.

Key Takeaways Digital Transformation in Banking and Finance Market Size & Forecast

Common user questions regarding the key takeaways from the Digital Transformation in Banking and Finance market size and forecast typically focus on the strategic implications of the projected growth, the urgency for adoption, and the primary drivers of success. Users want to understand what the substantial market expansion means for existing financial institutions, new entrants, and technology providers. There is also a keen interest in identifying the critical success factors for institutions navigating this transformative period.

A central takeaway is the undeniable shift from traditional banking models to digitally-centric ecosystems, driven by both consumer demand and competitive pressures. Financial institutions that fail to embrace comprehensive digital transformation risk significant market share erosion and obsolescence. The forecast growth underscores that digital capabilities are no longer a competitive edge but a fundamental requirement for operational resilience and market relevance in the modern financial landscape.

Another crucial insight is the accelerating pace of technological integration, necessitating agile development methodologies and a continuous innovation mindset. The substantial market size and projected growth highlight immense opportunities for technology providers specializing in AI, cloud computing, cybersecurity, and data analytics. Success will increasingly depend on strategic partnerships, fostering a culture of innovation, and meticulously addressing data privacy and security concerns to build customer trust.

- Sustained and Rapid Growth: The market is projected for substantial expansion, indicating digital transformation is a long-term strategic imperative, not a temporary trend.

- Mandatory for Competitiveness: Digital adoption is no longer optional; it is critical for financial institutions to remain competitive and relevant.

- Customer-Centric Evolution: The focus of transformation is increasingly on enhancing customer experience through personalization and seamless digital interactions.

- Technological Imperative: Cloud, AI, Blockchain, and advanced analytics are foundational technologies driving this growth and enabling new service models.

- Strategic Partnerships: Collaboration between traditional banks and fintechs, as well as technology providers, is essential for accelerating innovation and market penetration.

- Regulatory Adaptation: The evolving regulatory landscape, particularly around data privacy and open banking, plays a significant role in shaping transformation strategies.

Digital Transformation in Banking and Finance Market Drivers Analysis

The Digital Transformation in Banking and Finance Market is primarily propelled by a dynamic interplay of evolving customer expectations, rapid technological advancements, and the intense competitive landscape. Modern consumers, accustomed to instant, seamless, and personalized experiences in other industries, now demand similar capabilities from their financial service providers. This push for digital convenience and accessibility necessitates continuous innovation and investment in advanced digital solutions.

Moreover, the imperative for operational efficiency and cost reduction acts as a significant catalyst for digital transformation. By automating manual processes, leveraging data analytics for informed decision-making, and adopting cloud infrastructures, financial institutions can streamline operations, reduce overheads, and reallocate resources more strategically. This pursuit of efficiency is crucial for maintaining profitability in a highly competitive and often margin-pressured industry.

The emergence of agile fintech companies and challenger banks has intensified competition, compelling traditional financial institutions to accelerate their digital initiatives. These new entrants often possess inherent digital capabilities and customer-centric models, pressuring established players to innovate or risk losing market share. Additionally, supportive regulatory frameworks, such as Open Banking initiatives in various regions, encourage data sharing and collaboration, further driving the adoption of digital technologies and fostering a more interconnected financial ecosystem.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Evolving Customer Expectations | +4.2% | Global, particularly North America, Europe, APAC | Short-term to Long-term |

| Technological Advancements (AI, Cloud, Blockchain) | +3.8% | Global | Short-term to Long-term |

| Increased Competition from Fintechs & Neobanks | +3.5% | Global, high in Europe, APAC | Medium-term |

| Need for Operational Efficiency & Cost Reduction | +2.7% | Global | Short-term to Medium-term |

| Supportive Regulatory Initiatives (e.g., Open Banking) | +1.5% | Europe, UK, APAC, growing in North America | Medium-term |

Digital Transformation in Banking and Finance Market Restraints Analysis

Despite the compelling drivers, the Digital Transformation in Banking and Finance Market faces significant restraints that can impede its growth and implementation. One primary challenge is the pervasive presence of legacy IT infrastructure within many established financial institutions. These outdated systems are often complex, rigid, and costly to maintain, making integration with modern digital solutions exceptionally difficult and expensive. The sheer scale of data migration and system overhaul required can be a daunting barrier.

Another substantial restraint stems from the critical concerns surrounding data privacy and cybersecurity. As financial institutions increasingly handle vast amounts of sensitive customer data in digital environments, the risk of data breaches and cyber-attacks escalates. Adhering to stringent data protection regulations, such as GDPR and CCPA, while simultaneously safeguarding against sophisticated threats, demands substantial investment and expertise, often slowing down digital initiatives due to the imperative for security over speed.

Furthermore, the scarcity of specialized digital talent and resistance to change within organizational cultures pose considerable hurdles. Implementing digital transformation requires not only technological prowess but also a workforce capable of adapting to new tools, processes, and mindsets. Overcoming entrenched skepticism or fear of job displacement among employees, coupled with a shortage of skilled professionals in areas like AI, data science, and cloud architecture, can significantly delay or undermine transformation efforts, impacting the overall market growth trajectory.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Legacy IT Infrastructure & Integration Complexities | -3.0% | Global, particularly developed markets | Medium-term to Long-term |

| Data Privacy & Cybersecurity Concerns | -2.5% | Global | Short-term to Long-term |

| Regulatory Hurdles & Compliance Costs | -2.0% | Global, varies by region | Short-term to Medium-term |

| Talent Gap & Resistance to Change | -1.8% | Global | Medium-term |

| High Initial Investment & ROI Uncertainty | -1.2% | Global, prominent in emerging markets | Short-term |

Digital Transformation in Banking and Finance Market Opportunities Analysis

The Digital Transformation in Banking and Finance Market presents numerous lucrative opportunities for growth and innovation, driven by evolving market dynamics and technological advancements. One significant area of opportunity lies in the expansion of open banking and API-driven ecosystems. These initiatives enable financial institutions to collaborate more effectively with fintechs and third-party developers, fostering the creation of innovative products and services, expanding distribution channels, and enhancing the overall customer value proposition beyond traditional offerings.

Another compelling opportunity arises from the vast potential of underserved markets, particularly in developing economies. A significant portion of the global population remains unbanked or underbanked, representing an immense opportunity for digital financial services to provide accessible and affordable solutions through mobile-first strategies. Digital transformation can bridge this gap by offering simplified account opening, digital payments, and micro-lending services, thereby promoting financial inclusion and unlocking new customer segments.

Furthermore, the increasing sophistication of data analytics and artificial intelligence offers unprecedented opportunities for hyper-personalization and predictive insights. By leveraging these technologies, financial institutions can move beyond generic offerings to provide highly tailored financial advice, personalized product recommendations, and proactive customer support. This not only enhances customer loyalty but also creates new revenue streams through data-driven service innovation, allowing institutions to anticipate needs and offer truly bespoke solutions.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of Open Banking & API Ecosystems | +3.0% | Europe, UK, APAC, North America | Medium-term to Long-term |

| Financial Inclusion in Underserved Markets | +2.8% | APAC, Latin America, MEA | Medium-term to Long-term |

| Leveraging AI & Advanced Analytics for Hyper-personalization | +2.5% | Global | Short-term to Long-term |

| Adoption of Cloud Computing for Scalability & Cost-efficiency | +2.0% | Global | Short-term to Medium-term |

| Strategic Partnerships with Fintech & Tech Companies | +1.5% | Global | Short-term to Medium-term |

Digital Transformation in Banking and Finance Market Challenges Impact Analysis

The Digital Transformation in Banking and Finance Market faces several significant challenges that can complicate implementation and adoption. One major hurdle is the complexity of integrating new digital solutions with existing legacy systems. Many financial institutions operate on decades-old IT infrastructures that were not designed for modern digital functionalities, making the seamless integration of cloud-based applications, AI tools, and real-time data analytics a costly, time-consuming, and often disruptive process. This integration complexity can lead to delays, budget overruns, and operational inefficiencies, impacting the overall pace of transformation.

Another critical challenge is ensuring robust cybersecurity and data privacy in an increasingly interconnected digital environment. As financial services become more digital, they become more vulnerable to sophisticated cyber threats, including data breaches, ransomware attacks, and phishing scams. Maintaining customer trust and complying with stringent global data protection regulations requires continuous investment in advanced security measures, threat intelligence, and incident response capabilities, which can divert resources from other digital initiatives and slow down innovation.

Furthermore, managing organizational change and fostering a digital-first culture within traditional financial institutions presents a substantial challenge. Employees may resist new technologies or processes due to fear of job displacement, lack of training, or an unfamiliarity with agile methodologies. Overcoming this resistance requires comprehensive change management strategies, continuous employee upskilling, and strong leadership commitment to cultivate an environment that embraces innovation and adaptability. Without addressing these human elements, the most advanced technological solutions may fail to deliver their full potential within the organization.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complex Integration with Legacy Systems | -2.8% | Global, more pronounced in mature markets | Medium-term |

| Cybersecurity Threats & Data Privacy Compliance | -2.4% | Global | Short-term to Long-term |

| Talent Shortages & Skill Gaps | -2.0% | Global | Medium-term |

| Regulatory Compliance & Adapting to Evolving Rules | -1.7% | Global, high variability by region | Short-term to Medium-term |

| Maintaining Customer Trust & Adoption | -1.5% | Global | Short-term to Medium-term |

Digital Transformation in Banking and Finance Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the Digital Transformation in Banking and Finance market, covering historical trends, current market dynamics, and future growth projections from 2025 to 2033. The scope includes a detailed examination of market size, key drivers, restraints, opportunities, and challenges influencing the industry's trajectory. Furthermore, the report offers extensive segmentation analysis by component, deployment, end-user, and application, alongside a thorough regional assessment to provide a holistic view of the market landscape and strategic insights for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 295.4 Billion |

| Market Forecast in 2033 | USD 947.8 Billion |

| Growth Rate | 15.7% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Accenture, Infosys, Capgemini, Tata Consultancy Services (TCS), Wipro, Oracle, SAP, Microsoft, Amazon Web Services (AWS), Google Cloud, Finastra, Temenos, nCino, Mambu, Fidelity National Information Services (FIS), Fiserv, Jack Henry & Associates, DXC Technology, Genpact |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Digital Transformation in Banking and Finance market is meticulously segmented to provide a granular understanding of its diverse components, deployment models, target end-users, and application areas. This segmentation allows for a detailed analysis of market dynamics across various dimensions, revealing key growth pockets and strategic opportunities. The "By Component" segment differentiates between robust technology solutions and the essential services required for their implementation and ongoing management, reflecting the comprehensive nature of digital transformation initiatives.

The "By Deployment" segment critically distinguishes between traditional on-premise setups and the increasingly dominant cloud-based solutions, which offer scalability, flexibility, and cost efficiencies vital for modern financial operations. Cloud deployment further categorizes into public, private, and hybrid models, catering to varying security and compliance requirements of financial institutions. Understanding these deployment preferences is crucial for technology providers tailoring their offerings.

Furthermore, the "By End-user" and "By Application" segments illuminate the specific sectors within banking and finance that are driving adoption and the particular use cases where digital transformation is having the most significant impact. From retail banking to wealth management and insurance, each sub-segment presents unique challenges and opportunities for digital innovation, highlighting the breadth of transformation across the financial services industry. This detailed segmentation facilitates precise market forecasting and strategic planning for all stakeholders involved.

- By Component: This segment includes the foundational technologies and essential support services for digital transformation.

- Solutions: These are the software platforms and applications designed to modernize financial operations.

- Core Banking Systems: Modernized platforms replacing legacy systems to handle fundamental banking transactions.

- Digital Payment Solutions: Technologies enabling secure, instant, and varied digital payment methods.

- Lending Platforms: Digital systems for loan origination, processing, and management.

- Wealth Management Solutions: Tools for personalized investment advice, portfolio management, and financial planning.

- Customer Relationship Management (CRM): Systems to manage and analyze customer interactions and data throughout the customer lifecycle.

- Risk & Compliance Management: Software to identify, assess, and mitigate financial risks and ensure regulatory adherence.

- Cybersecurity Solutions: Technologies and services protecting digital assets, data, and systems from cyber threats.

- Data Analytics & Business Intelligence: Tools for processing large datasets to derive actionable insights for decision-making.

- AI & Machine Learning: Artificial intelligence and machine learning platforms for automation, personalization, and predictive analytics.

- Blockchain & DLT: Distributed Ledger Technologies for secure, transparent, and immutable record-keeping and transaction processing.

- Robotic Process Automation (RPA): Software robots automating repetitive, rule-based tasks across various banking operations.

- Cloud-based Solutions: Applications and infrastructure hosted on cloud platforms, offering scalability and flexibility.

- Services: Professional support necessary for implementing and maintaining digital transformation initiatives.

- Consulting: Expert advice on digital strategy, technology selection, and transformation roadmap.

- Integration: Services to seamlessly connect new digital solutions with existing IT infrastructure.

- Managed Services: Outsourced management and optimization of IT operations and digital platforms.

- Support & Maintenance: Ongoing technical assistance and updates for digital systems.

- Solutions: These are the software platforms and applications designed to modernize financial operations.

- By Deployment: Defines how the digital solutions are hosted and accessed.

- On-premise: Software installed and run on computers located at the user's financial institution.

- Cloud: Services delivered over the internet, offering scalability and reduced infrastructure costs.

- Public Cloud: Cloud services offered by third-party providers over the public internet.

- Private Cloud: Cloud infrastructure operated exclusively for a single financial institution.

- Hybrid Cloud: A mix of on-premise, private cloud, and public cloud services with orchestration between platforms.

- By End-user: Categorizes the types of financial entities adopting digital transformation.

- Banks: Traditional banking institutions.

- Retail Banks: Banks serving individual consumers with services like checking accounts, loans, and credit cards.

- Commercial Banks: Banks serving businesses with services like business loans, treasury management, and corporate finance.

- Investment Banks: Banks focused on corporate finance, mergers and acquisitions, and capital markets.

- Cooperative Banks: Member-owned financial institutions providing banking services primarily to their members.

- Financial Institutions: A broader category encompassing other entities in the financial sector.

- Credit Unions: Not-for-profit cooperative financial institutions owned by their members.

- NBFCs (Non-Banking Financial Companies): Financial institutions that do not have a full banking license but provide financial services.

- Fintech Companies: Technology-driven companies providing innovative financial services.

- Insurance Companies: Entities providing risk management and financial protection services.

- Banks: Traditional banking institutions.

- By Application: Specific functional areas within financial services benefiting from digital transformation.

- Retail Banking: Digitalization of consumer-facing services like mobile banking, online account opening, and personal finance management.

- Corporate Banking: Digital solutions for businesses, including cash management, trade finance, and corporate lending.

- Investment Banking: Digital platforms for trading, portfolio analysis, and capital raising.

- Wealth Management: Digital tools for financial advisors and clients to manage investments and financial planning.

- Payments: Digital transformation of payment processing, including real-time payments, mobile wallets, and cross-border transactions.

- Insurance: Digital solutions for policy management, claims processing, and personalized insurance products.

- Lending: Automation and digitalization of the entire lending lifecycle, from application to disbursement and collection.

- Trade Finance: Digital platforms for facilitating international trade transactions, including letters of credit and supply chain finance.

Regional Highlights

- North America: The region is at the forefront of digital transformation in banking and finance, driven by high technology adoption rates, significant investments in fintech, and a mature financial services ecosystem. The presence of major technology providers and early adoption of cloud and AI solutions contribute to its dominant market share. Innovation hubs in the US and Canada foster rapid development and deployment of advanced digital tools, with a strong focus on enhancing customer experience and operational efficiency.

- Europe: Europe is characterized by robust regulatory initiatives like PSD2 and Open Banking, which are compelling financial institutions to accelerate their digital transformation journeys. The region shows strong growth in mobile banking, digital payments, and collaborative models between traditional banks and fintechs. Countries like the UK, Germany, and the Nordic nations are leading in developing sophisticated digital banking platforms, with a growing emphasis on sustainable finance and ethical AI applications.

- Asia Pacific (APAC): APAC is projected to be one of the fastest-growing regions for digital transformation, fueled by a large unbanked population, rapid smartphone penetration, and supportive government initiatives for financial inclusion. Countries such as China, India, and Southeast Asian nations are witnessing explosive growth in digital payments, mobile-first banking solutions, and innovative uses of AI and blockchain. The region is a hotbed for fintech innovation and cross-border digital collaborations.

- Latin America: This region is experiencing significant digital transformation driven by the need for greater financial inclusion and the widespread adoption of mobile technology. Digital payment solutions and neobanks are gaining substantial traction, addressing the limitations of traditional banking infrastructure in many areas. Brazil and Mexico are leading the charge, with increasing investments in fintech and regulatory efforts to foster a more digital financial ecosystem.

- Middle East and Africa (MEA): The MEA region is undergoing a rapid digital evolution in its financial sector, often leapfrogging traditional stages of development directly into mobile and digital solutions. Government-led diversification efforts, particularly in the GCC countries, are driving massive investments in smart city initiatives and digital infrastructure. Africa is seeing a boom in mobile money and fintech solutions addressing financial access challenges, with a growing focus on cashless economies and digital remittances.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Transformation in Banking and Finance Market.- IBM

- Accenture

- Infosys

- Capgemini

- Tata Consultancy Services (TCS)

- Wipro

- Oracle

- SAP

- Microsoft

- Amazon Web Services (AWS)

- Google Cloud

- Finastra

- Temenos

- nCino

- Mambu

- Fidelity National Information Services (FIS)

- Fiserv

- Jack Henry & Associates

- DXC Technology

- Genpact

Frequently Asked Questions

Analyze common user questions about the Digital Transformation in Banking and Finance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Digital Transformation in Banking and Finance?

Digital Transformation in Banking and Finance refers to the strategic adoption of digital technologies by financial institutions to fundamentally change how they operate and deliver value to customers. This encompasses modernizing core systems, leveraging data analytics, implementing AI and cloud solutions, and redesigning customer experiences to be more seamless, personalized, and efficient.

Why is Digital Transformation critical for financial institutions?

Digital Transformation is critical for financial institutions to meet evolving customer expectations for convenience and personalization, improve operational efficiency and reduce costs, enhance cybersecurity measures, and maintain competitiveness against agile fintechs and neobanks. It enables institutions to innovate faster, scale operations, and adapt to dynamic market and regulatory demands, ensuring long-term relevance and growth.

What are the key technologies driving this transformation?

The key technologies driving digital transformation include Artificial Intelligence (AI) and Machine Learning (ML) for personalization and fraud detection, Cloud Computing for scalability and flexibility, Blockchain and Distributed Ledger Technologies (DLT) for secure transactions, Robotic Process Automation (RPA) for operational efficiency, and advanced Data Analytics for informed decision-making. Open Banking APIs also play a crucial role in fostering collaboration and innovation.

How does digital transformation impact the customer experience?

Digital transformation profoundly impacts the customer experience by enabling hyper-personalized services, intuitive mobile and online banking platforms, faster transaction processing, and proactive customer support through AI-powered chatbots. It provides customers with greater control over their finances, convenient access to services, and tailored financial advice, leading to higher satisfaction and loyalty.

What are the main challenges in implementing digital transformation?

Main challenges in implementing digital transformation include integrating new solutions with complex legacy IT systems, ensuring robust cybersecurity and compliance with stringent data privacy regulations, overcoming internal resistance to change among employees, and addressing the shortage of skilled digital talent. High initial investment costs and the need to demonstrate a clear return on investment also pose significant hurdles for many institutions.